Global Two Terminal Laser Diode Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

21.29 Billion

2024

2032

USD

7.50 Billion

USD

21.29 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 21.29 Billion | |

|

|

|

|

Global Two Terminal Laser Diode Market Size

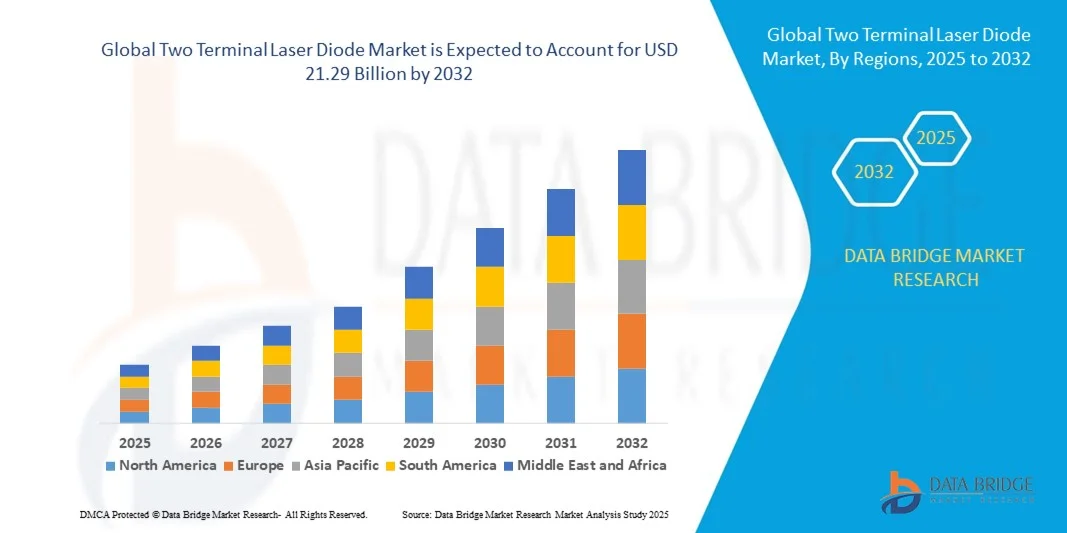

- The global Two Terminal Laser Diode Market size was valued at USD 7.50 billion in 2024 and is projected to reach USD 21.29billion by 2032, growing at a CAGR of 13.92% during the forecast period.

- The market expansion is primarily driven by increased integration of laser diodes in telecommunications, automotive, and consumer electronics, enhancing performance and miniaturization of devices.

- Additionally, rising demand for high-speed data transmission and advancements in laser diode technology, such as improved efficiency and wavelength precision, are propelling market growth across various industrial applications.

Global Two Terminal Laser Diode Market Analysis

- Two Terminal Laser Diodes, which convert electrical signals into coherent light, are critical components in a wide range of applications including telecommunications, consumer electronics, automotive, and medical devices, due to their high efficiency, compact size, and reliable performance.

- The growing demand for faster data transmission, miniaturization of electronic devices, and advancements in laser diode technology are key factors driving the increasing adoption of Two Terminal Laser Diodes across various industries.

- North America dominated the Two Terminal Laser Diode market with the largest revenue share of 34.1% in 2024, driven by rapid industrialization, expanding electronics manufacturing sectors, and increased investments in telecommunications infrastructure, with China, Japan, and South Korea being major contributors.

- Asia-Pacific is expected to witness significant growth during the forecast period, supported by strong R&D activities, increasing use of laser diodes in defense and aerospace applications, and the presence of leading technology companies advancing laser diode innovation.

- The Double Hetero Structure Lasers segment dominated the market with the largest revenue share of 28.6% in 2024, attributed to their high efficiency and widespread adoption across telecommunications and industrial applications.

Report Scope and Global Two Terminal Laser Diode Market Segmentation

|

Attributes |

Two Terminal Laser Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Global Two Terminal Laser Diode Market Trends

Performance Optimization Through AI and Advanced Control Systems

- A significant and accelerating trend in the global Two Terminal Laser Diode Market is the integration of artificial intelligence (AI) and advanced control algorithms to enhance the performance, efficiency, and reliability of laser diode systems across various industries. This synergy is transforming laser diode functionality, enabling smarter diagnostics, predictive maintenance, and adaptive performance tuning.

- For instance, AI-enhanced laser drivers in fiber optic communication systems can dynamically adjust output parameters based on data traffic conditions, optimizing power consumption and reducing latency. Similarly, in industrial manufacturing, laser systems equipped with AI-driven feedback loops can adjust beam focus or intensity in real-time to maintain precision during cutting or welding operations.

- In the medical field, AI is being utilized to calibrate laser output in dermatological and ophthalmic devices, ensuring consistent and safe treatments personalized to individual patients. Additionally, AI-enabled monitoring systems can detect early signs of component degradation in laser diodes, thereby minimizing downtime and extending product lifespan.

- The combination of AI and control systems also supports self-correcting functionalities. For example, automotive LiDAR systems that use laser diodes now incorporate AI to better interpret environmental data and dynamically adapt scanning patterns, improving object detection and navigation accuracy.

- These AI-integrated laser diode solutions are also being designed for seamless interoperability with broader digital platforms, including industrial automation systems and IoT ecosystems. This integration allows centralized monitoring and control of laser performance along with other key operational metrics, particularly in smart factories and advanced manufacturing settings.

- As industries move towards intelligent and autonomous systems, the demand for AI-optimized laser diodes is rising rapidly across sectors such as telecommunications, automotive, healthcare, and defense. Companies like Coherent, IPG Photonics, and TRUMPF are at the forefront, developing AI-powered laser modules that offer adaptive performance, real-time analytics, and seamless system integration.

Global Two Terminal Laser Diode Market Dynamics

Driver

Rising Demand for Optical Communication and Consumer Electronics

- The growing adoption of high-speed optical communication systems, coupled with increasing demand for advanced consumer electronics, is a key driver for the expanding global two-terminal laser diode market. As global data traffic surges and 5G infrastructure expands, the need for efficient and compact laser diodes in fiber-optic communication continues to grow.

- For Instance, in March 2024, Lumentum Holdings Inc. introduced a new range of high-power laser diodes designed for next-generation optical network applications, aiming to enhance bandwidth capacity while reducing power consumption. Such innovations from industry leaders are expected to boost the market during the forecast period.

- Two-terminal laser diodes, known for their compact design, energy efficiency, and high modulation speeds, are increasingly being integrated into a wide range of electronic devices including smartphones, LiDAR systems, and wearable devices. Their role in facial recognition, gesture control, and 3D sensing applications further underscores their growing relevance.

- Moreover, the accelerating adoption of automation, robotics, and industrial laser systems is driving the demand for reliable and high-performance laser diodes, particularly in the manufacturing and automotive sectors.

- The miniaturization trend in electronics and the rising preference for solid-state lighting over traditional light sources are also bolstering the use of laser diodes. The development of low-cost, high-efficiency laser diode solutions for commercial and consumer applications is expected to propel further growth in both developed and emerging markets.

Restraint/Challenge

Thermal Management and High Manufacturing Costs

- Despite their growing adoption, the two-terminal laser diode market faces significant challenges related to thermal management and production costs. Laser diodes are highly sensitive to temperature variations, which can affect performance, efficiency, and longevity. Ensuring consistent thermal performance often requires advanced cooling systems or packaging, adding complexity and cost.

- For instance, high-power laser diodes used in industrial and medical applications often require intricate heat dissipation mechanisms, which can limit their use in compact or cost-sensitive designs.

- Furthermore, the fabrication of high-performance laser diodes involves complex semiconductor manufacturing processes and precision materials, contributing to relatively high initial costs. This can be a barrier for small manufacturers or startups looking to enter the market or integrate laser diodes into lower-cost devices.

- Intellectual property barriers and the need for specialized R&D also limit the market entry of new players, thereby concentrating technological advancements within a few major companies.

- While efforts are being made to reduce production costs through improved manufacturing techniques and economies of scale, challenges persist—particularly in scaling up for mass-market applications without compromising on performance or reliability.

- Addressing these issues through advancements in thermal management technology, cost-effective packaging solutions, and increased investment in R&D will be critical to unlocking the full potential of two-terminal laser diodes across diverse application areas.

Global Two Terminal Laser Diode Market Scope

Two terminal laser diode market is segmented on the basis of type, doping material, wavelength, category, mode of operation, and industry vertical.

- By Type

On the basis of type, the laser diode market is segmented into Double Hetero Structure Lasers, Quantum Well Lasers, Quantum Cascade Lasers, Distributed Feedback Lasers, Separate Confinement Hetero Structure Laser Diodes, VCSELs, VECSELs, External Cavity Laser Diodes, Distributed Bragg Reflector Lasers, Quantum Dot Lasers, and Interband Cascade Laser Diodes. The Double Hetero Structure Lasers segment dominated the market with the largest revenue share of 28.6% in 2024, attributed to their high efficiency and widespread adoption across telecommunications and industrial applications. These lasers are favored for their stable performance and compatibility with existing manufacturing infrastructure.

The VCSEL (Vertical-Cavity Surface-Emitting Laser) segment is expected to register the fastest CAGR of 22.1% from 2025 to 2032, driven by rising demand in consumer electronics, such as facial recognition, LiDAR in autonomous vehicles, and high-speed data communication, owing to their compact size and high modulation speeds.

- By Doping Material

Based on doping material, the laser diode market is classified into InGaN, GaN, AlGaInP, GaAlAs, InGaAs, InGaAsP, GaInAsSb, and others. The AlGaInP segment held the largest market share of 26.1% in 2024, largely due to its use in producing efficient red and orange laser diodes widely applied in medical devices, barcode scanners, and optical storage. Its proven reliability and cost efficiency sustain steady demand.

the InGaN segment is projected to witness the fastest CAGR of 20.7% from 2025 to 2032, propelled by increasing utilization in blue and green laser diodes critical for applications like high-definition displays, laser projectors, and biomedical instruments, where precise wavelength control and high brightness are crucial.

- By Wavelength

The market is segmented by wavelength into Near Infrared, Red, Blue, Green, Ultra-Violet, Violet, Yellow, and others. The Near Infrared segment dominated the market in 2024, commanding a revenue share of 31.4%, owing to its extensive application in telecommunications, fiber optics, and night vision technologies. Near-infrared lasers provide deep penetration and superior transmission properties, making them versatile across sectors.

The Blue wavelength segment is expected to experience the fastest growth rate of 23.5% from 2025 to 2032, driven by rising demand in laser printing, 3D scanning, Blu-ray data storage, and advanced medical devices, where shorter wavelengths yield higher precision and efficiency.

- By Category

On the basis of category, the laser diode market is segmented into Injection Laser Diode (ILD) and Optically Pumped Semiconductor Laser (OPSL). The Injection Laser Diode (ILD) segment accounted for the largest revenue share of 68.9% in 2024, supported by its extensive use in telecommunications, data storage, and sensing applications due to its compact size, efficiency, and cost-effectiveness.

The OPSL segment is forecast to witness the fastest CAGR of 19.8% between 2025 and 2032, driven by growth in medical diagnostics, scientific research, and laser lighting applications, which require high beam quality and wavelength tunability.

- By Mode of Operation

The laser diode market is segmented by mode of operation into Continuous Wave (CW) and Pulsed modes. The Continuous Wave (CW) segment dominated the market in 2024, holding a revenue share of 62.7%, primarily due to its stable and consistent output, suitable for telecommunications, printing, and industrial manufacturing.

The Pulsed Mode segment is expected to register the fastest CAGR of 21.2% during 2025 to 2032, fueled by increasing applications in LiDAR, material processing, and medical treatments where precise, high-intensity laser pulses are required for accuracy and effectiveness.

- By Industry Vertical

On the basis of industry vertical, the laser diode market is segmented into Automotive, Defense, Medical, Consumer Electronics, Manufacturing, Data Storage, Communications, Displays, and others. The Communications segment held the largest market revenue share of 29.3% in 2024, driven by the escalating need for high-speed fiber optic networks and data center expansions globally. Laser diodes are integral to enabling fast and reliable data transmission.

The Automotive segment is projected to witness the fastest CAGR of 24.4% from 2025 to 2032, supported by increased adoption of laser-based LiDAR for autonomous vehicles, advanced driver-assistance systems (ADAS), and smart automotive lighting, demanding highly precise and efficient laser sources.

Global Two Terminal Laser Diode Market Regional Analysis

- North America dominated the global two terminal laser diode market with the largest revenue share of 34.1% in 2024, driven by the presence of advanced technology infrastructure, strong R&D activities, and high adoption of laser-based applications across telecommunications, healthcare, and automotive industries.

- Consumers and businesses in the region prioritize innovation, precision, and reliability, fueling demand for high-performance laser diodes used in fiber optic communication, medical devices, and automotive LiDAR systems.

- The widespread adoption is further supported by substantial investments in next-generation technologies, a skilled workforce, and government initiatives promoting smart manufacturing and defense applications, establishing North America as a leading hub for two terminal laser diode manufacturing and consumption.

U.S. Two Terminal Laser Diode Market Insight

The U.S. two terminal laser diode market captured the largest revenue share of 82% in 2024 within North America, driven by the rapid adoption of laser diode technology across telecommunications, healthcare, and automotive sectors. The surge in demand for high-speed data transmission, coupled with increased investment in advanced medical imaging and sensing technologies, fuels market growth. Furthermore, the country’s robust R&D ecosystem and strong presence of key laser diode manufacturers support innovation in product design and performance, propelling the market forward. The integration of laser diodes in emerging applications such as LiDAR for autonomous vehicles and industrial automation further strengthens the U.S. market position.

Europe Two Terminal Laser Diode Market Insight

The Europe two terminal laser diode market is projected to grow steadily over the forecast period, underpinned by stringent industry standards and rising demand for precision laser components in industrial and medical applications. Growth is further bolstered by government support for innovation in photonics and semiconductor technology. The market is expanding across sectors such as telecommunications, defense, and consumer electronics, with a growing emphasis on energy-efficient and miniaturized laser diode solutions. Germany, France, and the U.K. are key contributors to this growth, supported by well-established manufacturing and technological infrastructures.

U.K. Two Terminal Laser Diode Market Insight

The U.K. two terminal laser diode market is expected to witness significant growth during the forecast period, driven by increased investments in advanced photonics research and development. The rising demand for laser diodes in communication networks, healthcare diagnostics, and industrial automation is a major growth factor. Additionally, the U.K.'s focus on digital transformation and smart manufacturing practices supports the adoption of cutting-edge laser diode technologies. The country’s expanding startup ecosystem in photonics and semiconductor technology is also fueling innovation and market expansion.

Germany Two Terminal Laser Diode Market Insight

The Germany two terminal laser diode market is anticipated to grow at a considerable CAGR, propelled by strong industrial demand for laser diodes in manufacturing, automotive, and medical devices. Germany’s focus on Industry 4.0 and sustainable manufacturing solutions encourages the integration of advanced laser diode systems for automation and quality control. Moreover, investments in semiconductor research and the presence of leading technology companies create a conducive environment for market growth. Emphasis on eco-friendly and high-performance laser diodes aligns with local consumer and industrial preferences.

Asia-Pacific Two Terminal Laser Diode Market Insight

The Asia-Pacific two terminal laser diode market is poised to register the fastest CAGR of 25% from 2025 to 2032, driven by rapid industrialization, growing telecom infrastructure, and technological advancements in China, Japan, South Korea, and India. The region benefits from increased manufacturing capabilities and government initiatives promoting semiconductor and photonics industries. Rising demand for laser diodes in consumer electronics, automotive LiDAR, medical equipment, and data storage fuels market expansion. Additionally, the increasing adoption of laser diode technology in emerging markets due to cost-effective production and improved accessibility supports robust growth.

Japan Two Terminal Laser Diode Market Insight

Japan’s two terminal laser diode market is growing steadily due to its advanced technology ecosystem, strong focus on innovation, and robust semiconductor industry. The demand for laser diodes in high-precision manufacturing, healthcare diagnostics, and communication networks drives market expansion. Japan’s aging population also contributes to increased use of medical devices utilizing laser diode technology. Moreover, government-led initiatives to enhance IoT and smart infrastructure adoption further propel market growth by fostering integration of laser diodes in connected devices and systems.

China Two Terminal Laser Diode Market Insight

China held the largest revenue share in the Asia-Pacific two terminal laser diode market in 2024, propelled by the country's expanding electronics manufacturing sector, large consumer base, and substantial investments in telecom and industrial automation. The government's strong push towards semiconductor self-reliance, coupled with rapid urbanization and rising disposable incomes, accelerates the adoption of laser diode technologies. China's focus on smart city projects, electric vehicles, and 5G infrastructure significantly drives demand. Additionally, domestic manufacturers are rapidly enhancing their capabilities, contributing to the affordability and widespread use of laser diode components in various applications.

Global Two Terminal Laser Diode Market Share

The Two Terminal Laser Diode industry is primarily led by well-established companies, including:

- OSRAM Opto Semiconductors GmbH (Germany)

- Nuvoton Technology Corporation Japan (Japan)

- ROHM CO., LTD. (Japan)

- IPG Photonics Corporation (U.S.)

- SHARP CORPORATION (Japan)

- Coherent, Inc. (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- JENOPTIK AG (Germany)

- Newport Corporation (U.S.)

- Finisar Corporation (U.S.)

- TRUMPF (Germany)

- NICHIA CORPORATION (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Sony Semiconductor Solutions Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Broadcom (U.S.)

- SPI LASERS LIMITED (UK)

- Schneider Electric (France)

- Edmund Optics Inc. (U.S.)

What are the Recent Developments in Global Two Terminal Laser Diode Market?

- In April 2023, Osram Opto Semiconductors, a global leader in optoelectronics, announced the launch of its next-generation high-power two terminal laser diode series designed for industrial and medical applications. This initiative highlights the company’s focus on enhancing performance and reliability through advanced semiconductor technology. By leveraging innovative materials and precision manufacturing, Osram aims to address evolving market demands for efficient, compact, and durable laser diode solutions, reinforcing its competitive position in the global market.

- In March 2023, Lumentum Holdings Inc., a leading provider of optical and photonic products, unveiled a new line of quantum well two terminal laser diodes optimized for telecom and data center applications. These lasers offer improved modulation speeds and energy efficiency, catering to the increasing bandwidth requirements of next-generation communication networks. This development underscores Lumentum’s commitment to advancing laser diode technology to meet the needs of high-performance, scalable optical systems worldwide.

- In March 2023, II-VI Incorporated successfully expanded its production capabilities for distributed feedback (DFB) laser diodes at its new manufacturing facility in Asia. The move aims to support growing demand across telecommunications, sensing, and industrial sectors. II-VI’s investment in cutting-edge fabrication processes and quality control enhances its ability to supply high-precision laser diodes, reflecting its strategic focus on strengthening market presence in the Asia-Pacific region.

- In February 2023, Nichia Corporation, a prominent developer of semiconductor lasers, announced a strategic collaboration with a leading automotive supplier to integrate vertical-cavity surface-emitting lasers (VCSELs) into next-generation LiDAR systems for autonomous vehicles. This partnership targets the rapid growth of automotive applications requiring reliable, compact, and high-performance laser diodes. The initiative highlights Nichia’s dedication to innovation and expanding its footprint in emerging laser diode markets.

- In January 2023, Finisar Corporation, a key player in optical communication components, introduced a new external cavity laser diode model designed to enhance tunability and coherence for advanced data storage and telecom applications. The product launch at a major industry conference demonstrated Finisar’s focus on delivering versatile laser diode solutions that enable higher data transfer rates and improved system integration, strengthening its position in the competitive global market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Laser Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Laser Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Laser Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.