Global Triac Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.75 Billion

2024

2032

USD

1.60 Billion

USD

2.75 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.75 Billion | |

|

|

|

|

Global TRIAC Market Size

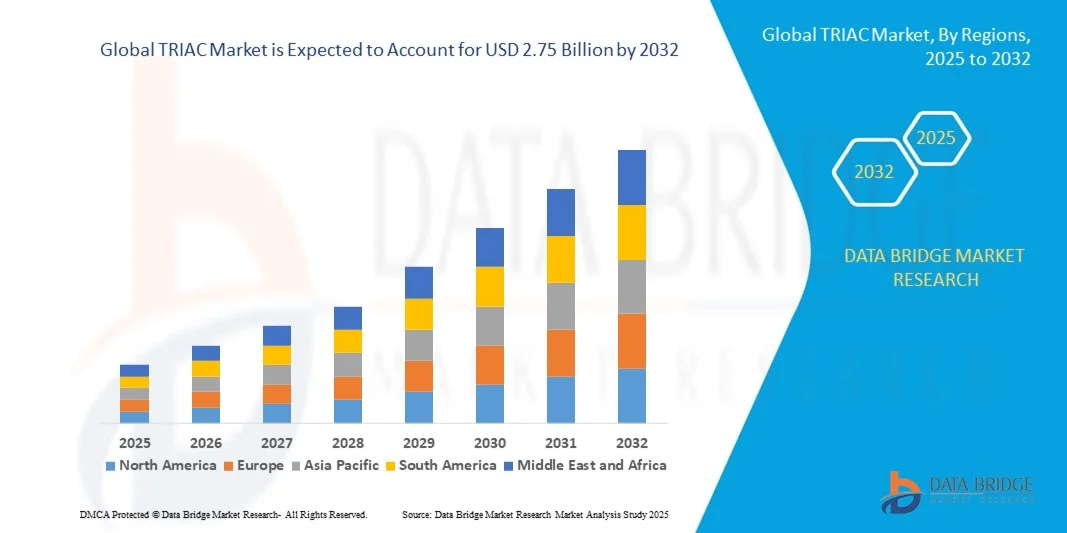

- The global TRIAC market size was valued at USD 1.60 billion in 2024 and is projected to reach USD 2.75 billion by 2032, growing at a CAGR of 7.00% during the forecast period.

- The market's growth is primarily driven by the increasing demand for efficient power control in consumer electronics, industrial automation, and lighting applications, fueled by global energy efficiency initiatives.

- In addition, ongoing advancements in semiconductor technologies and the growing trend of integrating TRIACs into smart and connected devices are expanding their use across sectors, further propelling the market's rapid expansion.

Global TRIAC Market Analysis

- TRIACs, or Triode for Alternating Current devices, are essential components in modern electronic systems, offering efficient and reliable control of AC power in applications such as light dimming, motor speed control, and home appliance automation across residential, commercial, and industrial sectors due to their compact size, cost-effectiveness, and ability to handle high voltage and current.

- The surging demand for TRIACs is largely driven by the rapid expansion of smart appliances, industrial automation, and energy-efficient lighting systems, alongside increasing global emphasis on reducing energy consumption and improving power efficiency.

- North America dominated the global TRIAC market with the largest revenue share of 32.5% in 2024, driven by robust manufacturing infrastructure, expanding consumer electronics sector, and aggressive government initiatives promoting industrial digitization, especially in countries like China, Japan, and South Korea.

- Asia Pacific is expected to be the fastest-growing region in the TRIAC market during the forecast period, fueled by increasing adoption of smart home technologies, industrial IoT applications, and a growing focus on sustainable energy management solutions.

- The bidirectional TRIAC segment dominated the market with a revenue share of 62.5% in 2024, owing to its widespread use in AC power control applications where current flows in both directions.

Report Scope and Global TRIAC Market Segmentation

|

Attributes |

TRIAC Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global TRIAC Market Trends

Advanced Control Through AI-Driven Power Management

- A notable and rapidly growing trend in the global TRIAC market is the integration of artificial intelligence (AI) and machine learning (ML) technologies for smarter and more adaptive AC power control, especially in applications like smart lighting, industrial automation, and energy-efficient appliances. This advancement is enabling more precise and dynamic control of voltage and current, enhancing both performance and energy savings.

- For Instance, AI-powered lighting systems using TRIACs can automatically adjust brightness and power output based on ambient light, time of day, or occupancy patterns. Similarly, smart HVAC systems leverage AI with TRIACs for efficient fan speed and compressor control, reducing energy usage without compromising comfort.

- In industrial settings, AI-driven predictive maintenance solutions are increasingly utilizing TRIAC-based systems to monitor power flow anomalies and forecast equipment failures before they occur. This not only minimizes downtime but also extends the life of machinery. Companies are developing TRIAC controllers that integrate AI algorithms to learn operational patterns and optimize load control in real-time.

- The convergence of TRIAC technology with smart building management systems is streamlining control of lighting, motorized blinds, heating, and ventilation, all from centralized dashboards. These smart systems can autonomously adapt based on user behavior, environmental data, or energy consumption trends, providing greater operational efficiency.

- This evolution towards AI-enhanced, self-optimizing TRIAC applications is setting new standards for precision and responsiveness in power control. Companies such as Infineon Technologies and STMicroelectronics are leading this shift by offering intelligent power modules and TRIACs with embedded AI compatibility for use in next-gen appliances and industrial automation systems.

- As industries and consumers alike seek smarter, greener, and more automated solutions, the demand for TRIACs integrated with AI-driven control systems is expected to accelerate significantly across residential, commercial, and industrial markets.

Global TRIAC Market Dynamics

Driver

Rising Demand Driven by Energy Efficiency Goals and Smart Infrastructure Growth

-

The global TRIAC market is witnessing significant growth due to the increasing demand for energy-efficient power control solutions in smart homes, industrial automation, and consumer electronics. This trend is closely aligned with global sustainability goals and government regulations promoting energy conservation across sectors.

- For instance, several national energy-efficiency programs, including the European Union’s Ecodesign Directive and energy labeling initiatives, are pushing manufacturers to adopt components like TRIACs for optimized power regulation in appliances and lighting systems. These regulatory drivers are expected to fuel TRIAC adoption through the forecast period.

- TRIACs play a crucial role in applications such as dimmable LED lighting, smart thermostats, and HVAC systems, allowing precise AC power control while reducing energy waste. Their small size, cost-effectiveness, and efficiency make them ideal for integration into next-generation smart devices and systems.

- The rapid expansion of smart cities and intelligent infrastructure is further accelerating TRIAC usage in automated lighting, motor control, and building energy management systems. Their ability to operate with minimal maintenance makes them suitable for large-scale, connected deployments that require long operational life.

- In residential and commercial environments, the integration of TRIACs into smart appliances enables seamless power modulation, contributing to reduced electricity bills and enhanced device lifespan. As IoT adoption grows, TRIACs are becoming essential in ensuring consistent, efficient AC power delivery across interconnected devices and platforms.

Restraint/Challenge

Thermal Management Issues and Limitations in High-Power Applications

- Despite their advantages, TRIACs face challenges in high-power and high-frequency applications due to issues such as heat dissipation and limited efficiency at higher switching speeds. These factors can restrict their use in demanding industrial or utility-scale systems.

- For Instance, TRIACs are typically not suitable for inductive loads or applications that require fast switching and precise timing, such as high-speed motors or complex automation systems. In such cases, alternative technologies like IGBTs or MOSFETs are often preferred.

- Excessive heat generation during operation can lead to device degradation and failure if proper heat sinks or thermal management solutions are not implemented. This adds to system complexity and cost, particularly in dense electronic designs or compact consumer devices.

- Furthermore, TRIACs are known to experience issues such as false triggering and susceptibility to electromagnetic interference (EMI), which can affect performance reliability in sensitive environments.

- To address these limitations, manufacturers are focusing on material innovations, such as silicon carbide (SiC) and gallium nitride (GaN), and integrating advanced gate-control technologies to improve TRIAC performance and reliability. However, these advancements may also result in increased production costs, which can be a concern for price-sensitive markets.

- Overcoming these technical constraints through improved design, better thermal solutions, and continued R&D will be critical to enabling TRIACs to meet the evolving needs of smart, energy-efficient systems while maintaining cost competitiveness.

Global TRIAC Market Scope

The market is segmented on the basis of type, application, end user.

- By Type

On the basis of type, the TRIAC market is segmented into bidirectional TRIAC and unidirectional TRIAC. The bidirectional TRIAC segment dominated the market with a revenue share of 62.5% in 2024, owing to its widespread use in AC power control applications where current flows in both directions. This includes common use cases such as light dimmers, motor speed controls, and domestic appliances. Bidirectional TRIACs are preferred in these scenarios due to their versatility, reliability, and ability to handle alternating current efficiently, making them integral in residential and commercial electronic systems.

The unidirectional TRIAC segment is expected to register the fastest CAGR from 2025 to 2032, driven by increasing use in specific low-cost or single-directional control applications where cost and circuit simplicity are prioritized. With growing interest in basic automation systems and cost-efficient solutions in emerging markets, unidirectional TRIACs are gaining traction for their role in simplified and targeted power control.

- By Application

Based on application, the TRIAC market is segmented into consumer electronics, industrial, automotive, telecommunications, and others. The consumer electronics segment held the largest market revenue share of 39.8% in 2024, supported by high demand for TRIACs in household appliances, light dimmers, and personal electronics. These devices increasingly require efficient AC switching and control, areas where TRIACs excel due to their compact form, cost-effectiveness, and operational stability. The rise in smart appliances, particularly in Asia-Pacific and North America, further strengthens demand in this segment.

The industrial segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the rising automation of manufacturing processes and the need for precise motor speed control, temperature regulation, and high-voltage power switching. Industrial environments rely on TRIACs for their robustness and durability in controlling AC power loads in systems such as HVAC, robotics, and automated machinery.

- By End-User

On the basis of end-user, the market is segmented into residential, commercial, and industrial. The residential segment dominated the market in 2024 with a revenue share of 46.3%, driven by widespread integration of TRIACs in home appliances, lighting systems, and smart home devices. Increasing consumer demand for energy-efficient solutions and the growing adoption of smart home ecosystems continue to support TRIAC use in household applications. Products like dimmable LED bulbs, smart thermostats, and fan speed regulators commonly rely on TRIAC-based switching to deliver smooth, noise-free AC control.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of building automation, centralized power control, and energy-saving lighting in offices, retail spaces, and institutional buildings. TRIACs play a vital role in delivering consistent and efficient AC power control across lighting systems, HVAC, and automated facility management systems, contributing to the drive for sustainable and intelligent commercial infrastructure.

Global TRIAC Market Regional Analysis

- North America dominated the global TRIAC market with the largest revenue share of 32.5% in 2024, driven by rapid industrialization, expansion of consumer electronics manufacturing, and government initiatives promoting energy-efficient technologies across the region.

- Countries such as China, Japan, South Korea, and India are major contributors, with robust demand for TRIACs in household appliances, LED lighting, and industrial automation systems. The region’s strong electronics production base and growing emphasis on sustainable energy usage further accelerate market growth.

- This dominance is also supported by increasing urbanization, rising disposable incomes, and a growing middle-class population seeking smart, energy-efficient solutions. Additionally, Asia-Pacific's role as a global manufacturing hub enables high-volume production and adoption of TRIAC-based components in both domestic and export-oriented industries, positioning the region as a key driver of long-term market expansion.

U.S. TRIAC Market Insight

The U.S. TRIAC market captured the largest revenue share of 74% in North America in 2024, driven by the rapid adoption of energy-efficient technologies and a high demand for advanced electronic devices. The strong presence of leading semiconductor manufacturers, coupled with early adoption of smart home and industrial automation systems, has solidified the U.S. as a key market for TRIAC applications. Growing interest in sustainable infrastructure and demand for precise AC power control in HVAC systems, smart lighting, and household appliances further fuel market growth. The expansion of electric vehicle (EV) infrastructure and renewable energy integration is also contributing to TRIAC usage in power management solutions.

Europe TRIAC Market Insight

The Europe TRIAC market is projected to grow at a significant CAGR during the forecast period, largely due to stringent energy efficiency regulations, increasing focus on carbon neutrality, and the widespread deployment of smart grids. As countries across Europe invest in modernizing electrical infrastructure, TRIACs are being utilized in both consumer electronics and industrial equipment for effective AC switching. Demand for advanced lighting control and smart building management systems is driving adoption, particularly in Germany, France, and the Nordic countries. Retrofitting existing infrastructure with energy-efficient components is also a key contributor to market growth.

U.K. TRIAC Market Insight

The U.K. TRIAC market is anticipated to grow at a notable CAGR, propelled by increasing government initiatives to reduce energy consumption and support smart building technologies. Rising demand for automation in residential and commercial settings is encouraging the use of TRIACs in lighting systems, motor controllers, and consumer electronics. The U.K.’s strong push toward net-zero carbon emissions and energy-efficient renovations across housing and public infrastructure is creating favorable conditions for TRIAC adoption. Additionally, local semiconductor innovation and a growing focus on green technology are supporting long-term market growth.

Germany TRIAC Market Insight

The Germany TRIAC market is expected to expand steadily, driven by the country's leadership in engineering innovation and its aggressive push towards industrial automation and energy efficiency. With a strong manufacturing base, Germany extensively uses TRIACs in motor control systems, HVAC, and process automation. The country's commitment to Industry 4.0 and smart factory integration is accelerating the adoption of reliable, compact AC switching devices like TRIACs. Demand is particularly strong in sectors like automotive, industrial machinery, and commercial construction, where efficiency and control are paramount.

Asia-Pacific TRIAC Market Insight

The Asia-Pacific TRIAC market is set to grow at the fastest CAGR of 22.3% from 2025 to 2032, fueled by rapid industrialization, urbanization, and strong growth in the electronics manufacturing sector. Countries such as China, Japan, South Korea, and India are major contributors to the region’s dominance. The increasing production and consumption of smart appliances, coupled with demand for cost-effective, energy-efficient solutions, are driving the use of TRIACs in household and industrial applications. Government policies supporting energy savings and digital transformation are further accelerating the pace of TRIAC adoption across the region.

Japan TRIAC Market Insight

The Japan TRIAC market is gaining strong momentum, reflecting the country's technological leadership and energy-conscious culture. TRIACs are widely used in Japan’s high-end electronics, automation systems, and smart infrastructure. With a mature smart home market and significant advancements in robotics and manufacturing automation, Japan relies on TRIACs for efficient AC control. Additionally, Japan’s focus on sustainable urban development and energy efficiency drives TRIAC integration in lighting, climate control, and consumer electronics. The aging population also contributes to the demand for user-friendly, automated appliances incorporating TRIAC-based controls.

China TRIAC Market Insight

The China TRIAC market held the largest revenue share in Asia-Pacific in 2024, supported by the country's dominance in electronics manufacturing, rapid urban growth, and expanding middle-class population. TRIACs are in high demand for use in home appliances, lighting systems, and electric motor controllers. Government support for domestic semiconductor development and energy efficiency is also playing a critical role in boosting the TRIAC market. Moreover, China's aggressive development of smart cities and the presence of leading TRIAC component manufacturers contribute to its leadership position within the region. As the nation continues to digitize its industrial and residential infrastructure, TRIAC usage is expected to rise steadily.

Global TRIAC Market Share

The TRIAC industry is primarily led by well-established companies, including:

- STMicroelectronics (Switzerland)

- NXP Semiconductors (Netherlands)

- ON Semiconductor (U.S.)

- Infineon Technologies (Germany)

- Texas Instruments (U.S.)

- Vishay Intertechnology (U.S.)

- Littelfuse (U.S.)

- Microchip Technology (U.S.)

- Renesas Electronics (Japan)

- Diodes Incorporated (U.S.)

- Toshiba Corporation (Japan)

- Fuji Electric (Japan)

- Mitsubishi Electric (Japan)

- IXYS Corporation (U.S.)

- Semikron (Germany)

- Central Semiconductor (U.S.)

- Sanken Electric (Japan)

- Shindengen Electric Manufacturing (Japan)

- Bourns Inc. (U.S.)

What are the Recent Developments in Global TRIAC Market?

- In April 2023, STMicroelectronics launched a new series of high-performance TRIAC components designed specifically for industrial automation and smart lighting applications. This initiative emphasizes the company’s focus on enhancing energy efficiency and reliability in power control systems across diverse markets. By integrating cutting-edge semiconductor technology, STMicroelectronics aims to meet the rising demand for precise AC load switching and to strengthen its leadership position in the global TRIAC market.

- In March 2023, ON Semiconductor introduced an advanced TRIAC solution optimized for automotive applications, particularly in electric vehicle (EV) charging and lighting control. This innovation reflects ON Semiconductor’s commitment to supporting the rapidly growing EV market with efficient power management components. The launch underscores the company’s strategy to expand its footprint in the automotive segment while addressing evolving industry requirements for compact, energy-saving devices.

- In March 2023, Infineon Technologies announced the successful deployment of TRIAC-based smart energy management systems in smart grid projects across Europe. These systems facilitate real-time load control and contribute to grid stability by integrating renewable energy sources more effectively. Infineon’s involvement in these projects highlights the increasing importance of TRIACs in enabling sustainable, intelligent power distribution infrastructures globally.

- In February 2023, Texas Instruments formed a strategic partnership with major home appliance manufacturers to embed its next-generation TRIAC components into smart home devices. This collaboration aims to enhance device performance through improved energy efficiency and robust switching capabilities. Texas Instruments’ initiative demonstrates its dedication to driving innovation within the consumer electronics sector and accelerating the adoption of smart, energy-saving technologies.

- In January 2023, Microchip Technology unveiled a new TRIAC product line featuring enhanced thermal protection and integrated diagnostics for industrial motor control applications. Showcased at the Consumer Electronics Show (CES) 2023, these TRIACs offer manufacturers improved safety and reliability for high-demand environments. Microchip’s latest offering reinforces its commitment to delivering advanced semiconductor solutions that address the evolving needs of industrial automation and control markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Triac Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Triac Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Triac Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.