Global Track Laying Equipment Market

Market Size in USD Million

CAGR :

%

USD

728.00 Million

USD

21.31 Million

2024

2032

USD

728.00 Million

USD

21.31 Million

2024

2032

| 2025 –2032 | |

| USD 728.00 Million | |

| USD 21.31 Million | |

|

|

|

|

What is the Global Track Laying Equipment Market Size and Growth Rate?

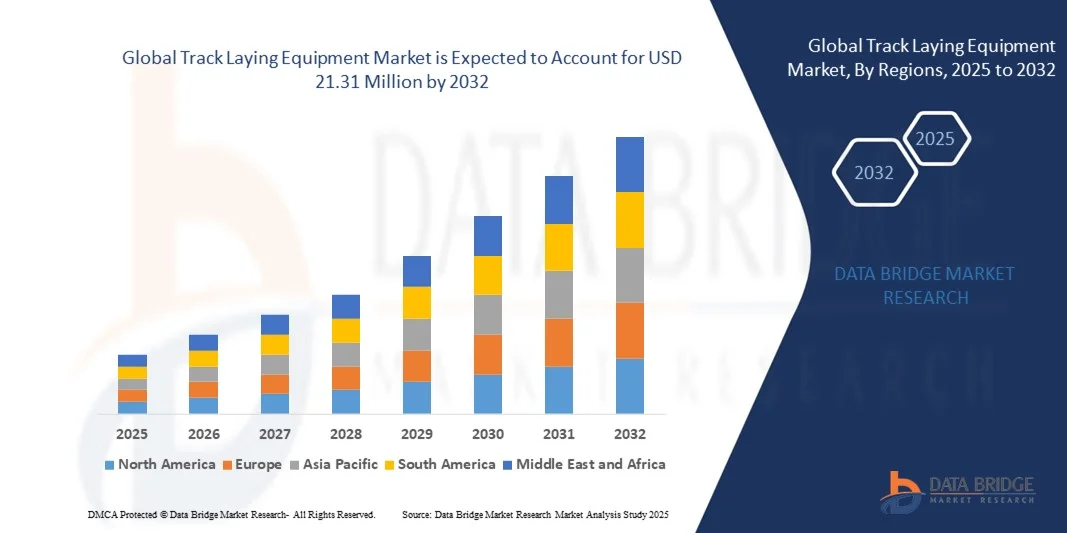

- The global track laying equipment market size was valued at USD 728.00 million in 2024 and is expected to reach USD 21.31 million by 2032, at a CAGR of 4.00% during the forecast period

- The track laying equipment market has a vast potential to grow, as the railway sector is inflowing into the refinement cycle to alter every walk of life, leading to the increasing need of lightweight equipment and machines

- In addition, the rapidly escalating demand towards the high performance of the devices and equipment’s is also largely influencing the growth of the track laying equipment market

What are the Major Takeaways of Track Laying Equipment Market?

- The increasing rail travel and demand to maintain quality is another driver flourishing the development of track laying equipment market, which in turn is raising the growth of the target market

- In addition, the track laying equipment has become one of the most significant parts of the modern railway track infrastructure development, which will also boost the growth of the track laying equipment market in the above-mentioned forecast period

- Likewise, the high adoption of heavier structures of the track, the use of track laying equipment is necessary to achieve the high quality of work proficiently which will also forward the product demand and enhance the growth of the track laying equipment market in the above-mentioned forecast period

- Asia-Pacific dominated the track laying equipment market with the largest revenue share of 42.5% in 2024, driven by extensive railway expansion projects, high-speed rail development, and urban transit upgrades across countries such as China, India, and Japan

- The North America track laying equipment market is projected to grow at the fastest CAGR of 9.8% during the forecast period (2025–2032), driven by increasing investments in railway modernization, high-speed corridors, and freight infrastructure upgrades

- The rails segment dominated the market with the largest revenue share of 38.6% in 2024, owing to continuous investments in high-speed and freight rail projects that require durable and high-performance track components

Report Scope and Track Laying Equipment Market Segmentation

|

Attributes |

Track Laying Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Track Laying Equipment Market?

Adoption of Automation and IoT-Enabled Machinery

- A major trend shaping the global track laying equipment market is the integration of automation technologies and IoT-based monitoring systems, enhancing operational efficiency, precision, and project safety. This shift is revolutionizing traditional railway track construction by enabling remote control, predictive maintenance, and real-time equipment tracking

- Automated track-laying systems now utilize GPS, sensors, and telematics to ensure accurate alignment, reduce manual labor, and optimize construction timelines. For instance, Plasser & Theurer introduced advanced automated track-laying trains capable of continuous track renewal and real-time performance data collection

- IoT connectivity enables remote diagnostics, predictive maintenance, and fleet optimization, reducing downtime and improving productivity. Companies such as Geismar and Harsco Corporation are incorporating smart sensors and analytics into their machinery to monitor wear, detect anomalies, and predict failures before they occur

- This integration of automation and IoT solutions is minimizing operational errors but also enhancing safety and sustainability by optimizing material usage and reducing carbon emissions

- The rising adoption of digitally connected, intelligent equipment is transforming the railway construction landscape, setting new standards for speed, safety, and cost efficiency in global track infrastructure projects

What are the Key Drivers of Track Laying Equipment Market?

- The global expansion of rail infrastructure projects, coupled with the growing emphasis on high-speed and metro rail systems, is significantly driving the demand for advanced track laying equipment

- For instance, in February 2024, Alstom (France) collaborated with Salcef Group S.p.A. (Italy) on a European high-speed rail modernization project using automated track-laying systems to enhance project efficiency and precision

- The rising need for faster construction timelines, improved worker safety, and cost efficiency is prompting railway authorities and contractors to adopt mechanized and automated track-laying solutions

- In addition, government investments in railway modernization and electrification, particularly across India, China, and European nations, are creating a robust demand for efficient track construction machinery

- The integration of AI, robotics, and sensor-based control systems in track-laying equipment is improving performance reliability and reducing maintenance costs, further boosting adoption among infrastructure developers worldwide

Which Factor is Challenging the Growth of the Track Laying Equipment Market?

- One of the major challenges hindering market growth is the high capital investment required for procuring and maintaining automated track laying equipment. Smaller contractors and developing regions often face financial constraints that limit adoption

- For instance, Swietelsky AG (Austria) and STRUKTON (Netherlands) have reported high upfront equipment costs and the need for specialized operators as significant barriers in small-scale railway projects

- Another concern is the lack of skilled technicians and operators capable of handling advanced digital and automated systems, which increases training costs and operational complexity

- Furthermore, maintenance and compatibility issues with existing rail infrastructure can hinder the seamless deployment of modern track-laying systems, especially in older networks

- Overcoming these challenges through government subsidies, training initiatives, and modular equipment designs will be crucial for promoting widespread adoption and ensuring sustainable market expansion in the coming years

How is the Track Laying Equipment Market Segmented?

The market is segmented on the basis of component type, system type, method type, operator type, and application.

- By Component Type

On the basis of component type, the track laying equipment market is segmented into sleepers, rails, ballast cushion, and rail panels. The rails segment dominated the market with the largest revenue share of 38.6% in 2024, owing to continuous investments in high-speed and freight rail projects that require durable and high-performance track components. Rails form the structural foundation of the track system, directly influencing stability, alignment, and load-bearing capacity.

The sleepers segment is expected to witness the fastest CAGR from 2025 to 2032, driven by technological advancements in concrete and composite sleeper manufacturing, offering enhanced durability and sustainability. The adoption of automated track-laying machinery for precise sleeper placement and alignment further supports segment growth. In addition, rising government initiatives to replace aging wooden sleepers with eco-friendly alternatives are boosting overall market demand for modernized rail components globally.

- By System Type

Based on system type, the track laying equipment market is bifurcated into hydraulic system and mechanical system. The hydraulic system segment dominated the market with a revenue share of 57.4% in 2024, attributed to its superior lifting capacity, precision control, and efficiency in heavy-duty rail installations. Hydraulic systems are extensively used in automated and continuous track-laying machines, ensuring smooth operation with minimal manual intervention.

The mechanical system segment is projected to register the fastest CAGR from 2025 to 2032, driven by its cost-effectiveness, simpler maintenance, and adaptability in small to medium-scale railway projects. Emerging economies are increasingly adopting mechanical systems for their lower initial investment and operational flexibility. However, ongoing innovations in hydraulic automation and energy-efficient components are expected to maintain the dominance of hydraulic systems in high-speed and heavy rail construction projects worldwide.

- By Method Type

On the basis of method type, the track laying equipment market is divided into assembly-line method and cyclic method. The assembly-line method segment accounted for the largest market revenue share of 61.2% in 2024, primarily due to its ability to support continuous and high-speed rail track installation with minimal interruptions. This method enables synchronized operation of equipment for ballast laying, sleeper placement, and rail fixing, ensuring consistency and productivity.

The cyclic method segment is anticipated to witness the fastest CAGR from 2025 to 2032, as it offers greater flexibility for shorter track sections and complex layouts, such as in urban or metro projects. The growing trend of modular railway construction and automation integration is enhancing the efficiency of cyclic methods. Moreover, advancements in machinery synchronization and data monitoring are further expanding its application across diverse railway infrastructure projects.

- By Operator Type

Based on operator type, the track laying equipment market is segmented into rail transportation and heavy and civil engineering construction. The rail transportation segment dominated the market with a revenue share of 54.7% in 2024, driven by railway operators’ direct investment in modern equipment to streamline maintenance and expansion of existing networks. These operators increasingly prefer in-house equipment fleets for improved control over project timelines and quality.

The heavy and civil engineering construction segment is projected to grow at the fastest CAGR from 2025 to 2032, owing to the rising participation of private infrastructure firms in railway development projects. Contractors are adopting advanced track-laying machinery to meet stringent project deadlines and safety standards. Public-private partnerships (PPP) and government funding for railway modernization are further accelerating equipment adoption across the civil construction segment globally.

- By Application

On the basis of application, the track laying equipment market is segmented into heavy rail and urban rail. The heavy rail segment held the largest market revenue share of 63.5% in 2024, fueled by large-scale expansion of freight corridors and intercity high-speed rail lines worldwide. The demand for durable, high-capacity track-laying systems capable of handling long-haul and heavy-load applications continues to strengthen this segment.

The urban rail segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increased government spending on metro and light rail networks, and the push toward sustainable public transport. Compact and automated track-laying systems designed for confined urban environments are gaining traction. As smart city initiatives and sustainable mobility goals advance globally, the urban rail application is expected to emerge as a critical growth driver in the market.

Which Region Holds the Largest Share of the Track Laying Equipment Market?

- Asia-Pacific dominated the track laying equipment market with the largest revenue share of 42.5% in 2024, driven by extensive railway expansion projects, high-speed rail development, and urban transit upgrades across countries such as China, India, and Japan. Governments in the region are heavily investing in modern railway infrastructure to enhance connectivity, trade efficiency, and sustainable transportation

- The region’s leadership is supported by strong public infrastructure budgets, rapid urbanization, and the adoption of automated and mechanized equipment for large-scale rail construction. Increasing partnerships between local contractors and global technology providers are further improving productivity and precision in track-laying operations

- Asia-Pacific’s focus on smart rail solutions, metro expansion, and cross-border connectivity has positioned it as the central hub for track-laying innovation and manufacturing, solidifying its dominance in the global market

China Track Laying Equipment Market Insight

The China track laying equipment market accounted for the largest revenue share of 58% within Asia-Pacific in 2024, fueled by the country’s ambitious high-speed rail and freight corridor projects. As part of its Belt and Road Initiative, China continues to expand both domestic and international rail networks, requiring continuous investments in advanced and automated track-laying systems. The government’s commitment to sustainable infrastructure, alongside strong manufacturing capabilities, is fostering the local production of efficient, IoT-enabled rail-laying machinery. Furthermore, collaborations between Chinese and European manufacturers are accelerating the integration of automation and digital monitoring technologies. With major players such as China Railway Construction Corporation (CRCC) and China Railway Group Limited (CREC) driving large-scale projects, the nation remains the epicenter of innovation and demand within the regional market.

India Track Laying Equipment Market Insight

The India track laying equipment market is expected to grow steadily, supported by government-led initiatives such as the Dedicated Freight Corridor (DFC) and ongoing metro rail expansions in major cities. Indian Railways’ focus on modernization, safety enhancement, and network electrification has increased the demand for mechanized track-laying and maintenance machinery. Domestic players such as Plasser India and Railtech Infraventure Pvt. Ltd. are expanding their manufacturing capabilities through joint ventures with global firms to introduce advanced automation technologies. In addition, the government’s “Make in India” policy is boosting local production, reducing import dependence, and encouraging technological self-reliance. With rising investments in high-speed rail projects such as the Mumbai–Ahmedabad bullet train, India is rapidly emerging as a key contributor to regional market growth and innovation.

Japan Track Laying Equipment Market Insight

The Japan track laying equipment market continues to evolve through advanced automation and precision engineering, driven by the country’s long-standing expertise in high-speed rail systems such as Shinkansen. Japan’s focus on reliability, efficiency, and safety in railway operations has prompted the adoption of cutting-edge track-laying machines equipped with digital monitoring, remote control, and predictive maintenance capabilities. Domestic manufacturers are integrating AI and IoT solutions to enhance performance and reduce operational downtime. Furthermore, Japan’s emphasis on green construction practices and sustainable transport is promoting the use of energy-efficient hydraulic systems and recyclable rail components. The government’s investments in upgrading existing rail infrastructure and exporting Japanese rail technologies across Asia reinforce the nation’s significant role in the regional market landscape.

Which Region is the Fastest Growing Region in the Track Laying Equipment Market?

The North America track laying equipment market is projected to grow at the fastest CAGR of 9.8% during the forecast period (2025–2032), driven by increasing investments in railway modernization, high-speed corridors, and freight infrastructure upgrades. The U.S. and Canada are witnessing a resurgence in rail construction, focusing on sustainability, safety, and automation. Technological advancements such as GPS-guided track alignment, AI-based monitoring, and IoT-integrated maintenance systems are fueling market demand. Federal funding initiatives such as the U.S. Infrastructure Investment and Jobs Act are boosting spending on rail projects, creating opportunities for equipment manufacturers.

U.S. Track Laying Equipment Market Insight

The U.S. track laying equipment market held the largest share of 79% within North America in 2024, driven by the modernization of freight and passenger rail networks. Rising investments in Amtrak’s infrastructure upgrade and regional high-speed projects such as California High-Speed Rail are propelling demand for efficient, automated track-laying systems. The growing emphasis on sustainability and digital integration has prompted companies such as Harsco Corporation (U.S.) and LARSEN & TOUBRO LIMITED (India) to collaborate on eco-efficient construction technologies. In addition, the adoption of predictive maintenance tools, advanced hydraulic systems, and remote-control track machinery is transforming U.S. rail infrastructure. With increased federal support for energy-efficient and interconnected transport systems, the country is set to lead North America’s rapid market expansion in the coming years.

Which are the Top Companies in Track Laying Equipment Market?

The track laying equipment industry is primarily led by well-established companies, including:

- Geismar (France)

- Eiffage Rail (France)

- Plasser & Theurer (Austria)

- Harsco Corporation (U.S.)

- Alstom (France)

- Railtech Infraventure Pvt. Ltd. (India)

- Hydro Mech Engineers (India)

- Swietelsky AG (Austria)

- KOMPASS INTERNATIONAL SA (France)

- Sunbeam (India)

- Plasser India (India)

- Rahee Group (India)

- Salcef Group S.p.A. (Italy)

- TATA Projects (India)

- LAXYO (India)

- LARSEN & TOUBRO LIMITED (India)

- Vardhaman Engineering (India)

- PTKgroup (Poland)

- STRUKTON (Netherlands)

- ROBEL Bahnbaumaschinen GmbH (Germany)

What are the Recent Developments in Global Track Laying Equipment Market?

- In April 2025, Morocco approved a USD 10.3 billion railway expansion project, which includes the development of a high-speed line connecting Marrakesh. This strategic initiative aims to enhance national connectivity and promote economic growth through advanced rail infrastructure

- In February 2025, Vietnam’s parliament approved an USD 8 billion railway project linking the country to China’s Yunnan province, with construction scheduled to commence by late 2025. This cross-border initiative is expected to strengthen regional trade and foster economic cooperation between the two nations

- In September 2024, Progress Rail and Borusan Cat signed a memorandum of understanding (MoU) to jointly pursue rail infrastructure projects in Türkiye and neighboring regions. This partnership aims to combine expertise and resources to accelerate railway modernization and construction efficiency

- In October 2021, Alstom launched a new track-laying machine designed for constructing 46 kilometers of a single-track metro line in Paris, backed by an investment of USD 153.5 million. This innovation is set to improve construction precision and reduce project completion time

- In September 2021, Solytek introduced its track-laying gantry F 40 TR, specifically engineered for railway construction and renovation projects. Equipped with a rapid work cycle and radio-controlled functionality, the system enhances operational flexibility and project safety

- In January 2021, Stabirail unveiled a slab construction track-laying system tailored for new and rehabilitation railway projects. Featuring automated alignment and quick placement capabilities, this equipment minimizes human error and ensures cost-efficient rail installation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.