Global Tiny Homes Market

Market Size in USD Billion

CAGR :

%

USD

5.81 Billion

USD

7.64 Billion

2024

2032

USD

5.81 Billion

USD

7.64 Billion

2024

2032

| 2025 –2032 | |

| USD 5.81 Billion | |

| USD 7.64 Billion | |

|

|

|

|

Tiny Homes Market Size

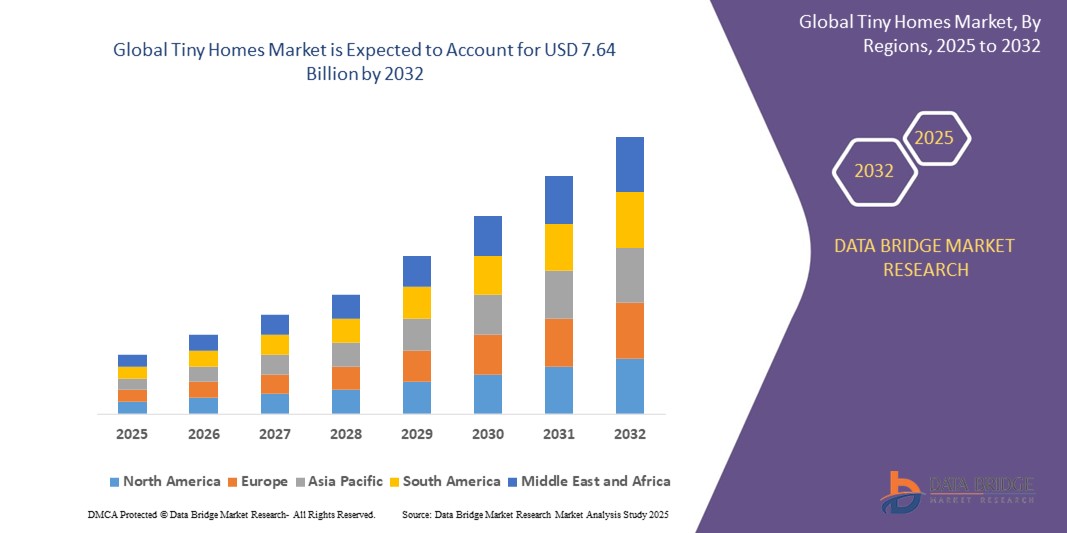

- The global tiny homes market size was valued at USD 5.81 billion in 2024 and is expected to reach USD 7.64 billion by 2032, at a CAGR of 3.5% during the forecast period

- The market growth is driven by increasing demand for affordable housing, growing interest in sustainable and minimalist lifestyles, and advancements in modular construction technologies

- Rising consumer preference for cost-effective, eco-friendly, and flexible living solutions is positioning tiny homes as a popular alternative to traditional housing, significantly boosting industry expansion

Tiny Homes Market Analysis

- Tiny homes, compact living spaces designed for efficiency and sustainability, are gaining traction as viable housing solutions for residential, commercial, and industrial applications due to their affordability, mobility, and minimal environmental footprint

- The surge in demand is primarily fueled by rising housing costs, environmental consciousness, and a growing preference for simplified, clutter-free living

- North America dominated the tiny homes market with the largest revenue share of 42.5% in 2024, driven by early adoption of minimalist lifestyles, high housing costs, and a strong presence of key manufacturers

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid urbanization, increasing housing demand, and rising disposable incomes

- The mobile tiny homes segment dominated the largest market revenue share of 52.3% in 2024, driven by the increasing demand for portable and flexible housing solutions, particularly among millennials and those seeking minimalist lifestyles

Report Scope and Tiny Homes Market Segmentation

|

Attributes |

Tiny Homes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tiny Homes Market Trends

“Increasing Integration of Smart Home Technologies and Sustainable Materials”

- The global tiny homes market is experiencing a significant trend toward integrating smart home technologies and sustainable building materials

- These technologies enable advanced automation and energy efficiency, providing enhanced control over lighting, heating, and appliances, as well as real-time monitoring of energy consumption

- Smart home-enabled tiny homes allow for proactive energy management, optimizing resource use and reducing environmental impact

- For instance, companies such as Nestron and Tumbleweed Tiny House Company are incorporating solar panels, smart thermostats, and modular furniture to create eco-friendly, customizable living spaces

- This trend enhances the appeal of tiny homes, making them attractive to eco-conscious consumers, minimalists, and those seeking affordable, high-tech housing solutions

- Sustainable materials, such as reclaimed wood and recycled metal, are increasingly used to minimize carbon footprints and align with the global push for environmentally responsible construction

Tiny Homes Market Dynamics

Driver

“Rising Demand for Affordable Housing and Minimalist Lifestyles”

- The growing consumer demand for cost-effective housing solutions, driven by rising real estate prices and economic pressures, is a major driver for the global tiny homes market

- Tiny homes offer affordability, requiring less land, construction materials, and maintenance costs compared to traditional homes, making them ideal for first-time buyers, retirees, and young professionals

- Government initiatives in regions such as North America and Europe, such as relaxed zoning regulations and incentives for sustainable housing, are further boosting market growth

- The proliferation of eco-friendly designs and the tiny house movement, which promotes minimalism and sustainable living, are driving adoption among environmentally conscious consumers

- Manufacturers are increasingly offering customizable, modular tiny homes as standard or optional solutions to meet diverse consumer preferences and enhance market appeal

Restraint/Challenge

“High Initial Costs and Regulatory Barriers”

- The significant upfront costs for designing, building, and integrating smart technologies or sustainable materials into tiny homes can be a barrier, particularly for cost-sensitive consumers in emerging markets

- Customizing or retrofitting tiny homes with advanced features, such as off-grid energy systems, can be complex and expensive

- Regulatory challenges, including restrictive zoning laws and building codes in many regions, pose significant hurdles to widespread adoption, as tiny homes often do not meet traditional housing standards

- Concerns over land availability and financing options for tiny homes further complicate market expansion, especially in densely populated urban areas or regions with strict regulations

- These factors can deter potential buyers and limit market growth, particularly in areas with low awareness of tiny home benefits or stringent regulatory environments

Tiny Homes market Scope

The market is segmented on the basis of product type, area, application, and distribution channel.

- By Product Type

On the basis of product type, the global tiny homes market is segmented into mobile tiny homes and stationary tiny homes. The mobile tiny homes segment dominated the largest market revenue share of 52.3% in 2024, driven by the increasing demand for portable and flexible housing solutions, particularly among millennials and those seeking minimalist lifestyles. Mobile tiny homes, often built on trailers, offer mobility and versatility for use as primary residences, vacation homes, or guest accommodations.

The stationary tiny homes segment is anticipated to witness the fastest growth rate of 5.37% from 2025 to 2032, fueled by rising urbanization and the need for affordable, permanent housing solutions in densely populated areas. Stationary tiny homes appeal to individuals and families seeking cost-effective and space-efficient living options, particularly in high-cost housing markets.

- By Area

On the basis of area, the global tiny homes market is segmented into less than 130 sq. ft., 130-500 sq. ft., and more than 500 sq. ft. The 130-500 sq. ft. segment dominated the market with a revenue share of 72.4% in 2024, as it strikes a balance between compact living and sufficient space for essential amenities, making it a preferred choice for both individuals and small families. A survey by the American Tiny House Association indicated that 67% of tiny home owners prefer this size range for its affordability and functionality.

The less than 130 sq. ft. segment is expected to experience the fastest growth rate of 8.43% from 2025 to 2032, driven by increasing urbanization and the demand for ultra-compact, affordable housing solutions in densely populated areas where space is limited.

- By Application

On the basis of application, the global tiny homes market is segmented into household, commercial, industrial, and others. The household segment held the largest market revenue share of 68.7% in 2024, driven by the rising popularity of tiny homes as primary residences, vacation homes, and secondary dwellings. The tiny house movement, emphasizing minimalism and sustainability, significantly contributes to this segment's dominance.

The commercial segment is anticipated to witness robust growth from 2025 to 2032, fueled by the increasing use of tiny homes in tourism activities, such as tiny home villages and rental facilities, as well as their adoption as office spaces and retail units. The integration of tiny homes in hospitality and real estate portfolios is enhancing market growth.

- By Distribution Channel

On the basis of distribution channel, the global tiny homes market is segmented into direct sales and distributors. The direct sales segment accounted for the largest market revenue share of 60.2% in 2024, as consumers prefer purchasing directly from manufacturers such as Nestron, Tumbleweed Tiny House Company, and Cavco Industries for customized and cost-effective solutions.

The distributors segment is expected to witness the fastest growth rate of 7.01% from 2025 to 2032, particularly in regions such as Japan, where distributors facilitate market penetration by bridging the gap between manufacturers and consumers, enhancing accessibility in diverse markets.

Tiny Homes Market Regional Analysis

- North America dominated the tiny homes market with the largest revenue share of 42.5% in 2024, driven by early adoption of minimalist lifestyles, high housing costs, and a strong presence of key manufacturers

- Consumers prioritize tiny homes for their affordability, minimal environmental impact, and flexibility, particularly in regions with rising real estate prices and a focus on minimalist lifestyles

- Growth is supported by advancements in construction technologies, such as 3D printing and modular designs, alongside rising adoption in both household and commercial applications

U.S. Tiny Homes Market Insight

The U.S. tiny homes market captured the largest revenue share of 81.7% in 2024 within North America, fueled by strong demand for affordable housing and growing consumer awareness of sustainability benefits. The trend towards minimalism and the tiny house movement, coupled with regulatory changes supporting tiny homes as accessory dwelling units (ADUs), further boosts market expansion. Major companies such as Tumbleweed Tiny House Company and Skyline Champion Corporation enhance market growth through innovative designs and customization options.

Europe Tiny Homes Market Insight

The Europe tiny homes market is expected to witness significant growth, supported by increasing emphasis on sustainable living and affordable housing solutions. Consumers seek tiny homes that offer energy efficiency and space-saving designs while complying with strict building regulations. The growth is prominent in both residential and tourism applications, with countries such as Germany and the U.K. showing notable uptake due to rising environmental concerns and urban space constraints.

U.K. Tiny Homes Market Insight

The U.K. market for tiny homes is expected to witness rapid growth, driven by demand for sustainable and minimalist living in urban and suburban settings. Increased interest in eco-friendly housing and rising awareness of tiny homes’ cost-effectiveness encourage adoption. Evolving zoning regulations that accommodate tiny homes as viable housing options further influence consumer choices, balancing affordability with compliance.

Germany Tiny Homes Market Insight

Germany is expected to witness robust growth in the tiny homes market, attributed to its advanced construction sector and high consumer focus on energy efficiency and sustainability. German consumers prefer technologically advanced tiny homes that reduce environmental impact and contribute to lower living costs. The integration of these homes in both premium residential projects and community-driven initiatives supports sustained market growth.

Asia-Pacific Tiny Homes Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid urbanization, rising housing costs, and increasing disposable incomes in countries such as China, Japan, and India. Growing awareness of sustainable living, affordability, and space-efficient designs boosts demand. Government initiatives promoting eco-friendly housing and innovative construction technologies, such as Japan’s “Kyosho Jutaku” micro-homes, further encourage the adoption of tiny homes.

Japan Tiny Homes Market Insight

Japan’s tiny homes market is expected to witness rapid growth due to strong consumer preference for high-quality, space-efficient homes that enhance living comfort and sustainability. The presence of major manufacturers such as Muji and Daiwa House Industry, along with the integration of tiny homes in OEM construction, accelerates market penetration. Rising interest in minimalist lifestyles and aftermarket customization also contributes to growth.

China Tiny Homes Market Insight

China holds the largest share of the Asia-Pacific tiny homes market, propelled by rapid urbanization, increasing vehicle ownership, and growing demand for affordable and sustainable housing solutions. The country’s expanding middle class and focus on innovative construction methods support the adoption of tiny homes. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, driving significant growth.

Tiny Homes Market Share

The tiny homes industry is primarily led by well-established companies, including:

- Skyline Champion Corporation (U.S.)

- Nestron (Singapore)

- The Tiny Housing Co. (Australia)

- THE QUBE (U.S.)

- TIMBERCARAFT TINY HOMES (Canada)

- CargoHome (U.S.)

- ATLAS VANS (U.S.)

- Oregon Cottage Company (U.S.)

- Tiny Home Builders (U.S.)

- Tiny SMART House, Inc. (U.S.)

- Tumbleweed Tiny House Company (U.S.)

- New Frontier Design(U.S.)

- Mustard Seed Tiny Homes LLC (U.S.)

- MAVERICK TINY HOMES, LLC (U.S.)

- California Tiny House (U.S.)

- Häuslein Pty Ltd (Australia)

- American Tiny House (U.S.)

- Tiny Heirloom(U.S.)

- B&B MICRO MANUFACTURING, INC. (U.S.)

What are the Recent Developments in Global Tiny Homes Market?

- In August 2025, Tiny House Manufacturing, Inc. announced plans to open a state-of-the-art production facility in Oregon, aimed at scaling its output of prefabricated and custom-built tiny homes. This strategic expansion responds to rising demand for affordable, sustainable housing across the Western United States, particularly in regions embracing minimalist living and eco-conscious design. The new factory will feature advanced automation, green building practices, and flexible production lines, enabling faster delivery and broader customization options. The initiative underscores the company’s commitment to market accessibility, community development, and housing innovation

- In November 2024, WeeCasa, a prominent operator of tiny home communities, secured Series C funding to accelerate the expansion of its co-living model across the United States. The investment reflects rising demand for affordable, sustainable housing and community-based living, especially among younger demographics and remote workers. WeeCasa plans to use the capital to develop new sites, enhance infrastructure, and scale its operational capabilities—bringing its eco-conscious, minimalist lifestyle to more regions nationwide

- In February 2024, Factory-Built Homes introduced a new line of net-zero energy tiny homes, marking a significant step toward sustainable and off-grid living. These compact dwellings feature integrated solar panels, high-efficiency appliances, and advanced insulation systems, enabling them to generate as much energy as they consume. Designed for eco-conscious consumers, the homes offer a blend of affordability, mobility, and environmental responsibility, aligning with broader industry trends toward modular construction and carbon-neutral housing. The launch reflects growing demand for energy-efficient alternatives that reduce reliance on traditional utilities and support a greener lifestyle

- In December 2023, Nestron, a manufacturer known for its futuristic designs, unveiled new models of its Cube series, including the Cube Two X. These homes are fully customizable and integrate smart home technology, showcasing the market's trend toward technologically advanced and aesthetically pleasing prefab designs

- In July 2022, a significant acquisition was announced when Alta Cima Corporation and Champion Retail Housing, a subsidiary of Skyline Champion Corp., entered an agreement for the purchase of the Factory Expo Home Centres' assets. This strategic acquisition expands Skyline Champion's retail footprint and production capabilities, consolidating its position in the North American tiny homes market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.