Global Tissue Testing Market

Market Size in USD Billion

CAGR :

%

USD

5.27 Billion

USD

8.29 Billion

2025

2033

USD

5.27 Billion

USD

8.29 Billion

2025

2033

| 2026 –2033 | |

| USD 5.27 Billion | |

| USD 8.29 Billion | |

|

|

|

|

Tissue Testing Market Size

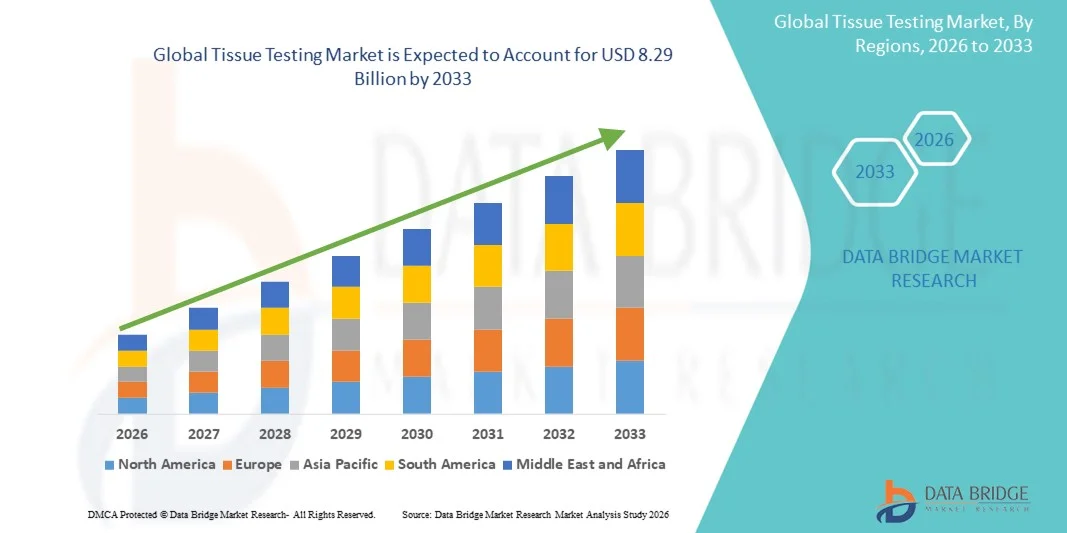

- The global tissue testing market size was valued at USD 5.27 billion in 2025 and is expected to reach USD 8.29 billion by 2033, at a CAGR of 5.83% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising adoption of advanced diagnostic technologies, and growing demand for personalized medicine and precision diagnostics

- Furthermore, continuous technological advancements in tissue analysis, including digital pathology and automated testing solutions, are enabling faster, more accurate, and cost-efficient diagnostics. These converging factors are accelerating the uptake of tissue testing solutions, thereby significantly boosting the industry's growth

Tissue Testing Market Analysis

- Tissue testing, encompassing advanced diagnostics of tissue samples for disease detection, prognosis, and treatment monitoring, is increasingly critical in modern healthcare due to its precision, ability to support personalized medicine, and integration with digital pathology and laboratory automation systems

- The escalating demand for tissue testing is primarily fueled by the rising prevalence of chronic diseases such as cancer, growing awareness of early diagnosis benefits, and the adoption of advanced diagnostic technologies for faster and more accurate results

- North America dominated the tissue testing market with the largest revenue share of 39.8% in 2025, characterized by early adoption of advanced diagnostic tools, high healthcare expenditure, and a strong presence of key industry players, with the U.S. witnessing substantial growth in tissue testing adoption across hospitals, research labs, and diagnostic centers, driven by innovations in AI-assisted pathology and automated tissue analysis platforms

- Asia-Pacific is expected to be the fastest-growing region in the tissue testing market during the forecast period due to increasing healthcare infrastructure investments, rising disposable incomes, and growing awareness about early disease detection

- Immunohistochemistry segment dominated the tissue testing market with a market share of 42.7% in 2025, driven by its established reliability, wide adoption in clinical diagnostics, and compatibility with both traditional and digital pathology workflows

Report Scope and Tissue Testing Market Segmentation

|

Attributes |

Tissue Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Tissue Testing Market Trends

Advancements in AI-Enabled Digital Pathology

- A significant and accelerating trend in the global tissue testing market is the integration of artificial intelligence (AI) with digital pathology platforms, enabling faster, more accurate, and automated tissue analysis in clinical and research settings

- For instance, Paige.AI offers AI-powered pathology solutions that assist pathologists in detecting cancerous tissues with higher precision, improving diagnostic efficiency and accuracy

- AI integration in tissue testing allows features such as predictive analytics for disease progression, automated detection of abnormal tissue patterns, and intelligent prioritization of high-risk samples. For instance, PathAI’s models help reduce diagnostic errors and provide actionable insights to clinicians

- The seamless integration of AI with laboratory information systems and digital pathology platforms facilitates centralized management of tissue samples, supporting multi-site laboratories and collaborative research environments

- The trend toward AI-enabled, automated, and data-driven tissue diagnostics is reshaping expectations for clinical accuracy and turnaround time. Consequently, companies such as Ibex Medical Analytics are developing AI-powered tools that enhance detection capabilities while reducing manual workload

- The demand for AI-integrated tissue testing solutions is growing rapidly across hospitals, diagnostic labs, and research centers, as healthcare providers prioritize precision, efficiency, and scalable diagnostic workflows

- Integration of cloud-based analytics and telepathology is emerging, enabling remote review of tissue samples and collaborative diagnosis, especially for underserved regions

- Adoption of multiplex and high-throughput tissue assays is increasing, allowing simultaneous testing of multiple biomarkers, which accelerates research and clinical decision-making

Tissue Testing Market Dynamics

Driver

Increasing Demand Due to Rising Chronic Disease Prevalence and Early Diagnosis Awareness

- The rising incidence of chronic diseases such as cancer, coupled with growing awareness of early diagnosis benefits, is a key driver for increased adoption of tissue testing solutions

- For instance, in March 2025, Roche Diagnostics expanded its tissue diagnostics portfolio to include AI-assisted pathology tools for early cancer detection, supporting more personalized treatment decisions

- As healthcare providers focus on timely and accurate disease detection, tissue testing offers advanced solutions for prognosis, treatment monitoring, and companion diagnostics

- Furthermore, the growing adoption of laboratory automation and digital pathology platforms is making tissue testing more accessible and efficient, driving its integration into clinical workflows

- The demand for high-precision, rapid, and reliable tissue analysis, along with rising investments in healthcare infrastructure and research initiatives, is propelling the market growth across hospitals, clinics, and research laboratories

- Increasing collaborations between diagnostic companies and research institutes are driving innovation in tissue testing technologies and accelerating product development

- Government initiatives promoting early cancer screening and precision medicine programs are expanding the adoption of tissue diagnostics, particularly in emerging markets

Restraint/Challenge

High Cost of Advanced Technologies and Regulatory Compliance

- The relatively high cost of advanced tissue testing equipment and AI-powered pathology platforms poses a challenge to broader adoption, especially in developing regions with limited healthcare budgets

- For instance, smaller diagnostic labs may delay adoption due to the upfront capital expenditure required for AI-enabled imaging systems or automated tissue analysis platforms

- Regulatory compliance and validation requirements for clinical diagnostics create hurdles, as manufacturers must meet stringent standards to ensure safety, accuracy, and reliability

- While technological adoption is growing, the need for skilled personnel to operate complex tissue testing systems and interpret AI outputs can slow market penetration

- Overcoming these challenges through cost-effective solutions, streamlined regulatory approvals, and workforce training will be critical for sustained growth in the tissue testing market

- Inconsistent reimbursement policies across regions for advanced tissue tests may limit adoption, particularly for high-cost assays

- Challenges in standardizing AI algorithms and tissue sample processing across different labs and geographies can hinder scalability and broader market acceptance

Tissue Testing Market Scope

The market is segmented on the basis of product type, technology, disease, and end user.

- By Product Type

On the basis of product type, the tissue testing market is segmented into instruments and consumables. The consumables segment dominated the market in 2025, driven by the recurring demand for reagents, slides, stains, antibodies, and other laboratory essentials required for tissue sample analysis. Consumables are essential for almost every test conducted, ensuring consistent revenue for suppliers. The high adoption of advanced staining techniques and immunohistochemistry assays further fuels consumables consumption. Hospitals, research laboratories, and diagnostic centers rely heavily on consumables for routine testing, particularly in high-volume laboratories. Continuous technological advancements, such as multiplex staining kits and automated reagents, are increasing the efficiency and reliability of tissue testing, thereby sustaining demand.

The instruments segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the increasing adoption of digital pathology platforms, automated tissue processors, slide scanners, and AI-enabled imaging systems. Instrumentation allows laboratories to scale operations and improve diagnostic accuracy, reducing manual errors and turnaround time. Growing investments in research and clinical diagnostic infrastructure, particularly in emerging regions, are accelerating the uptake of advanced tissue testing instruments. Innovations in compact, multi-functional instruments suitable for small to mid-sized labs are further contributing to growth.

- By Technology

On the basis of technology, the market is segmented into Haematoxylin and Eosin (H&E), Immunohistochemistry (IHC), In Situ Hybridization (ISH), Primary and Special Staining, Digital Pathology and Workflow, and Anatomic Pathology. The Immunohistochemistry (IHC) segment dominated the market in 2025 with a market share of 42.7%, driven by its widespread use in cancer diagnostics, biomarker identification, and personalized medicine applications. IHC allows for highly specific detection of proteins in tissue samples, which is critical for disease classification and prognosis. Clinical laboratories prioritize IHC for its accuracy, reproducibility, and compatibility with both traditional microscopy and digital pathology systems. The segment also benefits from continuous innovation in antibody panels, multiplexing techniques, and automated staining systems. High prevalence of cancers such as breast, prostate, and lung cancer further ensures consistent IHC testing demand.

The Digital Pathology and Workflow segment is expected to witness the fastest growth from 2026 to 2033, fueled by the integration of AI, cloud-based analytics, and remote diagnostics. Digital pathology enables faster image analysis, easier collaboration among pathologists, and improved diagnostic consistency. Laboratories are increasingly adopting whole-slide imaging and AI-assisted platforms to reduce manual workloads and enhance efficiency. Regulatory approvals and increasing acceptance of digital diagnostics in clinical settings are further boosting adoption. The COVID-19 pandemic also accelerated interest in remote pathology solutions, highlighting the need for scalable and automated workflows.

- By Disease

On the basis of disease, the tissue testing market is segmented into non-small cell lung cancer, breast cancer, lymphoma, gastric cancer, prostate cancer, and others. The Breast Cancer segment dominated the market in 2025, owing to high global prevalence, well-established screening programs, and the critical need for accurate biomarker testing. Tissue diagnostics, including IHC and molecular testing, play a central role in identifying hormone receptor status and guiding personalized treatment strategies. Breast cancer tissue testing is routinely performed in hospitals, diagnostic labs, and research centers, ensuring steady demand. Continuous advancements in multiplex assays and companion diagnostics further enhance the relevance of breast cancer testing. Growing awareness campaigns and early detection initiatives contribute to rising testing volumes.

The Lymphoma segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing incidence of hematologic malignancies and the complexity of diagnosis requiring specialized tissue and molecular testing. Advanced assays such as IHC panels, ISH, and gene expression profiling are critical for lymphoma subtyping and treatment decisions. Rising investments in cancer research, coupled with the development of targeted therapies, are expanding the need for accurate tissue diagnostics. Emerging markets are witnessing adoption of these specialized tests as healthcare infrastructure improves.

- By End User

On the basis of end user, the tissue testing market is segmented into hospitals, contract research organizations (CROs), ambulatory surgical centres, diagnostic laboratories, research organizations, and biotechnology companies. The Hospitals segment dominated the market in 2025, driven by the high volume of tissue testing conducted for patient diagnostics, cancer detection, and monitoring of treatment efficacy. Hospitals often maintain in-house pathology labs equipped with both instruments and consumables, providing convenience, timely reporting, and integrated patient care. Large hospital networks leverage advanced tissue diagnostics, including automated staining and AI-assisted analysis, to improve operational efficiency. Collaboration with research institutes for clinical trials further strengthens hospital demand.

The Diagnostic Laboratories segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the increasing outsourcing of tissue testing services, rising patient volumes, and demand for specialized tests. Laboratories benefit from economies of scale, automated workflows, and centralized sample processing capabilities. Growing awareness of early disease detection and the need for reliable, high-throughput testing is driving laboratory expansion. Partnerships with biotech firms and CROs for clinical research also support segment growth.

Tissue Testing Market Regional Analysis

- North America dominated the tissue testing market with the largest revenue share of 39.8% in 2025, characterized by early adoption of advanced diagnostic tools, high healthcare expenditure, and a strong presence of key industry players

- Healthcare providers and diagnostic laboratories in the region prioritize accuracy, rapid turnaround, and personalized medicine, which has led to widespread adoption of tissue testing solutions, including immunohistochemistry, molecular diagnostics, and digital pathology platforms

- This widespread adoption is further supported by strong government initiatives for early disease detection, significant healthcare spending, and a concentration of key industry players investing in AI-enabled tissue diagnostics, establishing North America as a leading region for tissue testing innovation

U.S. Tissue Testing Market Insight

The U.S. tissue testing market captured the largest revenue share of 82% in 2025 within North America, driven by the high adoption of advanced diagnostic technologies and a strong focus on early disease detection. Healthcare providers are increasingly prioritizing precision diagnostics, including immunohistochemistry, molecular testing, and digital pathology solutions. The growing integration of AI and automated laboratory workflows is further enhancing testing efficiency and accuracy. Moreover, the rising prevalence of chronic diseases such as cancer and cardiovascular disorders is fueling consistent demand. Strong investments in healthcare infrastructure and research collaborations with biotechnology companies continue to support market expansion.

Europe Tissue Testing Market Insight

The Europe tissue testing market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing awareness of early diagnosis and stringent regulatory standards for clinical diagnostics. The rising prevalence of cancers and other chronic diseases, combined with the demand for personalized medicine, is fostering tissue testing adoption. European laboratories are increasingly investing in advanced instruments and consumables to support precision diagnostics. The region is witnessing growth across hospitals, diagnostic laboratories, and research organizations, with tissue testing incorporated into both routine clinical practice and clinical trials.

U.K. Tissue Testing Market Insight

The U.K. tissue testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investment in healthcare infrastructure and the adoption of digital pathology platforms. Increasing patient awareness of early cancer screening and personalized therapies is encouraging hospitals and diagnostic labs to expand testing capabilities. The U.K.’s well-developed research and clinical ecosystem, alongside strong government support for healthcare innovation, is expected to continue driving market growth. In addition, collaborations between diagnostic providers and biotechnology companies are facilitating the development of advanced tissue testing solutions.

Germany Tissue Testing Market Insight

The Germany tissue testing market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s robust healthcare system and emphasis on technological innovation. German laboratories are increasingly adopting automated tissue processing systems and AI-enabled diagnostic platforms. Growing demand for precision medicine, cancer diagnostics, and high-throughput testing solutions supports market expansion. Furthermore, collaborations between research institutes, hospitals, and industry players are enhancing innovation and accessibility. The integration of digital pathology with laboratory workflows is also becoming prevalent, aligning with Germany’s focus on quality, reliability, and efficiency in healthcare.

Asia-Pacific Tissue Testing Market Insight

The Asia-Pacific tissue testing market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising healthcare expenditure, increasing prevalence of chronic diseases, and improving healthcare infrastructure in countries such as China, Japan, and India. Government initiatives promoting early disease detection and precision medicine are accelerating adoption. In addition, growing awareness of cancer screening programs and research collaborations is supporting market expansion. The region’s emerging diagnostic laboratories and increasing domestic production of instruments and consumables are enhancing affordability and accessibility of tissue testing solutions.

Japan Tissue Testing Market Insight

The Japan tissue testing market is gaining momentum due to the country’s advanced healthcare infrastructure, high demand for early cancer detection, and increasing adoption of digital pathology and AI-assisted diagnostics. Hospitals and research centers are leveraging automated tissue processing systems for improved accuracy and efficiency. In addition, Japan’s aging population is expected to spur demand for rapid and reliable tissue diagnostics. Integration of tissue testing platforms with laboratory information systems and precision medicine initiatives is further driving market growth across residential and clinical applications.

India Tissue Testing Market Insight

The India tissue testing market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expanding healthcare infrastructure, and rising awareness of early diagnosis benefits. India is witnessing strong adoption of both instruments and consumables in hospitals, diagnostic labs, and research centers. Government programs promoting cancer screening and precision diagnostics, alongside the availability of cost-effective tissue testing solutions, are fueling growth. In addition, domestic manufacturers and increasing collaborations with global diagnostic companies are supporting market expansion across the country.

Tissue Testing Market Share

The Tissue Testing industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher (U.S.)

- Leica Biosystems, (Germany)

- Agilent Technologies, Inc. (U.S.)

- Sakura Finetek Japan Co.,Ltd. (Japan)

- 3DHISTECH Ltd. (Hungary)

- Abbott (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- QIAGEN (Netherlands)

- Cell Signaling Technology, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bio Genex Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- Hologic, Inc. (U.S.)

- Bio SB, Inc. (U.S.)

- Enzo Biochem, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

What are the Recent Developments in Global Tissue Testing Market?

- In September 2025, 3DHISTECH’s Ki‑67 Quantification Module received IVDR certification (per EU in‑vitro diagnostics regulation), enabling reliable digital quantification of Ki‑67 proliferation index in tissue samples a key biomarker used in cancer diagnosis and prognosis under approved regulatory framework

- In March 2025, Agilent Technologies announced that it would showcase next‑generation digital pathology solutions at the United States and Canadian Academy of Pathology (USCAP) Conference highlighting collaborations with companies such as Hamamatsu Photonics, PathAI, Proscia and Visiopharm to deliver an end‑to‑end digital pathology workflow combining AI‑driven software and automated staining

- In January 2025, Proscia announced that its enterprise pathology platform saw its growth “more than double” during 2024, reflecting a surge in adoption of AI‑enabled digital pathology solutions by diagnostic labs and life‑sciences organisations

- In May 2024, 3DHISTECH launched the P480 2nd Generation slide scanner, an upgraded flagship digital pathology scanner featuring enhanced optics, polarization imaging, improved focusing mechanism and user‑friendly touchscreen aimed at improving throughput, image quality and durability for modern digitized labs

- In February 2024, Proscia received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Concentriq AP‑Dx digital pathology software for primary diagnosis marking a regulatory milestone enabling digital pathology workflows to be used clinically in place of traditional glass‑slide microscopy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.