Global Toluene Market

Market Size in USD Billion

CAGR :

%

USD

67.26 Billion

USD

104.41 Billion

2024

2032

USD

67.26 Billion

USD

104.41 Billion

2024

2032

| 2025 –2032 | |

| USD 67.26 Billion | |

| USD 104.41 Billion | |

|

|

|

|

What is the Global Toluene Market Size and Growth Rate?

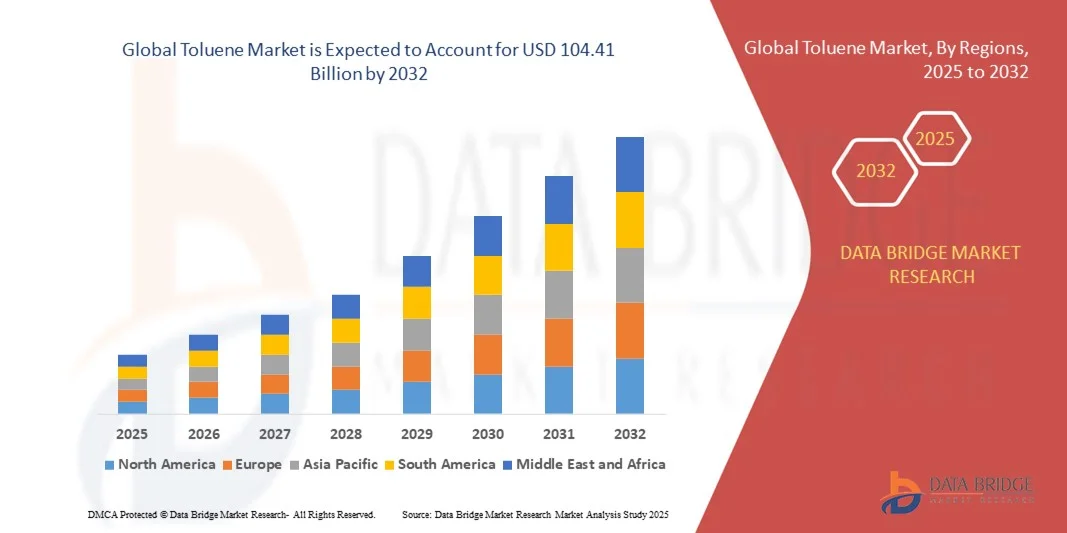

- The global Toluene market size was valued at USD 67.26 billion in 2024 and is expected to reach USD 104.41 billion by 2032, at a CAGR of 5.65% during the forecast period

- Major factors that are expected to boost the growth of the toluene market in the forecast period are the rise in the end user base of toluene. Furthermore, the increase in the petrochemical or aromatics industry is further anticipated to propel the growth of the toluene market

- On the other hand, the change in the trends in the oil ABD gas and petrochemical or aromatics industry is further estimated to impede the growth of the toluene market in the timeline period

What are the Major Takeaways of Toluene Market?

- The withdrawal of aromatics from shale oil or tight oil will further provide potential opportunities for the growth of the toluene market in the coming years. However, the stringent guidelines initiated by the government might further challenge the growth of the toluene market in the near future.

- Asia-Pacific dominated the toluene market with the largest revenue share of 42.3% in 2024, driven by rapid industrialization, expanding petrochemical capacity, and the rising consumption of toluene derivatives across pharmaceuticals, paints, coatings, and fuel additives

- North America is expected to grow at the fastest CAGR of 13.6% from 2025 to 2032, supported by robust expansion in petrochemicals, increased shale gas availability, and advanced R&D in specialty chemicals

- The Benzene and Xylene segment dominated the market with a revenue share of 46.3% in 2024, owing to their extensive use as feedstocks in the production of polymers, resins, and synthetic fibers

Report Scope and Toluene Market Segmentation

|

Attributes |

Toluene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Toluene Market?

Shift Towards Sustainable and Bio-Based Production

- A notable trend in the global toluene market is the growing shift towards sustainable production methods, with an emphasis on bio-based feedstocks and eco-friendly processing technologies. This shift is primarily driven by stringent environmental regulations and the need to reduce carbon footprints across industries

- For instance, leading chemical producers are investing in bio-aromatics derived from renewable raw materials, offering a sustainable alternative to petroleum-based toluene. Such initiatives address environmental concerns provide resilience against crude oil price volatility

- Furthermore, advancements in catalytic reforming and biomass conversion technologies are making large-scale production of bio-toluene increasingly feasible. This creates opportunities for industries such as paints, coatings, adhesives, and pharmaceuticals to integrate greener alternatives into their supply chains

- Companies such as BASF SE and Mitsubishi Chemical Corporation are exploring sustainable production pathways, reflecting the industry’s growing focus on circular economy practices

- The transition to sustainable toluene production is expected to reshape the competitive landscape by offering both economic and environmental advantages, making it a defining trend in the coming years

What are the Key Drivers of Toluene Market?

- The increasing demand for toluene in end-use industries, including paints, coatings, adhesives, and construction materials, is a key growth driver. Toluene’s role as a solvent and as a feedstock for benzene and xylene production makes it indispensable in chemical manufacturing

- For instance, in May 2023, PT Chandra Asri Petrochemical Tbk announced strategic agreements to develop an integrated chlor-alkali and ethylene dichloride plant, reinforcing the regional supply of toluene derivatives. Such expansions strengthen overall industry growth

- Rising automobile production and urbanization are also driving the demand for toluene-based octane boosters and gasoline additives, particularly in emerging economies

- Furthermore, the pharmaceutical and cosmetic industries are increasingly utilizing toluene derivatives for drug formulations and personal care products, providing additional market momentum

- The chemical versatility of toluene, coupled with global infrastructure expansion, positions it as a core driver of industrial growth worldwide

Which Factor is Challenging the Growth of the Toluene Market?

- A major challenge facing the toluene market is the growing concern regarding its toxicological effects and environmental hazards. Prolonged exposure to toluene poses health risks such as neurological effects, which has led to stricter workplace safety and environmental regulations

- For instance, regulatory bodies in the U.S. and Europe have imposed restrictions on the permissible exposure limits of toluene in industrial applications, impacting its large-scale use

- Price volatility linked to crude oil, the primary raw material for toluene production, further creates instability in market growth, especially for producers in developing regions

- In addition, the availability of eco-friendly substitutes and bio-based solvents challenges the dominance of petroleum-derived toluene in certain applications

- Overcoming these challenges requires continuous innovation in safer production methods, compliance with environmental standards, and strategic investment in alternative technologies, ensuring long-term market stability

How is the Toluene Market Segmented?

The market is segmented on the basis of derivative type, production process, and application.

- By Derivative Type

On the basis of derivative type, the toluene market is segmented into Benzene and Xylene, Toluene Diisocyanates (TDI), Solvents, Gasoline Additives, and Others. The Benzene and Xylene segment dominated the market with a revenue share of 46.3% in 2024, owing to their extensive use as feedstocks in the production of polymers, resins, and synthetic fibers. Industries such as plastics, automotive, and construction rely heavily on these derivatives, driving steady demand. Solvents also account for a significant portion due to their wide usage in paints, coatings, adhesives, and chemical formulations.

Meanwhile, the Toluene Diisocyanates (TDI) segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, driven by rising demand in the polyurethane sector for furniture, automotive seating, and insulation. Gasoline additives are also expected to grow steadily, particularly in emerging economies with expanding transportation needs. Overall, derivatives continue to define the value chain of the global toluene market.

- By Production Process

On the basis of production process, the toluene market is segmented into Reformate Process, Pygas Process, Coke or Coal Process, and Styrene Process. The Reformate Process held the largest revenue share of 52.6% in 2024, primarily because of its widespread adoption in refineries where catalytic reforming produces aromatics such as toluene, benzene, and xylene. The reformate process offers efficiency, integration with existing refining setups, and higher yields, making it the most preferred method globally.

The Pygas Process is projected to record the fastest CAGR of 8.3% from 2025 to 2032, driven by the growth of steam cracking in olefin production and the increasing recovery of toluene as a by-product. Coke or coal processes maintain relevance in Asia, where coal-based chemical production is more prevalent. Meanwhile, the styrene process, though smaller in scale, contributes significantly in niche applications. The dominance of reformate ensures a stable supply base, while pygas gains traction from petrochemical expansions.

- By Application

On the basis of application, the toluene market is segmented into Drugs, Dyes, Blending, Cosmetic Nail Products, and Others. The Drugs segment dominated the market with a revenue share of 41.7% in 2024, driven by its vital role as a precursor in pharmaceutical formulations such as pain relievers, antiseptics, and other intermediates. Toluene’s high solvency power makes it valuable for producing active pharmaceutical ingredients (APIs).

The Blending segment is anticipated to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by its growing use as a gasoline blending agent to enhance octane ratings and optimize fuel efficiency. Dyes and pigments also contribute notably, supported by rising textile and printing industries in Asia-Pacific. Cosmetic nail products, although niche, are expanding due to increasing consumer spending on personal care. Overall, applications in pharmaceuticals continue to anchor the market, while blending ensures robust growth linked to the global energy and transport sector.

Which Region Holds the Largest Share of the Toluene Market?

- Asia-Pacific dominated the toluene market with the largest revenue share of 42.3% in 2024, driven by rapid industrialization, expanding petrochemical capacity, and the rising consumption of toluene derivatives across pharmaceuticals, paints, coatings, and fuel additives

- The region benefits from cost-effective manufacturing, strong domestic demand, and supportive government policies in China, India, and Southeast Asia

- Growing investments in downstream industries, coupled with increasing urbanization and disposable incomes, further strengthen the region’s leadership, establishing Asia-Pacific as the core hub for toluene demand and production

China Toluene Market Insight

The China Toluene market captured the largest revenue share of 61% in Asia-Pacific in 2024, driven by rapid industrialization and strong domestic demand across pharmaceuticals, paints, coatings, and fuel additives. The country benefits from cost-efficient manufacturing, abundant feedstock availability, and supportive government policies promoting the chemical sector. Investments in downstream industries and expanding urbanization have further accelerated consumption. In addition, China’s strong presence in global chemical exports allows toluene derivatives to reach international markets efficiently. The integration of toluene in various high-demand applications reinforces China’s position as the regional leader in production and consumption.

Japan Toluene Market Insight

The Japan Toluene market is projected to grow at a steady CAGR, propelled by the country’s advanced chemical industry and high-purity solvent demand in pharmaceuticals, electronics, and specialty chemicals. Japan emphasizes sustainable and eco-friendly production, leading to the development of innovative toluene derivatives. Urbanization trends and an aging population are supporting healthcare-related applications, while industrial adoption continues across automotive and coatings sectors. Integration of advanced manufacturing technologies ensures high efficiency and quality. Japan’s focus on R&D and premium applications positions the market for sustained growth, with toluene becoming a critical component in high-value industrial and consumer products.

India Toluene Market Insight

The India Toluene market is expected to expand at a substantial CAGR, driven by rising demand in pharmaceuticals, dyes, paints, and gasoline blending. Rapid urbanization and industrial expansion in automotive, construction, and packaging sectors are fueling consumption. Government initiatives supporting petrochemical infrastructure and foreign investment further enhance market growth. India’s emerging role as a global export hub for chemical products provides cost advantages and increased production capabilities. Adoption of eco-friendly solvents and sustainable manufacturing practices is also gaining traction. The combination of domestic demand, industrial growth, and export opportunities makes India a key market for toluene derivatives in Asia-Pacific.

Which Region is the Fastest Growing Region in the Toluene Market?

North America is expected to grow at the fastest CAGR of 13.6% from 2025 to 2032, supported by robust expansion in petrochemicals, increased shale gas availability, and advanced R&D in specialty chemicals. The region’s strong focus on sustainable production and technological innovation, combined with rising demand in automotive and construction sectors, underpins rapid growth. High consumer spending and a growing emphasis on clean fuels and eco-friendly solvents further accelerate adoption, positioning North America as a dynamic growth engine.

U.S. Toluene Market Insight

The U.S. Toluene market accounted for 72% of North America in 2024, driven by shale gas feedstock advantages, large-scale refining capacity, and increasing demand in pharmaceuticals, coatings, and fuel blending. Expansion in specialty chemicals and R&D for high-value applications supports rapid growth. Technological advancements in sustainable chemical production, along with rising industrial and consumer demand for eco-friendly solutions, are further fueling adoption. The country’s strong infrastructure and integrated chemical value chains ensure efficient production and distribution. The U.S. continues to be the fastest-growing regional market due to innovative practices, regulatory support, and a focus on environmentally conscious chemical products.

Canada Toluene Market Insight

The Canada Toluene market is projected to grow steadily, backed by rising petrochemical production and increased use of industrial solvents, coatings, and adhesives. Government policies emphasizing clean energy and sustainability encourage the adoption of eco-friendly toluene derivatives. Demand is growing across pharmaceuticals, automotive, and packaging industries. Expansion of refining capabilities and integration with North American supply chains ensures efficient production and distribution. Focus on technological innovation, coupled with a highly skilled workforce, strengthens market growth. Canada’s increasing investments in green chemistry and sustainable applications position the country as a vital contributor to North America’s toluene market expansion.

Which are the Top Companies in Toluene Market?

The toluene industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- China Petroleum & Chemical Corporation (Sinopec) (China)

- Reliance Industries Limited (India)

- The Chemical Company (U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Pon Pure Chemicals (India)

- Brenntag Pte. Ltd. (Singapore)

- OCI Company Ltd. (South Korea)

- Dow (U.S.)

- HELM AG (Germany)

- Valero Marketing and Supply Company (U.S.)

- BASF SE (Germany)

- Indian Oil Corporation Ltd (India)

- Covestro AG (Germany)

- Solventis (U.K.)

- Central Drug House (India)

- Benzo Chem Industries Pvt. Ltd. (India)

- GNFC Limited (India)

- Yashdeep Chemicals (India) Pvt. Ltd. (India)

- Royal Dutch Shell plc (Shell) (U.K.)

What are the Recent Developments in Global Toluene Market?

- In May 2025, PetroChina South China reduced toluene prices in China, lowering the rate by Yuan 100/mt to Yuan 5400/mt. This adjustment provides relief to key industries such as automotive, electronics, and manufacturing, supporting continued sector growth and stability

- In January 2025, the Union Minister Hardeep Singh Puri launched MRPL’s toluene product, marking a significant expansion in the toluene market. This initiative is expected to drive innovation and enhance product offerings, strengthening domestic market capabilities

- In January 2025, Mangalore Refinery and Petrochemicals Limited inaugurated a 40 TMT toluene plant in Odisha, boosting India’s domestic production capacity. This expansion reinforces the country’s position in the regional toluene market and ensures better supply for industrial applications

- In January 2025, BASF raised Lupranate TDI prices by USD 300 per ton in ASEAN and South Asia to offset logistics, energy, and compliance cost inflation. This strategic price adjustment supports operational sustainability while maintaining supply chain stability for the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Toluene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Toluene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Toluene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.