Global Tubeless Tire Market

Market Size in USD Billion

CAGR :

%

USD

36.72 Billion

USD

65.97 Billion

2024

2032

USD

36.72 Billion

USD

65.97 Billion

2024

2032

| 2025 –2032 | |

| USD 36.72 Billion | |

| USD 65.97 Billion | |

|

|

|

|

Tubeless Tire Market Size

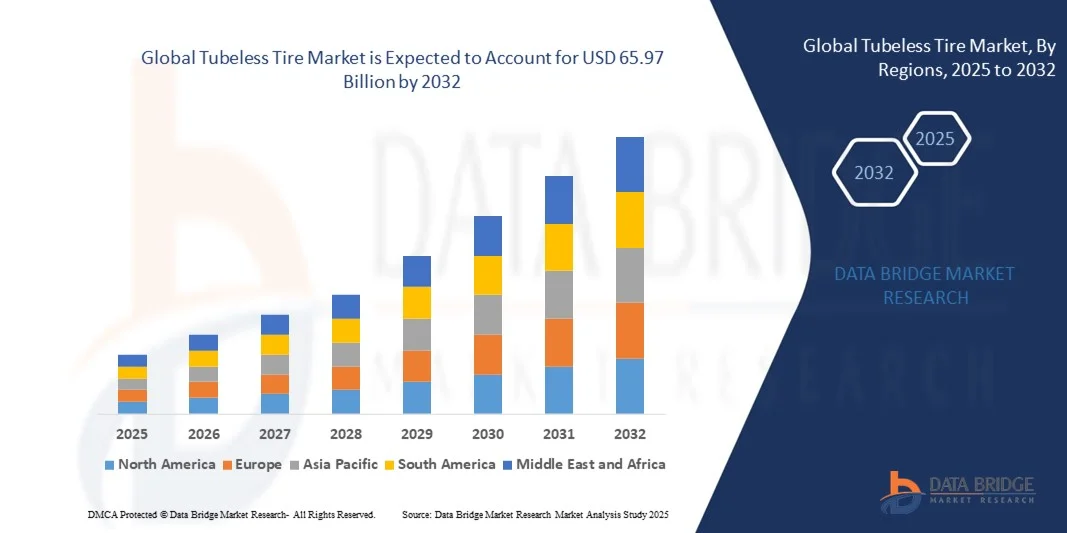

- The global tubeless tire market size was valued at USD 36.72 billion in 2024 and is expected to reach USD 65.97 billion by 2032, at a CAGR of 7.6% during the forecast period

- The market growth is largely fueled by the rising demand for safer, more durable, and low-maintenance tires across passenger cars, two-wheelers, and commercial vehicles, coupled with advancements in radial tubeless tire technology and manufacturing processes

- Furthermore, increasing vehicle production, urbanization, and consumer preference for fuel-efficient, puncture-resistant, and performance-enhancing tires are driving adoption. These factors are accelerating the uptake of tubeless tires, thereby significantly boosting the industry’s growth

Tubeless Tire Market Analysis

- Tubeless tires are pneumatic tires designed without an inner tube, offering advantages such as reduced air leakage, improved safety, enhanced fuel efficiency, and easier maintenance. They are widely used in passenger vehicles, two-wheelers, and commercial vehicles, with radial designs providing better durability and performance

- The escalating demand for tubeless tires is primarily fueled by rapid automotive industry growth, increasing vehicle parc, rising consumer awareness of tire safety and efficiency, and technological innovations in tire compounds and smart monitoring systems

- Asia-Pacific dominated the tubeless tire market with a share of 51.46% in 2024, due to rapid automotive production, increasing two-wheeler and passenger car sales, and a strong presence of tire manufacturing hubs

- North America is expected to be the fastest growing region in the tubeless tire market during the forecast period due to increasing vehicle sales, demand for replacement tires, and advancements in tire technology

- Radial tubeless tires segment dominated the market with a market share of 65.5% in 2024, due to its superior durability, fuel efficiency, and better heat dissipation compared to bias tires. Radial tubeless tires are widely preferred for their enhanced ride comfort, longer lifespan, and ability to maintain tire pressure even under punctured conditions, making them a top choice for both passenger and commercial vehicles. The increasing adoption of radial tires in modern vehicles, coupled with technological advancements in tread patterns and rubber compounds, further strengthens their market dominance

Report Scope and Tubeless Tire Market Segmentation

|

Attributes |

Tubeless Tire Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Tubeless Tire Market Trends

Rising Use of Radial Tubeless Tires

- A major trend driving the global tubeless tire market is the growing adoption of radial tubeless tires across passenger and commercial vehicles, supported by their enhanced durability, fuel efficiency, and superior road performance. Radial tubeless tires offer improved traction and heat dissipation, making them suitable for modern vehicles that demand high performance and reduced rolling resistance

- For instance, Bridgestone Corporation and Michelin have significantly expanded their radial tubeless tire portfolio for both passenger and heavy-duty segments, integrating advanced tread compounds and reinforced sidewalls for better stability and longer lifespan. Similarly, companies such as MRF and Continental AG are focusing on radialization to meet growing demand for efficient and eco-friendly tire solutions

- Radial tubeless tires are increasingly preferred due to their structural design, which allows the tread and sidewalls to function independently, improving shock absorption and extending tread life. This design enhances comfort and grip and also reduces wear, contributing to lower overall maintenance costs and improved driving efficiency

- The gradual replacement of bias-ply tires with radial designs in emerging markets is further driving market penetration. As vehicle manufacturing expands, automakers are equipping new models with radial tubeless tires to align with safety and performance standards mandated by international regulatory frameworks

- The commercial transport and logistics sectors are also embracing radial tubeless tires for better mileage, reduced vibration, and improved fuel economy. In addition, advanced air retention technologies and sealant-based innovations in modern tubeless tires are increasing driver confidence in long-distance and rough terrain conditions

- The rising shift toward radial tubeless tires highlights the automotive industry’s focus on innovation, performance efficiency, and cost-effective ownership. As consumers and fleet operators seek durable and energy-saving tire options, the growing use of radial designs is set to remain a major factor influencing the industry’s trajectory globally

Tubeless Tire Market Dynamics

Driver

Demand for Fuel-Efficient and Low-Maintenance Tires

- The increasing demand for fuel-efficient and low-maintenance tires is a key driver propelling the growth of the tubeless tire market worldwide. With mounting fuel costs and growing environmental awareness, both consumers and fleet operators are turning to tires that minimize energy loss while providing reliable performance over extended periods

- For instance, Goodyear has introduced its Fuel Max tubeless tire series for passenger and commercial applications, designed to reduce rolling resistance and enhance vehicle mileage. Such developments by major tire companies underscore how innovation in tire design is addressing the dual goals of fuel economy and maintenance reduction across vehicle categories

- The global trend toward sustainable mobility solutions has further elevated demand for tires that contribute to lower carbon emissions without compromising safety or performance. Modern tubeless designs achieve this through optimized tread patterns, lightweight construction, and balanced pressure distribution that improve vehicle handling and fuel conservation

- Rising consumer preference for vehicles that offer low total cost of ownership is pushing manufacturers to incorporate advanced tubeless technologies in both two-wheeler and four-wheeler categories. This technological shift ensures consistent long-term advantages in driving comfort, efficiency, and cost savings across global automotive markets

- The ongoing need for fuel-efficient and durable tire solutions demonstrates the growing value of tubeless designs in fulfilling the modern automotive industry’s objectives of sustainability, reliability, and economic performance, ensuring sustained adoption across consumer and commercial vehicles alike

Restraint/Challenge

High Cost of Premium Tires

- One of the primary challenges restraining the wider adoption of tubeless tires, especially in developing markets, is their higher upfront cost compared to conventional tube-type tires. Advanced raw materials, reinforced carcass construction, and specialized compounds used in premium tubeless models contribute to increased production expenses and market prices

- For instance, leading tire manufacturers such as Michelin and Pirelli have introduced high-performance tubeless radial models incorporating silica-based compounds and advanced tread designs. While these innovations offer long-term fuel and maintenance benefits, their premium pricing often limits uptake among cost-sensitive consumers and smaller fleet operators

- The rising prices of essential inputs such as natural rubber, carbon black, and synthetic polymers also contribute to the elevated cost structure of tubeless tires. In addition, modern radial tubeless designs require advanced machinery and precision engineering processes, resulting in higher capital investment for manufacturers and distributors

- Maintenance and replacement of damaged tubeless tires can also be more expensive due to the requirement for specialized equipment and trained service technicians. This can increase the total ownership cost in rural or remote areas where servicing facilities are limited, discouraging adoption at the mass consumer level

- To address these challenges, tire manufacturers are focusing on expanding localized production and using cost-effective materials without compromising on safety or performance. However, high production and retail costs remain key obstacles to broader affordability, limiting adoption primarily to premium and mid-tier vehicle segments in price-sensitive regions

Tubeless Tire Market Scope

The market is segmented on the basis of tire type, vehicle type, rim size, and distribution channel.

- By Tire Type

On the basis of tire type, the tubeless tire market is segmented into radial tubeless tires and bias tubeless tires. The radial tubeless tire segment dominated the largest market revenue share of 65.5% in 2024, driven by its superior durability, fuel efficiency, and better heat dissipation compared to bias tires. Radial tubeless tires are widely preferred for their enhanced ride comfort, longer lifespan, and ability to maintain tire pressure even under punctured conditions, making them a top choice for both passenger and commercial vehicles. The increasing adoption of radial tires in modern vehicles, coupled with technological advancements in tread patterns and rubber compounds, further strengthens their market dominance.

The bias tubeless tire segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in emerging markets for affordable and lightweight tire solutions. Bias tires offer advantages in terms of flexible sidewalls and cost-effective manufacturing, making them suitable for two-wheelers and commercial vehicles used in rural and off-road conditions. The growth is also supported by improvements in rubber technology and better load-handling capabilities, which enhance overall performance and safety.

- By Vehicle Type

On the basis of vehicle type, the tubeless tire market is segmented into two-wheelers, passenger cars, and commercial vehicles. The passenger car segment dominated the largest market revenue share in 2024, driven by increasing vehicle ownership, urbanization, and the rising preference for high-performance radial tires. Tubeless tires in passenger cars offer improved safety, fuel efficiency, and lower maintenance requirements, which are key factors influencing consumer preference. In addition, automakers’ growing focus on equipping new cars with tubeless tires as standard enhances their market penetration.

The two-wheeler segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rapid growth of two-wheeler sales in Asia-Pacific and Latin America. The lightweight nature, ease of maintenance, and puncture resistance of tubeless tires make them highly suitable for motorcycles and scooters. Rising demand for safer and more reliable tires, coupled with government initiatives promoting road safety and modern mobility solutions, further accelerates the adoption of tubeless tires in this segment.

- By Rim Size

On the basis of rim size, the tubeless tire market is segmented into 13-15 inch, 16-18 inch, 19-21 inch, and 22-26 inch. The 16-18 inch rim size segment dominated the largest market revenue share in 2024, driven by its wide adoption in mid-sized passenger cars and commercial vehicles. Tires in this rim range offer an optimal balance between performance, comfort, and load-carrying capacity, making them a preferred choice among OEMs and end-users. The availability of a variety of tubeless tire models for this rim size with enhanced tread patterns and safety features further reinforces its dominance.

The 13-15 inch rim size segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by high demand in compact cars, two-wheelers, and entry-level commercial vehicles in emerging economies. These rim sizes are cost-effective, lightweight, and offer better fuel efficiency, making them suitable for densely populated urban areas. Continuous innovations in tire design, such as improved puncture resistance and tread life, are also driving the growth of tubeless tires in this segment.

- By Distribution Channel

On the basis of distribution channel, the tubeless tire market is segmented into OEM and aftermarket. The OEM segment dominated the largest market revenue share in 2024, driven by increasing vehicle production and automakers’ preference to equip new vehicles with high-quality tubeless tires. OEM partnerships ensure standardized quality, reliability, and warranty support, which strongly influences consumer trust and adoption. The growing focus on enhancing vehicle performance and safety by integrating advanced tubeless tires further contributes to the segment’s dominance.

The aftermarket segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising vehicle parc and replacement demand for worn-out tires. Aftermarket sales are driven by consumer preference for cost-effective options, easy availability of different tire types, and the increasing number of service centers and online tire platforms. Growing awareness of tire maintenance, safety, and performance benefits also supports the accelerated adoption of tubeless tires through aftermarket channels.

Tubeless Tire Market Regional Analysis

- Asia-Pacific dominated the tubeless tire market with the largest revenue share of 51.46% in 2024, driven by rapid automotive production, increasing two-wheeler and passenger car sales, and a strong presence of tire manufacturing hubs

- The region’s cost-effective manufacturing infrastructure, rising investments in tire technology, and expanding exports of automotive components are accelerating market growth

- Availability of skilled labor, favorable government policies supporting automotive and manufacturing sectors, and rapid urbanization across developing economies are contributing to increased adoption of tubeless tires in both passenger and commercial vehicles

China Tubeless Tire Market Insight

China held the largest share in the Asia-Pacific tubeless tire market in 2024, owing to its status as the global leader in vehicle production and tire manufacturing. The country’s strong industrial base, advanced tire R&D capabilities, and extensive export network for automotive components are major growth drivers. Rising domestic demand for two-wheelers, passenger cars, and commercial vehicles, coupled with investments in high-performance and radial tubeless tires, further strengthens market dominance.

India Tubeless Tire Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of the two-wheeler and passenger car markets, increasing demand for replacement tires, and rising investments in tire manufacturing infrastructure. Government initiatives such as "Make in India" and incentives for automotive component production are strengthening the demand for tubeless tires. In addition, growing urban mobility, increasing disposable income, and a shift toward safer, low-maintenance tires are contributing to robust market expansion.

Europe Tubeless Tire Market Insight

The Europe tubeless tire market is expanding steadily, supported by stringent safety and environmental regulations, high adoption of high-performance tires, and growing investments in advanced manufacturing technology. The region emphasizes sustainability, quality standards, and tire efficiency, particularly in passenger cars and commercial vehicles. The increasing use of radial tubeless tires in OEMs and aftermarket, along with technological advancements in puncture-resistant and fuel-efficient designs, is further enhancing market growth.

Germany Tubeless Tire Market Insight

Germany’s tubeless tire market is driven by its leadership in automotive engineering, strong tire manufacturing heritage, and focus on high-precision, high-performance vehicles. The country has well-established R&D networks and collaborations between automotive and tire manufacturers, fostering continuous innovation in tubeless tire technology. Demand is particularly strong for premium passenger cars, commercial vehicles, and replacement tires in both domestic and export markets.

U.K. Tubeless Tire Market Insight

The U.K. market is supported by a mature automotive sector, growing adoption of fuel-efficient and safety-compliant tires, and rising demand in both passenger and commercial segments. Emphasis on environmental standards, R&D in advanced tire compounds, and development of high-performance radial tubeless tires are driving market growth. Collaborations between tire manufacturers and automotive OEMs continue to strengthen the U.K.’s position in the premium tire segment.

North America Tubeless Tire Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing vehicle sales, demand for replacement tires, and advancements in tire technology. Growth is supported by rising adoption of radial tubeless tires in passenger cars and commercial vehicles, focus on fuel efficiency, and growing awareness of tire safety and maintenance. Increasing reshoring of tire manufacturing and strong collaborations between OEMs and tire manufacturers are supporting market expansion.

U.S. Tubeless Tire Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its robust automotive industry, advanced R&D infrastructure, and high demand for replacement tires. Focus on high-performance radial tubeless tires, fuel efficiency standards, and sustainability initiatives is encouraging adoption across passenger cars and commercial vehicles. Presence of leading tire manufacturers, well-established distribution networks, and strong aftermarket demand further solidify the U.S.'s leading position in the region.

Tubeless Tire Market Share

The tubeless tire industry is primarily led by well-established companies, including:

- Toyo Tire Corporation (Japan)

- Bridgestone Corporation (Japan)

- Yokohama Tire Corporation. (Japan)

- The Goodyear Tire & Rubber Company (U.S.)

- CST Co. Inc. (Taiwan)

- Continental AG (Germany)

- Hankook Tire & Technology Co.,Ltd. (South Korea)

- Michelin. (France)

- Pirelli & C. S.p.A. (Italy)

- Sumitomo Rubber Industries, Ltd. (Japan)

- CEAT (India)

- MRF LIMITED (India)

- KUMHO TIRE CO., INC (South Korea)

- Apollo Tyres Ltd (India)

- Cooper Tire & Rubber Company (U.S.)

- Metro Tyre (India)

- Sonil Ventilfabrik (India)

- Kenda Tires. (Taiwan)

- Maxxis International–USA (U.S.)

- HUTCHINSON (France)

- Ralf Bohle GmbH (Germany)

Latest Developments in Global Tubeless Tire Market

- In March 2025, Continental collaborated with Schlager Transport Logistik to advance sustainable logistics, demonstrating the growing adoption of electric mobility solutions in the commercial transport sector. Schlager’s reliance on Continental Tires and the ContiConnect digital tire monitoring system highlights the increasing market demand for smart, connected, and sustainable tire solutions that improve fleet efficiency and reduce operational costs, positioning Continental as a key player in green logistics innovation

- In March 2025, Continental’s SportContact 7 and PremiumContact 7 achieved top rankings in AUTO BILD tire tests, with the SportContact 7 leading the sports car summer tire category and the PremiumContact 7 rated “exemplary” for electric vehicles. These accolades reinforce Continental’s strong market positioning in both performance and EV segments, enhancing brand credibility and driving consumer preference for high-performance and EV-compatible tires

- In February 2025, Bridgestone developed bespoke Potenza Sport tires for Porsche’s Macan Electric and Panamera models, along with the Panamera’s first winter fitment using Blizzak LM005 tires. This strategic development strengthens Bridgestone’s presence in the high-performance electric vehicle segment, meeting the rising market demand for specialized tires that combine sustainability, performance, and all-season reliability

- In September 2024, Bridgestone partnered with Audi to develop bespoke Potenza Sport ultra-high-performance tires for the e-tron GT family, supporting Audi’s ethos of “pure performance without compromise.” This collaboration enhances Bridgestone’s market reputation in the premium EV tire segment, showcasing its ability to provide tailored solutions for high-performance electric vehicles and solidifying long-term OEM partnerships

- In May 2024, Bridgestone collaborated with Maserati to produce custom 20-inch Potenza Sport ENLITEN tires for the all-electric Grecale Folgore SUV. These tires improve driving performance across various conditions while supporting sustainability through advanced lightweight technology, reinforcing Bridgestone’s leadership in premium EV tire innovation and meeting growing consumer demand for eco-friendly, high-performance solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.