Global Transient Ischemic Attack Tia Market

Market Size in USD Million

CAGR :

%

USD

537.71 Million

USD

831.50 Million

2025

2033

USD

537.71 Million

USD

831.50 Million

2025

2033

| 2026 –2033 | |

| USD 537.71 Million | |

| USD 831.50 Million | |

|

|

|

|

Transient Ischemic Attack (TIA) Market Size

- The global Transient Ischemic Attack (TIA) market size was valued at USD 537.71 million in 2025 and is expected to reach USD 831.50 million by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by rising prevalence of cardiovascular and vascular risk factors increasing incidence of stroke/TIA events globally, and growing demand for early diagnosis and preventive interventions

- Furthermore, technological advancement in neuroimaging (MRI, CT‑angiography, carotid ultrasound), wider adoption of diagnostic services, and increasing awareness of TIA as a serious warning sign for full‑blown stroke are driving the uptake of diagnostic and therapeutic solutions worldwide

Transient Ischemic Attack (TIA) Market Analysis

- Transient Ischemic Attack, brief episodes of neurological dysfunction caused by temporary disruption of cerebral blood flow, is becoming increasingly important in preventive neurology and stroke management due to its critical role in early diagnosis, timely intervention, and long-term patient monitoring

- The escalating demand for Transient Ischemic Attack management solutions is primarily fueled by the growing prevalence of cardiovascular risk factors such as hypertension, atherosclerosis, and diabetes, an aging global population, and increasing awareness of TIA as a warning sign for stroke, prompting more frequent screenings and preventive treatments

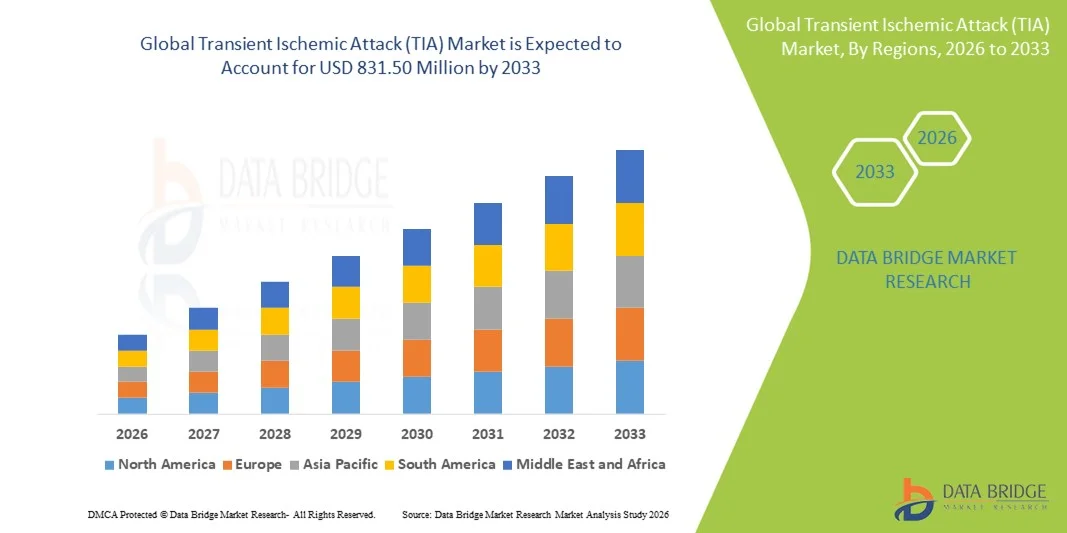

- North America dominated the Transient Ischemic Attack market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, widespread adoption of neuroimaging diagnostics, strong preventive care protocols, and high awareness among patients and healthcare providers, with the U.S. experiencing substantial growth in TIA diagnosis and management programs, particularly in hospitals and clinics implementing early detection strategies

- Asia-Pacific is expected to be the fastest-growing region in the Transient Ischemic Attack market during the forecast period due to rising incidence of cardiovascular diseases, expanding healthcare access, increasing diagnostic capabilities, and growing public awareness of stroke risks in countries such as China and India

- Anti-platelet drugs segment dominated the Transient Ischemic Attack market with a market share of 42.5% in 2025, driven by their critical role in preventing recurrent TIA events and widespread adoption as the first-line preventive therapy

Report Scope and Transient Ischemic Attack (TIA) Market Segmentation

|

Attributes |

Transient Ischemic Attack (TIA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Transient Ischemic Attack (TIA) Market Trends

Enhanced Preventive Care Through AI-Enabled Diagnostics

- A significant and accelerating trend in the global Transient Ischemic Attack market is the integration of artificial intelligence (AI) with diagnostic imaging and wearable monitoring devices, enabling earlier detection and more personalized risk assessment

- For instance, AI-powered MRI analysis tools can identify subtle cerebrovascular abnormalities, allowing clinicians to predict potential TIA events before symptoms fully manifest. Similarly, smart wearable devices can monitor blood pressure and heart rhythm, providing real-time alerts for high-risk patients

- AI integration in TIA diagnostics enables predictive risk modeling, personalized treatment recommendations, and improved patient monitoring. For instance, some AI-enabled platforms analyze patient history and imaging data to optimize antiplatelet therapy and alert physicians if abnormal patterns are detected. Furthermore, wearable devices enhance continuous monitoring, allowing early intervention without hospital visits

- The seamless integration of AI diagnostics with hospital information systems and telemedicine platforms facilitates centralized patient management. Through a single interface, healthcare providers can monitor multiple patients’ TIA risk factors, manage preventive therapies, and coordinate follow-up care efficiently

- This trend towards more intelligent, predictive, and interconnected diagnostic systems is fundamentally reshaping expectations for TIA management. Consequently, companies such as Viz.ai and Brainomix are developing AI-enabled platforms that integrate imaging analysis with clinical workflow to improve early detection and preventive outcomes

- The demand for TIA diagnostics and preventive monitoring solutions that leverage AI and wearable technology is growing rapidly across hospitals and clinics, as clinicians and patients increasingly prioritize early detection and personalized preventive care

- For instance, integration of cloud-based patient data platforms allows neurologists to track TIA recurrence trends and adjust treatments remotely, enhancing patient safety and operational efficiency

- Remote patient engagement platforms that combine AI alerts with mobile health apps are enabling continuous monitoring and education, further supporting early detection and patient adherence to preventive therapy

Transient Ischemic Attack (TIA) Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Risks and Preventive Care Focus

- The increasing prevalence of cardiovascular risk factors such as hypertension, diabetes, and atherosclerosis, coupled with rising awareness of TIA as a warning sign for stroke, is a significant driver of market growth

- For instance, in March 2025, Viz.ai launched an AI-assisted TIA detection platform that integrates hospital imaging data with predictive risk scoring, enhancing early intervention and preventive care. Such innovations by leading companies are expected to drive market adoption during the forecast period

- As healthcare providers and patients recognize the importance of early detection and preventive treatment, TIA management solutions such as advanced imaging, antiplatelet therapy, and remote monitoring are increasingly preferred over reactive stroke intervention

- Furthermore, growing investments in preventive neurology programs, telemedicine, and AI-based patient monitoring are making TIA diagnostics and management an essential component of cardiovascular care

- Improved patient convenience through remote monitoring, predictive alerts, and integration with hospital management systems, combined with user-friendly AI diagnostics, is propelling adoption in both hospitals and outpatient clinics

- For instance, government and private initiatives to raise awareness about stroke and TIA risks are increasing patient participation in preventive care programs, driving the demand for early diagnostics and therapy

- Integration of wearable health devices with hospital networks enables real-time patient monitoring and predictive alerts, supporting clinicians in timely intervention and enhancing adoption of TIA management solutions

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of advanced AI-enabled TIA diagnostics, imaging systems, and continuous monitoring devices poses a significant challenge for widespread adoption, particularly in emerging markets

- For instance, smaller clinics and hospitals may hesitate to implement AI imaging platforms due to upfront capital expenditure, limiting penetration in price-sensitive regions

- Addressing these cost barriers through scalable solutions, subscription-based software models, and insurance coverage is crucial to expand adoption. Companies such as Brainomix emphasize flexible pricing and cloud-based platforms to reduce upfront investment while ensuring compliance with healthcare regulations. In addition, navigating stringent regulatory approvals for medical AI devices and diagnostic tools can delay product launches and market entry

- While costs are gradually decreasing, the perceived premium for AI-driven diagnostics and wearable monitoring can still hinder adoption among budget-conscious healthcare providers and patients, especially where basic imaging and standard antiplatelet therapy are considered sufficient

- Overcoming these challenges through enhanced cost-effectiveness, regulatory support, and awareness programs on the benefits of early detection and continuous monitoring will be vital for sustained growth of the Transient Ischemic Attack market

- For instance, lack of standardized protocols across hospitals for AI-assisted TIA diagnosis may slow adoption, as institutions await regulatory clarity and clinical validation

- Variability in insurance reimbursement policies for advanced TIA diagnostics and remote monitoring devices may limit access for certain patient groups, constraining overall market penetration

Transient Ischemic Attack (TIA) Market Scope

The market is segmented on the basis of treatment, diagnosis, dosage, route of administration, symptoms, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Transient Ischemic Attack market is segmented into anti-platelet drugs, anticoagulants, surgery, angioplasty, and others. The anti-platelet drugs segment dominated the market with the largest revenue share of 42.5% in 2025, driven by its established role as the first-line preventive therapy to reduce recurrent TIA and stroke risk. Physicians widely prescribe anti-platelets due to their proven efficacy in minimizing platelet aggregation and thrombus formation. Hospitals and clinics favor anti-platelets for long-term outpatient management because of their favorable safety profile and ease of administration. Patient awareness campaigns and guideline endorsements by neurological associations further strengthen the segment’s dominance. Growing research into combination therapies also reinforces its use in high-risk populations.

The anticoagulants segment is anticipated to witness the fastest growth rate of 11.2% CAGR from 2026 to 2033, fueled by increasing adoption among high-risk TIA patients with atrial fibrillation or cardiac conditions. Novel oral anticoagulants (NOACs) with fewer monitoring requirements are driving adoption. Hospitals prefer anticoagulants for patients where anti-platelet therapy alone is insufficient. The segment benefits from expanding insurance coverage and improved physician confidence. Ongoing clinical trials and better safety profiles of new anticoagulants are further encouraging uptake. Telemedicine integration for remote monitoring of anticoagulant therapy is also boosting growth.

- By Diagnosis

On the basis of diagnosis, the market is segmented into carotid ultrasonography, MRI, CT scan, echocardiography, and others. The MRI segment dominated the market in 2025, owing to its high sensitivity and accuracy in detecting cerebral ischemic lesions associated with TIA. MRI allows detailed imaging without radiation exposure, making it suitable for repeated monitoring. Hospitals increasingly rely on MRI for early detection, risk stratification, and treatment planning. Technological enhancements such as AI-assisted interpretation and faster protocols further drive adoption. Integration with telemedicine enables remote diagnosis and patient management. Its ability to detect subtle infarcts ensures clinical confidence and drives widespread adoption.

The carotid ultrasonography segment is expected to witness the fastest growth from 2026 to 2033, driven by its non-invasive nature, affordability, and availability in outpatient and community settings. It is particularly effective in identifying carotid artery stenosis, a major TIA risk factor. Portable and point-of-care devices expand accessibility for early screening. Increasing awareness of preventive care and risk stratification programs supports growth. Clinicians value its quick results for timely intervention. Integration with telehealth platforms enhances patient monitoring.

- By Dosage

On the basis of dosage, the market is segmented into tablet, injection, and others. The tablet segment dominated the market in 2025 due to ease of oral administration for long-term preventive therapy. Tablets are preferred for anti-platelet and oral anticoagulant medications. High patient compliance and convenience support their dominance. Widespread availability and cost-effectiveness make tablets the preferred choice in hospitals and clinics. Tablets reduce hospital dependency and enable home-based therapy. Clinical guidelines favor tablets for routine TIA management.

The injection segment is anticipated to witness the fastest growth from 2026 to 2033, driven by acute care and emergency interventions. Injectable anticoagulants and thrombolytic therapies are crucial for immediate TIA management in hospitals. Adoption increases with expanding hospital infrastructure and emergency care protocols. IV formulations are preferred for patients unable to take oral medications. Growth is supported by new formulations with improved safety and efficacy. Hospitals increasingly rely on injection therapy for rapid intervention in high-risk patients.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and others. The oral segment dominated the market in 2025 due to convenience, patient compliance, and suitability for long-term therapy. Oral medications are compatible with anti-platelets and anticoagulants, forming the backbone of TIA preventive therapy. Hospitals prefer oral administration for outpatient care. High insurance coverage supports segment growth. Patients favor oral therapy for comfort and self-administration. Clinical protocols emphasize oral medications for standard TIA management.

The intravenous segment is expected to witness the fastest growth from 2026 to 2033, driven by acute care requirements where rapid therapeutic action is needed. IV administration is critical for thrombolytic therapy and anticoagulant loading doses. Hospitals increasingly adopt IV solutions for high-risk TIA patients. Growth is supported by improved emergency protocols and hospital readiness. Injectable therapies provide faster onset and controlled dosing. Telemedicine and remote monitoring platforms increasingly integrate IV treatment tracking.

- By Symptoms

On the basis of symptoms, the market is segmented into tingling, dysphasia, weakness, dysarthria, confusion, vision changes, balance issues, headache, dizziness, abnormal sense of taste and smell, and others. The weakness segment dominated the market in 2025 as motor deficits are the most common symptom prompting urgent hospital visits. Weakness triggers rapid imaging and preventive therapy initiation. Hospitals prioritize such patients for early intervention. Neurologists use standardized scales to assess severity. Patient awareness campaigns highlight weakness as a red flag. Early intervention for weakness ensures better outcomes and drives market adoption.

The dizziness segment is expected to witness the fastest growth from 2026 to 2033, driven by increased recognition of vertigo and balance issues as early TIA indicators. Outpatient clinics and telemedicine platforms monitor dizziness for preventive screening. Wearable devices track dizziness episodes for timely intervention. Awareness campaigns for subtle TIA symptoms support growth. Dizziness monitoring enables proactive treatment to prevent recurrent events. Integration with mobile health apps enhances patient engagement and therapy adherence.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The hospital segment dominated the market in 2025, due to access to advanced diagnostic tools, specialist neurologists, and emergency care infrastructure. Hospitals provide immediate intervention and continuous monitoring, enhancing patient outcomes. Integration of AI-assisted diagnostics further strengthens hospital adoption. Hospitals also serve as referral centers from clinics and community centers. Higher patient trust and insurance coverage support dominance. Clinical research and guideline-based protocols favor hospital settings for TIA management.

The clinic segment is expected to witness the fastest growth from 2026 to 2033, driven by preventive care initiatives and telemedicine adoption. Clinics provide screening, follow-up care, and long-term management for moderate-risk patients. Expansion in urban and semi-urban areas increases accessibility. AI-enabled point-of-care diagnostics enhance adoption. Outpatient clinics reduce hospital dependency and provide cost-effective care. Integration with wearable monitoring devices supports remote patient management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2025, due to direct access to high-risk patients and integration with hospital protocols. Hospital pharmacies ensure immediate availability of anti-platelets, anticoagulants, and emergency medications. Physicians prefer hospital pharmacies for controlled dispensing. Counseling and monitoring of patients enhance compliance. Hospitals maintain regulatory standards and patient trust. Integration with hospital supply chains supports consistent availability of medications.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, fueled by growing e-pharmacy adoption, convenient home delivery, and increasing patient preference for remote access. Online platforms expand access to preventive medications for TIA. Digital prescriptions and mobile app integration support growth. Patients benefit from doorstep delivery and subscription services. Telemedicine integration facilitates continuous therapy management. Online pharmacies improve accessibility in urban and semi-urban regions.

Transient Ischemic Attack (TIA) Market Regional Analysis

- North America dominated the Transient Ischemic Attack market with the largest revenue share of 39.8% in 2025, characterized by advanced healthcare infrastructure, widespread adoption of neuroimaging diagnostics, strong preventive care protocols, and high awareness among patients and healthcare providers

- Healthcare providers in the region prioritize early detection and preventive management, leveraging AI-assisted diagnostics, MRI, and carotid ultrasonography to minimize recurrent TIA and stroke risk

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced medical ecosystem, and government initiatives promoting preventive cardiovascular care, establishing hospitals and clinics as preferred points of care for TIA management in North America

U.S. Transient Ischemic Attack (TIA) Market Insight

The U.S. Transient Ischemic Attack market captured the largest revenue share of 40% in North America in 2025, fueled by advanced healthcare infrastructure, widespread adoption of neuroimaging diagnostics, and high awareness of TIA as a precursor to stroke. Hospitals and clinics are increasingly implementing AI-assisted MRI and carotid ultrasonography for early detection and risk stratification. Growing emphasis on preventive neurology programs and telemedicine platforms is driving patient engagement and adherence to preventive therapy. Furthermore, rising prevalence of cardiovascular risk factors such as hypertension, diabetes, and atrial fibrillation is increasing demand for TIA management solutions. The integration of wearable monitoring devices and mobile health applications further supports early diagnosis and continuous patient monitoring.

Europe Transient Ischemic Attack Market Insight

The Europe Transient Ischemic Attack market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong healthcare infrastructure, high awareness of stroke prevention, and stringent preventive care guidelines. Increasing urbanization, coupled with an aging population prone to cardiovascular conditions, is fostering demand for early TIA diagnosis and management. European hospitals are investing in AI-enabled imaging systems and telemedicine services for preventive care. In addition, government initiatives to improve cardiovascular health and patient education are further supporting market growth. The demand spans residential outpatient clinics, hospitals, and specialized neurology centers, ensuring comprehensive adoption across healthcare facilities.

U.K. Transient Ischemic Attack Market Insight

The U.K. Transient Ischemic Attack market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of stroke risk factors and growing patient awareness about early TIA management. Preventive care programs, coupled with advanced hospital diagnostics and neuroimaging facilities, encourage timely intervention. Moreover, national healthcare initiatives emphasizing cardiovascular health and risk factor management are boosting adoption of TIA preventive therapies. Clinics and hospitals increasingly employ AI-assisted imaging, wearable monitoring, and telemedicine platforms. The U.K.’s integration of digital health technologies and robust healthcare IT infrastructure is expected to further stimulate market growth.

Germany Transient Ischemic Attack Market Insight

The Germany Transient Ischemic Attack market is expected to expand at a considerable CAGR during the forecast period, fueled by technological advancements in neuroimaging, preventive care awareness, and well-established hospital networks. Germany’s focus on innovation in medical devices and AI-assisted diagnostic platforms promotes early TIA detection and continuous patient monitoring. The prevalence of cardiovascular diseases among an aging population drives demand for effective preventive therapies. Hospitals and clinics are increasingly integrating TIA management with telemedicine and remote monitoring systems. Patient emphasis on early diagnosis, safety, and adherence to therapy supports segment growth. Government health programs focusing on stroke prevention further strengthen market adoption.

Asia-Pacific Transient Ischemic Attack Market Insight

The Asia-Pacific Transient Ischemic Attack market is poised to grow at the fastest CAGR during 2026–2033, driven by rising incidence of cardiovascular diseases, expanding healthcare infrastructure, and increasing awareness of TIA as an early warning for stroke. Countries such as China, Japan, and India are witnessing significant adoption of preventive diagnostics, including AI-assisted imaging, wearable monitoring devices, and telemedicine services. Government initiatives promoting digital health, urbanization, and increasing disposable incomes are accelerating market penetration. Growing patient preference for early intervention, coupled with rising investments in healthcare facilities, supports adoption in both hospital and outpatient settings. The expansion of affordable diagnostic technologies and preventive medications is widening access across the region.

Japan Transient Ischemic Attack Market Insight

The Japan Transient Ischemic Attack market is gaining momentum due to the country’s technologically advanced healthcare system, aging population, and high prevalence of cardiovascular risk factors. Hospitals and clinics emphasize preventive care using AI-assisted MRI, carotid ultrasonography, and telemedicine platforms. Patients increasingly adopt continuous monitoring devices to track blood pressure, heart rhythm, and other TIA risk factors. Japan’s national programs for stroke prevention and digital health integration further fuel market growth. The demand for patient-friendly, accurate, and rapid diagnostics in both residential and hospital settings is increasing. Growing investments in research for AI-based predictive TIA tools are also contributing to market expansion.

India Transient Ischemic Attack Market Insight

The India Transient Ischemic Attack market accounted for the largest revenue share in Asia-Pacific in 2025, driven by increasing prevalence of cardiovascular diseases, urbanization, and rising healthcare awareness. Hospitals and clinics are adopting AI-assisted imaging, preventive therapies, and telemedicine platforms for early TIA diagnosis and management. The growing middle-class population and government initiatives promoting digital health and preventive care programs are further boosting market adoption. Affordable diagnostic solutions, combined with local manufacturing of medical devices, increase accessibility across urban and semi-urban regions. Rising awareness campaigns for TIA symptoms and the importance of early intervention are supporting patient engagement. Expansion of hospital networks and outpatient clinics enhances access to preventive therapies across the country.

Transient Ischemic Attack (TIA) Market Share

The Transient Ischemic Attack (TIA) industry is primarily led by well-established companies, including:

- Merck & Co., Inc., (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Services, Inc., (U.S.)

- Bayer AG (Germany)

- Sanofi (France)

- Boehringer Ingelheim International GmbH. (Germany)

- Abbott (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Stryker (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V., (Netherlands)

- Novartis AG (Switzerland)

- Eli Lilly and Company, (U.S.)

- Amgen Inc., (U.S.)

- Sun Pharmaceutical Industries Limited, (India)

- GE Healthcare (U.K.)

- Daiichi Sankyo Company, Limited (Japan)

- Bristol‑Myers Squibb Company (U.S.)

- Penumbra, Inc., (U.S.)

What are the Recent Developments in Global Transient Ischemic Attack (TIA) Market?

- In November 2025, a new study (the COMMIT study) demonstrated that aggressive early lowering of blood pressure (to < 130/80 mmHg) in the first days after TIA/minor stroke significantly reduced risk of recurrent ischemic stroke and intracerebral hemorrhage over a 5‑year follow-up period. This suggests that early, intensive BP management post‑TIA can materially improve long‑term outcomes, shifting some focus from just antiplatelets/ anticoagulants to better vascular risk control immediately after TIA

- In April 2025, a global meta‑analysis led by Hotchkiss Brain Institute (University of Calgary) found that patients who experienced a TIA or minor stroke remain at a high risk of a full stroke for up to 10 years about 1 in 5 will suffer a subsequent stroke within a decade. This challenges the common assumption that risk falls sharply after the first year, underscoring the need for long‑term preventive care beyond the acute period

- In March 2025, a retrospective observational study from a hospital in Romania revealed that among patients clinically diagnosed with TIA, a significant proportion previously thought to be “pure TIA” actually showed ischemic lesions on diffusion‑weighted imaging (DWI) MRI. This finding reinforces the evolving medical definition of TIA (based more on imaging than just symptoms) and highlights the importance of brain MRI in accurately distinguishing TIA from minor ischemic stroke, affecting diagnosis, treatment, and prognosis

- In February 2025, a study from University of Alabama at Birmingham (UAB) reported that first‑time TIA patients may suffer long‑term cognitive decline comparable to survivors of full stroke. This suggests that even “transient” cerebrovascular events can have lasting neurocognitive consequences prompting experts to recommend routine cognitive screening after TIA, not just in stroke cases

- In November 2024, results from the BRAIN-AF trial (presented at the American Heart Association Scientific Sessions) showed that in younger, low-risk patients with atrial fibrillation (AFib), routine use of the anticoagulant Rivaroxaban did not reduce the incidence of TIA, stroke or cognitive decline. This challenges prevailing assumptions about blanket anticoagulation in AFib and may influence future guidelines for TIA/ stroke prevention in low-risk subgroups

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.