Global Thin Insulation Market

Market Size in USD Billion

CAGR :

%

USD

2.55 Billion

USD

4.16 Billion

2024

2032

USD

2.55 Billion

USD

4.16 Billion

2024

2032

| 2025 –2032 | |

| USD 2.55 Billion | |

| USD 4.16 Billion | |

|

|

|

|

Thin Insulation Market Size

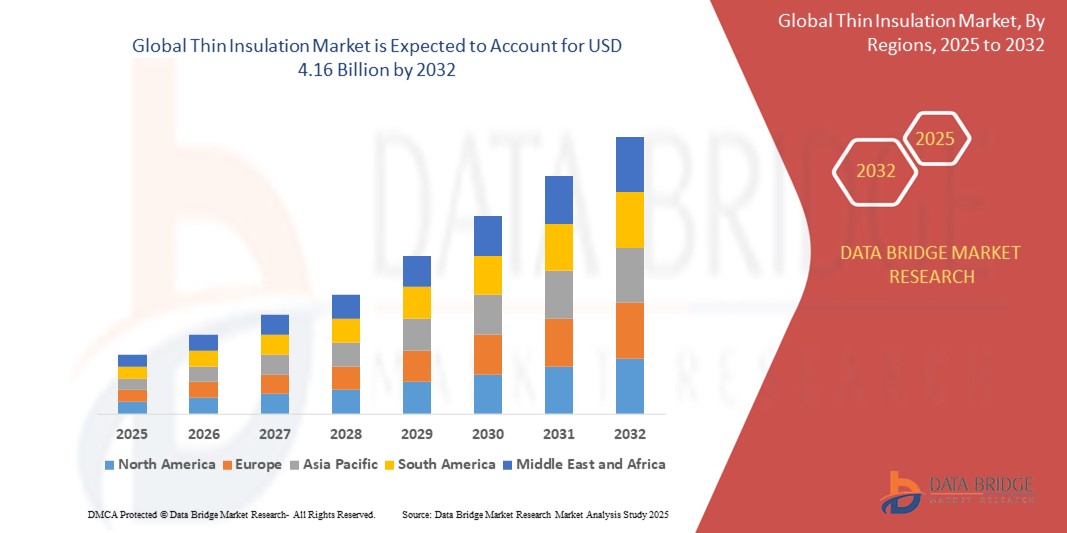

- The global thin insulation market size was valued at USD 2.55 billion in 2024 and is expected to reach USD 4.16 billion by 2032, at a CAGR of 6.3% during the forecast period

- The market growth is primarily driven by increasing demand for energy-efficient building solutions, advancements in lightweight and high-performance insulation materials, and growing adoption in automotive and industrial applications

- Rising awareness of sustainable construction practices and stringent energy efficiency regulations are further propelling the demand for thin insulation solutions, positioning them as a preferred choice for modern thermal management systems

Thin Insulation Market Analysis

- Thin insulation materials, known for their high thermal resistance in compact forms, are critical for energy-efficient solutions in construction, automotive, and industrial sectors, offering superior performance with minimal thickness

- The surge in demand is fueled by the global push for energy conservation, rapid urbanization, and the need for lightweight, space-saving insulation in advanced applications such as electric vehicles and thermal packaging

- Asia-Pacific dominated the thin insulation market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, booming construction activities, and strong manufacturing bases in countries such as China, Japan, and India

- North America is expected to be the fastest-growing region during the forecast period, attributed to increasing investments in green building initiatives, stringent energy regulations, and technological advancements in insulation materials

- The foams segment dominated the largest market revenue share of 38.2% in 2024, driven by its widespread use in construction, automotive, and oil & gas industries due to excellent thermal resistivity, ease of installation, and cost-effectiveness

Report Scope and Thin Insulation Market Segmentation

|

Attributes |

Thin Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thin Insulation Market Trends

“Increasing Integration of Advanced Materials and Technologies”

- The global thin insulation market is experiencing a significant trend toward the integration of advanced materials and technologies, such as aerogels, vacuum insulation panels (VIPs), and nanotechnology-based insulators

- These materials enable superior thermal resistance with minimal thickness, optimizing energy efficiency in space-constrained applications such as building thermal insulation, automotive, and thermal packaging

- Advanced technologies, such as reflective foils and bio-based aerogels, allow for enhanced insulation performance, addressing the growing demand for sustainable and energy-efficient solutions

- For instance, companies are developing silica aerogel-based insulation for high-performance applications in aerospace and construction, offering ultra-low thermal conductivity and lightweight properties

- This trend enhances the value proposition of thin insulation systems, making them increasingly attractive for industries such as construction, automotive, and oil & gas, where space and efficiency are critical

- Advanced materials can provide dynamic thermal regulation, adapting to environmental conditions, which further improves their applicability across diverse sectors

Thin Insulation Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Solutions”

- The increasing consumer and regulatory demand for energy-efficient building materials and sustainable construction practices is a major driver for the global thin insulation market

- Thin insulation systems enhance energy conservation by providing high thermal resistance in compact forms, ideal for applications such as building thermal insulation, thermal packaging, and automotive components

- Government mandates, particularly in regions such as Europe with strict energy efficiency regulations, are contributing to the widespread adoption of thin insulation materials

- The proliferation of green building initiatives and advancements in manufacturing processes are further enabling the expansion of thin insulation applications, offering cost-effective and eco-friendly solutions

- Manufacturers are increasingly incorporating recyclable and bio-based materials, such as cellulose-based aerogels, to meet consumer expectations and enhance sustainability

Restraint/Challenge

“High Cost of Advanced Materials and Regulatory Compliance”

- The substantial initial investment required for advanced materials such as aerogels and vacuum insulation panels, along with their complex manufacturing processes, can be a significant barrier to adoption, particularly in emerging markets

- Integrating thin insulation materials into existing structures or vehicles can be technically challenging and costly, limiting scalability for some application

- In addition, environmental and regulatory compliance poses a major challenge. The production and disposal of certain insulation materials, such as plastic foams, raise concerns about environmental impact and adherence to stringent sustainability standards.

- The fragmented regulatory landscape across different countries regarding environmental impact, material safety, and waste management complicates operations for international manufacturers and service providers

- These factors can deter potential buyers and limit market expansion, particularly in regions with high cost sensitivity or stringent environmental regulations

Thin Insulation market Scope

The market is segmented on the basis of type, materials, and application.

- By Type

On the basis of type, the global thin insulation market is segmented by type into sheets and films, vacuum insulation panels (VIP), coatings, foils, foams, and others. The foams segment dominated the largest market revenue share of 38.2% in 2024, driven by its widespread use in construction, automotive, and oil & gas industries due to excellent thermal resistivity, ease of installation, and cost-effectiveness. Plastic foams, such as expanded polystyrene (EPS) and polyurethane, are particularly favored for their versatility in applications requiring thicknesses of 10mm to 20mm.

The vacuum insulation panels (VIP) segment is expected to witness the fastest growth rate of 8.1% from 2025 to 2032, fueled by their exceptional thermal resistance and thin profile, making them ideal for high-performance energy-efficient buildings and refrigeration systems. Increasing adoption in space-constrained applications, such as automotive and thermal packaging, further accelerates demand.

- By Materials

On the basis of materials, the global thin insulation market is segmented by materials into aerogels, silica aerogels, metals, plastic foams, fiberglass, and others. The plastic foams segment dominated with a market revenue share of 32.7% in 2024, owing to their affordability, ease of installation, and versatility across residential and commercial construction, automotive, and industrial applications. Materials such as EPS, XPS, and polyurethane foams are widely used for their thermal and acoustic insulation properties.

The aerogels segment is anticipated to experience the fastest growth rate of 9.2% from 2025 to 2032, driven by their ultra-lightweight composition, superior insulating properties, and increasing affordability. Their adoption in high-performance applications across aerospace, automotive, and construction industries, particularly in Asia-Pacific and North America, supports this growth.

- By Application

On the basis of application, the global thin insulation market is segmented by application into building thermal insulation, thermal packaging, automotive, wires and cables, pipe coatings, and others. The building thermal insulation segment held the largest market revenue share of 35.6% in 2024, driven by the global surge in construction activities, rapid urbanization, and stringent energy efficiency regulations. Thin insulation materials are favored for their ability to provide superior insulation without compromising space, particularly in residential and commercial buildings in Asia-Pacific.

The automotive segment is expected to witness the fastest growth rate of 7.8% from 2025 to 2032, fueled by the increasing use of thin insulation materials such as aerogels and plastic foams to enhance energy efficiency, reduce noise, and maintain interior temperatures in vehicles. The growing demand for electric vehicles (EVs) and lightweight insulation solutions in North America further boosts this segment.

Thin Insulation Market Regional Analysis

- Asia-Pacific dominated the thin insulation market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, booming construction activities, and strong manufacturing bases in countries such as China, Japan, and India

- Consumers prioritize thin insulation solutions for enhanced thermal efficiency, space-saving designs, and environmental sustainability, particularly in regions with diverse climatic conditions and stringent building regulations

- Growth is supported by advancements in insulation technologies, such as aerogels and vacuum insulation panels (VIPs), alongside rising adoption in building thermal insulation, automotive, and thermal packaging applications

U.S. Thin Insulation Market Insight

The U.S. leads the North America thin insulation market, which is the fastest-growing region in 2024, driven by strong demand for energy-efficient building materials and automotive applications. Increasing consumer awareness of thermal efficiency and sustainability, coupled with stringent energy regulations, fuels market growth. The trend toward green building certifications and advanced insulation materials such as aerogels and VIPs further boosts both OEM and aftermarket segments.

Europe Thin Insulation Market Insight

The Europe thin insulation market is experiencing significant growth, supported by regulatory focus on energy efficiency and sustainable construction. Consumers demand insulation solutions that enhance thermal performance while maintaining space efficiency. Growth is notable in building thermal insulation and automotive applications, with countries such as Germany and France leading due to strong environmental policies and urban development.

U.K. Thin Insulation Market Insight

The U.K. market is expected to witness rapid growth, driven by demand for energy-efficient insulation in residential and commercial buildings. Increased focus on reducing carbon footprints and improving thermal comfort in urban settings encourages adoption. Evolving building regulations and consumer interest in sustainable materials such as fiberglass and aerogels further support market expansion.

Germany Thin Insulation Market Insight

Germany is anticipated to experience robust growth in the thin insulation market, attributed to its advanced construction and automotive sectors. Consumers prioritize high-performance insulation materials such as silica aerogels and VIPs for energy efficiency and reduced fuel consumption in vehicles. Integration of these materials in premium buildings and automotive applications drives sustained market growth.

Asia-Pacific Thin Insulation Market Insight

The Asia-Pacific region dominated the global thin insulation market revenue share of 87.7% in 2024, propelled by expanding construction, automotive production, and rising disposable incomes in countries such as China, India, and Japan. Growing awareness of energy efficiency, thermal packaging, and vehicle insulation boosts demand. Government initiatives promoting sustainable construction and energy conservation further accelerate the adoption of advanced thin insulation materials.

Japan Thin Insulation Market Insight

Japan’s thin insulation market is expected to grow rapidly due to strong consumer demand for high-quality, technologically advanced insulation solutions that enhance energy efficiency and thermal comfort. The presence of major automotive and construction industries, coupled with the integration of materials such as aerogels and foams in OEM applications, drives market penetration. Aftermarket demand for sustainable insulation also contributes to growth.

China Thin Insulation Market Insight

China holds the largest share of the Asia-Pacific thin insulation market, driven by rapid urbanization, increasing construction activities, and growing demand for energy-efficient solutions. The country’s expanding middle class and focus on sustainable infrastructure support the adoption of advanced materials such as VIPs and plastic foams. Strong domestic manufacturing and competitive pricing enhance market accessibility.

Thin Insulation Market Share

The thin insulation industry is primarily led by well-established companies, including:

- ACTIS INSULATION LTD (U.K.)

- BASF SE (Germany)

- Kingspan Group (U.K.)

- Owens Corning (U.S.)

- Johns Manville. A Berkshire Hathaway Company (U.S.)

- Saint-Gobain (France)

- Huntsman International LLC (U.S.)

- UNILIN Insulation (Ireland)

- ROCKWOOL A/S (Denmark)

- 3M (U.S.)

- Continental AG (Germany)

- BNZ Materials (U.S.)

What are the Recent Developments in Global Thin Insulation Market?

- In May 2025, Evonik Industries AG introduced an advanced aerogel-based insulation material for aircraft, designed to significantly enhance thermal efficiency. This innovative solution boasts ultra-low thermal conductivity while achieving up to 30% weight reduction compared to conventional insulation. By minimizing aircraft weight, it directly contributes to improved fuel efficiency and lower emissions, aligning with the aviation industry's sustainability goals. The material's cutting-edge properties make it a valuable addition to modern aircraft design, supporting airlines in their pursuit of greener operations

- In April 2025, Boyd Corporation unveiled advanced multi-functional insulation panels tailored for regional jets. These innovative panels integrate thermal, acoustic, and vibration control, enhancing aircraft efficiency while simplifying installation. By reducing maintenance costs for operators, they contribute to improved operational reliability and sustainability. Designed to optimize comfort and performance, these panels reflect Boyd Corporation’s commitment to cutting-edge aerospace solutions

- In April 2024, SA-Dynamics introduced a groundbreaking innovation in sustainable materials with the development of bio-based and recyclable insulation textiles. These advanced textiles, made from 100% bio-based aerogel fibers, offer superior insulation while significantly reducing environmental impact. Designed to replace fossil-based materials, they contain up to 90% air trapped in nano-pores, ensuring high thermal efficiency. This development aligns with global sustainability efforts, providing an eco-friendly alternative for various industries. SA-Dynamics' commitment to green technology has earned recognition, including an innovation award at Techtextil

- In November 2023, Audia Elastomers introduced its OP line of thermoplastic elastomers (TPEs), crafted from marine waste plastics. These innovative materials contain up to 45% marine waste and 70% total recycled content, offering a sustainable alternative for various applications, including insulation. By repurposing ocean-bound plastics, Audia Elastomers supports environmental conservation while maintaining high-performance standards. The OP line enhances design flexibility and durability, making it a valuable choice for industries prioritizing sustainability. This development aligns with the growing demand for eco-friendly materials.

- In June 2023, Aspen Aerogels, Inc. inaugurated a cutting-edge engineering and rapid prototyping facility in Marlborough, Massachusetts. This 59,000-square-foot Advanced Thermal Barrier Center (ATBC) serves as a hub for developing next-generation aerogel insulation solutions. The facility enhances Aspen’s ability to optimize thermal barriers for battery packs, supporting advancements in eMobility and energy storage systems. By fostering innovation and collaboration, this investment reinforces Aspen Aerogels’ commitment to sustainability and electrification

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thin Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thin Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thin Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.