Global Triazole Fungicides Market

Market Size in USD Billion

CAGR :

%

USD

4.13 Billion

USD

5.78 Billion

2024

2032

USD

4.13 Billion

USD

5.78 Billion

2024

2032

| 2025 –2032 | |

| USD 4.13 Billion | |

| USD 5.78 Billion | |

|

|

|

|

Triazole Fungicides Market Size

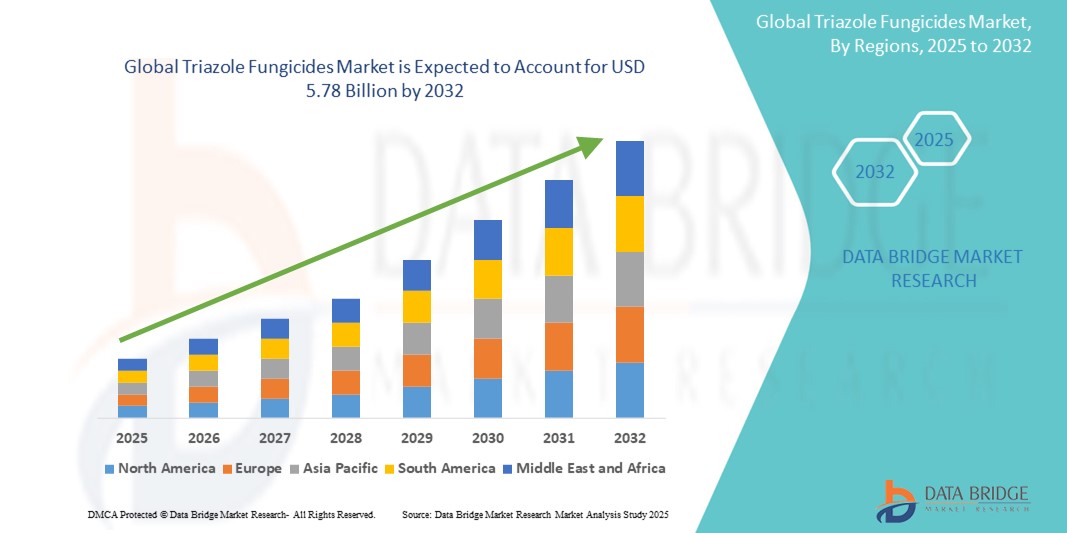

- The global triazole fungicides market size was valued at USD 4.13 billion in 2024 and is expected to reach USD 5.78 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing demand for high-yield agricultural produce, advancements in fungicide formulations, and the rising need for crop protection against fungal diseases in various agricultural settings

- In addition, growing awareness among farmers about the benefits of triazole fungicides, such as their broad-spectrum efficacy and systemic action, is positioning these products as essential tools for modern agriculture, significantly contributing to market expansion

Triazole Fungicides Market Analysis

- Triazole fungicides, known for their systemic and broad-spectrum antifungal properties, are critical components in modern agriculture for protecting crops from fungal diseases, enhancing yield, and ensuring food security

- The surge in demand for triazole fungicides is fueled by the increasing global population, rising food demand, and the need for effective crop protection solutions to combat fungal pathogens that threaten agricultural productivity

- North America dominated the triazole fungicides market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural practices, high adoption of modern farming technologies, and the presence of major agrochemical companies

- Europe is expected to be the fastest-growing region in the triazole fungicides market during the forecast period, attributed to stringent regulations on crop protection, increasing organic farming trends, and rising investments in sustainable agricultural practices

- The tebuconazole segment held the largest market revenue share of 28.5% in 2024, driven by its broad-spectrum efficacy and systemic action, making it a preferred choice for farmers combating fungal diseases such as rust, leaf spot, and powdery mildew across various crops

Report Scope and Triazole Fungicides Market Segmentation

|

Attributes |

Triazole Fungicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Triazole Fungicides Market Trends

“Increasing Integration of Precision Agriculture and Data-Driven Solutions”

- The global triazole fungicides market is experiencing a notable trend toward the integration of precision agriculture technologies and data-driven solutions

- These technologies enable precise application and monitoring of fungicides, optimizing their efficacy while minimizing environmental impact

- Advanced data analytics platforms allow for real-time monitoring of crop health, fungal disease patterns, and environmental conditions, enabling proactive disease management

- For instance, companies are developing smart agricultural systems that use IoT and AI to analyze field data, recommending targeted applications of triazole fungicides such as propiconazole or tebuconazole for specific crops such as cereals or fruits

- This trend enhances the efficiency of triazole fungicides, making them more appealing to farmers seeking sustainable and cost-effective crop protection solutions

- Data-driven solutions can analyze factors such as soil conditions, weather patterns, and disease prevalence to optimize the use of fungicides across various crop types, including cereals and grains, oilseeds and pulses, and fruits and vegetables

Triazole Fungicides Market Dynamics

Driver

“Rising Demand for Crop Protection and Food Security”

- The increasing global demand for food, driven by population growth and shrinking arable land, is a major driver for the triazole fungicides market

- Triazole fungicides, such as epoxiconazole, prothioconazole, and tebuconazole, provide broad-spectrum disease control, protecting crops such as cereals, oilseeds, and fruits from fungal pathogens, thereby enhancing yield and quality

- Government initiatives promoting sustainable agriculture and crop protection, particularly in North America, which dominates the market, are boosting the adoption of triazole fungicides

- The advancement of application methods, such as foliar spray, seed treatment, and chemigation, supported by IoT and precision agriculture technologies, enables more effective and efficient use of these fungicides

- Farmers are increasingly adopting triazole fungicides as standard solutions to meet the growing demand for high-quality crops and to combat the rising prevalence of fungal diseases due to climate change

Restraint/Challenge

“High Costs and Regulatory Challenges”

- The high cost of developing, manufacturing, and applying triazole fungicides, such as cyproconazole and flusilazole, can be a significant barrier to adoption, particularly in emerging markets with cost-sensitive agricultural sectors

- Integrating advanced application systems, such as precision chemigation or foliar spray equipment, into existing farming practices can be complex and expensive

- In addition, concerns over environmental impact and pesticide resistance pose major challenges. Triazole fungicides, such as paclobutrazol and triadimenol, can persist in the environment, raising concerns about soil and water contamination and their impact on non-target organisms

- Stringent and fragmented regulatory frameworks across regions, particularly in Europe, the fastest-growing market, regarding pesticide use, residue limits, and environmental safety, complicate compliance for manufacturers and limit market expansion

- These factors may deter adoption in regions with high environmental awareness or strict regulations, potentially slowing market growth in certain areas

Triazole Fungicides market Scope

The market is segmented on the basis of product type, crop type, and application.

- By Product Type

On the basis of product type, the global triazole fungicides market is segmented into epoxiconazole, triadimenol, propiconazole, prothioconazole, metconazole, cyproconazole, tebuconazole, flusilazole, and paclobutrazol. The tebuconazole segment held the largest market revenue share of 28.5% in 2024, driven by its broad-spectrum efficacy and systemic action, making it a preferred choice for farmers combating fungal diseases such as rust, leaf spot, and powdery mildew across various crops. Its prolonged residual effect ensures extended crop protection, enhancing its adoption in agriculture.

The propiconazole segment is expected to witness the fastest growth rate of 5.8% from 2025 to 2032. This growth is fueled by its cost-effectiveness, compatibility with tank-mix partners, and versatility in controlling fungal diseases across cereals, fruits, and oilseeds. Advancements in formulation technology and increasing demand for integrated pest management (IPM) practices further accelerate its adoption.

- By Crop Type

On the basis of crop type, the global triazole fungicides market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and other crop types. The cereals and grains segment dominated the market with a revenue share of 45.2% in 2024, driven by the high global consumption of crops such as wheat, barley, and rice, which are prone to fungal diseases. Triazole fungicides are critical for ensuring yield stability and quality in these staple crops, particularly in regions with intensive farming practices.

The fruits and vegetables segment is anticipated to experience the fastest growth rate of 6.2% from 2025 to 2032. Rising consumer demand for high-quality, disease-free produce, coupled with the expansion of horticulture and increasing fungal disease prevalence due to climate change, is driving the adoption of triazole fungicides in this segment.

- By Application

On the basis of application, the global triazole fungicides market is segmented into seed treatment, soil treatment, foliar spray, chemigation, and post-harvest. The foliar spray segment held the largest market revenue share of 38.7% in 2024, attributed to its effectiveness in providing broad-spectrum disease control and ease of application across diverse crops. Foliar sprays are widely used for real-time disease management, particularly for cereals and fruits, ensuring optimal crop health and yield.

The Seed Treatment segment is expected to witness the fastest growth rate of 5.9% from 2025 to 2032. The increasing focus on early-stage crop protection to combat seed- and soil-borne fungal diseases, along with advancements in seed coating technologies, is driving demand. Seed treatments enhance germination rates and crop resilience, making them a critical component of modern agricultural practices.

Triazole Fungicides Market Regional Analysis

- North America dominated the triazole fungicides market with the largest revenue share of 38.5% in 2024, driven by advanced agricultural practices, high adoption of modern farming technologies, and the presence of major agrochemical companies

- Farmers prioritize triazole fungicides for their broad-spectrum efficacy, systemic action, and ability to enhance crop yield and quality, particularly in regions with diverse climatic conditions

- Growth is supported by advancements in fungicide formulations, such as improved environmental profiles and resistance management, alongside rising adoption in both conventional and integrated pest management (IPM) practices

U.S. Triazole Fungicides Market Insight

The U.S. triazole fungicides market captured the largest revenue share of 76.7% in 2024 within North America, fueled by strong demand in large-scale agriculture and growing awareness of disease management benefits. The trend toward sustainable farming and increasing regulations promoting safer pesticide use further boost market expansion. Major agricultural producers’ integration of triazole fungicides in crop protection programs complements robust aftermarket sales, creating a diverse product ecosystem.

Europe Triazole Fungicides Market Insight

The European triazole fungicides market is expected to witness the fastest growth rate, supported by regulatory emphasis on sustainable agriculture and crop safety. Farmers seek fungicides that enhance yield while minimizing environmental impact. Growth is prominent in both new agricultural applications and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and intensive farming practices.

U.K. Triazole Fungicides Market Insight

The U.K. market for triazole fungicides is expected to witness rapid growth, driven by demand for effective fungal disease control in cereals and vegetables in urban and rural farming settings. Increased interest in sustainable crop protection and rising awareness of yield enhancement benefits encourage adoption. Evolving agricultural regulations influence farmer choices, balancing efficacy with compliance.

Germany Triazole Fungicides Market Insight

Germany is expected to witness the fastest growth rate in the triazole fungicides market, attributed to its advanced agricultural sector and high farmer focus on crop productivity and sustainability. German farmers prefer technologically advanced fungicides that reduce fungal resistance and contribute to lower environmental impact. The integration of these fungicides in high-value crops and aftermarket applications supports sustained market growth.

Asia-Pacific Triazole Fungicides Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding agricultural production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of crop protection, yield enhancement, and food security is boosting demand. Government initiatives promoting sustainable agriculture and disease management further encourage the use of advanced triazole fungicides.

Japan Triazole Fungicides Market Insight

Japan’s triazole fungicides market is expected to witness rapid growth due to strong farmer preference for high-quality, technologically advanced fungicides that enhance crop health and safety. The presence of major agricultural producers and integration of triazole fungicides in large-scale farming accelerate market penetration. Rising interest in aftermarket applications also contributes to growth.

China Triazole Fungicides Market Insight

China holds the largest share of the Asia-Pacific triazole fungicides market, propelled by rapid urbanization, rising agricultural output, and increasing demand for crop protection solutions. The country’s growing middle class and focus on food security support the adoption of advanced fungicides. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Triazole Fungicides Market Share

The triazole fungicides industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- DuPont (U.S.)

- Dow (U.S.)

- NIPPON SODA CO., LTD. (Japan)

- FMC Corporation (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nutrichem Products (India)

- ISHIHARA SANGYO KAISHA, LTD. (Japan)

- SEIPASA, S.A. (Spain)

- Verdesian Life Sciences (U.S.)

- Koppert (Netherlands)

- Pro Farm Group Inc. (U.S.)

- BioWorks Inc. (U.S.)

What are the Recent Developments in Global Triazole Fungicides Market?

- In June 2024, BASF Agricultural Solutions introduced Cevya, a groundbreaking rice fungicide in China containing 400g/L of mefentrifluconazole, the active ingredient known as Revysol. This marks the first registration of an isopropanol triazole fungicide for rice in the country in over 20 years. Cevya is specifically formulated to combat rice false smut, a persistent disease affecting crop yield and quality. The launch reflects BASF’s commitment to innovation in crop protection and offers Chinese rice growers a new solution to manage resistance and improve productivity

- In June 2024, FMC India introduced two innovative fungicides—VELZO and COSUIT—to safeguard fruit and vegetable crops from fungal diseases right from the start of the crop cycle. VELZO is registered for use in grapes, tomatoes, and potatoes, offering dual-mode, multisite action against pathogens such as Oomycete fungi that cause blight and downy mildew. COSUIT targets crops such as grapes, paddy, tomato, chilli, and tea, and features a copper-based formulation for broad-spectrum, contact-driven disease control. While their active ingredients aren’t explicitly listed as triazoles, the launch reflects FMC’s continued investment in advanced fungicide technologies, including those within the triazole class

- In October 2023, Syngenta’s novel active ingredient cyclobutrifluram, branded as Tymirium, received regulatory approval in China for use against tomato root-knot nematodes. This dual-action fungicide and nematicide represents a major step forward in crop protection, offering long-lasting defense against soil-borne pests and diseases. Although not part of the triazole class, Tymirium exemplifies Syngenta’s commitment to innovation, with future applications planned for crops such as wheat to combat stem rot and other threats

- In August 2023, ADAMA launched Almada, a new fungicide in Brazil formulated with fluxapyroxade, mancozeb, and prothioconazole—the latter being a member of the triazole class of fungicides. Almada is designed to combat major soybean diseases such as Asian rust, powdery mildew, and target spot. Its triple-action formulation offers broad-spectrum control and has been recognized for its high efficacy and productivity in field trials. The product reflects ADAMA’s commitment to delivering innovative crop protection solutions tailored to the needs of Brazilian farmers

- In January 2023, Bayer and Oerth Bio announced a strategic collaboration to revolutionize crop protection through sustainable and ecologically friendly technologies. Central to this partnership is Oerth Bio’s PROTAC protein degradation platform, originally developed for medical applications, now adapted to agriculture. This technology enables precise targeting of harmful proteins in weeds, pests, and diseases, minimizing environmental impact and reducing application rates. While not directly involving triazole fungicides, the initiative reflects a broader industry shift toward innovative, low-residue solutions that complement and influence fungicide development strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.