Global Transparent Ceramics Market

Market Size in USD Million

CAGR :

%

USD

471.22 Million

USD

1,487.20 Million

2024

2032

USD

471.22 Million

USD

1,487.20 Million

2024

2032

| 2025 –2032 | |

| USD 471.22 Million | |

| USD 1,487.20 Million | |

|

|

|

|

Transparent Ceramics Market Size

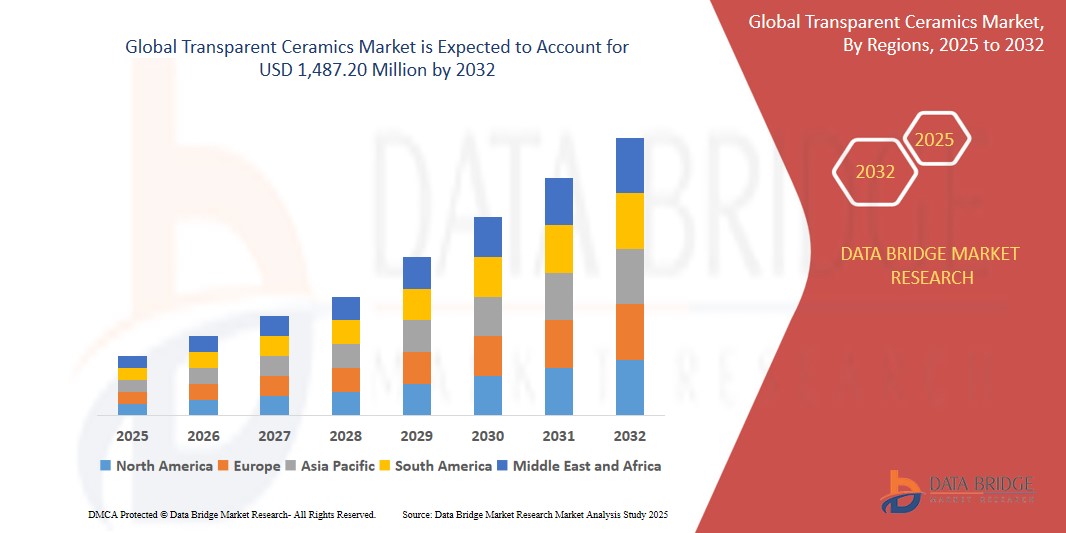

- The global Transparent Ceramics market was valued at USD 471.22 Million in 2024 and is expected to reach USD 1,487.20 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.50%, primarily driven by the Rise in the technological advancements

- This growth is driven by factors such as the usage of permanent Transparent Ceramicss, increase in the shift in preference to hot melt adhesives encouraging small players, increase in the government regulations pertaining to food safety

Transparent Ceramics Market Analysis

- Transparent Ceramics are advanced materials with unique optical properties, including high transparency, strength, and heat resistance. These materials are used in a wide range of industries, such as electronics, defense, medical devices, and energy production. Transparent Ceramics are ideal for applications requiring durability and clarity, including optical windows, laser systems, sensors, and protective covers for high-performance equipment.

- The demand for Transparent Ceramics is primarily driven by the increasing need for advanced, durable materials in high-tech sectors. Innovations in consumer electronics, defense technologies, and renewable energy are key growth factors. Additionally, the rise in demand for high-performance materials in the automotive and aerospace industries is contributing to the growth of the market.

- The North America region stands out as the dominant region for Transparent Ceramics, fueled by the expanding rapidly due to the increased use of Transparent Ceramics in electronics, automotive, and industrial applications.

- Globally, Transparent Ceramics are considered one of the most crucial materials in the advanced materials and electronics sectors. They are essential for improving the performance and efficiency of products across various industries, playing a critical role in the development of next-generation technologies.

Report Scope and Transparent Ceramics Market Segmentation

|

Attributes |

Transparent Ceramics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Transparent Ceramics Market Trends

“Growing Demand for High-Performance Materials in Aerospace and Defense”

- A major trend in the Transparent Ceramics market is the increasing demand for high-performance materials in aerospace and defense applications.

- Transparent ceramics, known for their superior optical properties, impact resistance, and heat tolerance, are becoming essential in the production of transparent armor, domes, and windows used in military aircraft, vehicles, and protective gear. These materials offer enhanced protection without compromising on optical clarity, making them ideal for defense technologies.

- For instance, transparent ceramic materials such as sapphire and aluminum oxynitride are gaining popularity in transparent armor systems due to their durability and resistance to ballistic impact, critical in military applications.

- The aerospace sector is also leveraging transparent ceramics for advanced optical systems in satellites, sensors, and communication devices, where both clarity and toughness are necessary.

- This trend is driving innovation in material science, as companies in the transparent ceramics industry work to develop even more advanced products that meet the stringent requirements of high-tech industries like aerospace and defense. This is opening up new market opportunities for businesses that can provide customized solutions in these sectors.

Transparent Ceramics Market Dynamics

Driver

““Increasing Demand for Transparent Ceramics in High-Performance Applications”

- The demand for Transparent Ceramics is significantly driven by the need for high-performance materials in industries such as aerospace, defense, optics, and electronics.

- Transparent ceramics are used for applications that require superior optical clarity, strength, and heat resistance, including windows and domes in military and aerospace vehicles, as well as in high-performance optical systems.

- These materials are gaining traction for use in transparent armor, domes, and laser systems due to their enhanced mechanical properties and resistance to harsh environmental conditions.

- As industries continue to advance in technologies that require durability and clarity, the demand for Transparent Ceramics is expected to grow, particularly in defense and optics applications.

For instance,

- In 2025, increasing focus on military and aerospace capabilities globally, especially in North America and Asia-Pacific, is expected to drive substantial growth in the Transparent Ceramics market as these sectors demand more specialized, high-performance materials.

Opportunity

“Expanding Application in Renewable Energy and Photovoltaic Systems”

- Transparent Ceramics have strong potential in renewable energy applications, particularly in photovoltaic systems and solar energy technologies.

- As the demand for sustainable energy sources grows, Transparent Ceramics, known for their high durability and ability to withstand extreme weather conditions, offer promising opportunities for integration into solar panels and energy-efficient windows.

- The materials' transparency and heat resistance make them ideal for use in solar energy applications, where maximizing sunlight absorption while maintaining structural integrity is crucial.

For instance,

- In January 2025, Companies are exploring the use of transparent ceramics in the development of more efficient solar panels, with market leaders in the energy sector like First Solar focusing on advanced materials to improve energy conversion rates.

Restraint/Challenge

“High Manufacturing Costs and Limited Production Capacity”

- One of the main challenges facing the Transparent Ceramics market is the high cost of manufacturing and the complexity involved in producing these advanced materials.

- The production of high-quality Transparent Ceramics requires specialized equipment, highly controlled manufacturing processes, and raw materials that can be expensive and scarce. This makes scaling up production challenging for many companies, especially in price-sensitive markets.

- The limited production capacity of manufacturers and the capital-intensive nature of Transparent Ceramics production can act as a barrier to meeting the rising demand in multiple industries, particularly in fast-growing sectors like aerospace and defense.

For instance,

- In November 2023, manufacturers faced difficulties in ramping up production capacity due to the high capital investment required for the facilities and technology needed to produce Transparent Ceramics, causing delays in product availability and increased costs.

Transparent Ceramics Market Scope

The market is segmented on the basis type, material, application and end-user,

|

Segmentation |

Sub-Segmentation |

|

By type |

|

|

By Material |

|

|

By Application |

|

|

By End-User

|

|

Transparent Ceramics Market Regional Analysis

“North America is the Dominant Region in the Transparent Ceramics Market”

- North America remains a dominant force in the global Transparent Ceramics market, driven by significant demand from the aerospace, defense, healthcare, and electronics sectors.

- The U.S. holds a substantial market share due to its strong technological infrastructure, advanced manufacturing capabilities, and high investment in research and development of Transparent Ceramics.

- Major players in the region, such as II-VI Optical Systems and Surmet Corporation, are at the forefront of innovation in high-performance applications, including transparent armor, optical components, and sensors.

- Additionally, increasing investments in defense and aerospace technologies, particularly in the military and satellite sectors, are fueling the region's growth in Transparent Ceramics applications..

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to register the highest growth rate in the Transparent Ceramics market due to rapid industrialization, a booming electronics sector, and increasing demand for high-performance materials in aerospace and defense.

- China, India, and Japan are key drivers of this growth, with China leading the market due to its large-scale manufacturing capabilities and expanding aerospace and defense industries.

- India is adopting Transparent Ceramics in applications such as defense, consumer electronics, and medical devices, while Japan is focusing on high-tech applications in optics, optoelectronics, and automotive sectors.

- Furthermore, Southeast Asian nations are seeing rising demand for Transparent Ceramics in various applications, particularly in electronics and industrial machinery, driven by their growing manufacturing and export industries.

Transparent Ceramics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Technology dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Murata Manufacturing Co., Ltd. (Japan)

- CILAS (France)

- Ceranova (Germany)

- Brightcrystals Technology Inc. (U.S.)

- Ceramtec-Etec GmbH (Germany)

- Coorstek, Inc. (U.S.)

- Konoshima Chemicals Co., Ltd. (Japan)

- Surmet Corporation (U.S.)

- Schott AG (Germany)

- II-VI Optical Systems (U.S.)

- American Elements (U.S.)

- Advanced Ceramic Manufacturing, LLC (U.S.)

- Blasch Precision Ceramics Inc. (U.S.)

- Ceradyne (U.S.)

- Koito Manufacturing Co., Ltd. (Japan)

- Kyocera Corporation (Japan)

- Mcdanel Advanced Ceramic Technologies (U.S.)

- Morgan Advanced Materials (U.K.)

- Rauschert GmbH (Germany)

- Saint-Gobain Ceramics & Plastics, Inc. (France)

Latest Developments in Global Transparent Ceramics Market

- In March 2025, Murata Manufacturing Co., Ltd. unveiled its new line of high-strength transparent ceramics aimed at aerospace and defense applications. These ceramics are designed to withstand extreme environmental conditions while maintaining optical clarity, providing enhanced protection in military vehicles and aerospace components.

- In February 2025, Schott AG launched a new range of transparent ceramics specifically designed for high-performance optical systems. The new ceramics offer superior thermal stability and scratch resistance, making them ideal for use in high-precision instruments, sensors, and laser systems in the defense and industrial sectors.

- In January 2025, Kyocera Corporation expanded its Transparent Ceramics portfolio by introducing a new series of transparent sapphire components tailored for the electronics and healthcare markets. The company plans to enhance the durability and optical properties of these components to meet the growing demand for advanced medical devices and high-end consumer electronics.

- In December 2024, II-VI Optical Systems announced the acquisition of a leading transparent ceramics manufacturer to bolster its capabilities in producing advanced materials for aerospace and defense applications. This acquisition will allow II-VI to provide cutting-edge solutions for transparent armor, optical windows, and laser components.

- In November 2024, Coorstek, Inc. introduced a new line of ceramic nanomaterials aimed at improving the performance of transparent ceramics used in optical communication systems. The innovation enhances the optical clarity and strength of the ceramics, making them suitable for use in high-demand environments such as satellite communications and advanced optical technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Transparent Ceramics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Transparent Ceramics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Transparent Ceramics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.