Global Tree Trimmers Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

3.17 Billion

2025

2033

USD

2.60 Billion

USD

3.17 Billion

2025

2033

| 2026 –2033 | |

| USD 2.60 Billion | |

| USD 3.17 Billion | |

|

|

|

|

Tree Trimmers Market Size

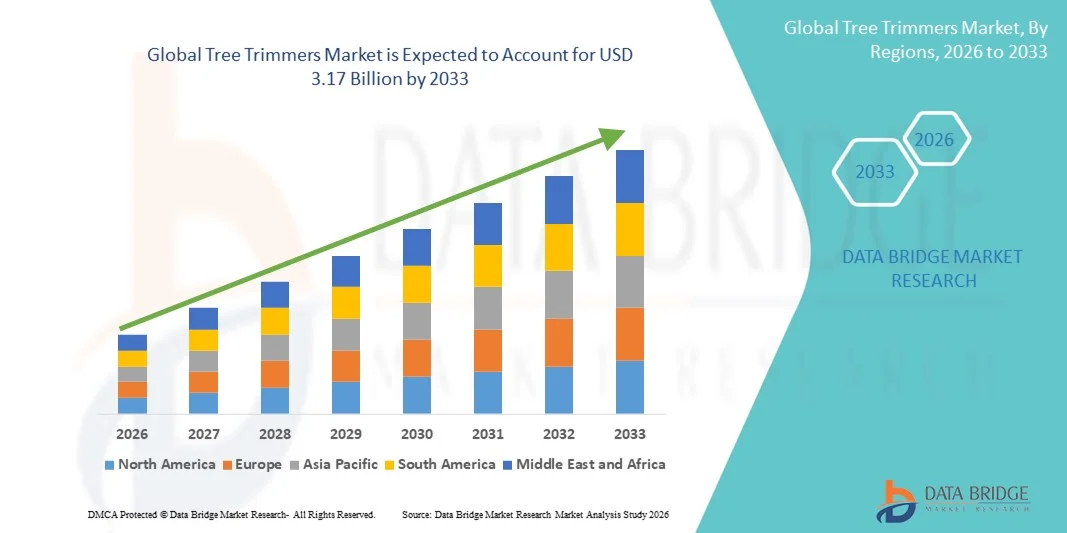

- The global tree trimmers market size was valued at USD 2.60 billion in 2025 and is expected to reach USD 3.17 billion by 2033, at a CAGR of 2.50% during the forecast period

- The market growth is largely fuelled by increasing urban landscaping activities, rising demand for residential and commercial gardening equipment, and the growing adoption of electric and battery-powered trimmers

- Growing awareness of tree maintenance and safety practices among homeowners and landscaping companies is further driving market demand

Tree Trimmers Market Analysis

- The market is witnessing steady growth due to the expansion of the landscaping and horticulture industries, along with increased spending on garden maintenance and outdoor aesthetics

- Rising demand for eco-friendly and low-noise electric trimmers, coupled with easy availability through e-commerce platforms, is shaping consumer preferences and driving sales

- North America dominated the tree trimmers market with the largest revenue share of 35.50% in 2025, driven by increasing investments in landscaping, municipal maintenance, and urban green spaces

- Asia-Pacific region is expected to witness the highest growth rate in the global tree trimmers market, driven by increasing urbanization, expanding horticulture and landscaping industries, and technological adoption in gardening equipment

- The chain saw segment held the largest market revenue share in 2025, driven by its versatility, high cutting efficiency, and widespread use among both professional landscapers and residential users. Chain saws are particularly preferred for their ability to handle a variety of tree sizes and types, making them a popular choice for routine trimming and tree maintenance

Report Scope and Tree Trimmers Market Segmentation

|

Attributes |

Tree Trimmers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tree Trimmers Market Trends

Rising Demand for Efficient and Ergonomic Tree Trimming Solutions

- Increasing focus on maintaining urban landscapes, gardens, and green spaces is significantly shaping the tree trimmers market, as consumers and professionals increasingly prefer tools that are lightweight, safe, and easy to use. Modern tree trimmers are gaining traction due to their ability to improve trimming efficiency, reduce labor effort, and ensure precise cutting, strengthening adoption across residential, commercial, and municipal applications

- Growing awareness around outdoor maintenance, safety, and eco-friendly practices has accelerated the demand for electric and battery-powered tree trimmers. Homeowners, landscapers, and municipal authorities are actively seeking products that minimize noise and emissions while providing reliable performance, prompting manufacturers to prioritize sustainable designs and innovative features

- Technological advancements, such as ergonomic designs, adjustable lengths, and enhanced battery life, are influencing purchasing decisions, with manufacturers emphasizing ease of use, durability, and safety. These factors are helping brands differentiate products in a competitive market and build consumer trust, while driving the adoption of professional-grade and consumer-friendly models

- For instance, in 2024, Stihl in Germany and Husqvarna in Sweden expanded their product portfolios by introducing battery-powered and lightweight tree trimmers for residential and professional use. These launches responded to rising consumer preference for eco-friendly, low-noise, and high-performance trimming solutions, with distribution across retail, online, and specialty outlets

- While demand for tree trimmers is growing, sustained market expansion depends on continuous innovation, cost-effective production, and maintenance of functional performance across electric, battery, and gasoline-powered models. Manufacturers are focusing on improving supply chain efficiency, product reliability, and ergonomic designs to encourage broader adoption

Tree Trimmers Market Dynamics

Driver

Rising Preference for Efficient, Lightweight, and Eco-Friendly Trimmers

- Increasing consumer and professional demand for electric and battery-powered tree trimmers is a major driver for the market. Manufacturers are developing products that combine high performance with reduced noise and emissions, meeting regulatory standards and consumer expectations

- Expanding landscaping, gardening, and municipal maintenance applications are influencing market growth. Tree trimmers help enhance operational efficiency, trimming precision, and safety, enabling users to maintain greenery with minimal effort. The rising popularity of home gardening and urban green projects further reinforces this trend

- Equipment manufacturers are actively promoting ergonomic, energy-efficient, and technologically advanced tree trimmers through product innovation, marketing campaigns, and professional endorsements. These efforts are supported by the growing emphasis on outdoor aesthetics, sustainability, and ease of use, encouraging partnerships between suppliers and retailers

- For instance, in 2023, Makita in Japan and Black+Decker in the U.S. reported increased sales of battery-powered and electric tree trimmers for residential and professional users. This expansion followed growing awareness of low-noise, eco-friendly, and easy-to-handle solutions, driving repeat purchases and brand loyalty

- Although rising demand supports market growth, wider adoption depends on cost optimization, battery efficiency, and availability of spare parts and service networks. Investment in R&D, supply chain reliability, and innovative features will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost And Maintenance Requirements Compared To Conventional Tools

- The relatively higher cost of electric and battery-powered tree trimmers compared to manual or gasoline-powered alternatives remains a key challenge, limiting adoption among price-sensitive users. Expensive components, battery replacement, and maintenance costs contribute to elevated pricing

- Consumer and professional awareness of advanced trimming solutions remains uneven, particularly in developing markets where traditional manual trimmers are still preferred. Limited understanding of ergonomic and eco-friendly benefits restricts adoption in certain regions

- Supply chain and service challenges also impact market growth, as advanced tree trimmers require spare parts, battery replacements, and proper maintenance. Logistical complexities and after-sales service availability increase operational costs, which can deter potential buyers

- For instance, in 2024, distributors in India and Brazil supplying battery-powered tree trimmers reported slower uptake due to high prices, limited awareness, and insufficient servicing networks. These factors also prompted some retailers to allocate limited shelf space for premium trimmers, affecting visibility and sales

- Overcoming these challenges will require cost-efficient production, expanded distribution and service networks, and focused educational initiatives for users and retailers. Collaboration with distributors, e-commerce platforms, and professional landscapers can help unlock the long-term growth potential of the global tree trimmers market. In addition, developing affordable, durable, and low-maintenance solutions will be essential for widespread adoption

Tree Trimmers Market Scope

The tree trimmers market is segmented on the basis of equipment, power, and application type.

- By Equipment

On the basis of equipment, the tree trimmers market is segmented into stump grinder, chain saw, tree lopper, and wood chipper. The chain saw segment held the largest market revenue share in 2025, driven by its versatility, high cutting efficiency, and widespread use among both professional landscapers and residential users. Chain saws are particularly preferred for their ability to handle a variety of tree sizes and types, making them a popular choice for routine trimming and tree maintenance.

The wood chipper segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing demand for eco-friendly disposal of tree debris and the efficiency of converting branches and trimmings into mulch or compost. Wood chippers are gaining traction among commercial landscaping companies and municipal authorities for their productivity and environmental benefits.

- By Power

On the basis of power, the market is segmented into gas powered tree trimmers and electric powered tree trimmers. Electric powered tree trimmers held the largest share in 2025 due to their low noise, ease of use, and growing adoption among residential consumers for home gardening and small-scale landscaping.

Gas powered tree trimmers are expected to witness the fastest growth from 2026 to 2033, driven by their high power output, portability, and suitability for large-scale commercial and industrial applications. These trimmers are preferred for heavy-duty trimming, professional landscaping, and areas with limited access to electricity.

- By Application Type

On the basis of application type, the market is segmented into commercial application and residential application. The commercial application segment held the largest market share in 2025, supported by the expansion of landscaping, municipal maintenance, and urban development projects.

The residential application segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing awareness of home garden maintenance, ease of use of modern tree trimmers, and the rising popularity of do-it-yourself (DIY) landscaping among homeowners.

Tree Trimmers Market Regional Analysis

- North America dominated the tree trimmers market with the largest revenue share of 35.50% in 2025, driven by increasing investments in landscaping, municipal maintenance, and urban green spaces

- Consumers and commercial operators in the region value the durability, efficiency, and versatility of modern tree trimmers for both residential and commercial applications

- This widespread adoption is further supported by high disposable incomes, a technologically aware population, and the growing preference for professional landscaping services, establishing tree trimmers as essential tools for maintenance and horticultural activities

U.S. Tree Trimmers Market Insight

The U.S. tree trimmers market captured the largest revenue share in 2025 within North America, fueled by the expansion of landscaping services, urban development projects, and the increasing trend of residential garden maintenance. Consumers and businesses are prioritizing high-performance equipment that ensures efficient trimming, pruning, and debris management. The growing preference for electric-powered and gas-powered trimmers for ease of use and productivity further drives market growth. Moreover, the rising adoption of automated and semi-automatic equipment is significantly contributing to the market's expansion.

Europe Tree Trimmers Market Insight

The Europe tree trimmers market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by urbanization, stringent safety regulations, and the increasing emphasis on green landscaping. The growing adoption of commercial and residential tree maintenance equipment, coupled with environmentally conscious initiatives, is fostering market growth. European consumers and landscaping firms are also drawn to energy-efficient and ergonomic trimmers, enhancing productivity and reducing operational costs.

U.K. Tree Trimmers Market Insight

The U.K. tree trimmers market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for home garden maintenance and professional landscaping services. Concerns regarding property aesthetics and green space management are encouraging both homeowners and businesses to invest in advanced tree trimming equipment. The UK’s well-established e-commerce and retail infrastructure is also facilitating greater access to high-quality tree trimmers, supporting market expansion.

Germany Tree Trimmers Market Insight

The Germany tree trimmers market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing awareness of sustainable landscaping, high safety standards, and technological innovations in trimmer design. Germany’s emphasis on innovation, combined with robust infrastructure and environmental regulations, promotes the adoption of advanced and eco-friendly tree trimming solutions, particularly in commercial and municipal applications.

Asia-Pacific Tree Trimmers Market Insight

The Asia-Pacific tree trimmers market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing adoption of landscaping equipment in countries such as China, Japan, and India. The region’s increasing focus on green urban development, supported by government initiatives promoting landscaping and horticulture, is boosting the demand for tree trimmers. In addition, APAC is emerging as a manufacturing hub for electric and gas-powered trimmers, increasing affordability and accessibility for a wide range of consumers.

Japan Tree Trimmers Market Insight

The Japan tree trimmers market is expected to witness steady growth from 2026 to 2033 due to the country’s high focus on urban greenery, technological advancement, and demand for convenience. Japanese consumers and professional landscapers prefer high-quality, efficient, and easy-to-use equipment for maintaining residential gardens and commercial green spaces. The integration of electric and automated trimmers with ergonomic designs is driving adoption.

China Tree Trimmers Market Insight

The China tree trimmers market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing investments in landscaping, and growing awareness of residential garden maintenance. China is witnessing rising demand for both commercial and residential tree trimming solutions, with electric and gas-powered equipment becoming increasingly popular. The availability of affordable and high-performance trimmers, along with strong domestic manufacturing, is a key factor propelling market growth.

Tree Trimmers Market Share

The Tree Trimmers industry is primarily led by well-established companies, including:

• Koki Holdings Co., Ltd. (Japan)

• Husqvarna Group (Sweden)

• STIHL Incorporated (U.S.)

• YAMABIKO Corporation (Japan)

• Makita.in (Japan)

• Oregon Tool, Inc. (U.S.)

• STIGA S.p.A (Italy)

• Emak S.p.A. (Italy)

• Craftsman Automation, India (India)

• The Toro Company (U.S.)

• Zhejiang Zomax Garden Machinery Co., Ltd. (China)

• WORX (China)

• Fiskars Group (Finland)

• Robert Bosch GmbH (Germany)

• American Honda Motor Co., Inc. (U.S.)

• Deere & Company (U.S.)

• Greenworks Tools (U.S.)

• Briggs & Stratton, LLC. (U.S.)

• Stanley Black & Decker, Inc. (U.S.)

• Hitachi, Ltd. (Japan)

Latest Developments in Global Tree Trimmers Market

- In March 2024, Husqvarna Group (Sweden) announced the acquisition of ETwater, a development aimed at expanding the commercial offerings of its Gardena division in North America by integrating smart irrigation management technology into its portfolio. The move is expected to enhance Husqvarna’s presence in the gardening and landscaping market, provide enterprise customers with advanced water‑management solutions, and strengthen its competitive position in sustainable outdoor equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.