Global Traditional Toys And Games Market

Market Size in USD Billion

CAGR :

%

USD

96.63 Billion

USD

139.74 Billion

2025

2033

USD

96.63 Billion

USD

139.74 Billion

2025

2033

| 2026 –2033 | |

| USD 96.63 Billion | |

| USD 139.74 Billion | |

|

|

|

|

Traditional Toys and Games Market Size

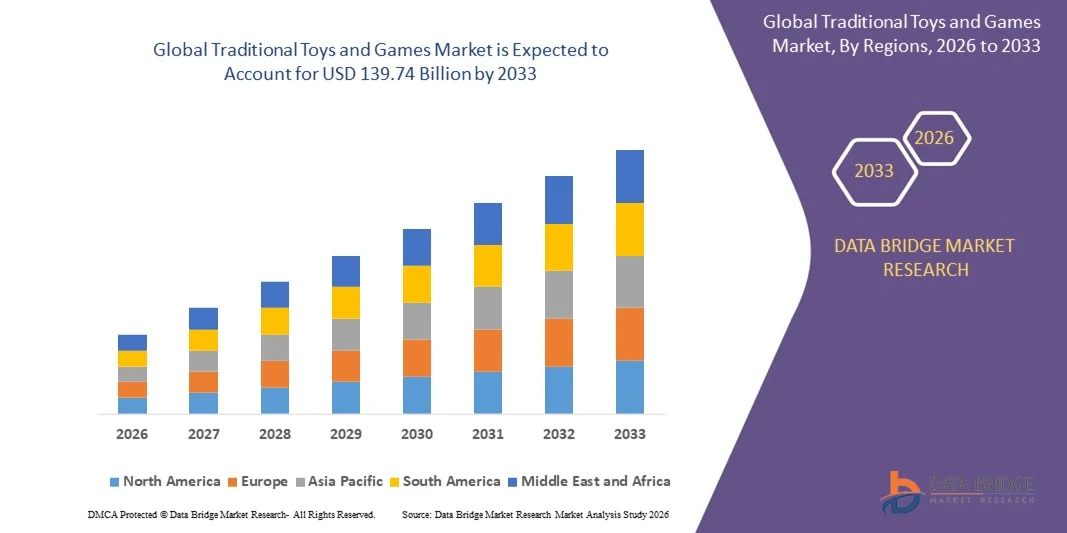

- The global traditional toys and games market size was valued at USD 96.63 billion in 2025 and is expected to reach USD 139.74 billion by 2033, at a CAGR of 4.72% during the forecast period

- The market growth is largely fuelled by the rising preference for educational and developmental toys among children, growing awareness of traditional play benefits, and increasing consumer inclination toward safe and eco-friendly toys

- Increasing demand from emerging markets due to rising disposable incomes and growing population of children is further contributing to market expansion

Traditional Toys and Games Market Analysis

- The market is witnessing steady growth driven by the resurgence of interest in classic toys, puzzles, board games, and educational playsets among children and families

- Consumers are increasingly valuing interactive and skill-building toys that enhance cognitive development, creativity, and social interaction, contributing to sustained demand

- North America dominated the traditional toys and games market with the largest revenue share of 38.50% in 2025, driven by the growing popularity of educational and interactive toys, as well as increasing consumer spending on child development and recreational products

- Asia-Pacific region is expected to witness the highest growth rate in the global traditional toys and games market, driven by increasing population of children, rising disposable incomes, and government initiatives promoting early childhood education and skill development through toys

- The Construction Sets segment held the largest market revenue share in 2025, driven by the rising adoption of STEM-based building blocks and activity kits that enhance cognitive development and problem-solving skills. These toys are increasingly preferred by parents and educators for their educational value, hands-on engagement, and ability to improve creativity and fine motor skills

Report Scope and Traditional Toys and Games Market Segmentation

|

Attributes |

Traditional Toys and Games Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Games Workshop Limited (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Traditional Toys and Games Market Trends

Rise of Educational and Interactive Play

- The growing preference for educational and interactive toys is transforming the traditional toys and games landscape by promoting cognitive development, creativity, and skill-building in children. Toys that combine fun with learning enable early childhood education, improve problem-solving abilities, and enhance social interaction, resulting in higher parental satisfaction and repeat purchases. This trend is also influencing manufacturers to design multi-functional toys that cater to both learning and entertainment, boosting overall market engagement

- The high demand for STEM-based, role-playing, and activity-oriented toys in urban and semi-urban regions is accelerating the adoption of puzzles, board games, and building blocks. These toys are particularly effective in nurturing critical thinking, teamwork, and motor skills, supporting holistic child development. Moreover, increasing awareness among parents regarding the importance of early education is driving consistent demand for such interactive toys

- The affordability and easy accessibility of modern traditional toys are making them attractive across different consumer segments. Families benefit from durable, safe, and engaging play experiences without compromising on educational value or entertainment. Retailers are also leveraging e-commerce channels to reach a wider audience, ensuring these products are available to both urban and semi-urban households

- For instance, in 2023, several toy retailers in the U.S. reported increased sales and positive consumer feedback after launching STEM-focused board games and interactive puzzle sets, highlighting the functional benefits and market acceptance. The success of these products encouraged further investment in innovation, helping brands expand their educational toy portfolios

- While educational and interactive toys are driving growth through engagement and learning benefits, their impact depends on continued innovation, quality assurance, and marketing. Manufacturers must focus on product differentiation, safety standards, and parent education to fully capitalize on the growing demand. Collaborative efforts with schools and educational institutions also help in enhancing credibility and adoption

Traditional Toys and Games Market Dynamics

Driver

Rising Demand for Skill-Based and Educational Toys

- The rising focus on child development and early learning is encouraging parents and educators to invest in skill-based and educational toys. Products such as building blocks, puzzle games, and activity kits are preferred for their proven cognitive and developmental benefits. This trend is further supported by government initiatives promoting early childhood education and learning through play

- Parents and teachers are increasingly aware of the value of toys that promote learning while entertaining children, driving adoption across different age groups. This awareness accelerates sales of educational and interactive toys in schools, play centers, and homes. Marketing campaigns emphasizing both fun and educational outcomes are strengthening consumer confidence in these products

- Expansion of retail networks and e-commerce platforms is supporting wider distribution and visibility of traditional toys, enabling easier access for consumers across urban and semi-urban regions. Online marketplaces and direct-to-consumer platforms allow manufacturers to showcase product features and interactive demonstrations, further driving sales

- For instance, in 2022, European toy manufacturers reported a surge in online sales of STEM-based kits and interactive games, fueled by rising consumer demand for safe and educational play options. The data from e-commerce channels also informed product innovation, helping brands tailor offerings to evolving consumer preferences

- While rising awareness and retail expansion are driving the market, sustained growth requires product innovation, regulatory compliance, and strong brand positioning to ensure long-term adoption. Companies investing in research and development and collaborating with educational experts are better positioned to maintain market leadership

Restraint/Challenge

High Cost of Premium Educational Toys and Safety Concerns

- The premium pricing of high-quality, educational, and branded toys limits adoption among price-sensitive consumers, particularly in emerging markets. Cost remains a key barrier for widespread usage. In addition, imported toys often carry higher tariffs and shipping costs, further restricting affordability for lower-income households

- In many regions, safety concerns and lack of awareness regarding quality standards reduce market penetration. Parents often prefer familiar brands and traditional play options over innovative or imported products. This has prompted manufacturers to invest in safety certifications, quality assurance, and clear labeling to build trust with consumers

- Supply chain and manufacturing challenges, particularly for intricate or STEM-based toys, can impact product availability and timely distribution, affecting market growth. Delays in raw material procurement, production bottlenecks, and fluctuating shipping costs may disrupt supply, especially during peak seasons

- For instance, in 2023, several small toy retailers in Southeast Asia reported lower sales of premium educational toys due to limited awareness, high costs, and logistical issues. This highlighted the need for improved distribution networks and localized production to meet market demand efficiently

- While traditional toys continue to evolve with educational and interactive features, addressing affordability, safety, and distribution barriers is essential for broader adoption and sustained growth in the global traditional toys and games market. Continued investments in product innovation, parent education, and omni-channel distribution strategies will be key to capturing new consumer segments and maximizing market potential

Traditional Toys and Games Market Scope

The market is segmented on the basis of product type and distribution channel.

- By Product Type

On the basis of product type, the global traditional toys and games market is segmented into Outdoor and Sports Toys, Construction Sets, Dolls and Plush Toys, Vehicles, Action Figures, and Others. The Construction Sets segment held the largest market revenue share in 2025, driven by the rising adoption of STEM-based building blocks and activity kits that enhance cognitive development and problem-solving skills. These toys are increasingly preferred by parents and educators for their educational value, hands-on engagement, and ability to improve creativity and fine motor skills.

The Dolls and Plush Toys segment is expected to witness the fastest growth rate from 2026 to 2033, driven by innovations in interactive and sensory-rich dolls that enhance imaginative play and social development. These toys often incorporate audio-visual elements, customizable features, or educational content, making them highly attractive to children and supporting long-term engagement. The growing popularity of branded and collectible dolls also contributes to increased market adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hypermarket/Supermarket, Specialty Retail Stores, and Online Retail Stores. The Hypermarket/Supermarket segment held the largest market share in 2025, fueled by the convenience of one-stop shopping, wide product variety, and promotional offers that attract families. Hypermarkets also enable manufacturers to showcase educational and interactive toys to a large consumer base, enhancing visibility and sales.

The Online Retail Stores segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of e-commerce platforms, easy access to product information, and home delivery convenience. Online channels allow consumers to compare products, read reviews, and purchase premium educational toys that may not be readily available in physical stores, further boosting market penetration.

Traditional Toys and Games Market Regional Analysis

- North America dominated the traditional toys and games market with the largest revenue share of 38.50% in 2025, driven by the growing popularity of educational and interactive toys, as well as increasing consumer spending on child development and recreational products

- Parents and caregivers in the region highly value toys that combine learning and fun, promoting cognitive development, creativity, and skill-building in children. This preference is boosting demand for STEM-based kits, puzzles, and role-playing toys

- The widespread adoption is further supported by established retail networks, high disposable incomes, and strong e-commerce penetration, positioning traditional toys as a preferred choice for both educational and recreational purposes

U.S. Traditional Toys and Games Market Insight

The U.S. traditional toys and games market captured the largest revenue share in 2025 within North America, fueled by increasing interest in educational and skill-based toys. Parents and educators are prioritizing toys that enhance learning and problem-solving abilities, while retailers are expanding offerings of interactive and STEM-focused products. In addition, the growing presence of specialty stores and online platforms, combined with marketing campaigns emphasizing child development, is significantly contributing to market expansion.

Europe Traditional Toys and Games Market Insight

The Europe traditional toys and games market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising parental awareness about child education and play-based learning. The growth of toy retail chains, specialty stores, and e-commerce platforms is fostering easier access to educational and interactive toys. European consumers are also increasingly focused on safety standards, eco-friendly materials, and innovative designs, which is boosting adoption across households, schools, and play centers.

U.K. Traditional Toys and Games Market Insight

The U.K. traditional toys and games market is expected to witness the fastest growth rate from 2026 to 2033, driven by increased consumer spending on educational toys and a preference for skill-based play. Parents are investing in toys that support cognitive and social development, while retailers are promoting STEM kits, board games, and building sets. The region’s strong e-commerce infrastructure, along with growing awareness of quality and safety standards, is expected to further stimulate market growth.

Germany Traditional Toys and Games Market Insight

The Germany traditional toys and games market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing interest in innovative and educational toys. Germany’s focus on early childhood education, combined with strong retail networks and regulatory emphasis on toy safety, supports the adoption of STEM-based, interactive, and eco-friendly toys. Integration of modern toy designs into schools, daycare centers, and recreational programs is also contributing to growth, particularly in urban areas.

Asia-Pacific Traditional Toys and Games Market Insight

The Asia-Pacific traditional toys and games market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, urbanization, and a growing emphasis on child education in countries such as China, India, and Japan. Increasing penetration of modern retail formats and e-commerce platforms is facilitating wider access to educational, interactive, and skill-based toys. Furthermore, the growing manufacturing capabilities in APAC, along with government initiatives promoting learning through play, are expanding affordability and availability across a broad consumer base.

Japan Traditional Toys and Games Market Insight

The Japan traditional toys and games market is expected to witness the fastest growth rate from 2026 to 2033, due to the country’s focus on child development, technological integration in toys, and high consumer interest in STEM and educational products. Japanese parents increasingly prefer toys that combine play with learning, and the integration of tech-enabled toys is gaining traction in schools and households. In addition, Japan’s aging population is driving demand for high-quality, safe, and easy-to-use toys that support both educational and recreational needs.

China Traditional Toys and Games Market Insight

The China traditional toys and games market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increasing parental awareness about child education. China is one of the largest markets for educational and interactive toys, with high demand for STEM kits, puzzles, and skill-building products. The rise of e-commerce, domestic toy manufacturers, and government initiatives promoting play-based learning are key factors driving market expansion across residential, educational, and recreational segments.

Traditional Toys and Games Market Share

The Traditional Toys and Games industry is primarily led by well-established companies, including:

• Games Workshop Limited (U.K.)

• NECA/WizKids LLC (WizKids) (U.S.)

• IELLO (France)

• Grey Fox Games (U.S.)

• Disney (U.S.)

• Buffalo Games (U.S.)

• University Games Corporation (U.S.)

• LongPack Games (China)

• Boda Games (China)

• Shenzhen YHD Packaging Products Co., Ltd. (China)

• Shenzhen ITIS Packaging Products Co., Ltd. (China)

• Shenzhen Yahong Color Printing Limited Company (China)

• Zhejiang Chinu Packing & Printing Co., Ltd. (China)

• Ningbo Charron Industry Co., Ltd. (China)

• Bright Sea Industrial Limited (China)

• Custom Playing Cards (U.S.)

• Board Games Makers (U.S.)

• Cartamundi USA (U.S.)

• Delano Games (U.S.)

• Kylinmanu Factory (China)

Latest Developments in Global Traditional Toys and Games Market

- In May 2025, LEGO, through a partnership with Ample Group, opened Asia’s largest store in India, expanding from online platforms and multi-brand retailers to a dedicated retail location. This expansion enhances brand visibility, provides an immersive shopping experience, and strengthens LEGO’s foothold in the rapidly growing Indian market

- In April 2025, Hasbro renewed its multi-year licensing agreement with Disney Consumer Products to continue producing toys and games based on Star Wars and Marvel properties. This renewal ensures sustained product offerings for popular franchises, driving consumer engagement and reinforcing Hasbro’s market leadership in licensed toys

- In February 2025, Hasbro launched PLAY-DOH Barbie playsets through a licensing collaboration with Mattel. The product line allows children to design and create their own PLAY-DOH clothing and accessories, promoting creativity, enhancing playtime experiences, and boosting sales in interactive toy segments

- In September 2024, Cobi partnered with Hobbycraft to soft-launch its core products in select premium Hobbycraft stores, with a broader rollout planned before the Christmas season. This collaboration expands Cobi’s retail reach, increases brand awareness, and targets peak seasonal demand for toys and games

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.