Global Transportation Management System Market

Market Size in USD Billion

CAGR :

%

USD

15.25 Billion

USD

46.01 Billion

2024

2032

USD

15.25 Billion

USD

46.01 Billion

2024

2032

| 2025 –2032 | |

| USD 15.25 Billion | |

| USD 46.01 Billion | |

|

|

|

|

Transportation Management System Market Size

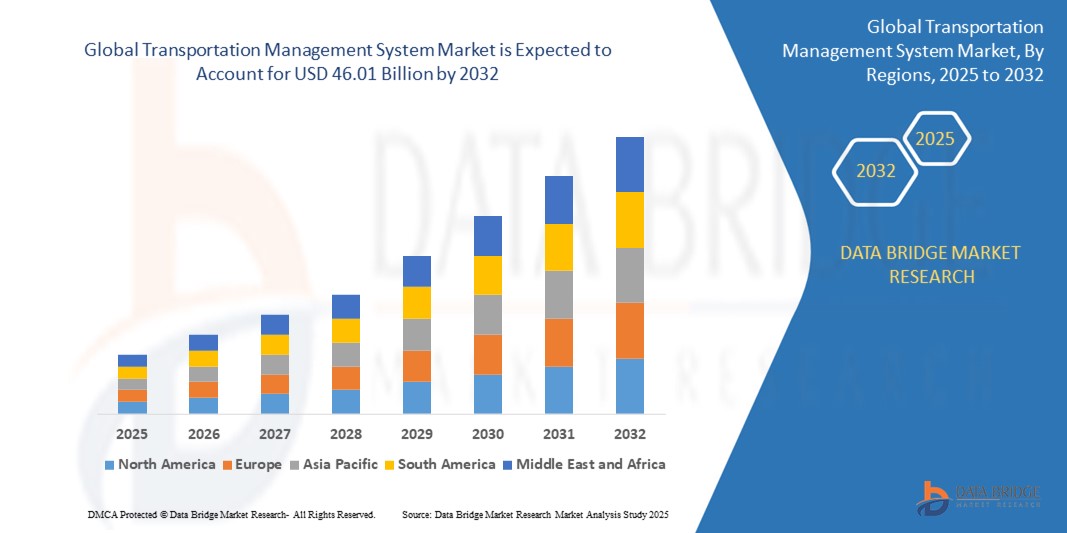

- The global transportation management system market was valued at USD 15.25 billion in 2024 and is expected to reach USD 46.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 14.80 % primarily driven by the increasing demand for efficient logistics operations and the growing adoption of cloud-based solutions

- This growth is driven by factors such as the rising need for real-time visibility in supply chain operations, advancements in AI and IoT technologies, and the expansion of e-commerce and global trade

Transportation Management System Market Analysis

- A Transportation Management System (TMS) is software used to plan, execute, and optimize the movement of goods, improving efficiency, reducing costs, and ensuring timely delivery in the supply chain

- Transportation systems are becoming smarter, enabling real-time decision-making and proactive issue resolution

- For instance, FedEx and DHL use AI-powered platforms to optimize routes, cut fuel usage, and adapt to weather or traffic disruptions

- Cloud platforms are now essential for managing multi-location supply chains with flexibility and speed

- For instance, Unilever uses a cloud-based transportation system to coordinate its logistics across continents and supply partners

- Enhanced visibility and control over shipments are made possible through connected tracking technologies

- For instance, Amazon leverages Internet of Things devices to monitor fleet movements, improve ETA accuracy, and manage delivery exceptions

- Companies are embedding green practices into transportation planning to meet environmental goals

- For instance, PepsiCo uses eco-friendly routing tools and electric vehicles to reduce emissions and fuel consumption

- Flexible transportation platforms are helping smaller and mid-sized firms manage logistics efficiently

- For instance, HelloFresh implements modular transportation systems to align with inventory, warehouse, and delivery tools seamlessly

Report Scope and Transportation Management System Market Segmentation

|

Attributes |

Transportation Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Transportation Management System Market Trends

“Increasing Adoption of Cloud-Based Solutions”

- Cloud-based transportation management systems are gaining popularity due to their ability to offer real-time data access, enabling businesses to manage logistics operations from anywhere, anytime

- For instance, Companies such as Unilever use cloud platforms to coordinate their global supply chain, allowing teams in different regions to collaborate seamlessly

- The scalability of cloud solutions allows businesses to adjust their transportation management systems as their operations grow or change, providing greater flexibility without the need for significant IT infrastructure investment

- For instance, Amazon scales its logistics operations using cloud-based solutions to manage a vast network of suppliers and distribution centers across different regions

- Cloud-based systems significantly reduce the need for on-site IT resources, making them a cost-effective option for businesses of all sizes, from small enterprises to large corporations

- For instance, HelloFresh, a meal kit delivery company, uses cloud-based systems to manage its transportation and inventory efficiently, without heavy IT overhead

- Enhanced security features in cloud-based solutions ensure data protection and business continuity with built-in disaster recovery tools and encryption

- For instance, FedEx leverages secure cloud solutions to protect shipment and customer data, ensuring a seamless and safe service experience

- Cloud platforms enable the integration of emerging technologies such as artificial intelligence and Internet of Things, enhancing data analysis and operational efficiency

- For instance, DHL integrates AI with its cloud-based systems to predict delivery times and optimize routes, improving overall performance and customer satisfaction

Transportation Management System Market Dynamics

Driver

“Increasing Demand for Efficiency in Supply Chains”

- The growing demand for efficiency and optimization within supply chains is a primary driver for the adoption of transportation management systems

- For instance, Walmart uses transportation management systems to streamline logistics and improve delivery times while reducing operational costs

- Transportation management systems automate time-consuming tasks such as route optimization, load planning, and carrier selection, helping businesses save time and reduce human error

- For instance, Coca-Cola uses these systems to optimize delivery routes, cutting down on fuel costs and reducing time spent on manual planning

- Real-time tracking and visibility offered by transportation management systems enable businesses to monitor shipments, track progress, and proactively address any disruptions

- For instance, FedEx employs real-time tracking to provide customers with accurate delivery times and improve operational responsiveness

- Data analytics capabilities in transportation management systems allow companies to make data-driven decisions and optimize logistics operations, improving supply chain efficiency

- For instance, Amazon analyzes historical data to predict demand, optimize routes, and improve delivery accuracy, staying ahead in the competitive market

- The adoption of transportation management systems is becoming crucial for businesses that want to stay ahead in a competitive market by enhancing supply chain performance

- For instance, Nike utilizes transportation management systems to boost its supply chain efficiency and meet customer expectations for on-time deliveries

Opportunity

“Growing E-Commerce and Last-Mile Delivery Needs”

- The rapid growth of e-commerce is creating significant opportunities for transportation management systems, driven by the need to handle an increasing volume of small packages and faster delivery expectations

- For instance, Shopify uses transportation management systems to optimize last-mile delivery operations and meet the growing demand for fast e-commerce shipments

- Last-mile delivery has become a critical focus, being one of the most expensive and complex parts of the logistics chain, with transportation management systems offering solutions to optimize these operations

- For instance, FedEx utilizes transportation management systems to streamline last-mile deliveries, improving both cost efficiency and delivery speed

- Transportation management systems enable businesses to identify the most efficient routes for last-mile deliveries, helping to reduce costs and improve delivery times

- For instance, UPS uses route optimization software to enhance delivery efficiency, cutting down on fuel consumption and reducing delivery delays

- These systems can integrate with customer-facing platforms to provide real-time tracking, enhancing transparency and communication between companies and end consumers

- For instance, Amazon integrates real-time tracking features in their transportation management system, providing customers with up-to-date delivery information and improving the overall experience

- As e-commerce continues to expand, the demand for efficient last-mile delivery grows, presenting a significant opportunity for transportation management systems to cater to this sector

- For instance, Walmart leverages transportation management systems to optimize its last-mile delivery, meeting consumer expectations for faster and more reliable deliveries

Restraint/Challenge

“Integration and Adoption Costs”

- The integration and implementation costs of transportation management systems present a significant challenge, particularly for small and mid-sized enterprises, requiring considerable time, resources, and technical expertise

- For instance, Zara faced challenges integrating transportation management systems with its existing infrastructure, requiring significant investment in training and system compatibility

- The initial investment in software, hardware, and maintenance costs can be a barrier to adoption, especially for smaller businesses with limited budgets

- For instance, Small online retailers often find it difficult to justify the high upfront costs of implementing complex transportation management systems

- Large organizations, while better equipped financially, still face challenges related to overcoming the learning curve and ensuring full system adoption across all departments

- For instance, Nike invested heavily in a transportation management system but had to dedicate resources to ensure smooth system integration and staff training across its global network

- Data migration from legacy systems to new transportation management systems can lead to potential errors or inefficiencies if not managed carefully, creating additional complexities

- For instance, Target encountered data migration issues when transitioning from a legacy system to a new platform, requiring additional resources to ensure accurate data transfer

- Ensuring proper employee training and system compatibility is another key challenge, often requiring both time and financial resources to avoid disruption and inefficiencies in ongoing operations

- For instance, Coca-Cola invested in extensive employee training to ensure that its new transportation management system was used effectively across its global supply chain

Transportation Management System Market Scope

The market is segmented on the basis of transportation mode, component, and deployment mode

|

Segmentation |

Sub-Segmentation |

|

By Transportation Mode |

|

|

By Component |

|

|

By Deployment Mode |

|

Transportation Management System Market Regional Analysis

“North America is the Dominant Region in the Transportation Management System Market”

- North America is the dominant region in the transportation management system market due to its advanced logistics infrastructure and high technological adoption

- The region benefits from established supply chains and a strong focus on improving operational efficiency across various industries

- Leading companies in retail, manufacturing, and e-commerce, such as FedEx, Walmart, and Amazon, heavily rely on transportation management systems to streamline operations and enhance customer satisfaction

- The adoption of cloud-based solutions, real-time tracking, and advanced data analytics has further strengthened North America's position in the market

- As businesses continue to innovate and adopt new technologies, the demand for transportation management systems in North America is expected to remain strong, reinforcing its market leadership

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is the fastest-growing market for transportation management systems, driven by rapid industrialization and the expansion of e-commerce

- Countries such as China and India are investing heavily in their transportation infrastructure, integrating advanced technologies such as artificial intelligence and Internet of Things devices to optimize supply chain visibility

- The growing middle class and rising consumer demand in the region are creating a need for faster and more reliable delivery systems

- Businesses in the region are adopting transportation management systems to improve last-mile delivery efficiency and reduce operational costs

- As the region continues to develop, the adoption of digital logistics solutions is expected to accelerate, making Asia-Pacific a key area of growth in the transportation management system market

Transportation Management System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Oracle (U.S.)

- Manhattan Associates (U.S.)

- The Descartes Systems Group Inc. (Canada)

- CTSI-Global (U.S.)

- Alpega Group (Belgium)

- BluJay Solutions Ltd. (U.S.)

- Metro Infrasys Pvt. Ltd. (India)

- Software Group (Bulgaria)

- 3GTMS (U.S.)

- Infor (U.S.)

- C.H. Robinson Worldwide, Inc. (U.S.)

- The Descartes Systems Group Inc. (Canada)

- BluJay Solutions Ltd. (U.S.)

- MercuryGate (U.S.)

- Omnitracs (U.S.)

- Next Generation Logistics, Inc. (U.S.)

Latest Developments in Global Transportation Management System Market

- In March 2024, Ocean State Job Lot (U.S.) selected Manhattan Active Transportation Management (TMS) from Manhattan Associates (U.S.) to enhance its logistics planning and execution capabilities. By replacing its legacy transportation management system, OSJL aims to improve operational efficiency, gain better visibility into its transportation network, and reduce costs. This moves marks OSJL's first step towards unifying distribution, transportation, labor, and automation within a single, cloud-native application built on Manhattan Active technology. The implementation of Manhattan Active TMS is expected to streamline OSJL's supply chain operations, providing the retailer with powerful tools to operate, analyze, and optimize its entire logistics network

- In March 2024, Blue Yonder (U.S.) announced a binding agreement to acquire One Network Enterprises (U.S.) for approximately USD 839 million. This strategic acquisition aims to create a unified, end-to-end supply chain ecosystem by integrating One Network’s Digital Supply Chain Network and intelligent control towers with Blue Yonder’s existing capabilities. The combined platform will enable real-time, multi-enterprise optimization and collaboration across customers, carriers, and suppliers. By unifying disparate data silos and leveraging AI-powered insights, the solution will enhance visibility, agility, and decision-making throughout the supply chain. This moves positions Blue Yonder to better serve customers' needs across planning, execution, commerce, and networks, offering a comprehensive solution to navigate supply chain complexities and disruptions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW AND INDUSTRY TRENDS

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 DOMINANT SOLUTIONS PROVIDER_REGION WISE

5.2 KEY SI WHO CAN BE PARTNERED

6 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY COMPONENTS

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 TRAFFIC MANAGEMENT

6.2.1.1. INFORMATION MANAGEMENT

6.2.1.2. SIGNALING

6.2.1.3. AUTOMATIC NUMBERPLATE RECOGNITION

6.2.2 OPERATIONS MANAGEMENT

6.2.2.1. RISK MANAGEMENT

6.2.2.2. PREDICTIVE FLEET MAINTENANCE

6.2.2.3. DRIVING MONITORING

6.2.2.4. MAPPING AND ROUTE GUIDANCE

6.2.2.5. REAL-TIME VEHICLE AND ASSET TRACKING

6.2.2.6. AUTOMATIC SCHEDULING AND VEHICLE LOAD OPTIMIZATION

6.2.2.7. TRANSPORT DATA MANAGEMENT, VISUALIZATION AND ANALYTICS

6.2.3 OTHERS

6.3 HARDWARE

6.3.1 CAMERAS

6.3.1.1. VEHICLE SURVEILLANCE

6.3.1.2. ON-STREET SURVEILLANCE

6.3.2 SENSORS

6.3.3 OTHERS

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICES

6.4.1.1. CSONSULTING

6.4.1.2. IMPLEMENTATION

6.4.1.3. TRAINING & SUPPORT

6.4.2 MANAGED SERVICES

7 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY TRANSPORTATION MODE

7.1 OVERVIEW

7.2 ROADWAYS

7.3 RAILWAYS

7.4 AIRWAYS

7.5 WATERWAYS

8 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 ON-PREMISES

8.3 CLOUD

9 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 PLANNING & EXECUTION

9.3 FLEET MANAGEMENT

10 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY END-USER

10.1 OVERVIEW

10.2 AUTOMOTIVE

10.2.1 SOLUTION

10.2.2 HARDWARE

10.2.3 SERVICES

10.3 CHEMICAL

10.3.1 SOLUTION

10.3.2 HARDWARE

10.3.3 SERVICES

10.4 ELECTRONICS & ELECTRICAL

10.4.1 SOLUTION

10.4.2 HARDWARE

10.4.3 SERVICES

10.5 FOOD & BEVERAGE

10.5.1 SOLUTION

10.5.2 HARDWARE

10.5.3 SERVICES

10.6 HOUSEHOLD & PERSONAL CARE

10.6.1 SOLUTION

10.6.2 HARDWARE

10.6.3 SERVICES

10.7 LOGISTICS

10.7.1 SOLUTION

10.7.2 HARDWARE

10.7.3 SERVICES

10.8 MANUFACTURING

10.8.1 SOLUTION

10.8.2 HARDWARE

10.8.3 SERVICES

10.9 RETAIL

10.9.1 SOLUTION

10.9.2 HARDWARE

10.9.3 SERVICES

10.1 HEALTHCARE

10.10.1 SOLUTION

10.10.2 HARDWARE

10.10.3 SERVICES

10.11 OTHERS

11 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, BY GEOGRAPHY

11.1 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1.1 NORTH AMERICA

11.1.1.1. U.S.

11.1.1.2. CANADA

11.1.1.3. MEXICO

11.1.2 EUROPE

11.1.2.1. GERMANY

11.1.2.2. FRANCE

11.1.2.3. U.K.

11.1.2.4. ITALY

11.1.2.5. SPAIN

11.1.2.6. RUSSIA

11.1.2.7. TURKEY

11.1.2.8. BELGIUM

11.1.2.9. NETHERLANDS

11.1.2.10. SWITZERLAND

11.1.2.11. REST OF EUROPE

11.1.3 ASIA PACIFIC

11.1.3.1. JAPAN

11.1.3.2. CHINA

11.1.3.3. SOUTH KOREA

11.1.3.4. INDIA

11.1.3.5. AUSTRALIA

11.1.3.6. SINGAPORE

11.1.3.7. THAILAND

11.1.3.8. MALAYSIA

11.1.3.9. INDONESIA

11.1.3.10. PHILIPPINES

11.1.3.11. NEW ZEALAND

11.1.3.12. REST OF ASIA PACIFIC

11.1.4 SOUTH AMERICA

11.1.4.1. BRAZIL

11.1.4.2. ARGENTINA

11.1.4.3. COLOMBIA

11.1.4.4. PERU

11.1.4.5. CHILE

11.1.4.6. VENEZUALA

11.1.4.7. ECUADOR

11.1.4.8. REST OF SOUTH AMERICA

11.1.5 MIDDLE EAST AND AFRICA

11.1.5.1. SOUTH AFRICA

11.1.5.2. EGYPT

11.1.5.3. SAUDI ARABIA

11.1.5.4. U.A.E

11.1.5.5. ISRAEL

11.1.5.6. REST OF MIDDLE EAST AND AFRICA

11.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET , SWOT & DBMR ANALYSIS

14 GLOBAL TRANSPORTATION MANAGEMENT SYSTEM MARKET, COMPANY PROFILE

14.1 ORACLE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 SAP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 MANHATTAN ASSOCIATES

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 DESCARTES SYSTEMS GROUP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 3T LOGISTICS & TECHNOLOGY GROUP

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 TSI GLOBAL

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENTS

14.7 GENERIX GROUP

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENTS

14.8 UNIFAUN

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENTS

14.9 SUPPLYSTACK

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENTS

14.1 ULTRASHIP TMS

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENTS

14.11 INFOR

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 WELLDEX LOGISTICS

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENTS

14.13 KORBER AG

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENTS

14.14 BLUE YONDER TRANSPORTATION MANAGEMENT SYSTEMS

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 ALPEGA TMS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 INFOR

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENTS

14.17 ULTRASHIP TMS

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 UNIFAUN

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENTS

14.19 GENERIX GROUP

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 CTSI GLOBAL

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENTS

14.21 WISETECH GLOBALGROUP

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENTS

14.22 FRETRON

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENTS

14.23 INTELLITRANS

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENTS

14.24 ELEMICA

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENTS

14.25 LOGISTICALLY

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 GEOGRAPHIC PRESENCE

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENTS

14.26 ALPEGA GROUP

14.26.1 COMPANY SNAPSHOT

14.26.2 REVENUE ANALYSIS

14.26.3 GEOGRAPHIC PRESENCE

14.26.4 PRODUCT PORTFOLIO

14.26.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 CONCLUSION

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.