Global Transport And Logistics Market

Market Size in USD Billion

CAGR :

%

USD

1,207.84 Billion

USD

1,798.17 Billion

2024

2032

USD

1,207.84 Billion

USD

1,798.17 Billion

2024

2032

| 2025 –2032 | |

| USD 1,207.84 Billion | |

| USD 1,798.17 Billion | |

|

|

|

|

Transport and Logistics Market Size

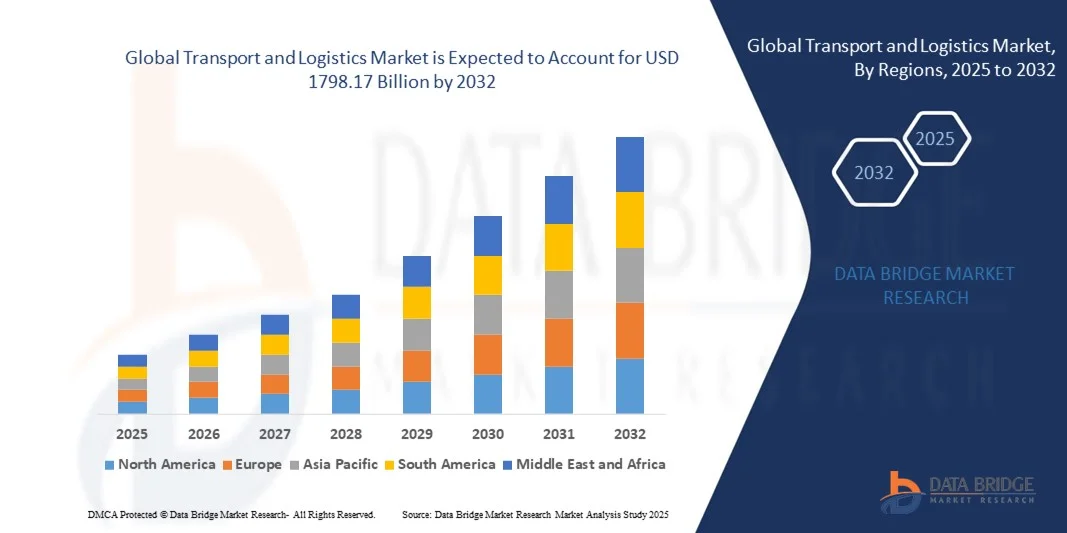

- The global transport and logistics market size was valued at USD 1207.84 billion in 2024 and is expected to reach USD 1798.17 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fueled by increasing global trade, rapid e-commerce expansion, and technological advancements in logistics operations, leading to enhanced efficiency in transportation, warehousing, and supply chain management

- Furthermore, rising demand for faster, reliable, and cost-effective delivery solutions, coupled with the adoption of digital tracking, automation, and real-time data analytics, is establishing advanced logistics services as a critical component of modern supply chains. These factors are driving investments and innovation, thereby significantly boosting the industry's growth

Transport and Logistics Market Analysis

- Transport and logistics encompass the movement, storage, and management of goods across various modes, including roadways, airways, railways, and waterways. Companies are increasingly leveraging smart warehouse systems, fleet management tools, and supply chain visibility platforms to improve operational efficiency, reduce costs, and meet customer expectations

- The escalating demand for integrated logistics solutions is primarily fueled by growing e-commerce activities, globalization of supply chains, and the need for timely, transparent, and optimized distribution networks across domestic and international markets

- North America dominated the transport and logistics market in 2024, due to increasing e-commerce penetration, advanced supply chain infrastructure, and rising demand for efficient freight and warehouse solutions

- Asia-Pacific is expected to be the fastest growing region in the transport and logistics market during the forecast period due to rapid urbanization, rising disposable incomes, and growing e-commerce and manufacturing activities in countries such as China, Japan, and India

- Roadways segment dominated the market with a market share of 47.8% in 2024, due to its flexibility, widespread network coverage, and ability to provide door-to-door delivery. Road transport remains the backbone of domestic logistics, catering to multiple industries and ensuring last-mile connectivity. It supports small-scale businesses, e-commerce, and perishable goods transportation efficiently. Technological integrations such as telematics, GPS tracking, and automated fleet management further enhance the reliability and efficiency of road transport

Report Scope and Transport and Logistics Market Segmentation

|

Attributes |

Transport and Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Transport and Logistics Market Trends

Growth of Automation and Digitalization in Logistics

- The transport and logistics sector is witnessing a significant transformation with the rapid incorporation of automation and digitalization, aiming to streamline supply chain processes and enhance operational efficiency. Companies are embracing smart software platforms, robotics, and advanced data analytics to improve delivery speeds, reduce costs, and ensure reliability

- For instance, DHL has been investing heavily in automated warehouses and robotic sorting systems to meet the rising demands of global trade and e-commerce. The company’s deployment of AI-powered logistics solutions, along with advanced data-driven route mapping, demonstrates the growing reliance on automation to optimize supply chains

- Digitalization is enabling logistics providers to integrate Internet of Things (IoT) technology for real-time tracking of shipments, predictive maintenance of fleet vehicles, and better asset visibility across multi-modal transportation systems. These advancements reduce risks of delays and increase transparency of operations, helping businesses make more informed decisions

- Automation in warehouses through autonomous guided vehicles, robotic arms for sorting, and AI-aided demand prediction is transforming traditional logistics models. Such trends are contributing to improved productivity, reduced human error, and strengthened distribution efficiency to address the complexities of modern supply chains

- The adoption of blockchain in logistics transactions is enhancing security and transparency in documentation processes such as bills of lading and customs clearance. Companies such as Maersk have introduced blockchain-enabled solutions to streamline documentation and improve container visibility, making cross-border logistics more efficient

- The overall trend of automation and digitalization is redefining customer expectations in transport and logistics by creating smarter, faster, and more resilient supply chains. This transition is fueling competition among service providers, encouraging continuous investment in next-generation digital solutions to support scaling of logistics globally

Transport and Logistics Market Dynamics

Driver

Rising E-Commerce and Global Trade Demand

- The exponential growth of e-commerce platforms has significantly increased the volume of shipments and deliveries, driving the need for advanced logistics and transportation solutions. Companies are enhancing their distribution networks to keep pace with shorter delivery timelines and rising customer expectations

- For instance, Amazon is consistently developing its logistics infrastructure with investments in fulfillment centers, advanced last-mile delivery fleets, and air cargo services. These efforts are aimed at providing faster deliveries and maintaining dominance in the highly competitive digital retail environment, which stimulates parallel growth in logistics demand

- The continued expansion of cross-border trade and globalized manufacturing has created rising pressure for efficient international shipping services. Logistics companies are adopting advanced technologies to manage customs compliance, optimize shipment consolidation, and reduce transportation costs while meeting strict delivery schedules

- In addition, the growing shift toward omni-channel retail is boosting demand for reliable and scalable logistics operations. Retailers are increasingly depending on integrated logistics partners to handle their e-commerce shipments, store distribution, and cross-docking facilities to accommodate diverse retail channels

- The rising trade volumes coupled with digital retail expansion are directly reinforcing the dependence on transport and logistics service providers, making the sector indispensable to the functioning of modern economies. The continued evolution of e-commerce and international trade is expected to sustain high demand for logistics services globally

Restraint/Challenge

Infrastructure and Regulatory Hurdles

- A significant challenge for the transport and logistics industry lies in the inadequacies of infrastructure such as congested urban roads, limited port capacities, and aging rail networks in several regions. These gaps often lead to delays, higher costs, and inefficiencies across supply chains, impacting customer satisfaction

- For instance, India’s logistics sector has struggled with road bottlenecks, administrative delays at ports, and outdated warehousing facilities. Companies such as Flipkart and Reliance Retail have invested in private logistics networks to bypass systemic inefficiencies and reduce dependency on limited public infrastructure

- Strict regulations across different countries related to customs clearance, taxation, and environmental compliance add to the complexity faced by logistics providers. Navigating these varied standards often requires significant resources, extended timelines, and reliance on intermediaries, which impact operational flexibility and cost efficiency

- Regulatory hurdles also hinder the penetration of innovative solutions such as autonomous trucks and drone deliveries due to safety concerns and lack of harmonized approval frameworks. In many regions, experimental technologies are years away from mainstream adoption despite their promising potential to alleviate infrastructure stress

- To overcome these infrastructure and regulatory barriers, governments and private players need to collaborate on improving logistics frameworks, harmonizing trade regulations, and investing in modernization of transportation systems. Addressing these hurdles will be crucial for scaling the full potential of the global transport and logistics sector in the coming years

Transport and Logistics Market Scope

The market is segmented on the basis of service type, mode of transport type, and end use.

- By Service Type

On the basis of service type, the transport and logistics market is segmented into warehouse services, transportation, inventory management, and administration and supplies. The transportation segment dominated the largest market revenue share in 2024, driven by the ever-increasing demand for the movement of goods across domestic and international markets. Transportation services, including last-mile delivery and long-haul logistics, are critical for ensuring timely and efficient supply chain operations. Businesses rely heavily on these services for on-time delivery, cost optimization, and route efficiency. Growing e-commerce penetration and globalization of trade have further strengthened the demand for robust transportation solutions. The segment also benefits from technological advancements such as GPS tracking, route optimization, and fleet management systems that enhance operational efficiency.

The warehouse services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for automated and smart storage solutions. The expansion of e-commerce and retail industries requires sophisticated warehousing systems with real-time inventory tracking and automated retrieval systems. Companies are increasingly adopting advanced warehouse management systems (WMS) to improve storage efficiency, reduce operational costs, and ensure faster order fulfillment. The rising trend of outsourcing warehousing operations to third-party logistics providers further supports growth in this segment.

- By Mode of Transport Type

On the basis of mode of transport, the market is segmented into airways, railways, roadways, and waterways. The roadways segment dominated the largest market revenue share of 47.8% in 2024, driven by its flexibility, widespread network coverage, and ability to provide door-to-door delivery. Road transport remains the backbone of domestic logistics, catering to multiple industries and ensuring last-mile connectivity. It supports small-scale businesses, e-commerce, and perishable goods transportation efficiently. Technological integrations such as telematics, GPS tracking, and automated fleet management further enhance the reliability and efficiency of road transport.

The airways segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing demand for fast and time-sensitive deliveries, particularly in high-value goods, pharmaceuticals, and perishables. Air cargo offers unparalleled speed for international and intercity shipments, supporting global trade expansion. Rising e-commerce cross-border deliveries, just-in-time inventory requirements, and improved air freight infrastructure contribute to the rapid adoption of air transport solutions.

- By End Use

On the basis of end use, the transport and logistics market is segmented into automobiles, machinery, apparel and footwear, pharmaceutical products, retail, aircraft, ships and railways, electronics, petrochemicals, agriculture, building materials, and others. The retail segment dominated the largest market revenue share in 2024, driven by the exponential growth of e-commerce, omnichannel retail strategies, and rising consumer demand for fast and reliable deliveries. Retail logistics encompasses the transportation, storage, and management of diverse product categories, making it a vital part of the supply chain. Investments in advanced fulfillment centers, real-time tracking, and last-mile delivery optimization further enhance efficiency and customer satisfaction.

The pharmaceutical products segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing global healthcare demands, rising pharmaceutical production, and the need for temperature-controlled and compliant logistics solutions. The growing prevalence of life-saving drugs, vaccines, and biologics necessitates specialized cold chain and secure transportation systems. Companies are adopting IoT-enabled monitoring, smart containers, and automated handling systems to maintain product integrity, minimize losses, and ensure regulatory compliance, driving rapid segment growth.

Transport and Logistics Market Regional Analysis

- North America dominated the transport and logistics market with the largest revenue share in 2024, driven by increasing e-commerce penetration, advanced supply chain infrastructure, and rising demand for efficient freight and warehouse solutions

- Businesses and consumers in the region prioritize fast, reliable, and technologically advanced logistics services, including last-mile delivery, cold chain management, and integrated inventory solutions

- The widespread adoption is further supported by high disposable incomes, a technologically sophisticated population, and the growing emphasis on supply chain optimization across industries

U.S. Transport and Logistics Market Insight

The U.S. captured the largest revenue share in North America in 2024, fueled by the growing demand for integrated logistics solutions, adoption of automation in warehouses, and expanding e-commerce operations. Companies are increasingly investing in fleet management systems, AI-driven route optimization, and real-time tracking technologies to enhance operational efficiency. In addition, government initiatives supporting infrastructure development and smart transport networks further propel market growth.

Europe Transport and Logistics Market Insight

The Europe transport and logistics market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by the need for efficient cross-border transportation, stringent regulatory compliance, and adoption of green logistics practices. The increase in urbanization, coupled with the demand for advanced warehouse and freight services, fosters market growth. European companies are also integrating IoT and automation technologies to improve supply chain visibility and reduce operational costs.

U.K. Transport and Logistics Market Insight

The U.K. market is expected to grow at a significant CAGR, driven by the expansion of e-commerce, rising consumer expectations for fast deliveries, and investments in smart warehousing. The emphasis on sustainability, including reduced carbon emissions in logistics operations, is encouraging companies to adopt energy-efficient transport solutions. Moreover, robust retail and industrial infrastructure supports the growth of integrated logistics services.

Germany Transport and Logistics Market Insight

Germany’s transport and logistics market is anticipated to expand at a considerable CAGR, fueled by its advanced industrial base, technological adoption, and focus on eco-friendly logistics solutions. The country’s strategic location in Europe, along with strong infrastructure and automation in warehousing and transportation, supports the seamless movement of goods across domestic and international markets. Demand for high-security and temperature-controlled logistics is also increasing across pharmaceutical and high-value sectors.

Asia-Pacific Transport and Logistics Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, rising disposable incomes, and growing e-commerce and manufacturing activities in countries such as China, Japan, and India. The region’s focus on smart logistics, including warehouse automation, cold chain infrastructure, and real-time tracking solutions, is accelerating adoption. Government initiatives promoting digitalization and the development of smart ports, rail networks, and highways further boost market expansion.

Japan Transport and Logistics Market Insight

Japan’s market is gaining momentum due to high technological adoption, demand for efficient last-mile delivery, and increasing automation in warehousing and transportation. Companies are leveraging robotics, AI, and IoT-based tracking systems to optimize logistics operations. In addition, Japan’s aging population is driving the demand for more accessible and reliable transport and delivery solutions.

China Transport and Logistics Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its expanding e-commerce sector, rapid urbanization, and robust industrial growth. The country is a major hub for manufacturing and exports, increasing the need for efficient domestic and international logistics solutions. Investments in smart warehouses, automated sorting, and fleet management technologies, along with government support for smart transport infrastructure, are key factors propelling market growth.

Transport and Logistics Market Share

The transport and logistics industry is primarily led by well-established companies, including:

- Nippon Express Co., Ltd. (Japan)

- Deutsche Post AG (Germany)

- DB Schenker (Germany)

- DSV (Denmark)

- A.P. Moller - Maersk (Denmark)

- FedEx Corporation (U.S.)

- Kuehne+Nagel Inc. (Switzerland)

- GEODIS (France)

- C.H. Robinson Worldwide Inc. (U.S.)

- United Parcel Service of America, Inc. (U.S.)

Latest Developments in Global Transport and Logistics Market

- In September 2023, Kellogg Company received Board approval for its planned separation into two publicly traded companies, Kellanova and WK Kellogg Co. This strategic move allowed each entity to concentrate on specific product categories and optimize its respective supply chains. The separation enabled tailored logistics strategies, enhancing efficiency in transportation routes, inventory management, and distribution networks. As a result, both companies can respond more quickly to market demands, reduce operational costs, and strengthen competitiveness in their targeted product segments

- In February 2023, FourKites partnered with RCS Logistics to offer RCS customers a unified service providing complete real-time visibility across ocean, air, intermodal, and over-the-road (OTR) shipments. Leveraging FourKites’ advanced supply chain data, RCS enhanced its operational transparency, allowing customers and internal teams to track the exact location and status of shipments worldwide. This collaboration strengthens market trust, improves on-time delivery rates, and positions both companies as leaders in technologically advanced supply chain solutions

- In November 2022, A.P. Moller – Maersk launched its Shaheen Express ocean shipping service, connecting Mundra, Pipavav, Jebel Ali, and Dammam. This stable and reliable service addresses the growing trade demand between India and the Gulf region. By providing a consistent shipping schedule, Maersk improves supply chain predictability for exporters and importers, enhancing regional trade efficiency and reinforcing its position as a key player in the India-Gulf logistics corridor

- In October 2022, DHL Supply Chain expanded its services with a new electronic waste recovery solutions suite. This circular supply chain approach supports companies in properly reprocessing, reusing, or recycling electronic components such as processors, touchscreens, and computer modules. By enabling responsible e-waste management, DHL helps businesses reduce environmental impact, conserve scarce resources, and comply with sustainability regulations, thereby strengthening its market presence in eco-conscious logistics solutions

- In June 2022, FedEx Corp formed a strategic alliance with FourKites to enhance multi-modal and multi-carrier supply chain visibility. By integrating FedEx’s extensive logistics network with FourKites’ granular tracking and analytics capabilities, the collaboration allows for smarter supply chain operations. This partnership improves shipment transparency, optimizes delivery performance, and reinforces both companies’ competitive positioning in the global logistics market by providing highly reliable, data-driven services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.