Global Truck As A Service Market

Market Size in USD Billion

CAGR :

%

USD

41.52 Billion

USD

237.37 Billion

2025

2033

USD

41.52 Billion

USD

237.37 Billion

2025

2033

| 2026 –2033 | |

| USD 41.52 Billion | |

| USD 237.37 Billion | |

|

|

|

|

Truck-as-a-Service Market Size

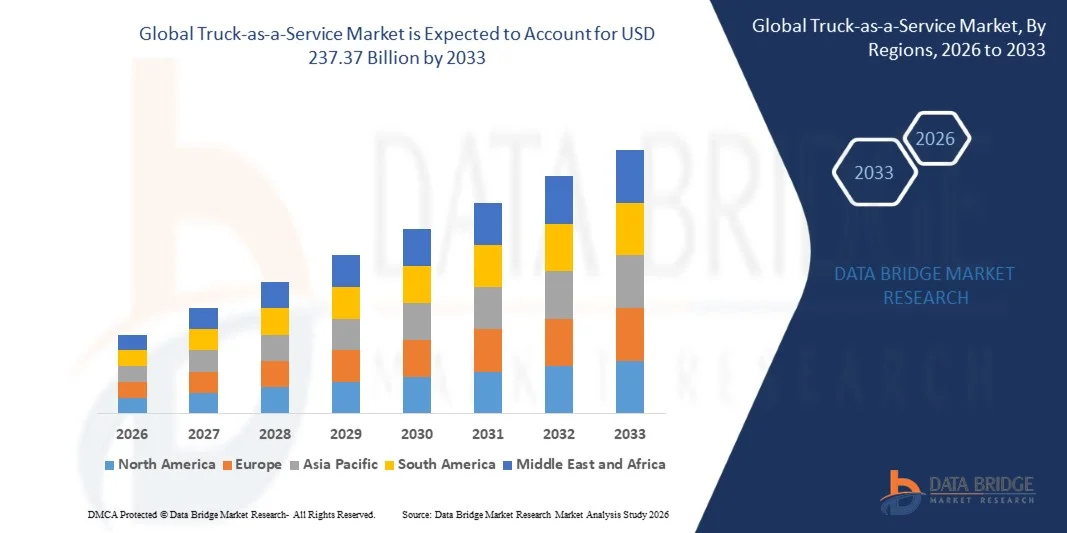

- The global truck-as-a-service market size was valued at USD 41.52 billion in 2025 and is expected to reach USD 237.37 billion by 2033, at a CAGR of 24.35% during the forecast period

- The market growth is largely driven by the increasing shift toward asset-light logistics models and the rising need for cost optimization across freight and transportation operations, encouraging fleet operators to move away from traditional truck ownership

- Furthermore, growing demand for flexible, scalable, and technology-enabled trucking solutions, combined with advancements in telematics, fleet management platforms, and service-based mobility models, is accelerating the adoption of Truck-as-a-Service offerings and supporting overall market expansion

Truck-as-a-Service Market Analysis

- Truck-as-a-Service, offering bundled access to vehicles, maintenance, compliance, and digital fleet management, is becoming an essential solution for logistics, retail, and industrial users seeking operational efficiency and reduced capital expenditure

- The increasing adoption of subscription-based and pay-per-use transportation models, along with rising pressure to improve fleet utilization and manage fluctuating freight demand, is significantly driving the growth of the Truck-as-a-Service market

- Europe dominated the truck-as-a-service market with a share of 35% in 2025, due to strong adoption of asset-light transportation models, stringent emission regulations, and the rapid shift toward sustainable and shared mobility solutions

- Asia-Pacific is expected to be the fastest growing region in the truck-as-a-service market during the forecast period due to rapid urbanization, expanding e-commerce activity, and increasing demand for scalable logistics solutions

- Vehicle subscription & pay-per-use segment dominated the market with a market share of 32.6% in 2025, due to its high flexibility and cost efficiency for fleet operators facing fluctuating freight demand. This model enables businesses to access trucks without long-term ownership commitments, reducing upfront capital investment and improving cash-flow management. Strong adoption among small and mid-sized logistics providers, along with growing acceptance of usage-based pricing, reinforced the segment’s leading market position

Report Scope and Truck-as-a-Service Market Segmentation

|

Attributes |

Truck-as-a-Service Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Truck-as-a-Service Market Trends

“Shift Toward Asset-Light and Subscription-Based Trucking Models”

- A major trend in the Truck-as-a-Service market is the growing shift toward asset-light and subscription-based trucking models, driven by fleet operators seeking to reduce capital expenditure and improve financial flexibility. Companies are increasingly moving away from outright truck ownership and instead adopting service-based access to vehicles bundled with maintenance, insurance, and digital fleet tools

- For instance, Volvo Trucks has expanded its Volvo on Demand offering to provide fleets with flexible access to trucks without long-term ownership commitments. Such models help logistics operators manage fluctuating freight volumes while maintaining predictable operating costs

- The demand for subscription-based trucking is rising across regional and last-mile logistics where seasonal demand variability requires scalable fleet solutions. This trend supports improved fleet utilization and reduces idle asset risks for operators

- Digital platforms enabling real-time vehicle availability, usage tracking, and cost transparency are strengthening the appeal of Truck-as-a-Service models. These technologies enhance operational visibility and support data-driven decision-making

- Sustainability goals are also influencing this trend, as service-based models simplify access to low-emission and electric trucks without high upfront investment. This is encouraging faster adoption of cleaner fleets

- Overall, the shift toward asset-light trucking is reshaping fleet ownership structures and accelerating the adoption of Truck-as-a-Service as a core logistics strategy

Truck-as-a-Service Market Dynamics

Driver

“Rising Demand for Cost-Efficient and Flexible Fleet Operations”

- The increasing need for cost-efficient and flexible fleet operations is a key driver of the Truck-as-a-Service market. Logistics and transportation companies face rising fuel costs, maintenance expenses, and regulatory compliance requirements, making traditional ownership models less attractive

- For instance, large logistics providers are adopting full-service leasing and fleet management solutions from companies such as Daimler Truck to stabilize operating costs and improve fleet uptime. These services reduce financial uncertainty and operational burden

- The growth of e-commerce and just-in-time delivery models requires fleets that can scale quickly in response to demand fluctuations. Truck-as-a-Service enables businesses to add or reduce capacity without long-term financial commitments

- Fleet operators are also prioritizing operational efficiency, predictive maintenance, and route optimization, which are increasingly bundled within service-based trucking models. This improves productivity and reduces downtime

- The need for predictable monthly expenses and improved cash-flow management continues to strengthen demand for Truck-as-a-Service offerings, positioning flexibility and cost control as primary growth drivers

Restraint/Challenge

“High Complexity in Fleet Integration and Service Standardization”

- The Truck-as-a-Service market faces challenges related to the complexity of integrating vehicles, telematics, maintenance services, and digital platforms into a unified operating model. Managing multiple service components across diverse fleets increases implementation difficulty for providers and users

- For instance, integrating third-party telematics, charging infrastructure, and fleet management software across mixed truck fleets requires significant coordination and technical alignment. These challenges can slow adoption and increase deployment timelines

- Differences in regulatory requirements, service expectations, and operational practices across regions further complicate standardization efforts. Providers must customize offerings, which raises operational complexity

- Ensuring consistent service quality across large, geographically dispersed fleets remains a challenge for Truck-as-a-Service providers. Variability in maintenance networks and infrastructure availability can impact reliability

- These integration and standardization challenges place pressure on service providers to invest in interoperable platforms and scalable service frameworks to support sustained market growth

Truck-as-a-Service Market Scope

The market is segmented on the basis of service, truck type, propulsion, and end user.

- By Service

On the basis of service, the Truck-as-a-Service market is segmented into vehicle subscription & pay-per-use, full-service leasing & fleet management, freight capacity-as-a-service (FaaS), dedicated fleet heavy-duty trucks (HDT), and other services. The vehicle subscription & pay-per-use segment dominated the market with the largest share of 32.6% in 2025, supported by its high flexibility and cost efficiency for fleet operators facing fluctuating freight demand. This model enables businesses to access trucks without long-term ownership commitments, reducing upfront capital investment and improving cash-flow management. Strong adoption among small and mid-sized logistics providers, along with growing acceptance of usage-based pricing, reinforced the segment’s leading market position.

The full-service leasing & fleet management segment is projected to register the fastest growth from 2026 to 2033, driven by rising demand for comprehensive, end-to-end fleet solutions. Enterprises increasingly prefer outsourcing maintenance, compliance, telematics, and vehicle lifecycle management to improve operational efficiency and fleet uptime. The growing complexity of fleet operations and the need for predictable operating costs are accelerating adoption of full-service models across large logistics and industrial users.

- By Truck Type

On the basis of truck type, the market is categorized into heavy-duty trucks (HDT), medium-duty trucks (MDT), and light-duty trucks (LDT). The heavy-duty trucks segment accounted for the largest revenue share in 2025, owing to its extensive use in long-haul freight, intercity logistics, and industrial transportation. HDTs are preferred for high payload capacity and durability, making them critical for large-scale logistics networks. Truck-as-a-Service models allow operators to deploy HDTs without high upfront investment, improving capital efficiency. Strong demand from cross-border trade and infrastructure-driven freight movement supports continued dominance. Fleet operators also benefit from integrated maintenance and uptime assurance for HDTs.

The medium-duty trucks segment is expected to witness the fastest growth during the forecast period, driven by expanding urban and regional distribution networks. MDTs are increasingly used for last-mile and mid-mile logistics due to their balance of payload capacity and maneuverability. The rapid growth of regional e-commerce fulfillment hubs supports higher adoption of MDT-based service models. Businesses favor MDT subscriptions to address urban delivery restrictions and cost optimization. Rising demand for flexible delivery fleets across tier-2 and tier-3 cities further accelerates growth.

- By Propulsion

On the basis of propulsion, the Truck-as-a-Service market is segmented into internal combustion engine (ICE), battery electric vehicle (BEV), hybrid, and fuel cell electric vehicle (FCEV). The ICE segment dominated the market in 2025, supported by its established fueling infrastructure and widespread fleet familiarity. ICE trucks remain the preferred option for long-distance freight and heavy payload operations where charging infrastructure is limited. Lower acquisition costs and proven performance reliability contribute to continued adoption. Many fleet operators rely on ICE-based service models to ensure operational continuity across diverse geographies. The availability of trained maintenance networks further strengthens dominance.

The battery electric vehicle segment is anticipated to grow at the fastest rate from 2026 to 2033, driven by tightening emission regulations and rising fuel cost pressures. BEV-based Truck-as-a-Service offerings allow businesses to transition toward sustainability without high capital investment. Government incentives and corporate decarbonization targets accelerate BEV adoption in urban and regional logistics. Lower operating and maintenance costs enhance long-term economic benefits. Expanding charging infrastructure and advancements in battery range further support rapid growth.

- By End User

On the basis of end user, the market is segmented into logistics & transportation, retail & e-commerce, manufacturing & industrial, construction & mining, and other end users. The logistics & transportation segment held the largest market revenue share in 2025, driven by high fleet utilization requirements and demand for cost-efficient freight solutions. Logistics companies increasingly adopt Truck-as-a-Service to improve scalability and reduce downtime. Outsourced fleet models help operators manage peak demand and route variability more effectively. The integration of telematics and route optimization tools further enhances operational efficiency. Continuous growth in domestic and cross-border freight strengthens this segment’s dominance.

The retail & e-commerce segment is projected to experience the fastest growth over the forecast period, supported by the rapid expansion of online shopping and omnichannel distribution models. E-commerce players rely on flexible trucking solutions to manage last-mile and reverse logistics operations. Truck-as-a-Service enables retailers to scale fleets during promotional periods without long-term ownership commitments. Growing demand for faster delivery timelines accelerates adoption. The rise of urban fulfillment centers further reinforces strong growth prospects.

Truck-as-a-Service Market Regional Analysis

- Europe dominated the truck-as-a-service market with the largest revenue share of 35% in 2025, driven by strong adoption of asset-light transportation models, stringent emission regulations, and the rapid shift toward sustainable and shared mobility solutions

- Fleet operators across the region increasingly favor Truck-as-a-Service to reduce capital expenditure, ensure regulatory compliance, and accelerate the transition toward low-emission and electric trucks

- This dominance is further supported by well-developed cross-border logistics networks, high penetration of fleet leasing services, and advanced telematics and fleet management adoption, positioning Europe as a mature and innovation-driven market

Germany Truck-as-a-Service Market Insight

The Germany Truck-as-a-Service market accounted for the largest share within Europe in 2025, supported by the country’s strong industrial base and leadership in logistics and automotive innovation. German fleet operators emphasize operational efficiency, predictive maintenance, and sustainability, driving demand for full-service leasing and fleet management solutions. The presence of major logistics hubs and a strong focus on reducing carbon emissions further fuels market expansion.

U.K. Truck-as-a-Service Market Insight

The U.K. Truck-as-a-Service market is projected to grow at a steady CAGR during the forecast period, driven by rising demand for flexible freight solutions and increasing adoption of pay-per-use and subscription-based trucking models. The growth of e-commerce and urban delivery networks encourages businesses to avoid long-term fleet ownership. Regulatory pressure to reduce emissions and congestion also supports service-based truck adoption.

North America Truck-as-a-Service Market Insight

The North America Truck-as-a-Service market holds a substantial market share, supported by high freight volumes, long-haul transportation demand, and widespread adoption of fleet outsourcing models. Logistics providers in the region leverage service-based trucking to manage operating costs and improve fleet utilization. Strong digital infrastructure and advanced fleet analytics further strengthen market growth.

Asia-Pacific Truck-as-a-Service Market Insight

The Asia-Pacific Truck-as-a-Service market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid urbanization, expanding e-commerce activity, and increasing demand for scalable logistics solutions. Businesses across emerging economies are adopting service-based trucking to avoid high upfront vehicle costs. Government investments in logistics infrastructure and smart mobility accelerate regional growth.

China Truck-as-a-Service Market Insight

China dominated the Asia-Pacific Truck-as-a-Service market in 2025, supported by its extensive logistics network, large manufacturing base, and rapid adoption of digital freight platforms. The push toward smart logistics and cost-efficient transportation solutions drives strong demand for Truck-as-a-Service models. Growing emphasis on emission reduction and fleet modernization further contributes to market expansion.

Truck-as-a-Service Market Share

The truck-as-a-service industry is primarily led by well-established companies, including:

- Daimler Truck AG (Germany)

- AB Volvo (Sweden)

- TRATON SE (Germany)

- Tata Motors Limited (India)

- Einride AB (Sweden)

- BYD Company Limited (China)

- Volta Trucks (Sweden)

- Xos, Inc. (U.S.)

- Nikola Corporation (U.S.)

- Hyliion Holdings Corp. (U.S.)

- Convoy Inc. (U.S.)

- Trimble Transportation (U.S.)

- Omnitracs LLC (U.S.)

- OCTO Telematics Ltd. (Italy)

- Microlise Limited (India)

- Masternaut Limited (U.K.)

- Transfix (U.S.)

- Fleet Advantage LLC (U.S.)

Latest Developments in Global Truck-as-a-Service Market

- In September 2024, Volvo Trucks strengthened the Truck-as-a-Service market by delivering 70 Volvo VNR Electric trucks under the SWITCH-ON initiative, enabling multiple fleets in Southern California to adopt zero-emission trucks for regional freight and drayage operations. Backed by EPA and South Coast AQMD funding, the program lowers financial and operational barriers to electrification. The integration of Volvo on Demand further accelerates market adoption by allowing fleets to access electric trucks through a service-based model with minimal upfront investment, reinforcing the shift toward asset-light and sustainable freight solutions

- In November 2023, Hydrogen Vehicle Systems Limited (HVS) partnered with Zeti, alongside Gravis Capital, to introduce a Transport-as-a-Service model for hydrogen fuel cell trucks, expanding service-based mobility into the hydrogen segment. This collaboration supports broader commercialization of hydrogen trucks by bundling vehicles, financing, and operational services into a single offering. The initiative enhances market confidence in hydrogen-powered Truck-as-a-Service solutions by addressing cost, financing, and adoption challenges faced by fleet operators

- In August 2023, Webfleet’s partnership with e-fleet solutions provider VEV significantly contributed to the Truck-as-a-Service ecosystem by supporting end-to-end electric fleet transitions. The collaboration enables fleets to manage vehicle sourcing, charging infrastructure, site electrification, and ongoing operations through data-driven telematics insights. This development enhances operational efficiency and energy optimization, strengthening the value proposition of service-based truck models and accelerating commercial EV fleet adoption

- In June 2022, WattEV announced plans to operate 12,000 electric trucks under its Truck-as-a-Service model by 2030, signaling large-scale confidence in service-based electrified freight. Supported by a gigawatt-scale charging network, the initiative addresses critical infrastructure gaps that limit EV truck adoption. The launch of the Bakersfield Electric Truck Stop, featuring solar generation, battery storage, and megawatt charging, reinforces the scalability and long-term viability of electric Truck-as-a-Service platforms

- In March 2022, American startup WattEV placed an order for 50 Volvo VNR Electric trucks to deploy under its Truck-as-a-Service model, marking an early move toward commercial electrified freight services. Alongside vehicle deployment, the development of high-capacity charging depots across California enhances operational readiness for electric trucking. This initiative supported early market momentum by demonstrating how integrated vehicles and charging infrastructure can enable practical, service-based electric freight operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.