Global Thermoformed Shallow Trays Market

Market Size in USD Billion

CAGR :

%

USD

6.03 Billion

USD

8.32 Billion

2024

2032

USD

6.03 Billion

USD

8.32 Billion

2024

2032

| 2025 –2032 | |

| USD 6.03 Billion | |

| USD 8.32 Billion | |

|

|

|

|

Thermoformed Shallow Trays Market Size

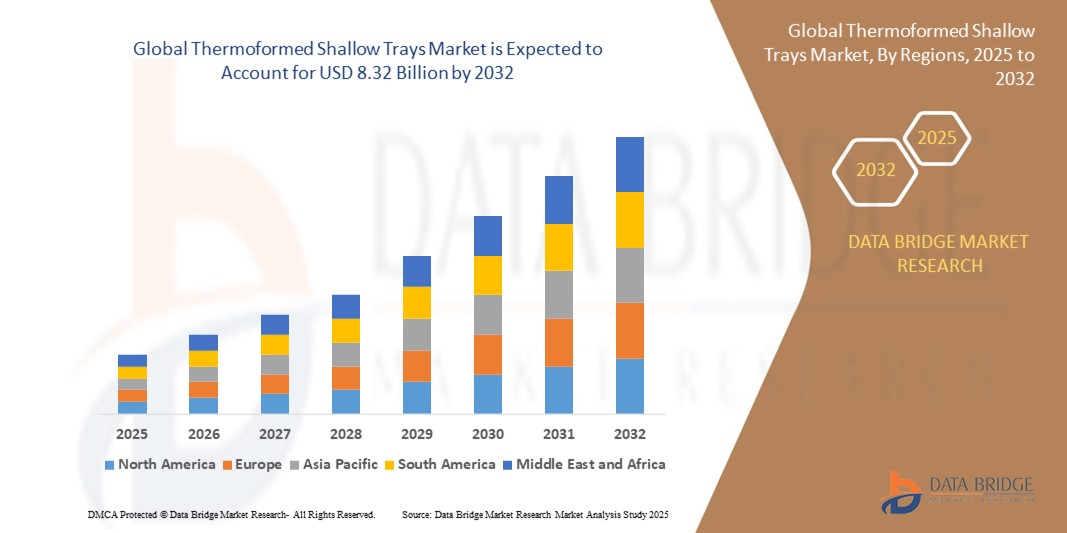

- The global thermoformed shallow trays market was valued at USD 6.03 billion in 2024 and is expected to reach USD 8.32 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.10%, primarily driven by the rising demand from the food packaging and healthcare sectors

- This growth is driven by factors such as the expanding ready-to-eat food industry, increased adoption of sustainable and recyclable packaging, and innovations in lightweight, durable tray designs for pharmaceuticals and medical

Thermoformed Shallow Trays Market Analysis

- Thermoformed shallow trays are widely used across multiple industries for protective, lightweight, and cost-effective packaging, especially in food, healthcare, consumer electronics, and industrial applications. These trays are particularly favored for their ability to securely hold products in place during transportation and display

- The demand for thermoformed shallow trays is significantly driven by the growth in ready-to-eat meals, pre-packaged fresh produce, and single-serve packaging solutions, especially in developed regions. Additionally, pharmaceutical and medical device manufacturers are increasingly adopting shallow trays for sterile packaging

- The Asia-Pacific region stands out as one of the dominant regions in the thermoformed shallow trays market, fueled by its expanding manufacturing base, rising middle-class population, and growing demand for convenient packaging solutions in countries like China, India, and Japan

- For instance, major regional food producers and retailers in Asia-Pacific have adopted customized shallow tray packaging for fresh produce and frozen foods, enhancing shelf visibility and consumer convenience

- Globally, thermoformed shallow trays are among the top packaging formats in the food and healthcare sectors, following flexible pouches and rigid containers. Their sustainability, material efficiency, and compatibility with automation lines make them a preferred choice for modern, high-throughput packaging environments

Report Scope and Thermoformed Shallow Trays Market Segmentation

|

Attributes |

Thermoformed Shallow Trays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermoformed Shallow Trays Market Trends

“Increased Focus on Sustainable and Eco-friendly Materials”

- One prominent trend in the global thermoformed shallow trays market is the growing adoption of sustainable and eco-friendly materials

- Consumers and businesses are increasingly focused on reducing environmental impact and shifting towards recyclable or biodegradable packaging solutions, a trend driven by stricter regulations and heightened consumer awareness about sustainability

- `For instance, companies in the food and beverage industry are turning to PLA (polylactic acid) and PET (polyethylene terephthalate) thermoformed trays as environmentally responsible alternatives to traditional plastic packaging. This shift is particularly prevalent in regions like Europe and North America, where sustainable practices are a key priority

- In addition, the demand for biodegradable and compostable trays is increasing as manufacturers seek to comply with government regulations on plastic waste and packaging disposal

- This trend is revolutionizing the way thermoformed shallow trays are designed and produced, improving the eco-profile of the packaging industry and increasing the demand for green packaging solutions in the market

Thermoformed Shallow Trays Market Dynamics

Driver

“Growing Demand Driven by the Rise in Packaged Food and Convenience Products”

- The increasing demand for ready-to-eat meals, pre-packaged foods, and convenience products is significantly driving the demand for thermoformed shallow trays

- As consumers lead increasingly busy lives, the need for quick and easy meal solutions has surged, leading to a higher consumption of single-serve packaging that provides convenience, freshness, and portability

- This shift in consumer behavior, especially in food and beverage packaging, is fostering an increased demand for innovative and sustainable packaging solutions, such as thermoformed shallow trays made from recyclable or biodegradable materials

- The rise of meal kit delivery services and the popularity of pre-packaged fresh produce have caused a spike in the use of thermoformed shallow trays. This trend is particularly strong in regions like North America and Europe, where consumers prioritize convenience in their daily food choices

For instance,

- In 2024, a major food processing company in the U.S. began using PLA-based thermoformed shallow trays for their fresh fruit and vegetable packaging, capitalizing on the growing consumer preference for eco-friendly and biodegradable packaging materials

- In 2023, a leading global manufacturer of thermoformed packaging announced the development of a new line of microwave-safe shallow trays for use in the growing market of heat-and-eat convenience foods, reflecting the increasing demand for functional, versatile packaging solutions

- As the global population continues to urbanize and the demand for processed and ready-to-eat food grows, thermoformed shallow trays are becoming the preferred packaging solution due to their cost-effectiveness, lightweight nature, and ability to protect and display products in an appealing way

Opportunity

“Advancement in Sustainable Packaging Materials”

- The increasing focus on sustainability presents a major opportunity for the thermoformed shallow trays market. Companies are now exploring innovative sustainable packaging materials to meet both consumer demand and regulatory requirements

- The development of biodegradable, compostable, and recyclable thermoformed trays aligns with global trends towards reducing environmental impact, especially in sectors like food packaging and pharmaceuticals

For instance,

- In 2024, a global packaging company unveiled a new line of compostable thermoformed trays made from plant-based materials, specifically targeting the increasing demand for eco-friendly packaging in the fast-food and retail sectors

- In 2023, a leading food packaging manufacturer announced a collaboration with a biotech firm to develop bio-based, recyclable thermoformed trays that can replace conventional plastic trays in frozen food packaging, catering to both sustainability demands and consumer convenience

- bioplastics such as PLA (polylactic acid) are gaining popularity in thermoformed tray production due to their renewable, plant-based origins and reduced environmental footprint compared to traditional plastics. Additionally, recycled PET (rPET) is emerging as a popular material choice, driven by the growing demand for circular economy practices

- In line with these trends, innovation in barrier technologies—such as oxygen and moisture barriers—is providing new opportunities for the thermoformed shallow trays market to meet the growing need for longer shelf life in food packaging and sterile packaging for medical products

- The push towards sustainability and functional packaging solutions is expected to drive significant growth in regions with stringent packaging regulations, such as Europe and North America

Restraint/Challenge

“Rising Raw Material Costs and Supply Chain Disruptions”

- One of the key challenges facing the thermoformed shallow trays market is the increasing cost of raw materials, particularly due to fluctuations in the prices of petroleum-based plastics and the limited availability of sustainable materials

- The global supply chain disruptions, partly due to geopolitical tensions and post-pandemic effects, have also led to delays in production and higher costs, further affecting the profitability of manufacturers

- These price hikes create financial pressures on companies, particularly smaller manufacturers who struggle to keep up with rising production costs, resulting in a potential reduction in market competitiveness

For instance,

- In 2023, a prominent global packaging company reported increased costs of raw materials and longer lead times due to disruptions in the supply chain, which impacted the cost structure of their thermoformed packaging solutions for the food sector

- In 2024, a leading tray manufacturer based in Europe announced that due to higher costs of compostable and biodegradable materials, it would be increasing the price of its eco-friendly thermoformed shallow trays for retail customers

- the price of PET and polystyrene—two common materials used for thermoforming—has risen sharply in recent years due to supply chain challenges and the fluctuating cost of crude oil. This increase in raw material costs is particularly felt in the food packaging industry, which heavily relies on these materials for single-serve containers and trays

- the price of PET and polystyrene—two common materials used for thermoforming—has risen sharply in recent years due to supply chain challenges and the fluctuating cost of crude oil. This increase in raw material costs is particularly felt in the food packaging industry, which heavily relies on these materials for single-serve containers and trays

- As manufacturers face these economic pressures, they may need to pass on the increased costs to consumers, potentially leading to higher prices for packaged food, medications, and other products using thermoformed shallow trays, which could hinder market growth

Thermoformed Shallow Trays Market Scope

The market is segmented on the basis material type, tray type, distribution channel, manufacturing, end user, capacity, and shape.

|

Segmentation |

Sub-Segmentation |

|

By Material Type |

|

|

By Tray Type |

|

|

By Distribution Channel |

|

|

By Manufacturing |

|

|

By End Use |

|

|

By Capacity |

|

|

By Shape |

|

Thermoformed Shallow Trays Market Regional Analysis

“North America is the Dominant Region in the Thermoformed Shallow Trays Market”

- North America leads the global thermoformed shallow trays market, driven by strong demand across food packaging, pharmaceuticals, and consumer goods sectors. The region benefits from advanced manufacturing infrastructure, a well-regulated packaging industry, and high consumer preference for packaged and convenience products

- The U.S. accounts for a substantial market share, fueled by the widespread use of thermoformed packaging in supermarkets, quick-service restaurants, and healthcare institutions. The rise in ready-to-eat meals, frozen foods, and on-the-go packaging is a key factor accelerating tray consumption

- North America is also home to several leading packaging manufacturers, which invest heavily in research & development to enhance tray functionality, improve sustainability, and meet evolving regulatory standards for food safety and recyclability

- Moreover, increasing awareness and consumer preference for eco-friendly packaging alternatives are driving innovation in the use of biodegradable and recyclable materials in thermoformed tray production across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is anticipated to register the highest growth rate in the global thermoformed shallow trays market, fueled by rapid industrialization, expanding retail and food sectors, and increasing demand for convenient and cost-effective packaging solutions

- Countries such as China, India, and Japan are emerging as key markets due to rising urbanization, changing consumer lifestyles, and a growing focus on food safety and hygiene, which boost the adoption of sealed and secure packaging formats

- Japan, known for its innovation in packaging technology, remains a crucial contributor, particularly in sectors like electronics and pharmaceuticals, where precise and protective packaging is essential. Japanese manufacturers continue to lead in adopting sustainable and high-performance materials in thermoforming applications

- In addition, growing environmental regulations and consumer awareness around plastic waste are encouraging regional producers to explore recyclable and biodegradable alternatives, opening new avenues for innovation

Thermoformed Shallow Trays Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Amcor Plc (Australia)

- DS Smith plc (U.K.)

- Sonoco Products Company (U.S.)

- Sealed Air Corporation (U.S.)

- Berry Global Group, Inc. (U.S.)

- Winpak Ltd. (Canada)

- Royal InterPack Group (Netherlands)

- Anchor Packaging LLC (U.S.)

- Tekni-Plex, Inc. (U.S.)

- Universal Protective Packaging, Inc. (U.S.)

- Placon Corporation (U.S.)

- Easypack LLC (U.K.)

- Pöppelmann GmbH & Co. KG (Germany)

- Faerch A/S (Denmark)

- Lindar Corporation (U.S.)

- Lacerta Group LLC (U.S.)

- Universal Plastics Group, Inc. (U.S.)

- Sinclair & Rush, Inc. (U.S.)

- Dordan Manufacturing, Inc. (U.S.)

- Andex (Germany)

Latest Developments in Global Thermoformed Shallow Trays Market

- In April 2024, Amcor introduced a new range of packaging trays made from PETG and APET, specifically designed for healthcare applications. These trays aim to enhance safety standards and improve packaging efficiency, aligning with the industry's demand for reliable and sustainable solutions. By leveraging advanced materials, Amcor seeks to support the healthcare sector with innovative packaging options that ensure product integrity and user safety. This launch reflects the company's commitment to addressing the evolving needs of medical and pharmaceutical industries

- In March 2023, Sonoco Products Company introduced innovative shallow trays tailored for the food service industry, emphasizing sustainability and ease of use. These trays are designed to meet the growing demand for environmentally friendly packaging solutions while enhancing user convenience. The launch reflects Sonoco's commitment to advancing sustainable practices and providing practical solutions for the food service sector. By addressing industry needs, the company aims to support eco-conscious initiatives and improve operational efficiency

- In April 2023, a Chinese manufacturer partnered with a European company to launch biodegradable thermoformed packaging, addressing both domestic and export market needs. This collaboration aligns with China's plastic reduction mandates and aims to support sustainable packaging solutions. By combining expertise, the joint venture seeks to enhance eco-friendly production capabilities and cater to the growing demand for biodegradable materials. This initiative reflects the commitment of both firms to environmental sustainability and innovation in packaging technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermoformed Shallow Trays Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoformed Shallow Trays Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoformed Shallow Trays Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.