Global Tillage Equipment Market

Market Size in USD Billion

CAGR :

%

USD

9.59 Billion

USD

15.51 Billion

2024

2032

USD

9.59 Billion

USD

15.51 Billion

2024

2032

| 2025 –2032 | |

| USD 9.59 Billion | |

| USD 15.51 Billion | |

|

|

|

|

Global Tillage Equipment Market Size

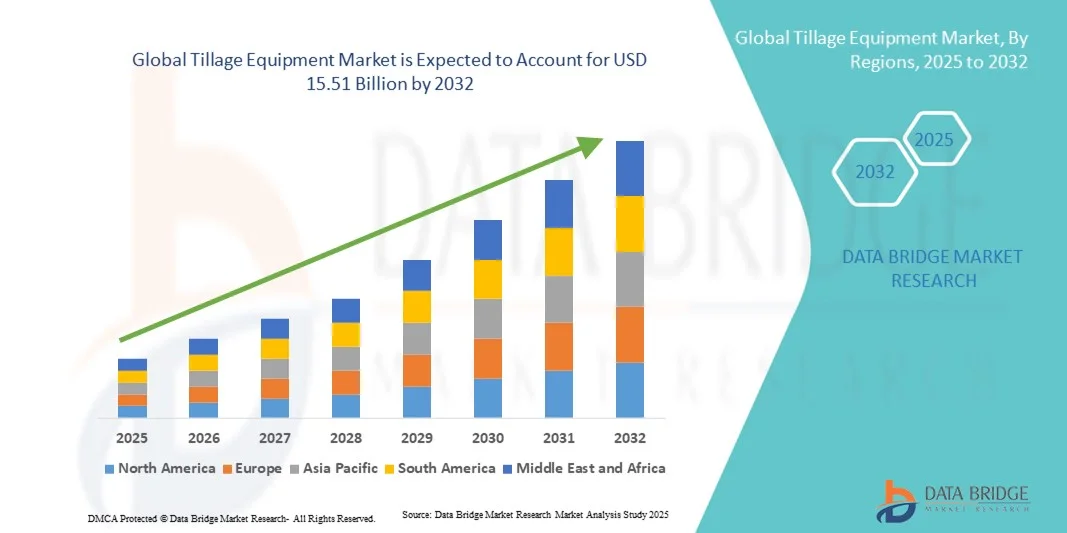

- The global Tillage Equipment Market size was valued at USD 9.59 billion in 2024 and is projected to reach USD 15.51 billion by 2032, exhibiting a CAGR of 6.20% during the forecast period.

- The market expansion is primarily driven by the increasing adoption of advanced agricultural machinery and the rising focus on improving soil productivity and crop yield efficiency across both developed and emerging economies.

- Moreover, the growing emphasis on sustainable farming practices, coupled with the integration of precision agriculture technologies such as GPS-guided tillage systems and automated tractors, is further accelerating market growth and transforming the global tillage landscape.

Global Tillage Equipment Market Analysis

- Tillage equipment, encompassing machinery used for soil preparation, seedbed formation, and weed control, plays a crucial role in modern agriculture by enhancing soil aeration, nutrient distribution, and crop productivity across both small- and large-scale farming operations.

- The surging demand for tillage equipment is primarily fueled by the increasing mechanization of agriculture, the growing need for higher crop yields to meet global food demand, and farmers’ rising preference for efficient and time-saving farming solutions.

- Asia-Pacific dominated the Global Tillage Equipment Market with the largest revenue share of 35.1% in 2024, attributed to the early adoption of precision farming technologies, high farm mechanization rates, and the strong presence of leading manufacturers. The U.S. market, in particular, experienced robust growth driven by technological innovations such as GPS-integrated tractors and autonomous tillage systems.

- North America is expected to be the fastest-growing region in the Global Tillage Equipment Market during the forecast period, supported by rapid agricultural modernization, government subsidies for farm equipment, and increasing awareness of sustainable soil management practices.

- The plough segment dominated the market with the largest revenue share of 42.6% in 2024, attributed to its crucial role in primary tillage operations, enabling deep soil turning, weed control, and residue management.

Report Scope and Global Tillage Equipment Market Segmentation

|

Attributes |

Tillage Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Tillage Equipment Market Trends

Technological Advancements Through AI and Automation Integration

- A significant and accelerating trend in the Global Tillage Equipment Market is the growing integration of artificial intelligence (AI), automation, and IoT-based precision farming systems. This convergence of advanced technologies is revolutionizing traditional tillage operations by enhancing accuracy, efficiency, and soil health management.

- For instance, John Deere’s autonomous tractors leverage AI-driven sensors and GPS technologies to perform tillage tasks with minimal human intervention, while Kubota’s smart farming solutions utilize data analytics to optimize soil preparation and reduce fuel consumption.

- AI integration in tillage machinery enables features such as real-time soil condition monitoring, automated depth control, and predictive maintenance, allowing farmers to make data-driven decisions. For example, sensors embedded in plows and harrows can detect soil compaction levels and automatically adjust blade depth for optimal performance.

- The incorporation of IoT connectivity allows tillage equipment to communicate with other farm systems—such as irrigation, seeding, and nutrient management—creating a fully integrated and automated agricultural ecosystem. Farmers can remotely monitor and control tillage operations through centralized digital platforms or mobile applications.

- This trend toward smarter, more connected, and autonomous machinery is fundamentally reshaping modern farming practices, improving operational efficiency while promoting sustainable soil management. Companies like AGCO Corporation and CNH Industrial are actively developing AI-enabled tillage systems that integrate advanced sensors, machine learning, and automated guidance for precision-driven results.

- The demand for intelligent and automated tillage equipment is rapidly increasing across both developed and emerging agricultural markets, as farmers seek to maximize productivity, reduce labor dependency, and embrace the benefits of digital farming technologies.

Global Tillage Equipment Market Dynamics

Driver

Growing Demand Driven by Rising Food Security Needs and Farm Mechanization

-

The increasing global demand for food, coupled with the urgent need to enhance agricultural productivity, is a significant driver for the heightened adoption of modern tillage equipment. Rapid population growth, shrinking arable land, and the pressure to maximize yield per hectare are pushing farmers to invest in efficient soil preparation technologies.

- For instance, in March 2024, John Deere announced an expansion of its precision tillage solutions, integrating advanced sensors and data analytics to optimize soil health and reduce energy use. Similarly, Mahindra & Mahindra and Kubota Corporation are investing in mechanized equipment suitable for small and mid-sized farms to improve accessibility and affordability in developing regions.

- As farmers become more aware of sustainable soil management and conservation practices, modern tillage machinery—featuring adjustable depth control, reduced soil compaction, and residue management—offers a major upgrade over traditional manual methods. These innovations not only enhance efficiency but also promote environmental sustainability.

- Furthermore, the growing emphasis on farm automation, government incentives for agricultural modernization, and the expanding use of precision farming technologies are making advanced tillage equipment an integral part of modern agricultural systems.

- The ability to improve soil structure, enhance water retention, and prepare optimal seedbeds for crop growth are key factors driving adoption across both commercial and smallholder farms. The trend toward smart, connected, and sustainable farming practices is further accelerating the global demand for technologically advanced tillage machinery.

Restraint/Challenge

High Equipment Costs and Environmental Sustainability Concerns

- The relatively high initial investment required for advanced tillage machinery remains a significant challenge for widespread adoption, especially among small and marginal farmers in developing economies. High-end equipment such as GPS-guided or automated tillage systems often exceeds the budget constraints of small-scale agricultural operations.

- For instance, the upfront cost of precision tillage machines equipped with automation and IoT connectivity can be several times higher than traditional plows, limiting accessibility despite long-term efficiency gains.

- Additionally, environmental concerns related to over-tillage—such as soil degradation, erosion, and loss of organic matter—pose challenges to the market’s growth. Excessive tillage practices can disturb soil structure and carbon content, leading to sustainability issues.

- Addressing these concerns through conservation tillage, no-till techniques, and the development of eco-friendly, energy-efficient machinery is crucial for balancing productivity with environmental stewardship. Companies like AGCO Corporation and CLAAS KGaA mbH are focusing on research and innovation to reduce soil disturbance while maintaining effective seedbed preparation.

- Moreover, promoting financing options, rental programs, and government subsidies for equipment acquisition can help overcome cost barriers, especially in regions where smallholder farming dominates. Overcoming these challenges through sustainable innovation and affordability will be vital for ensuring steady growth in the Global Tillage Equipment Market.

Global Tillage Equipment Market Scope

The tillage equipment market is segmented on the basis of type, product, size, distribution channel and end use.

- By Type

On the basis of type, the Global Tillage Equipment Market is segmented into plough, cultivators, disc harrow, harrow, and others. The plough segment dominated the market with the largest revenue share of 42.6% in 2024, attributed to its crucial role in primary tillage operations, enabling deep soil turning, weed control, and residue management. Ploughs are widely adopted across large-scale farms for their effectiveness in improving soil aeration and crop yield potential.

The cultivator segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by its versatility in both seedbed preparation and weed control during crop growth stages. Increasing demand for multi-purpose and adjustable cultivators suitable for various soil types is further boosting segment growth. Lightweight design innovations and compatibility with tractors of varying horsepower are also making cultivators a preferred choice among medium and small-scale farmers.

- By Product

On the basis of product, the market is categorized into gas power, electric power, and others. The gas-powered segment held the largest market share of 47.9% in 2024, driven by its high power output, reliability in large farming operations, and compatibility with heavy-duty implements. Gas-powered tillage equipment continues to dominate due to its ability to handle tough soil conditions and longer operational hours without dependence on charging infrastructure.

The electric-powered segment is expected to witness the fastest growth from 2025 to 2032, fueled by the global shift toward sustainable and low-emission agricultural practices. The integration of battery technology, lower maintenance costs, and government incentives for eco-friendly machinery are accelerating adoption. Electric tillage tools are increasingly popular in urban and small-scale farming, where energy efficiency and reduced noise pollution are prioritized.

- By Size

On the basis of size, the Global Tillage Equipment Market is segmented into small type equipment, medium type equipment, and large type equipment. The medium type equipment segment dominated with a market share of 44.3% in 2024, owing to its adaptability across diverse farm sizes and compatibility with mid-range tractors commonly used in both developed and emerging agricultural economies. Farmers favor medium-sized machinery for its balance of power, efficiency, and cost-effectiveness.

The large type equipment segment is projected to record the fastest CAGR during 2025–2032, driven by the expansion of commercial farming operations and the growing demand for high-capacity machines that reduce operational time and labor dependency. Large tillage equipment equipped with GPS guidance and automated steering systems is gaining traction for precision farming applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into OEM and aftermarket. The OEM segment dominated the market with the largest revenue share of 56.8% in 2024, supported by direct manufacturer sales, wide product availability, and ongoing innovations in design and technology integration. OEMs benefit from strong brand reputation and long-term relationships with large-scale farming enterprises.

The aftermarket segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for replacement parts, maintenance services, and cost-effective equipment upgrades. Farmers in developing regions increasingly prefer aftermarket options to extend machinery lifespan and reduce total ownership costs. The growth of e-commerce platforms and local dealer networks is also supporting aftermarket expansion.

- By End Use

on the basis of end use, the Global Tillage Equipment Market is segmented into personal use, rent, and others. The personal use segment accounted for the largest market revenue share of 48.5% in 2024, attributed to widespread ownership of small and medium tillage equipment by individual farmers aiming to enhance productivity and reduce labor dependency.

The rental segment is anticipated to witness the fastest CAGR during 2025–2032, driven by the growing popularity of equipment leasing and shared farming models, particularly in developing economies. High upfront costs of modern machinery and seasonal demand fluctuations make renting an attractive option for smallholder farmers. Rental service providers and agricultural cooperatives are expanding their fleets with advanced tillage machinery to cater to this rising demand efficiently.

Global Tillage Equipment Market Regional Analysis

- Asia-Pacific dominated the Global Tillage Equipment Market with the largest revenue share of 35.1% in 2024, driven by the widespread adoption of advanced agricultural machinery, high farm mechanization rates, and the growing integration of precision farming technologies across the U.S. and Canada.

- Farmers in the region highly value the efficiency, durability, and technological sophistication offered by modern tillage equipment, which enhances soil preparation, improves crop yields, and reduces operational time. The use of GPS-guided tractors, AI-based soil monitoring systems, and autonomous tillage machinery is rapidly transforming large-scale farming practices.

- This strong regional presence is further supported by high agricultural investment, favorable government policies promoting sustainable farming, and the presence of leading equipment manufacturers such as John Deere, AGCO Corporation, and CNH Industrial, solidifying North America’s position as a key contributor to global market revenue.

U.S. Tillage Equipment Market Insight

The U.S. tillage equipment market captured the largest revenue share of 81% in 2024 within North America, fueled by the strong adoption of precision farming technologies and the growing demand for efficient soil management solutions. Farmers are increasingly prioritizing mechanization and automation to enhance productivity and address labor shortages. The widespread use of GPS-enabled tractors, AI-based soil sensors, and autonomous tillage machinery is further propelling market growth. Moreover, continuous innovation by major players such as John Deere, AGCO Corporation, and CNH Industrial and the availability of government support for sustainable agricultural practices are strengthening the U.S. market position.

Europe Tillage Equipment Market Insight

The Europe tillage equipment market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing focus on sustainable and conservation tillage practices and compliance with stringent environmental regulations. The region’s farmers are adopting reduced-till and no-till methods to preserve soil structure and minimize carbon emissions. Additionally, the surge in technological integration, including smart farming tools and precision-guided machinery, is fostering adoption. Strong agricultural infrastructure in countries such as Germany, France, and the U.K. supports the demand for advanced tillage solutions across both crop and livestock sectors.

U.K. Tillage Equipment Market Insight

The U.K. tillage equipment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on modernizing farming operations and addressing labor efficiency challenges. The adoption of medium and small-scale tillage machinery suitable for diversified crops and variable soil conditions is rising steadily. Furthermore, the government’s encouragement of sustainable and precision farming practices, combined with the country’s transition towards low-carbon agriculture, is enhancing demand for energy-efficient and data-driven tillage solutions.

Germany Tillage Equipment Market Insight

The Germany tillage equipment market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced agricultural infrastructure, strong mechanization rate, and commitment to sustainable soil management. German farmers emphasize innovation, automation, and environmental responsibility, driving demand for energy-efficient, precision-guided tillage machinery. The integration of AI-based monitoring systems and IoT-enabled implements is becoming increasingly common, aligning with Germany’s broader goal of digitalizing agriculture and enhancing operational efficiency.

Asia-Pacific Tillage Equipment Market Insight

The Asia-Pacific tillage equipment market is poised to grow at the fastest CAGR of 24% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing adoption of mechanized farming practices in countries such as China, India, and Japan. Government initiatives promoting farm modernization, subsidy programs for machinery purchases, and agricultural digitalization efforts are accelerating adoption. The region’s expanding agricultural base and the emergence of local manufacturers offering cost-effective and efficient equipment are making tillage technology more accessible to smallholder farmers.

Japan Tillage Equipment Market Insight

The Japan tillage equipment market is gaining momentum due to the nation’s technological expertise, limited arable land, and aging farming population, which drive the need for automation and compact machinery. Japanese farmers increasingly prefer smart and multi-functional tillage equipment capable of operating efficiently on small farms. Integration with IoT systems and robotic automation enhances productivity and ease of use. Moreover, the government’s focus on precision agriculture and energy-efficient solutions supports steady market growth.

China Tillage Equipment Market Insight

The China tillage equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s rapid agricultural modernization, expanding mechanization rates, and strong domestic manufacturing base. China’s government initiatives promoting smart farming and rural mechanization are boosting demand for advanced tillage solutions across both large and small-scale farms. Additionally, the development of low-cost, durable, and automated machinery tailored for diverse soil conditions enhances market accessibility. The growing emphasis on sustainable farming and soil conservation is further propelling the adoption of innovative tillage technologies nationwide.

Global Tillage Equipment Market Share

The Tillage Equipment industry is primarily led by well-established companies, including:

• Deere & Company (U.S.)

• CNH Industrial N.V. (U.K.)

• AGCO Corporation (U.S.)

• Kubota Corporation (Japan)

• Mahindra & Mahindra Ltd. (India)

• CLAAS KGaA mbH (Germany)

• KUHN Group (France)

• Great Plains Manufacturing, Inc. (U.S.)

• Bucher Industries AG (Switzerland)

• Lemken GmbH & Co. KG (Germany)

• Maschio Gaspardo S.p.A. (Italy)

• Baldan Implementos Agrícolas S/A (Brazil)

• Tirth Agro Technology Pvt. Ltd. (India)

• Väderstad AB (Sweden)

• Sonalika Group (India)

• Alpler Agricultural Machinery (Turkey)

• Horsch Maschinen GmbH (Germany)

• Bomet Sp. z o.o. (Poland)

• Landoll Company, LLC (U.S.)

• Farmet a.s. (Czech Republic)

What are the Recent Developments in Global Tillage Equipment Market?

- In April 2023, John Deere, a global leader in agricultural machinery, launched a strategic initiative in South Africa aimed at strengthening farm productivity through its advanced tillage equipment. The program focused on introducing precision-guided ploughs and cultivators designed for local soil conditions, demonstrating John Deere’s commitment to delivering innovative, efficient solutions tailored to regional farming challenges. By leveraging its global expertise and cutting-edge machinery, the company reinforced its position in the rapidly growing Global Tillage Equipment Market.

- In March 2023, AGCO Corporation, headquartered in the U.S., introduced the next-generation Fendt Disc Harrow series, engineered for commercial farms and large-scale crop production. The high-efficiency equipment optimizes soil turnover and enhances fuel efficiency, reflecting AGCO’s dedication to innovation and sustainable farming practices. This launch highlights the company’s efforts to provide technologically advanced, reliable, and high-performance solutions in the global tillage machinery sector.

- In March 2023, CNH Industrial successfully deployed its Case IH Precision Tillage Solutions in India, aiming to improve productivity and reduce soil compaction through smart, sensor-integrated implements. This project underscores CNH Industrial’s commitment to leveraging advanced machinery and IoT-enabled features to enhance farming efficiency, positioning the company as a key player in Asia-Pacific’s expanding tillage equipment market.

- In February 2023, Mahindra & Mahindra Ltd., a leading Indian agricultural machinery manufacturer, announced a strategic partnership with local cooperatives to deploy electric-powered cultivators and small-scale tillage solutions across rural farms. This collaboration enhances accessibility and efficiency for smallholder farmers, demonstrating Mahindra’s dedication to driving innovation, mechanization, and operational effectiveness within the agricultural sector.

- In January 2023, Kubota Corporation, headquartered in Japan, unveiled its Kubota Smart Plough Series at the International Agritech Expo 2023. Equipped with GPS-based guidance and real-time soil monitoring, the series allows farmers to optimize ploughing patterns and improve crop yields. The launch highlights Kubota’s focus on integrating advanced technology into traditional tillage practices, offering farmers enhanced convenience, efficiency, and sustainability.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.