Global Tubular Membranes Market

Market Size in USD Million

CAGR :

%

USD

851.20 Million

USD

14,651.02 Million

2024

2032

USD

851.20 Million

USD

14,651.02 Million

2024

2032

| 2025 –2032 | |

| USD 851.20 Million | |

| USD 14,651.02 Million | |

|

|

|

|

Tubular Membranes Market Size

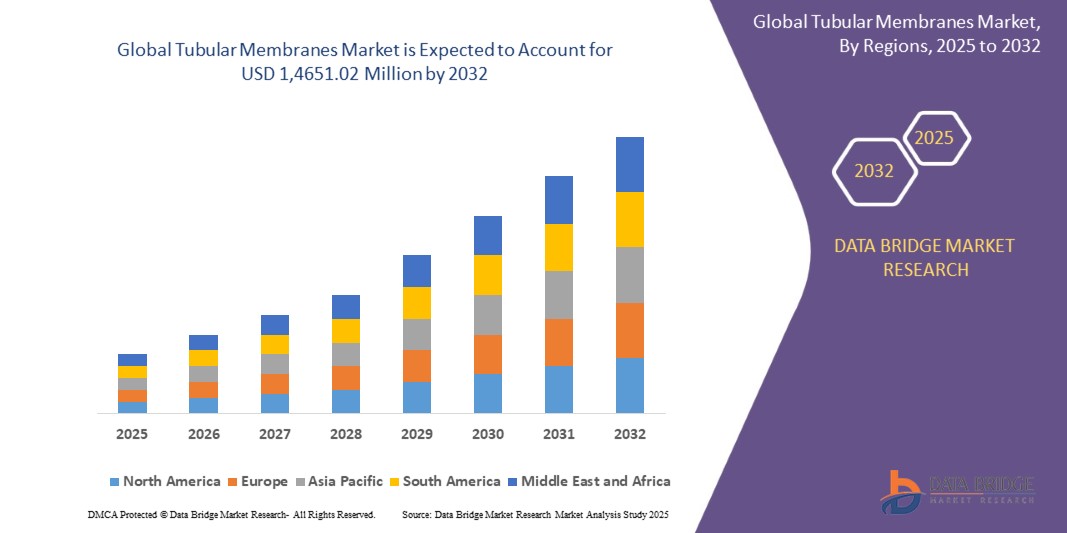

- The global Tubular Membranes market size was valued at USD 851.2 Million in 2024 and is expected to reach USD 1,4651.02 Million by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by the rising demand for highly efficient and durable filtration technologies, especially in industrial water & wastewater treatment, as well as increasing enforcement of strict water quality regulations worldwide

- Furthermore, expanding adoption of zero liquid discharge (ZLD) systems and growing need for reliable process separation are major drivers contributing to the greater usage of tubular membranes across municipal, industrial, and environmental sectors

Tubular Membranes Market Analysis

- Tubular membranes are a class of filtration technologies designed to efficiently separate suspended solids, pathogens, and dissolved contaminants from water and industrial process streams. Their robust design allows for superior fouling resistance and easy cleaning, making them essential in challenging wastewater and industrial effluent applications.

- Growing demand for tubular membranes is primarily driven by the increasing need for reliable water and wastewater treatment in municipal and industrial sectors, expansion of zero liquid discharge (ZLD) systems, stricter environmental regulations, and the pursuit of sustainability goals across manufacturing, food & beverage, chemicals, and energy industries.

- Asia-Pacific holds the largest revenue share in the global tubular membranes market as of 2024, supported by rapid industrialization, infrastructure investments, and strong government focus on pollution control and clean water management in countries such as China, India, and Southeast Asia. Market growth is further boosted by the region’s adoption of advanced membrane solutions for large-scale industrial and municipal projects.

- ·Ultrafiltration tubular membranes represent the leading segment, accounting for a significant portion of global market revenue due to their high selectivity, efficiency in removing macromolecules and suspended solids, and broad applicability in both municipal water recycling and industrial process optimization.

- Water and wastewater treatment applications continue to dominate market traction, as industries face increasing pressure to meet discharge standards and reuse water resources. Simultaneously, food & beverage, chemical, and pharmaceutical sectors are experiencing accelerated growth in tubular membrane usage for process separation, product quality management, and environmental compliance.

Report Scope and Tubular Membranes Market Segmentation

|

Attributes |

Tubular Membranes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tubular Membranes Market Trends

Advancement Toward Sustainable and High-Performance Filtration Solutions

- An important emerging trend in the global tubular membranes market is the increasing development and adoption of sustainable and energy-efficient filtration technologies as industries face stricter environmental regulations and evolving discharge standards. Manufacturers are shifting toward materials and designs that enhance long-term durability, fouling resistance, and operational efficiency while reducing energy and chemical consumption in filtration processes.

- The demand for recyclable and eco-friendly tubular membrane modules is growing, supported by advancements that enable easier cleaning, longer service life, and lower waste generation. These solutions are gaining traction in municipal water treatment, industrial recycling, and food & beverage processing where sustainability and operational savings are key priorities.

- Focus on system integration and modularity is shaping product innovation, allowing for flexible installation in diverse industrial settings and easier scalability for future expansions. There is also a rising preference for membranes compatible with advanced process automation and smart monitoring to ensure optimal system performance.

- As end-users prioritize long-term reliability and compliance with water reuse and zero liquid discharge initiatives, companies that invest in high-performing, environmentally responsible tubular membrane technologies are gaining a distinct market edge.

Tubular Membranes Market Dynamics

Driver

Escalating Demand for Industrial Water Reuse and Robust Treatment Solutions

- There is a growing global emphasis on water conservation and sustainability, making high-efficiency and low-maintenance water and wastewater treatment technologies critically important. As industries seek to reduce water usage, tubular membranes are increasingly favored for their ability to facilitate water reuse and resource recovery, especially in heavy-duty and complex effluent applications.

- The market is benefiting from expanding zero liquid discharge (ZLD) operations. These systems require dependable filtration solutions to ensure complete recovery of water and minimal discharge of pollutants, driving greater adoption of tubular membranes in manufacturing, mining, energy, and chemical processing industries.

- Regulatory agencies around the world are tightening standards for effluent quality and environmental protection, compelling companies to upgrade to robust membrane technologies that can reliably meet discharge limits and water safety requirements.

- Tubular membranes are particularly suitable for treating complex and high-strength industrial effluents because of their superior resistance to fouling and ease of cleaning, supporting long-term operational stability and lower downtime.

- Advancements in process automation, remote monitoring, and modular system designs are making tubular membrane facilities more cost-effective and adaptable for varying operational demands, further accelerating market growth.

- The pressure to reduce operational costs while maintaining high water treatment performance encourages industries to invest in durable membrane systems that ensure longevity, optimized maintenance, and efficient resource utilization.

Restraint/Challenge

Cost, Fouling Issues, and Stringent Compliance Hurdles

- Despite their advantages, tubular membrane systems typically require high initial investment and considerable operational expenses for installation, maintenance, and energy consumption. These financial barriers can slow adoption among smaller enterprises or in cost-sensitive markets.

- Membrane fouling—from suspended solids, organics, and scaling—can impair system efficiency and increase cleaning frequency, resulting in higher lifecycle costs and unpredictable performance. Research and development efforts are focused on materials that resist fouling and simplify routine cleaning.

- Meeting today’s strict environmental, health, and safety standards necessitates extensive product validation, ongoing documentation, and certification, often making it difficult for smaller manufacturers to enter or expand in regulated markets rapidly.

- These regulatory requirements not only lengthen the time-to-market for new membrane systems but also raise compliance costs for both suppliers and end-users.

- To address these challenges, leading companies are investing in new antifouling technologies, developing modular membrane components for operational flexibility, and boosting customer support for system optimization, compliance guidance, and efficient maintenance protocols.

- Efforts to educate customers about the total cost of ownership, long-term savings, and regulatory advantages of tubular membranes are essential for overcoming adoption hurdles and building market confidence.

Tubular Membranes Market Scope

The market is segmented on the basis of type and end-use industry.

- By Type

On the basis of type, the tubular membranes market is segmented into microfiltration, ultrafiltration, nanofiltration, and others. Microfiltration dominates the market revenue share in 2024 due to its effectiveness in removing suspended solids, bacteria, and macromolecules in municipal and industrial water treatment. Microfiltration is widely utilized for pre-treatment and coarse filtration needs, while nanofiltration sees growing adoption for selective separation and high-purity applications. The ultrafiltration and nanofiltration segments are expected to see the fastest growth through 2032, driven by advancing technologies and expanding industrial requirements for efficient liquid separation and water reuse.

- By End-Use Industry

On the basis of end-use industry, the tubular membranes market is segmented into water & wastewater treatment, food & beverage, chemicals & petrochemicals, pharmaceuticals, energy, and others. Water & wastewater treatment leads the market owing to stricter environmental regulations, rising demand for reclaimed water, and widespread zero liquid discharge (ZLD) implementation. Food & beverage and chemical processing represent rapidly growing segments fueled by increasing needs for product purity, process optimization, and regulatory compliance. Pharmaceutical and energy industries also contribute significantly, utilizing tubular membranes for high-quality filtration, resource recovery, and process efficiency enhancements.

Tubular Membranes Market Regional Analysis

- Asia-Pacific dominates the tubular membranes market with the largest revenue share of 40.01% in 2024, fueled by rapid industrialization, increasing investments in water infrastructure, and stringent environmental regulations across countries like China, India, Japan, and South Korea.

- Industries and municipalities in the region are increasingly adopting tubular membranes for advanced water and wastewater treatment, process separation, and zero liquid discharge solutions, driven by rising concerns over water quality, pollution control, and sustainable resource management—especially in densely populated urban and industrial hubs.

- The region’s growth is further supported by robust government policies on clean water access, expanding food & beverage and chemical manufacturing sectors, and the availability of affordable labor and raw materials. Asia-Pacific’s strong export-oriented industrial base and growing implementation of high-performance tubular membrane technologies reinforce its market leadership.

U.S. Tubular Membranes Market Insight

The U.S. dominates the North American tubular membranes market in 2024, benefiting from advanced water infrastructure, rigorous regulatory standards for water quality, and significant investments in industrial process optimization. Demand is high across municipal utilities, food & beverage, chemical production, and energy sectors, driven by strict compliance, water reuse initiatives, and the need for robust solutions for complex effluent treatment. Major suppliers are innovating with modular membrane systems and enhanced antifouling technologies to meet evolving operational and sustainability requirements.

Europe Tubular Membranes Market Insight

The Europe tubular membranes market is set for strong growth, led by stringent environmental regulations, broad adoption of zero liquid discharge systems, and expanding applications in industrial, municipal, and resource recovery sectors. Leading countries such as Germany, France, and the U.K. are contributing to regional demand with substantial investments in clean water technology, food processing, and wastewater recycling. Innovation in durable, low-maintenance membrane modules and support from EU-funded sustainability projects further bolster the market’s momentum.

U.K. Tubular Membranes Market Insight

The U.K. tubular membranes market is expected to witness notable growth, propelled by expanding adoption in municipal utilities, industrial wastewater management, and specialized process industries. There is increasing demand for premium tubular membrane solutions in both public infrastructure upgrades and private sector projects, with heightened awareness of water reuse, regulatory standards, and lifecycle cost efficiency driving market penetration.

Germany Tubular Membranes Market Insight

Germany’s tubular membranes market is projected to grow steadily as the country continues to lead in sustainable process engineering, industrial manufacturing, and advanced water treatment. Strong emphasis on environmental protection and resource efficiency drives the deployment of high-performance membranes for municipal, food & beverage, chemical, and power applications. Innovation in antifouling materials and smart monitoring systems supports adoption in technically demanding and regulatory-driven sectors.

Asia-Pacific Tubular Membranes Market Insight

The Asia-Pacific region accounted for the largest revenue share in 2024, powered by rapid industrial growth, urban infrastructure investment, and strict water and environmental regulations across China, India, Japan, and Southeast Asia. The region’s robust manufacturing output and rising demand for sustainable water treatment are accelerating the implementation of advanced tubular membrane systems in municipal, industrial, and resource recovery projects. Government initiatives promoting clean water and pollution control further support regional leadership.

India Tubular Membranes Market Insight

India’s tubular membranes market is projected to register a substantial CAGR over the forecast period, driven by expanding investments in industrial and municipal water treatment, rising awareness of water reuse and sustainability, and government focus on “Make in India” and infrastructure modernization. The growing middle class and rapid urbanization fuel adoption of tubular membranes in both cost-effective and high-performance applications from municipal utilities to chemical manufacturing and energy sectors.

China Tubular Membranes Market Insight

China leads the Asia-Pacific tubular membranes market in terms of revenue share, backed by its dominant manufacturing sector, large-scale investments in clean water infrastructure, and increasing regulatory pressure on effluent quality and pollution reduction. The market is expanding in municipal water, food processing, chemicals, and power with strong domestic demand and export activities. Technological innovation in membrane modules and local expertise in process industries further strengthen China’s leadership in the sector.

Tubular Membranes Market Share

The Tubular Membranes industry is primarily led by well-established companies, including:

- PCI Membranes (U.K.)

- Koch Separation Solutions (U.S.)

- Berghof Membranes (Germany)

- Pentair/X-Flow (Netherlands)

- Microdyn-Nadir (Germany)

- Alfa Laval (Sweden)

- Veolia Water Technologies (France)

- Suez (France)

- Evoqua Water Technologies (U.S.)

- MEMOS Membrane Modules (Germany)

- Synder Filtration (U.S.)

- Aquatech International (U.S.)

- Hyflux (Singapore)

- HUBER SE (Germany)

- Pall Corporation (U.S.)

- Toray Industries, Inc. (Japan)

- Kubota Corporation (Japan)

Latest Developments in Global Tubular Membranes Market

- In February 2024, Koch Separation Solutions launched an advanced series of tubular ultrafiltration modules designed to enhance performance in high-solids industrial and municipal wastewater treatment applications, improving fouling resistance and operational life.

- In November 2023, Berghof Membranes expanded its footprint in Asia-Pacific by installing large-scale tubular membrane systems for zero liquid discharge projects in industrial parks, supporting growth across China, India, and Southeast Asia.

- In September 2023, Veolia Water Technologies introduced new cleaning and maintenance solutions for tubular membranes, focused on optimizing system reliability and reducing lifecycle costs for food & beverage and chemical processing industries.

- In July 2023, Pentair/X-Flow upgraded its membrane manufacturing facilities in Europe to increase capacity, improve quality control, and support the rising demand for customized tubular membrane modules in water reuse and recycling.

- In April 2022, Microdyn-Nadir announced the development of next-generation polymeric tubular membranes engineered for challenging effluent streams in pharmaceuticals and specialty chemicals, offering improved selectivity and resistance to aggressive contaminants.

- In December 2021, Alfa Laval partnered with major water utilities in North America to implement high-efficiency tubular membrane plants for drinking water treatment and resource recovery, leveraging digital monitoring and automation technologies.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.