Global Turf And Forage Seeds Market

Market Size in USD Billion

CAGR :

%

USD

3.05 Billion

USD

6.04 Billion

2025

2033

USD

3.05 Billion

USD

6.04 Billion

2025

2033

| 2026 –2033 | |

| USD 3.05 Billion | |

| USD 6.04 Billion | |

|

|

|

|

Turf and Forage Seeds Market Size

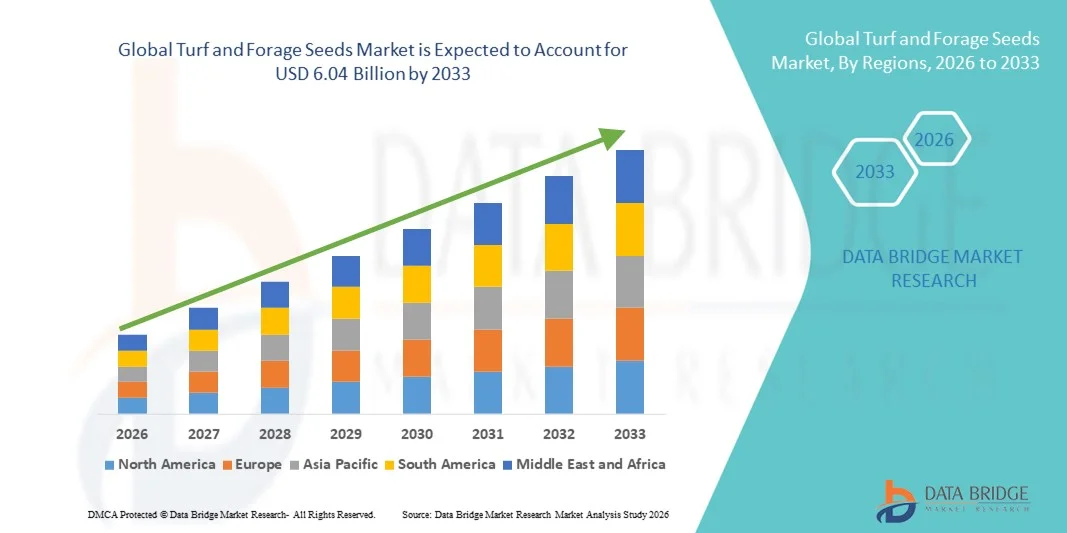

- The global turf and forage seeds market size was valued at USD 3.05 billion in 2025 and is expected to reach USD 6.04 billion by 2033, at a CAGR of 8.89% during the forecast period

- The market growth is largely fueled by increasing adoption of improved seed varieties, advanced forage cultivation practices, and technological innovations in seed breeding, leading to higher crop yields and enhanced livestock productivity

- Furthermore, rising demand for nutrient-rich, high-quality forage for livestock and dairy farms is establishing improved and hybrid seeds as the preferred solution for sustainable animal feed. These converging factors are accelerating the adoption of premium turf and forage seeds, thereby significantly boosting the industry's growth

Turf and Forage Seeds Market Analysis

- Turf and forage seeds, providing essential feed for livestock and improving pasture productivity, are increasingly critical in modern livestock and dairy farming systems due to their high nutritional content, resilience, and adaptability to different climatic conditions

- The escalating demand for turf and forage seeds is primarily fueled by the growing focus on sustainable livestock farming, rising awareness of soil fertility improvement, and the need for high-quality feed to enhance livestock performance and overall farm profitability

- North America dominated the turf and forage seeds market with a share of 42.8% in 2025, due to advanced livestock farming practices, high adoption of improved seed varieties, and increasing awareness of quality forage for sustainable animal feed

- Asia-Pacific is expected to be the fastest growing region in the turf and forage seeds market during the forecast period due to rising livestock farming activities, increasing disposable incomes, and growing awareness of high-quality feed in countries such as China, India, and Japan

- Grasses segment dominated the market with a market share of 55.6% in 2025, due to their widespread use in pasture, hay, and silage production. Grasses offer high productivity, consistent quality feed, and adaptability to different soil and climatic conditions. The segment’s dominance is further supported by the development of hybrid and improved grass varieties that enhance resistance to pests, diseases, and environmental stress. Livestock owners increasingly rely on grasses for cost-effective and nutrient-rich feed, ensuring steady growth in this segment

Report Scope and Turf and Forage Seeds Market Segmentation

|

Attributes |

Turf and Forage Seeds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Turf and Forage Seeds Market Trends

Rising Adoption of High-Yield and Climate-Resilient Forage Seed Varieties

- A key trend influencing the turf and forage seeds market is the growing adoption of high-yield and climate-resilient seed varieties aimed at enhancing feed productivity and pasture sustainability. Farmers and livestock owners are prioritizing improved seed strains that sustain optimal growth under varying environmental conditions and soil profiles, ensuring consistent forage supply throughout the year

- For instance, Barenbrug Group has developed a range of drought-tolerant and disease-resistant grass and clover hybrids designed to perform effectively in warmer and drier regions. These innovations have helped reduce pasture losses during extreme weather events while improving livestock grazing efficiency and overall field resilience

- The focus on climate-adaptive genetics is intensifying as global weather variability threatens traditional forage crops. Breeding programs are increasingly selecting varieties with improved heat resistance, water-use efficiency, and faster regrowth to maintain biomass output under stress conditions

- Advancements in biotechnology and seed treatment methods are further enhancing germination rates, pest tolerance, and soil compatibility. These developments support greater seed longevity and performance while increasing farmers' capacity to manage degraded soils and adapt to changing precipitation patterns

- The adoption of high-performance forage seeds is also driven by the rising preference for sustainable farming practices. Integrating resilient seed varieties within mixed pasture systems enables balanced nutrition and efficient land utilization while contributing to carbon sequestration and soil health restoration

- The transition toward climate-resilient and high-yield seed innovation reflects the agricultural industry’s strategic shift toward productivity and environmental sustainability. This trend is expected to redefine livestock feed production, ensuring long-term stability in food and dairy supply chains

Turf and Forage Seeds Market Dynamics

Driver

Increasing Demand for Nutrient-Rich and Sustainable Livestock Feed

- The rising global demand for nutrient-dense and environmentally sustainable livestock feed is a significant driver propelling the turf and forage seeds market. Livestock producers are focusing on forages that offer enhanced protein, fiber, and energy content to meet the nutritional needs of dairy, beef, and sheep herds efficiently

- For instance, DLF Seeds introduced a line of nutrient-optimized perennial ryegrass and alfalfa hybrids that improve digestibility and milk yield in high-performing dairy cattle. This innovation aligns with the growing demand for protein-rich forage options compatible with sustainable farming systems

- Rapid growth in the livestock sector and expansion of intensive animal husbandry practices are emphasizing the need for high-quality forage to sustain productivity. Farmers are investing in improved seed varieties capable of providing nutrient stability throughout multiple harvest cycles

- The increasing adoption of rotational and regenerative grazing systems has bolstered the market for seeds that support rapid regeneration and soil enrichment. These systems contribute to animal health, reduced dependence on synthetic feed additives, and enhanced sustainability across the production chain

- The combined effect of rising livestock populations and consumer preference for ethically sourced meat and dairy products is reinforcing the shift toward sustainable feed production. This consistency in demand is expected to accelerate innovation and adoption of nutrient-rich forage seed varieties globally

Restraint/Challenge

Vulnerability of Seed Production to Climate Change and Pest Infestations

- The vulnerability of turf and forage seed production to climate fluctuations and pest infestations remains a key restraint for market growth. Frequent droughts, irregular rainfall patterns, and changing temperature profiles are increasingly disrupting field productivity and seed germination across major agricultural regions

- For instance, forage grass and legume producers in Australia and the United States have reported reduced yields due to rising pest pressures and erratic weather, affecting leading suppliers such as Pennington Seed and Hancock Seed. These challenges have increased dependence on irrigation and pest-management interventions, thereby raising production costs

- Pest infestations such as aphids, root nematodes, and fungal diseases pose severe threats to seedling survival, particularly during early growth stages. These disruptions lead to poor seed quality and delayed harvesting cycles, undermining yield consistency and economic returns for farmers

- Unpredictable climatic events such as heatwaves, floods, and frost stress further complicate timely cultivation and harvesting. As a result, production companies must regularly adjust seed multiplication and storage strategies to maintain supply continuity

- Building resilient supply chains and investing in climate-smart breeding programs are crucial for overcoming these limitations. Strengthening pest surveillance systems and improving adaptive agronomic practices will be essential to ensure consistent output and safeguard the long-term stability of the turf and forage seeds market

Turf and Forage Seeds Market Scope

The market is segmented on the basis of product type, type, and crop type.

- By Product Type

On the basis of product type, the turf and forage seeds market is segmented into stored forage and fresh forage. The stored forage segment dominated the market with the largest market revenue share in 2025, driven by its long shelf life and ability to provide a consistent feed supply throughout the year. Farmers and livestock owners often prefer stored forage for its reliability during off-season periods and for regions with variable climatic conditions. The demand is also bolstered by its ease of transportation, standardized nutritional content, and compatibility with mechanized feeding systems. Moreover, stored forage varieties offer better preservation of protein and fiber content, making them a preferred choice in commercial livestock operations.

The fresh forage segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of nutritional benefits and demand for high-quality feed in organic and small-scale livestock farming. Fresh forage is preferred for its higher palatability and digestibility, supporting better animal health and productivity. Farmers increasingly adopt fresh forage systems integrated with rotational grazing practices to maximize yield and soil health. The growing trend of sustainable and eco-friendly farming practices further drives the adoption of fresh forage varieties.

- By Type

On the basis of type, the turf and forage seeds market is segmented into cool season grasses and warm season grasses. The cool season grasses segment held the largest market revenue share in 2025, driven by their adaptability to temperate climates and high nutritional value. These grasses, including ryegrass and fescues, are widely preferred for dairy and livestock farms due to their high digestible energy content and consistent yield throughout spring and autumn. The segment also benefits from strong research and breeding programs that enhance disease resistance and growth performance. Farmers often prioritize cool season grasses for their suitability in mixed forage systems and compatibility with various soil types.

The warm season grasses segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing adoption in tropical and subtropical regions. Varieties such as Bermuda and Napier grass are gaining popularity due to their drought tolerance, high biomass yield, and ability to recover quickly after grazing or cutting. Warm season grasses are increasingly used for large-scale livestock operations, including beef and dairy farms, where sustained forage production is critical. Rising government initiatives promoting forage cultivation in arid and semi-arid regions also support the segment’s growth.

- By Crop Type

On the basis of crop type, the turf and forage seeds market is segmented into cereals, legumes, and grasses. The grasses segment dominated the market with the largest market revenue share of 55.6% in 2025, driven by their widespread use in pasture, hay, and silage production. Grasses offer high productivity, consistent quality feed, and adaptability to different soil and climatic conditions. The segment’s dominance is further supported by the development of hybrid and improved grass varieties that enhance resistance to pests, diseases, and environmental stress. Livestock owners increasingly rely on grasses for cost-effective and nutrient-rich feed, ensuring steady growth in this segment.

The legumes segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption due to their nitrogen-fixing properties and high protein content. Legumes, such as alfalfa and clover, enhance soil fertility and complement grasses in mixed forage systems. Their inclusion in feed improves livestock productivity, particularly in dairy and meat production. Increased awareness of sustainable agricultural practices and government incentives for legume cultivation further drive the adoption of this crop type.

Turf and Forage Seeds Market Regional Analysis

- North America dominated the turf and forage seeds market with the largest revenue share of 42.8% in 2025, driven by advanced livestock farming practices, high adoption of improved seed varieties, and increasing awareness of quality forage for sustainable animal feed

- Farmers in the region highly value high-yielding, nutrient-rich seeds such as stored forage and cool season grasses that enhance livestock productivity

- The widespread adoption is further supported by modern agricultural infrastructure, access to high-quality inputs, and government initiatives promoting sustainable livestock production, establishing North America as a key hub for turf and forage seeds

U.S. Turf and Forage Seeds Market Insight

The U.S. turf and forage seeds market captured the largest revenue share in North America in 2025, fueled by the increasing demand for high-quality animal feed and the adoption of hybrid and improved seed varieties. Farmers are increasingly prioritizing forage that improves livestock health, enhances milk and meat yield, and supports sustainable grazing practices. The growing integration of precision agriculture and advanced seed technologies, along with government programs promoting forage cultivation, further propels the market.

Europe Turf and Forage Seeds Market Insight

The Europe turf and forage seeds market is projected to grow steadily throughout the forecast period, driven by high demand for high-quality pasture for dairy and livestock farms. Strict quality regulations, increasing organic livestock farming, and the need for climate-resilient seed varieties are fostering the adoption of improved forage seeds. European farmers are also focusing on enhancing soil fertility through legumes and grasses, supporting sustainable livestock practices. The market growth is supported across both small-scale farms and large commercial operations, with emphasis on efficient feed production.

U.K. Turf and Forage Seeds Market Insight

The U.K. turf and forage seeds market is anticipated to expand at a notable CAGR, driven by the growing trend of sustainable and precision livestock farming. Concerns regarding livestock nutrition and feed efficiency encourage the adoption of nutrient-rich stored forage and cool season grasses. Government support for sustainable farming practices and the country’s well-established dairy and beef sectors are expected to continue stimulating market growth.

Germany Turf and Forage Seeds Market Insight

The Germany turf and forage seeds market is expected to grow steadily, fueled by increasing focus on soil health, climate-adaptive seed varieties, and livestock productivity. Germany’s advanced agricultural infrastructure, coupled with strong research in forage improvement and crop diversification, promotes the adoption of high-yield grasses and legumes. The integration of modern farming practices with quality forage production is becoming increasingly prevalent, aligning with local farmers’ preference for sustainable and efficient solutions.

Asia-Pacific Turf and Forage Seeds Market Insight

The Asia-Pacific turf and forage seeds market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising livestock farming activities, increasing disposable incomes, and growing awareness of high-quality feed in countries such as China, India, and Japan. The region’s expanding livestock population and adoption of improved forage varieties are fueling market growth. Furthermore, government initiatives supporting sustainable agriculture and investments in seed technology are enhancing accessibility and affordability of high-quality forage seeds across the region.

Japan Turf and Forage Seeds Market Insight

The Japan turf and forage seeds market is gaining momentum due to the increasing focus on high-quality feed for dairy and livestock farms. Farmers prioritize nutrient-dense forage, including cool season grasses and legumes, to enhance livestock productivity and maintain soil health. The adoption of modern farming techniques and sustainable practices, alongside the country’s high-tech agricultural sector, is driving market expansion.

China Turf and Forage Seeds Market Insight

The China turf and forage seeds market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding livestock sector and growing middle-class demand for meat and dairy products. High adoption of hybrid and improved forage seeds, combined with government programs supporting pasture development and smart livestock farming, are key factors propelling the market. China’s focus on modernizing agriculture and increasing domestic forage production ensures sustained market growth.

Turf and Forage Seeds Market Share

The turf and forage seeds industry is primarily led by well-established companies, including:

- AgReliant Genetics, LLC (U.S.)

- BRETTYOUNG (Canada)

- Allied Seed, LLC (U.S.)

- BASF SE (Germany)

- DuPont (U.S.)

- Corteva (U.S.)

- Foragen Seeds (U.S.)

- S&W Seed Co. (U.S.)

- Germinal GB (U.K.)

- Landmark Turf & Native Seed (Canada)

- Oregon Grass Seed (U.S.)

- BARENBRUG (Netherlands)

- Pennington Seed, Inc. (U.S.)

- Newsom Seed (U.S.)

- Greenleaf Turf Solutions (U.S.)

- Hancock Seed & Company (U.S.)

- Central Garden & Pet Company (U.S.)

- Northstar Seed Ltd (Canada)

- Ampac Seed (U.S.)

- DLF Seeds A/S (Denmark)

Latest Developments in Global Turf and Forage Seeds Market

- In October 2024, Millborn Seeds completed the acquisition of Kaste Seed, a supplier of native grasses and wildflower seeds in the U.S. Midwest, strengthening its seed supply chain and expanding product diversity. This development signals intensified competition in forage and specialty seed segments and highlights the growing market focus on diversified, high-quality forage options for both livestock and land reclamation applications

- In August 2024, DLF launched its new “4Most Seed Enhancement” solution for turf and forage applications, integrating slow‑release nitrogen, beneficial microorganisms, and a biodegradable moisture‑retaining coating. This launch strengthens DLF’s competitive position by offering advanced seed‑enhancement technology, supporting the trend toward high‑value, performance-driven forage seeds, and creating higher entry barriers for lower-cost alternatives

- In July 2024, DLF opened a new seed‑enhancement facility in Albany, Oregon, connected to its 4Most product launch, featuring state-of-the-art production and packaging capabilities. This development reflects the market shift from commodity seed sales toward technology-enabled seed solutions, increasing the overall growth potential and promoting innovation in the turf and forage seeds sector

- In March 2024, Millborn Seeds acquired Union Forage, a Canadian forage‑seed firm, expanding its North American footprint and integrating Union Forage’s dealer network and product lineup with Millborn’s existing portfolio. This acquisition accelerates consolidation in the forage‑seed sector, broadens market access in Western Canada, and pressures competitors to enhance distribution and partnership strategies

- In September 2023, DLF acquired Corteva Agriscience’s alfalfa breeding program, including global germplasm and proprietary varieties such as Hi‑Gest®, Hi‑Ton®, and Hi‑Salt®. This acquisition enhances DLF’s genetics portfolio and global market access, emphasizing the importance of high-yielding, nutrient-rich alfalfa varieties and the strategic focus on advanced genetics to differentiate in the forage seeds marke

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.