Global Trace Minerals In Poultry Feed Market

Market Size in USD Million

CAGR :

%

USD

470.36 Million

USD

727.34 Million

2025

2033

USD

470.36 Million

USD

727.34 Million

2025

2033

| 2026 –2033 | |

| USD 470.36 Million | |

| USD 727.34 Million | |

|

|

|

|

Trace Minerals in Poultry Feed Market Size

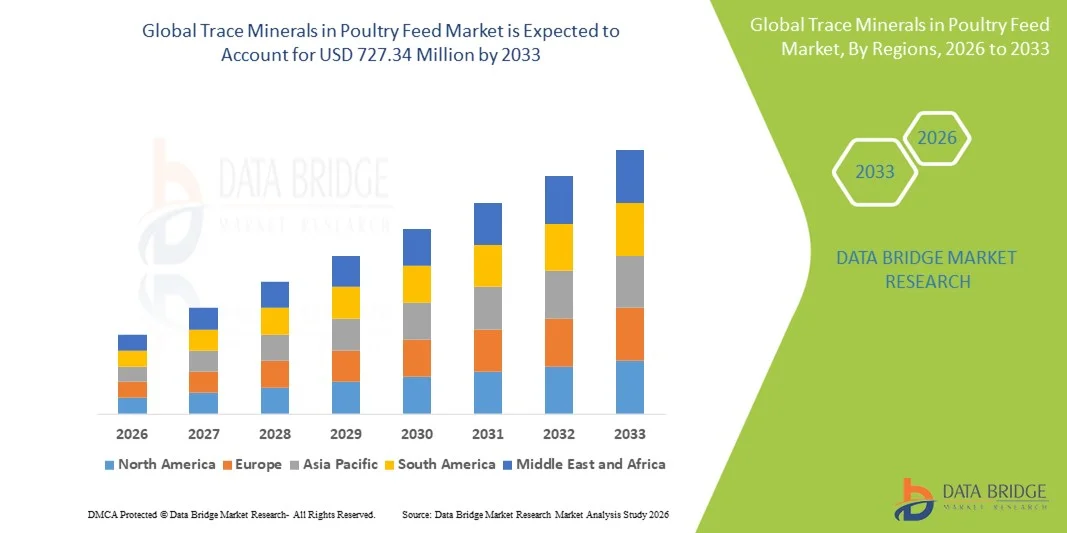

- The global trace minerals in poultry feed market size was valued at USD 470.36 million in 2025 and is expected to reach USD 727.34 million by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the expanding demand for high-performance poultry nutrition, driven by the rising global consumption of poultry meat and eggs, and the increasing adoption of fortified feed formulations containing essential trace minerals

- Furthermore, growing emphasis on flock health, productivity, and feed efficiency is encouraging poultry producers to integrate bioavailable trace minerals such as zinc, manganese, and copper into diets. These converging factors are accelerating the uptake of trace mineral solutions, thereby significantly boosting the market’s growth

Trace Minerals in Poultry Feed Market Analysis

- Trace minerals, providing essential micronutrients for metabolic, skeletal, and reproductive functions, are increasingly recognized as critical components of poultry feed in both commercial and integrated farming systems due to their role in enhancing immunity, performance, and overall flock health

- The escalating demand for trace minerals is primarily fueled by the intensification of poultry farming, rising preference for scientifically formulated diets, and increasing awareness among producers about the benefits of chelated and organic mineral sources in improving nutrient absorption and reducing environmental impact

- Asia-Pacific dominated the trace minerals in poultry feed market with a share of over 42% in 2025, due to expanding commercial poultry production, rising meat consumption, and increasing adoption of performance-focused feed formulations

- North America is expected to be the fastest growing region in the trace minerals in poultry feed market during the forecast period due to strong demand for high-performance feed, advanced poultry production systems, and rapid adoption of precision nutrition

- Dry segment dominated the market with a market share of 72.9% in 2025, due to its superior stability, longer shelf life, and ease of incorporation into standard feed manufacturing processes. Feed mills prefer dry trace minerals as they blend efficiently with premixes and maintain consistent nutrient uniformity during large-scale production. Producers rely on dry formulations for accurate dosing, minimized nutrient degradation, and improved storage convenience across diverse climatic conditions. In addition, dry mineral forms often provide cost advantages, which attracts small and large poultry operations. Their strong compatibility with automated feed systems reinforces their wide uptake across commercial broiler and layer farms

Report Scope and Trace Minerals in Poultry Feed Market Segmentation

|

Attributes |

Trace Minerals in Poultry Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trace Minerals in Poultry Feed Market Trends

Growth of Organic and Chelated Trace Minerals

- The poultry feed industry is experiencing a significant trend toward the use of organic and chelated trace minerals, driven by a global shift toward improving nutrient absorption, animal health, and feed efficiency. Chelated forms of minerals such as zinc, copper, manganese, and iron offer superior bioavailability and stability compared to traditional inorganic mineral sources, enabling better performance and immunity in poultry flocks

- For instance, companies such as Alltech and Zinpro Corporation are developing proprietary chelated mineral complexes that enhance absorption and retention in poultry diets. These products have demonstrated improved feed conversion ratios and growth rates in broilers and layers, supporting producers in achieving higher productivity and profitability under competitive market conditions

- The preference for organic trace minerals is also increasing due to heightened focus on reducing mineral excretion into the environment. By ensuring better metabolization, chelated minerals lower waste output and align with sustainability-driven livestock management practices aimed at minimizing environmental pollution through feed optimization

- Advancements in mineral chelation technologies are enabling controlled release and targeted delivery within the poultry digestive tract. This innovation supports improved nutrient utilization, immune response, and skeletal development, decreasing the dependence on antibiotic growth promoters and improving overall bird welfare

- In addition, the expansion of premium poultry production, including antibiotic-free and organic meat segments, is accelerating adoption of high-quality trace mineral formulations. Producers are adjusting formulations to meet market expectations for cleaner, nutritionally enriched poultry products

- The wider acceptance of organic and chelated trace minerals highlights the poultry industry’s transition toward performance-focused and environmentally conscious nutrition strategies. As feed manufacturers adopt precision nutrition principles, organic trace minerals are expected to become central to future poultry feed formulations, driving sustained market expansion across major producing regions

Trace Minerals in Poultry Feed Market Dynamics

Driver

Rising Demand for High-Performance Poultry Nutrition

- The increasing emphasis on high-performance poultry nutrition is a key driver for the trace minerals market, as producers seek to enhance bird growth, reproduction, and overall health outcomes. Trace minerals are essential elements supporting metabolic activities, enzymatic functions, and immune system integrity that together ensure optimal flock productivity

- For instance, Cargill and DSM have invested in developing targeted trace mineral premixes designed to enhance mineral bioavailability and uniformity in feed. These formulations aim to improve body weight gain, feed conversion efficiency, and immunity in poultry, catering to the rising demand for animal proteins in both developed and emerging economies

- As global consumption of poultry meat and eggs continues to grow, producers are prioritizing nutritional balance to maintain consistent output and quality. Trace minerals such as zinc, selenium, and manganese contribute to key physiological processes, including bone development, enzyme regulation, and oxidative stress control, essential for sustaining rapid poultry growth cycles

- In addition, advancements in precision feeding systems allow optimized inclusion of trace minerals, reducing nutrient wastage and ensuring consistent mineral levels across flocks. Such technologies contribute to cost efficiency and sustainability while maintaining high performance in intensive poultry production systems

- The global drive for efficient, safe, and healthy poultry products continues to reinforce the demand for trace minerals in poultry feed. As producers integrate next-generation feed technologies and bioavailable mineral sources, the market is set for steady growth supported by the dual goals of performance improvement and sustainable animal nutrition

Restraint/Challenge

High Cost and Limited Availability of Bioavailable Minerals

- The high cost and restricted availability of bioavailable trace minerals represent a major challenge for the poultry feed market. As organic and chelated mineral formulations require complex production processes and premium raw materials, their prices are significantly higher than conventional inorganic options, limiting access for small and medium-scale feed producers

- For instance, companies such as Balchem and Kemin Industries have reported continued pressure on raw material sourcing for chelated mineral production due to supply chain volatility and fluctuating prices of binding agents such as amino acids and organic acids. This cost escalation often impacts feed affordability across price-sensitive markets

- The limited supply of high-grade chelated minerals, especially in regions with underdeveloped feed manufacturing infrastructure, restricts widespread adoption. Import dependence and inconsistent quality standards across suppliers can further hamper supply continuity and product uniformity

- In addition, the lack of awareness among smaller poultry farmers regarding the long-term benefits of bioavailable mineral supplementation creates hesitancy in transitioning from traditional mineral sources. Short-term cost concerns often outweigh efficiency benefits, slowing penetration in low-income production regions

- To overcome these challenges, scaling up localized production, improving raw material access, and supporting adoption through education and cost-sharing initiatives will be essential. Long-term market stability will depend on balancing production costs with accessibility, ensuring widespread use of high-quality trace mineral solutions that deliver both nutritional and economic benefits for the poultry industry

Trace Minerals in Poultry Feed Market Scope

The market is segmented on the basis of type, form, chelate type, and livestock.

- By Type

On the basis of type, the trace minerals in poultry feed market is segmented into zinc, copper, cobalt, manganese, iron, chromium, and other types. The zinc segment dominated the market in 2025 with the largest revenue share due to its essential role in enzyme activation, immune performance, and growth efficiency in poultry. Feed manufacturers rely on zinc for improving skeletal development and reducing mortality risks, which reinforces its extensive inclusion across broiler and layer diets. Strong scientific validation supporting zinc’s impact on feed conversion ratios continues to drive adoption across commercial farms. In addition, rising disease management concerns among producers encourage higher usage of zinc to support resilience and productivity. Its wide availability in multiple formulations and stable pricing dynamics further contributes to its sustained dominance across poultry nutrition programs.

The manganese segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by its increasing application in improving eggshell strength, reproductive performance, and bone mineralization. Producers are incorporating higher manganese levels due to growing demand for premium quality eggs with uniform shell thickness in commercial layer operations. Its role in preventing skeletal deformities and enhancing leg health in broilers elevates its significance as flock sizes expand globally. Rising emphasis on mineral optimization in intensive farming systems is pushing nutritionists to shift towards more bioavailable manganese sources. In addition, innovations in chelated manganese forms are enhancing absorption rates, which strengthens its future growth across highly productive poultry systems.

- By Form

On the basis of form, the market is segmented into dry and liquid. The dry form segment dominated the market with the largest share of 72.9% in 2025 due to its superior stability, longer shelf life, and ease of incorporation into standard feed manufacturing processes. Feed mills prefer dry trace minerals as they blend efficiently with premixes and maintain consistent nutrient uniformity during large-scale production. Producers rely on dry formulations for accurate dosing, minimized nutrient degradation, and improved storage convenience across diverse climatic conditions. In addition, dry mineral forms often provide cost advantages, which attracts small and large poultry operations. Their strong compatibility with automated feed systems reinforces their wide uptake across commercial broiler and layer farms.

The liquid form segment is expected to witness the fastest CAGR from 2026 to 2033 driven by increasing adoption in precision nutrition and water-soluble supplementation programs. Poultry producers use liquid trace minerals to deliver targeted mineral intake during stress events, heat conditions, or disease outbreaks where feed intake may decline. Liquid forms support faster absorption and immediate physiological responses, which benefits farms aiming to optimize flock performance in shorter production cycles. Their growing use in early chick nutrition and vaccination programs further strengthens demand among integrated poultry companies. In addition, advancements in stabilized liquid formulations are improving ease of handling and uniform dispersion in drinking systems, fueling rapid market growth.

- By Chelate Type

On the basis of chelate type, the market is segmented into amino acids, proteinates, polysaccharides, and other chelate types. The amino acids segment dominated the market in 2025 due to its high bioavailability and efficient mineral absorption properties. Nutritionists prioritize amino acid-chelated minerals for enhancing metabolic functions, antioxidant activity, and overall growth performance in poultry systems. These chelates help reduce mineral excretion, improving environmental sustainability while delivering stronger feed efficiency outcomes. Their compatibility with high-density diets and positive impact on immune response support strong adoption across broiler and breeder operations. In addition, expanding scientific data validating absorption advantages over inorganic minerals further reinforces their dominance.

The polysaccharides segment is projected to witness the fastest growth rate from 2026 to 2033 supported by increasing interest in natural and highly stable chelated mineral forms. Poultry producers value polysaccharide chelates for their improved tolerance in digestive environments and sustained mineral release, which supports consistent physiological benefits. These chelates help mitigate mineral antagonism issues, making them attractive in diets containing higher levels of competitive nutrients. In addition, rising regulatory focus on reducing inorganic mineral inclusion is shifting demand toward more efficient chelated solutions such as polysaccharide complexes. Their expanding application in antibiotic-free production systems further drives rapid growth across global poultry operations.

- By Livestock

On the basis of livestock, the market is segmented into poultry, ruminant, swine, aquaculture, and other livestock. The poultry segment dominated the market in 2025 due to the large global population of broilers and layers and the high mineral requirements for rapid growth and egg production. Producers rely heavily on trace minerals to improve feed efficiency, immune strength, and carcass yield, resulting in substantial volume consumption. Rising demand for premium poultry meat and value-added eggs accelerates mineral optimization trends across integrated systems. In addition, continuous expansion of commercial hatcheries and breeder farms increases the need for carefully formulated mineral premixes. The strong dependence of poultry operations on well-balanced mineral nutrition ensures the segment’s leading position.

The aquaculture segment is anticipated to record the fastest CAGR from 2026 to 2033 due to rising global fish and shrimp production and increasing emphasis on fortified feed solutions. Producers incorporate trace minerals to improve metabolic efficiency, stress resistance, and disease management in intensive aquaculture environments. Growing research highlighting the benefits of mineral supplementation in improving survival rates and growth performance is accelerating adoption across freshwater and marine species. In addition, expansion of commercial aquafeed manufacturing and rising investments in high-value species support stronger mineral incorporation. Enhanced focus on sustainable farming practices and optimized micronutrient utilization contributes to aquaculture’s rapid market growth.

Trace Minerals in Poultry Feed Market Regional Analysis

- Asia-Pacific dominated the trace minerals in poultry feed market with the largest revenue share of over 42% in 2025, driven by expanding commercial poultry production, rising meat consumption, and increasing adoption of performance-focused feed formulations

- The region’s strong feed manufacturing base, growing investments in modern poultry farming systems, and rising demand for high-quality animal protein are accelerating market expansion

- The availability of cost-effective raw materials, supportive government programs for livestock development, and rapid industrialization across developing economies are contributing to increased utilization of trace minerals in poultry nutrition

China Trace Minerals in Poultry Feed Market Insight

China held the largest share in the Asia-Pacific trace minerals in poultry feed market in 2025, supported by its position as one of the world’s largest poultry-producing nations and its highly developed feed manufacturing infrastructure. The country’s strong commercial broiler and layer industry continues to rely on mineral-enriched feed to achieve optimal growth performance. Demand is strengthened by ongoing modernization of poultry farms, rising preference for premium meat and eggs, and increasing use of advanced feed formulations across integrated producers.

India Trace Minerals in Poultry Feed Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of commercial poultry farms, increasing consumption of affordable protein sources, and rising adoption of fortified feed solutions. The country’s growing broiler integration model, along with government-led livestock development initiatives, is strengthening mineral utilization in poultry feed. In addition, advancements in feed milling capacity and expanding demand for high-performance nutrition in both rural and urban markets are contributing to strong market growth.

Europe Trace Minerals in Poultry Feed Market Insight

The Europe trace minerals in poultry feed market is expanding steadily, supported by stringent feed quality regulations, strong focus on animal health, and rising preference for bioavailable mineral sources. The region emphasizes precision nutrition, sustainability, and controlled feed formulations, particularly in antibiotic-reduced poultry systems. Growing adoption of organic and chelated minerals in advanced poultry breeds is further enhancing market development.

Germany Trace Minerals in Poultry Feed Market Insight

Germany’s market is driven by its advanced poultry farming practices, strong focus on high-quality feed production, and leadership in technology-driven livestock management. The country’s well-established integration networks and strict nutrient optimization standards promote consistent adoption of trace minerals. Demand remains strong for specialized mineral premixes used in broilers, breeders, and high-yield layer flocks.

U.K. Trace Minerals in Poultry Feed Market Insight

The U.K. market is supported by a mature poultry sector, increasing focus on domestic feed production, and rising adoption of enhanced nutritional strategies for animal health and productivity. Growing emphasis on research-driven feed solutions and expanded collaboration between feed manufacturers and poultry producers is strengthening the role of trace minerals in the nutrition cycle. The shift toward sustainable farming practices further contributes to mineral optimization.

North America Trace Minerals in Poultry Feed Market Insight

North America is projected to record the fastest CAGR from 2026 to 2033, driven by strong demand for high-performance feed, advanced poultry production systems, and rapid adoption of precision nutrition. The region’s focus on animal welfare, improved feed efficiency, and enhanced immune performance supports continuous mineral innovation. In addition, rising investments in feed automation and integrated poultry operations are accelerating market growth.

U.S. Trace Minerals in Poultry Feed Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by its large-scale broiler production, strong feed industry, and advanced research capabilities in poultry nutrition. The country maintains high standards for feed formulation, encouraging adoption of optimized trace mineral blends across commercial producers. Presence of major feed manufacturers and integrated poultry companies reinforces the U.S.’s leadership in the regional market.

Trace Minerals in Poultry Feed Market Share

The trace minerals in poultry feed industry is primarily led by well-established companies, including:

- Phibro Animal Health Corporation (U.S.)

- Green Mountain Nutritional Services Inc. (U.S.)

- VETLINE, a division of Simfa Labs Pvt Ltd (India)

- Dr. Eckel Animal Nutrition GmbH & Co. KG (Germany)

- Cargill, Incorporated (U.S.)

- Kemin Industries, Inc. (U.S.)

- NOVUS INTERNATIONAL (U.S.)

- Nutreco N.V. (Netherlands)

- pancosma (Switzerland)

- DSM (Netherlands)

- Zinpro Corporation (U.S.)

- Vamso Biotec Pvt. Ltd. (India)

- Tanke Veterinary Professional Services Ltd (U.K.)

- LALLEMAND Inc. (Canada)

- BASF SE (Germany)

- Alltech (U.S.)

- ADM (U.S.)

- Biochem Zusatzstoffe Handels (Germany)

Latest Developments in Global Trace Minerals in Poultry Feed Market

- In February 2025, Zinpro expanded its Availa Zinc methionine product line, focusing on enhancing immune function, reproductive performance, and overall growth in poultry. This expansion allows poultry producers to achieve higher flock productivity and better feed efficiency through highly bioavailable zinc supplementation. The move strengthens Zinpro’s market leadership in high-performance mineral nutrition, supports precision feeding programs, and meets the rising demand for sustainable, efficient mineral solutions in commercial poultry operations

- In November 2024, Biochem launched BetaTrace, a next-generation organic trace mineral complex that combines betaine with zinc, copper, manganese, and iron. BetaTrace improves mineral absorption and utilization, enhances gut health, and supports optimal growth and performance of poultry flocks. By introducing this innovation, Biochem addresses growing industry demand for more bioavailable and environmentally sustainable mineral products, helping producers improve flock health, productivity, and profitability

- In April 2024, Alltech introduced its Total Replacement Technology™ (TRT) for poultry, enabling complete replacement of inorganic minerals with chelated minerals in feed formulations. This innovation reduces mineral excretion, supports environmental sustainability, and improves overall flock health and growth performance. Alltech’s TRT strengthens its competitive position in precision nutrition solutions, meeting the increasing demand from commercial poultry producers for feed strategies that maximize efficiency, productivity, and regulatory compliance

- In May 2024, Lonza completed the acquisition of BASF’s organic trace-minerals business, significantly expanding its portfolio in bioavailable mineral products for poultry feed. This acquisition increases Lonza’s production capacity, accelerates the development of innovative mineral solutions, and reinforces its presence in key global markets. By integrating BASF’s technologies and expertise, Lonza is better positioned to meet growing demand for high-quality, sustainable, and performance-enhancing trace minerals in poultry nutrition

- In March 2024, Evonik formed a strategic partnership with Nutriad to co-develop and commercialize organic trace minerals for poultry feed. By combining Evonik’s mineral production capabilities with Nutriad’s animal nutrition expertise, the partnership aims to accelerate innovation in sustainable and bioavailable trace mineral products. This collaboration enhances both companies’ ability to deliver advanced nutritional solutions to poultry producers, improving flock performance, feed efficiency, and overall market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.