Global Thermoset Composites Market

Market Size in USD Billion

CAGR :

%

USD

18.17 Billion

USD

29.95 Billion

2024

2032

USD

18.17 Billion

USD

29.95 Billion

2024

2032

| 2025 –2032 | |

| USD 18.17 Billion | |

| USD 29.95 Billion | |

|

|

|

|

Thermoset Composites Market Size

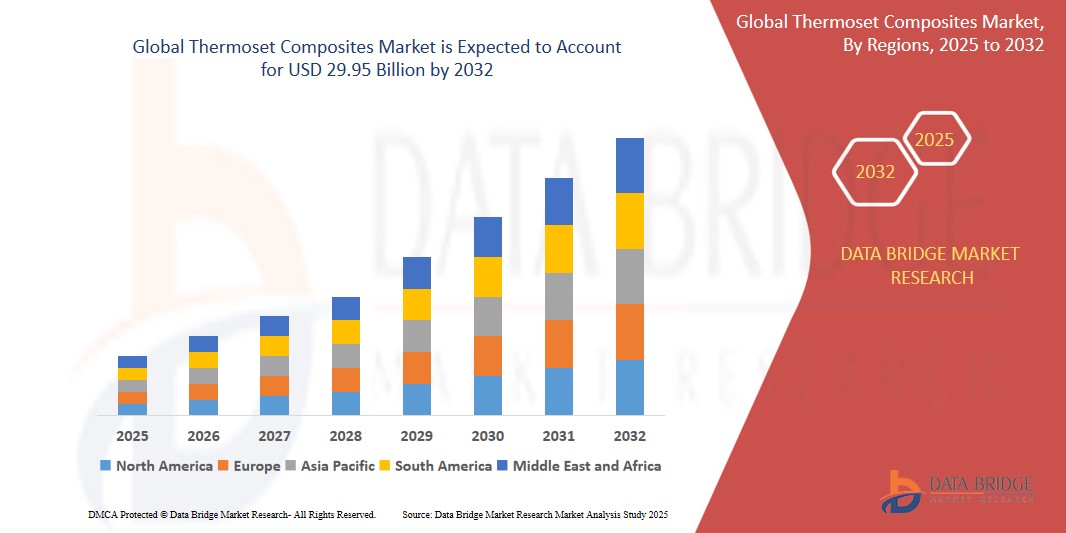

- The Global c was valued at USD 18.17 Billion in 2024 and is expected to reach USD 29.95 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.5%, primarily driven by increasing use of thermoset composites in automotive, aerospace, construction, and electrical & electronics industries, owing to their superior mechanical strength, chemical resistance, and thermal stability

- This growth is further propelled by the expansion of renewable energy projects (especially wind energy), rising infrastructure investments in emerging economies, and a shift toward lightweight and durable materials in transportation and consumer goods

Thermoset Composites Market Analysis

- Thermoset composites are extensively used in the manufacturing of structural components for automotive, aerospace, construction, marine, and electrical & electronics industries due to their superior mechanical strength, chemical resistance, and dimensional stability

- These composites are made by combining thermosetting resins (like epoxy, polyester, and phenolic resins) with reinforcing fibers, offering lightweight, durable, and high-performance solutions ideal for demanding applications such as aircraft panels, automotive body parts, circuit boards, and building facades

- The demand for thermoset composites is significantly driven by increasing urbanization and infrastructure development, the growing need for lightweight and fuel-efficient vehicles, and the expansion of wind energy projects, along with a rising emphasis on corrosion-resistant and low-maintenance materials across industries

Report Scope and Thermoset Composites Market Segmentation

|

Attributes |

Thermoset Composites Key Market Insights |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thermoset Composites Market Trends

“Rising Shift Toward Lightweight and High-Strength Composite Materials”

- Manufacturers are increasingly investing in lightweight, high-performance thermoset composites that offer enhanced mechanical properties, corrosion resistance, and extended lifespan, especially for use in automotive, aerospace, and wind energy sectors.

- Innovation in resin technologies—such as the development of high-temperature-resistant epoxies and low-VOC polyester resins—is driving the market toward more sustainable and application-specific composite solutions.

- For instance, in January 2024, Hexcel Corporation introduced a new generation of epoxy-based thermoset composites designed for aerospace interiors, offering reduced weight and enhanced fire resistance.

- This trend aligns with the global push for energy-efficient materials, reducing carbon footprints while maintaining structural integrity and performance across demanding applications.

Thermoset Composites Market Dynamics

Driver

“Expanding Application of Thermoset Composites in Automotive and Wind Energy Sectors”

- The increased adoption of thermoset composites in vehicle manufacturing is driven by their lightweight nature and structural rigidity, aiding in fuel efficiency and emissions reduction

- In the wind energy sector, these composites are essential for producing large, durable, and weather-resistant turbine blades that ensure long-term operational performance

- For example, in March 2024, LM Wind Power expanded its production of epoxy-based thermoset blades for offshore wind projects, boosting demand for high-performance composite materials

- The growing emphasis on renewable energy infrastructure and lightweight transport solutions continues to boost the global demand for thermoset composites

Opportunity

“Integration of Thermoset Composites in Infrastructure and Electronics”

- The construction industry is increasingly turning to thermoset composites for corrosion-resistant pipelines, rebar, and architectural panels, which reduce maintenance costs and extend service life

- In electronics, thermoset composites are being utilized for printed circuit boards (PCBs), insulating components, and casings due to their electrical insulating properties and thermal stability

- For instance, in February 2024, SABIC launched a thermoset composite-grade epoxy for use in electronic substrates, offering better heat resistance and electrical insulation

- As demand grows for smart infrastructure and durable electronic components, thermoset composites are positioned to capture more applications across these rapidly evolving sectors

Restraint/Challenge

“Recycling Limitations and High Processing Costs”

- Thermoset composites, once cured, cannot be remelted or reshaped, which presents significant challenges in recycling and end-of-life disposal, limiting their adoption in circular economy models

- The complex manufacturing processes, including precise resin-fiber ratios and curing cycles, contribute to higher production costs and limit scalability, especially in price-sensitive markets

- According to a 2023 report by CompositesWorld, the average production cost of aerospace-grade thermoset composites is 30–50% higher than conventional alternatives due to stringent material specifications

- Additionally, the lack of standardized recycling technologies and limited availability of skilled technicians in developing regions remain key obstacles to broader market penetration

Thermoset Composites Market Scope

The market is segmented on the basis of product, raw material, and application.

|

Segmentation |

Sub-Segmentation |

|

By Fibre Type |

|

|

By Resin Type |

|

|

By Manufacturing Process |

|

|

By End-Use |

|

Thermoset Composites Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Thermoset Composites Market”

- Asia-Pacific leads the Global Thermoset Composites Market, supported by its robust manufacturing ecosystem, rapid industrial growth, and strong demand from end-use sectors such as automotive, construction, marine, and electronics

- Accelerated infrastructure development and a rising need for composite materials in the automotive and building industries are major growth drivers in the region

- Countries like China, India, and Japan serve as key markets due to the presence of major chemical manufacturers, favorable government policies, and efficient supply chain networks

- Additionally, the cost efficiency and high mechanical strength of thermoset composites are encouraging their widespread use across industries in the region

“North America is Projected to Register the Highest Growth Rate”

- North America is anticipated to witness the fastest growth in the thermoset composites market, driven by advanced resin technologies and rising demand for lightweight, durable materials in automotive, aerospace, and construction sectors

- The U.S. is a key contributor, supported by a well-established industrial base, innovative production capabilities, and significant consumption of high-performance resins in automotive and marine applications

- Enhanced research and development investments, along with the presence of major players like Dow, BASF, Huntsman, and 3M, continue to fuel regional market expansion

Thermoset Composites Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Owens Corning.

- TORAY INDUSTRIES, INC.

- JEC Group.

- Hexcel Corporation

- Mitsubishi Chemical Corporation.

- Teijin Aramid B.V.

- SGL Carbon

- Huntsman International LLC.

- Arkema

- PPG Industries, Inc.

- Solvay

- TAEKWANG INDUSTRIAL CO., LTD.

- Carbon Mods

- Hexion.

- Johns Manville.

- AGY

- Quantum Composites

- Plasan Carbon Composites

- Gaffco Ballistics

- KINECO – KAMAN

Latest Developments in Global Thermoset Composites Market

- In March 2024, Hexcel Corporation announced the expansion of its carbon fiber and prepreg production capacity at its plant in Utah, USA. This move aims to meet the rising demand for high-performance thermoset composites used in aerospace and defense applications, particularly for lightweight structural components

- In October 2023, SGL Carbon inaugurated a new composite production line in Germany focused on thermoset-based materials for automotive and industrial applications. This investment is part of the company’s broader strategy to increase output of glass and carbon fiber-reinforced thermoset composites, supporting the shift towards lightweight mobility solutions and renewable energy infrastructure

- In February 2024, Toray Industries, Inc. launched a new line of high-heat-resistant epoxy thermoset composites targeting electric vehicle (EV) battery enclosures and underbody protection systems. The new materials offer enhanced fire resistance and mechanical integrity, supporting the growing demand for safer, lightweight EV components.

- In September 2023, Owens Corning expanded its glass fiber reinforcement capacity in India to support increasing regional demand for thermoset composites in infrastructure and wind energy applications. The expansion aims to improve supply chain responsiveness and promote sustainable construction materials in Asia-Pacific markets.

- In May 2023, Huntsman Corporation unveiled its latest Araldite thermoset resin system designed for fast-curing industrial applications, including aerospace interiors, marine structures, and consumer goods. The system improves productivity by reducing curing time while maintaining high mechanical performance and chemical resistance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thermoset Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thermoset Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thermoset Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.