Global Tubatoxin Market

Market Size in USD Billion

CAGR :

%

USD

13.80 Billion

USD

25.92 Billion

2024

2032

USD

13.80 Billion

USD

25.92 Billion

2024

2032

| 2025 –2032 | |

| USD 13.80 Billion | |

| USD 25.92 Billion | |

|

|

|

|

What is the Global Tubatoxin Market Size and Growth Rate?

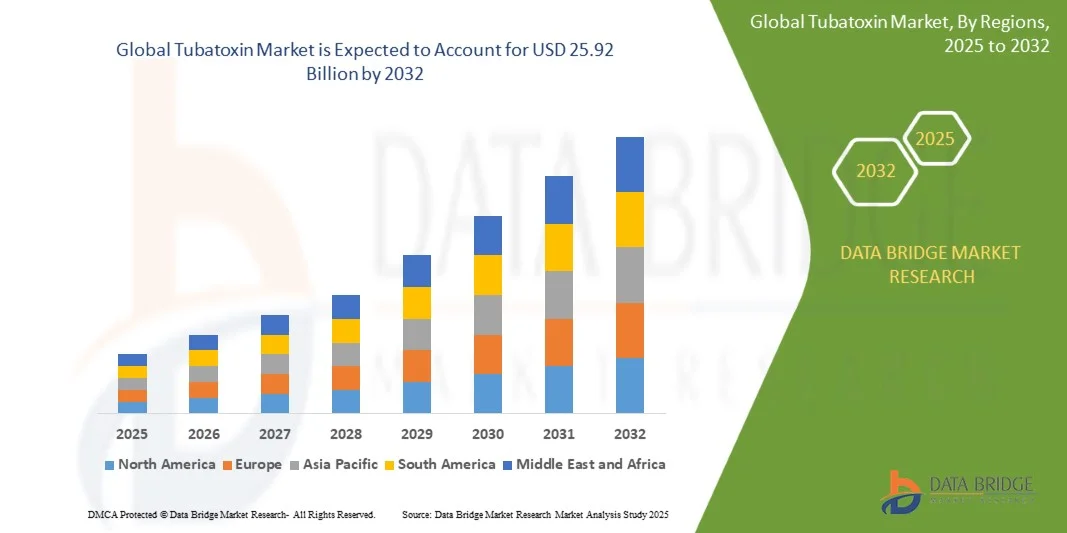

- The global tubatoxin market size was valued at USD 13.8 billion in 2024 and is expected to reach USD 25.92 billion by 2032, at a CAGR of 8.20% during the forecast period

- Market growth is primarily driven by increasing demand for Tubatoxins in agricultural applications, including crop protection and animal feed, as well as in pharmaceutical and biotechnological sectors

- Rising awareness of mycotoxin contamination in food and feed, coupled with regulatory emphasis on safety standards, is driving adoption of tubatoxin-based solutions, thereby accelerating market expansion and supporting sustained industry growth

What are the Major Takeaways of Tubatoxin Market?

- Tubatoxins, which are naturally occurring mycotoxins, play a critical role in animal feed, crop safety, and biotechnological applications, helping control contamination, improve yield, and support product safety

- The market growth is fueled by the rising global demand for high-quality animal protein, stricter food safety regulations, and advancements in biocontrol and detoxification technologies. The use of Tubatoxins in feed additives, analytical testing, and pharmaceutical research is contributing to wider adoption, driving consistent market expansion

- The Asia-Pacific region dominated the tubatoxin market with the largest revenue share of 46.5% in 2024, driven by rapid urbanization, rising disposable incomes, and strong government initiatives supporting digitalization in agriculture and feed industries

- The North America tubatoxin market is poised to grow at the fastest CAGR of 9.54% during 2025–2032, fueled by rising adoption of modern feed technologies, aquaculture expansion, and increasing focus on livestock health and productivity

- The powder segment dominated the market with the largest revenue share of 52% in 2024, owing to its ease of handling, longer shelf life, and widespread usage in feed and agricultural applications

Report Scope and Tubatoxin Market Segmentation

|

Attributes |

Tubatoxin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Tubatoxin Market?

“Advancements in Detection and Detoxification Technologies”

- A significant and accelerating trend in the global tubatoxin market is the adoption of advanced detection, monitoring, and detoxification technologies. These innovations are improving safety, quality, and regulatory compliance across food, feed, and agricultural sectors

- For instance, rapid ELISA kits and high-throughput LC-MS/MS systems are increasingly used for precise Tubatoxin detection in cereals, grains, and animal feed, enabling early intervention and reducing contamination risks

- Integration of biosensors and IoT-enabled monitoring allows real-time tracking of Tubatoxin levels in storage facilities and supply chains. These systems provide actionable alerts to prevent mycotoxin outbreaks and ensure safe consumption

- Companies are also investing in enzymatic and microbial detoxification solutions that neutralize Tubatoxins in feed, improving livestock health and yield

- This trend towards innovative, automated, and integrated detection and mitigation solutions is fundamentally reshaping safety standards and operational efficiency in the tubatoxin industry

What are the Key Drivers of Tubatoxin Market?

- The rising global concern over food and feed safety, along with stringent regulatory standards, is a major driver for tubatoxin testing and control solutions

- Increasing livestock production and the growing consumption of cereals and grains worldwide are boosting demand for Tubatoxin management to prevent contamination and economic losses

- Technological advancements in rapid detection, biosensors, and detoxification products are improving efficiency and reliability, encouraging widespread adoption in both commercial and industrial applications

- Awareness campaigns about mycotoxin-related health risks and the need for safer animal feed are driving market growth, especially in emerging economies

- The combination of regulatory enforcement, consumer safety concerns, and cost-effective mitigation solutions is propelling the tubatoxin market forward across global food, feed, and agricultural sectors

Which Factor is Challenging the Growth of the Tubatoxin Market?

- The tubatoxin market faces challenges due to the high cost of detection and detoxification technologies, which can limit adoption, particularly in small-scale farms and developing regions. Advanced analytical equipment such as LC-MS/MS or rapid ELISA kits require significant investment, making them less accessible to budget-conscious users.

- Limited awareness about tubatoxin contamination and its impact on livestock health and human consumption is another barrier. Many farmers and feed producers lack knowledge of contamination risks, reducing proactive testing and control measures.

- Variability in global regulatory standards and inconsistent enforcement across regions also hampers market growth. Inconsistent policies create uncertainty for companies developing tubatoxin detection and detoxification solutions, affecting market penetration.

- In addition, the complexity of handling tubatoxins in diverse feed, food, and agricultural matrices requires specialized expertise, which may not be widely available, limiting adoption.

- Overcoming these challenges through cost-effective technologies, awareness campaigns, regulatory harmonization, and training programs will be critical for sustained growth in the tubatoxin market

How is the Tubatoxin Market Segmented?

The market is segmented on the basis of product type and application.

• By Product

On the basis of product, the tubatoxin market is segmented into powder, liquid, and other forms. The powder segment dominated the market with the largest revenue share of 52% in 2024, owing to its ease of handling, longer shelf life, and widespread usage in feed and agricultural applications. Powdered Tubatoxins are preferred by feed manufacturers and livestock farms for their stability and cost-effectiveness.

The liquid segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by its increasing adoption in automated dosing systems, fertigation, and precision agriculture applications. Liquid Tubatoxins provide improved dispersion, faster absorption, and compatibility with modern application machinery, making them highly attractive for large-scale operations. Growing demand for convenient and easy-to-use formulations further fuels the expansion of the liquid segment.

• By Application

On the basis of application, the tubatoxin market is segmented into acaricide, piscicide, insecticide, and pesticide applications. The acaricide segment held the largest revenue share of 45% in 2024, driven by the prevalence of mites and ticks in livestock, which significantly impact animal health and productivity. Acaricidal Tubatoxins are critical in feed and agricultural treatments to ensure safety and compliance with health standards.

The insecticide segment is expected to witness the fastest CAGR of 17% from 2025 to 2032, owing to the increasing adoption of Tubatoxins for pest management in crops and stored grains. The rising demand for safer, targeted, and environmentally friendly insecticide solutions is further encouraging the uptake of this segment, particularly in modern agricultural setups emphasizing integrated pest management practices.

Which Region Holds the Largest Share of the Tubatoxin Market?

- The Asia-Pacific region dominated the tubatoxin market with the largest revenue share of 46.5% in 2024, driven by rapid urbanization, rising disposable incomes, and strong government initiatives supporting digitalization in agriculture and feed industries

- Adoption of Tubatoxins is being accelerated by increasing awareness of advanced, nutrient-enhanced feed solutions and the growing demand for high-quality agricultural and aquaculture outputs

- Strong manufacturing capabilities and the presence of key Tubatoxin producers in countries such as China, Japan, and India further support wide-scale availability and adoption, establishing Tubatoxins as a preferred choice across the residential, commercial, and industrial agricultural sectors

China Tubatoxin Market Insight

The China tubatoxin market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and the modernization of livestock and aquaculture practices. The push towards smart agriculture and increasing government support for feed quality standards is encouraging widespread Tubatoxin adoption. In addition, the presence of domestic manufacturers offering cost-effective Tubatoxin solutions makes the products accessible to a wider consumer base.

Japan Tubatoxin Market Insight

The Japan tubatoxin market is experiencing steady growth due to its high-tech agricultural culture, advanced farming systems, and demand for convenience in feed supplementation. Japanese producers increasingly integrate Tubatoxins into livestock and aquaculture feed to ensure higher productivity and compliance with strict quality standards. Furthermore, the aging population is driving demand for easier-to-use, reliable feed additives to support farm efficiency in both small and large operations.

Which Region is the Fastest Growing Region in the Tubatoxin Market?

The North America tubatoxin market is poised to grow at the fastest CAGR of 9.54% during 2025–2032, fueled by rising adoption of modern feed technologies, aquaculture expansion, and increasing focus on livestock health and productivity. Growing awareness of nutrient management, coupled with the rising popularity of high-efficiency feed solutions, is driving Tubatoxin adoption across commercial and industrial farming sectors.

U.S. Tubatoxin Market Insight

The U.S. tubatoxin market captured the largest revenue share within North America in 2024, with 81% of regional sales, driven by technological advancements in feed formulation and rising demand for high-quality protein sources. Producers increasingly adopt Tubatoxins for livestock and aquaculture to enhance nutrient intake and growth efficiency. Furthermore, strong research and development, coupled with the widespread availability of premium feed additives, continues to support sustained market growth in the region.

Canada Tubatoxin Market Insight

The Canadian tubatoxin market is growing steadily due to government support for modern livestock practices and an increasing focus on sustainable, high-efficiency feed supplements. Rising awareness about animal health and productivity is driving farmers to adopt Tubatoxins in both livestock and aquaculture sectors. The increasing integration of Tubatoxins into precision feeding systems further accelerates adoption, ensuring optimized nutrient delivery and improved operational efficiency.

Which are the Top Companies in Tubatoxin Market?

The tubatoxin industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Zhejiang Rayfull Chemicals Co., Ltd. (China)

- ECOMPAL S.A.C. (Peru)

- ALFA AESAR (USA)

- ARE XI’AN B‑THRIVING I/E CO., LTD. (China)

- WUJIANG SHUGUANG CHEMICAL CO. LTD (China)

- Shandong Qiaochang Chemical (China)

- Shanghai Xinglu Chemical Technology (China)

- Shaanxi Undersun Biomedtech (China)

- Lisi (Xian) Bio‑Tech (China)

- Xi’an Lyphar Biotech (China)

- Nuona Chem (China)

- Kono Chem (Japan)

- Hubei Yuancheng Saichaung (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.