Global Traffic Analytics Management Market

Market Size in USD Billion

CAGR :

%

USD

56.89 Billion

USD

155.59 Billion

2025

2033

USD

56.89 Billion

USD

155.59 Billion

2025

2033

| 2026 –2033 | |

| USD 56.89 Billion | |

| USD 155.59 Billion | |

|

|

|

|

What is the Global Traffic Analytics Management Market Size and Growth Rate?

- The global traffic analytics management market size was valued at USD 56.89 billion in 2025 and is expected to reach USD 155.59 billion by 2033, at a CAGR of13.40% during the forecast period

- Increasing need for real-time traffic information systems, prevalence of regulatory frameworks and government policies to reduce global carbon emissions, increasing number of government initiatives for traffic management across cities, increasing urban population along with high demographic rates, growing public concern for safety are some of the major as well as vital factors which will likely to augment the growth of the traffic analytics management market

What are the Major Takeaways of Traffic Analytics Management Market?

- Rising emergence of internet of things and sensor technologies in traffic management along with penetration of analytics in traffic management network systems which will further contribute by generating massive opportunities that will lead to the growth of the traffic analytics management market

- Lack of standardized and uniform technologies along with multiple sensors and touchpoints pose data fusion which will likely to act as market restraints factor for the growth of the traffic analytics management in the above mentioned projected timeframe. Security threats and hackers along with low penetration of product which will become the biggest and foremost challenge for the growth of the market

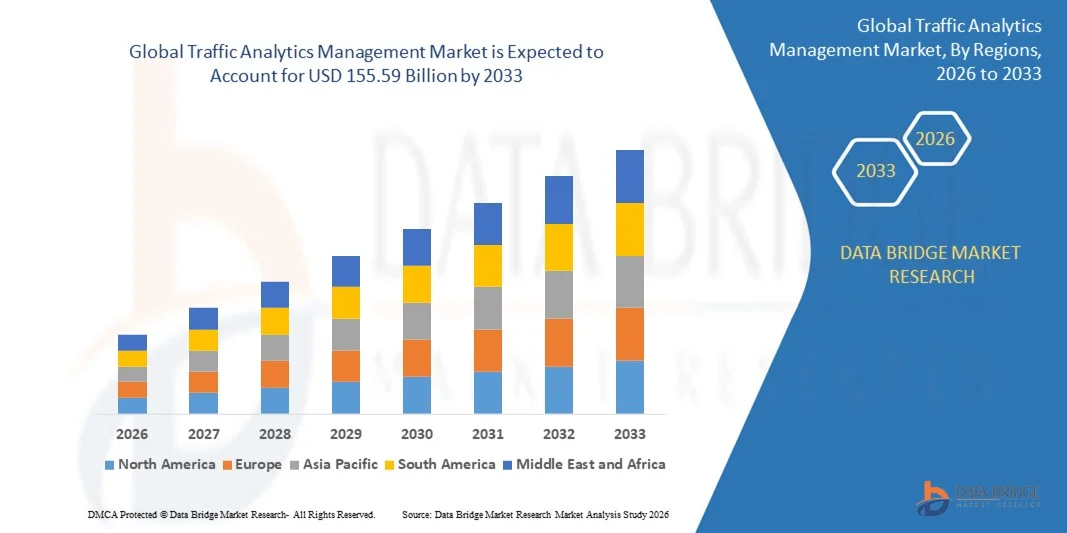

- North America dominated the traffic analytics management market with a 36.95% revenue share in 2025, driven by widespread adoption of intelligent transportation systems (ITS), smart city programs, and advanced traffic monitoring infrastructure across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.9% from 2026 to 2033, driven by rapid urbanization, expanding road infrastructure, and increasing investments in smart city and intelligent traffic management projects across China, Japan, India, South Korea, and Southeast Asia

- The Surveillance Cameras segment dominated the market with an estimated 41.6% share in 2025, driven by their widespread deployment across highways, urban intersections, toll plazas, and smart city infrastructure

Report Scope and Traffic Analytics Management Market Segmentation

|

Attributes |

Traffic Analytics Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Traffic Analytics Management Market?

Increasing Shift Toward AI-Driven, Real-Time, and Cloud-Integrated Traffic Analytics Platforms

- The traffic analytics management market is witnessing strong adoption of AI-powered, cloud-based, and real-time analytics platforms designed to process high-volume traffic data from cameras, sensors, GPS devices, and connected infrastructure

- Vendors are introducing scalable platforms with machine learning algorithms, edge analytics, and advanced visualization dashboards that enable real-time congestion monitoring, incident detection, and predictive traffic modeling

- Growing demand for cost-efficient, centralized, and remotely deployable traffic management solutions is driving adoption across smart cities, highways, urban mobility networks, and transportation authorities

- For instance, companies such as Siemens, Kapsch TrafficCom, SWARCO, Cubic Corporation, and Iteris have enhanced their traffic analytics solutions with AI-based video analytics, cloud integration, and real-time decision support tools

- Increasing need for dynamic traffic control, congestion reduction, and data-driven urban planning is accelerating the shift toward intelligent, software-centric traffic analytics management systems

- As urbanization and vehicle density continue to rise, Traffic Analytics Management systems will remain critical for improving road safety, mobility efficiency, and sustainable transportation planning

What are the Key Drivers of Traffic Analytics Management Market?

- Rising demand for real-time traffic monitoring, congestion optimization, and incident response solutions to improve urban mobility and reduce travel delays

- For instance, in 2025, leading companies such as Siemens, Indra Sistemas, and TransCore expanded their traffic analytics portfolios with AI-enabled traffic prediction, adaptive signal control, and cloud-based analytics platforms

- Growing deployment of smart city initiatives, intelligent transportation systems (ITS), and connected infrastructure across the U.S., Europe, and Asia-Pacific is boosting demand for traffic analytics solutions

- Advancements in computer vision, big data analytics, cloud computing, and edge processing have significantly improved traffic data accuracy, scalability, and operational efficiency

- Rising adoption of connected vehicles, autonomous driving technologies, and mobility-as-a-service (MaaS) platforms is increasing the need for high-performance traffic data analysis

- Supported by government investments in smart infrastructure, digital transformation, and sustainable mobility, the Traffic Analytics Management market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Traffic Analytics Management Market?

- High initial deployment costs associated with advanced sensors, AI software platforms, cloud infrastructure, and system integration limit adoption among smaller municipalities and developing regions

- For instance, during 2024–2025, rising hardware costs, data storage expenses, and integration complexities increased overall project costs for several large-scale traffic analytics deployments

- Complexity in integrating traffic analytics platforms with legacy traffic management systems, surveillance infrastructure, and multiple data sources increases implementation challenges

- Data privacy concerns, cybersecurity risks, and regulatory compliance requirements related to video analytics and vehicle tracking slow adoption in certain regions

- Competition from traditional traffic management systems and basic traffic monitoring solutions creates pricing pressure and slows the transition to advanced analytics platforms

- To address these challenges, companies are focusing on modular deployments, cloud-based pricing models, AI automation, and enhanced cybersecurity features to accelerate global adoption of traffic analytics management systems

How is the Traffic Analytics Management Market Segmented?

The market is segmented on the basis of hardware, services, and system.

- By Hardware

On the basis of hardware, the traffic analytics management market is segmented into Display Boards, Sensors, Surveillance Cameras, and Others. The Surveillance Cameras segment dominated the market with an estimated 41.6% share in 2025, driven by their widespread deployment across highways, urban intersections, toll plazas, and smart city infrastructure. High-resolution video cameras combined with AI-based computer vision enable real-time vehicle detection, traffic density analysis, incident monitoring, and violation detection, making them a core component of traffic analytics systems. Increasing adoption of ANPR, thermal cameras, and edge-enabled video analytics further strengthens this segment’s dominance.

The Sensors segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising deployment of radar sensors, LiDAR, inductive loops, and IoT-based traffic sensors. Growing demand for accurate, real-time traffic flow data, predictive analytics, and integration with adaptive traffic control systems is accelerating sensor adoption across advanced traffic management networks.

- By Services

On the basis of services, the traffic analytics management market is segmented into Consulting, Deployment and Integration, and Support and Maintenance. The Deployment and Integration segment dominated the market with a 44.2% share in 2025, as traffic analytics solutions require complex system integration involving hardware installation, software configuration, data platform integration, and interoperability with legacy traffic management systems. Large-scale smart city projects and intelligent transportation system (ITS) deployments significantly drive demand for end-to-end deployment services.

The Support and Maintenance segment is projected to register the fastest CAGR from 2026 to 2033, fueled by the growing installed base of traffic analytics platforms. Continuous software updates, AI model optimization, cybersecurity management, and system performance monitoring are becoming critical to ensure uninterrupted operations. Increasing reliance on cloud-based platforms and subscription-driven service models further supports long-term growth of support and maintenance services.

- By System

On the basis of system, the traffic analytics management market is segmented into Urban Traffic Management and Control, Adaptive Traffic Control System, Journey Time Measurement System, Predictive Traffic Modelling System, Incident Detection and Location System, and Dynamic Traffic Management System. The Urban Traffic Management and Control segment dominated the market with a 38.9% share in 2025, driven by large-scale deployment across metropolitan areas to manage congestion, optimize signal timing, and enhance road safety. Government investments in smart city initiatives and centralized traffic control centers continue to support this segment’s leadership.

The Predictive Traffic Modelling System segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of AI, machine learning, and big data analytics. Growing need for traffic forecasting, congestion prediction, and proactive mobility planning is accelerating demand for predictive analytics systems across urban and regional transportation networks.

Which Region Holds the Largest Share of the Traffic Analytics Management Market?

- North America dominated the traffic analytics management market with a 36.95% revenue share in 2025, driven by widespread adoption of intelligent transportation systems (ITS), smart city programs, and advanced traffic monitoring infrastructure across the U.S. and Canada. High deployment of AI-enabled traffic cameras, real-time data analytics platforms, and cloud-based traffic management solutions continues to fuel demand across urban road networks, highways, and transit systems

- Leading companies in North America are introducing AI-powered traffic analytics platforms with real-time incident detection, predictive congestion modelling, and integrated control dashboards, strengthening the region’s technological leadership. Continuous investments in connected mobility, autonomous vehicle infrastructure, and digital traffic optimization support long-term market expansion

- Strong government funding, high technology adoption rates, and mature smart mobility ecosystems further reinforce North America’s dominance in the global market

U.S. Traffic Analytics Management Market Insight

The U.S. is the largest contributor in North America, supported by extensive deployment of smart traffic signals, adaptive traffic control systems, and AI-driven surveillance across major cities. Rising investments in smart highways, congestion management, and road safety analytics drive demand for advanced traffic analytics platforms. Presence of major technology providers, strong public–private partnerships, and large-scale smart city initiatives continue to accelerate market growth.

Canada Traffic Analytics Management Market Insight

Canada contributes significantly to regional growth, driven by increasing adoption of smart transportation solutions, urban mobility analytics, and data-driven traffic planning initiatives. Municipal authorities increasingly deploy traffic analytics platforms for congestion reduction, journey time optimization, and accident prevention. Government-backed smart city programs, skilled technology workforce, and growing focus on sustainable mobility support steady market expansion.

Asia-Pacific Traffic Analytics Management Market

Asia-Pacific is projected to register the fastest CAGR of 10.9% from 2026 to 2033, driven by rapid urbanization, expanding road infrastructure, and increasing investments in smart city and intelligent traffic management projects across China, Japan, India, South Korea, and Southeast Asia. Rising vehicle density and congestion challenges are accelerating adoption of real-time traffic analytics solutions. Growing deployment of AI-enabled cameras, IoT sensors, and cloud-based traffic platforms supports demand for predictive traffic modelling, incident detection, and adaptive signal control systems. Expansion of digital infrastructure, smart mobility initiatives, and government-led urban transport modernization continues to boost regional market growth

China Traffic Analytics Management Market Insight

China is the largest contributor to Asia-Pacific, supported by massive smart city investments, extensive urban road networks, and strong government backing for intelligent transportation systems. Rapid deployment of AI-based traffic surveillance, predictive analytics, and centralized traffic command centers drives strong market adoption across major metropolitan regions.

Japan Traffic Analytics Management Market Insight

Japan shows steady growth driven by advanced transportation infrastructure, high adoption of smart traffic control systems, and strong focus on traffic safety and efficiency. Integration of real-time analytics, adaptive signal control, and predictive congestion management supports sustained market development.

India Traffic Analytics Management Market Insight

India is emerging as a high-growth market, supported by rising smart city projects, increasing urban congestion, and government initiatives focused on intelligent traffic monitoring. Growing deployment of traffic cameras, command-and-control centers, and AI-based analytics accelerates market penetration across metropolitan and tier-1 cities.

South Korea Traffic Analytics Management Market Insight

South Korea contributes significantly due to strong adoption of smart mobility solutions, AI-powered traffic monitoring, and connected infrastructure. Advanced digital ecosystems, high technology readiness, and continuous innovation in intelligent transportation systems support sustained market growth.

Which are the Top Companies in Traffic Analytics Management Market?

The traffic analytics management industry is primarily led by well-established companies, including:

- Cisco (U.S.)

- SWARCO (Austria)

- Siemens (Germany)

- IBM Corporation (U.S.)

- Kapsch Aktiengesellschaft (Austria)

- LG CNS (South Korea)

- Indra Sistemas, S.A. (Spain)

- Cubic Corporation (U.S.)

- Accenture (Ireland)

- Iteris, Inc. (U.S.)

- Cellint (Israel)

- Metro Infrasys Pvt. Ltd. (India)

- Global Traffic Technologies, LLC. (U.S.)

- JENOPTIK AG (Germany)

- FLIR Systems, Inc. (U.S.)

- Esri (U.S.)

- PTV Planung Transport Verkehr AG (Germany)

- IntelliVision (U.S.)

- TransCore (U.S.)

- imtac (India)

What are the Recent Developments in Global Traffic Analytics Management Market?

- In September 2024, Teledyne Technologies launched the TrafiBot Dual AI multispectral camera system, an advanced closed-circuit traffic monitoring solution designed to enhance bridge and tunnel safety by using artificial intelligence to assess real-time traffic conditions and detect risks such as hidden obstacles and sudden vehicle fires, strengthening proactive traffic safety and infrastructure protection capabilities

- In July 2024, SWARCO acquired Ireland-based Elmore Group, a provider of LED traffic signals and traffic infrastructure maintenance services, expanding SWARCO’s footprint in the Irish intelligent transportation systems market and enabling the delivery of more comprehensive turnkey traffic solutions to key municipal clients

- In February 2024, Yunex Traffic Italy entered a strategic partnership with Municipia SpA, part of the Engineering Group, through a Memorandum of Understanding to accelerate digital mobility and traffic management initiatives across Italian cities, supporting CO₂ reduction goals and improving overall urban traffic efficiency

- In July 2023, Mundys and ACS Group signed a strategic collaboration agreement to reinforce Abertis’ global leadership in transport infrastructure concessions, supporting long-term investment plans aimed at expanding asset portfolios and driving sustainable growth and value creation

- In July 2022, TomTom partnered with the Dutch Ministry of Infrastructure and Water Management in a multi-year road safety initiative, collaborating with ANWB, Be-Mobile, INRIX, Hyundai, and Kia to provide reliable traffic intelligence to Dutch drivers, significantly improving real-time traffic awareness and national road safety outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.