Global Tpu Films For Ev Battery Protection Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

13.75 Billion

2024

2032

USD

8.50 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 13.75 Billion | |

|

|

|

|

TPU Films for EV Battery Protection Market Size

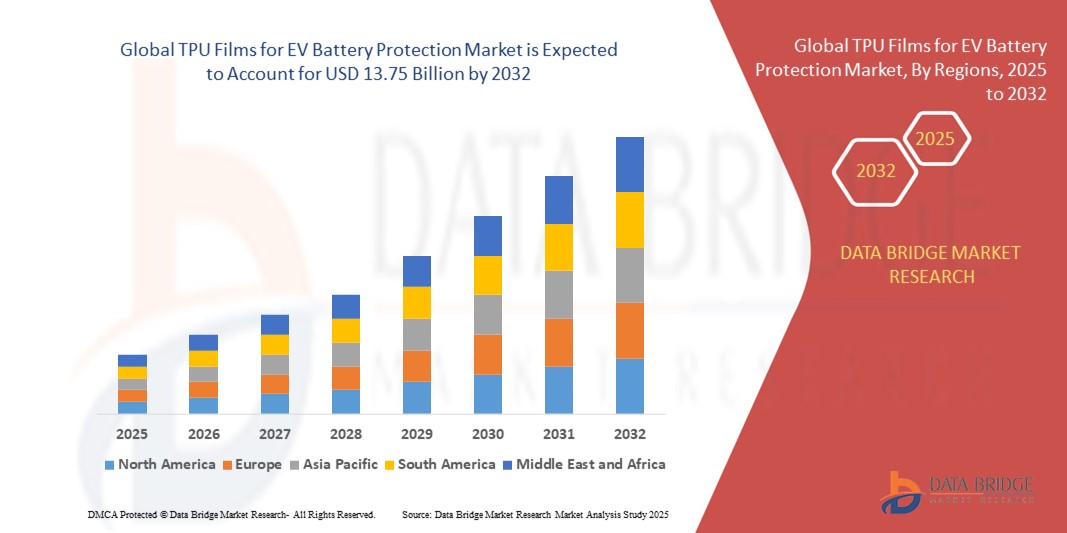

- The global TPU films for EV battery protection market size was valued at USD 8.5 billion in 2024 and is expected to reach USD 13.75 billion by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electric vehicles (EVs) worldwide, the rising need for enhanced battery safety and longevity, and the growing preference for lightweight, durable, and heat-resistant protective materials in battery packs

- The demand for TPU films is further supported by technological advancements in polymer materials, higher regulatory standards for battery safety, and the expansion of EV manufacturing across North America, Europe, and Asia-Pacific

TPU Films for EV Battery Protection Market Analysis

- The market is witnessing strong growth due to the increasing penetration of EVs, which drives the need for reliable insulation, thermal management, and protective layers for lithium-ion battery cells

- Rising investments by automotive OEMs and battery manufacturers in research and development of advanced TPU films are further accelerating adoption

- Asia-Pacific dominated the TPU films for EV battery protection market with the largest revenue share of 38.5% in 2024, driven by rapid adoption of electric vehicles, government incentives, and the presence of major battery manufacturers in the region

- U.S. is expected to witness the highest compound annual growth rate (CAGR) in the TPU films for EV battery protection market due to the accelerating shift toward electric mobility, investments in next-generation battery technologies, and increasing demand for high-performance protective materials

- The Polyester TPU Films segment held the largest market revenue share in 2024, driven by its superior dimensional stability, chemical resistance, and mechanical strength, making it highly suitable for high-voltage EV battery packs. These films are widely adopted by battery manufacturers for enhanced durability and long-term performance under extreme operating conditions

Report Scope and TPU Films for EV Battery Protection Market Segmentation

|

Attributes |

TPU Films for EV Battery Protection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Covestro AG (Germany) |

|

Market Opportunities |

• Growing Adoption Of Electric Vehicles Globally |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

TPU Films for EV Battery Protection Market Trends

Increasing Adoption of TPU Films for Enhanced Battery Safety

- The growing adoption of TPU films is transforming the EV battery protection landscape by providing superior insulation, chemical resistance, and mechanical durability. The material’s flexibility and heat resistance allow for safer battery operation, particularly in high-capacity and fast-charging applications, reducing risks of thermal runaway or short circuits

- Rising demand for lightweight and high-performance battery components is accelerating the integration of TPU films into next-generation EV battery packs. Manufacturers are increasingly leveraging advanced coating and lamination technologies to improve film efficiency and battery lifecycle

- The cost-effectiveness and scalability of TPU films are making them attractive for large-scale EV production, supporting widespread adoption in passenger vehicles, commercial EVs, and energy storage systems. Improved manufacturing methods are helping reduce material waste and production costs

- For instance, in 2023, several EV manufacturers in Germany and China implemented TPU film-based battery packs, reporting enhanced thermal stability and extended battery lifespan. These implementations have strengthened confidence in TPU films as a reliable protective material

- While TPU films are gaining traction, market growth depends on continued R&D for next-generation formulations, compatibility with diverse battery chemistries, and cost optimization for mass adoption

TPU Films for EV Battery Protection Market Dynamics

Driver

Rising Demand for Electric Vehicles and Enhanced Battery Safety

• The increasing production and adoption of electric vehicles worldwide are driving demand for TPU films as a protective layer for lithium-ion and next-generation batteries. Safety, durability, and thermal management are critical factors influencing material selection. The push toward longer driving ranges and faster charging cycles further amplifies the need for advanced TPU films

• Battery manufacturers and OEMs are focusing on lightweight, efficient, and reliable protection solutions to enhance vehicle performance and reduce risks of fire or short circuits. This is fueling consistent demand for TPU films in EV battery assemblies. In addition, integration with battery management systems and modular battery designs is supporting broader adoption

• Government regulations and safety standards for EV batteries are encouraging manufacturers to adopt high-quality insulation and protective films. Compliance with international standards is accelerating TPU film usage across regions. Incentives for sustainable and safe EV technologies are also encouraging investment in premium TPU materials

• For instance, in 2022, European battery producers adopted TPU films for high-voltage EV packs to meet stringent safety standards, driving significant market uptake. The adoption also reduced warranty claims and improved consumer confidence in EV safety

• While EV adoption and regulatory support are key drivers, ongoing innovation in material properties, flame retardancy, and chemical resistance will determine the sustained growth of TPU films. Collaborative R&D between chemical suppliers and automakers is expected to bring next-generation TPU formulations to market

Restraint/Challenge

High Cost of Advanced TPU Films and Production Limitations

• The high manufacturing cost of specialized TPU films, particularly those with enhanced thermal and chemical resistance, limits adoption in cost-sensitive EV models. Premium formulations are often reserved for high-end or performance vehicles. Small and mid-tier EV manufacturers may face higher production costs, slowing widespread adoption

• Limited availability of advanced production facilities and skilled workforce in certain regions can slow the supply of high-quality TPU films, affecting timely deployment in battery packs. This may result in project delays or reliance on imports, increasing lead times and operational costs. Manufacturers are seeking partnerships to expand local production capacity

• Supply chain constraints for raw materials, such as specialty polyols and isocyanates, can further restrict production capacity and raise costs. Price volatility in global chemical markets and dependency on a few suppliers can impact consistent availability and profit margins

• For instance, in 2023, several small-scale EV battery suppliers in Asia reported delays in TPU film procurement due to limited local manufacturing, affecting production schedules. These delays occasionally led to postponed vehicle deliveries and strained relationships with OEMs

• While technological advancements continue to improve performance, addressing cost, scalability, and raw material availability remains essential for widespread market penetration. Industry collaboration, investment in automated production lines, and alternative material research are critical for overcoming these challenges

TPU Films for EV Battery Protection Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the global TPU films for EV battery protection market is segmented into Polyester TPU Films, Polyether TPU Films, and Polycaprolactone TPU Films. The Polyester TPU Films segment held the largest market revenue share in 2024, driven by its superior dimensional stability, chemical resistance, and mechanical strength, making it highly suitable for high-voltage EV battery packs. These films are widely adopted by battery manufacturers for enhanced durability and long-term performance under extreme operating conditions.

The Polyether TPU Films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent flexibility, low-temperature resistance, and hydrolytic stability. Polyether-based films are particularly preferred for applications requiring vibration damping, thermal cycling endurance, and lightweight protective layers in compact EV battery modules.

- By Application

On the basis of application, the market is segmented into Battery Insulation, Thermal Management, Vibration Damping, Protective Coatings, and Others. The Battery Insulation segment held the largest market revenue share in 2024, fueled by the increasing demand for electrically safe and thermally stable batteries in electric vehicles. Insulation films help prevent short circuits, enhance battery lifespan, and ensure compliance with global safety standards.

The Thermal Management segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing need for efficient heat dissipation in high-capacity EV batteries. TPU films used for thermal management offer excellent heat transfer, flame retardancy, and chemical stability, supporting the performance and safety of next-generation EV battery systems.

TPU Films for EV Battery Protection Market Regional Analysis

• Asia-Pacific dominated the TPU films for EV battery protection market with the largest revenue share of 38.5% in 2024, driven by rapid adoption of electric vehicles, government incentives, and the presence of major battery manufacturers in the region.

• Manufacturers and EV OEMs in the region are increasingly focusing on using high-performance TPU films to enhance battery safety, thermal management, and durability.

• This widespread adoption is further supported by growing urbanization, rising disposable incomes, and technological advancements, establishing TPU films as a preferred solution for next-generation EV batteries.

China TPU Films for EV Battery Protection Market Insight

The China TPU films for EV battery protection films market captured the largest revenue share in 2024 within Asia-Pacific, fueled by the country’s massive EV production, expanding middle class, and strong adoption of lithium-ion and next-generation battery technologies. Battery manufacturers are increasingly integrating TPU films for insulation, protective coatings, and vibration damping to meet safety and performance standards. Furthermore, domestic production of TPU films ensures affordability and availability, driving rapid market expansion.

Japan TPU Films for EV Battery Protection Market Insight

The Japan TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s high technological adoption, focus on EV innovation, and stringent battery safety regulations. Japanese manufacturers are leveraging advanced TPU film formulations to improve battery thermal stability and electrical insulation. In addition, the growing demand for lightweight, efficient, and durable EV battery components is expected to continue fueling market growth.

Europe TPU Films for EV Battery Protection Market Insight

The Europe TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict safety regulations, increasing EV production, and government incentives for clean mobility. Battery manufacturers are adopting high-quality TPU films to comply with EU safety standards and enhance battery performance. Countries such as Germany, France, and the U.K. are witnessing strong demand from both passenger EVs and commercial electric mobility solutions.

Germany TPU Films for EV Battery Protection Market Insight

The Germany TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s leading automotive industry, emphasis on advanced EV technologies, and robust R&D infrastructure. German EV battery manufacturers are increasingly deploying TPU films for thermal management, vibration damping, and protective coatings to meet high safety and performance requirements. Integration with battery assembly lines and compliance with international safety standards further accelerates adoption.

U.K. TPU Films for EV Battery Protection Market Insight

The U.K. TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising EV adoption, investment in electric mobility infrastructure, and government incentives. Battery manufacturers are adopting TPU films to enhance safety, prolong battery life, and ensure compliance with evolving regulations. The increasing shift toward electric fleet vehicles and renewable energy storage solutions is expected to drive significant market growth.

North America TPU Films for EV Battery Protection Market Insight

The North America TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing EV production in the U.S. and Canada, growing demand for battery safety, and rising investments in advanced battery technologies. Manufacturers are integrating TPU films for insulation, thermal management, and protective applications in lithium-ion and next-generation batteries. The presence of leading battery and EV manufacturers, combined with supportive government policies, is fueling market adoption.

U.S. TPU Films for EV Battery Protection Market Insight

The U.S. TPU films for EV battery protection market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid EV adoption, stringent battery safety standards, and technological advancements in battery assembly. OEMs and battery manufacturers are increasingly deploying TPU films for protective coatings, insulation, and vibration damping to improve battery safety and efficiency. Furthermore, ongoing R&D and material innovations are expected to sustain market growth.

TPU Films for EV Battery Protection Market Share

The TPU Films FOR EV Battery Protection industry is primarily led by well-established companies, including:

• Covestro AG (Germany)

• DUNMORE (U.S.)

• AMERICAN POLYFILM, INC. (U.S.)

• Plastic Film Corporation of America (U.S.)

• Wiman Corporation (U.S.)

• RTP Company (U.S.)

• San Fang Chemical Industry Co., Ltd. (China)

• Shanghai Metal Corporation (China)

• Adhtapes (U.K.)

• Singhal Industries (India)

Latest Developments in Global TPU Films For EV Battery Protection Market

- In April 2024, Huntsman introduced its new SHOKLESS polyurethane systems, a range of lightweight and durable foam technologies. The development is designed for the potting and fixation of EV battery cells, serving as moldable encapsulants for battery modules and packs. These systems provide enhanced structural and thermal protection during impacts or thermal incidents. The innovation improves overall battery safety, reduces potential damage, and supports the growing adoption of electric vehicles. This launch is expected to strengthen Huntsman’s position in the EV battery protection market and drive demand for advanced protective materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Tpu Films For Ev Battery Protection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Tpu Films For Ev Battery Protection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Tpu Films For Ev Battery Protection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.