Global Two Terminal Diode For Alternating Current Diac Market

Market Size in USD Billion

CAGR :

%

USD

10.06 Billion

USD

12.16 Billion

2024

2032

USD

10.06 Billion

USD

12.16 Billion

2024

2032

| 2025 –2032 | |

| USD 10.06 Billion | |

| USD 12.16 Billion | |

|

|

|

|

What is the Global Two Terminal Diode for Alternating Current (DIAC) Market Size and Growth Rate?

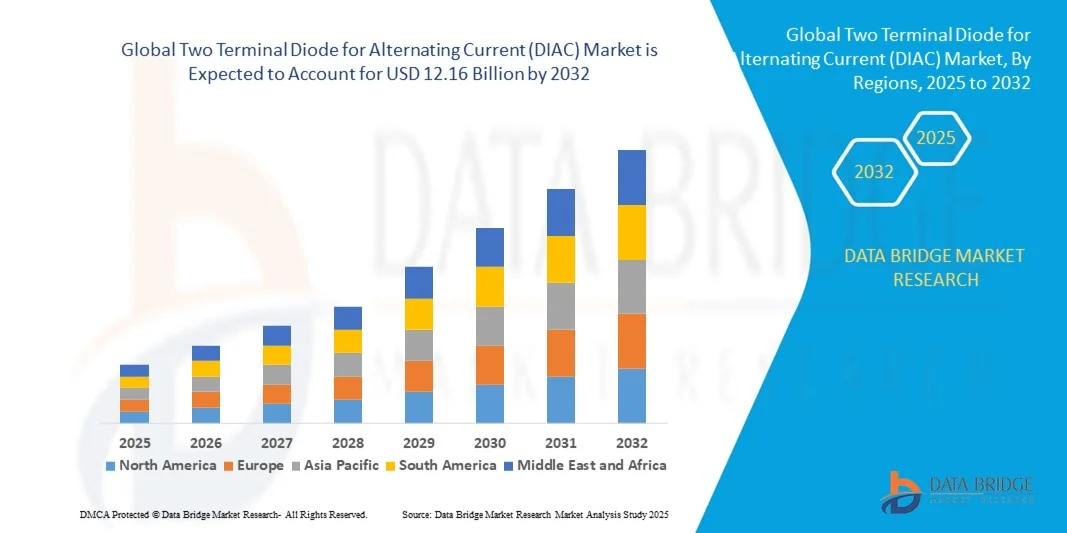

- The global two terminal diode for alternating current (DIAC) market size was valued at USD 10.06 billion in 2024 and is expected to reach USD 12.16 billion by 2032, at a CAGR of 2.40% during the forecast period

- Increasing usages of the product to trigger device in phase control circuits of motor speed control, light dimmers, heat control, and others, growth of the semiconductor industry across the globe, two terminal diode for alternating current can be used with a TRIAC in a series combination for triggering, growing demand of the two terminal diode for alternating current as an open circuit when the voltage is less than its avalanche breakdown voltage are some of the major as well as vital factors which will likely to augment the growth of the two terminal diode for alternating current (DIAC) market

What are the Major Takeaways of Two Terminal Diode for Alternating Current (DIAC) Market?

- Reliability of product for low power applications along with smooth control of power and current is achieved using two terminal diode for alternating current which will further contribute by generating immense opportunities that will led to the growth of the two terminal diode for alternating current (DIAC) market in the above mentioned projected timeframe

- North America dominated the two terminal diode for alternating current (DIAC) market with the largest revenue share of 39.93% in 2024, driven by increasing adoption of smart devices, industrial automation, and advanced electronic systems

- The Asia-Pacific two terminal diode for alternating current market is poised to grow at the fastest CAGR of 11.69% from 2025 to 2032, driven by rising urbanization, increased electronics manufacturing, and technological adoption in countries such as China, Japan, and India

- The switch element segment dominated the market with the largest revenue share of 42.8% in 2024, driven by its critical role in triggering AC loads and enabling precise control in household and industrial electronics

Report Scope and Two Terminal Diode for Alternating Current (DIAC) Market Segmentation

|

Attributes |

Two Terminal Diode for Alternating Current (DIAC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Two Terminal Diode for Alternating Current (DIAC) Market?

Advancements in Miniaturization and High-Frequency Applications

- A major and accelerating trend in the global two terminal diode for alternating current (DIAC) market is the increasing development of compact, high-efficiency DIACs optimized for high-frequency AC switching and low-voltage applications. These devices are being widely adopted in modern electronics, particularly in power control, lighting, and industrial automation systems

- For instance, ROHM’s latest two terminal diode for alternating current series integrates ultra-low switching delays and compact packaging, allowing precise triggering in AC circuits with minimal energy loss. Similarly, STMicroelectronics has developed DIACs compatible with next-generation AC dimmer and motor control modules, supporting smoother operations

- Enhanced reliability and thermal stability are also key focus areas, as DIACs are increasingly required to withstand higher temperatures and repeated switching cycles. Advanced material engineering and precise fabrication techniques enable improved performance in residential, commercial, and industrial applications

- The trend toward smaller, more efficient two terminal diode for alternating current is enabling integration with modern smart devices and electronic control units (ECUs), facilitating automated and energy-efficient operations. For instance, DIACs are being embedded in smart lighting systems to allow smooth dimming without flicker, enhancing end-user experience

- This shift toward miniaturization, high-frequency performance, and improved thermal stability is redefining user expectations for AC switching components, prompting semiconductor companies such as Texas Instruments and ROHM to innovate two terminal diode for alternating current for next-generation electronics

- The rising demand for compact, high-performance two terminal diode for alternating current across residential, commercial, and industrial sectors is driving R&D investments and encouraging broader adoption of these devices

What are the Key Drivers of Two Terminal Diode for Alternating Current (DIAC) Market?

- The increasing demand for energy-efficient AC control solutions in household appliances, lighting, and industrial automation is a significant growth driver for the two terminal diode for alternating current market. two terminal diode for alternating current offer precise switching for AC circuits, enabling smooth control and improved energy efficiency

- For instance, in March 2024, STMicroelectronics introduced DIAC modules optimized for smart lighting systems, supporting low-power AC switching and high-frequency operation, which is expected to accelerate two terminal diode for alternating current adoption globally

- Modern consumer electronics and industrial systems require compact and reliable AC switching devices, and two terminal diode for alternating current meet these requirements by providing consistent performance and high durability under repeated switching cycles

- The proliferation of smart appliances, automated motor controls, and AC dimmers is further driving the adoption of two terminal diode for alternating current, as these devices enable seamless integration with microcontrollers and smart control units

- Manufacturers are increasingly offering two terminal diode for alternating current with enhanced voltage tolerance, thermal stability, and precise triggering, which improves reliability and reduces component failure risks, fostering broader deployment across end-user sectors

Which Factor is Challenging the Growth of the Two Terminal Diode for Alternating Current (DIAC) Market?

- The high complexity and cost associated with developing high-performance DIACs for specialized applications can limit adoption, particularly in cost-sensitive markets or low-budget consumer electronics

- For instance, advanced DIACs with ultra-low switching times and compact packaging from companies such as ROHM or STMicroelectronics command a premium price, which may deter price-conscious manufacturers

- In addition, the growing preference for alternative AC switching technologies, such as TRIACs or MOSFET-based solutions, poses competition to DIACs in certain applications, limiting market growth

- Ensuring thermal stability, precise triggering, and long-term reliability under high-frequency operations remains a technological challenge, requiring continuous R&D investments

- To sustain market expansion, manufacturers must focus on cost optimization, innovative packaging, and improved performance metrics. Educating consumers on DIAC advantages over alternatives and developing versatile, affordable solutions are key strategies to overcome these challenges

How is the Two Terminal Diode for Alternating Current (DIAC) Market Segmented?

The market is segmented on the basis of type, product, specification, and application.

- By Application

On the basis of application, the two terminal diode for alternating current (DIAC) market is segmented into rectification, switch element, amplitude limiting, following the flow, detecting action, and display element. The switch element segment dominated the market with the largest revenue share of 42.8% in 2024, driven by its critical role in triggering AC loads and enabling precise control in household and industrial electronics. Switch element two terminal diode for alternating current are extensively used in lighting dimmers, motor controls, and heating systems, offering reliable performance under repetitive AC cycles. The rectification segment is anticipated to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by the increasing adoption of AC-to-DC conversion in energy-efficient appliances and industrial automation. The growing need for compact, high-performance two terminal diode for alternating current in smart electronics and renewable energy applications is further accelerating growth in rectification applications.

- By Product

On the basis of product, the two terminal diode for alternating current market is segmented into light dimmer circuits and heater control circuits. The light dimmer circuit segment held the largest revenue share of 46.5% in 2024, attributed to rising consumer demand for energy-efficient, adjustable lighting solutions in residential and commercial settings. Two terminal diode for alternating current integrated into dimmer circuits enable smooth voltage control and flicker-free dimming, enhancing user comfort and reducing energy consumption.

The heater control circuit segment is projected to record the fastest CAGR of 21.8% from 2025 to 2032, driven by increasing adoption in HVAC systems, industrial heating applications, and smart appliances. With the growing focus on automated energy management and precise temperature regulation, two terminal diode for alternating current -based heater control solutions are gaining popularity, particularly in regions with cold climates and rapid industrialization.

- By Specification

On the basis of specification, the two terminal diode for alternating current (DIAC) market is segmented into breakover voltage and breakover voltage symmetry, breakover current, output voltage, repetitive peak on-state current, and power dissipation. The breakover voltage and breakover voltage symmetry segment dominated the market with the largest share of 44.3% in 2024, as precise triggering thresholds are critical for device reliability and circuit protection in AC applications.

The breakover current segment is expected to witness the fastest CAGR of 22.5% from 2025 to 2032, driven by the increasing need for two terminal diode for alternating current that can handle higher currents in industrial automation, motor control, and high-power consumer appliances. These specifications are key in ensuring consistent performance, improved thermal stability, and enhanced safety under high-frequency switching conditions.

- By Type

On the basis of type, the two terminal diode for alternating current (DIAC) market is segmented into discrete packaging (DPAK), power packaging (PPAK), and in-line packaging (IPAK). The discrete packaging (DPAK) segment dominated the market with a revenue share of 47.6% in 2024, due to its compact footprint, ease of integration into printed circuit boards (PCBs), and compatibility with modern electronic devices.

The power packaging (PPAK) segment is projected to record the fastest CAGR of 21.9% from 2025 to 2032, fueled by rising demand in industrial and high-power applications where enhanced thermal performance and current-handling capabilities are required. Manufacturers are increasingly focusing on advanced packaging designs to improve heat dissipation, reduce switching losses, and enhance overall DIAC reliability.

Which Region Holds the Largest Share of the Two Terminal Diode for Alternating Current (DIAC) Market?

- North America dominated the two terminal diode for alternating current (DIAC) market with the largest revenue share of 39.93% in 2024, driven by increasing adoption of smart devices, industrial automation, and advanced electronic systems

- Consumers and manufacturers in the region highly value the performance reliability, low power consumption, and durability offered by DIACs in AC switching, dimming, and control circuits

- The market growth is further supported by high disposable incomes, a strong electronics manufacturing base, and a technological inclination toward energy-efficient and automated solutions, establishing DIACs as a preferred choice for residential, commercial, and industrial applications

U.S. Two Terminal Diode for Alternating Current (DIAC) Market Insight

The U.S. two terminal diode for alternating current market accounted for the largest revenue share of 81% in North America in 2024, driven by the rapid adoption of smart appliances, energy-efficient lighting, and automated industrial controls. DIACs are widely used in light dimmer circuits, heater control systems, and other AC switching applications. Increasing awareness about energy conservation and government initiatives supporting smart grid technology further boost adoption. Moreover, the integration of DIACs into compact and high-efficiency consumer and industrial devices is enhancing product reliability and functionality.

Europe Two Terminal Diode for Alternating Current (DIAC) Market Insight

The Europe two terminal diode for alternating current market is projected to expand at a substantial CAGR during the forecast period, driven by stringent energy efficiency regulations, rising automation in industrial processes, and growing adoption in residential and commercial electronic systems. DIACs are increasingly incorporated into energy-efficient lighting, HVAC systems, and industrial control circuits. Urbanization and a preference for smart and connected electronics are accelerating demand across countries such as Germany, France, and Italy.

U.K. Two Terminal Diode for Alternating Current (DIAC) Market Insight

The U.K. two terminal diode for alternating current market is expected to grow at a noteworthy CAGR, fueled by the demand for home automation, industrial automation, and energy-efficient appliances. DIACs play a key role in electronic switching and AC control applications, and the integration of smart electronic solutions in homes and commercial buildings is driving adoption. The growing focus on energy efficiency, supported by government incentives, is further boosting market penetration.

Germany Two Terminal Diode for Alternating Current (DIAC) Market Insight

The Germany two terminal diode for alternating current market is witnessing considerable growth due to strong industrial automation infrastructure, emphasis on energy efficiency, and adoption of advanced electronic control solutions. DIACs are increasingly used in motor control, light dimmers, and heating control systems. Local manufacturers are focusing on reliability, precision, and compliance with eco-conscious standards, making DIACs a preferred component in industrial and residential electronics.

Which Region is the Fastest Growing Region in the Two Terminal Diode for Alternating Current (DIAC) Market?

The Asia-Pacific two terminal diode for alternating current market is poised to grow at the fastest CAGR of 11.69% from 2025 to 2032, driven by rising urbanization, increased electronics manufacturing, and technological adoption in countries such as China, Japan, and India. The region’s growing inclination toward energy-efficient appliances, industrial automation, and smart home systems is driving DIAC adoption. Furthermore, APAC’s emergence as a manufacturing hub for electronic components is enhancing affordability and availability, expanding the consumer base for DIAC-based devices.

Japan Two Terminal Diode for Alternating Current (DIAC) Market Insight

The Japan two terminal diode for alternating current market is gaining momentum due to rapid urbanization, strong electronics manufacturing, and high consumer demand for automated and energy-efficient appliances. DIACs are extensively used in light dimming, heater control, and industrial automation applications. The country’s aging population also favors devices that improve convenience, reliability, and energy savings in both residential and commercial sectors.

China Two Terminal Diode for Alternating Current (DIAC) Market Insight

The China two terminal diode for alternating current market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s growing middle class, industrial automation, and strong electronics sector. DIACs are widely used in residential, commercial, and industrial electronics for AC switching, motor control, and energy-efficient applications. Government initiatives promoting smart cities and sustainable energy solutions, coupled with a strong domestic manufacturing ecosystem, are key factors driving market expansion.

Which are the Top Companies in Two Terminal Diode for Alternating Current (DIAC) Market?

The two terminal diode for alternating current (DIAC) industry is primarily led by well-established companies, including:

- Digi-Key Electronics (U.S.)

- ABB (Switzerland)

- Siemens (Germany)

- Eurotherm by Schneider Electric (U.K.)

- ROHM Co., Ltd. (Japan)

- STMicroelectronics (Switzerland)

- Sunrom Technologies (India)

- Semiconductor Components Industries, LLC (U.S.)

- Arrow Electronics, Inc. (U.S.)

- Adafruit Industries, LLC (U.S.)

- Texas Instruments Incorporated (U.S.)

- Advanced Power Technologies, LLC (U.S.)

- Mouser Electronics, Inc. (U.S.)

- Electronic Devices Inc. (U.S.)

- PERFECT SWITCH LLC (U.S.)

- Applied Power Systems, Inc. (U.S.)

- C&H Technology (U.S.)

- Northrop Grumman Corporation (U.S.)

- RFE International, Inc (U.S.)

- Avnet (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Diode For Alternating Current Diac Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Diode For Alternating Current Diac Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Diode For Alternating Current Diac Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.