Global Tomato Ketchup Market

Market Size in USD Billion

CAGR :

%

USD

14.31 Billion

USD

23.68 Billion

2024

2032

USD

14.31 Billion

USD

23.68 Billion

2024

2032

| 2025 –2032 | |

| USD 14.31 Billion | |

| USD 23.68 Billion | |

|

|

|

|

Tomato Ketchup Market Size

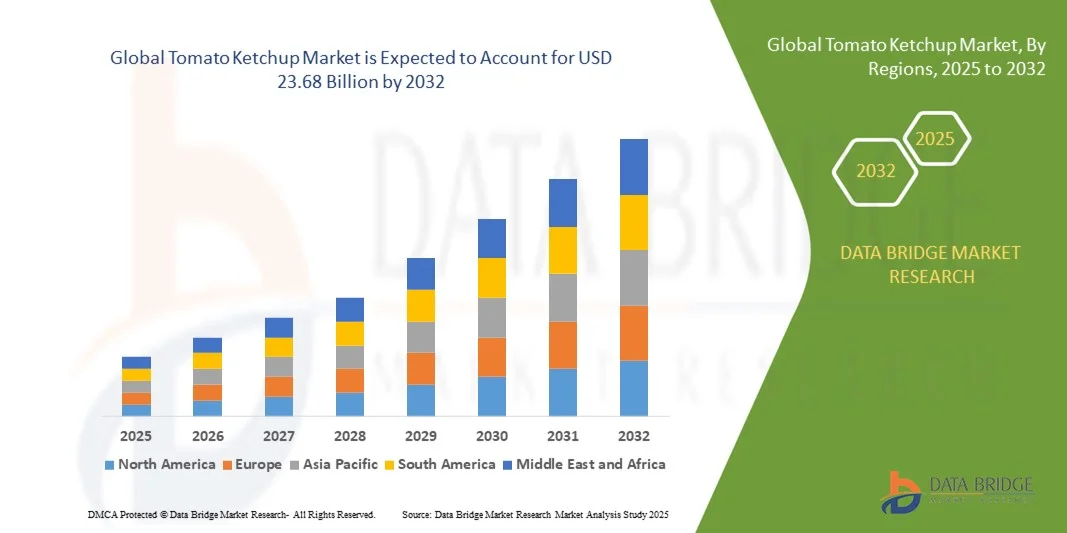

- The global tomato ketchup market size was valued at USD 14.31 billion in 2024 and is expected to reach USD 23.68 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by increasing consumer demand for convenient, ready-to-use condiments, coupled with rising fast-food consumption and changing dietary habits in both developed and emerging markets

- Furthermore, growing interest in flavored, premium, and health-conscious ketchup variants, alongside expanding organized retail and e-commerce channels, is driving product innovation and wider market adoption. These factors are accelerating the uptake of tomato ketchup across households and foodservice sectors, thereby significantly boosting industry growth

Tomato Ketchup Market Analysis

- Tomato ketchup is a popular condiment made from tomatoes, vinegar, sugar, and spices, used widely in households, restaurants, and quick-service restaurants to enhance flavor and complement meals

- The escalating demand for tomato ketchup is primarily fueled by increasing consumption of convenience foods, growing preference for branded and flavored variants, and the expansion of modern retail and online grocery platforms, enabling easier access for consumers across regions

- North America dominated the tomato ketchup market with a share of 37.9% in 2024, due to the high consumption of convenience foods, established retail infrastructure, and rising preference for branded condiments

- Asia-Pacific is expected to be the fastest growing region in the tomato ketchup market during the forecast period due to rising disposable incomes, urbanization, and expanding fast-food chains in countries such as China, India, and Japan

- Household segment dominated the market with a market share of 55.6% in 2024, due to consistent daily consumption as a staple condiment in meals, snacks, and sandwiches. Convenience, taste consistency, and easy storage in kitchens make household usage the primary driver of market demand. Promotional campaigns targeting families, coupled with multi-pack offerings and ready-to-use packaging, strengthen the appeal of ketchup for home consumption

Report Scope and Tomato Ketchup Market Segmentation

|

Attributes |

Tomato Ketchup Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tomato Ketchup Market Trends

Rising Demand for Flavored and Premium Ketchup Variants

- The tomato ketchup market is witnessing strong growth due to increasing consumer preference for flavored varieties such as spicy, smoky, and herb-infused options. These new flavors are expanding market reach by appealing to diverse taste preferences across different age groups and regions, enhancing the versatility of ketchup beyond its traditional use

- For instance, Heinz has introduced product lines such as Heinz Hot Chili and Heinz Sweet & Spicy ketchup, which cater to consumers seeking bold and non-traditional flavor experiences. Similarly, Nestlé under its Maggi brand offers ketchup variants infused with Indian spices to appeal to regional palates, strengthening its presence in fast-growing emerging markets

- Premium ketchup products are becoming more popular as consumers increasingly value high-quality ingredients, innovative packaging, and organic formulations. Brands are focusing on natural ingredients without artificial preservatives or high-fructose corn syrup, appealing to health-conscious buyers who are willing to pay more for better nutritional value and clean-label products

- The rise of experiential dining and shifting consumer habits are encouraging brands to position ketchup as more than just a side condiment. Tomato ketchup is being paired with gourmet dishes, premium sandwiches, and plant-based snacks, which is creating a fresh premiumization narrative supported by modern retail strategies and attractive product placement in supermarkets and online platforms

- Brands are leveraging limited-edition launches and localized flavor experiments to tap into changing consumer interests. For instance, McCormick introduced seasonal ketchup flavors aligned with consumer interest in festive occasions, adding value through exclusivity and local resonance, while simultaneously boosting brand engagement

- The overall trend towards product diversification, health-conscious innovation, and premium offerings is stimulating rapid evolution in the ketchup market. As a result, flavored and premium ketchup variants are redefining traditional condiment positioning, ensuring the product remains a core part of evolving diets and global food consumption patterns

Tomato Ketchup Market Dynamics

Driver

Growing Consumption of Convenience Foods and Fast-Food Products

- The strong global appetite for convenience foods and fast-food products has been one of the most influential forces driving tomato ketchup consumption worldwide. Increasing urbanization, busier lifestyles, and rising disposable incomes are accelerating the demand for ready-to-eat and quick-service meals that universally incorporate tomato ketchup as a key condiment

- For instance, McDonald’s and Burger King continue to rely heavily on ketchup as a fundamental product in their menu offerings, with supply partnerships maintained with major ketchup producers such as Kraft Heinz. Their global expansion amplifies ketchup’s demand through quick-service restaurants and delivery platforms, directly influencing the ketchup supply chain and sales volumes

- Growing consumer dependence on packaged snacks and frozen food, which often include ketchup as part of combo meals or dip accompaniments, is creating consistent market traction. In addition, at-home consumption through frozen snacks such as fries, nuggets, and patties ensures a continual boost for ketchup demand across domestic and food service channels

- Fast-food culture is also rapidly expanding in emerging economies due to increased youth populations and a rise in Western-style dining habits. Coupled with aggressive fast-food chain expansion and food delivery platforms, this trend is strongly consolidating ketchup consumption in Asia-Pacific and Latin America

- The accelerating shift towards convenience-oriented menus at QSR chains, casual dining restaurants, and online meal delivery apps ensures that ketchup remains an integral condiment in both traditional and modern diets. As more consumers turn to easy meal solutions supported by delivery ecosystems, ketchup sales are set to remain on a strong and steady growth path

Restraint/Challenge

Consumer Resistance to Experimental or Unconventional Flavors

- Despite the growing trend toward flavor diversification, many consumers remain reluctant to move away from the traditional taste of tomato ketchup. Resistance to flavors perceived as too experimental or non-traditional can limit the scalability of certain product innovations, causing challenges for companies attempting to enter new flavor niches

- For instance, Heinz faced pushback after experimenting with unique flavors such as Green and Purple EZ Squirt ketchups, which generated initial hype but eventually failed to secure long-term acceptance among mainstream consumers. Such cases demonstrate that while curiosity attracts trial, broader market adoption often hinges on flavor familiarity and trust

- Consumer loyalty to the original tomato flavor is particularly strong in mature ketchup markets such as North America and Europe, where deviations from the expected taste profile can be met with indifference or rejection. Shoppers often expect ketchup to complement rather than overpower food, creating hurdles for highly innovative flavor launches

- Cultural preferences further complicate adoption, as tastes vary significantly across regions, making it difficult for companies to standardize new flavors globally. Investments into flavor innovations carry marketing and distribution risks if products do not resonate with target regions, resulting in wasted resources and slower returns

- Overcoming this challenge requires companies to balance innovation with familiarity by offering gradual flavor variations and aligning with local consumer expectations. Developing hybrid products such as mildly spicy, sweeter, or herb-enhanced ketchup ensures companies can expand their portfolio without alienating consumers who remain hesitant about unconventional shifts in ketchup offerings

Tomato Ketchup Market Scope

The market is segmented on the basis of type, distribution channel, and application.

- By Type

On the basis of type, the tomato ketchup market is segmented into flavoured tomato paste, catsup tomato paste, and others. The catsup tomato paste segment dominated the largest market revenue share in 2024, driven by its long-standing consumer preference, consistent taste, and wide availability in retail channels. Catsup varieties are favored for their balanced sweetness and tanginess, making them a staple condiment in households and restaurants alike. The market also sees strong demand due to brand recognition, convenience packaging, and compatibility with various culinary applications, from fast food to home cooking. The reliability of flavor and shelf stability further reinforce its dominance among other ketchup types.

The flavoured tomato paste segment is anticipated to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by increasing consumer interest in unique taste profiles and gourmet culinary experiences. These variants cater to evolving consumer preferences for experimental flavors such as spicy, smoky, or herb-infused ketchups. Rising adoption in foodservice sectors and the launch of innovative flavors by leading brands are key factors driving the growth of this segment. In addition, the premium positioning and social media influence around exotic flavors enhance its appeal among younger, adventurous consumers.

- By Distribution Channel

On the basis of distribution channel, the tomato ketchup market is segmented into online stores, supermarkets, departmental stores, and convenience stores. The supermarket segment held the largest market revenue share in 2024, driven by the extensive product variety, competitive pricing, and ease of comparison across brands. Supermarkets remain the preferred shopping destination for households seeking one-stop solutions for condiments, enabling bulk purchases and access to promotional offers. The presence of private label brands and loyalty programs also strengthens supermarket dominance in ketchup sales.

The online stores segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing penetration of e-commerce platforms and increasing consumer preference for doorstep delivery. Online channels offer convenient access to both domestic and imported ketchup variants, subscription options, and the ability to explore niche or specialty brands. Enhanced digital marketing, easy payment solutions, and fast delivery services further accelerate online sales, particularly among tech-savvy and urban consumers.

- By Application

On the basis of application, the tomato ketchup market is segmented into household, commercial, and others. The household segment dominated the largest market revenue share of 55.6% in 2024, driven by consistent daily consumption as a staple condiment in meals, snacks, and sandwiches. Convenience, taste consistency, and easy storage in kitchens make household usage the primary driver of market demand. Promotional campaigns targeting families, coupled with multi-pack offerings and ready-to-use packaging, strengthen the appeal of ketchup for home consumption.

The commercial segment is anticipated to witness the fastest growth rate of 17.8% from 2025 to 2032, fueled by the expansion of the foodservice industry, including fast-food chains, restaurants, and cafes. Commercial kitchens increasingly adopt packaged ketchup for its standardization, long shelf life, and ease of use in bulk servings. Rising demand from organized food chains seeking consistent flavor profiles and cost-effective supply solutions contributes to the accelerated growth of this segment. In addition, brand partnerships with the hospitality sector enhance visibility and adoption.

Tomato Ketchup Market Regional Analysis

- North America dominated the tomato ketchup market with the largest revenue share of 37.9% in 2024, driven by the high consumption of convenience foods, established retail infrastructure, and rising preference for branded condiments

- Consumers in the region value consistent taste, quality assurance, and diverse packaging options, making ketchup a household staple

- The widespread adoption is further supported by high disposable incomes, increasing fast-food consumption, and strong brand loyalty, establishing tomato ketchup as a preferred condiment in both households and foodservice outlets

U.S. Tomato Ketchup Market Insight

The U.S. tomato ketchup market captured the largest revenue share in 2024 within North America, fueled by strong demand in households, restaurants, and QSR chains. Consumers increasingly prefer convenient, ready-to-use condiments, while product innovations in low-sodium, organic, and flavored variants are enhancing market appeal. The country’s mature retail network, e-commerce growth, and promotional campaigns by major brands further drive consumption. In addition, rising awareness about quality and safety standards in condiments supports sustained market growth.

Europe Tomato Ketchup Market Insight

The Europe tomato ketchup market is projected to expand at a substantial CAGR during the forecast period, driven by high demand in households and the foodservice industry, along with increasing preference for premium and flavored variants. Consumers are drawn to taste consistency, packaging innovation, and brand reputation. Growth is further supported by organized retail expansion, growing fast-food chains, and rising health-conscious trends encouraging low-sugar and preservative-free options. Countries such as Germany, France, and Italy are witnessing increasing adoption across both domestic and commercial segments.

U.K. Tomato Ketchup Market Insight

The U.K. tomato ketchup market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising household consumption and the popularity of ready-to-eat meals. Brand loyalty, product innovation in gourmet and flavored ketchups, and the convenience offered by pre-packaged options are key drivers. In addition, the strong presence of QSRs, coupled with online grocery platforms and supermarket chains, further enhances product accessibility, sustaining market growth.

Germany Tomato Ketchup Market Insight

The Germany tomato ketchup market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing preference for premium, organic, and flavored variants. German consumers value quality, hygiene, and taste consistency, boosting demand in both households and commercial kitchens. The well-developed retail infrastructure, strong e-commerce penetration, and growing influence of fast-food chains promote consistent consumption. Sustainability trends, including eco-friendly packaging and locally sourced ingredients, also play a role in shaping market growth.

Asia-Pacific Tomato Ketchup Market Insight

The Asia-Pacific tomato ketchup market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising disposable incomes, urbanization, and expanding fast-food chains in countries such as China, India, and Japan. The increasing adoption of western-style diets, coupled with growing awareness of branded condiments, is boosting market penetration. In addition, the expansion of modern retail formats and e-commerce platforms is improving product accessibility, while the emergence of domestic manufacturers offering affordable and flavored options is accelerating consumption.

Japan Tomato Ketchup Market Insight

The Japan tomato ketchup market is gaining momentum due to high consumer preference for convenience foods and growing western-style culinary habits. Consumers value flavor consistency, innovative packaging, and variety in ketchup offerings. The presence of organized retail and supermarkets, coupled with rising fast-food consumption and online grocery adoption, supports market growth. Furthermore, premium and flavored variants are increasingly popular among younger and health-conscious consumers, enhancing demand across households and commercial kitchens.

China Tomato Ketchup Market Insight

The China tomato ketchup market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising disposable incomes, and growing western-style eating habits. Ketchup is increasingly used in both household cooking and QSR chains. The push towards packaged and convenience foods, coupled with local manufacturing and competitive pricing, supports widespread adoption. In addition, the growing fast-food industry and the popularity of flavored and low-sugar variants are key factors propelling market growth in China.

Tomato Ketchup Market Share

The tomato ketchup industry is primarily led by well-established companies, including:

- JBS S.A.(U.S.)

- Kraft Foods (U.S.)

- BRF S.A. (Netherlands)

- Astral Foods (India)

- Hormel Foods (Hungary)

- 2 Sisters Food (France)

- Waitrose (Columbia)

- Wm. Morrison Supermarkets (U.K.)

- Samworth Brothers (U.S.)

- General Mills Inc (U.K.)

- Conagra Brands, Inc (U.S.)

- Nestlé (U.S.)

- Unilever (India)

- Kellogg Co (U.S.)

- McCain Foods Ltd. (U.S.)

- The Kraft Heinz Company. (U.S.)

- Associated British Foods plc (U.K.)

- Ajinomoto Foods (Japan)

- LantmännenUnibake (Germany)

Latest Developments in Global Tomato Ketchup Market

- In September 2024, Doritos collaborated with Heinz to launch limited-edition Ketchup and Mustard-flavored chips in Brazil. This partnership was part of PepsiCo’s 2024 innovation strategy and aimed to introduce familiar flavors to a broader consumer base. The collaboration strengthened brand visibility for both companies and also highlighted the growing trend of cross-brand flavor innovation, creating excitement among younger and adventurous consumers. By leveraging the popularity of well-known snack and condiment brands, the initiative reinforced consumer engagement and positioned ketchup flavors as a versatile ingredient beyond traditional use

- In April 2024, Heinz introduced a Smokey Bacon-flavored tomato ketchup in the U.K., building on previous flavor innovations such as curry and jalapeno. This launch generated mixed reactions, reflecting the market’s cautious approach to experimental flavors, yet it successfully drew attention and curiosity from consumers seeking bold and unique taste experiences. The introduction of such novel variants emphasizes the growing importance of flavor differentiation in the ketchup market, with brands exploring ways to appeal to adventurous eaters while balancing traditional preferences

- In March 2024, Heinz launched Tomato Ketchup Zero in the U.K., a healthier version of its classic ketchup with no added sugar or salt and 35% more tomatoes. This product catered to the increasing consumer demand for health-conscious options without compromising on flavor. The market impact was significant as it demonstrated that innovation in nutritional content can drive adoption among households and health-focused foodservice channels. The introduction of Tomato Ketchup Zero also positioned Heinz as a brand attentive to evolving dietary trends, reinforcing trust and loyalty among health-conscious consumers

- In 2023, Heinz expanded its flavored ketchup portfolio in North America by launching Sweet Chili and Spicy Jalapeno variants. These offerings targeted younger demographics and food enthusiasts looking for bold, international flavors. The expansion contributed to market growth by attracting consumers to premium and differentiated products, encouraging repeat purchases, and enhancing shelf visibility in supermarkets and online retail. It also underscored the importance of continuous flavor innovation to maintain engagement in a mature and highly competitive market

- In 2022, Heinz launched a limited-edition Garlic & Herb ketchup in Europe, catering to consumers seeking gourmet and specialty condiments. This launch reinforced the trend of premiumization in the ketchup market, highlighting that consumers are willing to experiment with unique flavor profiles. The initiative helped Heinz tap into niche segments such as foodservice and gourmet retail, supporting both brand prestige and market expansion. It also demonstrated the growing potential for regional flavor adaptations to drive consumer interest and diversify the product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tomato Ketchup Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tomato Ketchup Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tomato Ketchup Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.