Global Total Ankle Replacement Market

Market Size in USD Million

CAGR :

%

USD

748.06 Million

USD

1,283.40 Million

2024

2032

USD

748.06 Million

USD

1,283.40 Million

2024

2032

| 2025 –2032 | |

| USD 748.06 Million | |

| USD 1,283.40 Million | |

|

|

|

|

Total Ankle Replacement Market Size

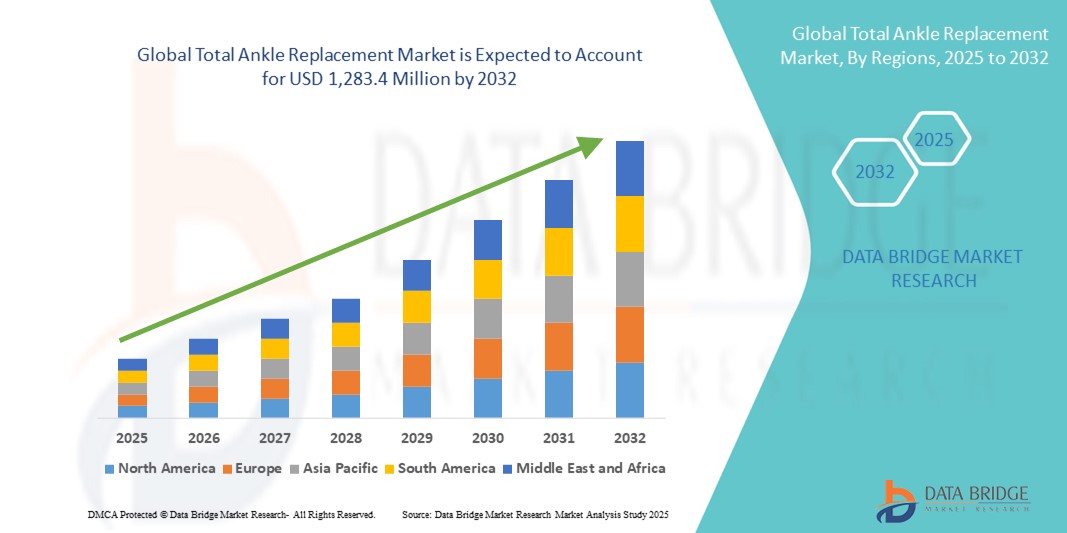

- The global total ankle replacement market size was valued at USD 748.06 million in 2024 and is expected to reach USD 1,283.4 million by 2032, at a CAGR of 6.98% during the forecast period

- The market growth is largely fueled by the increasing incidence of ankle arthritis, rising geriatric population, and growing adoption of minimally invasive orthopedic procedures, all of which are contributing to the demand for advanced joint replacement technologies in both developed and developing regions

- Furthermore, rising patient demand for pain relief, improved mobility, and faster recovery is establishing total ankle replacement as a preferred alternative to ankle fusion. These converging factors are accelerating the uptake of Total Ankle Replacement solutions, thereby significantly boosting the industry's growth

Total Ankle Replacement Market Analysis

- Total Ankle Replacement (TAR), also known as ankle arthroplasty, is increasingly becoming a vital surgical procedure for patients suffering from severe ankle arthritis, trauma, or degenerative joint disease. The procedure helps preserve joint motion, reduce pain, and improve mobility—making it an essential alternative to ankle fusion, especially among aging and active patient populations

- The growing demand for total ankle replacement is primarily fueled by an increase in osteoarthritis cases, rising geriatric populations, advancements in implant technology, and improved post-operative outcomes. The introduction of third-generation implants, which offer better alignment, reduced wear rates, and enhanced longevity, is contributing significantly to market growth

- North America dominated the total ankle replacement market with the largest revenue share of 42.6% in 2024, driven by a high incidence of osteoarthritis and sports injuries, well-developed healthcare infrastructure, and widespread availability of skilled orthopedic surgeons. The U.S. accounts for the majority of procedures performed in the region, bolstered by favorable reimbursement policies and ongoing R&D by companies such as Stryker, Zimmer Biomet, and Wright Medical Group

- Asia-Pacific is expected to be the fastest-growing region in the total ankle replacement market during the forecast period (2025–2032), registering a CAGR of 9.7%, due to increasing healthcare access, a rapidly aging population, and a rising middle class in countries such as China, India, and South Korea. Government initiatives to improve orthopedic care, growing medical tourism, and increasing awareness about motion-preserving surgeries are also driving growth in the region

- Total Replacement dominated the total ankle replacement market with a revenue share of 68.4% in 2024, due to its effectiveness in managing end-stage ankle arthritis and the introduction of new-generation implants offering greater durability and range of motion

Report Scope and Total Ankle Replacement Market Segmentation

|

Attributes |

Total Ankle Replacement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Total Ankle Replacement Market Trends

Enhanced Precision and Outcomes Through AI and Digital Integration

- A significant and accelerating trend in the global total ankle replacement (TAR) market is the growing integration of artificial intelligence (AI), robotic-assisted surgery, and preoperative planning software to improve surgical precision, implant alignment, and long-term patient outcomes

- For instance, Stryker’s Mako robotic-arm system, though primarily used in hip and knee arthroplasty, is paving the way for similar applications in ankle replacement by enhancing bone preparation accuracy and personalized implant placement based on real-time intraoperative data. These systems reduce variability and improve recovery timelines

- AI-powered preoperative planning tools such as Materialise’s 3D visualization and modeling software are helping surgeons simulate TAR procedures in advance, allowing for customized implant fitting based on the patient’s anatomy and gait. This enhances surgical confidence and reduces operative time

- Digital navigation systems are increasingly used in conjunction with AI algorithms to ensure proper tibial and talar alignment, critical for implant longevity and joint function. Advanced imaging data—CT and MRI—can be converted into precise surgical guides and templates, allowing surgeons to plan and execute with sub-millimeter accuracy

- Post-operative rehabilitation is also being transformed through AI-driven wearable devices and remote monitoring platforms, which provide real-time feedback on mobility, range of motion, and gait analysis. These tools help clinicians remotely adjust recovery protocols and identify complications early

- This trend toward technology-enabled, personalized, and data-driven ankle replacement surgery is reshaping clinical workflows and patient expectations. Companies such as Zimmer Biomet, Wright Medical (a Stryker subsidiary), and Exactech are increasingly integrating AI and digital tools into their surgical platforms to offer comprehensive joint care solutions

- The demand for TAR systems enhanced by AI, robotics, and digital planning is expected to grow significantly as healthcare providers prioritize precision medicine, patient-specific implants, and faster, safer recovery—especially among the aging, active, and sports-injury-prone populations

Total Ankle Replacement Market Dynamics

Driver

Growing Need Due to Increasing Geriatric Population and Rising Incidence of Osteoarthritis

- The rising prevalence of osteoarthritis and post-traumatic arthritis, particularly among the aging population, is a significant driver for the growing demand for Total Ankle Replacement procedures. As more patients seek to regain mobility and reduce pain, the demand for long-lasting joint solutions is steadily increasing

- For instance, in March 2024, Stryker introduced enhancements to its STAR Total Ankle system, focusing on improving implant longevity and patient comfort. Such developments by leading players are expected to further propel the Total Ankle Replacement industry growth over the forecast period

- In addition, the increasing preference for motion-preserving surgeries as alternatives to ankle arthrodesis (fusion) is accelerating the adoption of total ankle arthroplasty, which offers better post-operative mobility and quality of life for patients

- Furthermore, the growing popularity of minimally invasive surgical techniques and robotic-assisted orthopedic surgeries is enhancing clinical outcomes and shortening recovery periods, making total ankle replacement more accessible and appealing to a broader patient base

- Healthcare providers and orthopedic surgeons are increasingly recommending total ankle replacement for younger and more active patients, thanks to improved implant designs and the availability of patient-specific instrumentation. These converging factors are accelerating the uptake of total ankle replacement solutions, thereby significantly boosting the industry's growth

Restraint/Challenge

High Surgical Costs and Post-operative Complications

- Despite its clinical benefits, total ankle replacement is associated with high surgical and implant costs, which can limit its adoption, particularly in emerging markets where reimbursement structures are weak or absent. The upfront financial burden can deter both patients and providers from opting for this procedure

- For instance, while insurance coverage has improved in developed countries, the out-of-pocket cost for advanced implants and post-operative care still presents a barrier for many patients, especially in underinsured populations

- Moreover, concerns regarding implant longevity, loosening, and the potential need for revision surgeries add to the hesitation among both patients and clinicians. Complications such as infection, nerve damage, and implant misalignment can impact the long-term success of the procedure

- To address these concerns, companies such as Zimmer Biomet and DJO Global are investing in research to develop more durable implants and improve surgical planning tools. Nevertheless, the Total Ankle Replacement market must continue to focus on reducing costs, improving clinical training, and enhancing outcomes to foster broader acceptance

- Overcoming these challenges through innovative implant technology, better post-operative management, and favorable reimbursement reforms will be essential to ensure sustained growth in the total ankle replacement market

Total Ankle Replacement Market Scope

The market is segmented on the basis of product, fixation type, end-use, and procedure.

- By Product

On the basis of product, the total ankle replacement market is segmented into knees, hips, and extremities. The Knees segment held the largest market revenue share in 2024 at 47.3%, supported by the high volume of knee replacement surgeries performed globally and the presence of robust clinical outcomes and established reimbursement models

The Extremities segment which includes ankle replacements—accounted for the fastest-growing sub-segment, projected to register a CAGR of 8.9% from 2025 to 2032, driven by rising incidences of osteoarthritis and trauma affecting the ankle joint, especially in the aging and physically active population.

- By Fixation Type

On the basis of fixation type, the total ankle replacement market is segmented into cemented, cementless, hybrid, and reverse hybrid. The Cementless segment dominated the market with a revenue share of 41.2% in 2024, driven by its biological fixation advantages and the increasing preference among surgeons for press-fit components that allow natural bone growth.

The Hybrid segment is anticipated to grow at the fastest CAGR of 9.5% during the forecast period, owing to its balanced approach of combining cemented and uncemented fixation, especially effective in younger patients with good bone quality.

- By End-use

On the basis of end-use, the total ankle replacement market is segmented into hospitals, orthopedic clinics, and others. Hospitals held the largest market revenue share of 54.7% in 2024, attributed to the high patient volume, availability of advanced surgical infrastructure, and multidisciplinary post-operative care.

Orthopedic Clinics are projected to experience the fastest CAGR of 10.1% from 2025 to 2032, due to the growing trend of outpatient joint replacement surgeries, increasing specialization, and faster recovery models.

- By Procedure

On the basis of procedure, the total ankle replacement market is segmented into total replacement, partial replacement, and others. Total replacement dominated the market with a revenue share of 68.4% in 2024, due to its effectiveness in managing end-stage ankle arthritis and the introduction of new-generation implants offering greater durability and range of motion.

Partial Replacement is anticipated to grow at the fastest CAGR of 8.6% during the forecast period, particularly in younger patients and those with localized damage.

Total Ankle Replacement Market Regional Analysis

- North America dominated the total ankle replacement market with the largest revenue share of 42.6% in 2024, driven by rising prevalence of osteoarthritis and favorable reimbursement policies that encourage surgical interventions

- Patients and healthcare providers in the region are increasingly opting for advanced ankle implants due to their long-term durability, improved mobility outcomes, and reduced revision rates

- This widespread adoption is further supported by a well-established healthcare infrastructure, high awareness among orthopedic surgeons, and the availability of technologically advanced solutions from key market players

U.S. Total Ankle Replacement Market Insight

The U.S. total ankle replacement market captured the largest revenue share of 77% in 2024 within North America, fueled by the increasing demand for joint preservation procedures and a growing elderly population seeking motion-preserving alternatives to ankle fusion. Patients are showing higher acceptance of Total Ankle Arthroplasty (TAA) due to faster recovery times and long-term pain relief. In addition, the expansion of outpatient orthopedic centers and integration of robotics and 3D-printed implants are significantly enhancing surgical precision and boosting the Total Ankle Replacement market.

Europe Total Ankle Replacement Market Insight

The Europe total ankle replacement market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of post-traumatic arthritis and government-supported healthcare systems that cover advanced orthopedic procedures. Increasing adoption of patient-specific implants and innovations in surgical techniques are enhancing functional outcomes, while orthopedic surgeons across the region continue to emphasize joint-preserving surgeries for long-term mobility. The demand is particularly growing across Germany, the U.K., France, and Italy.

U.K. Total Ankle Replacement Market Insight

The U.K. total ankle replacement market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by early adoption of minimally invasive surgical techniques and NHS-supported access to ankle arthroplasty procedures. The country is witnessing growing clinical interest in newer prosthetic designs with enhanced longevity and performance. In addition, a shift in surgeon and patient preference toward total replacement over fusion procedures is fueling market demand.

Germany Total Ankle Replacement Market Insight

The Germany total ankle replacement market is expected to expand at a considerable CAGR during the forecast period, supported by a strong medical device manufacturing ecosystem and rising healthcare expenditures. Germany’s orthopedic sector is increasingly adopting personalized implants and robotic-assisted surgical technologies. With aging demographics and a preference for motion-preserving interventions, the German market is experiencing steady demand for high-quality ankle implants in both public and private healthcare institutions.

Asia-Pacific Total Ankle Replacement Market Insight

The Asia-Pacific total ankle replacement market is poised to grow at the fastest CAGR of 9.7% during 2025 to 2032, driven by growing healthcare investments, improving access to orthopedic care, and a rising elderly population in countries such as China, Japan, and India. The increasing prevalence of osteoarthritis and diabetes-related foot deformities are further contributing to rising procedure volumes. Local manufacturing, expanding medical tourism, and wider availability of affordable implants are enhancing the accessibility of Total Ankle Replacement across the region.

Japan Total Ankle Replacement Market Insight

The Japan total ankle replacement market is gaining momentum due to the country's advanced healthcare infrastructure, rapid technological adoption, and the need for surgical treatments for aging-related joint degeneration. Japanese surgeons are increasingly embracing newer implants and surgical navigation tools, especially in university hospitals and orthopedic centers. In addition, public insurance support for advanced orthopedic procedures is driving higher adoption of Total Ankle Replacement.

China Total Ankle Replacement Market Insight

The China total ankle replacement market accounted for the largest market revenue share in Asia-Pacific in 2024, owing to increasing urbanization, rising incidence of sports injuries and arthritis, and growing investments in orthopedic infrastructure. China is witnessing increased surgeon training programs, government-backed modernization of hospitals, and strong local production of cost-effective implants. These factors, combined with a large patient pool, are accelerating market expansion and procedure adoption.

Total Ankle Replacement Market Share

The total ankle replacement industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Enovis Corporation (U.S.)

- Exactech, Inc. (U.S.)

- MicroPort Orthopedics (U.S.)

- Corin Group (U.K.)

- Integra LifeSciences Corporation

- Arthrex, Inc.

- Implants International (U.K.)

- MatOrtho Limited (U.K.)

- Biotechni (France)

Latest Developments in Global Total Ankle Replacement Market

- In June 2025, Stryker received FDA clearance for its Incompass Total Ankle System, a next-generation implant designed using insights from over 85,000 CT scans and 100,000 clinical cases. The system features innovative porous surfaces and bone-ingrowth technologies for improved implant fixation and stability—marking a major advancement in TAR outcomes and positioning personalized surgical planning at the forefront of ankle arthroplasty

- In May 2025, restor3d, Inc. announced the successful limited market release of its new Aeros Modular Stem Total Ankle System, part of the Kinos Total Ankle family. The dorsal-inserted modular tibial implant debuted in five cases at OrthoCarolina Foot & Ankle Institute. The system leverages proprietary TIDAL technology for enhanced osseointegration and demonstrates significantly reduced operative trays and preparation time, improving procedure efficiency. Commercial launch is scheduled for 2026

- In late 2024 and 2025, orthopedic AI and digital planning tools have seen broad adoption. Platforms such as Materialise’s 3D preoperative modeling and Stryker's mobius‑based AI navigation are being increasingly used to plan TAR surgeries with sub-millimeter precision. These tools support improved alignment, reduced intraoperative variability, and better anatomical matching of implants

- In 2025, Smith+Nephew, in collaboration with 3D Systems, received FDA approval for new patient-specific guide systems tailored for TAR procedures. These guides use additive manufacturing to create custom-fit cutting templates, enhancing accuracy and reducing surgical time

- In January 2021, DJO, LLC acquired Trilliant Surgical, bolstering its orthopedic implant offerings for the foot and ankle. This strategic move aligns with DJO's expansion into the USD 1 billion US foot and ankle market, enhancing product diversity and clinical efficacy

- In November 2021, Stryker launched the Prophecy Infinity Resect-Through Guides for total ankle replacement surgeries, streamlining procedures by eliminating intraoperative complexities. This advancement represents a significant leap in Stryker's surgical techniques, promising surgeons a more efficient operative experience

- In August 2021, Smith+Nephew launched additions to its Extremities portfolio at the American Academy of Orthopaedic Surgeons 2021 Annual Meeting in San Diego. The launch included the CADENCE Total Ankle Flat Cut Talar Dome System and ATLASplan Shoulder 3D Planning and patient-specific instrument (PSI) System, catering to the total ankle and total shoulder replacement segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.