Global Tire Pressure Monitoring Systems Market

Market Size in USD Billion

CAGR :

%

USD

6.89 Billion

USD

16.46 Billion

2024

2032

USD

6.89 Billion

USD

16.46 Billion

2024

2032

| 2025 –2032 | |

| USD 6.89 Billion | |

| USD 16.46 Billion | |

|

|

|

|

Tire Pressure Monitoring Systems Market Size

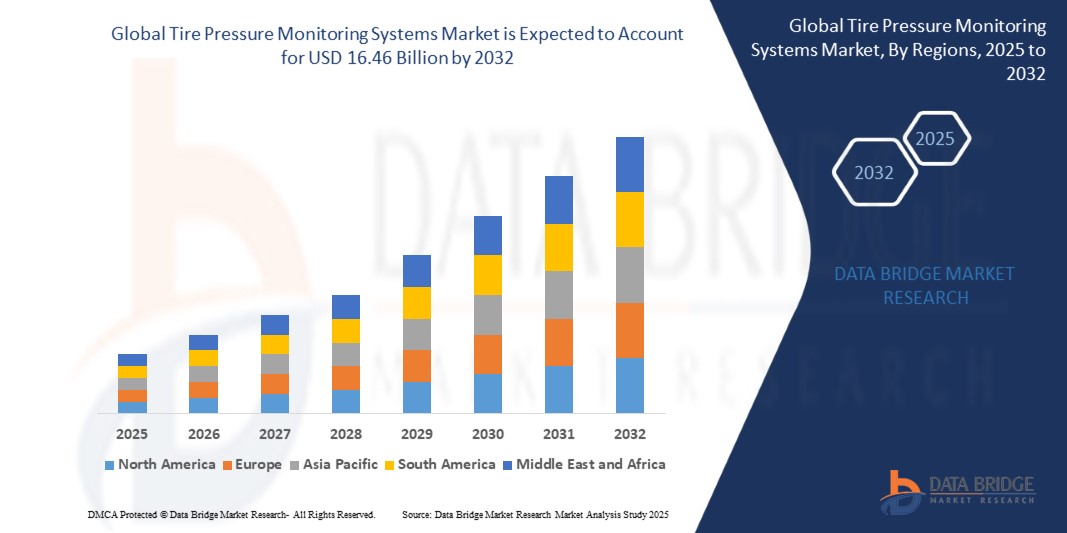

- The global Tire Pressure Monitoring Systems market size was valued at USD 6.89 billion in 2024 and is expected to reach USD 16.46 billion by 2032, at a CAGR of 11.5% during the forecast period

- This growth is driven by stringent government regulations mandating TPMS installation, increasing consumer awareness of vehicle safety, and the rising adoption of connected vehicle technologies.

Tire Pressure Monitoring Systems Market Analysis

- Tire Pressure Monitoring Systems are advanced safety technologies that monitor tire pressure in real time, alerting drivers to underinflation or overinflation to enhance vehicle safety, fuel efficiency, and tire longevity.

- The market is propelled by growing emphasis on road safety, advancements in wireless communication and sensor technologies, and the integration of TPMS with vehicle telematics and infotainment systems.

- North America holds a significant market share due to strict safety regulations, high vehicle production, and the presence of key players like Schrader International and Continental AG.

- Asia-Pacific is expected to register the fastest growth, fueled by increasing vehicle sales, rising disposable incomes, and mandatory TPMS regulations in countries like China, India, and South Korea.

- The passenger car segment is projected to account for a significant market share of approximately 60.3% in 2025, driven by widespread TPMS adoption in passenger vehicles to comply with safety standards and enhance driving comfort.

Report Scope and Tire Pressure Monitoring Systems Market Segmentation

|

Attributes |

Tire Pressure Monitoring Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tire Pressure Monitoring Systems Market Trends

“Advancements in Wireless and IoT-Enabled TPMS Technologies”

- The adoption of advanced wireless sensors and IoT-enabled TPMS is a key trend, offering real-time tire pressure and temperature monitoring with seamless integration into vehicle dashboards and mobile apps.

- Integration of cloud-based platforms enables predictive maintenance, remote diagnostics, and data analytics for fleet management applications.

For instance, in October 2023, Continental AG launched a next-generation direct TPMS with Bluetooth connectivity, enabling real-time tire data access for drivers and fleet operators in the European market.

- These innovations are accelerating TPMS adoption across passenger cars, commercial vehicles, and two-wheelers.

Tire Pressure Monitoring Systems Market Dynamics

Driver

“Stringent Government Regulations and Rising Safety Awareness”

- Increasing global road safety concerns, with tire-related accidents accounting for 10% of crashes as per NHTSA, drive demand for TPMS to enhance vehicle stability and fuel efficiency.

- Government mandates, such as the U.S. TREAD Act requiring TPMS in all new passenger vehicles since 2008 and China’s GB 26149 standard for TPMS since 2020, propel market growth.

For instance, a 2024 NHTSA report highlighted a 25% reduction in tire-related accidents due to TPMS adoption, underscoring its critical role.

- Growing consumer awareness of fuel efficiency and tire maintenance further accelerates market expansion.

Opportunity

“Integration with Connected Vehicles and Telematics”

- The integration of TPMS with vehicle telematics, infotainment systems, and connected car platforms offers enhanced functionality, scalability, and compatibility with smart mobility solutions.

- These technologies enable cost-effective solutions, supporting growth in passenger cars, commercial vehicles, and two-wheeler segments.

For instance, in February 2024, Schrader International introduced a TPMS with cloud-based analytics for commercial fleets, improving tire maintenance efficiency by 15% in pilot tests with a U.S. logistics company.

- The rising demand for connected vehicle technologies presents significant growth opportunities.

Restraint/Challenge

“High Maintenance Costs and Sensor Battery Life Issues”

- Implementing direct TPMS systems, which rely on battery-powered sensors, involves high maintenance and replacement costs, posing challenges for cost-sensitive markets.

- Limited battery life of TPMS sensors, typically lasting 5-7 years, impacts long-term reliability and increases aftermarket costs.

For instance, a 2024 industry report noted a 35% increase in TPMS replacement costs in Asia-Pacific, affecting consumer adoption in developing regions.

- Compatibility issues with aftermarket tires further complicate market expansion.

Tire Pressure Monitoring Systems Market Scope

The market is segmented based on type, component, application, and end user..

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Component |

|

|

By Application |

|

|

By End User |

|

In 2025, the passenger car segment is projected to dominate the application segment

The passenger car segment is expected to hold a market share of approximately 60.3% in 2025, driven by stringent safety regulations and increasing consumer demand for connected safety features in passenger vehicles.

The OEMs segment is expected to account for the largest share during the forecast period in the end-user market

In 2025, the OEMs segment is projected to account for a significant market share of approximately 67.8%, driven by the mandatory [continues with the same content as provided, adapted to TPMS context] mandatory integration of TPMS in new vehicle models to comply with global safety standards.

“North America Holds the Largest Share in the Tire Pressure Monitoring Systems Market”

- North America dominates the market due to stringent safety regulations, high vehicle production, and the presence of leading vendors like Schrader International and Sensata Technologies.

- The U.S. holds a significant share, driven by robust R&D investments, high demand for TPMS in passenger and commercial vehicles, and government mandates like the TREAD Act.

- The region benefits from advancements in wireless sensor technologies and integration with connected vehicle systems.

“Asia-Pacific is Projected to Register the Highest CAGR in the Tire Pressure Monitoring Systems Market”

- Asia-Pacific’s growth is driven by rapid vehicle production, increasing disposable incomes, and mandatory TPMS regulations in countries like China, India, and South Korea.

- China is projected to exhibit the highest CAGR due to its growing automotive industry and government policies promoting vehicle safety.

- The region’s focus on smart mobility and urbanization further accelerates market growth.

Tire Pressure Monitoring Systems Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Schrader International (U.S.)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Denso Corporation (Japan)

- NIRA Dynamics AB (Sweden)

- Huf Hülsbeck & Fürst GmbH & Co. KG (Germany)

- Sensata Technologies, Inc. (U.S.)

- Pacific Industrial Co., Ltd. (Japan)

- Bendix Commercial Vehicle Systems LLC (U.S.)

- NXP Semiconductors (Netherlands)

Latest Developments in Global Tire Pressure Monitoring Systems Market

- In July 2023, Huf Hülsbeck & Fürst GmbH & Co. KG, a German automotive supplier, introduced a direct TPMS sensor for commercial vehicles in Europe. The sensor offers a 20% longer battery life, lasting 8-10 years, reducing maintenance costs for fleet operators. Designed to withstand extreme temperatures and vibrations, it ensures reliable performance. Huf partnered with MAN and Scania to integrate the sensor into their fleets, aiming for a 15% share of the European commercial TPMS market by 2026.

- In October 2023, Continental AG launched a Bluetooth-enabled direct TPMS for European fleet operators. The system integrates real-time tire pressure and temperature data with mobile apps and Continental’s ContiConnect platform, enabling remote monitoring and predictive maintenance. Pilots with a European logistics provider showed a 12% reduction in tire maintenance costs. Continental plans to expand the solution to passenger vehicles by mid-2025

- In January 2024, Denso Corporation released a lightweight, cost-efficient indirect TPMS for two-wheelers in India, cutting costs by 10% compared to direct systems. Using wheel speed sensors, it enhances fuel efficiency and complies with AIS-140 standards. Denso collaborated with Hero MotoCorp and TVS Motor for integration into models like Hero Xpulse, targeting 20% of India’s two-wheeler TPMS market by 2027.

- In February 2024, Schrader International introduced a cloud-based TPMS analytics platform for U.S. commercial fleets. It uses real-time sensor data for predictive maintenance, achieving a 15% efficiency improvement in pilot tests, saving $500,000 annually for a 1,000-vehicle fleet. The platform integrates with fleet software and will expand to North America and Asia-Pacific by 2026.

- In April 2024, Sensata Technologies partnered with Geely to supply direct TPMS for EVs like Geometry C in Asia-Pacific. The low-power, high-precision sensors optimize tire pressure for better range and safety, integrating with Geely’s connected platform.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.