Global Tonsillitis Drugs Market

Market Size in USD Billion

CAGR :

%

USD

2.97 Billion

USD

4.42 Billion

2024

2032

USD

2.97 Billion

USD

4.42 Billion

2024

2032

| 2025 –2032 | |

| USD 2.97 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Tonsillitis Drugs Market Size

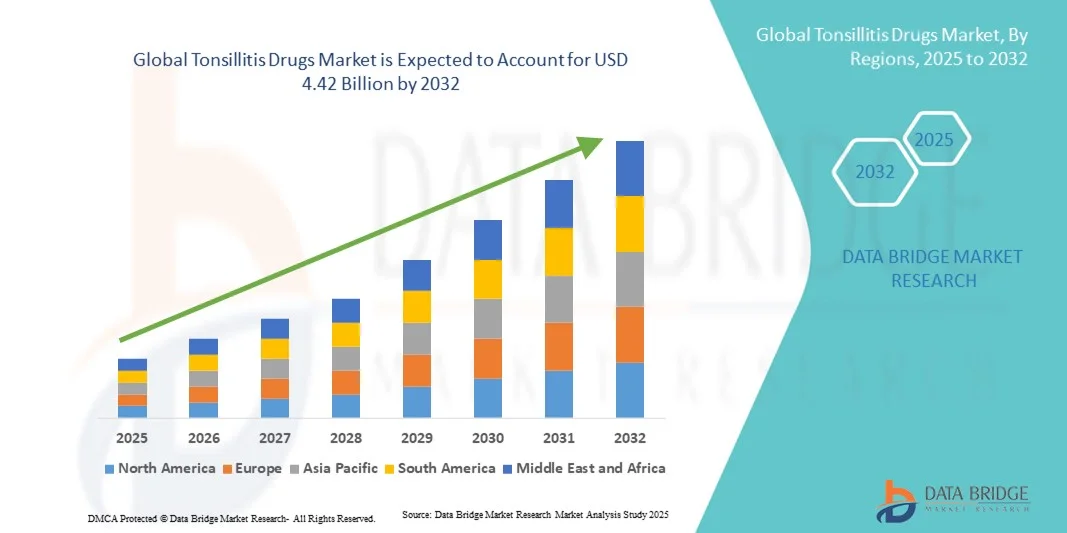

- The global tonsillitis drugs market size was valued at USD 2.97 billion in 2024 and is expected to reach USD 4.42 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of tonsillitis and related upper respiratory infections, along with growing awareness about timely treatment and the availability of effective drug therapies. Advances in pharmaceutical formulations, including antibiotics and symptomatic relief medications, are enhancing treatment outcomes and driving significant growth within the tonsillitis drugs market

- Furthermore, rising healthcare access, increasing physician awareness, and expanding pharmaceutical distribution networks are accelerating the adoption of tonsillitis drug solutions. These converging factors are establishing effective drug therapies for tonsillitis as a critical component in respiratory healthcare, thereby significantly boosting the industry’s growth

Tonsillitis Drugs Market Analysis

- Tonsillitis drugs, including antibiotics, anti-inflammatory, and symptomatic relief medications, are increasingly vital in managing bacterial and viral tonsillitis, improving patient recovery, and reducing complications associated with upper respiratory infections

- The escalating demand for tonsillitis drugs is primarily fueled by the rising incidence of tonsillitis worldwide, growing awareness among healthcare professionals and patients, and increasing adoption of effective pharmaceutical treatments

- North America dominated the tonsillitis drugs market with the largest revenue share of 41.0% in 2024, driven by well-established healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies. The U.S. experienced substantial growth in tonsillitis drug usage, particularly in hospitals, clinics, and pharmacies, supported by advanced treatment guidelines and robust drug availability

- Asia-Pacific is expected to be the fastest-growing region in the tonsillitis drugs market during the forecast period, with a projected CAGR due to increasing urbanization, rising disposable incomes, and expanding healthcare access

- Solid dosage form dominated the largest market revenue share of 65.1% in 2024, due to widespread use of tablets and capsules for both children (chewable forms) and adults

Report Scope and Tonsillitis Drugs Market Segmentation

|

Attributes |

Tonsillitis Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Tonsillitis Drugs Market Trends

Advancements Driving Improved Therapeutic Outcomes

- A significant and accelerating trend in the global tonsillitis drugs market is the development and adoption of advanced therapeutic options, including new formulations and improved drug delivery methods. These innovations are significantly enhancing patient compliance, treatment efficacy, and overall convenience for healthcare providers and patients alike

- For instance, novel formulations of tonsillitis drugs allow for faster absorption, reduced dosing frequency, and improved tolerability, contributing to better clinical outcomes and higher patient satisfaction. Similarly, combination therapies are being explored to provide broader coverage against resistant bacterial strains while minimizing side effects

- Enhanced pharmacokinetic and pharmacodynamic profiles in recently approved drugs are allowing clinicians to tailor treatment more precisely to patient needs, reducing the risk of overtreatment or suboptimal therapy. Furthermore, new oral and pediatric-friendly formulations are supporting easier administration and adherence in younger populations

- The integration of updated clinical guidelines, real-world evidence, and post-market surveillance data into therapeutic strategies enables healthcare providers to make more informed decisions, optimize treatment protocols, and monitor patient progress effectively. This fosters a more streamlined and patient-centered approach to tonsillitis management

- The trend towards targeted therapies and innovative formulations is fundamentally reshaping patient expectations and clinician practices in Tonsillitis treatment. Consequently, pharmaceutical companies are focusing on research and development of advanced drugs with improved safety, efficacy, and ease of use

- The demand for such enhanced therapeutic options is growing rapidly across both developed and emerging markets, as healthcare systems and patients increasingly prioritize efficacy, convenience, and comprehensive treatment solutions

Tonsillitis Drugs Market Dynamics

Driver

Growing Need Due to Rising Incidence and Awareness

- The increasing prevalence of tonsillitis and related infections, coupled with growing public awareness about effective treatment options, is a significant driver for the heightened demand for advanced tonsillitis drugs

- For instance, in April 2024, several pharmaceutical companies launched new oral formulations aimed at improving patient compliance and reducing treatment duration. Such developments are expected to drive the Tonsillitis Drugs industry growth in the forecast period

- As healthcare providers increasingly recognize the benefits of early and effective treatment, newer drugs with enhanced efficacy, safety, and tolerability are gaining preference over traditional therapies

- Furthermore, the rising demand for pediatric and adult-friendly formulations, combined with the focus on minimizing side effects, is making advanced Tonsillitis Drugs a key component of standard treatment protocols

- The convenience of reduced dosing frequency, improved palatability, and easy administration are key factors propelling the adoption of these drugs across hospitals, clinics, and outpatient settings. The trend towards evidence-based prescribing and guideline-driven care further contributes to market growth

Restraint/Challenge

Concerns Regarding Drug Resistance and High Treatment Costs

- The increasing prevalence of antibiotic resistance and concerns over potential side effects pose a significant challenge to broader market adoption of Tonsillitis Drugs

- Reports of resistant bacterial strains have made some clinicians cautious in selecting first-line treatments, emphasizing the need for careful monitoring and susceptibility testing

- Addressing these concerns through robust clinical trials, post-market surveillance, and patient education is crucial for building trust and ensuring effective outcomes. In addition, the relatively high cost of some advanced Tonsillitis Drugs compared to generic alternatives can be a barrier to adoption for price-sensitive patients, particularly in developing regions or for those without adequate insurance coverage

- While prices are gradually decreasing, the perceived premium for newer therapeutic options can still hinder widespread adoption, especially for patients who do not see an immediate need for enhanced formulations

- Overcoming these challenges through improved drug accessibility, awareness campaigns on proper antibiotic use, and continued innovation in safer, more affordable formulations will be vital for sustained market growth

Tonsillitis Drugs Market Scope

The market is segmented on the basis of cause, type, drug type, population type, dosage form, mode of purchase, end user, and distribution channel.

- By Cause

On the basis of cause, the Tonsillitis Drugs market is segmented into Viral Tonsillitis, Bacterial Tonsillitis, and Others. Viral Tonsillitis dominated the largest market revenue share of 55.3% in 2024, driven by the high prevalence of viral infections such as adenovirus, influenza, and rhinovirus, which are the most common causes of tonsillitis globally. The segment benefits from the frequent occurrence of viral infections during seasonal changes and the rising awareness of early diagnosis and symptomatic treatment. Hospitals and clinics focus on supportive care using antipyretics and analgesics to manage symptoms. Viral tonsillitis is particularly common in children and young adults, who constitute the majority of patients. Increasing urbanization, school attendance, and population density contribute to virus transmission, driving demand for treatments. OTC availability of symptom-relieving drugs strengthens adoption. Awareness campaigns by healthcare professionals promote timely intervention. Technological advances in diagnostic kits aid early detection, reinforcing treatment demand. Physician confidence in symptom management protocols sustains market stability. Insurance coverage for pediatric care ensures accessibility. Clinical guidelines favor supportive care in viral tonsillitis, maintaining steady demand. The segment’s dominance is supported by seasonal peaks and preventive health measures. Overall, viral tonsillitis remains the leading cause segment in the market.

Bacterial Tonsillitis is expected to witness the fastest CAGR of 6.8% from 2025 to 2032, driven by the rising incidence of bacterial infections, especially Group A Streptococcus. The segment benefits from improved diagnostic capabilities and rapid testing in hospitals and clinics. Increasing awareness about early treatment to prevent complications like rheumatic fever boosts adoption. Targeted antibiotic therapies, including penicillin and amoxicillin, are widely used in treatment protocols. Growth is further supported by pediatric and adult patient populations at higher risk. The development of combination drugs and easier dosing formulations enhances patient compliance. Hospitals are standardizing bacterial tonsillitis treatment in surgical and outpatient care. Telemedicine initiatives promote early intervention and prescription management. Regional healthcare expansion in Asia-Pacific and Latin America contributes to growth. Increased government initiatives for infectious disease management support market penetration. Clinical evidence of improved patient outcomes strengthens physician preference. Educational programs and campaigns increase awareness among caregivers. The rising demand for effective treatment options positions bacterial tonsillitis as the fastest-growing segment.

- By Type

On the basis of type, the Tonsillitis Drugs market is segmented into Acute Tonsillitis, Recurrent Tonsillitis, and Chronic Tonsillitis. Acute Tonsillitis dominated the largest market revenue share of 47.6% in 2024, owing to the high incidence of sudden-onset infections caused by viruses and bacteria. The segment benefits from frequent occurrence among children and young adults, leading to increased demand for rapid symptom relief. Hospitals and clinics rely on antipyretics and antibiotics for immediate management. OTC availability of symptom-relief drugs ensures accessibility and high adoption rates. Physician guidelines recommend prompt treatment to avoid complications. Seasonal prevalence during cold and flu outbreaks increases demand. Educational campaigns for parents and caregivers enhance early intervention. Clinical trials support the efficacy of commonly used medications. Patient compliance is improved through easy-to-administer formulations like syrups and tablets. Hospital stocking protocols ensure availability in pediatric and adult wards. Insurance coverage supports treatment affordability. Physician confidence in rapid recovery protocols sustains market growth. Overall, acute tonsillitis remains the dominant type segment.

Chronic Tonsillitis is expected to witness the fastest CAGR of 5.5% from 2025 to 2032, fueled by growing awareness of long-term health impacts and complications such as recurrent infections and sleep apnea. Hospitals increasingly perform surgical interventions like tonsillectomy for chronic cases. Rising demand from pediatric and adult populations with persistent symptoms contributes to market growth. Minimally invasive surgical techniques and advancements in pain management enhance adoption. Physician guidelines recommend long-term management and preventive strategies. Telemedicine consultations support follow-up care and compliance. Awareness programs highlight risks of untreated chronic tonsillitis. Insurance and reimbursement schemes for surgeries boost accessibility. Hospital and specialty clinics expand chronic care services. Patient education initiatives encourage timely medical attention. Development of combination drug formulations supports symptomatic relief before surgery. Regional expansion in Asia-Pacific and Latin America accelerates adoption. Overall, chronic tonsillitis is the fastest-growing type segment.

- By Drug Type

On the basis of drug type, the Tonsillitis Drugs market is segmented into Antipyretic Analgesics, Antibiotics, and Others. Antibiotics held the largest market revenue share of 62.4% in 2024, driven by widespread use in bacterial tonsillitis treatment. Hospitals and clinics rely on antibiotics like amoxicillin and penicillin for effective eradication of infections. The segment benefits from clinical evidence supporting faster recovery and prevention of complications. Multiple dosage forms, including syrups, tablets, and injectables, provide flexibility in treatment. High prescription rates among pediatric and adult patients ensure sustained demand. Standard treatment protocols in hospitals favor antibiotics for confirmed bacterial cases. Regulatory approvals in major markets guarantee supply consistency. Physician confidence is reinforced by clinical trials demonstrating efficacy and safety. Pre-filled and easy-to-administer formulations improve patient compliance. Telemedicine prescriptions enhance accessibility for remote patients. Awareness programs by healthcare authorities promote appropriate antibiotic use. Insurance and reimbursement policies support adoption. Overall, antibiotics dominate the drug type segment.

Antipyretic Analgesics are expected to witness the fastest CAGR of 4.9% from 2025 to 2032, driven by increasing demand for symptomatic relief from fever and pain. OTC availability and ease of access contribute to widespread adoption. Hospitals, home healthcare, and specialty clinics utilize these drugs for supportive care in both viral and bacterial tonsillitis. Rising awareness about symptom management improves patient comfort and compliance. Combination drugs offering both analgesic and antipyretic effects further enhance usage. Pediatric and adult populations with recurrent fever episodes drive market growth. Telemedicine platforms allow digital prescriptions and home delivery, supporting adoption. Physicians recommend antipyretics for initial care before diagnostic confirmation. Seasonal spikes in viral infections increase demand. Patient preference for convenient dosage forms like syrups, tablets, and suspensions boosts usage. Regional expansion in emerging markets accelerates segment growth. Educational campaigns by healthcare professionals encourage proper symptom management. Overall, antipyretic analgesics represent the fastest-growing drug type segment.

- By Population Type

On the basis of population type, the Tonsillitis Drugs market is segmented into Children and Adults. Children dominated the largest market revenue share of 59.7% in 2024, as tonsillitis prevalence is highest among pediatric populations due to underdeveloped immune systems and frequent exposure to viral and bacterial pathogens in schools and daycare centers. Physicians prioritize early intervention in children to prevent complications. Hospitals and specialty clinics stock pediatric formulations such as syrups and chewable tablets for accurate dosing. OTC availability of symptom-relief medications supports adoption at home. Seasonal spikes in infections drive peak demand during winter and spring. Pediatric treatment guidelines emphasize safety and efficacy, increasing caregiver trust. Educational campaigns for parents highlight early symptom recognition. Telemedicine services allow convenient prescriptions for remote areas. Hospitals ensure consistent availability through standardized procurement. Insurance coverage for pediatric care enhances accessibility. Clinical studies support safe use of antibiotics and antipyretics in children. Overall, children remain the dominant population segment.

Adults are expected to witness the fastest CAGR of 5.2% from 2025 to 2032, driven by increasing awareness about preventive healthcare, rising incidence of recurrent and chronic tonsillitis, and growing outpatient visits. Adult patients increasingly prefer convenient OTC solutions for symptomatic relief. Hospitals and home healthcare services administer targeted antibiotics for confirmed bacterial infections. Rising corporate healthcare initiatives encourage adults to seek timely treatment. Telemedicine platforms and e-pharmacies support easy access to medications. Adult populations with comorbidities drive demand for effective and safe treatments. Educational campaigns promote adherence to prescription guidelines. Combination drug formulations improve compliance in adults with multiple symptoms. The growing focus on chronic disease management contributes to the segment’s growth. Urbanization and lifestyle changes increase susceptibility to recurrent infections. Digital health apps facilitate prescription reminders and dosage tracking. Overall, adults represent the fastest-growing population segment.

- By Dosage Form

On the basis of dosage form, the Tonsillitis Drugs market is segmented into Solid and Liquid. Solid dosage form dominated the largest market revenue share of 65.1% in 2024, due to widespread use of tablets and capsules for both children (chewable forms) and adults. Solid forms ensure accurate dosing, longer shelf-life, and easier storage, making them preferred in hospitals and pharmacies. Physician confidence in solid formulations is high due to standardized efficacy. Hospitals procure tablets and capsules for inpatient and outpatient treatment. OTC availability and patient familiarity support adoption. Solid forms are convenient for recurrent infections and chronic tonsillitis cases. Standard dosing regimens for antibiotics and antipyretics enhance compliance. Hospitals maintain inventory for seasonal peaks in tonsillitis cases. Prescription protocols favor solid forms for adult and pediatric populations. Insurance coverage ensures affordability and accessibility. Clinical evidence supports effectiveness in bacterial and viral tonsillitis management. Overall, solid forms dominate the dosage form segment.

Liquid dosage form is expected to witness the fastest CAGR of 6.1% from 2025 to 2032, driven by high demand for pediatric-friendly syrups and suspensions that allow precise dosing. Liquid formulations are preferred for children and adults with swallowing difficulties. Home healthcare and specialty clinics increasingly rely on liquid forms for patient convenience. OTC availability of syrups supports rapid adoption. Telemedicine prescriptions and e-pharmacy deliveries enhance access. Pediatricians and physicians recommend liquid forms for accurate symptom management. Seasonal spikes in viral infections increase demand for liquid medications. Liquid antibiotics and antipyretics ensure quick absorption and efficacy. Hospitals and pharmacies stock a variety of flavors and concentrations to improve compliance. Home care providers use liquid forms for safe administration. Combination liquid drugs improve symptom relief in acute tonsillitis cases. Overall, liquid formulations represent the fastest-growing dosage form segment.

- By Mode of Purchase

On the basis of mode of purchase, the Tonsillitis Drugs market is segmented into OTC and Prescription. Prescription dominated the largest market revenue share of 60.8% in 2024, driven by the high prevalence of bacterial tonsillitis cases requiring antibiotics, which are strictly prescribed by physicians. Hospitals, specialty clinics, and pharmacies rely on prescriptions to ensure appropriate drug selection, dosage, and monitoring. Prescription drugs allow for targeted therapy, reducing the risk of resistance and complications. Regulatory guidelines mandate prescriptions for antibiotics in most countries, sustaining market control. Physicians prefer prescriptions to monitor patient compliance and side effects. Pediatric and adult patient care relies on accurate dosing via prescription. Telemedicine platforms facilitate electronic prescriptions, increasing accessibility. Insurance coverage for prescription drugs ensures affordability for patients. Prescription-based distribution supports hospital inventory management. Standardized clinical protocols reinforce physician confidence. Awareness campaigns promote proper use and discourage misuse. Overall, prescription mode remains dominant due to safety, efficacy, and regulatory compliance.

OTC is expected to witness the fastest CAGR of 5.6% from 2025 to 2032, driven by the increasing demand for symptomatic relief in viral tonsillitis and self-managed care. OTC availability enables patients to quickly access antipyretics, analgesics, and mild antibiotics for minor infections. Convenience and familiarity with OTC medications drive adoption in home healthcare. Retail pharmacies and e-pharmacies expand OTC reach. Pediatric OTC formulations like syrups enhance usability for children. Seasonal viral outbreaks contribute to spikes in OTC sales. Patient education on proper dosing improves compliance. Telehealth platforms guide safe OTC usage. Combination OTC drugs improve symptom control. Urbanization and rising disposable income boost OTC adoption. OTC channels allow rapid response to acute infections without hospital visits. Overall, OTC represents the fastest-growing mode of purchase segment.

- By End User

On the basis of end user, the Tonsillitis Drugs market is segmented into Hospitals, Home Healthcare, Specialty Clinics, and Others. Hospitals dominated the largest market revenue share of 58.9% in 2024, owing to the high volume of patient visits, surgical procedures, and post-operative care requiring supervised drug administration. Hospitals stock both prescription and OTC drugs for inpatient and outpatient care. Pediatric and adult departments maintain specialized formulations. Standard clinical protocols favor hospital administration for effective treatment. Physician confidence in hospital-supplied medications ensures reliability. Hospitals procure drugs through bulk purchasing agreements for cost-effectiveness. Seasonal surges in tonsillitis cases drive demand in hospitals. Hospitals also serve as primary centers for diagnostic testing, increasing treatment administration. Insurance and reimbursement coverage facilitate access. Physician training and clinical guidelines reinforce proper usage. Partnerships with pharmaceutical companies ensure consistent supply. Overall, hospitals remain the dominant end-user segment.

Home Healthcare is expected to witness the fastest CAGR of 6.4% from 2025 to 2032, fueled by the increasing preference for at-home care and self-management of tonsillitis symptoms. Patients rely on home-administered antipyretics and antibiotics under physician guidance. Telemedicine services facilitate prescription delivery and dosage instructions. Pediatric and adult populations increasingly opt for home treatment for convenience. Home healthcare providers support safe drug administration for elderly and mobility-challenged patients. OTC and pre-filled medications enhance usability. E-pharmacy partnerships enable doorstep delivery. Rising awareness about avoiding unnecessary hospital visits drives adoption. Seasonal peaks in viral infections increase home treatment demand. Patients appreciate combination formulations for multiple symptoms. Insurance coverage for home care contributes to adoption. Overall, home healthcare represents the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the Tonsillitis Drugs market is segmented into Hospital Pharmacy, Retail Pharmacy, Online Pharmacies, and Others. Hospital Pharmacy dominated the largest market revenue share of 57.6% in 2024, as it ensures controlled distribution of prescription drugs like antibiotics for bacterial tonsillitis. Hospitals maintain inventories of both solid and liquid formulations to meet inpatient and outpatient needs. Bulk procurement and standardized dosing enhance efficiency. Physicians rely on hospital pharmacies for safe and timely medication supply. Seasonal spikes in infection rates increase hospital pharmacy demand. Pediatric and adult wards depend on hospital pharmacy supply for accurate dosing. Clinical guidelines and physician oversight reinforce prescription compliance. Hospital pharmacies facilitate insurance reimbursement and cost management. Partnerships with pharmaceutical companies ensure consistent availability. Telemedicine prescriptions integrate with hospital pharmacy fulfillment. Patient trust in hospital-administered drugs maintains strong market share. Overall, hospital pharmacy remains the dominant distribution channel.

Online Pharmacies are expected to witness the fastest CAGR of 8.2% from 2025 to 2032, driven by increasing digital adoption, convenience, and home delivery services. Patients, particularly those managing chronic or recurrent tonsillitis, prefer online platforms for prescription and OTC medications. Pediatric and adult patients benefit from doorstep delivery and automated refill services. Telemedicine prescriptions integrated with e-pharmacies enhance safe usage. Seasonal outbreaks increase online pharmacy orders. Easy access to multiple formulations, including syrups and tablets, supports compliance. Growing penetration of smartphones and internet connectivity accelerates adoption. Combination products for fever and pain management are widely available online. Insurance coverage for online orders improves affordability. Educational resources on digital platforms promote correct dosage administration. Urban and semi-urban areas show rapid adoption. Overall, online pharmacies represent the fastest-growing distribution channel segment

Tonsillitis Drugs Market Regional Analysis

- North America dominated the tonsillitis drugs market with the largest revenue share of 41.0% in 2024

- Driven by well-established healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies

- The market experienced substantial growth in tonsillitis drug usage, particularly in hospitals, clinics, and pharmacies, supported by advanced treatment guidelines and robust drug availability

U.S. Tonsillitis Drugs Market Insight

The U.S. tonsillitis drugs market captured the largest revenue share in North America in 2024, fueled by rapid advancements in therapeutic approaches, increasing prevalence of tonsillitis and related infections, and widespread adoption in hospitals and clinics. The presence of leading pharmaceutical companies and enhanced public awareness regarding treatment protocols further contribute to the market’s expansion.

Europe Tonsillitis Drugs Market Insight

The Europe tonsillitis drugs market is projected to expand at a substantial CAGR throughout the forecast period, driven by established healthcare systems, rising patient awareness, and increasing adoption of guideline-based therapies. Significant growth is observed across hospitals, specialty clinics, and retail pharmacies, ensuring wider accessibility of effective tonsillitis drugs.

U.K. Tonsillitis Drugs Market Insight

The U.K. tonsillitis drugs market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by high healthcare standards, increasing incidence of tonsillitis, and availability of advanced treatment protocols. The strong pharmaceutical distribution network ensures efficient delivery to hospitals and clinics, driving market adoption.

Germany Tonsillitis Drugs Market Insight

The Germany tonsillitis drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing patient awareness, supportive healthcare policies, and the presence of key pharmaceutical players. Focus on research-driven treatment approaches and hospital-based drug administration contributes to steady market growth.

Asia-Pacific Tonsillitis Drugs Market Insight

The Asia-Pacific tonsillitis drugs market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding healthcare infrastructure, and growing patient awareness. Countries such as China, Japan, and India are witnessing higher adoption of effective treatment regimens, supported by government initiatives to enhance healthcare access and pharmaceutical availability.

Japan Tonsillitis Drugs Market Insight

The Japan tonsillitis drugs market is gaining momentum due to the country’s advanced healthcare system, high patient awareness, and demand for timely intervention in tonsillitis cases. Hospitals and specialty clinics focusing on early diagnosis and treatment further support market growth. In addition, the presence of strong pharmaceutical research capabilities and ongoing innovation in antibiotic and anti-inflammatory formulations are driving therapeutic advancements. The increasing adoption of evidence-based clinical practices and government initiatives to improve drug accessibility are also contributing to the steady expansion of the market in Japan.

China Tonsillitis Drugs Market Insight

The China tonsillitis drugs market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to expanding healthcare infrastructure, increasing number of hospitals and specialty clinics, rising prevalence of tonsillitis, and growing public awareness regarding effective treatments. Strong domestic pharmaceutical manufacturing and distribution networks further facilitate widespread availability and adoption of tonsillitis drugs across the country.

Tonsillitis Drugs Market Share

The Tonsillitis Drugs industry is primarily led by well-established companies, including:

• GSK plc (U.K.)

• Pfizer Inc. (U.S.)

• Novartis AG (Switzerland)

• Sanofi (France)

• Johnson & Johnson and its affiliates (U.S.)

• Bayer AG (Germany)

• AstraZeneca plc (U.K.)

• Merck & Co., Inc. (U.S.)

• Abbott (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Bristol-Myers Squibb Company (U.S.)

• Boehringer Ingelheim GmbH (Germany)

• Roche Holding AG (Switzerland)

• Takeda Pharmaceutical Company Limited (Japan)

Latest Developments in Global Tonsillitis Drugs Market

- In August 2021, a healthcare project in Wales initiated a program utilizing pharmacists to treat sore throats, aiming to alleviate pressure on general practitioners and tackle antibiotic resistance. This initiative allowed patients with sore throats to receive treatment directly from pharmacists, streamlining the process and promoting more efficient use of healthcare resources

- In November 2023, a systematic review published in Pharmacy Times highlighted the benefits of tonsillectomy over prolonged antibiotic use for adults with recurrent acute tonsillitis. The study emphasized that surgical intervention could be more effective in reducing recurrence rates and improving quality of life for these patients

- In March 2024, a clinical trial published in the Journal of Antimicrobial Chemotherapy evaluated the efficacy of a novel antibiotic combination therapy for treating group A streptococcal tonsillitis. The study found that the combination therapy was more effective than standard treatments, suggesting a potential shift in treatment protocols

- In May 2024, a study published in the Journal of Clinical Microbiology assessed the antibiotic-prescribing patterns for pediatric tonsillitis in Saudi Arabia. The findings indicated a high rate of antibiotic prescriptions, raising concerns about potential overuse and the need for more stringent prescribing guidelines to combat antibiotic resistance

- In January 2025, the World Health Organization (WHO) released updated guidelines on the management of acute sore throat and tonsillitis, emphasizing the importance of accurate diagnosis to distinguish between viral and bacterial causes and recommending appropriate treatment strategies to reduce unnecessary antibiotic use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.