Global Treasury Software Market

Market Size in USD Billion

CAGR :

%

USD

3.67 Billion

USD

4.68 Billion

2024

2032

USD

3.67 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Treasury Software Market Size

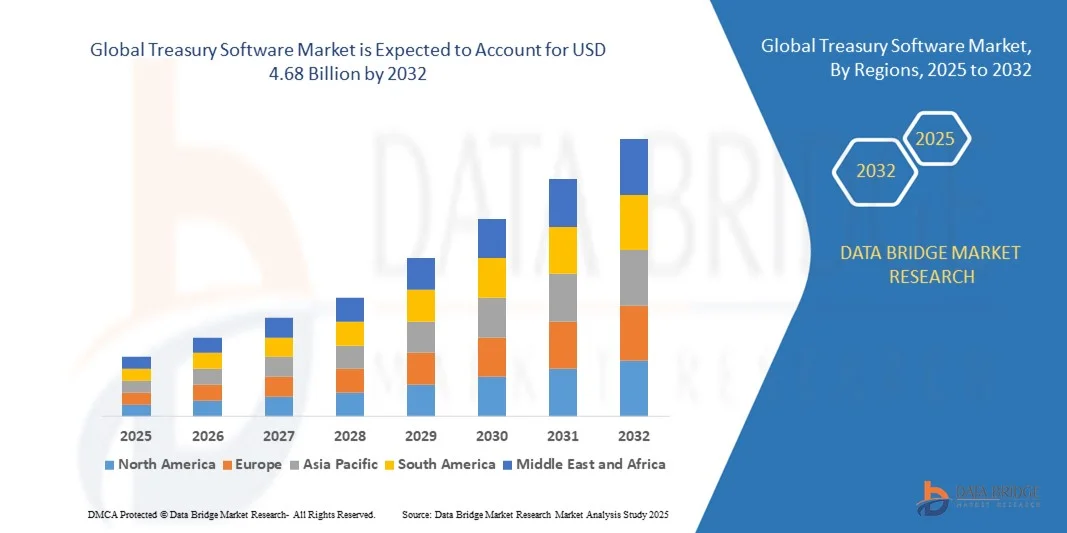

- The global treasury software market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 4.68 billion by 2032, at a CAGR of 3.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital financial management solutions and the ongoing technological advancements in treasury operations, leading to enhanced automation, real-time reporting, and improved cash flow visibility for enterprises

- Furthermore, rising demand from organizations for secure, integrated, and user-friendly platforms to manage liquidity, investments, risk, and compliance is establishing treasury software as an essential tool for modern financial management. These converging factors are accelerating the adoption of treasury solutions, thereby significantly driving market growth

Treasury Software Market Analysis

- Treasury software refers to digital platforms that enable organizations to manage cash, liquidity, investments, debt, financial risks, and regulatory compliance efficiently. These systems integrate with enterprise resource planning (ERP) and banking platforms to provide centralized control, real-time insights, and automation of routine processes

- The escalating demand for treasury software is primarily fueled by the need for operational efficiency, enhanced financial transparency, regulatory compliance, and the growing preference for cloud-based and mobile-accessible solutions that allow treasurers to monitor and manage corporate finances remotely

- North America dominated the treasury software market with a share of 41.55% in 2024, due to a growing demand for digital financial management and automation across enterprises

- Asia-Pacific is expected to be the fastest growing region in the treasury software market during the forecast period due to rising urbanization, increasing digital adoption, and technological advancements in countries such as China, Japan, and India

- On premise segment dominated the market with a market share of 52.8% in 2024, due to organizations’ preference for full control over sensitive financial data, security compliance, and customization options. Many large enterprises continue to invest in on-premise solutions to maintain internal governance and integrate deeply with existing IT infrastructure. The reliability and stability of on-premise deployments make them a preferred choice for mission-critical treasury operations

Report Scope and Treasury Software Market Segmentation

|

Attributes |

Treasury Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Treasury Software Market Trends

Rising Adoption of Cloud-Based and Mobile Treasury Solutions

- The treasury software market is increasingly being shaped by the integration of cloud-based and mobile-enabled solutions, offering improved accessibility, scalability, and security for corporate finance teams. Cloud technology allows organizations to centralize treasury operations across different geographies, reducing infrastructure costs and enhancing operational agility

- For instance, Kyriba has gained prominence in cloud treasury and risk management platforms, providing enterprise clients with secure cloud-native tools for liquidity management, cash visibility, and mobile access. The company’s partnerships with financial institutions demonstrate how providers are offering cloud-enabled innovation to meet evolving treasury demands

- The adoption of mobile-based treasury solutions provides executives and finance leaders with round-the-clock access to critical financial data through smartphones and tablets. This ensures that treasury operations such as authorizing payments, checking liquidity positions, and monitoring market risks can be conducted in real time regardless of location

- Cloud-native treasury platforms also provide embedded analytics and machine learning for predictive cash forecasting and scenario analysis, improving decision-making speed and accuracy. These advancements allow businesses to proactively identify currency exposures, manage interest rate risks, and align liquidity strategies with market fluctuations

- Integration of cloud treasury with digital payment infrastructures and blockchain is further advancing transaction transparency and cross-border payment efficiencies. Providers such as FIS Global are incorporating blockchain-enabled solutions for faster settlement of payments and more secure reconciliation processes, driving innovation within financial workflows

- The growing reliance on cloud and mobile treasury solutions reflects a broader transition toward digital transformation in corporate finance. This trend is enabling resilience and flexibility in treasury operations and also supporting strategic objectives such as improved compliance and risk mitigation across diversified financial networks

Treasury Software Market Dynamics

Driver

Demand for Real-Time Cash Flow and Risk Management

- The need for real-time insights into corporate liquidity and risk management has emerged as a primary driver in treasury software adoption. Companies are facing increasing complexity in financial operations, requiring treasury teams to handle fluctuating currency exposures, interest rate volatility, and global payment challenges with precision and speed

- For instance, SAP’s treasury and risk management modules enable corporates to integrate cash positions, forecast liquidity requirements, and automate hedge accounting processes. By offering visibility and real-time control, these tools help organizations minimize financial risks while maintaining compliance with evolving regulatory frameworks

- Treasury software facilitates centralized visibility over multi-entity and multi-currency cash positions, providing CFOs and treasurers with instant access to cash balances and funding needs. This level of transparency allows organizations to optimize liquidity allocation, reduce idle balances, and improve investment strategies for surplus funds

- The increasing globalization of businesses and complex cross-border financial transactions have heightened the need for robust risk management tools. Treasury platforms are supporting firms by delivering advanced analytics for exposure measurement, regulatory compliance management, and real-time reporting to stakeholders

- The growing demand for continuous liquidity monitoring and proactive risk assessment is making treasury solutions indispensable. As corporations scale operations globally, real-time treasury practices are becoming a critical enabler of stability and financial efficiency across industries

Restraint/Challenge

Integration with Legacy ERP and Banking Systems

- A critical challenge for treasury software adoption lies in the difficulty of integrating advanced digital solutions with existing enterprise resource planning (ERP) systems and diverse banking platforms. Many multinational firms operate on legacy IT environments that complicate seamless data migration and interoperability

- For instance, companies relying on traditional ERP systems such as Oracle E-Business Suite or older banking interfaces often face delays and increased costs while integrating modern treasury applications. This limits the effectiveness of real-time cash visibility and transaction reconciliation

- Legacy system dependencies result in fragmented data silos that obstruct comprehensive financial insights. Without streamlined connections between treasury software, ERP modules, and bank networks, companies struggle with manual reconciliation efforts, duplicative processes, and reporting inefficiencies

- Interoperability challenges extend to limitations in automating payment workflows and ensuring standardization of formats across multiple global banks. Treasury teams often encounter inconsistencies in data exchange and settlement messages, which can increase error rates and compliance risks

- Resolving these integration concerns requires investment in middleware technology, open banking APIs, and gradual modernization of ERP frameworks. Addressing these barriers will be essential for ensuring that advanced treasury platforms can function optimally within interconnected financial ecosystems

Treasury Software Market Scope

The market is segmented on the basis of operating system, application, deployment mode, organization size, and vertical.

- By Operating System

On the basis of operating system, the treasury software market is segmented into Windows, Linux, iOS, Android, and MAC. The Windows segment dominated the largest market revenue share in 2024, driven by its widespread adoption in corporate IT environments and compatibility with legacy financial systems. Enterprises often prefer Windows-based treasury solutions due to their robust support ecosystem, user-friendly interface, and integration capabilities with enterprise resource planning (ERP) and financial software. The familiarity of IT teams with Windows environments further encourages its continued deployment in treasury operations, enabling seamless workflows and efficient system management.

The Android segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising use of mobile-based treasury applications and the need for real-time access to financial data. Android-supported treasury solutions allow professionals to manage liquidity, payments, and investments remotely, enhancing operational efficiency. The platform’s scalability, broad device compatibility, and lower development costs compared to iOS contribute to its accelerating adoption across enterprises of various sizes.

- By Application

On the basis of application, the market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others. The liquidity and cash management segment held the largest revenue share in 2024, as organizations prioritize real-time monitoring of cash positions and optimization of working capital. These solutions help treasurers maintain adequate liquidity, manage short-term investments, and streamline internal cash flows, ensuring operational continuity. The growing complexity of financial transactions and the need for automated cash forecasting further drive adoption of liquidity-focused treasury software.

The financial risk management segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing exposure to market, credit, and operational risks. Organizations are increasingly leveraging treasury solutions to model, monitor, and mitigate risks associated with currency fluctuations, interest rates, and counterparties. Enhanced analytics, scenario planning, and regulatory compliance tools integrated into these systems boost confidence in strategic decision-making, encouraging rapid adoption across sectors.

- By Deployment Mode

On the basis of deployment mode, the treasury software market is segmented into on-premise and cloud. The on-premise segment dominated the market with a share of 52.8% in 2024, supported by organizations’ preference for full control over sensitive financial data, security compliance, and customization options. Many large enterprises continue to invest in on-premise solutions to maintain internal governance and integrate deeply with existing IT infrastructure. The reliability and stability of on-premise deployments make them a preferred choice for mission-critical treasury operations.

The cloud segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the growing demand for scalable, accessible, and cost-efficient treasury solutions. Cloud-based systems offer remote access, real-time reporting, and seamless updates, allowing organizations to quickly adapt to dynamic financial environments. Small and medium-sized enterprises, in particular, are increasingly adopting cloud deployments to reduce IT overhead while gaining enterprise-grade functionalities.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market revenue share in 2024, as these organizations manage complex treasury operations across multiple geographies and currencies. Large enterprises benefit from advanced treasury solutions for consolidating cash management, automating payments, mitigating risks, and ensuring compliance with global financial regulations. Their significant investment capacity allows for customization and integration of treasury software with other enterprise systems, driving adoption.

The SME segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing awareness of digital treasury tools and the need for efficient cash and risk management. SMEs are adopting scalable and cost-effective solutions to enhance operational efficiency, gain real-time visibility into cash flows, and improve decision-making. Cloud-based offerings and subscription pricing models further facilitate adoption among smaller businesses with limited IT resources.

- By Vertical

On the basis of vertical, the treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others. The BFSI segment dominated the market in 2024, owing to the sector’s need to manage large volumes of financial transactions, liquidity, and compliance requirements. Banks and financial institutions rely heavily on treasury solutions to streamline cash management, investment operations, and risk monitoring, ensuring regulatory adherence and operational efficiency. Advanced analytics and real-time monitoring capabilities make these solutions indispensable for the BFSI vertical.

The manufacturing segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the increasing complexity of supply chains, international transactions, and cash flow management requirements. Manufacturers are adopting treasury software to optimize working capital, manage foreign exchange exposure, and improve overall financial planning. Integration with ERP systems and automated payment processing further enhances efficiency, driving rapid adoption across the sector.

Treasury Software Market Regional Analysis

- North America dominated the treasury software market with the largest revenue share of 41.55% in 2024, driven by a growing demand for digital financial management and automation across enterprises

- Organizations in the region highly value real-time cash flow monitoring, risk management, and streamlined compliance offered by treasury solutions

- The widespread adoption is further supported by technologically advanced infrastructure, high IT spending, and the presence of major financial institutions, establishing treasury software as a key tool for efficient corporate financial operations

U.S. Treasury Software Market Insight

The U.S. treasury software market captured the largest revenue share in North America in 2024, fueled by rapid digital transformation and adoption of automated treasury solutions. Enterprises are increasingly prioritizing liquidity optimization, investment oversight, and risk mitigation through integrated software platforms. The rising demand for cloud-based solutions, mobile access, and advanced analytics for real-time decision-making further propels market growth. In addition, the presence of leading software providers and the country’s emphasis on fintech innovation significantly contribute to market expansion.

Europe Treasury Software Market Insight

The Europe treasury software market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by regulatory compliance requirements and the increasing need for enhanced financial transparency in businesses. Organizations are adopting treasury solutions to optimize cash management, manage financial risks, and improve investment oversight. The rise in cross-border transactions, coupled with growing digital adoption in the corporate sector, is fostering the deployment of treasury software. European companies are also integrating treasury systems with ERP and financial reporting platforms to ensure efficiency and compliance.

U.K. Treasury Software Market Insight

The U.K. treasury software market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the demand for robust financial risk management and automated liquidity solutions. Enterprises are focusing on real-time cash visibility, regulatory adherence, and efficient fund allocation, boosting adoption of treasury software. The U.K.’s strong fintech ecosystem, digital banking infrastructure, and widespread use of cloud solutions further support market growth across large enterprises and SMEs.

Germany Treasury Software Market Insight

The Germany treasury software market is expected to expand at a considerable CAGR during the forecast period, fueled by the adoption of advanced digital financial solutions and a focus on risk management and compliance. Enterprises are increasingly implementing treasury software to optimize liquidity, monitor investment portfolios, and automate reporting processes. Germany’s strong industrial base, emphasis on digitalization, and rigorous financial regulations encourage the deployment of treasury solutions in both corporate and governmental sectors.

Asia-Pacific Treasury Software Market Insight

The Asia-Pacific treasury software market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising urbanization, increasing digital adoption, and technological advancements in countries such as China, Japan, and India. Enterprises in the region are increasingly embracing cloud-based and mobile-accessible treasury solutions to enhance liquidity management and financial risk control. Government initiatives promoting digital finance, coupled with the emergence of regional software providers, are driving the adoption of treasury software across industries.

Japan Treasury Software Market Insight

The Japan treasury software market is gaining momentum due to the country’s advanced technological infrastructure and the increasing adoption of automation in financial operations. Enterprises are leveraging treasury solutions for cash flow optimization, investment monitoring, and regulatory compliance. The integration of treasury software with enterprise resource planning and financial reporting systems is fueling growth, while the demand for user-friendly, secure solutions in both large enterprises and SMEs continues to rise.

China Treasury Software Market Insight

The China treasury software market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, technological adoption, and the growth of corporate financial operations. Organizations are implementing treasury software for efficient liquidity management, investment oversight, and risk mitigation. The strong push toward digital finance, coupled with the availability of cost-effective solutions from domestic and global providers, is propelling market growth across multiple sectors including manufacturing, BFSI, and consumer goods.

Treasury Software Market Share

The treasury software industry is primarily led by well-established companies, including:

- Finastra (U.K.)

- ZenTreasury Ltd (Finland)

- Emphasys Software (U.S.)

- SS&C Technologies, Inc. (U.S.)

- CAPIX (Australia)

- Adenza (U.K. & U.S.)

- Coupa Software Inc. (U.S.)

- DataLog Finance (France & Singapore)

- FIS (U.S.)

- Access Systems (UK) Limited (U.K.)

- Treasury Software Corp. (U.S.)

- MUREX S.A.S (France)

- EdgeVerve Systems Limited (India)

- Financial Sciences Corp. (U.S.)

- Broadridge Financial Solutions, Inc. (U.S.)

- CashAnalytics (Ireland)

- Oracle (U.S.)

- Fiserv, Inc. (U.S.)

- ION (U.K.)

- SAP (Germany)

- Solomon Software (U.S.)

- ABM CLOUD (Georgia)

Latest Developments in Global Treasury Software Market

- In June 2023, ZenTreasury introduced significant enhancements to its IFRS 16 Lease Accounting Software, streamlining compliance processes for businesses. The updated software features advanced automation capabilities, enabling real-time tracking and reporting of lease obligations. This improvement reduces manual data entry and minimizes the risk of errors, ensuring accurate financial reporting. By integrating seamlessly with existing enterprise resource planning (ERP) systems, the software facilitates smoother audits and enhances overall operational efficiency. The upgrade positions ZenTreasury as a leader in providing comprehensive lease accounting solutions that meet evolving regulatory requirements

- In May 2023, Treasury Intelligence Solutions (TIS) and Delega expanded their collaboration to enhance electronic Bank Account Management (eBAM) functionalities. The integration now offers advanced features for managing signatory rights across multiple banking relationships. This development allows corporate treasurers to automate the creation, modification, and deletion of signatory records, significantly reducing manual interventions and the associated risks. The expanded eBAM capabilities ensure compliance with global banking regulations and improve the efficiency of treasury operations. This strategic enhancement underscores the commitment of TIS and Delega to provide cutting-edge solutions for modern treasury management

- In April 2023, ZenTreasury launched a multi-currency module within its IFRS 16 Lease Accounting Software, addressing the complexities faced by multinational corporations. This new feature enables businesses to manage lease obligations across different currencies within a single platform. The module automates currency conversions and ensures accurate financial reporting in compliance with international accounting standards. By centralizing lease data and providing real-time insights, the multi-currency module enhances decision-making processes and supports global financial consolidation efforts. This addition reinforces ZenTreasury's commitment to offering scalable solutions for businesses operating in diverse financial environments

- In March 2022, ZenTreasury and its local partner MCA provided Redington Gulf with Lease Accounting Software for IFRS-16. Customers are no longer obliged to import data from several sources and store it on multiple platforms. Everything is performed with a single piece of software. This integration simplifies workflows, reduces data redundancy, and enhances data accuracy, leading to more efficient lease accounting processes. The solution's comprehensive approach streamlines compliance and reporting tasks, allowing businesses to focus more on strategic financial management

- In September 2022, TIS and Delega collaborated to provide customers with next-generation automated multi-bank signatory rights management. Customers of TIS and Delega can take advantage of NextGen electronic bank account management (eBAM) thanks to the agreement. This collaboration enables organizations to automate and centralize the management of bank account signatories, improving efficiency and reducing the risk of errors. By streamlining the process, businesses can ensure better compliance with banking regulations and enhance the security of their financial operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.