Global Time Division Multiple Access Market

Market Size in USD Billion

CAGR :

%

USD

7.18 Billion

USD

9.99 Billion

2024

2032

USD

7.18 Billion

USD

9.99 Billion

2024

2032

| 2025 –2032 | |

| USD 7.18 Billion | |

| USD 9.99 Billion | |

|

|

|

|

Time Division Multiple Access Market Size

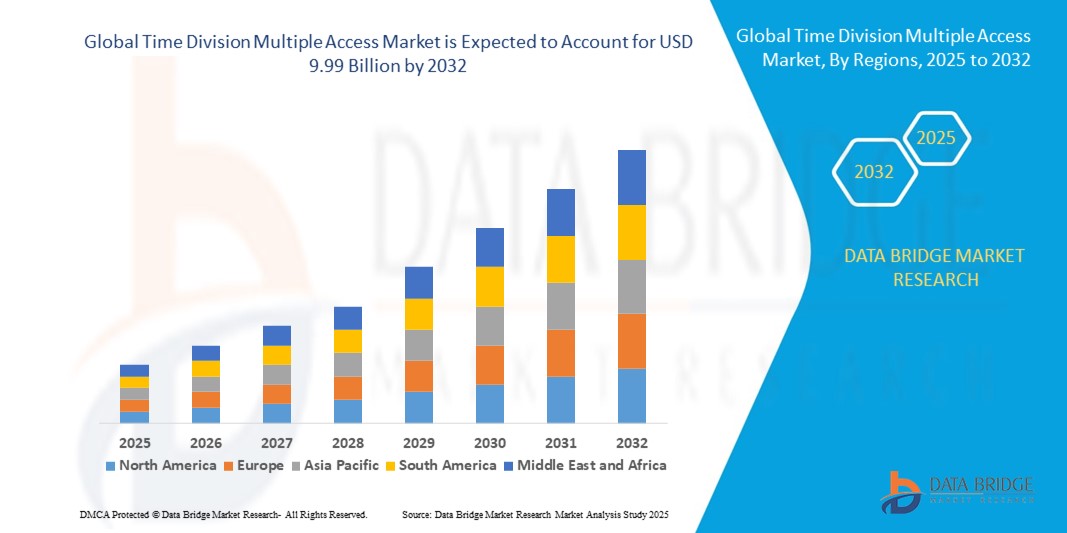

- The global time division multiple access market size was valued at USD 7.18 billion in 2024 and is expected to reach USD 9.99 billion by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fueled by the increasing deployment of mobile networks and the rising adoption of 4G and 5G technologies, which are driving the need for efficient, high-capacity communication systems in both urban and rural areas

- Furthermore, growing demand for reliable, low-latency, and secure communication across mobile, public safety, defense, automotive, and IoT applications is establishing time division multiple access as a preferred access technology. These converging factors are accelerating the adoption of time division multiple access solutions, thereby significantly boosting the market's growth

Time Division Multiple Access Market Analysis

- Time division multiple access is a channel access method that allows multiple users to share the same frequency channel by dividing the signal into time slots, enabling efficient spectrum utilization and reliable communication. This technology is widely used in mobile, satellite, defense, public safety, and automotive communication networks

- The escalating demand for time division multiple access solutions is primarily driven by increasing mobile and satellite communication requirements, rising adoption of IoT and connected devices, and the need for secure, high-performance networks that can support growing data traffic and next-generation applications

- North America dominated the time division multiple access market in 2024, due to the region's advanced telecommunications infrastructure and early adoption of high-speed mobile networks

- Asia-Pacific is expected to be the fastest growing region in the time division multiple access market during the forecast period due to rapid urbanization, increasing smartphone penetration, and the rollout of next-generation mobile networks in countries such as China, Japan, and India

- Mobile communication segment dominated the market with a market share of 46.8% in 2024, due to the ever-growing need for high-quality voice, data, and multimedia services across urban and rural areas. Telecom operators leverage time division multiple access technology to efficiently allocate bandwidth, reduce network congestion, and ensure reliable connectivity for billions of users worldwide. The demand for mobile communication services is further strengthened by increasing smartphone penetration, rising digital consumption, and the proliferation of mobile applications that rely on stable network infrastructure

Report Scope and Time Division Multiple Access Market Segmentation

|

Attributes |

Time Division Multiple Access Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Time Division Multiple Access Market Trends

Growing Demand for Efficient Communication Systems

- The rising demand for efficient communication systems in telecommunications, aerospace, defense, and enterprise networks is driving the continued relevance of time division multiple access technology. Despite the growing adoption of advanced standards such as LTE and 5G, time division multiple access remains vital in supporting mission-critical communications where reliability, cost efficiency, and bandwidth optimization are necessary

- For instance, Ericsson has continued leveraging TDMA-based technologies in some of its legacy infrastructure solutions used across rural and remote locations. Similarly, Motorola Solutions employs time division multiple access in land mobile radio (LMR) systems that are widely deployed by public safety agencies, highlighting its importance in reliable mission-critical voice communications

- The need for efficient spectrum utilization is reinforcing the adoption of TDMA, as it allows multiple users to share the same frequency band by dividing signals into time slots. This maximizes network efficiency while reducing interference, making it suitable for geographies and industries where high-capacity communication systems are required

- Industrial sectors such as energy, transportation, and defense are also prioritizing robust communication networks that minimize congestion and guarantee stable connections during operations. TDMA’s structured allocation of time slots ensures predictable performance, which is essential in environments that require continuous and uninterrupted data flow

- In addition, governments and enterprises in developing regions with limited 4G or 5G penetration continue to rely on time division multiple access networks due to their cost-effectiveness and ability to operate in challenging environments. This underscores TDMA’s transitional role as markets migrate toward newer technologies while still demanding efficient communication performance

- Ultimately, the growing demand for efficient and reliable communication is ensuring that time division multiple access remains a critical technology in several applications. While its long-term future may be gradually phased out in certain markets, its reliability, proven capabilities, and efficiency sustain its relevance in specific industries and geographies

Time Division Multiple Access Market Dynamics

Driver

Increasing Mobile Data Traffic

- The exponential rise in mobile data traffic worldwide is a key driver for time division multiple access systems, as communication networks require efficient solutions to handle growing capacity. Emerging digital ecosystems relying on mobile video consumption, cloud services, and app usage are putting immense pressure on network infrastructure to maintain service quality

- For instance, Nokia has highlighted the continued application of time division multiple access technologies in certain 2G and 3G mobile systems where mobile data traffic is still significant, particularly in developing markets. By leveraging TDMA, operators can effectively manage bandwidth allocation in high-demand environments while minimizing costs

- Time division multiple access provides operators with a method to divide bandwidth into time slots, enabling more efficient use of available spectrum. This becomes crucial in regions where spectrum scarcity remains a challenge, and mobile operators must maximize efficiency without substantial additional investments in new infrastructure

- The surge in mobile traffic is also supported by increased smartphone penetration and adoption of IoT devices. In markets where next-generation 4G or 5G deployment is limited, time division multiple access continues to provide a practical solution for ensuring service continuity and stable user experiences

- In conclusion, rising mobile data volumes are strengthening the ongoing adoption of time division multiple access technologies in specific contexts, particularly in regions with limited access to advanced infrastructure. This driver ensures that time division multiple access remains an important tool for sustaining telecommunications networks during periods of evolving infrastructure transitions

Restraint/Challenge

High Cost of Maintaining Legacy Infrastructure

- One of the major challenges facing the time division multiple access market is the high cost associated with maintaining legacy systems, particularly in regions that are transitioning to 4G, 5G, and beyond. Prolonging the operational life of TDMA-based infrastructure requires consistent investment in service, upgrades, and skilled workforce expertise, adding financial strain for operators

- For instance, telecom operators in Africa and Latin America have reported rising operating costs as they continue to support TDMA-based 2G networks. These systems remain critical for basic communication services, but maintenance of legacy equipment has proven more expensive compared to transitioning directly to newer technologies

- The complexity of finding spare parts and expertise for legacy time division multiple access infrastructure is further driving up costs for operators. As vendors shift focus toward modern technologies, the availability of affordable maintenance, hardware replacements, and network support services for TDMA-based systems becomes increasingly scarce

- Moreover, the business case for investing in time division multiple access maintenance is weakening as subscribers demand advanced services such as high-speed internet, video conferencing, and cloud-based solutions. With time division multiple access unable to fully support these functions, operators are facing strategic dilemmas in balancing ongoing expenses with investment into new-generation networks

- As a result, the high cost of maintaining legacy time division multiple access infrastructure is a significant barrier for long-term market sustainability. This challenge highlights the gradual but inevitable transition of telecom providers to advanced systems, even while time division multiple access continues to serve niche roles in selected regions and industries

Time Division Multiple Access Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the time division multiple access (Time Division Multiple Access) market is segmented into 2G (Second Generation), 3G (Third Generation), 4G (Fourth Generation), and 5G (Fifth Generation). The 4G segment dominated the largest market revenue share in 2024, driven by its widespread global adoption for high-speed data services and mobile internet connectivity. 4G time division multiple access networks provide reliable voice and data transmission, supporting multimedia applications and LTE-based services, making them essential for both residential and enterprise users. Telecom operators continue to invest in 4G infrastructure due to its compatibility with existing networks, cost-effectiveness, and mature ecosystem of devices and applications. The high penetration of smartphones and growing demand for streaming and mobile data services further reinforce the dominance of 4G time division multiple access systems.

The 5G segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the global rollout of next-generation networks and the need for ultra-low latency, high-speed communication, and massive IoT connectivity. 5G time division multiple access solutions offer enhanced spectral efficiency, improved network capacity, and better support for emerging applications such as autonomous vehicles, smart cities, and industrial automation. The increasing adoption of 5G-enabled devices and government initiatives to modernize telecommunications infrastructure are key drivers accelerating the growth of 5G time division multiple access systems globally.

- By Application

On the basis of application, the time division multiple access market is segmented into mobile communication, satellite communication, military and defense, public safety, automotive, and railways. The mobile communication segment dominated the largest market revenue share of 46.8% in 2024, driven by the ever-growing need for high-quality voice, data, and multimedia services across urban and rural areas. Telecom operators leverage time division multiple access technology to efficiently allocate bandwidth, reduce network congestion, and ensure reliable connectivity for billions of users worldwide. The demand for mobile communication services is further strengthened by increasing smartphone penetration, rising digital consumption, and the proliferation of mobile applications that rely on stable network infrastructure.

The Military and Defense segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the need for secure, reliable, and high-capacity communication networks in defense operations. TDMA-based systems offer advantages such as efficient spectrum utilization, low latency, and high reliability, making them suitable for real-time military communication, surveillance, and tactical operations. Increasing defense budgets, modernization of armed forces, and the adoption of advanced communication technologies are key factors driving the rapid growth of time division multiple access applications in the defense sector.

Time Division Multiple Access Market Regional Analysis

- North America dominated the time division multiple access market with the largest revenue share in 2024, driven by the region's advanced telecommunications infrastructure and early adoption of high-speed mobile networks

- Telecom operators are investing heavily in upgrading network capabilities to support mobile communication, IoT applications, and connected services. Consumers and enterprises in the region prioritize reliable, low-latency, and high-capacity communication solutions, fueling the demand for TDMA-based networks

- The widespread presence of 4G and growing deployment of 5G networks further enhance the market growth, while high disposable incomes and technological awareness continue to support adoption across both residential and commercial sectors

U.S. Time Division Multiple Access Market Insight

The U.S. time division multiple access market captured the largest revenue share in North America in 2024, propelled by extensive mobile communication services and the adoption of 4G and 5G technologies. Telecom providers are leveraging time division multiple access to optimize spectrum efficiency and improve network performance for a growing base of smartphone and IoT users. The demand for reliable voice and data transmission, coupled with enterprise adoption for defense, public safety, and automotive applications, further drives the market. Continuous investment in network modernization and government initiatives supporting next-generation communications also strengthen market growth in the U.S.

Europe Time Division Multiple Access Market Insight

The Europe time division multiple access market is projected to expand at a substantial CAGR during the forecast period, supported by stringent regulatory frameworks for spectrum allocation and a focus on advanced mobile communications. Countries such as Germany, France, and the U.K. are investing in next-generation mobile networks to enhance connectivity, reduce latency, and improve data throughput. Increasing adoption across mobile communication, public safety, and defense applications is further propelling market growth. The region also benefits from a technologically savvy population and strong infrastructure, facilitating the deployment of time division multiple access networks across urban and rural areas.

U.K. Time Division Multiple Access Market Insight

The U.K. time division multiple access market is expected to grow at a noteworthy CAGR during the forecast period, driven by robust mobile and public safety communication networks. Telecom operators are expanding their network coverage and capacity, focusing on TDMA-based solutions for low-latency and secure communications. The rising adoption of connected devices, government-backed smart city initiatives, and integration of time division multiple access with emergency and defense applications further contribute to market growth in the U.K.

Germany Time Division Multiple Access Market Insight

The Germany time division multiple access market is anticipated to expand at a considerable CAGR during the forecast period, fueled by increasing demand for high-speed mobile connectivity and secure communication networks. Germany's focus on Industry 4.0, smart transportation systems, and defense modernization is promoting time division multiple access adoption across enterprise and public sectors. Continuous investment in network upgrades, combined with a tech-savvy population and supportive regulatory environment, strengthens the market. time division multiple access solutions are also increasingly integrated with mobile, automotive, and railway communication systems to enhance efficiency and reliability.

Asia-Pacific Time Division Multiple Access Market Insight

The Asia-Pacific time division multiple access market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid urbanization, increasing smartphone penetration, and the rollout of next-generation mobile networks in countries such as China, Japan, and India. The demand for high-speed, reliable communication for mobile, defense, automotive, and public safety applications is accelerating time division multiple access adoption. Government initiatives promoting digital infrastructure, smart city projects, and industrial automation further enhance market growth. The region also benefits from being a hub for telecommunications equipment manufacturing, which improves affordability and accessibility of time division multiple access solutions.

Japan Time Division Multiple Access Market Insight

The Japan time division multiple access market is gaining momentum due to the country’s advanced telecom infrastructure, high mobile penetration, and focus on IoT and smart city initiatives. time division multiple access networks support high-speed mobile communication, public safety, and defense operations, ensuring reliable and low-latency connectivity. The integration of time division multiple access with 5G networks and connected automotive systems is driving demand. In addition, Japan’s aging population and the need for efficient communication solutions in transportation and healthcare sectors are further boosting market growth.

China Time Division Multiple Access Market Insight

The China time division multiple access market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, expanding middle class, and massive adoption of mobile and connected devices. Telecom providers are leveraging time division multiple access to enhance network efficiency, support high data traffic, and enable smart city and industrial IoT applications. Government initiatives for nationwide 5G deployment, combined with strong domestic manufacturing capabilities, have made time division multiple access solutions widely accessible, driving significant market growth across residential, commercial, and industrial sectors.

Time Division Multiple Access Market Share

The time division multiple access industry is primarily led by well-established companies, including:

- Nokia Corporation (Finland)

- Ericsson (Sweden)

- Huawei Technologies Co., Ltd. (China)

- ZTE Corporation (China)

- Motorola Solutions, Inc. (U.S.)

- NEC Corporation (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- Harris Corporation (U.S.)

- Thales Group (France)

- Alcatel-Lucent (France)

Latest Developments in Global Time Division Multiple Access Market

- In June 2023, ST Engineering iDirect introduced the Mx-DMA MRC (Maximum Rate Carrier) technology, achieving a new maximum symbol rate of 100 Msps. This development underscores the company's commitment to advancing satellite communication capabilities and supporting very high data rate applications. By integrating this technology with its MDM5010 modem, ST Engineering iDirect is enhancing time division multiple access network performance and reinforcing its position in the evolving global satellite communication market

- In February 2023, Kacific and ST Engineering iDirect extended their long-term technology partnership to expand satellite connectivity in Southeast Asia and other regions. This collaboration highlights their focus on leveraging time division multiple access technology to improve broadband access in underserved areas. By combining their expertise in ground systems and satellite communications, the partnership is strengthening network infrastructure and supporting the growing demand for reliable high-speed connectivity

- In December 2022, Comtech EF Data, which secured a contract to support the U.S. Navy’s time division multiple access Advanced Time Division Multiple Access Interface Processor (ATIP) terminals. These ATIP terminals are designed to enhance communication on U.S. Navy vessels, submarines, and shore platforms by providing advanced data management and communication capabilities, especially in environments with impaired signals. The new delivery order under this contract will allow the U.S. Navy to leverage time division multiple access technology for improved throughput and dynamic bandwidth management. This contract highlights the increasing importance of time division multiple access systems in military applications, particularly for secure and reliable communication in challenging environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Time Division Multiple Access Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Time Division Multiple Access Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Time Division Multiple Access Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.