Global Trailer Telematics Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.46 Billion

2024

2032

USD

1.30 Billion

USD

2.46 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 2.46 Billion | |

|

|

|

|

Trailer Telematics Market Size

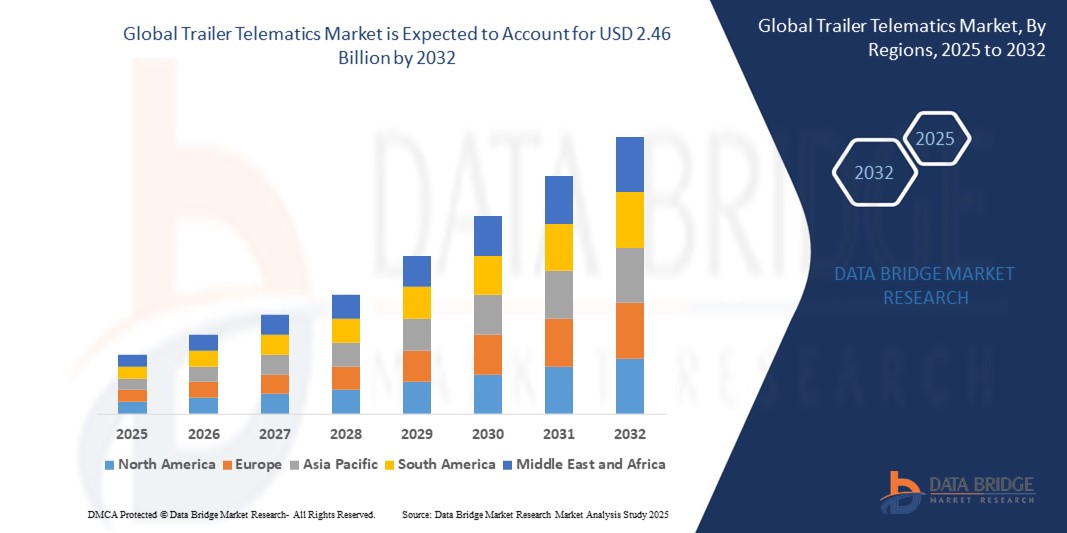

- The global trailer telematics market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 2.46 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is driven by the increasing adoption of advanced technologies such as IoT, GPS, and AI in fleet management, coupled with stringent regulatory requirements for safety, emissions, and compliance in the transportation sector

- Rising demand for real-time tracking, operational efficiency, and cost reduction in logistics and transportation is positioning trailer telematics as a critical solution for modern fleet management

Trailer Telematics Market Analysis

- Trailer telematics systems integrate telecommunications and vehicle technologies to enable real-time monitoring, diagnostics, and management of trailers, enhancing fleet visibility, safety, and operational efficiency in industries such as logistics, transportation, and construction

- The growing demand for trailer telematics is fueled by the need for optimized fleet operations, reduced fuel consumption, predictive maintenance, and compliance with regulations such as the Electronic Logging Device (ELD) mandate in the U.S

- North America dominated the trailer telematics market with a revenue share of approximately 37.8% in 2024, driven by a robust transportation and logistics sector, stringent safety regulations, and the presence of key market players. The U.S. leads due to rapid adoption of connected vehicle technologies and fleet management solutions

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing logistics demands, and government initiatives promoting smart transportation infrastructure in countries such as China and India

- The semi-trailer segment dominates the largest market revenue share of 56.12% in 2024, driven by its widespread use in the transportation industry and suitability for transporting large amounts of cargo across various sectors

Report Scope and Trailer Telematics Market Segmentation

|

Attributes |

Trailer Telematics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Trailer Telematics Market Trends

“Rising Preference for Advanced Telematics Solutions”

- Advanced telematics solutions are gaining traction due to their ability to provide real-time tracking, diagnostics, and predictive maintenance, enhancing fleet efficiency and safety

- These systems maintain connectivity for GPS, IoT, and cellular networks, ensuring seamless data transmission for fleet management, such as older systems with limited integration

- In regions with high logistics demands, such as the U.S. and Europe, advanced telematics are favored for optimizing operations and reducing fuel costs

- Fleet operators, particularly in the e-commerce sector, seek advanced telematics for real-time shipment tracking and improved delivery efficiency

- For instance, companies such as Samsara offer next-generation smart trailer features that provide maintenance insights and real-time visibility into safety systems, such as anti-lock braking systems (ABS)

- Dealerships and OEMs are increasingly integrating telematics packages into new trailers to meet the demand for connected solutions

Trailer Telematics Market Dynamics

Driver

“Rising Demand for Enhanced Vehicle Tracking and Safety”

- Growing awareness of the need for operational efficiency and regulatory compliance is driving demand for trailer telematics with advanced tracking and safety features

- Telematics systems help monitor trailer location, cargo conditions, and driver behavior, reducing operational costs and improving safety outcomes

- These systems contribute to safer fleet operations by providing alerts for maintenance, compliance reporting, and real-time diagnostics, particularly in regions with stringent regulations such as North America and Europe

- Trailer manufacturers are responding by offering factory-installed telematics or partnering with providers such as Geotab and Omnitracs to enhance fleet management

- For instance, Renault collaborates with Geotab to integrate telematics into its MyGeotab platform for improved fleet efficiency

- The rise of electric and refrigerated trailers, which require precise monitoring for energy efficiency and cargo preservation, is further fueling the adoption of high-performance telematics systems to optimize operations and ensure compliance

Restraint/Challenge

“Regulatory Restrictions on Data Privacy and Security”

- Regulatory restrictions on data privacy, such as GDPR in Europe, limit how telematics data can be collected, stored, and shared, impacting market growth and system design

- Varying global data protection laws complicate standardization efforts for telematics providers operating international

- Excessive data collection is often viewed as a privacy risk, raising concerns among fleet operators and end-users about potential cyberattacks or data breaches

- For instance, in the U.S., compliance with data security standards is critical, as telematics systems collect sensitive information such as driver behavior and cargo details

- These strict regulations may discourage some fleet operators from adopting advanced telematics solutions and could result in penalties for non-compliance, limiting market expansion

Trailer Telematics Market Scope

The market is segmented on the basis of type, communication protocol, application, provider type, and end-use industry.

- By Type

On the basis of type, the global trailer telematics market is segmented into full trailer and semi-trailer. The semi-trailer segment dominates the largest market revenue share of 56.12% in 2024, driven by its widespread use in the transportation industry and suitability for transporting large amounts of cargo across various sectors. Semi-trailers are favored for their versatility and compatibility with advanced telematics systems, enhancing operational efficiency and safety.

The full trailer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the expansion of the logistics industry and increasing demand for efficient cargo transport solutions. Full trailers offer enhanced stability and are increasingly integrated with telematics for real-time monitoring and management, making them appealing for long-haul transportation.

- By Communication Protocol

On the basis of communication protocol, the global trailer telematics market is segmented into cellular, satellite, wi-fi, bluetooth, and others. The cellular segment held the largest market revenue share in 2024, driven by its extensive coverage, scalability, and ability to provide real-time data transmission. Cellular networks are favored for their reliability in urban and remote areas, making them a popular choice for fleet operators requiring consistent connectivity.

The satellite segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its ability to provide connectivity in remote areas where cellular networks are unavailable. Satellite-enabled telematics are particularly valuable for long-haul transportation and industries operating in geographically challenging regions, ensuring uninterrupted data transmission.

- By Application

On the basis of application, the global trailer telematics market is segmented into fleet tracking and monitoring, cold chain monitoring, weight utilization, performance management, predictive and preventive maintenance, and others. The fleet tracking and monitoring segment held the largest market revenue share in 2024, driven by the critical need for real-time visibility and route optimization in logistics operations. This segment is widely adopted for improving operational efficiency, reducing fuel costs, and enhancing security.

The predictive and preventive maintenance segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by advancements in IoT and data analytics. These solutions enable fleet operators to predict maintenance needs, minimize downtime, and reduce operational costs, making them increasingly essential for large-scale logistics and transportation businesses.

- By Provider Type

On the basis of provider type, the global trailer telematics market is segmented into OEM and aftermarket. The aftermarket segment held the largest market revenue share of 69.4% in 2024, driven by the flexibility and cost-effectiveness of retrofitting existing trailers with telematics solutions. Aftermarket systems are popular for their ability to cater to diverse trailer types and provide customizable solutions for fleet operators.

The OEM segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing integration of advanced telematics systems during trailer manufacturing. OEM-fitted systems offer high reliability, seamless integration with vehicle systems, and enhanced data capabilities, making them a preferred choice for new trailers in the logistics and transportation sectors.

- By End-Use Industry

On the basis of end-use industry, the global trailer telematics market is segmented into logistics and transportation, construction, retail, and others. The logistics and transportation segment accounted for the largest market revenue share in 2024, driven by the rising demand for efficient fleet management, real-time tracking, and regulatory compliance. The growth in e-commerce and global supply chains further fuels the adoption of telematics in this sector.

The construction segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the need for equipment tracking, operational efficiency, and safety in construction site logistics. Telematics solutions provide real-time data on trailer location, utilization, and maintenance, enabling construction companies to optimize operations and reduce costs.

Trailer Telematics Market Regional Analysis

- North America dominated the trailer telematics market with a revenue share of approximately 37.8% in 2024, driven by a robust transportation and logistics sector, stringent safety regulations, and the presence of key market players. The U.S. leads due to rapid adoption of connected vehicle technologies and fleet management solutions

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing logistics demands, and government initiatives promoting smart transportation infrastructure in countries such as China and India

U.S. Trailer Telematics Market Insight

The U.S. trailer telematics market share of 80% of the North American market revenue in 2024, driven by the widespread adoption of telematics for real-time tracking, predictive maintenance, and compliance with federal regulations. The integration of advanced technologies such as AI and IoT in fleet management systems enhances operational efficiency and safety. The growing demand for aftermarket telematics solutions, such as plug-and-play devices for dry van trailers, supports market expansion, particularly among fleet operators seeking cost-effective retrofitting options.

Europe Trailer Telematics Market Insight

The European trailer telematics market is anticipated to grow at a substantial CAGR during the forecast period, driven by stringent safety and compliance regulations, such as the EU’s tachograph rules and EN12830 standards for cold chain monitoring. The region’s focus on sustainability and real-time data analytics for fleet optimization supports the adoption of telematics in countries such as Germany and the U.K. The increasing integration of telematics in refrigerated and dry van trailers, particularly for logistics and food safety compliance, is a key growth driver.

U.K. Trailer Telematics Market Insight

The U.K. trailer telematics market is expected to grow at a significant CAGR during the forecast period, driven by the increasing demand for efficient fleet management and compliance with stringent EU-derived regulations, such as tachograph rules and safety standards. The U.K.’s robust logistics and e-commerce sectors, combined with the adoption of IoT-enabled technologies, are fueling the uptake of telematics for real-time tracking, fuel optimization, and predictive maintenance. The growing emphasis on sustainability and reducing carbon emissions in transportation further supports market expansion, particularly for refrigerated and dry van trailers used in retail and food supply chains.

Germany Trailer Telematics Market Insight

The Germany trailer telematics market is poised for significant growth, driven by the country’s advanced logistics sector and adherence to stringent EU regulations. In 2024, partnerships such as Geotab’s collaboration with a leading German logistics provider for refrigerated trailer monitoring highlighted the demand for precise temperature control and compliance with food safety standards. The emphasis on predictive maintenance and real-time tracking in Germany’s commercial vehicle fleet supports the adoption of advanced telematics systems, particularly in OEM-integrated solutions.

Asia-Pacific Trailer Telematics Market Insight

The Asia-Pacific trailer telematics market is projected to grow at the fastest CAGR of 11.8% from 2024 to 2030, reaching USD 379.2 million by 2030. Rapid urbanization, increasing logistics demand, and government initiatives promoting digitalization in countries such as China, Japan, and India drive market growth. The region’s emergence as a manufacturing hub for telematics components enhances affordability and accessibility, boosting adoption in both commercial and industrial applications.

Japan Trailer Telematics Market Insight

The Japan trailer telematics market is gaining traction due to the country’s high-tech infrastructure and growing demand for efficient logistics solutions. The adoption of telematics is driven by the need for real-time tracking and predictive maintenance in Japan’s advanced transportation sector. Integration with IoT devices and smart logistics systems, coupled with the country’s focus on technological innovation, supports market growth, particularly in urban logistics and cold chain applications.

China Trailer Telematics Market Insight

The China trailer telematics market held the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, a growing middle class, and strong domestic manufacturing of telematics systems. The push towards smart cities and the increasing adoption of IoT technologies in logistics and transportation fuel market expansion. Affordable aftermarket solutions and the integration of telematics in semi-trailers for long-haul logistics are key factors propelling growth in China.

Trailer Telematics Market Share

The trailer telematics industry is primarily led by well-established companies, including:

- CalAmp (US)

- Geotab Inc. (Canada)

- Verizon (US)

- Samsara Inc. (US)

- Clarience Technologies (US)

- The Descartes Systems Group Inc. (Canada)

- Qualcomm Technologies Inc. (US)

- Omnitracs (US)

- Wabco Solution Centre (Germany)

- Novacom (Netherlands)

- Solera Holdings (US)

- FleetPulse (US)

- KRONE Trailer (Germany)

- IDEM Technologies (UK)

- Microlise Limited (UK)

Latest Developments in Global Trailer Telematics Market

- In February 2025, Avery Dennison launched the Encore Series, a new automotive window film portfolio designed to enhance heat rejection, glare reduction, and UV protection. The lineup includes Encore, Encore Supreme, and Encore Supreme IR, each offering advanced nanoceramic technology for superior clarity and durability. The films block over 99% of harmful UV rays, ensuring long-lasting color stability while improving privacy and aesthetics. This innovation strengthens Avery Dennison’s presence in the global automotive tinting market, particularly in high solar exposure regions

- In February 2025, Luminous introduced its Carbon Window Film through Al-Rabiya Auto Accessories, expanding its presence in the MENA region. This advanced carbon-infused film offers high durability, superior heat rejection, and over 99% UV protection, catering to hot climate conditions. Such as traditional dyed films, it resists fading and discoloration, ensuring long-lasting performance. The film enhances privacy, glare reduction, and energy efficiency, making it a preferred choice for automotive tinting. The launch strengthens Luminous’s market share in the Middle East and Africa, reinforcing its commitment to premium car care solutions

- In April 2024, Microlise Limited introduced Proximity Beacons, a low-cost telematics solution designed for tracking unpowered trailers and safeguarding high-value assets during transit. These Bluetooth-enabled beacons create an interconnected mesh network, enhancing visibility and security for fleet operators. The innovation aims to boost efficiency, prevent theft, and improve asset utilization across logistics operations. This launch aligns with Microlise’s commitment to continuous development, reinforcing its role in advanced fleet management solutions.

- In January 2024, Continental AG and Google Cloud unveiled a generative AI voice assistant at CES 2024, integrated into Continental’s Smart Cockpit HPC. This innovation enables natural, intuitive interactions, enhancing conversational navigation, driver personalization, and in-car control. The system improves connectivity and convenience, offering a seamless, intelligent interface for modern vehicles

- In October 2023, Clarience Technologies introduced an enhanced Road Ready Light Out Detection System (LODS) at the American Trucking Associations Management Conference & Exhibition. This telematics-enabled solution monitors trailer lighting systems, alerting fleets to light outages for improved safety and compliance. The latest in-line configuration expands LODS coverage to flatbed, tank, and chassis/intermodal trailers, ensuring visibility across all trailer types. The system integrates with Road Ready telematics, reinforcing Clarience’s commitment to fleet safety.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.