Global Thermos Drinkware Market

Market Size in USD Billion

CAGR :

%

USD

4.19 Billion

USD

7.26 Billion

2024

2032

USD

4.19 Billion

USD

7.26 Billion

2024

2032

| 2025 –2032 | |

| USD 4.19 Billion | |

| USD 7.26 Billion | |

|

|

|

|

Thermos Drinkware Market Size

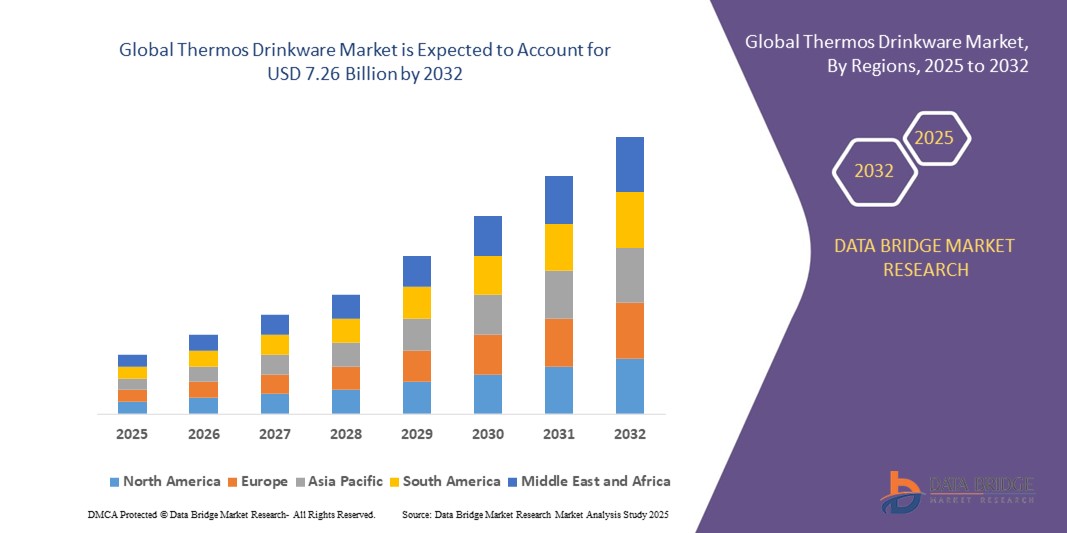

- The global thermos drinkware market size was valued at USD 4.19 billion in 2024 and is expected to reach USD 7.26 billion by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of health, wellness, and sustainability, leading to higher demand for reusable and insulated drinkware for both hot and cold beverages

- Furthermore, rising consumer preference for convenient, portable, and durable beverage containers is driving the adoption of Thermos products across residential, office, and outdoor applications. These factors are accelerating the uptake of premium insulated bottles, tumblers, and mugs, thereby significantly boosting the market’s growth

Thermos Drinkware Market Analysis

- Thermos drinkware includes insulated bottles, tumblers, and mugs designed to maintain beverage temperature, enhance portability, and provide durability for everyday use. Products often feature vacuum insulation, ergonomic designs, and spill-resistant lids, catering to diverse consumer needs

- The escalating demand for Thermos products is primarily fueled by growing health and fitness trends, an increasing preference for sustainable alternatives to disposable cups, and the popularity of on-the-go beverage consumption, making insulated drinkware a practical and lifestyle-oriented solution

- North America dominated thermos drinkware market with a share of 35% in 2024, due to growing health consciousness, a preference for reusable beverage containers, and increasing adoption of sustainable lifestyle products

- Asia-Pacific is expected to be the fastest growing region in the thermos drinkware market during the forecast period due to rising disposable incomes, urbanization, and increasing health and fitness awareness

- Bottles segment dominated the market with a market share of 56.8% in 2024, due to its versatility, portability, and strong consumer preference for carrying beverages on the go. Bottles are widely used across daily commuting, outdoor activities, and fitness routines, making them a staple in personal hydration solutions. Their design often incorporates advanced insulation technology, ensuring temperature retention for both hot and cold beverages, which enhances user convenience. Moreover, bottles are compatible with various caps, filters, and accessories, appealing to a broad range of consumers from students to professionals

Report Scope and Thermos Drinkware Market Segmentation

|

Attributes |

Thermos Drinkware Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermos Drinkware Market Trends

Growing Demand for Sustainable and Reusable Products

- The thermos drinkware market is expanding rapidly in response to increasing consumer demand for sustainable and reusable products. As single-use plastics face bans and restrictions worldwide, reusable insulated bottles and tumblers have emerged as popular choices among environmentally conscious consumers

- For instance, Thermos LLC and Hydro Flask have strengthened their portfolios with eco-friendly drinkware designed from stainless steel and BPA-free materials. These brands emphasize durability, style, and reduced environmental footprint, supporting the shift toward sustainable consumer habits

- The growing popularity of on-the-go lifestyles has also pushed consumers toward premium reusable drinkware. With rising coffee culture, outdoor activities, and gym usage, thermos products serve as functional accessories that reduce reliance on disposable cups and bottles

- In addition, customization and design innovation, such as color variations, personalized engravings, and portability features, are increasing consumer affinity. Sustainable and stylish thermos drinkware is becoming a utility item and also a lifestyle accessory

- Expansion through e-commerce and specialty retail channels is further accelerating adoption. Online platforms allow eco-driven startups and established brands alike to tap into a wide audience seeking alternatives to disposable beverage packaging

- Altogether, the trend towards eco-conscious consumption and regulatory push against single-use plastics is solidifying thermos drinkware’s position as a sustainable choice. Reusable thermos products are becoming mainstream, merging function with lifestyle-driven consumer value propositions

Thermos Drinkware Market Dynamics

Driver

Rising Awareness of Sustainability and Eco-Friendly Products

- The growing awareness of eco-friendly alternatives is becoming a key driver for thermos drinkware demand, as consumers seek long-lasting and sustainable products for everyday use. The shift is reinforced by environmental campaigns and government regulations on reducing waste

- For instance, S’well has positioned itself as a lifestyle brand emphasizing sustainability, offering stylish insulated bottles that resonate with eco-conscious urban consumers. Their branding and wide retail placement highlight the strong connection between sustainability and thermos adoption

- Consumers are increasingly motivated by reducing personal carbon footprints. Reusable thermos bottles are replacing disposable water bottles, aligning with campaigns by NGOs and corporations promoting sustainable living and circular economy practices

- In addition, the wellness and fitness industry is reinforcing the driver by popularizing thermos bottles as hydration essentials. The blend of health consciousness with environmental responsibility makes thermos drinkware a desirable product in both developed and emerging markets

- These factors collectively highlight how sustainability awareness is driving market expansion. Thermos drinkware is evolving into a consumer essential, supported by environmental consciousness, lifestyle trends, and regulatory frameworks banning single-use plastics globally

Restraint/Challenge

Consumer Preference for Lower-Cost Alternatives

- Despite the momentum, consumer preference for low-cost alternatives is a major challenge to the thermos drinkware market. Many consumers, particularly in price-sensitive markets, opt for inexpensive plastic or unbranded reusable bottles rather than premium thermos products

- For instance, brands such as Thermos and Hydro Flask face competition from cheaper local manufacturers in Asia-Pacific, where affordability often outweighs premium features such as durability or insulation. This puts pressure on branded players to adapt pricing strategies without sacrificing quality

- Lower-cost competitors also make it difficult for consumers to distinguish between premium and generic options, slowing adoption of higher-margin branded products. This preference limits brand penetration and market share expansion in emerging economies

- In addition, economic downturns or inflationary pressures amplify this restraint, as consumers cut discretionary spending, prioritizing affordability over sustainability or brand appeal. Such cycles reduce sales in mid- to premium-priced thermos categories

- Addressing these price-driven barriers requires introducing product ranges at multiple price points, strengthening brand education on durability benefits, and leveraging incentives such as corporate gifting or promotional campaigns. Overcoming cost sensitivity will be crucial to broadening global adoption of thermos drinkware

Thermos Drinkware Market Scope

The market is segmented on the basis of product type, material, and distribution channel.

- By Product Type

On the basis of product type, the Thermos drinkware market is segmented into bottles, tumblers, and mugs. The bottles segment dominated the largest market revenue share of 56.8% in 2024, driven by its versatility, portability, and strong consumer preference for carrying beverages on the go. Bottles are widely used across daily commuting, outdoor activities, and fitness routines, making them a staple in personal hydration solutions. Their design often incorporates advanced insulation technology, ensuring temperature retention for both hot and cold beverages, which enhances user convenience. Moreover, bottles are compatible with various caps, filters, and accessories, appealing to a broad range of consumers from students to professionals.

The tumblers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in the coffee culture, office, and casual dining sectors. Tumblers offer a combination of portability and aesthetic appeal, making them popular for premium beverage experiences. Their integration with spill-resistant lids, ergonomic designs, and advanced insulation technology provides a practical and stylish solution for everyday use. In addition, the growing awareness of sustainable alternatives to disposable cups is driving consumer preference for reusable tumblers, accelerating market adoption globally.

- By Material

On the basis of material, the Thermos drinkware market is segmented into stainless steel, plastic, glass, and others. The stainless steel segment dominated the largest market revenue share in 2024, driven by its durability, corrosion resistance, and superior temperature retention capabilities. Stainless steel drinkware is widely favored for both hot and cold beverages, making it a preferred choice among working professionals, travelers, and outdoor enthusiasts. Its sleek and premium appearance, along with compatibility with various beverage types, further strengthens its market dominance. In addition, stainless steel products often include double-wall vacuum insulation, ensuring beverages maintain their temperature for extended periods.

The plastic segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its lightweight nature, cost-effectiveness, and design versatility. Plastic drinkware is increasingly adopted in casual, on-the-go, and sports applications where portability is essential. Its ability to incorporate bright colors, ergonomic shapes, and spill-proof features enhances consumer appeal, particularly among younger demographics. Furthermore, innovations in BPA-free and recyclable plastics are boosting the popularity of plastic drinkware as a sustainable and safe choice.

- By Distribution Channel

On the basis of distribution channel, the Thermos drinkware market is segmented into online and offline. The offline segment dominated the largest market revenue share in 2024, driven by widespread availability in supermarkets, hypermarkets, specialty retail stores, and convenience outlets. Offline channels allow consumers to physically inspect product quality, test usability, and compare designs before purchase, making them a preferred option for higher-value and durable drinkware. Established retail networks and promotional activities, such as in-store discounts and brand showcases, further support offline dominance.

The online segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rapid expansion of e-commerce platforms and the convenience of doorstep delivery. Online channels offer access to a broader product variety, including premium and limited-edition drinkware, which may not be available offline. Features such as customer reviews, easy comparison, and subscription-based purchasing models enhance the online buying experience. Rising smartphone penetration, digital payment adoption, and targeted online marketing campaigns are also accelerating the growth of online distribution for Thermos drinkware globally.

Thermos Drinkware Market Regional Analysis

- North America dominated the thermos drinkware market with the largest revenue share of 35% in 2024, driven by growing health consciousness, a preference for reusable beverage containers, and increasing adoption of sustainable lifestyle products

- Consumers in the region prioritize high-quality, durable, and insulated drinkware that can maintain beverage temperature, making Thermos products a favored choice for daily use, commuting, and outdoor activities

- This widespread adoption is further supported by high disposable incomes, technologically inclined and environmentally aware consumers, and the rising trend of on-the-go beverage consumption

U.S. Thermos Drinkware Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by rising health awareness, a strong coffee culture, and demand for portable, reusable containers. Consumers are prioritizing products that offer superior insulation, durability, and ease of cleaning, which makes Thermos bottles and tumblers highly attractive. The market benefits from both offline and online retail channels, with e-commerce platforms facilitating access to a wider product range, including premium and customizable options. Marketing strategies emphasizing sustainability, lifestyle branding, and convenience are further driving adoption. In addition, the increasing trend of home and office beverage consumption, coupled with the popularity of fitness and wellness routines, continues to boost demand for Thermos drinkware across the country.

Europe Thermos Drinkware Market Insight

The European Thermos drinkware market is projected to grow at a substantial CAGR, driven by heightened awareness of environmental sustainability, reduced use of disposable cups, and a preference for premium, insulated beverage containers. Consumers in the region seek products that combine functionality, design, and eco-friendly features, which promotes adoption across urban and suburban populations. The rising coffee culture, active lifestyles, and demand for convenient on-the-go hydration solutions support growth across residential, office, and commercial applications. In addition, European consumers are increasingly influenced by innovative designs, multifunctionality, and quality certifications, which reinforce the preference for Thermos-branded products. The availability of Thermos drinkware in both traditional retail and online platforms also enhances market penetration.

U.K. Thermos Drinkware Market Insight

The U.K. market is expected to grow at a noteworthy CAGR during the forecast period, supported by rising health consciousness, sustainability awareness, and the convenience offered by reusable drinkware. Consumers increasingly prefer insulated bottles, tumblers, and mugs that can be easily carried for work, school, or outdoor activities. The popularity of fitness, coffee culture, and eco-friendly alternatives to disposable cups drives the market growth further. A robust e-commerce ecosystem allows consumers to access a wide range of Thermos products, including limited-edition and personalized options. Marketing campaigns emphasizing quality, design, and sustainability reinforce brand trust, while on-the-go lifestyles ensure consistent demand across urban centers.

Germany Thermos Drinkware Market Insight

Germany’s Thermos drinkware market is expected to expand at a considerable CAGR, driven by high consumer expectations for durability, performance, and eco-conscious materials. Stainless steel and BPA-free plastic drinkware are particularly popular for their insulation performance and environmental benefits. Consumers favor products that offer functionality, design, and long-term reliability for both daily use and travel. The market growth is further supported by a strong culture of sustainability and health awareness, promoting the use of reusable drinkware over disposable alternatives. In addition, Germany’s advanced retail network, combined with e-commerce adoption, allows broad access to premium and mid-range Thermos products, supporting widespread adoption in homes, offices, and outdoor settings.

Asia-Pacific Thermos Drinkware Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising disposable incomes, urbanization, and increasing health and fitness awareness. Countries such as China, Japan, and India are witnessing a growing trend toward reusable, insulated drinkware for daily hydration and lifestyle purposes. Social media influence, lifestyle marketing, and growing interest in premium products further accelerate adoption. APAC’s emergence as a manufacturing hub for high-quality drinkware ensures affordability and wider availability of products. The popularity of coffee, tea, and fitness beverages, along with government initiatives promoting sustainability, reinforces the increasing consumer preference for Thermos bottles, tumblers, and mugs in the region.

Japan Thermos Drinkware Market Insight

The Japanese market is gaining momentum due to a strong focus on convenience, health, and eco-conscious living. Consumers prefer compact, functional, and durable insulated drinkware suitable for commuting, office, and outdoor use. The country’s coffee and tea culture, combined with fitness and wellness trends, drives steady demand for Thermos products. Integration of stylish designs with high-performance insulation meets the expectations of both younger and aging populations seeking practical solutions. Japan’s tech-savvy and environmentally aware consumers also favor reusable products over disposable alternatives, further supporting market expansion across residential, workplace, and commercial sectors.

China Thermos Drinkware Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by a growing middle class, urbanization, and increasing health and fitness awareness. Consumers show strong preference for portable, durable, and temperature-retentive bottles, tumblers, and mugs for daily use. Expanding online and offline retail networks, coupled with the availability of affordable high-quality products, enhance market penetration. Government initiatives supporting sustainability and eco-friendly lifestyles, alongside domestic manufacturing capabilities, further fuel adoption. The rising coffee and tea culture, along with active lifestyle trends, positions China as a key growth market for Thermos drinkware in the coming years.

Thermos Drinkware Market Share

The thermos drinkware industry is primarily led by well-established companies, including:

- Thermos L.L.C. (U.S.)

- YETI Holding Inc. (U.S.)

- Contigo (U.S.)

- Hydro Flask (U.S.)

- Stanley PMI (U.S.)

- Zojirushi America Corporation (Japan)

- Klean Kanteen (U.S.)

- Camelbak (U.S.)

- Sigg Switzerland AG (Switzerland)

- Tiger Corporation (Japan)

- KINTO Co., Ltd. (Japan)

- Miir (U.S.)

- Mizu Life (U.S.)

- The BlenderBottle (U.S.)

- Igloo (U.S.)

- Ello Products (U.S.)

- Nalgene (U.S.)

Latest Developments in Global Thermos Drinkware Market

- In May 2025, Hydro Flask restocked its popular Micro Hydro Mini Bottle in five new colors, including Surf, Agave, Trillium, Reef, and Aloe. The compact 6.7-ounce bottle features a leakproof lid, wide mouth for ice, and double-wall insulation that keeps beverages hot or cold for up to seven hours. This restock reflects Hydro Flask’s commitment to meeting rising consumer demand for portable, stylish, and functional drinkware, enhancing brand loyalty and supporting growth in the premium reusable bottle segment

- In September 2024, Hydro Flask launched its brand campaign titled "We Make It. You Own It.," emphasizing the company’s focus on high-quality, well-designed drinkware and celebrating how customers personalize and use its products. The campaign aims to strengthen brand identity and deepen consumer engagement by highlighting product versatility and lifestyle integration, ultimately driving market expansion and reinforcing Hydro Flask’s position in the premium segment

- In November 2023, Thermos L.L.C. expanded its Icon Series with the Cooler collection, featuring vacuum insulation technology along with the Griptec Non-Slip Base and True-Coat Finish for durability and ease of use. This extension addresses growing consumer demand for versatile, reliable, and convenient drinkware solutions, reinforcing Thermos L.L.C.’s market leadership and supporting adoption across both residential and on-the-go usage

- In February 2023, Thermos L.L.C. unveiled the Icon Series, introducing a range of hot beverage, food storage, and cold beverage products. Designed with consumer convenience in mind, the series features the Griptec Non-Slip Base and True-Coat finish, ensuring durability and user-friendly handling. This launch reinforced Thermos L.L.C.’s commitment to innovation and practical design, meeting evolving consumer needs and strengthening its market presence

- In January 2023, Xiaomi launched the MIJIA Thermos Flask with a 1.8L capacity, designed for long-term heat retention and cold storage. The flask combines functionality with style, keeping beverages hot at 75°C and cold at 9°C for extended periods. This entry into the thermos drinkware market reflects Xiaomi’s strategy to tap growing consumer demand for high-performance, durable, and portable drinkware solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.