Global Thermoplastic Carbon Fiber Tapes Market

Market Size in USD Million

CAGR :

%

USD

659.08 Million

USD

959.03 Million

2024

2032

USD

659.08 Million

USD

959.03 Million

2024

2032

| 2025 –2032 | |

| USD 659.08 Million | |

| USD 959.03 Million | |

|

|

|

|

Thermoplastic Carbon Fiber Market Size

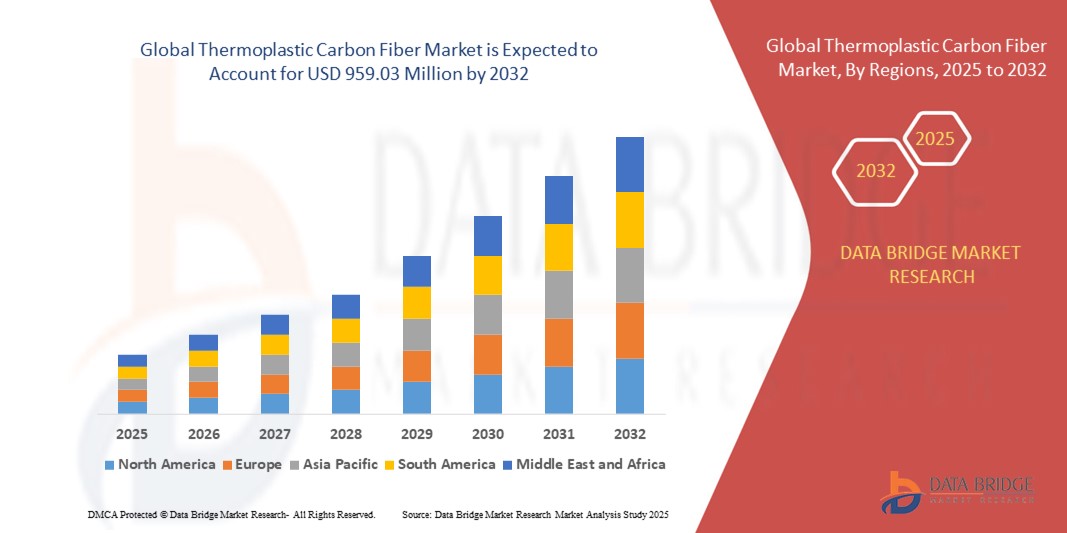

- The global thermoplastic carbon fiber market size was valued at USD 659.08 million in 2024 and is expected to reach USD 959.03 million by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and high-strength materials in automotive, aerospace, and defense industries, as manufacturers increasingly focus on improving fuel efficiency and reducing emissions

- Growing adoption of thermoplastic composites in consumer electronics and sporting goods, driven by their durability, recyclability, and cost-effectiveness, is also boosting the market expansion

Thermoplastic Carbon Fiber Market Analysis

- The market analysis highlights a shift towards sustainable and recyclable materials, with thermoplastic carbon fiber emerging as a preferred alternative to thermoset composites due to its reprocessability and reduced environmental impact

- Increasing investment in research and development activities to enhance product performance and develop cost-effective manufacturing techniques is further supporting the growth of the thermoplastic carbon fiber market

- North America dominated the thermoplastic carbon fiber market with the largest revenue share in 2024, driven by high adoption in aerospace, automotive, and defense sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global thermoplastic carbon fiber market, driven by rising infrastructure development, increasing demand for consumer electronics, and growing investments in wind energy and aerospace sectors

- The UD Carbon Fiber Tapes segment held the largest market revenue share in 2024, driven by their superior strength-to-weight ratio and widespread use in aerospace and automotive structural components requiring high stiffness and precision performance

Report Scope and Thermoplastic Carbon Fiber Market Segmentation

|

Attributes |

Thermoplastic Carbon Fiber Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion Into Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermoplastic Carbon Fiber Market Trends

Growing Adoption Of Lightweight And Sustainable Materials

• The increasing demand for lightweight, high-strength materials in aerospace, automotive, and energy sectors is driving the adoption of thermoplastic carbon fiber. Its recyclability, fast processing, and superior mechanical properties compared to traditional thermoset composites make it a preferred choice for manufacturers seeking efficiency and performance benefits

• Industries are focusing on reducing carbon footprints and energy consumption, leading to growing preference for thermoplastic composites. Their reprocessability, low VOC emissions, and compatibility with automated manufacturing processes position them as an eco-friendly alternative in sustainability-driven markets worldwide

• Rapid advancements in manufacturing techniques such as automated fiber placement (AFP), compression molding, and 3D printing are enabling mass production of thermoplastic carbon fiber components. These processes reduce labor costs, shorten cycle times, and ensure consistent quality for high-volume applications across diverse sectors

• For instance, in 2024, several electric vehicle (EV) manufacturers integrated thermoplastic carbon fiber into battery enclosures and structural components. This helped lower vehicle weight by up to 30%, enhanced crash safety, and improved energy efficiency, supporting the global transition toward green mobility solutions

• While the trend toward sustainability is boosting demand, manufacturers must focus on scaling production capacity and improving cost efficiency. In addition, maintaining uniform fiber-matrix bonding quality remains crucial for meeting stringent aerospace and automotive certification standards

Thermoplastic Carbon Fiber Market Dynamics

Driver

Rising Demand In Aerospace And Automotive Industries

• The growing emphasis on lightweight materials for fuel efficiency and emission reduction in aerospace and automotive sectors is significantly driving the thermoplastic carbon fiber market. Its high strength-to-weight ratio, corrosion resistance, and recyclability make it ideal for structural and semi-structural applications

• The expansion of electric mobility and autonomous vehicles is accelerating the adoption of advanced composites, with thermoplastic carbon fiber used in body panels, chassis parts, and energy storage systems. This not only reduces weight but also enhances vehicle performance, safety, and fuel economy

• Supportive government regulations targeting emission reductions and safety standards are encouraging OEMs to shift toward sustainable, lightweight materials. This trend is expected to expand further as carbon neutrality targets become a priority across global manufacturing supply chains

• For instance, in 2023, Airbus and Boeing announced increased use of thermoplastic composites in next-generation aircraft designs. Their goal was to minimize assembly costs, accelerate production timelines, and reduce lifecycle emissions through fully recyclable aerospace components

• While demand from key end-use industries continues to grow, developing cost-effective processing technologies remains essential. Research collaborations between universities, composite producers, and OEMs are critical for unlocking economies of scale in this evolving market

Restraint/Challenge

High Production Costs And Limited Recycling Infrastructure

• The complex manufacturing processes and high cost of carbon fiber precursors result in elevated prices for thermoplastic carbon fiber. This cost factor makes it less competitive against metals and thermoset composites in industries with tight profit margins or limited sustainability mandates

• Recycling infrastructure for advanced composites remains underdeveloped, limiting the circularity potential of thermoplastic carbon fiber products despite their inherent reprocessability. Many regions lack industrial-scale facilities capable of reclaiming fibers with consistent mechanical properties for reuse

• Small- and mid-scale manufacturers face technological barriers in integrating automated production techniques, leading to slower commercialization rates. This technology gap restricts them from competing with large corporations that have greater R&D budgets and economies of scale advantages

• For instance, in 2023, several automotive suppliers reported challenges in scaling up thermoplastic composite production due to expensive tooling and limited material availability. These bottlenecks slowed adoption despite rising demand for lightweight materials in electric vehicles

• Addressing cost barriers and developing robust recycling ecosystems are critical for achieving widespread adoption across industries, especially in emerging economies. Public-private partnerships and policy incentives could play a key role in overcoming these structural challenges

Thermoplastic Carbon Fiber Market Scope

The market is segmented on the basis of type, application, and end-use industry.

- By Type

On the basis of type, the thermoplastic carbon fiber market is segmented into Uni-Directional (UD) Carbon Fiber Tapes, Bi-Directional (BD) Carbon Fiber Tapes, and Other Configurations. The UD Carbon Fiber Tapes segment held the largest market revenue share in 2024, driven by their superior strength-to-weight ratio and widespread use in aerospace and automotive structural components requiring high stiffness and precision performance.

The BD Carbon Fiber Tapes segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand in sports equipment, wind turbine blades, and automotive body panels where multi-directional load-bearing capacity and design flexibility are essential for durability and safety.

- By Application

On the basis of application, the thermoplastic carbon fiber market is segmented into Structural Reinforcement, Surface Protection, Electrical Conductivity, Thermal Conductivity, and Others. The Structural Reinforcement segment accounted for the largest revenue share in 2024, driven by its critical role in aerospace fuselage parts, automotive chassis components, and construction materials where lightweight strength is a priority.

The Electrical Conductivity segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising adoption of carbon-fiber-reinforced materials in advanced electronics, energy storage systems, and next-generation electric vehicles requiring lightweight conductive solutions.

- By End-Use Industry

On the basis of end-use industry, the thermoplastic carbon fiber market is segmented into Aerospace, Automotive, Sports and Leisure, Wind Energy, Construction, and Others. The Aerospace segment dominated the market in 2024, supported by increasing use of thermoplastic composites in commercial aircraft, defense applications, and next-generation spacecraft designs to reduce fuel consumption and lifecycle costs.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid electrification of vehicles, demand for lightweight materials in EV batteries and body structures, and stringent regulatory norms targeting emission reductions across global automotive manufacturing.

Thermoplastic Carbon Fiber Market Regional Analysis

- North America dominated the thermoplastic carbon fiber market with the largest revenue share in 2024, driven by high adoption in aerospace, automotive, and defense sectors

- The region’s strong manufacturing base, technological advancements, and stringent emission regulations are accelerating the shift toward lightweight, high-performance materials

- Furthermore, the presence of leading aerospace manufacturers and R&D investments supports sustained market growth in the region

U.S. Thermoplastic Carbon Fiber Market Insight

The U.S. accounted for the majority revenue share in North America in 2024, fueled by growing demand for advanced composites in next-generation aircraft, electric vehicles, and renewable energy applications. Federal policies encouraging sustainable materials and rising defense spending are further boosting demand. In addition, the expansion of automated production technologies is enabling large-scale, cost-effective manufacturing of thermoplastic composites.

Europe Thermoplastic Carbon Fiber Market Insight

Europe’s thermoplastic carbon fiber market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict environmental regulations and the EU’s focus on circular economy initiatives. The growing adoption of lightweight composites in automotive and wind energy sectors is accelerating regional demand. Moreover, partnerships between composite manufacturers and research institutions are fostering innovation and cost optimization across the value chain.

U.K. Thermoplastic Carbon Fiber Market Insight

The U.K. thermoplastic carbon fiber market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of lightweight, high-strength materials in aerospace, automotive, and renewable energy sectors. The country’s advanced engineering base and focus on sustainability are fueling demand for recyclable, performance-enhancing composites. Government incentives for green mobility and continued R&D collaborations between composite manufacturers and academic institutions further support market expansion. In addition, innovative UK ventures—such as Arrival’s use of thermoplastic composites in modular electric vehicle platforms—are raising the profile of local applications and driving broader industry interest.

Germany Thermoplastic Carbon Fiber Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, supported by its automotive and industrial engineering sectors. The country’s emphasis on high-performance materials for electric mobility, along with government-backed sustainability initiatives, is driving growth. In addition, the presence of leading automotive OEMs and material technology firms is fostering research collaborations and commercialization efforts in the region.

Asia-Pacific Thermoplastic Carbon Fiber Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and increasing aerospace and automotive production in China, Japan, and India. Government incentives promoting renewable energy and electric vehicles are further strengthening demand for lightweight composite materials. APAC’s cost advantages and growing manufacturing capabilities are also enabling mass production at competitive pricing.

China Thermoplastic Carbon Fiber Market Insight

China accounted for the largest revenue share in the Asia-Pacific thermoplastic carbon fiber market in 2024, owing to its extensive automotive manufacturing base and rising aerospace investments. The country’s focus on electric mobility and renewable energy infrastructure is boosting demand for high-strength, recyclable composite materials. Furthermore, collaborations with global composite manufacturers are accelerating technology transfer and production capacity expansion.

Japan Thermoplastic Carbon Fiber Market Insight

Japan’s thermoplastic carbon fiber market is expected to witness the fastest growth rate from 2025 to 2032 due to its advanced material technologies and strong presence in automotive and aerospace industries. Increasing demand for sustainable, high-performance materials for electric vehicles and hydrogen mobility projects is driving adoption. In addition, Japan’s emphasis on precision engineering and automated manufacturing processes supports the production of high-quality thermoplastic composites.

Thermoplastic Carbon Fiber Market Share

The Thermoplastic Carbon Fiber industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- Jushi Group Co., Ltd. (China)

- Nippon Electric Glass Co., Ltd. (NEG) (Japan)

- Saint-Gobain Vetrotex (France)

- Chongqing Polycomp International Corporation (CPIC) (China)

- Binani 3B-The Fibreglass Company (India)

- PPG Industries, Inc. (U.S)

- AGY Holding Corp. (U.S.)

- Taishan Fiberglass Inc. (China)

- Johns Manville (U.S.)

- China Beihai Fiberglass Co., Ltd. (China)

- Chomarat Group (France)

- Nitto Boseki Co., Ltd. (Japan)

- Taiwan Glass Ind. Corp. (Taiwan)

- AGC Inc. (Japan)

Latest Developments in Global Thermoplastic Carbon Fiber Market

- In October 2021, Teijin Limited, a leading manufacturer of carbon fibers, announced the development of a new carbon fiber recycling technology called "Eco Circle Solution." This innovative process enables the chemical recycling of thermoset carbon fiber reinforced plastics (CFRPs) into new thermoplastic carbon fiber materials. By recycling and reusing carbon fibers, Teijin aims to contribute to the circular economy and reduce the environmental impact of carbon fiber production and waste

- In September 2021, Hexcel Corporation introduced a new range of thermoplastic carbon fiber prepreg tapes designed for high-volume production of composite parts. The new product line, "HexPly M77," offers enhanced processing characteristics and shorter cycle times than traditional thermoset prepregs. These tapes are specifically targeted at industries such as automotive, aerospace, and industrial applications, where rapid production cycles and cost efficiency are critical factors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermoplastic Carbon Fiber Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoplastic Carbon Fiber Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoplastic Carbon Fiber Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.