Global Thyristors Market

Market Size in USD Billion

CAGR :

%

USD

1.49 Billion

USD

2.50 Billion

2024

2032

USD

1.49 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Thyristors Market Size

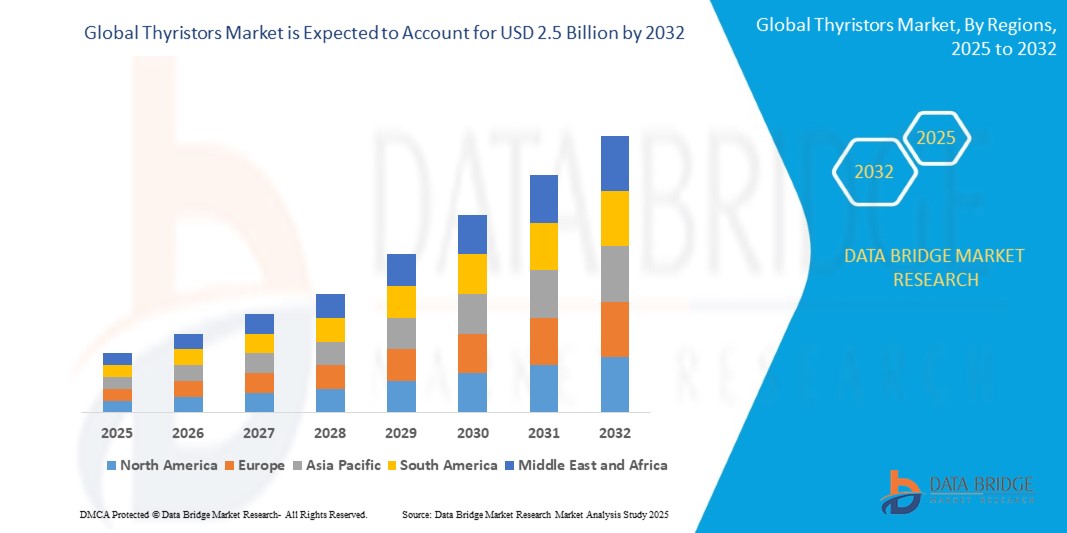

- The global thyristors market size was valued at USD 1.49 Billion in 2024 and is expected to reach USD 2.5 Billion by 2032, at a CAGR of 7.7% during the forecast period

- The Global Thyristors Market's growth is driven by increasing demand for efficient power control in industrial automation, electric vehicles, and high-voltage power transmission systems.

Thyristors Market Analysis

The global thyristors market is experiencing steady growth, driven by the increasing global demand for efficient power management, high-voltage switching, and reliable electronic control in a variety of applications including power electronics, industrial automation, renewable energy, electric vehicles (EVs), consumer electronics, and utility infrastructure. As industries continue to prioritize energy efficiency and miniaturization, thyristors are gaining prominence due to their high current-carrying capability, thermal stability, and cost-effectiveness in controlling large amounts of power.

A primary driver of market growth is the global push toward electrification and renewable energy integration. Thyristors play a critical role in power conversion and control systems for solar inverters, wind turbines, and smart grids, making them vital components in the transition to cleaner energy sources. Their ability to handle high voltages and fast switching is also essential for grid stability and power factor correction.

The rapid expansion of electric vehicles and rail transportation is another key contributor. Thyristors are widely used in EV chargers, battery management systems, and motor drives due to their ability to regulate current flow and improve energy efficiency. In railway traction systems, they facilitate smooth and efficient power control, reducing mechanical wear and improving safety.

In industrial settings, thyristors are deployed in motor speed controllers, light dimmers, welding machines, and HVAC systems, where their reliability and durability are valued in high-stress, high-temperature environments. Their widespread use in consumer appliances such as washing machines, microwave ovens, and induction cookers also supports market demand, especially in emerging economies.

Technological advancements, including the development of Gate Turn-Off (GTO) thyristors, Bidirectional Triacs, and Silicon-Controlled Rectifiers (SCRs), are expanding application areas and improving efficiency and control. Moreover, the increasing adoption of smart manufacturing and Industry 4.0 initiatives is expected to further drive demand for thyristor-based solutions.

However, the market faces challenges such as competition from newer semiconductor technologies like IGBTs (Insulated Gate Bipolar Transistors) and MOSFETs, which offer faster switching and higher efficiency in low-to-medium voltage applications. Additionally, price fluctuations in raw materials, particularly silicon, and complex thermal management requirements may limit widespread adoption in certain cost-sensitive or compact design scenarios.

Despite these challenges, the market outlook remains positive. Increasing investments in high-voltage transmission infrastructure, the global shift toward electrified transport, and continued demand for robust and affordable power electronics are expected to sustain market momentum. Government initiatives supporting green energy, industrial digitalization, and infrastructure modernization are also providing favorable conditions for thyristor manufacturers.

As power electronics become more integrated into daily life and industrial operations, the Global Thyristors Market is poised for continued growth, innovation, and expanded use across a range of high-impact sectors.

Report Scope and Thyristors Market Segmentation

|

Attributes |

Thyristors Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Thyristors Market Trends

Increasing adoption in electric vehicles (EVs) and rail traction systems

- The increasing adoption of thyristors in electric vehicles (EVs) and rail traction systems is a major trend driving growth in the global thyristors market. As the world shifts toward electrified transportation, there is growing demand for power electronic components that can handle high voltages and currents with precision and reliability. Thyristors, particularly Silicon Controlled Rectifiers (SCRs) and Gate Turn-Off (GTO) thyristors, play a critical role in managing power flow in EVs and rail applications due to their ability to efficiently switch and control large electrical loads.

- In electric vehicles, thyristors are used in various subsystems such as on-board chargers (OBCs), battery management systems (BMS), DC-DC converters, and motor controllers. Their robustness and high efficiency make them ideal for fast charging infrastructure and powertrain applications where thermal stability and high current handling are essential. As EVs move toward higher voltage architectures (e.g., 800V systems), the need for reliable high-voltage switching devices like thyristors becomes even more pronounced.

- Similarly, in the rail industry, thyristors are a key component in traction converters and inverters that control the motors of electric locomotives and metro trains. They also enable regenerative braking, where kinetic energy is converted back into electrical energy and returned to the grid, improving energy efficiency and reducing operational costs. The electrification of rail networks, especially in countries focusing on sustainable transport, has led to a surge in the demand for power electronics solutions like thyristors.

- Overall, the rising adoption of EVs and electric rail systems is creating strong and sustained demand for advanced thyristors that offer high performance, durability, and compactness. This trend is expected to continue accelerating as global investments in green transportation and renewable-powered transit systems grow.

Thyristors Market Dynamics

Driver

Rising Demand for Energy-Efficient Power Electronics

- The rising demand for energy-efficient power electronics is one of the primary drivers fueling growth in the global thyristors market. As industries, governments, and consumers increasingly focus on reducing energy consumption and improving system efficiency, the role of advanced power semiconductor devices like thyristors has become critical. These components are designed to control and convert electrical power efficiently, making them essential in applications where high current and voltage levels must be managed with minimal energy loss.

- Thyristors are particularly valuable in systems that require precise switching, thermal stability, and low conduction losses, such as motor drives, lighting controls, HVAC systems, and power converters. In industrial settings, they are used to regulate large machinery and equipment, allowing for better energy management and reduced operational costs. Their ability to switch rapidly and handle substantial power loads enables more efficient operation of systems that were previously dependent on mechanical relays or less efficient semiconductor devices.

- This shift is also driven by growing environmental regulations and sustainability goals. Governments and corporations worldwide are promoting the adoption of energy-efficient technologies through incentives and mandates, further boosting the demand for power electronics built on thyristor technology. Whether it’s improving the efficiency of consumer appliances or supporting renewable energy integration into power grids, thyristors play a vital role in advancing global energy efficiency objectives.

- As a result, the push for greener and more efficient energy systems is not only increasing the adoption of thyristors in traditional sectors but is also opening new opportunities in emerging markets such as electric mobility, smart buildings, and digital infrastructure.

Restraint/Challenge

Struggle with high-frequency operations and complex switching requirements

- Thyristors, while highly effective in handling high voltage and current, are inherently limited when it comes to high-frequency operations and complex switching requirements. This technical limitation arises from their basic turn-on and turn-off characteristics. Unlike modern semiconductor devices such as MOSFETs and IGBTs, thyristors require the current flowing through them to fall to zero before they can switch off. This means they cannot be easily turned off through a gate signal, which significantly restricts their use in circuits where rapid or repeated switching is needed.

- In high-frequency applications such as those in DC-DC converters, high-speed inverters, and radio frequency systems the ability to switch devices on and off quickly and efficiently is crucial for maintaining performance, minimizing losses, and reducing heat. Thyristors, due to their relatively slow switching speeds and limited control flexibility, are not suitable for these environments. Their slow recovery time and long turn-off durations can lead to performance bottlenecks, electromagnetic interference (EMI), and efficiency drops when used in systems requiring rapid switching.

- Moreover, modern applications such as electric vehicle powertrains, advanced motor drives, and precision medical equipment demand semiconductor devices that support pulse-width modulation (PWM) and complex timing control, which thyristors are not inherently designed to handle. Their inability to efficiently operate at these higher frequencies makes them less desirable in cutting-edge electronics that require compact, lightweight, and high-performance solutions.

- As a result, many manufacturers and system designers are opting for more advanced alternatives like IGBTs and wide-bandgap semiconductors (e.g., SiC and GaN), which offer superior switching speed, efficiency, and thermal performance in high-frequency environments. This technological shift presents a notable restraint on the broader adoption of thyristors in emerging applications.

Thyristors Market Scope

The market is segmented on the basis of Power Rating, Type, and Application.

- By Power Rating

The global thyristors market, segmented by power rating into Below 500 MW, 500–999 MW, and 1,000 MW and above, addresses diverse energy control needs across industrial and utility sectors. The Below 500 MW category encompasses low-to-medium power applications such as motor drives, HVAC systems, domestic appliances, and smaller renewable energy projects, where compact and cost-effective thyristor solutions are used for efficient power regulation. The 500–999 MW range targets mid-scale infrastructure, including medium-sized power plants, EV charging stations, and large industrial complexes, requiring robust, high-current thyristor modules. The 1,000 MW and above segment caters to large-scale power generation and transmission systems such as HVDC interconnects, large utility grids, and major renewable energy farms where thyristors are essential for high-voltage switching, grid stabilization, and power flow control. This segmentation reflects the wide-ranging adaptability of thyristor technology across low-power and high-capacity energy conversion applications.

- By Type

The global thyristors market, segmented by type into Gate-Commutated Thyristor (GCT), Integrated Gate-Commutated Thyristor (IGCT), Gate Turn-Off Thyristor (GTO), Silicon-Controlled Rectifier (SCR), Triacs, and Unidirectional & Bidirectional Thyristors, reflects the broad range of switching and power control needs across various applications. GCTs and IGCTs are used in high-power and high-efficiency applications such as industrial drives and HVDC transmission systems, where fast switching and low conduction loss are critical. GTOs, capable of being turned on and off by gate signals, are employed in electric traction, power inverters, and heavy-duty motor control systems. The SCR, one of the most widely used thyristors, dominates in applications requiring controlled rectification, such as in power supplies, battery chargers, and welding machines. Triacs are favored for AC switching and light dimming in consumer electronics and home appliances due to their bidirectional current capability. Unidirectional and bidirectional thyristors offer design flexibility for low- to mid-power control systems. Each type serves distinct voltage, current, and control requirements, underlining the versatility of thyristors in modern power electronics.

- By Application

The global thyristors market, segmented by application into Industrial and Manufacturing, Consumer Electronics, Telecommunications, Automotive, Aerospace and Defense, Healthcare, and Power Transmission and Utilities, highlights the diverse use of thyristor technology across sectors requiring precise power control and high efficiency. In industrial and manufacturing, thyristors are crucial for motor drives, welding equipment, and automation systems, ensuring efficient control of heavy machinery. Consumer electronics utilize thyristors in devices like dimmers, power tools, and household appliances for compact and reliable AC switching. In telecommunications, they play a role in surge protection and power regulation of sensitive communication equipment. The automotive sector integrates thyristors in EV powertrains, battery charging systems, and power inverters, supporting the growing shift toward electrification. Aerospace and defense applications demand rugged thyristors for aircraft systems, radar, and military-grade power electronics where performance under extreme conditions is essential. In healthcare, thyristors are used in imaging equipment and precise medical devices requiring stable and controlled power delivery. Finally, power transmission and utilities represent a major market, using high-power thyristors for grid stability, HVDC transmission, and smart grid technologies, where they enable efficient and reliable energy flow over long distances.

Thyristors Market Regional Analysis

North America

North America leads the global thyristors market, propelled by strong investment in industrial automation, renewable energy, and heavy-duty power infrastructure. Major utilities are upgrading transmission systems with HVDC and smart grid technologies that rely on thyristor-based converters and switching modules. The rise of electric vehicle (EV) charging networks and railway electrification also contributes significantly, as thyristors play a vital role in controlling high-current charging and traction systems. Established semiconductor manufacturers and supportive R&D environments in the U.S. and Canada ensure continuous innovation in compact, high-efficiency thyristor devices. Despite increasing competition from IGBT and SiC technologies, North America remains a key region where thyristors maintain significant relevance in high-power applications.

Europe

Europe plays a crucial role in the global thyristors market, driven by its aggressive push toward renewable energy integration, smart grid upgrades, and electrification of rail systems. Countries such as Germany, France, and the UK are heavily investing in wind and solar power plants, where thyristor-based converters are essential for efficient power regulation and grid management. The region’s commitment to decarbonization and strong energy efficiency mandates has accelerated the deployment of HVDC systems and power electronics incorporating high-performance thyristors. Additionally, Europe's focus on industrial automation and factory modernization is increasing demand for robust motor control solutions, further solidifying the importance of thyristor technology in regional energy and manufacturing ecosystems.

Asia Pacific

Asia Pacific is the fastest-growing region in the global thyristors market, accounting for a significant share of the overall revenue. The growth is fueled by rapid industrialization, urban expansion, and increasing energy demands across countries such as China, India, Japan, and South Korea. Governments in the region are heavily investing in renewable energy projects and HVDC transmission systems, both of which require high-performance thyristor modules for efficient energy conversion and control. The region is also witnessing a surge in electric vehicle adoption and the expansion of railway electrification programs, further driving demand for robust power electronic components like thyristors. Additionally, Asia Pacific benefits from strong local manufacturing ecosystems and the presence of several key semiconductor players, which supports cost-effective production and technological advancement in thyristor technologies.

Latin America

Latin America’s thyristors market is steadily growing, driven by expanding renewable energy installations particularly solar and wind farms and ongoing modernization of industrial and power infrastructure. Countries such as Brazil, Chile, and Argentina are integrating HVDC systems and solar inverter technologies, where thyristor converters play a crucial role in power regulation and grid stability. The electrification of transport and rail systems in urban centers, coupled with increased demand for energy-efficiency in mining and manufacturing, is also fueling adoption. However, market expansion faces challenges from periodic economic volatility, slower regulatory progress, and limited local production capacity. Nonetheless, planned utility upgrades and green-energy initiatives present compelling opportunities for continued regional market development.

Middle East and Africa

The Middle East and Africa (MEA) region is witnessing a growing demand for thyristors, particularly driven by large-scale energy infrastructure and industrial modernization initiatives. Significant investment in solar and wind power projects in the Gulf Cooperation Council (GCC) countries, alongside grid upgrades in South Africa, requires robust power electronics like thyristors for efficient voltage regulation and high-capacity power conversion. Additionally, rising automation in oil & gas, manufacturing, and petrochemical sectors is increasing the need for precise motor control and energy management systems that rely on thyristor technology. While adoption is still emerging, government programs focused on sustainability and industrial diversification are laying the groundwork for meaningful growth in thyristor applications across the MEA market.

Thyristors Market Share

The global thyristors industry is primarily led by well-established companies, including:

- ABB Ltd.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Renesas Electronics Corporation

- Semikron International GmbH

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

- Hitachi Ltd.

- IXYS Corporation

- Sanken Electric Co., Ltd.

- SanRex Corporation

- Dynex Semiconductor Ltd.

Latest Developments in Global Thyristors Market

- In April 2024, ABB Ltd. launched a new IGCT-based high-power converter system for industrial drive applications and renewable energy integration, significantly enhancing energy efficiency and system reliability in solar and wind farms

- In December 2023, Infineon Technologies AG introduced next-generation silicon-controlled rectifiers (SCRs) and SiC-based thyristors under its CoolSiC™ brand, optimized for EV inverters, fast-charging stations, and power grid applications

- In February 2024, Mitsubishi Electric Corporation unveiled a new 3.3 kV IGCT module targeting railway traction and industrial automation systems, alongside expanded production capacity in Fukuoka to meet rising demand in Asia and Europe

- In May 2024, STMicroelectronics formed a strategic development partnership with Schneider Electric to co-create thyristor-based AC power controllers for smart industrial grids and energy storage systems, incorporating digital twin simulations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Thyristors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Thyristors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Thyristors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.