Global Tow Tractor Market

Market Size in USD Billion

CAGR :

%

USD

2.41 Billion

USD

3.53 Billion

2025

2033

USD

2.41 Billion

USD

3.53 Billion

2025

2033

| 2026 –2033 | |

| USD 2.41 Billion | |

| USD 3.53 Billion | |

|

|

|

|

Tow Tractor Market Size

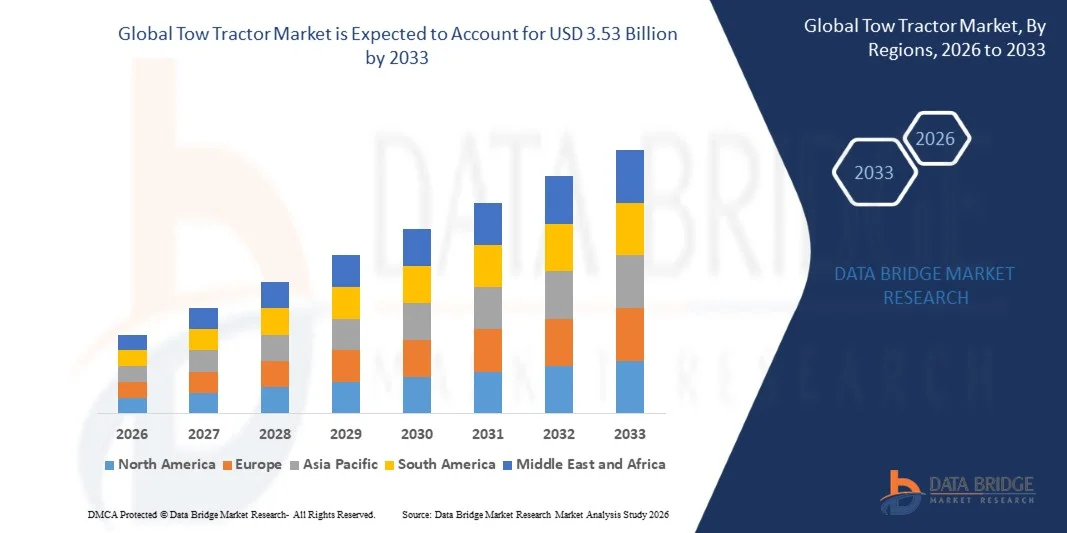

- The global tow tractor market size was valued at USD 2.41 billion in 2025 and is expected to reach USD 3.53 billion by 2033, at a CAGR of 4.88% during the forecast period

- The market growth is largely fueled by rising demand for efficient internal transportation and material handling solutions across airports, manufacturing plants, and logistics facilities, supported by increasing automation and operational optimization initiatives

- Furthermore, growing emphasis on workplace safety, productivity enhancement, and the transition toward electric and low-emission industrial vehicles is positioning tow tractors as essential equipment in modern industrial and logistics environments, thereby accelerating overall market growth

Tow Tractor Market Analysis

- Tow tractors, designed for towing heavy loads over short and long distances, play a critical role in streamlining material flow across aviation, industrial manufacturing, warehousing, and distribution operations due to their reliability, load-handling capability, and operational efficiency

- The increasing adoption of tow tractors is primarily driven by expanding airport infrastructure, rapid growth of warehousing and distribution centers, and rising investments in electric and automated material handling equipment aimed at reducing operational costs and improving sustainability

- North America dominated the tow tractor market with a share of 33% in 2025, due to strong demand from airports, large-scale manufacturing facilities, and advanced warehousing infrastructure

- Asia-Pacific is expected to be the fastest growing region in the tow tractor market during the forecast period due to rapid industrialization, expanding airport infrastructure, and growth in warehousing and distribution centers

- Rider-seated tow tractors segment dominated the market with a market share of 48.1% in 2025, due to their high towing capacity, operator comfort, and suitability for long-distance material movement in airports, ports, and large industrial facilities. These tractors are widely preferred for heavy-duty applications where continuous operation and reduced operator fatigue are critical. Their advanced safety features, higher speed capability, and compatibility with automated fleet management systems further support strong adoption. Industries with large operational footprints favor rider-seated models for productivity optimization. In addition, increasing investments in airport expansion and industrial logistics continue to reinforce demand for this segment

Report Scope and Tow Tractor Market Segmentation

|

Attributes |

Tow Tractor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Tow Tractor Market Trends

“Increasing Adoption of Electric and Autonomous Tow Tractors”

- A key trend in the tow tractor market is the rising adoption of electric and autonomous models as airports, manufacturing plants, and logistics hubs focus on reducing emissions and improving operational efficiency. This shift is strengthening the role of tow tractors as intelligent and sustainable material handling solutions across high-traffic industrial environments

- For instance, TLD Group and JBT AeroTech have expanded their portfolios of electric and semi-autonomous tow tractors that are widely deployed at major international airports for aircraft ground handling operations. These solutions support lower fuel consumption, reduced noise levels, and improved maneuverability in constrained operational spaces

- The demand for autonomous tow tractors is increasing as advanced navigation, sensor integration, and fleet management software improve operational accuracy. This trend is supporting safer material movement and minimizing human intervention in repetitive towing tasks

- Industrial facilities are adopting electric tow tractors to meet internal sustainability targets and regulatory requirements related to carbon emissions. This transition is accelerating the replacement of internal combustion engine models with battery-powered alternatives

- Warehousing and manufacturing sectors are focusing on automated material flow systems where tow tractors integrate seamlessly with smart factory layouts. This is enhancing throughput and ensuring consistent handling performance across production lines

- The growing emphasis on energy efficiency and automation is reinforcing the long-term adoption of electric and autonomous tow tractors. This trend is positioning the market for sustained growth driven by cleaner technology and intelligent operational control

Tow Tractor Market Dynamics

Driver

“Growing Demand for Efficient Material Handling Operations”

- The increasing need to optimize internal logistics and reduce handling time is driving demand for tow tractors that enable efficient movement of heavy loads across industrial facilities. Companies are prioritizing equipment that improves productivity while minimizing labor dependency

- For instance, Toyota Material Handling supplies tow tractors that are extensively used in automotive manufacturing plants to support just-in-time production and internal material transport. These solutions help streamline workflows and reduce bottlenecks in high-volume operations

- Manufacturing industries are expanding production capacities, which is increasing reliance on tow tractors to handle components and finished goods efficiently. This supports smoother material flow and reduces operational delays

- The rapid growth of e-commerce and distribution centers is increasing demand for towing equipment that can handle continuous load movement over long distances. Tow tractors play a critical role in maintaining speed and consistency in fulfillment operations

- The sustained emphasis on cost-effective and time-efficient material handling continues to reinforce this driver. The need for reliable towing solutions remains central to improving overall operational performance

Restraint/Challenge

“High Upfront and Maintenance Costs”

- The tow tractor market faces challenges due to the high initial investment required for advanced electric and autonomous models. These costs can limit adoption among small and mid-sized enterprises with constrained capital budgets

- For instance, advanced electric tow tractors offered by manufacturers such as KION Group require significant investment in battery systems, charging infrastructure, and onboard electronics. These requirements increase total ownership costs and slow purchasing decisions

- Maintenance of sophisticated drive systems, sensors, and control software adds to long-term operational expenses. Skilled technicians and specialized spare parts are often required to ensure consistent performance

- Battery replacement and charging downtime can further impact cost efficiency for electric tow tractor fleets. This creates additional planning and infrastructure challenges for operators

- The pressure to balance performance, durability, and affordability remains a key market constraint. These cost-related challenges continue to influence purchasing strategies and adoption rates across end-use industries

Tow Tractor Market Scope

The market is segmented on the basis of type, load capacity, power source, and application.

• By Type

On the basis of type, the tow tractor market is segmented into rider-seated tow tractors, stand-in tow tractors, and pedestrian tow tractors. The rider-seated tow tractors segment dominated the market with the largest revenue share of 48.1% in 2025, driven by their high towing capacity, operator comfort, and suitability for long-distance material movement in airports, ports, and large industrial facilities. These tractors are widely preferred for heavy-duty applications where continuous operation and reduced operator fatigue are critical. Their advanced safety features, higher speed capability, and compatibility with automated fleet management systems further support strong adoption. Industries with large operational footprints favor rider-seated models for productivity optimization. In addition, increasing investments in airport expansion and industrial logistics continue to reinforce demand for this segment.

The pedestrian tow tractors segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for compact, cost-effective, and easy-to-operate equipment in warehouses and retail back-end operations. These tractors are gaining traction due to their maneuverability in confined spaces and lower maintenance requirements. Small and mid-sized facilities increasingly adopt pedestrian models to improve material flow without significant infrastructure changes. Their suitability for short-distance towing and growing emphasis on workplace safety further contribute to accelerated growth.

• By Load Capacity

On the basis of load capacity, the tow tractor market is categorized into below 5 tons, 5–10 tons, 11–25 tons, and above 25 tons. The 11–25 tons segment accounted for the largest market revenue share in 2025, owing to its versatility across a wide range of industrial, aviation, and logistics applications. This capacity range effectively balances towing power and operational efficiency, making it suitable for handling heavy carts, baggage trolleys, and industrial loads. Manufacturing plants and large distribution centers widely deploy these tractors to streamline internal transportation. Their adaptability to both indoor and outdoor operations further strengthens market dominance. Continuous upgrades in powertrain efficiency and ergonomics also enhance their appeal.

The below 5 tons segment is projected to register the fastest CAGR from 2026 to 2033, driven by rapid growth in e-commerce warehousing and retail logistics. Lightweight tow tractors are increasingly adopted for last-mile material handling and short-haul movements. Their lower acquisition cost, reduced energy consumption, and ease of training make them attractive for smaller facilities. Rising automation in warehouses further accelerates demand for compact towing solutions in this capacity range.

• By Power Source

On the basis of power source, the market is segmented into electric, diesel, LPG, and hybrid tow tractors. The electric segment dominated the market in 2025, driven by growing emphasis on zero-emission operations and compliance with stringent environmental regulations. Electric tow tractors are widely adopted in indoor environments such as airports, warehouses, and manufacturing plants due to their low noise levels and absence of exhaust emissions. Advancements in battery technology have significantly improved operating hours and charging efficiency. Lower operating and maintenance costs compared to internal combustion models further support strong demand. Many organizations also align electric fleets with sustainability and carbon reduction targets.

The hybrid segment is anticipated to grow at the fastest rate during the forecast period, supported by the need for operational flexibility across indoor and outdoor environments. Hybrid tow tractors offer extended operating range and reduced fuel consumption compared to conventional diesel models. Industries with continuous operations benefit from minimized downtime and improved fuel efficiency. Increasing focus on transitional energy solutions further accelerates adoption of hybrid systems.

• By Application

On the basis of application, the tow tractor market is segmented into airports & aviation, ground support & transportation hubs, retail & supermarkets, industrial manufacturing plants, and warehousing & distribution centers. The airports & aviation segment held the largest revenue share in 2025, driven by the critical role of tow tractors in baggage handling, aircraft ground support, and cargo movement. High passenger traffic and expanding airport infrastructure significantly increase demand for reliable towing equipment. Airlines and airport operators prioritize efficiency, safety, and turnaround time, favoring advanced tow tractor solutions. Continuous modernization of ground support equipment further strengthens market leadership.

The warehousing & distribution centers segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rapid expansion of e-commerce and third-party logistics operations. Increasing order volumes and the need for efficient internal material flow drive adoption of tow tractors. Automation trends and rising investment in large-scale fulfillment centers further support strong growth. Enhanced focus on operational efficiency and labor optimization continues to accelerate demand in this application segment.

Tow Tractor Market Regional Analysis

- North America dominated the tow tractor market with the largest revenue share of 33% in 2025, driven by strong demand from airports, large-scale manufacturing facilities, and advanced warehousing infrastructure

- Consumers in the region prioritize high-performance, durable, and ergonomically designed tow tractors to support continuous material movement across aviation, logistics, and industrial operations

- This strong adoption is supported by high capital investment, early integration of electric and automated tow tractors, and a mature industrial ecosystem, positioning the region as a key revenue contributor

U.S. Tow Tractor Market Insight

The U.S. tow tractor market captured the largest revenue share within North America in 2025, supported by extensive airport networks, high cargo traffic, and advanced logistics operations. Airports and distribution hubs increasingly deploy electric and rider-seated tow tractors to improve efficiency and reduce emissions. The presence of major manufacturing facilities and large-scale warehouses further strengthens demand. Continuous investments in airport modernization and automated material handling systems continue to propel market growth.

Europe Tow Tractor Market Insight

The Europe tow tractor market is projected to grow at a steady CAGR during the forecast period, driven by stringent emission regulations and the increasing shift toward electric ground support equipment. The region’s strong focus on sustainability and workplace safety is accelerating adoption across airports and industrial facilities. Growing automation in warehouses and manufacturing plants further supports market expansion. Demand is rising across both Western and Eastern Europe due to modernization of logistics infrastructure.

U.K. Tow Tractor Market Insight

The U.K. tow tractor market is expected to grow at a notable CAGR, supported by expanding airport operations and rising investments in logistics and distribution centers. Increased focus on reducing carbon emissions is encouraging the adoption of electric tow tractors. The country’s well-developed retail and e-commerce sector is driving demand for efficient internal transportation solutions. Ongoing upgrades in airport ground support equipment further stimulate market growth.

Germany Tow Tractor Market Insight

The Germany tow tractor market is anticipated to expand at a considerable CAGR, driven by the country’s strong industrial base and advanced manufacturing sector. Germany’s emphasis on automation, precision engineering, and energy-efficient equipment supports adoption of technologically advanced tow tractors. High demand from automotive manufacturing plants and logistics hubs contributes significantly to market growth. The shift toward electric and hybrid models aligns with national sustainability objectives.

Asia-Pacific Tow Tractor Market Insight

The Asia-Pacific tow tractor market is poised to grow at the fastest CAGR during the forecast period, fueled by rapid industrialization, expanding airport infrastructure, and growth in warehousing and distribution centers. Rising manufacturing output and increasing air passenger traffic are boosting demand for tow tractors across the region. Governments are investing heavily in transportation hubs and logistics infrastructure, accelerating equipment adoption. The availability of cost-effective models further supports market penetration.

Japan Tow Tractor Market Insight

The Japan tow tractor market is gaining steady momentum due to advanced industrial automation and high efficiency standards in manufacturing and logistics. Airports and industrial facilities increasingly adopt compact and electric tow tractors to optimize space utilization and reduce emissions. The country’s focus on precision, safety, and reliability supports consistent demand. Aging workforce trends also encourage adoption of ergonomic and easy-to-operate towing solutions.

China Tow Tractor Market Insight

China accounted for the largest revenue share in the Asia-Pacific tow tractor market in 2025, driven by rapid industrial expansion, large-scale manufacturing, and extensive airport development. The country’s strong logistics and e-commerce growth is significantly increasing demand for tow tractors in warehouses and distribution centers. Government initiatives supporting electric industrial vehicles further accelerate market growth. The presence of domestic manufacturers offering cost-competitive solutions strengthens widespread adoption across multiple end-use sectors.

Tow Tractor Market Share

The tow tractor industry is primarily led by well-established companies, including:

- Jungheinrich AG (Germany)

- Bradshaw Electric Vehicles (U.K.)

- Polaris Industries, Inc. (U.S.)

- Simai SPA (Italy)

- The Raymond Corporation (U.S.)

- Alke (Italy)

- Hyster-Yale Group, Inc. (U.S.)

- Toyota Material Handling (Japan)

- Eagle Tugs (U.S.)

- Motrec International Inc. (Canada)

- Linde Material Handling (Germany)

- SPAN Trading LLC. (U.S.)

- JBT (U.S.)

Latest Developments in Global Tow Tractor Market

- In May 2025, TractEasy strengthened the tow tractor market’s shift toward autonomous industrial logistics by deploying its EZTow Level 4 autonomous tow tractor at Airbus’ Saint-Nazaire facility in France, enabling fully automated, standardized material movement between production units. This deployment reduces reliance on manual driving, improves operational consistency, and highlights the growing role of autonomous tow tractors in aerospace manufacturing environments. The initiative underscores how automation is becoming a key differentiator for productivity and cost efficiency in high-value industrial applications

- In May 2025, Oxa accelerated the adoption of autonomous towing solutions through its partnership with Bradshaw EV by integrating Oxa Driver software into the T800 8-tonne tow tractor for use in airports, factories, and distribution centres. This collaboration supports scalable deployment of autonomous tow tractors across light logistics operations, enhancing safety and reducing labor dependency. The development reflects increasing market demand for software-driven, autonomous material handling systems across diverse end-use sectors

- In March 2025, Toyota Material Handling expanded its electric tow tractor portfolio with the introduction of next-generation lithium-ion powered models designed for continuous industrial and airport operations. This launch reinforces the market’s transition toward low-emission, energy-efficient towing solutions while addressing customer demand for reduced downtime and lower operating costs. The development strengthens competition in the electric tow tractor segment and supports broader sustainability objectives across logistics and manufacturing facilities

- In August 2024, Goldhofer advanced the zero-emission aircraft ground support segment by securing a framework agreement with EFM GmbH to supply 14 Phoenix E battery-electric towbar-less aircraft tractors to Munich Airport by 2028. This agreement supports the handling of aircraft up to 352 tonnes while eliminating local emissions, reinforcing the role of electric tow tractors in modern airport operations. The deal highlights growing long-term investments by airports in sustainable and high-capacity towing solutions

- In June 2024, Konecranes enhanced its industrial towing solutions by upgrading its heavy-duty tow tractor range with improved operator ergonomics and digital fleet monitoring capabilities. These enhancements improve productivity, safety, and asset utilization in manufacturing plants and logistics hubs. The development reflects the market’s increasing focus on smart features and data-driven operations to optimize internal transportation efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.