Global Thermic Fluids Market

Market Size in USD Billion

CAGR :

%

USD

12.65 Billion

USD

17.45 Billion

2024

2032

USD

12.65 Billion

USD

17.45 Billion

2024

2032

| 2025 –2032 | |

| USD 12.65 Billion | |

| USD 17.45 Billion | |

|

|

|

|

What is the Global Thermic Fluids Market Size and Growth Rate?

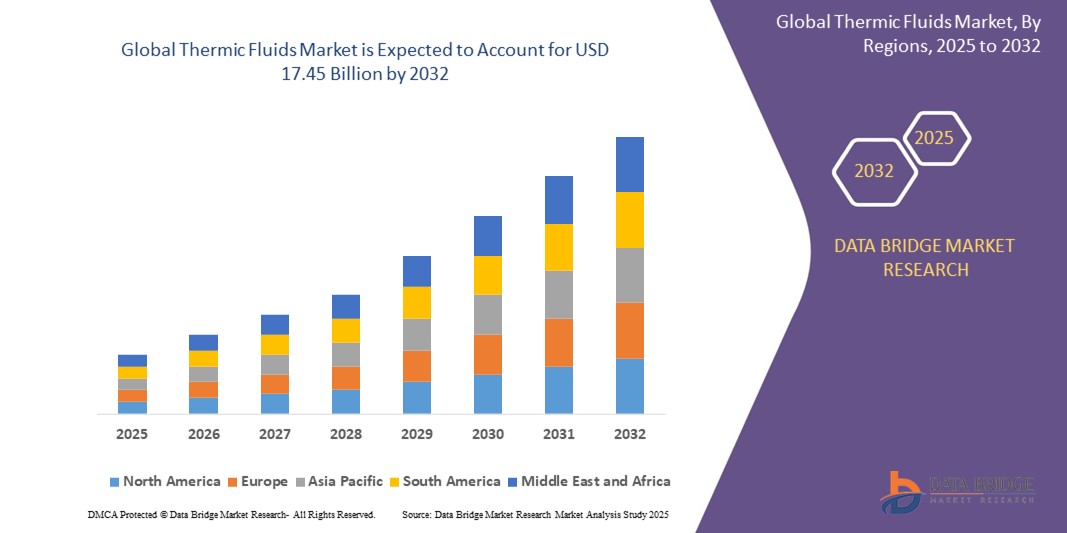

- The global thermic fluids market size was valued at USD 12.65 billion in 2024 and is expected to reach USD 17.45 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market expansion is primarily driven by increasing industrial activities across sectors such as oil & gas, chemical processing, and food & beverage, where efficient heat transfer systems are essential

- In addition, the growing emphasis on energy efficiency, operational safety, and advanced heat management systems is accelerating the adoption of thermic fluids, thereby fueling consistent market growth worldwide

What are the Major Takeaways of Thermic Fluids Market?

- Thermic fluids, used as heat transfer agents, are critical for maintaining temperature stability and operational efficiency in industrial systems involving high-temperature processes

- Market demand is significantly boosted by rising adoption in concentrated solar power plants, chemical manufacturing, and HVAC systems, where reliable thermal management is vital

- The shift toward synthetic and bio-based thermic fluids, driven by environmental concerns and regulatory mandates, further reinforces the market’s trajectory toward sustainable and efficient thermal solutions

- Asia-Pacific dominated the thermic fluids market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, rising investments in renewable energy projects, and expanding manufacturing sectors across countries such as China, India, and Japan

- North America is projected to register the fastest CAGR of 21.8% from 2025 to 2032, attributed to rising investments in CSP plants, growing demand for energy-efficient industrial processes, and favorable government regulations promoting sustainability

- The Silicone and Aromatic-Based segment dominated the Thermic Fluids market with the largest market revenue share of 46.3% in 2024, primarily due to its superior thermal stability, low volatility, and broad temperature operating range

Report Scope and Thermic Fluids Market Segmentation

|

Attributes |

Thermic Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Thermic Fluids Market?

“Shift Toward Bio-Based and Energy-Efficient Heat Transfer Solutions”

- A prominent trend shaping the global Thermic Fluids market is the accelerating adoption of bio-based and energy-efficient fluids as industries prioritize sustainability, environmental compliance, and cost-effective operations

- For instance, manufacturers are increasingly replacing traditional mineral oil-based fluids with synthetic or bio-derived alternatives to reduce carbon emissions and align with green regulatory frameworks such as REACH and EPA guidelines

- Companies such as Eastman and BASF SE are innovating in eco-friendly thermic fluid formulations, delivering products that offer superior thermal stability, longer fluid life, and lower environmental impact across high-temperature applications

- This transition is further supported by the growing use of Thermic Fluids in renewable energy systems such as concentrated solar power (CSP) and in closed-loop heat recovery systems, where energy efficiency is paramount

- As industrial users seek long-lasting, low-maintenance thermal solutions, the demand for green thermic fluids is expected to expand significantly across Europe, North America, and Asia-Pacific

- Ultimately, this trend toward sustainable and high-performance thermic fluid technologies is transforming the thermal management landscape and pushing manufacturers to innovate for a cleaner industrial future

What are the Key Drivers of Thermic Fluids Maret?

- The rising demand for efficient heat transfer in industrial processes, especially in sectors such as oil & gas, chemical manufacturing, and renewable energy, is a primary growth driver for the Thermic Fluids market

- For instance, in May 2024, Global Heat Transfer Ltd. announced the launch of a new synthetic thermic fluid tailored for solar thermal applications, aligning with the global push for clean energy integration and improved system performance

- In addition, the increasing emphasis on energy efficiency, equipment longevity, and process optimization is prompting companies to replace traditional fluids with advanced thermal oils that ensure stable performance under extreme temperature conditions

- Regulatory mandates regarding worker safety, environmental emissions, and equipment maintenance are further driving the adoption of high-quality thermic fluids, especially those with high flash points, low volatility, and oxidation resistance

- Moreover, the expansion of smart manufacturing and Industry 4.0 practices has increased the demand for thermic fluids in automated and continuous production systems, where thermal stability and reliability are critical to minimizing downtime and maintaining operational excellence

Which Factor is challenging the Growth of the Thermic Fluids Market?

- One of the most significant challenges limiting market expansion is the environmental and disposal concerns associated with certain synthetic and petroleum-based thermic fluids. These fluids can pose risks related to toxicity, flammability, and waste management if not handled or disposed of properly

- For instance, regulations in Europe and the U.S. regarding hazardous waste classification and emission standards have prompted industries to rethink their fluid usage, creating pressure on manufacturers to innovate safer alternatives

- In addition, high initial investment costs for premium synthetic fluids, especially those used in solar thermal and high-performance industrial systems, may deter small- and medium-scale industries from transitioning from traditional fluids

- Supply chain fluctuations and raw material price volatility, particularly for specialty base oils and additives, can further impact market growth and end-user affordability

- Overcoming these barriers will require strategic efforts such as cost-effective product development, enhanced environmental compliance, and stronger end-user education on the long-term benefits of switching to advanced thermic fluids

How is the Thermic Fluids Market Segmented?

The market is segmented on the basis of product, application, and sales channel.

• By Product

On the basis of product, the Thermic Fluids market is segmented into Silicone and Aromatic-Based, Mineral Oil-Based, PAG and Glycol-Based, and Others. The Silicone and Aromatic-Based segment dominated the Thermic Fluids market with the largest market revenue share of 46.3% in 2024, primarily due to its superior thermal stability, low volatility, and broad temperature operating range. These fluids are extensively used in high-temperature industrial applications such as chemical processing and solar power plants, where consistent performance and long fluid life are crucial.

The PAG and Glycol-Based segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in environmentally sensitive applications and sectors such as food processing and pharmaceutical manufacturing. Their low toxicity and excellent heat transfer capabilities make them a preferred choice in industries where regulatory compliance and safety are critical.

• By Application

On the basis of application, the Thermic Fluids market is segmented into Oil and Gas, Chemical Industry, Concentrated Solar Power (CSP), Food and Beverages, Plastics, Pharmaceuticals, Manufacturing Processes, Biodiesel Production, HVAC, and Others. The Oil and Gas segment held the largest market revenue share of 29.7% in 2024, owing to the extensive usage of Thermic Fluids in refinery operations, gas processing, and offshore facilities, where high thermal efficiency and fluid stability are essential under extreme conditions.

The CSP (Concentrated Solar Power) segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing adoption of renewable energy systems. CSP plants require high-temperature fluids to transfer and store solar energy efficiently, positioning Thermic Fluids as a vital component in achieving sustainable energy targets worldwide.

• By Sales Channel

On the basis of sales channel, the Thermic Fluids market is segmented into Direct Channel and Distribution Channel. The Distribution Channel segment dominated the market with the largest revenue share of 58.4% in 2024, primarily due to the extensive global network of suppliers, resellers, and dealers that ensure product availability across diverse end-use industries. These channels provide tailored support and after-sales services, enhancing market reach and customer engagement.

The Direct Channel segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing partnerships between manufacturers and large-scale industrial users who prefer direct procurement for custom solutions, bulk orders, and consistent supply chain control.

Which Region Holds the Largest Share of the Thermic Fluids Market?

- Asia-Pacific dominated the thermic fluids market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, rising investments in renewable energy projects, and expanding manufacturing sectors across countries such as China, India, and Japan

- The region benefits from strong demand in key industries such as chemicals, oil & gas, food processing, and solar power, where Thermic Fluids are essential for maintaining optimal heat transfer and operational efficiency

- The growth is further supported by government initiatives focused on energy efficiency and infrastructure expansion, making Asia-Pacific a key hub for Thermic Fluids consumption in both established and emerging sectors

China Thermic Fluids Market Insight

China Thermic Fluids market captured the largest revenue share in Asia-Pacific in 2024, driven by large-scale industrial development and robust demand in the chemical and manufacturing sectors. With China emerging as a global leader in concentrated solar power (CSP) installations, the need for high-temperature thermal fluids continues to rise. Local production capacity and cost competitiveness also enable widespread adoption across both domestic and export markets.

India Thermic Fluids Market Insight

India Thermic Fluids market is projected to grow at a significant CAGR during the forecast period, fueled by the increasing deployment of Thermic Fluids in industrial heating, food processing, and pharmaceutical manufacturing. Supportive policy frameworks such as Make in India and strong emphasis on clean energy sources such as CSP are enhancing market prospects. In addition, the shift toward eco-friendly fluids aligns with the country’s sustainability goals.

Japan Thermic Fluids Market Insight

Japan Thermic Fluids market is witnessing steady growth, driven by the country's precision-driven manufacturing and electronics sectors. Japan’s focus on energy-efficient industrial processes and advanced material development promotes the adoption of high-performance Thermic Fluids. With stringent quality standards and demand for reliability, the market favors synthetic-based fluids with long service life and thermal stability.

Which Region is the Fastest Growing Region in the Thermic Fluids Market?

North America is projected to register the fastest CAGR of 21.8% from 2025 to 2032, attributed to rising investments in CSP plants, growing demand for energy-efficient industrial processes, and favorable government regulations promoting sustainability. The region’s chemical and oil & gas industries heavily utilize Thermic Fluids for controlled heating in critical operations, while increased interest in bio-based thermal fluids is reshaping product development trends. Strong research and innovation in thermal management technologies, combined with the presence of major Thermic Fluid manufacturers, are reinforcing North America’s position as a rapidly advancing regional market.

U.S. Thermic Fluids Market Insight

U.S. Thermic Fluids market accounted for the majority share in North America in 2024, driven by its advanced infrastructure, strong focus on industrial automation, and continued expansion in renewable energy projects. The country’s leadership in petrochemical production and CSP deployment makes it a major consumer of Thermic Fluids. Furthermore, rising demand for synthetic and silicone-based fluids is fueling technological advancements in the region.

Canada Thermic Fluids Market Insight

Canada Thermic Fluids market is expected to expand steadily, supported by growth in the food & beverage, mining, and power generation sectors. Canada’s emphasis on sustainable development and clean energy usage encourages the adoption of biodegradable and non-toxic Thermic Fluids. Increasing investments in localized manufacturing and export-oriented industries also contribute to market expansion.

Which are the Top Companies in Thermic Fluids Market?

The thermic fluids industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Eastman Chemical Company (U.S.)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c. (U.K.)

- BASF SE (Germany)

- Dynalene, Inc. (U.S.)

- paratherm (U.S.)

- MULTITHERM LLC (U.S.)

- Chevron Corporation (U.S.)

- Shell (U.K.)

- Indian Oil Corporation Ltd (India)

- TULSTAR PRODUCTS INC. (U.S.)

- Radco Industries, Inc. (U.S.)

- Clariant (Switzerland)

- Wattco (Canada)

- Caldera (U.S.)

- Arkema (France)

- Peter Huber Kältemaschinenbau SE (Germany)

- HP Lubricants (India)

- Tide Water Oil Co. (India) Ltd. (India)

What are the Recent Developments in Global Thermic Fluids Market?

- In June 2024, Global Heat Transfer introduced Globaltherm 55, a synthetic heat transfer fluid tailored for moderate-temperature applications, offering greater cost efficiency over conventional mineral oil-based fluids throughout its service life. This launch highlights the increasing preference for high-performance and economically viable thermic fluids in industrial heat management systems

- In February 2024, Castrol unveiled a refreshed brand identity featuring a modern design, marking a strategic move to diversify beyond traditional lubricants. The company is actively developing a comprehensive range of advanced EV Fluids—such as EV Thermal Fluids, Transmission Fluids, and Greases—under the Castrol ON line. This evolution reflects the growing significance of thermal fluid technologies in the expanding electric vehicle ecosystem

- In February 2024, SK Enmove signed a Memorandum of Understanding (MOU) with Iceotope Technologies and SK Telecom to explore advanced cooling solutions for data centers. The collaboration aims to integrate SK Enmove’s thermal fluids into Iceotope’s precision liquid cooling systems and evaluate their effectiveness in SK Telecom’s AI Data Center Testbed. This initiative emphasizes the role of thermic fluids in supporting next-gen cooling infrastructure for digital transformation and AI technologies

- In January 2022, Linde plc partnered with Yara to build a 24 MW green hydrogen plant, representing a major advancement in sustainable hydrogen production. This venture underscores the rising demand for thermic fluid systems to manage heat efficiently during hydrogen generation processes. The development reinforces the strategic value of thermal fluids in the renewable energy supply chain

- In December 2021, Chart Industries collaborated with Howden to enhance hydrogen capabilities by incorporating Howden’s gas compression technologies. This partnership strengthens Chart’s hydrogen portfolio while emphasizing the need for high-efficiency thermic fluid systems in gas compression. The alliance further solidifies thermic fluids as vital components in the hydrogen value chain and industrial process efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.