Global Toys Packaging Market

Market Size in USD Billion

CAGR :

%

USD

2.45 Billion

USD

6.30 Billion

2025

2033

USD

2.45 Billion

USD

6.30 Billion

2025

2033

| 2026 –2033 | |

| USD 2.45 Billion | |

| USD 6.30 Billion | |

|

|

|

|

What is the Global Toys Packaging Market Size and Growth Rate?

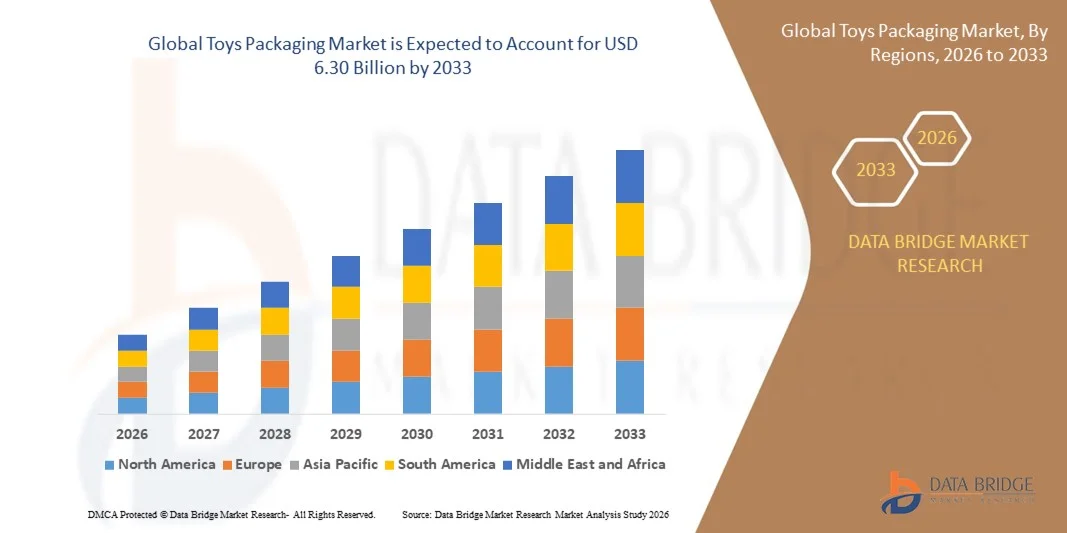

- The global toys packaging market size was valued at USD 2.45 billion in 2025 and is expected to reach USD 6.30 billion by 2033, at a CAGR of12.50% during the forecast period

- The increase in the sales of toys across the globe acts as one of the major factors driving the growth of toys packaging market. The use of interactive packaging in taking a product’s branding to the next level, and rise in the need for reducing the advertising and sales promotion cost accelerate the market growth

What are the Major Takeaways of Toys Packaging Market?

- The surge in demand for playful packaging of children’s toys to attract the consumers, and changing lifestyle of customers because of quick urbanization further influence the market. In addition, breakthrough in new technologies, increase in disposable income and developments in the printing processes positively affect the toys packaging market

- On the other hand, excessive cost of capital for installment and security issues are expected to obstruct the market growth. The concerns regarding use of non-recyclable materials and carbon footprint are projected to challenge the toys packaging market

- North America dominated the toys packaging market with a 40.6% revenue share in 2025, driven by strong toy consumption, established retail networks, and high demand for premium, licensed, and branded toys across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by rising disposable income, expanding middle-class population, and rapid growth of domestic toy manufacturing in China, India, Japan, South Korea, and Southeast Asia

- The Folding Boxes segment dominated the market with a 42.8% share in 2025, as they remain the most widely adopted packaging format across action figures, board games, dolls, and educational toys

Report Scope and Toys Packaging Market Segmentation

|

Attributes |

Toys Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Toys Packaging Market?

Rising Adoption of Sustainable, Interactive, and Visually Engaging Toys Packagings

- The toys packaging market is witnessing increasing demand for eco-friendly, recyclable, and biodegradable packaging solutions as brands focus on sustainability and reducing plastic waste

- Manufacturers are introducing lightweight paper-based cartons, molded pulp trays, and minimalistic packaging designs that reduce material usage while maintaining durability and visual appeal

- Growing emphasis on attractive graphics, character licensing, window displays, and augmented reality AR-enabled packaging is enhancing consumer engagement and shelf visibility

- For instance, leading companies such as Hasbro, Mattel, and LEGO have expanded the use of recyclable paper-based packaging and reduced single-use plastics across major toy product lines

- Rising consumer preference for sustainable and safe packaging materials, especially for children’s products, is accelerating innovation in non-toxic inks, soy-based coatings, and FSC-certified paper materials

- As environmental awareness and branding competition increase, sustainable and interactive toys packagings will remain central to product differentiation and retail success

What are the Key Drivers of Toys Packaging Market?

- Increasing demand for sustainable packaging solutions in response to global plastic reduction regulations and retailer sustainability mandates

- For instance, in 2024–2025, several global toy manufacturers announced commitments to transition toward fully recyclable or paper-based packaging formats

- Rapid expansion of e-commerce and online toy retailing is driving demand for durable corrugated boxes and protective paper-based cushioning solutions

- Growth in licensed toys, premium collectibles, and seasonal gifting products is boosting demand for high-quality, visually attractive packaging formats

- Rising parental awareness regarding child-safe, non-toxic, and environmentally responsible packaging materials is influencing purchasing decisions

- Supported by growth in global toy consumption, retail expansion, and sustainability commitments, the Toys Packaging market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Toys Packaging Market?

- Higher production costs associated with sustainable materials such as molded pulp, recycled paperboard, and biodegradable coatings compared to conventional plastic packaging

- For instance, during 2024–2025, fluctuations in raw material prices and supply chain disruptions increased paper pulp and recycled fiber costs for packaging manufacturers

- Maintaining product visibility, durability, and moisture resistance while reducing plastic content presents technical and design challenges

- Stringent safety regulations for children’s products require compliance with labeling, choking hazard warnings, and tamper-evident features, increasing packaging complexity

- Intense competition and pricing pressure in the toy industry limit manufacturers’ ability to fully pass sustainability-related cost increases to consumers

- To address these challenges, companies are investing in material innovation, lightweight design optimization, recycling infrastructure partnerships, and cost-efficient sustainable packaging technologies to enhance adoption of advanced Toys Packagings

How is the Toys Packaging Market Segmented?

The market is segmented on the basis of packages, type of interaction, and technology.

- By Packages

On the basis of packages, the toys packaging market is segmented into Folding Boxes, Labels, Cases, Posters & Brochures, POS Materials, Calendars, and Others. The Folding Boxes segment dominated the market with a 42.8% share in 2025, as they remain the most widely adopted packaging format across action figures, board games, dolls, and educational toys. Folding boxes provide strong structural integrity, high-quality printing surfaces, transparent display windows, and excellent branding opportunities. Their recyclability and cost-effectiveness further support widespread usage across retail shelves and e-commerce distribution.

The POS Materials segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing retail competition and demand for eye-catching in-store promotional displays. Brands are investing in creative point-of-sale packaging, seasonal promotional stands, and character-themed retail setups to enhance impulse purchases and brand visibility.

- By Type of Interaction

On the basis of type of interaction, the market is segmented into Sound, Smell, Visual, and Touch. The Visual segment dominated the market with a 49.5% share in 2025, supported by strong demand for vibrant graphics, licensed character artwork, holographic prints, embossed finishes, and transparent windows that allow product preview. Visual appeal significantly influences children’s buying behavior and parental purchasing decisions, making it a critical packaging element.

The Sound segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising integration of interactive sound modules that play music, character voices, or sound effects upon activation. Increasing focus on immersive unboxing experiences and experiential marketing strategies is accelerating demand for interactive packaging innovations in the toy industry.

- By Technology

On the basis of technology, the toys packaging market is segmented into Active Packaging and Intelligent Packaging. The Active Packaging segment dominated the market with a 58.4% share in 2025, as it includes moisture-resistant coatings, tamper-evident seals, shock-absorbing inserts, and protective materials that ensure product safety during transportation and storage. This is particularly important for electronic, battery-operated, and premium collectible toys.

The Intelligent Packaging segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the integration of QR codes, NFC tags, augmented reality features, and digital authentication tools. Brands are leveraging smart packaging technologies to enhance consumer engagement, enable product verification, and create connected digital experiences, supporting long-term innovation in the Toys Packaging market.

Which Region Holds the Largest Share of the Toys Packaging Market?

- North America dominated the toys packaging market with a 40.6% revenue share in 2025, driven by strong toy consumption, established retail networks, and high demand for premium, licensed, and branded toys across the U.S. and Canada. The region benefits from the presence of leading toy manufacturers, advanced printing technologies, and early adoption of sustainable packaging solutions. Growing emphasis on recyclable materials, plastic reduction commitments, and child-safe packaging standards further supports regional market leadership

- Leading companies in North America are introducing innovative folding cartons, interactive packaging formats, and eco-friendly molded pulp solutions to enhance shelf appeal and sustainability performance. Increasing investment in digital printing, customized packaging, and e-commerce-ready corrugated formats strengthens competitive positioning

- Strong consumer spending power, developed distribution infrastructure, and continuous product innovation further reinforce North America’s dominance in the global Toys Packaging market

U.S. Toys Packaging Market Insight

The U.S. is the largest contributor within North America, supported by high toy sales volumes, rapid expansion of online retail platforms, and strong demand for licensed character-based packaging. Major retailers and brands are shifting toward recyclable, paper-based, and minimal-plastic packaging formats to align with sustainability goals. Seasonal demand peaks during holidays and promotional campaigns further drive packaging innovation and volume growth. The presence of global toy brands and advanced packaging manufacturers accelerates technological adoption and market expansion.

Canada Toys Packaging Market Insight

Canada contributes significantly to regional growth, driven by increasing adoption of sustainable packaging solutions and expanding retail distribution networks. Rising environmental awareness among consumers and government regulations targeting plastic reduction support demand for recyclable cartons and molded fiber packaging. Growth in educational toys and board games further strengthens packaging demand across retail and e-commerce channels.

Asia-Pacific Toys Packaging Market

Asia-Pacific is projected to register the fastest CAGR of 11.02% from 2026 to 2033, driven by rising disposable income, expanding middle-class population, and rapid growth of domestic toy manufacturing in China, India, Japan, South Korea, and Southeast Asia. Increasing urbanization and expansion of organized retail and online marketplaces accelerate demand for cost-effective and visually appealing packaging solutions. Growth in exports of toys from Asian countries further fuels corrugated and folding carton demand across global supply chains.

China Toys Packaging Market Insight

China is the largest contributor in Asia-Pacific due to its strong position as a global toy manufacturing hub. Large-scale production capacity, competitive pricing, and expanding domestic consumption drive high demand for folding boxes, labels, and protective packaging materials. Government initiatives promoting sustainable manufacturing practices further boost eco-friendly packaging adoption.

Japan Toys Packaging Market Insight

Japan demonstrates steady growth supported by demand for high-quality, visually refined packaging designs and premium toy products. Strong retail presentation standards and consumer preference for compact, aesthetically appealing packaging formats drive innovation. Technological advancement in printing and finishing techniques further supports market growth.

India Toys Packaging Market Insight

India is emerging as a high-growth market driven by expanding domestic toy production, rising e-commerce penetration, and government support for local manufacturing initiatives. Increasing demand for affordable and sustainable packaging formats accelerates adoption across organized retail and export channels.

South Korea Toys Packaging Market Insight

South Korea contributes significantly due to strong demand for character-based toys, premium collectibles, and technologically advanced products. Growing focus on sustainable materials and attractive retail packaging enhances market expansion. Rising exports and digital retail growth continue to support long-term Toys Packaging market development.

Which are the Top Companies in Toys Packaging Market?

The toys packaging industry is primarily led by well-established companies, including:

- 3M (U.S.)

- American Thermal Instruments (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- BASF SE (Germany)

- International Paper (U.S.)

- R.R. Donnelley & Sons Company (U.S.)

- Stora Enso (Finland)

- Thin Film Electronics ASA (Norway)

- Huhtamaki (Finland)

- Temptime Corporation (U.S.)

- Emerson Electric Co (U.S.)

What are the Recent Developments in Global Toys Packaging Market?

- In May 2023, VTech introduced a new range of educational toys designed to teach children coding, robotics, and basic STEM concepts through interactive and engaging play formats. The product line focuses on early skill development, logical thinking, and hands-on learning experiences aligned with modern digital education trends, thereby strengthening the company’s position in the smart learning toys segment

- In April 2023, Spin Master launched a new collection of toys inspired by the popular children’s television series Paw Patrol, expanding its licensed merchandise portfolio. The new range includes character-based action figures, playsets, and themed accessories aimed at enhancing brand engagement among young audiences, thereby reinforcing its presence in the character-driven toy category

- In March 2023, Hasbro announced plans to introduce a new edition of its traditional board game Monopoly featuring a female mascot, Ms. Monopoly, reflecting greater inclusivity and brand modernization. This initiative highlights the company’s effort to align classic games with evolving social narratives, thereby supporting broader consumer appeal and market relevance

- In February 2023, Mattel unveiled a new line of Barbie dolls designed to reflect greater inclusivity and real-world diversity in body types, ethnicities, and abilities. The launch supports the brand’s commitment to representation and social awareness, thereby strengthening customer engagement and global brand loyalty

- In January 2023, LEGO Group announced a partnership with Epic Games to develop a new line of LEGO sets inspired by the globally popular video game Fortnite. This collaboration aims to merge digital gaming culture with physical play experiences, thereby expanding LEGO’s footprint in cross-platform entertainment and licensed product innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Toys Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Toys Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Toys Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.