Tokenization Market Analysis and Size

Service providers were continuously trying to find out ways to increase the precision of work, enhanced services, safety and work with growing technology. The requirement for these reasons is being fulfilled through the implementation of the tokenization as they are used to provide enhanced, uninterrupted free, and timely services at the industrial operations. The tokenization in various industries is being used widely due to the rising demand for customer experience. It enables industries to enhance their operations and productivity. Tokenization’s help end-users to make better decision regarding payment modes, assets management, safeguard customer data, and others. The global tokenization market is in the growth phase rapidly due to growing digitization in various industries which drives the demand for the tokenization. The companies are even launching new products to gain a larger market share.

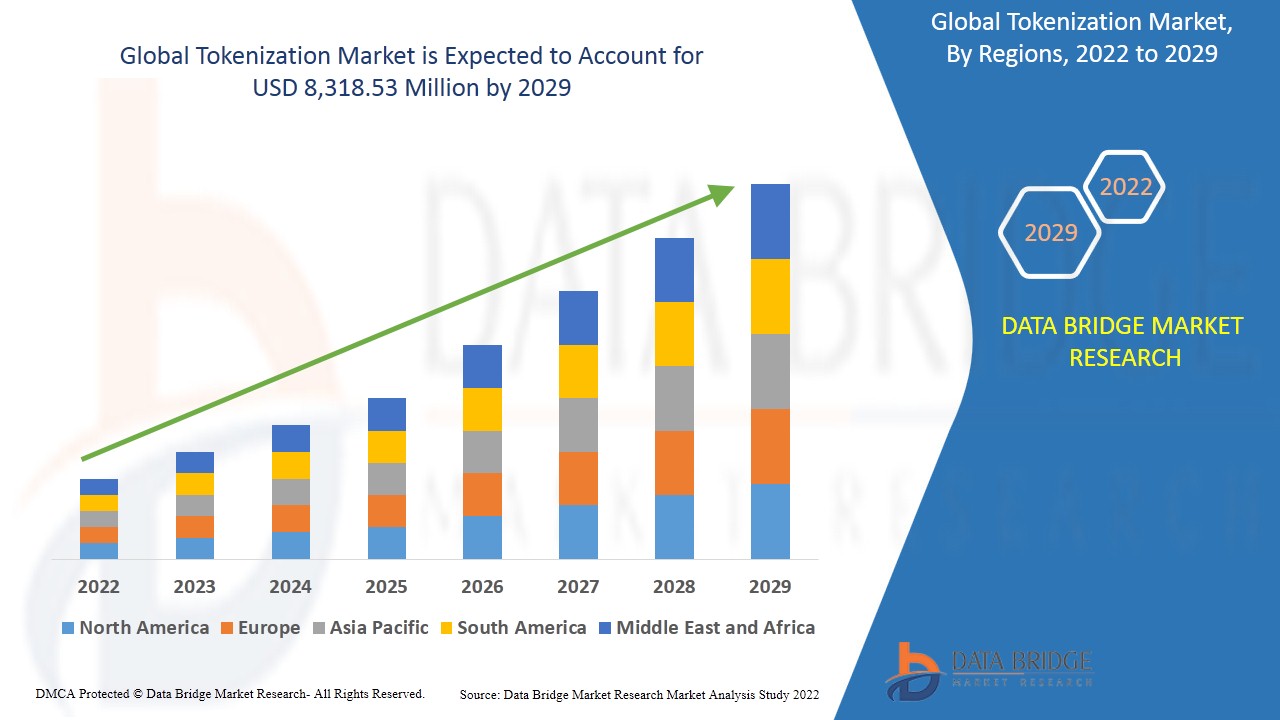

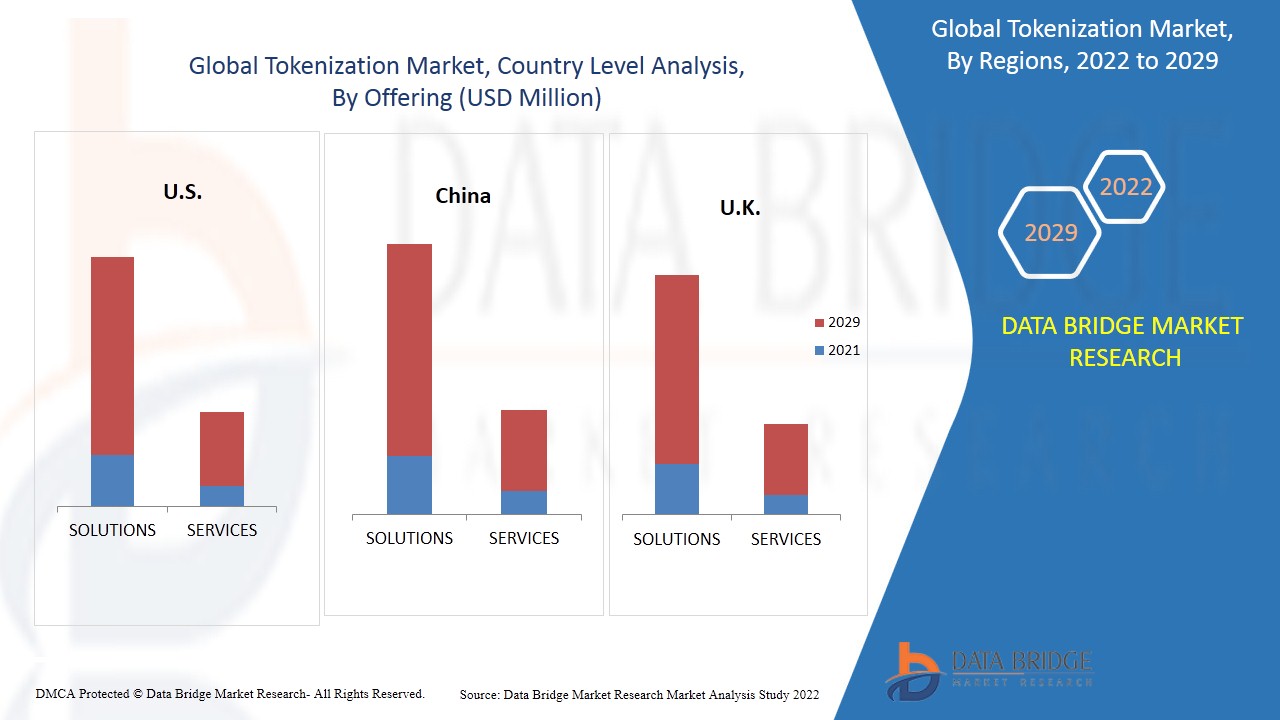

Data Bridge Market Research analyses that the global tokenization market is expected to reach the value of USD 8,318.53 million by 2029, at a CAGR of 16.8% during the forecast period. Solutions" accounts for the largest offering segment in the tokenization market. The solutions provides accurate information which is utilized to develop high precision IoT network. The tokenization market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Forecast Period |

2022 – 2029 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Offering (Solutions and Services), Organization Size (Large Organizations and SMES), Deployment (Cloud and On-Premises), Technique (API-Based and Gateway-Based), Technology (Internet of Things (IOT), Machine learning and artificial intelligence, Cloud computing, Natural language processing (NLP), Block chain, and Others), Application (Payment Security, User-Authentication, Compliance Management, Data Processing, Encryption and Others), End-User (Banking, Financial Services & Insurance, IT&Telecommunications, Government & Public Sector, Media & Entertainment, Retail & E-Commerce, Manufacturing, Energy & Utilities, Automotive, Aerospace & defence & others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Fiserv, Inc., Thales Group, Broadcom, Futurex, Hewlett Packard Enterprise Development LP, FIS, Lookout, Inc., Protegrity Inc., Visa, Mastercard, Micro Focus, American Express Company, Entrust Corporation, VeriFone, Inc., utimaco GmbH, PaymentVision, Tokeny Solutions, Quantoz NV, HST, Paya, Inc., Baffle, StrongKey, Inc., Prime Factors, Fortanix, AsiaPay Limited, Marqeta, Inc., Open Text Corporation, Randtronics, Bluefin Payment Systems, Sygnum Pte. Ltd., among others.

|

Market Definition

Tokenization is the process of exchanging sensitive data for non-sensitive data called "tokens" that can be used in a database or internal system without bringing it into scope.

Unlike encrypted data, tokenized data is undecipherable and irreversible. This distinction is particularly important because there is no mathematical relationship between the token and its original number, tokens cannot be returned to their original form without the presence of additional, separately stored data. Tokens have virtually no value on their own—they are only useful because they represent something bigger, such as a credit card primary account number (PAN) or Social Security number (SSN). A good analogy is a poker chip. Instead of filling a table with cash (which can be easily lost or stolen), players use chips as placeholders

Thus, it is a technology, which are useful in institutions such as financial institutes, government, and healthcare for the application of converting data into tokens. Currently this market has wide applications in the corporate world for professional collaborations and in educational and training sectors.

Tokenization Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Rise in Need for Customer Experience

Companies or enterprises that successfully implement a customer experience strategy are likely to achieve higher customer satisfaction rates and thus improve revenue growth. The improvement of customer experience involves various strategies such as empowering employees to provide better service, value ideas, customer journey mapping, capturing customer feedback, and others.

- Upsurge of Contactless Payments for All Businesses

Contactless payments offer significant advantages to both consumers and businesses through ease of usage to provide quicker transactions with more reliability and security through tap–to-pay technology, which confers loyalty benefits for business and improve customer relationships. Thus, contactless payments are adopted very fast by both consumers and businesses.

- Upsurge in stringent rules and regulatory standards lead to developed security

The data protection and cross-border flow of data is the main reason for the establishment of various legal frameworks. As day by day, the amount of information or the data transmitted, stored, and collected across the globe is increasing due to rise in online social and financial activity facilities available through mobile phones and improved internet connectivity which enables the rise in the importance of data protection and privacy.

Data protection and security is directly related to trading of goods and services in the digital economy and lack of protection can restrict businesses resulting adverse economic effects. Hence, data protection seems to be a fundamental right with increase in information economy which, influences many opportunities to develop business through customer experience. Thus, data security and transactional efficiency make tokenization increasingly popular with the increasing digital economy, innovators, market participants, and regulators.

- Rise in Complexities of Data Management

The decisions taken for the business process are by analyzing a huge volume of data, hence the data needs to be managed very well in order to get the relevant insight easily. Hence, each data has to be encrypted into tokens. At the time of analyzing the data, user can access the data with the help of tokens assigned.

The created tokens are considered to be data, which needs to be managed in a systematic manner, else the managing the data becomes a hectic task and elaborates the working culture. Similarly, tokenizing the language seems to be very easy but extracting it along with the integration with other language that is machine language, would be a difficult factor to be resolved.

- Rise in Demand for Cloud Based Solution and Services

Cloud computing solutions and services support businesses to function effectively with less dependency on human resources, which helps to propel the market growth with greater operational efficiency. The efficiency growth for business purpose across multiple verticals has resulted in adoption of variety of business models which drive the demand for software such as Software-as-a-Serve (SaaS) based solutions.

The SaaS offering companies are involved in the business of recurring and invoicing payment capabilities within their platforms which has the ability to generate automatic payment tokens in real time guarantying a smooth transaction for customers every time. The SaaS companies will provide extra layer of security for payments through tokenizing the sensitive data, hence rise in the SaaS-based software is expected to provide boost to the market growth.

Post COVID-19 Impact on Tokenization Market

COVID-19 created a major impact on the tokenization market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the tokenization market is attributed to the rise in need for unique data identification. However, factors such as requirements of large volume data storage space are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Financial institutions are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the tokenization. With this, the companies will bring advanced and accurate controllers to the market. In addition, the use of tokenization by government authorities in asset management, and defence and security has led to the market's growth.

Recent Development

- In August 2021, Lookout, Inc. announced the launch of a new mobile security offering for small businesses. This development will help the company to diversify the portfolio to offer better solutions for various purposes, which could be one-stop solution for customers, which helps to attract new customers

In January 2022, Visa has announced a new platform, Visa Acceptance Cloud (VAC), to modernize the capabilities of payments services. This new platform will help the company to improvise and strengthen the capabilities of solutions provided to the customers, which can improve the customer relationship with the company

Global Tokenization Market Scope

The tokenization market is segmented on the basis of offerings, organization size, technique, technology, deployment, application and End-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Services

On the basis of offering, the tokenization market is segmented into solutions and services.

Organization Size

- Large organizations

- SMES

On the basis of organization size, the tokenization market has been segmented into large organizations and SMES.

Deployment

- Cloud

- On-Premises

On the basis of deployment, the tokenization market has been segmented into cloud and on-premises.

Technology

- Internet of Thing (IOT)

- Machine Learning and Artificial Intelligence

- Cloud Computing

- Natural Language Processing (NLP)

- Block chain

- Others

On the basis of technology, the tokenization market has been segmented into cloud computing, Internet of Things (IoT), blockchain, machine learning and artificial intelligence, natural language processing (NLP), and others.

Technique

- API-Based

- Gateway-Based

On the basis of technique, the Global tokenization market has been segmented into API-Based and gateway-based.

Application

- Payment Security

- User Authentication

- Compliance Management

- Data Processing

- Encryption

- Others

On the basis of application, the tokenization market has been segmented into payment security, data processing, encryption, user authentication, compliance management, and others.

End-User

- Banking, Financial Services and Insurance

- It and Telecommunications

- Government and Public Sector

- Media and Entertainment

- Retail & E-Commerce

- Manufacturing

- Energy and Utilities

- Automotive

- Aerospace and Defense

- Others

On the basis of end-user, the tokenization market has been segmented into banking, financial services and insurance (BSFI), IT & telecommunications, media and entertainment, retail & e-commerce, automotive, healthcare and life sciences, manufacturing, energy and utilities, aerospace and defense, government and public sector, and others.

Tokenization Market Regional Analysis/Insights

The tokenization market is analysed and market size insights and trends are provided by country, offering, organization size, deployment, technology, technique, application, and end user industry as referenced above.

The countries covered in the tokenization market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Global (APAC) in the Global (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The tokenization market is expected to be the fastest-growing in the world. The rising infrastructure, commercial, and industrial developments in emerging countries such as China, Japan, India, and South Korea are credited with the market's dominance. The U.S. is expected to dominate the market due to the rise in deduction of the data breach. China dominates the global region as countries' old infrastructure, such as bridges, highways, sewage systems, and tunnels, is continually being repaired and improved with the use of various machine control equipment, such as excavators, paving systems, and dozers. The U.K. is expected to dominate the market due to the rise in demand for customer experience.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Tokenization Market Share Analysis

The tokenization market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to tokenization market.

Some of the major players operating in the tokenization market are Fiserv, Inc., Thales Group, Broadcom, Futurex, Hewlett Packard Enterprise Development LP, FIS, Lookout, Inc., Protegrity Inc., Visa, Mastercard, Micro Focus, American Express Company, Entrust Corporation, VeriFone, Inc., utimaco GmbH, PaymentVision, Tokeny Solutions, Quantoz NV, HST, Paya, Inc., Baffle, StrongKey, Inc., Prime Factors, Fortanix, AsiaPay Limited, Marqeta, Inc., Open Text Corporation, Randtronics, Bluefin Payment Systems, Sygnum Pte. Ltd., among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TOKENIZATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCE MODEL

4.2 BENEFITS OF TOKENIZATION SOLUTION FOR BUSINESSES

4.3 THE FUTURE OF FINANCIAL MARKETS: TOKENIZATION

4.4 SUPPLY CHAIN ANALYSIS

4.5 CHALLENGE MATRIX

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR CUSTOMER EXPERIENCE

5.1.2 UPSURGE OF CONTACTLESS PAYMENTS FOR ALL BUSINESSES

5.1.3 RISE IN INCTANCES OF DATA BREACH

5.1.4 RISE IN THE NEED FOR UNIQUE DATA IDENTIFICATION

5.2 RESTRAINTS

5.2.1 RISE IN COMPLEXITY OF DATA MANAGEMENT

5.2.2 REQUIREMENT OF LARGE VOLUME DATA STORAGE SPACE

5.3 OPPORTUNITIES

5.3.1 UPSURGE OF STRINGENT RULES AND REGULATORY STANDARDS LEAD TO DEVELOPED SECURITY

5.3.2 RISE IN DEMAND FOR DATA SECURITY

5.3.3 RISE IN DEMAND FOR CLOUD-BASED SOLUTIONS AND SERVICES

5.3.4 INCREASE IN DIGITALIZING THE BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 LACK OF MANAGING AND ADOPTION PROCESS

5.4.2 RISE OF TECHNICAL COMPLEXITY

6 GLOBAL TOKENIZATION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 PAYMENT TOKENIZATION

6.2.2 DATA TOKENIZATION

6.2.3 ASSET TOKENIZATION

6.2.4 PLATFORM TOKENIZATION

6.2.5 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL

6.3.2 SUPPORT & MAINTENANCE

6.3.3 INTEGRATION & IMPLEMENTATION

6.3.4 TRAINING & CONSULTING

6.3.5 MANAGED

7 GLOBAL TOKENIZATION MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ORGANIZATIONS

7.3 SMES

8 GLOBAL TOKENIZATION MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 CLOUD

8.2.1 PUBLIC CLOUD

8.2.2 PRIVATE CLOUD

8.2.3 HYBRID CLOUD

8.3 ON-PREMISES

9 GLOBAL TOKENIZATION MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 CLOUD COMPUTING

9.3 INTERNET OF THINGS (IOT)

9.4 BLOCKCHAIN

9.5 MACHINE LEARNING & ARTIFICIAL INTELLIGENCE

9.6 NATURAL LANGUAGE PROCESSING (NLP)

9.7 OTHERS

10 GLOBAL TOKENIZATION MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 API-BASED

10.3 GATEWAY-BASED

11 GLOBAL TOKENIZATION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 PAYMENT SECURITY

11.3 DATA PROCESSING

11.4 ENCRYPTION

11.5 USER AUTHENTICATION

11.6 COMPLIANCE MANAGEMENT

11.7 OTHERS

12 GLOBAL TOKENIZATION MARKET, BY END USER

12.1 OVERVIEW

12.2 BANKING, FINANCIAL SERVICES & INSURANCE (BFSI)

12.2.1 LARGE ORGANIZATIONS

12.2.2 SMES

12.3 IT & TELECOMMUNICATIONS

12.3.1 LARGE ORGANIZATIONS

12.3.2 SMES

12.4 RETAIL & E-COMMERCE

12.4.1 LARGE ORGANIZATIONS

12.4.2 SMES

12.5 AUTOMOTIVE

12.5.1 LARGE ORGANIZATIONS

12.5.2 SMES

12.6 HEALTHCARE & LIFE SCIENCES

12.6.1 LARGE ORGANIZATIONS

12.6.2 SMES

12.7 MANUFACTURING

12.7.1 LARGE ORGANIZATIONS

12.7.2 SMES

12.8 ENERGY & UTILITIES

12.8.1 LARGE ORGANIZATIONS

12.8.2 SMES

12.9 AEROSPACE & DEFENCE

12.9.1 LARGE ORGANIZATIONS

12.9.2 SMES

12.1 GOVERNMENT & PUBLIC SECTOR

12.10.1 LARGE ORGANIZATIONS

12.10.2 SMES

12.11 MEDIA & ENTERTAINMENT

12.11.1 LARGE ORGANIZATIONS

12.11.2 SMES

12.12 OTHERS

12.12.1 LARGE ORGANIZATIONS

12.12.2 SMES

13 GLOBAL TOKENIZATION MARKET, BY REGION

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 U.K.

13.3.2 GERMANY

13.3.3 FRANCE

13.3.4 SPAIN

13.3.5 ITALY

13.3.6 RUSSIA

13.3.7 TURKEY

13.3.8 NETHERLANDS

13.3.9 SWITZERLAND

13.3.10 BELGIUM

13.3.11 REST OF EUROPE

13.4 ASIA-PACIFIC

13.4.1 CHINA

13.4.2 JAPAN

13.4.3 INDIA

13.4.4 SOUTH KOREA

13.4.5 SINGAPORE

13.4.6 MALAYSIA

13.4.7 AUSTRALIA

13.4.8 THAILAND

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA-PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 U.A.E.

13.5.2 SAUDI ARABIA

13.5.3 ISRAEL

13.5.4 SOUTH AFRICA

13.5.5 EGYPT

13.5.6 REST OF MIDDLE EAST AND AFRICA

13.6 SOUTH AMERICA

13.6.1 BRAZIL

13.6.2 ARGENTINA

13.6.3 REST OF SOUTH AMERICA

14 GLOBAL TOKENIZATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 VISA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MASTERCARD

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 AMERICAN EXPRESS COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 VERIFONE, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 HEWLETT PACARD ENTERPRISE DEVELOPMENT LP

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASIAPAY LIMITED

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BAFFLE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BLUEFIN PAYMENT SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BROADCOM

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 ENTRUST CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 FIS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 FISERVE, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 FORTANIX

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 FUTUREX

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 HST

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LOOKOUT, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 MARQETA, INC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOLUTION PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 MICRO FOCUS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 OPEN TEXT CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 SOLUTION PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PAYA, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SOLUTION PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 PAYMENTVISION

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 PRIME FACTORS

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PROTEGRITY INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 QUANTOZ NV

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 RANDTRONICS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 STRONGKEY, INC.

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 SYGNUM PTE. LTD.

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

16.28 THALES GROUP

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 TOKENY SÀRL

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

16.3 UTIMACO GMBH

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 GLOBAL TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL SOLUTIONS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL SERVICES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL LARGE ORGANIZATION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL SMES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL CLOUD IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL ON-PREMISES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL CLOUD COMPUTING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL INTERNET OF THINGS (IOT) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL BLOCKCHAIN IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL MACHINE LEARNING & ARTIFICIAL INTELLIGENCE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL NATURAL LANGUAGE PROCESSING (NLP) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL API-BASED IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL GATEWAY-BASED IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL PAYMENT SECURITY IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL DATA PROCESSING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL ENCRYPTION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL USER AUTHENTICATION IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL COMPLIANCE MANAGEMENT IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL BANKING, FINANCIAL SERVICES & INSURANCE (BFSI ) IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 GLOBAL AUTOMOTIVE IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 GLOBAL AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 40 GLOBAL HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 GLOBAL HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 42 GLOBAL MANUFACTURING IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 GLOBAL MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 44 GLOBAL ENERGY & UTILITIES IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 45 GLOBAL ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 46 GLOBAL AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 47 GLOBAL AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 GLOBAL GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 49 GLOBAL GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 50 GLOBAL MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 51 GLOBAL MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 GLOBAL OTHERS IN TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 GLOBAL OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 GLOBAL TOKENIZATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TOKENIZATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 U.S. TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 79 U.S. SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 83 U.S. TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 84 U.S. CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 U.S. TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 87 U.S. TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 U.S. BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 90 U.S. IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 91 U.S. RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 U.S. AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 94 U.S. MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 95 U.S. ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 U.S. AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 97 U.S. GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 U.S. MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 99 U.S. OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 100 CANADA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 101 CANADA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 105 CANADA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 106 CANADA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 CANADA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 109 CANADA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 CANADA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 112 CANADA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 113 CANADA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 CANADA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 115 CANADA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 116 CANADA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 CANADA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 119 CANADA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 CANADA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 128 MEXICO CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 MEXICO TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 131 MEXICO TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 133 MEXICO BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 135 MEXICO RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 136 MEXICO AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 137 MEXICO HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 139 MEXICO ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 140 MEXICO AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 141 MEXICO GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 144 EUROPE TOKENIZATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 145 EUROPE TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 146 EUROPE SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 EUROPE SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 EUROPE PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 EUROPE TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 150 EUROPE TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 151 EUROPE CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 EUROPE TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 153 EUROPE TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 154 EUROPE TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 EUROPE TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 156 EUROPE BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 157 EUROPE IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 158 EUROPE RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 159 EUROPE AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 160 EUROPE HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 161 EUROPE MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 162 EUROPE ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 163 EUROPE AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 164 EUROPE GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 165 EUROPE MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 166 EUROPE OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 167 U.K. TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 168 U.K. SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 U.K. SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.K. PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.K. TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 172 U.K. TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 173 U.K. CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 U.K. TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 175 U.K. TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 176 U.K. TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 U.K. TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 178 U.K. BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 179 U.K. IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 180 U.K. RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 181 U.K. AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 182 U.K. HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 183 U.K. MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 184 U.K. ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 185 U.K. AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 186 U.K. GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 187 U.K. MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 188 U.K. OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 189 GERMANY TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 190 GERMANY SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 GERMANY SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 GERMANY PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 GERMANY TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 194 GERMANY TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 195 GERMANY CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 GERMANY TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 197 GERMANY TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 198 GERMANY TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 GERMANY TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 200 GERMANY BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 201 GERMANY IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 202 GERMANY RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 203 GERMANY AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 204 GERMANY HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 205 GERMANY MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 206 GERMANY ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 207 GERMANY AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 208 GERMANY GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 209 GERMANY MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 210 GERMANY OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 211 FRANCE TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 212 FRANCE SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 FRANCE SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 FRANCE PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 FRANCE TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 216 FRANCE TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 217 FRANCE CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 FRANCE TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 FRANCE TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 220 FRANCE TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 FRANCE TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 222 FRANCE BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 223 FRANCE IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 224 FRANCE RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 225 FRANCE AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 226 FRANCE HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 227 FRANCE MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 228 FRANCE ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 229 FRANCE AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 230 FRANCE GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 231 FRANCE MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 232 FRANCE OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 233 SPAIN TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 SPAIN SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 SPAIN SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 SPAIN PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 SPAIN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 238 SPAIN TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 239 SPAIN CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 SPAIN TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 241 SPAIN TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 242 SPAIN TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 243 SPAIN TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 244 SPAIN BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 245 SPAIN IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 246 SPAIN RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 247 SPAIN AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 248 SPAIN HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 249 SPAIN MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 250 SPAIN ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 251 SPAIN AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 252 SPAIN GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 253 SPAIN MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 254 SPAIN OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 255 ITALY TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 256 ITALY SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 ITALY SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 ITALY PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 ITALY TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 260 ITALY TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 261 ITALY CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 ITALY TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 263 ITALY TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 264 ITALY TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 ITALY TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 266 ITALY BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 267 ITALY IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 268 ITALY RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 269 ITALY AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 270 ITALY HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 271 ITALY MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 272 ITALY ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 273 ITALY AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 274 ITALY GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 275 ITALY MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 276 ITALY OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 277 RUSSIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 278 RUSSIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 RUSSIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 RUSSIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 RUSSIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 282 RUSSIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 283 RUSSIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 RUSSIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 285 RUSSIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 286 RUSSIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 287 RUSSIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 288 RUSSIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 289 RUSSIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 290 RUSSIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 291 RUSSIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 292 RUSSIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 293 RUSSIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 294 RUSSIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 295 RUSSIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 296 RUSSIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 297 RUSSIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 298 RUSSIA OTHERS IN TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 299 TURKEY TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 300 TURKEY SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 TURKEY SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 TURKEY PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 TURKEY TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 304 TURKEY TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 305 TURKEY CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 TURKEY TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 307 TURKEY TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 308 TURKEY TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 309 TURKEY TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 310 TURKEY BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 311 TURKEY IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 312 TURKEY RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 313 TURKEY AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 314 TURKEY HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 315 TURKEY MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 316 TURKEY ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 317 TURKEY AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 318 TURKEY GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 319 TURKEY MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 320 TURKEY OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 321 NETHERLANDS TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 322 NETHERLANDS SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 323 NETHERLANDS SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 NETHERLANDS PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 325 NETHERLANDS TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 326 NETHERLANDS TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 327 NETHERLANDS CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 NETHERLANDS TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 329 NETHERLANDS TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 330 NETHERLANDS TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 331 NETHERLANDS TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 332 NETHERLANDS BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 333 NETHERLANDS IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 334 NETHERLANDS RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 335 NETHERLANDS AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 336 NETHERLANDS HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 337 NETHERLANDS MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 338 NETHERLANDS ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 339 NETHERLANDS AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 340 NETHERLANDS GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 341 NETHERLANDS MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 342 NETHERLANDS OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 343 SWITZERLAND TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 344 SWITZERLAND SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 345 SWITZERLAND SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 346 SWITZERLAND PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 347 SWITZERLAND TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 348 SWITZERLAND TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 349 SWITZERLAND CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 350 SWITZERLAND TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 351 SWITZERLAND TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 352 SWITZERLAND TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 353 SWITZERLAND TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 354 SWITZERLAND BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 355 SWITZERLAND IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 356 SWITZERLAND RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 357 SWITZERLAND AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 358 SWITZERLAND HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 359 SWITZERLAND MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 360 SWITZERLAND ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 361 SWITZERLAND AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 362 SWITZERLAND GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 363 SWITZERLAND GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 364 SWITZERLAND OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 365 BELGIUM TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 366 BELGIUM SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 367 BELGIUM SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 368 BELGIUM PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 369 BELGIUM TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 370 BELGIUM TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 371 BELGIUM CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 372 BELGIUM TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 373 BELGIUM TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 374 BELGIUM TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 375 BELGIUM TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 376 BELGIUM BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 377 BELGIUM IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 378 BELGIUM RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 379 BELGIUM AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 380 BELGIUM HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 381 BELGIUM MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 382 BELGIUM ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 383 BELGIUM AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 384 BELGIUM GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 385 BELGIUM MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 386 BELGIUM OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 387 REST OF EUROPE TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 388 ASIA-PACIFIC TOKENIZATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 389 ASIA-PACIFIC TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 390 ASIA-PACIFIC SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 391 ASIA-PACIFIC SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 392 ASIA-PACIFIC PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 393 ASIA-PACIFIC TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 394 ASIA-PACIFIC TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 395 ASIA-PACIFIC CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 396 ASIA-PACIFIC TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 397 ASIA-PACIFIC TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 398 ASIA-PACIFIC TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 399 ASIA-PACIFIC TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 400 ASIA-PACIFIC BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 401 ASIA-PACIFIC IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 402 ASIA-PACIFIC RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 403 ASIA-PACIFIC AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 404 ASIA-PACIFIC HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 405 ASIA-PACIFIC MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 406 ASIA-PACIFIC ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 407 ASIA-PACIFIC AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 408 ASIA-PACIFIC GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 409 ASIA-PACIFIC MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 410 ASIA-PACIFIC OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 411 CHINA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 412 CHINA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 413 CHINA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 414 CHINA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 415 CHINA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 416 CHINA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 417 CHINA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 418 CHINA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 419 CHINA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 420 CHINA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 421 CHINA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 422 CHINA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 423 CHINA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 424 CHINA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 425 CHINA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 426 CHINA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 427 CHINA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 428 CHINA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 429 CHINA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 430 CHINA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 431 CHINA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 432 CHINA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 433 JAPAN TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 434 JAPAN SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 435 JAPAN SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 436 JAPAN PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 437 JAPAN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 438 JAPAN TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 439 JAPAN CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 440 JAPAN TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 441 JAPAN TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 442 JAPAN TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 443 JAPAN TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 444 JAPAN BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 445 JAPAN IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 446 JAPAN RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 447 JAPAN AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 448 JAPAN HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 449 JAPAN MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 450 JAPAN ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 451 JAPAN AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 452 JAPAN GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 453 JAPAN MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 454 JAPAN OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 455 INDIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 456 INDIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 457 INDIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 458 INDIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 459 INDIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 460 INDIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 461 INDIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 462 INDIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 463 INDIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 464 INDIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 465 INDIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 466 INDIA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 467 INDIA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 468 INDIA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 469 INDIA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 470 INDIA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 471 INDIA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 472 INDIA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 473 INDIA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 474 INDIA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 475 INDIA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 476 INDIA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 477 SOUTH KOREA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 478 SOUTH KOREA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 479 SOUTH KOREA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 480 SOUTH KOREA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 481 SOUTH KOREA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 482 SOUTH KOREA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 483 SOUTH KOREA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 484 SOUTH KOREA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 485 SOUTH KOREA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 486 SOUTH KOREA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 487 SOUTH KOREA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 488 SOUTH KOREA BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 489 SOUTH KOREA IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 490 SOUTH KOREA RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 491 SOUTH KOREA AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 492 SOUTH KOREA HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 493 SOUTH KOREA MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 494 SOUTH KOREA ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 495 SOUTH KOREA AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 496 SOUTH KOREA GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 497 SOUTH KOREA MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 498 SOUTH KOREA OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 499 SINGAPORE TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 500 SINGAPORE SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 501 SINGAPORE SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 502 SINGAPORE PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 503 SINGAPORE TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 504 SINGAPORE TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 505 SINGAPORE CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 506 SINGAPORE TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 507 SINGAPORE TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 508 SINGAPORE TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 509 SINGAPORE TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 510 SINGAPORE BANKING, FINANCIAL SERVICES & INSURANCE (BFSI) IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 511 SINGAPORE IT & TELECOMMUNICATIONS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 512 SINGAPORE RETAIL & E-COMMERCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 513 SINGAPORE AUTOMOTIVE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 514 SINGAPORE HEALTHCARE & LIFE SCIENCES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 515 SINGAPORE MANUFACTURING IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 516 SINGAPORE ENERGY & UTILITIES IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 517 SINGAPORE AEROSPACE & DEFENCE IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 518 SINGAPORE GOVERNMENT & PUBLIC SECTOR IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 519 SINGAPORE MEDIA & ENTERTAINMENT IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 520 SINGAPORE OTHERS IN TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 521 MALAYSIA TOKENIZATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 522 MALAYSIA SOLUTIONS IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 523 MALAYSIA SERVICES IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 524 MALAYSIA PROFESSIONAL IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 525 MALAYSIA TOKENIZATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 526 MALAYSIA TOKENIZATION MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 527 MALAYSIA CLOUD IN TOKENIZATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 528 MALAYSIA TOKENIZATION MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 529 MALAYSIA TOKENIZATION MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 530 MALAYSIA TOKENIZATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 531 MALAYSIA TOKENIZATION MARKET, BY END USER, 2020-2029 (USD MILLION)