Global Timber Wrap Films Market

Market Size in USD Million

CAGR :

%

USD

745.47 Million

USD

993.08 Million

2024

2032

USD

745.47 Million

USD

993.08 Million

2024

2032

| 2025 –2032 | |

| USD 745.47 Million | |

| USD 993.08 Million | |

|

|

|

|

Timber Wrap Films Market Size

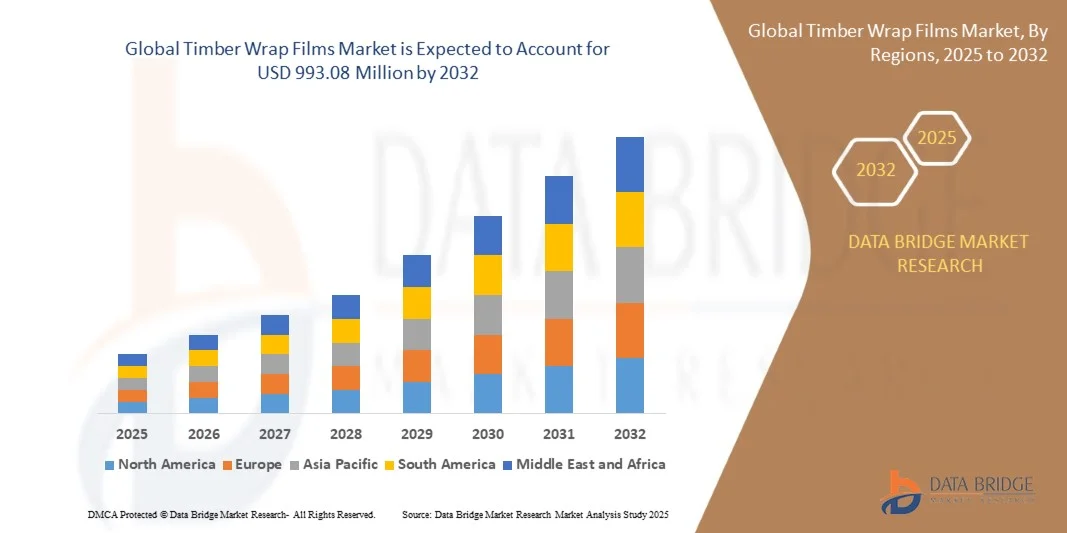

- The global timber wrap films market size was valued at USD 745.47 million in 2024 and is expected to reach USD 993.08 million by 2032, at a CAGR of 3.65% during the forecast period

- The market growth is largely fueled by the increasing demand for durable and moisture-resistant packaging solutions in the timber and lumber industries, driven by the need to protect wood products during storage and transportation. The expanding construction and furniture manufacturing sectors are also contributing to higher consumption of timber wrap films, as they help maintain wood quality and reduce damage losses across the supply chain

- Furthermore, rising awareness of sustainable and recyclable packaging materials is propelling manufacturers to develop eco-friendly timber wrap films using polyethylene (PE) and polypropylene (PP). These innovations ensure superior protection, flexibility, and cost efficiency, making them a preferred choice among timber processors. The combination of environmental focus and performance benefits is accelerating market growth globally, positioning timber wrap films as a critical component in modern timber packaging solutions

Timber Wrap Films Market Analysis

- Timber wrap films, used for protecting lumber, hardwoods, and softwoods, play a crucial role in preventing moisture ingress, surface damage, and UV exposure during handling and transportation. Their superior tensile strength and weather resistance make them essential for maintaining the quality and integrity of timber across varying climatic conditions

- The escalating demand for these films is primarily fueled by growth in global timber exports, increasing use of automation in timber wrapping, and the adoption of sustainable materials. As industries emphasize operational efficiency and environmental compliance, the market for advanced timber wrap films continues to expand across both developed and emerging economies

- North America dominated the timber wrap films market in 2024, due to the growing demand for protective packaging in the timber and furniture industries, as well as increasing awareness of quality preservation during transportation and storage

- Asia-Pacific is expected to be the fastest growing region in the timber wrap films market during the forecast period due to increasing timber production, rapid industrialization, and rising export activities in countries such as China, Japan, and India

- Polyethylene (PE) segment dominated the market with a market share of 65.5% in 2024, due to its versatility, chemical resistance, and affordability. PE wrap films are widely utilized across timber industries for their superior elasticity, moisture barrier properties, and compatibility with automated wrapping machines. Manufacturers often prefer PE films as they provide consistent protection while allowing easy handling and storage. The strong availability of PE raw materials and extensive supplier networks further reinforce its dominance. Its eco-friendly variants are also increasingly adopted, aligning with sustainability goals in timber packaging

Report Scope and Timber Wrap Films Market Segmentation

|

Attributes |

Timber Wrap Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Timber Wrap Films Market Trends

“Rising Adoption of Sustainable and Recyclable Timber Wrap Films”

- The global timber wrap films market is witnessing steady growth driven by the increasing shift toward sustainable and recyclable packaging solutions in the timber industry. Manufacturers are focusing on producing eco-friendly polymer films that offer superior protection against moisture, UV radiation, and mechanical damage while reducing environmental impact through material recyclability

- For instance, Berry Global Inc. and Coveris Group have introduced recyclable polyethylene (PE)-based timber wrap films designed for high tear resistance and long-term weather protection. These initiatives demonstrate how leading packaging manufacturers are addressing the market’s growing need for durable and sustainable materials within the wood processing and export sectors

- Sustainability-driven regulations and corporate environmental policies are encouraging the transition from conventional plastic wraps to biodegradable or mono-material films. These products minimize landfill waste and also support circular economy objectives through reusability and material recovery

- Technological innovation in polymer blending and extrusion processes has enhanced the mechanical strength, UV stability, and water resistance of timber wraps. Advanced printing and branding capabilities incorporated into such films also help manufacturers improve visibility and traceability across global supply chains

- The rising demand from timber exporters for lightweight yet high-protection materials is fueling product development in high-performance multilayer films. These films safeguard sawn timber, plywood, and wooden panels during long-distance shipment and storage under varying climatic conditions

- As the lumber and wood packaging industries continue to prioritize sustainability, recyclable timber wrap films are emerging as a critical solution balancing environmental goals with functional performance. This transition reflects a broader industry-wide push toward resource-efficient and eco-friendly packaging systems

Timber Wrap Films Market Dynamics

Driver

“Growing Demand for Protective Packaging in Timber Exports”

- The expansion of global timber trade and the need for enhanced product protection during transportation are driving demand for specialized timber wrap films. These films are essential for shielding sawn timber and lumber from weathering, cracking, and microbial contamination during extended shipping and outdoor storage

- For instance, Inteplast Group and Trioplast Industrier AB offer customized UV-stabilized and puncture-resistant wraps that ensure superior protection against moisture and sunlight exposure. Such product advancements cater to exporters seeking long-term preservation of product quality through reliable packaging performance

- Timber producers and suppliers are increasingly focusing on protective wrapping to comply with international trade standards and prevent product degradation during long-haul shipments. This has made film wrapping an integral component of export packaging strategies for both hardwood and softwood varieties

- The rising globalization of the lumber supply chain and the growing construction demand in regions such as Asia-Pacific and the Middle East are further supporting the use of protective wraps. These films play a critical role in maintaining the structural and visual integrity of timber under diverse environmental conditions

- Growing consumer preference for defect-free building materials and aesthetic consistency is encouraging lumber brands to invest in reliable protective packaging. As a result, the demand for high-performance timber wrap films is expected to grow in tandem with the global expansion of timber and wood-based product exports

Restraint/Challenge

“Fluctuating Prices of Raw Materials”

- Volatility in raw material prices, especially polyethylene and polypropylene resins, presents a key challenge for the timber wrap films market. Since these films predominantly rely on petrochemical-derived polymers, fluctuations in crude oil prices directly impact manufacturing costs and pricing stability

- For instance, manufacturers such as Coveris Group and Trioplast have experienced profit margin pressures owing to unpredictable resin supply and escalating energy expenses. These cost fluctuations affect production planning and hinder long-term pricing agreements with customers in the lumber export sector

- Global supply chain disruptions and trade restrictions affecting resin imports also contribute to material shortages, leading to production delays and inconsistent product availability. Such factors make it difficult for small and medium-sized producers to maintain competitive pricing while ensuring quality consistency

- In addition, the introduction of bio-based alternatives, though environmentally favorable, often involves higher production costs and limited scalability. This transition phase increases cost disparities between conventional and sustainable wrap materials, particularly for cost-sensitive export applications

- Manufacturers are increasingly focusing on raw material optimization, recycled resin utilization, and long-term supplier partnerships to mitigate these risks. Stabilizing input supply and advancing material efficiency will be essential in ensuring sustainable profitability across the timber wrap film value chain

Timber Wrap Films Market Scope

The market is segmented on the basis of thickness, material type, types, and applications.

• By Thickness

On the basis of thickness, the timber wrap films market is segmented into up to 75 microns, 76–150 microns, 151–225 microns, and above 225 microns. The 76–150 microns segment dominated the market with the largest revenue share in 2024, driven by its ideal balance between durability and flexibility for various timber packaging applications. This thickness is widely preferred by timber manufacturers as it provides adequate protection against moisture, dust, and mechanical damage during transportation and storage. Moreover, films in this range are cost-effective and compatible with most wrapping machines, facilitating operational efficiency for timber processing units. The consistent performance in preserving wood quality and minimizing wastage contributes to its high adoption among both small-scale and large-scale timber producers.

The above 225 microns segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for heavy-duty protective films in industrial and long-distance timber shipments. Thicker films offer enhanced puncture resistance and structural integrity, ensuring safe handling of large timber logs and panels. Industries increasingly adopt these films for premium hardwoods and high-value timber products, prioritizing long-term protection and reduction of damage-related losses. The growing emphasis on premium wood quality and sustainable packaging solutions further accelerates the adoption of above 225-micron timber wrap films.

• By Material Type

On the basis of material type, the market is segmented into polyethylene (PE) and polypropylene (PP). The polyethylene segment held the largest market revenue share of 65.5% in 2024, driven by its versatility, chemical resistance, and affordability. PE wrap films are widely utilized across timber industries for their superior elasticity, moisture barrier properties, and compatibility with automated wrapping machines. Manufacturers often prefer PE films as they provide consistent protection while allowing easy handling and storage. The strong availability of PE raw materials and extensive supplier networks further reinforce its dominance. Its eco-friendly variants are also increasingly adopted, aligning with sustainability goals in timber packaging.

The polypropylene segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by increasing industrial demand for higher strength and heat-resistant packaging films. PP films offer enhanced toughness and clarity, making them suitable for premium timber products requiring visual inspection and robust protection. Industries are adopting PP films for long-haul transportation and export shipments, where high durability and resistance to environmental stress are critical. The growing focus on innovative materials and performance-driven solutions positions polypropylene as a rapidly expanding segment in the timber wrap films market.

• By Types

On the basis of types, the timber wrap films market is segmented into HDPE wrap films, LDPE wrap films, and PP wrap films. The LDPE wrap films segment dominated the market with the largest revenue share in 2024, driven by its superior flexibility, ease of use, and cost-efficiency for packaging timber of varying sizes. LDPE films provide effective protection against moisture, abrasion, and minor impacts, making them suitable for both hardwood and softwood packaging. Timber processors often favor LDPE films for their compatibility with semi-automatic and automatic wrapping machines, which enhances productivity and reduces labor costs. The widespread availability and adaptability of LDPE films across multiple applications further reinforce their market leadership.

The HDPE wrap films segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the demand for high-strength, tear-resistant films for heavy timber and export-grade wood shipments. HDPE films offer enhanced puncture resistance, longevity, and dimensional stability, ensuring safe transportation over long distances. Industries increasingly adopt HDPE for wrapping large timber logs and panels, focusing on minimizing damage and maintaining timber quality. The rising adoption of premium packaging solutions in line with stringent shipping standards is driving the accelerated growth of HDPE wrap films.

• By Applications

On the basis of applications, the market is segmented into hardwoods and softwoods. The hardwoods segment dominated the market with the largest revenue share in 2024, driven by the high value and sensitivity of hardwoods that require premium protection during storage and transport. Timber wrap films for hardwoods are specifically engineered to prevent moisture penetration, surface scratches, and fungal damage, which helps maintain the quality and market value of the wood. Manufacturers and exporters prioritize using protective films for hardwoods to ensure compliance with international shipping standards. The consistent demand for premium furniture and construction-grade hardwoods further supports the dominance of this segment.

The softwoods segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising production and export of softwood timber in construction and furniture industries. Softwoods, though less dense, require reliable protection against environmental factors such as humidity and UV exposure during transit. Industries are increasingly adopting specialized wrap films for softwoods to prevent warping, discoloration, and mechanical damage. The expanding use of softwood in residential construction and packaging solutions positions this segment for significant market growth over the forecast period.

Timber Wrap Films Market Regional Analysis

- North America dominated the timber wrap films market with the largest revenue share in 2024, driven by the growing demand for protective packaging in the timber and furniture industries, as well as increasing awareness of quality preservation during transportation and storage

- Consumers and businesses in the region highly value durability, moisture resistance, and ease of use offered by timber wrap films, ensuring the safe handling of both hardwoods and softwoods

- This widespread adoption is further supported by advanced manufacturing infrastructure, high disposable incomes, and a strong emphasis on sustainable packaging practices, establishing timber wrap films as a preferred solution for timber protection

U.S. Timber Wrap Films Market Insight

The U.S. timber wrap films market captured the largest revenue share in North America in 2024, fueled by extensive timber processing, rising exports, and the demand for premium packaging solutions. Manufacturers are increasingly adopting high-quality wrap films to reduce damage during storage and long-distance transport. The growing trend of automated timber handling systems, combined with rising awareness of sustainable and eco-friendly packaging materials, further propels the market. In addition, strong domestic production of polyethylene (PE) and polypropylene (PP) films ensures availability and cost-effectiveness for large-scale timber processing units.

Europe Timber Wrap Films Market Insight

The Europe timber wrap films market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations for timber preservation and increasing export of high-value timber products. Growing urbanization, industrialization, and modernization of packaging practices are fostering the adoption of advanced wrap films. European timber processors prioritize protection against moisture, mechanical damage, and environmental factors, particularly for hardwoods and export-grade softwoods. The region is witnessing significant growth in applications across residential construction, furniture, and industrial timber, with films being incorporated into both domestic and international supply chains.

U.K. Timber Wrap Films Market Insight

The U.K. timber wrap films market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for premium and sustainable timber packaging solutions. Concerns regarding timber quality preservation, especially for exports and high-value projects, are encouraging businesses to adopt robust protective films. The U.K.’s strong timber processing industry, combined with the increasing preference for eco-friendly polyethylene (PE) and polypropylene (PP) films, is expected to continue stimulating market growth. Integration of advanced wrapping machinery and automation is further enhancing efficiency and adoption rates.

Germany Timber Wrap Films Market Insight

The Germany timber wrap films market is expected to expand at a considerable CAGR during the forecast period, fueled by growing industrial timber production, exports, and a focus on high-quality packaging. Germany’s well-developed manufacturing infrastructure, emphasis on precision and sustainability, and adoption of technologically advanced protective films drive market growth. The integration of durable wrap films for both hardwoods and softwoods is becoming increasingly prevalent, with manufacturers prioritizing long-term preservation and compliance with environmental standards.

Asia-Pacific Timber Wrap Films Market Insight

The Asia-Pacific timber wrap films market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing timber production, rapid industrialization, and rising export activities in countries such as China, Japan, and India. The region’s expanding timber processing sector, coupled with government initiatives supporting quality preservation and sustainable packaging, is fueling adoption. Affordable and locally manufactured wrap films are making high-quality protective solutions accessible to a broader customer base, further supporting market expansion.

Japan Timber Wrap Films Market Insight

The Japan timber wrap films market is gaining momentum due to the country’s high emphasis on product quality, technological adoption, and demand for efficient packaging solutions. Japanese timber processors prioritize films that ensure minimal moisture penetration, mechanical protection, and compatibility with automated wrapping systems. In addition, the growing export of processed timber and the integration of advanced wrapping technology are supporting market growth, particularly for premium hardwood and softwood products.

China Timber Wrap Films Market Insight

The China timber wrap films market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, industrial growth, and increasing timber exports. The country’s large-scale timber processing industry requires durable and cost-effective wrap films to protect wood during storage and transportation. Government support for quality standards and the growing availability of both polyethylene (PE) and polypropylene (PP) films at competitive prices are key factors propelling the market. The expansion of e-commerce and construction sectors further accelerates demand for reliable timber packaging solutions.

Timber Wrap Films Market Share

The timber wrap films industry is primarily led by well-established companies, including:

- Trioplast Industrier AB (Sweden)

- Intertape Polymer Group (Canada)

- Inteplast Group (U.S.)

- RKW Finland Ltd (Finland)

- Ab Rani Plast Oy (Finland)

- Polytarp Products (Canada)

- Scott Lumber Packaging (U.S.)

- InterWrap Inc. (Canada)

- Multifab Packaging (U.K.)

- Balcan Plastic (Canada)

- Davidson Plastics (U.S.)

- FLEXOPLAS PACKAGING LTD (U.K.)

- Polyprint Packaging (U.K.)

- Pak-Line Ltd. (New Zealand)

- Pakaflex Pty Ltd (Australia)

- Tri Pac Inc. (U.S.)

- FROMM Packaging LTD (New Zealand)

- PINPAK (Australia)

- Tigerpak Packaging (Australia)

- Signode India (India)

Latest Developments in Global Timber Wrap Films Market

- In November 2024, Mondi introduced a new timber wrap film designed specifically for moisture resistance, enhancing the protection of timber products during shipment. This product addresses challenges related to environmental factors such as humidity and rain, ensuring that timber quality is maintained throughout storage and transportation. The innovation demonstrates Mondi’s commitment to providing advanced packaging solutions that safeguard timber products across the supply chain

- In June 2024, Berry Global acquired a specialty films producer to expand its portfolio of timber wrap films and scale production for large timber and lumber customers. This acquisition strengthens Berry Global’s ability to offer high-quality protective packaging solutions, ensuring the safe handling of both hardwoods and softwoods. By integrating the acquired technologies and expertise, Berry Global aims to enhance operational efficiency and meet growing industrial demand

- In March 2024, Avery Dennison formed a strategic partnership with Printpack to co-develop advanced timber wrap films incorporating recycled content and improved barrier properties. The collaboration focuses on creating sustainable and high-performance films that protect timber during transportation and storage. Leveraging the combined technological expertise, the companies plan to pilot these innovative solutions to address increasing environmental and operational demands in the timber packaging sector

- In 2023, Covertec launched a range of sustainable timber wrap films made from recycled materials, offering protection for timber products while promoting environmental responsibility. These films provide an eco-friendly alternative to conventional wraps, balancing durability and sustainability. The initiative reflects a growing trend among timber processors and manufacturers to adopt packaging solutions that minimize environmental impact

- In September 2022, UPM Timber collaborated with Lassila & Tikanoja to develop a recycling concept for sawn timber wrappings, converting used plastic wrapping into new materials. Customers participating in the program receive compensation, encouraging wider adoption of eco-friendly practices. This initiative supports sustainability in the timber wrap films market while promoting circular economy practices in industrial packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Timber Wrap Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Timber Wrap Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Timber Wrap Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.