Global Transportation Condensing Units Market

Market Size in USD Billion

CAGR :

%

USD

3.16 Billion

USD

4.79 Billion

2025

2033

USD

3.16 Billion

USD

4.79 Billion

2025

2033

| 2026 –2033 | |

| USD 3.16 Billion | |

| USD 4.79 Billion | |

|

|

|

|

Transportation Condensing Units Market Size

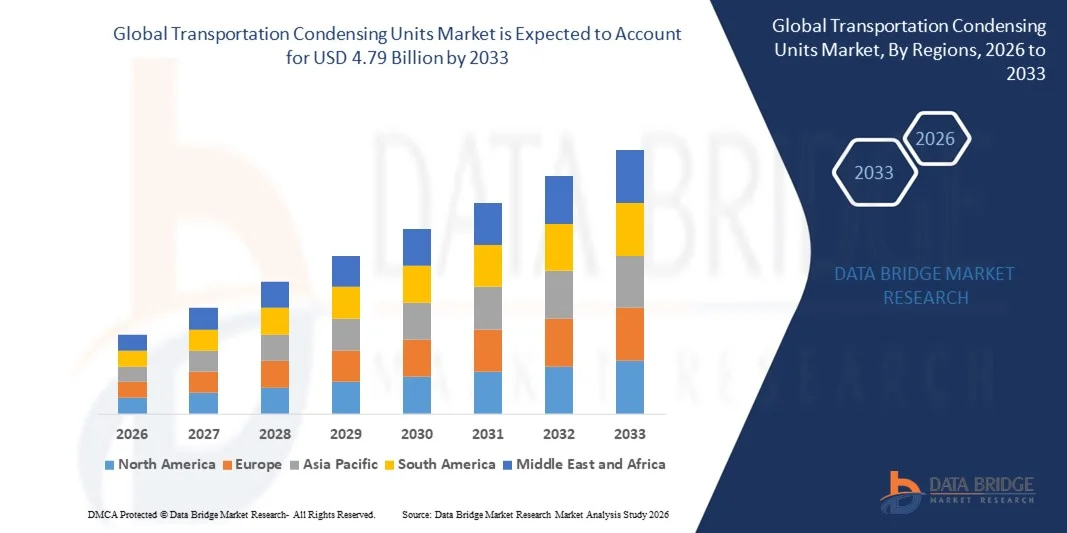

- The global transportation condensing units market size was valued at USD 3.16 billion in 2025 and is expected to reach USD 4.79 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely driven by the rapid expansion of cold chain logistics and the increasing need for reliable temperature-controlled transportation across food, pharmaceutical, and chemical supply chains

- Furthermore, rising demand for fresh, frozen, and temperature-sensitive products, combined with stricter regulatory requirements for temperature compliance during transit, is accelerating the adoption of advanced transportation condensing units, thereby significantly supporting overall market growth

Transportation Condensing Units Market Analysis

- Transportation condensing units, which provide precise and consistent cooling for refrigerated trucks and trailers, have become essential components of modern cold chain logistics due to their role in preserving product quality, safety, and shelf life during transportation

- The growing reliance on organized food distribution, pharmaceutical logistics, and long-distance trade, along with increasing investments in energy-efficient and low-emission refrigeration technologies, is driving sustained demand for transportation condensing units across global markets

- North America dominated the transportation condensing units market with a share of around 40% in 2025, due to the well-established cold chain infrastructure and high demand for temperature-controlled transportation across food, pharmaceutical, and chemical sectors

- Asia-Pacific is expected to be the fastest growing region in the transportation condensing units market during the forecast period due to rapid urbanization, expanding cold chain infrastructure, and rising consumption of frozen and processed foods

- 5 - 10 KW segment dominated the market with a market share of 39% in 2025, due to its extensive use in medium-sized refrigerated trucks transporting dairy, pharmaceuticals, and fresh produce. This range offers an optimal balance between cooling efficiency and energy consumption, making it suitable for urban and intercity distribution. Fleet operators prefer these units due to their compatibility with standard truck sizes and stable temperature control performance. The segment also benefits from lower installation and operating costs compared to higher-capacity systems

Report Scope and Transportation Condensing Units Market Segmentation

|

Attributes |

Transportation Condensing Units Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Transportation Condensing Units Market Trends

Shift Toward Energy-Efficient Transportation Refrigeration Systems

- A key trend in the transportation condensing units market is the growing shift toward energy-efficient and low-emission refrigeration systems, driven by rising fuel costs and stricter environmental regulations governing cold chain transportation. Manufacturers are increasingly focusing on improving system efficiency to reduce operating expenses while ensuring stable temperature control for perishable goods

- For instance, Carrier Transicold has expanded its portfolio of electric and hybrid transport refrigeration units designed to lower fuel consumption and emissions in refrigerated trucks and trailers. These solutions help fleet operators comply with sustainability targets while maintaining consistent cooling performance during transit

- The adoption of advanced compressor technologies and optimized airflow designs is improving overall system efficiency and reducing energy losses. This trend supports longer operational cycles and enhances reliability across varied climatic conditions

- Transportation condensing units are also being developed to support alternative refrigerants with lower global warming potential, aligning with global decarbonization efforts. This is reinforcing the market’s transition toward environmentally responsible refrigeration solutions

- Fleet operators are prioritizing energy-efficient units to minimize lifecycle costs and meet regulatory compliance across cross-border transportation routes. This preference is strengthening demand for next-generation condensing units optimized for performance and sustainability

- The continued focus on efficiency, emissions reduction, and operational reliability is positioning energy-efficient transportation condensing units as a core component of modern cold chain logistics

Transportation Condensing Units Market Dynamics

Driver

Rising Demand for Cold Chain Logistics

- The increasing demand for cold chain logistics across food, pharmaceutical, and healthcare sectors is a major driver of the transportation condensing units market. Growth in the distribution of fresh produce, frozen foods, vaccines, and temperature-sensitive medicines requires reliable refrigeration during transportation

- For instance, Thermo King supplies transport refrigeration systems that support large-scale pharmaceutical and food logistics operations, ensuring compliance with strict temperature control requirements. These systems play a critical role in preserving product quality and safety throughout long-distance transportation

- Expansion of organized retail, e-commerce grocery delivery, and pharmaceutical supply chains is increasing the number of refrigerated vehicles in operation. This directly boosts demand for efficient and durable transportation condensing units

- Regulatory standards related to food safety and pharmaceutical storage are compelling logistics providers to invest in advanced refrigeration systems. These regulations emphasize precise temperature maintenance, further strengthening market demand

- The increasing scale and complexity of cold chain networks is firmly establishing transportation condensing units as essential infrastructure within global logistics ecosystems

Restraint/Challenge

High Upfront and Maintenance Costs

- High initial investment and ongoing maintenance costs present a significant challenge for the transportation condensing units market, particularly for small and mid-sized fleet operators. Advanced refrigeration systems require substantial capital expenditure, which can limit adoption in cost-sensitive markets

- For instance, high-performance refrigeration units supplied by companies such as Danfoss and BITZER SE incorporate advanced compressors and control technologies that raise system costs. While these solutions offer efficiency benefits, the upfront pricing can be a barrier for smaller logistics providers

- Maintenance of transportation condensing units involves specialized components and skilled service support, increasing long-term operational expenses. Downtime related to repairs can also impact logistics efficiency and delivery schedules

- The need for regular servicing to ensure compliance with temperature regulations further adds to ownership costs. This creates financial pressure on operators managing large fleets with tight margins

- Fluctuations in component prices and refrigerant costs also affect overall system affordability. These factors collectively slow adoption in price-sensitive regions. Despite long-term efficiency gains, the challenge of balancing performance requirements with cost constraints continues to influence purchasing decisions and market expansion

Transportation Condensing Units Market Scope

The market is segmented on the basis of cooling capacity, compressor type, sales channel, and vehicle type.

- By Cooling Capacity

On the basis of cooling capacity, the transportation condensing units market is segmented into below 5 kW, 5–10 kW, 10–15 kW, and above 15 kW. The 5–10 kW segment dominated the market with the largest revenue share of 39% in 2025, supported by its extensive use in medium-sized refrigerated trucks transporting dairy, pharmaceuticals, and fresh produce. This range offers an optimal balance between cooling efficiency and energy consumption, making it suitable for urban and intercity distribution. Fleet operators prefer these units due to their compatibility with standard truck sizes and stable temperature control performance. The segment also benefits from lower installation and operating costs compared to higher-capacity systems.

The above 15 kW segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising demand for long-haul cold chain logistics. Increasing transportation of frozen foods, seafood, and temperature-sensitive pharmaceuticals over long distances is accelerating adoption. High-capacity units provide consistent cooling in large trailers and extreme ambient conditions. Growth in cross-border trade and large-scale food distribution networks further supports this trend.

- By Compressor Type

On the basis of compressor type, the market is segmented into reciprocating compressors, screw compressors, rotary compressors, and others. Reciprocating compressors accounted for the dominant market share in 2025 due to their widespread adoption in small and mid-sized transportation refrigeration systems. These compressors are valued for their proven reliability, ease of maintenance, and cost-effectiveness. Their ability to operate efficiently under variable load conditions makes them suitable for diverse transportation needs. Strong aftermarket availability of spare parts further reinforces their dominance.

Screw compressors are anticipated to register the fastest growth rate during the forecast period, supported by increasing demand for high-capacity and continuous-duty refrigeration. These compressors offer higher efficiency, lower vibration, and longer operational life, making them ideal for large trailers and long-distance transport. Adoption is increasing among fleet operators seeking reduced downtime and improved fuel efficiency. Advancements in compressor design are also enhancing their performance in harsh operating environments.

- By Sales Channel

On the basis of sales channel, the transportation condensing units market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2025, driven by the rising production of refrigerated trucks and trailers equipped with factory-installed condensing units. OEM-fitted systems ensure optimized integration, standardized performance, and warranty coverage, which are highly valued by fleet owners. Growth in organized cold chain infrastructure and logistics companies is further strengthening OEM demand. Manufacturers also benefit from long-term supply contracts with vehicle producers.

The aftermarket segment is projected to grow at the fastest pace from 2026 to 2033, fueled by the expanding operational fleet of refrigerated vehicles. Increasing replacement of aging units, demand for system upgrades, and frequent maintenance requirements are driving aftermarket sales. Fleet operators are investing in retrofitting advanced, energy-efficient condensing units to extend vehicle lifespan. Availability of customized solutions and quicker service turnaround further supports aftermarket growth.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into trucks and trailers. Trucks held the largest market revenue share in 2025, supported by their extensive use in short- and medium-haul distribution of perishable goods. Urban food delivery, pharmaceutical distribution, and retail replenishment rely heavily on refrigerated trucks. Their flexibility, lower operating costs, and suitability for last-mile delivery make them a preferred choice. Growth in e-commerce grocery and food service logistics continues to reinforce truck segment dominance.

Trailers are expected to witness the fastest growth rate during the forecast period, driven by increasing demand for long-distance and bulk cold chain transportation. Large trailers are essential for transporting frozen and chilled products across regions and borders. Expansion of large-scale food processing, export-oriented agriculture, and pharmaceutical logistics is accelerating trailer adoption. Improved refrigeration efficiency and higher load capacity further enhance their appeal among logistics providers.

Transportation Condensing Units Market Regional Analysis

- North America dominated the transportation condensing units market with the largest revenue share of around 40% in 2025, driven by the well-established cold chain infrastructure and high demand for temperature-controlled transportation across food, pharmaceutical, and chemical sectors

- The region shows strong adoption of advanced refrigeration technologies to ensure regulatory compliance and product quality during transit

- Growth is further supported by a large fleet of refrigerated trucks and trailers, high logistics spending, and continuous investments in cold storage and transportation efficiency, positioning transportation condensing units as a critical component of regional supply chains

U.S. Transportation Condensing Units Market Insight

The U.S. transportation condensing units market accounted for the largest revenue share within North America in 2025, supported by the extensive movement of perishable food products and pharmaceuticals across long distances. Strong demand from organized retail, foodservice chains, and healthcare logistics is driving adoption. The presence of major logistics providers and strict temperature control regulations further accelerates market growth. In addition, increasing demand for frozen and ready-to-eat foods continues to strengthen the need for reliable transportation refrigeration solutions.

Europe Transportation Condensing Units Market Insight

The Europe transportation condensing units market is expected to grow at a steady CAGR during the forecast period, driven by stringent food safety regulations and rising cross-border trade of perishable goods. The region’s focus on sustainable and energy-efficient refrigeration systems is encouraging adoption of technologically advanced condensing units. Growth in pharmaceutical logistics and temperature-sensitive chemical transport further supports market expansion across the region.

U.K. Transportation Condensing Units Market Insight

The U.K. transportation condensing units market is projected to witness notable growth, fueled by increasing demand for cold chain logistics in food retail and healthcare sectors. Expansion of online grocery delivery and pharmaceutical distribution is driving the need for reliable refrigerated transportation. The country’s strong logistics infrastructure and regulatory emphasis on temperature compliance are supporting sustained adoption of transportation condensing units.

Germany Transportation Condensing Units Market Insight

The Germany transportation condensing units market is anticipated to expand at a considerable CAGR, supported by the country’s advanced logistics network and strong food processing industry. Germany’s emphasis on high-quality cold chain management and energy-efficient refrigeration solutions is driving demand. Increasing exports of temperature-sensitive products across Europe further contribute to market growth.

Asia-Pacific Transportation Condensing Units Market Insight

The Asia-Pacific transportation condensing units market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid urbanization, expanding cold chain infrastructure, and rising consumption of frozen and processed foods. Growth in pharmaceutical manufacturing and distribution is further accelerating demand. Government initiatives to reduce food wastage and improve supply chain efficiency are significantly supporting market expansion across the region.

Japan Transportation Condensing Units Market Insight

The Japan transportation condensing units market is gaining traction due to strong demand for high-quality refrigerated transport in food and pharmaceutical sectors. The country’s focus on precision temperature control and advanced refrigeration technologies supports steady adoption. Increasing distribution of ready-to-eat meals and temperature-sensitive medical products is further fueling market growth.

China Transportation Condensing Units Market Insight

China accounted for the largest market revenue share in the Asia-Pacific region in 2025, driven by rapid expansion of cold chain logistics and large-scale food distribution networks. Rising urban populations and increasing consumption of frozen foods are strengthening demand. The growth of pharmaceutical logistics and government investments in cold storage and transportation infrastructure are key factors propelling the transportation condensing units market in China.

Transportation Condensing Units Market Share

The transportation condensing units industry is primarily led by well-established companies, including:

- Emerson Electric Co. (U.S.)

- Carrier (U.S.)

- Danfoss (Denmark)

- GEA Group Aktiengesellschaft (Germany)

- Heatcraft Worldwide Refrigeration (U.S.)

- Voltas (India)

- BITZER SE (Germany)

- SCM Frigo S.p.A. (Italy)

- JINAN RETEK INDUSTRIES INC (China)

- Rivacold UK Ltd (U.K.)

- Patton International Limited (U.K.)

Latest Developments in Global Transportation Condensing Units Market

- In March 2025, Carrier Transicold introduced ultra-low-emission refrigeration units for refrigerated trucks and trailers, strengthening its position in the transportation condensing units market by addressing the rising demand for sustainable and low-carbon logistics. The company’s focus on electric and autonomous vehicle-compatible refrigeration systems enhances its competitiveness as fleet operators increasingly transition toward zero-emission and future-ready transport solutions, particularly in urban and regulated markets

- In February 2025, Daikin Industries expanded its R-452A and CO₂-based refrigeration portfolio, reinforcing its market presence by aligning with global environmental regulations and demand for natural refrigerants. The launch of modular and compact condensing units for intermodal container applications improves efficiency in cross-border fresh food transportation, enabling Daikin to capture growing demand from international cold chain logistics providers

- In November 2024, Thermo King introduced connected refrigeration systems featuring real-time temperature and location tracking, significantly enhancing value for fleet operators focused on compliance and operational visibility. The expansion of its all-electric series supports zero-emission goals in urban areas and food distribution hubs, strengthening Thermo King’s leadership in smart, sustainable transportation refrigeration solutions

- In September 2024, Guchen Industry launched battery-powered transportation condensing units designed for last-mile delivery, expanding its footprint in the rapidly growing urban logistics segment. By strengthening partnerships with electric vehicle manufacturers, the company improved integration of efficient cooling systems into EV delivery fleets, positioning itself strongly within the evolving electric cold chain ecosystem

- In July 2024, Kingtec intensified its focus on solar-assisted refrigeration units for transportation applications, enhancing its market appeal in regions with high fuel costs and sustainability mandates. Increased R&D investment aimed at lightweight, durable, and energy-efficient designs supports broader adoption across diverse vehicle types, reinforcing Kingtec’s competitiveness in energy-efficient transportation condensing solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.