Global Two Terminal Photo Cell Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

3.83 Billion

2024

2032

USD

2.20 Billion

USD

3.83 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 3.83 Billion | |

|

|

|

|

Two Terminal Photo Cell Market Size

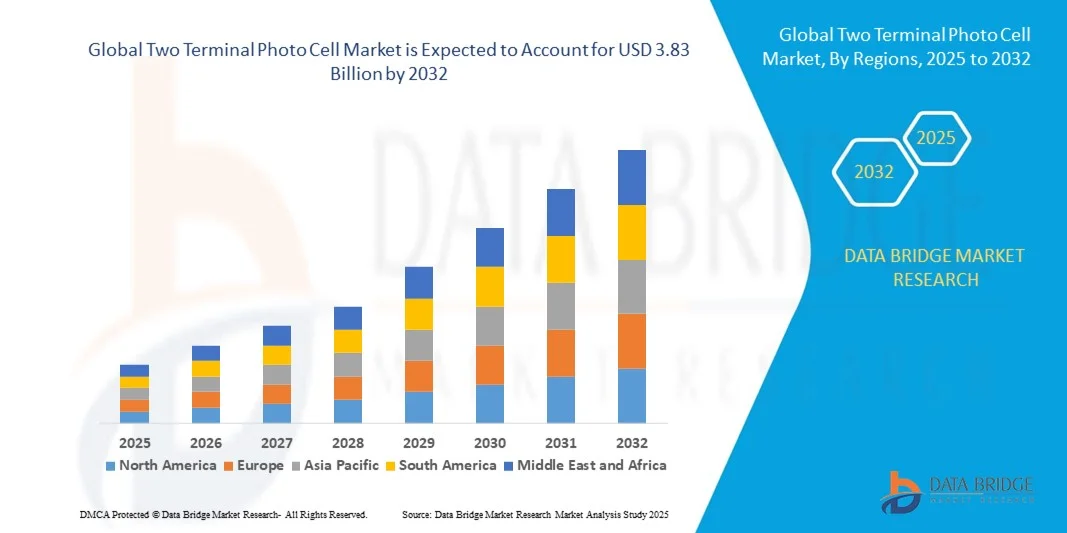

- The global two terminal photo cell market size was valued at USD 2.20 billion in 2024 and is expected to reach USD 3.83 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation technologies and energy-efficient systems across residential, commercial, and industrial sectors, driving the demand for reliable and precise light-sensing devices

- Furthermore, rising emphasis on smart lighting, automatic doors, safety systems, and industrial automation is creating a strong need for two terminal photocells. These converging trends are accelerating the uptake of photocell solutions, thereby significantly boosting market expansion

Two Terminal Photo Cell Market Analysis

- Two terminal photocells are light-sensitive electronic devices that convert light intensity into electrical signals, enabling applications such as automatic lighting control, safety switches, smoke alarms, and industrial automation. They are widely integrated into building management, industrial, and smart home systems to enhance efficiency and safety

- The escalating demand for two terminal photocells is primarily driven by the global push for energy-efficient solutions, growing industrial automation, and the rising trend of smart infrastructure, coupled with increasing consumer and commercial preference for automated and reliable light-sensitive control systems

- North America dominated the two terminal photo cell market with a share of 40.5% in 2024, due to increasing adoption of automated lighting systems, industrial controls, and smart home devices

- Asia-Pacific is expected to be the fastest growing region in the two terminal photo cell market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing industrial automation in countries such as China, Japan, and India

- Ordinary photocell segment dominated the market with a market share of 62.5% in 2024, due to its widespread use in traditional lighting and control systems. Its established performance, reliability, and cost-effectiveness make it a preferred choice for large-scale installations and legacy systems. Ordinary photocells are also compatible with various voltage ranges and environmental conditions, further enhancing their adoption across industrial, commercial, and residential applications. The segment’s broad availability and proven track record continue to reinforce its market leadership

Report Scope and Two Terminal Photo Cell Market Segmentation

|

Attributes |

Two Terminal Photo Cell Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Two Terminal Photo Cell Market Trends

Integration of Photocells in Smart Lighting and Automation

- The two terminal photo cell market is witnessing considerable growth driven by the expanding integration of photocells into smart lighting control systems and automated building environments. These light-sensitive devices are increasingly being utilized to enhance energy efficiency, automate lighting operations, and reduce electricity consumption across residential, commercial, and industrial applications

- For instance, Signify (Philips Lighting) and Eaton Corporation have incorporated photocell sensors into their connected lighting systems, enabling automatic brightness adjustment based on ambient conditions. Similarly, Legrand and Lutron Electronics are integrating photocells into building automation platforms to optimize lighting performance through daylight sensing and occupancy-based control

- The rise of smart cities and intelligent infrastructure initiatives is further supporting the adoption of photocells in public lighting systems, where they enable dusk-to-dawn operation and energy savings. Municipalities are increasingly deploying photo-controlled street lighting networks that respond dynamically to environmental conditions, thereby minimizing unnecessary energy usage and maintenance costs

- In addition, the combination of photocells with IoT-enabled controllers and wireless communication protocols allows centralized monitoring of multiple lighting zones. This integration enhances functionality by enabling predictive maintenance, real-time data insights, and adaptive illumination control—all critical for next-generation smart lighting ecosystems

- Two terminal photocells, known for their reliability, compact design, and low power requirements, are preferred in various end-use sectors including home automation, retail lighting, and solar energy systems. They provide a cost-effective way to implement automatic lighting control without extensive wiring or software integrations, making them suitable for both retrofits and new installations

- As smart lighting and automation technologies continue to evolve, photocells will play an indispensable role in optimizing energy efficiency and ensuring sustainable lighting solutions. The growing intersection between sensor innovation and intelligent infrastructure is expected to drive sustained market expansion in the coming years

Two Terminal Photo Cell Market Dynamics

Driver

Rising Demand for Energy-Efficient, Automated Solutions

- The growing focus on energy efficiency and automation across industrial and commercial sectors is a key driver for the two terminal photo cell market. Organizations are adopting light-sensitive control components to minimize energy waste and streamline operations through automatic adjustment of lighting intensity based on environmental conditions

- For instance, General Electric (GE) and Autonics Corporation supply photocells for integration into automated lighting systems that reduce operational costs by adjusting illumination levels to real-time daylight availability. These systems provide measurable energy savings and contribute to compliance with green building certifications such as LEED and BREEAM

- The increasing popularity of smart homes and smart workplaces has also strengthened demand for photo-based sensors embedded in lighting fixtures. They enhance user convenience through hands-free operation and align with sustainability targets by ensuring optimal energy consumption without manual intervention

- In addition, industrial facilities and warehouses are adopting photocells as part of sensor networks for process automation. Light-sensitive switches help regulate illumination and trigger automated responses in production or storage environments, improving safety and productivity while reducing electrical load

- As governments and corporations continue to pursue energy efficiency goals and carbon reduction commitments, photocell-equipped automation systems are gaining prominence. The scalability, durability, and operational stability of two terminal photocells will keep driving their use in both retrofitted and newly constructed energy-efficient infrastructure

Restraint/Challenge

High Initial Costs and Legacy System Compatibility

- Despite their growing adoption, high installation costs and challenges in integrating photocells with legacy systems remain significant market restraints. Advanced smart lighting systems incorporating photocells and IoT-based controllers require upgraded infrastructure, which adds to the upfront investment for businesses and municipalities

- For instance, retrofitting older lighting frameworks with modern photo-based automation components often demands rewiring, fixture modification, or additional network hardware, leading to higher implementation costs. This poses limitations for small and medium-sized enterprises and public projects operating under tight budgets

- Legacy systems that rely on manual or time-based lighting control also face compatibility issues when integrating smart photocell modules. Differences in voltage ratings, communication protocols, and sensor calibration standards often require specialized converters or controllers, increasing overall system complexity

- In addition, the cost of high-quality, weather-resistant photocells with optical filters and extended lifespan is relatively high, particularly for large-scale outdoor lighting applications. Maintenance in harsh conditions—such as high humidity or pollution—can further add to operational expenditure over time

- While rapid advancements in sensor miniaturization, modular lighting controllers, and cloud-based automation platforms are gradually lowering integration barriers, initial cost and system compatibility challenges still hinder broader adoption. Continued innovation in plug-and-play and interoperable photocell solutions will be essential to ensure seamless and cost-effective implementation across diverse lighting infrastructures

Two Terminal Photo Cell Market Scope

The market is segmented on the basis of product, material, type, and application.

- By Product

On the basis of product, the two terminal photocell market is segmented into ordinary photocell and miniature photocell. The ordinary photocell segment dominated the largest market revenue share of 62.5% in 2024, driven by its widespread use in traditional lighting and control systems. Its established performance, reliability, and cost-effectiveness make it a preferred choice for large-scale installations and legacy systems. Ordinary photocells are also compatible with various voltage ranges and environmental conditions, further enhancing their adoption across industrial, commercial, and residential applications. The segment’s broad availability and proven track record continue to reinforce its market leadership.

The miniature photocell segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand in compact electronic devices and smart systems. Its small form factor enables integration into modern gadgets, portable sensors, and automation devices. In addition, advancements in fabrication technology have improved the sensitivity and efficiency of miniature photocells, making them attractive for precision applications and energy-efficient designs. Growing interest in miniaturized IoT and smart home devices further accelerates the adoption of miniature photocells.

- By Material

On the basis of material, the market is segmented into crystalline silicon, amorphous silicon, polysilicon, and others. The crystalline silicon segment held the largest market revenue share in 2024 due to its superior efficiency, long lifespan, and robust performance in various lighting and sensing conditions. Its high photoconductivity and stability make it a reliable choice for industrial and commercial installations requiring consistent output. Crystalline silicon photocells also benefit from mature manufacturing processes and established supply chains, ensuring broad availability and cost efficiency.

The amorphous silicon segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its flexibility, lightweight structure, and suitability for thin-film applications. It allows easy integration into curved surfaces and portable devices, expanding its use in emerging electronic and automation technologies. Energy-efficient and low-cost production methods make amorphous silicon photocells particularly attractive for next-generation applications, including smart lighting, IoT devices, and wearable sensors.

- By Type

On the basis of type, the two terminal photocell market is segmented into photovoltaic, charge-coupled devices (CCD), photoresistor, Golay cell, photomultiplier, photo conductive cell, and photo emissive cell. The photoresistor segment dominated the largest market revenue share in 2024 due to its simple design, high sensitivity to ambient light, and ease of integration into lighting control systems. Its widespread use in street lighting, automatic lamps, and industrial automation systems ensures consistent demand. Photoresistors are also cost-effective and compatible with a wide voltage range, making them ideal for large-scale applications.

The photovoltaic segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing adoption in energy-harvesting applications and solar-powered automation devices. Photovoltaic cells efficiently convert light into electrical energy, enabling self-powered systems in remote and smart locations. Increasing focus on sustainable and energy-efficient technologies further drives the demand for photovoltaic photocells in emerging residential, commercial, and industrial sectors.

- By Application

On the basis of application, the market is segmented into automatic lights, automatic doors, aviation, meteorology, burglar alarms, smoke alarms, safety switches, light meters, and others. The automatic lights segment dominated the largest market revenue share in 2024 due to the rising global adoption of energy-efficient lighting solutions and automated lighting systems in residential and commercial spaces. Photocells used in automatic lights provide reliable light detection, ensuring optimal illumination while reducing energy consumption. Their compatibility with smart lighting ecosystems further reinforces their dominance in the market.

The automatic doors segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by expanding commercial infrastructure, airports, hospitals, and retail spaces. Photocells integrated into automatic doors ensure smooth operation, enhance safety, and reduce manual intervention. Rising focus on convenience, security, and efficiency in public and private buildings further accelerates the adoption of photocells in automatic door applications.

Two Terminal Photo Cell Market Regional Analysis

- North America dominated the two terminal photo cell market with the largest revenue share of 40.5% in 2024, driven by increasing adoption of automated lighting systems, industrial controls, and smart home devices

- Consumers in the region prioritize energy efficiency, reliability, and precise light-sensing capabilities offered by advanced photocells

- The widespread adoption is further supported by high disposable incomes, technological awareness, and the presence of well-established manufacturers and suppliers, making North America a key market for residential, commercial, and industrial applications

U.S. Two Terminal Photocell Market Insight

The U.S. two terminal photocell market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of automation technologies and smart building solutions. Rising demand for energy-efficient lighting systems, automatic doors, and safety devices is encouraging the integration of photocells across residential and commercial properties. Furthermore, the growing preference for IoT-enabled automation, along with government incentives for energy-saving technologies, is significantly driving market growth.

Europe Two Terminal Photocell Market Insight

The Europe two terminal photocell market is projected to expand at a substantial CAGR during the forecast period, supported by stringent energy efficiency standards and rising adoption of automation in commercial and residential buildings. Consumers and businesses in the region are increasingly adopting photocell-based solutions for automatic lighting, security systems, and industrial automation. The demand is further strengthened by urbanization, modernization of infrastructure, and growing awareness regarding energy conservation.

U.K. Two Terminal Photocell Market Insight

The U.K. two terminal photocell market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of smart and energy-efficient buildings. Increasing concerns over safety and automation in commercial and residential properties are encouraging adoption. In addition, the robust presence of technology integrators and the growing e-commerce infrastructure for smart devices are expected to continue supporting market growth in the country.

Germany Two Terminal Photocell Market Insight

The Germany two terminal photocell market is expected to expand at a considerable CAGR during the forecast period, fueled by high adoption of industrial automation, smart infrastructure projects, and energy-efficient technologies. Germany’s emphasis on sustainability, innovation, and automation promotes the use of photocells in lighting systems, security applications, and safety equipment. Integration of photocells with advanced building management systems is increasingly prevalent, aligning with local consumer and industrial expectations.

Asia-Pacific Two Terminal Photocell Market Insight

The Asia-Pacific two terminal photocell market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing industrial automation in countries such as China, Japan, and India. Government initiatives promoting smart buildings, energy-efficient infrastructure, and IoT adoption are accelerating the uptake of photocell solutions. In addition, APAC’s role as a manufacturing hub for photocell components ensures affordability and accessibility, expanding the market to a broader consumer base.

Japan Two Terminal Photocell Market Insight

The Japan two terminal photocell market is growing steadily due to the country’s technological advancement, high adoption of smart devices, and emphasis on automation. Rising demand for energy-efficient lighting, automatic doors, and security applications is driving market adoption. The integration of photocells with smart home and industrial IoT solutions, combined with an aging population requiring convenient automation systems, is further supporting growth in residential and commercial sectors.

China Two Terminal Photocell Market Insight

The China two terminal photocell market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding industrial and commercial infrastructure, and high technology adoption rates. Growing demand for smart lighting systems, automatic doors, and industrial safety equipment is boosting market growth. Government support for smart city initiatives, availability of cost-effective photocell solutions, and strong domestic manufacturing capabilities are key factors propelling the market in China.

Two Terminal Photo Cell Market Share

The two terminal photo cell industry is primarily led by well-established companies, including:

- Longjoin Electronics Co., Ltd. (China)

- SICK AG (Germany)

- Unitech Combustion (India)

- TDC Power Products Co., Ltd. (Taiwan)

- ABB (Switzerland)

- Walnut Innovations (India)

- Pepperl+Fuchs (India) Pvt. Ltd. (India)

- Autonics Corporation (South Korea)

- Banner Engineering Corp. (U.S.)

- OMRON Corporation (Japan)

- Cooper Industries, Inc. (Ireland)

- Westire Technology Ltd (Australia)

- Lucy Group Ltd. (U.K.)

- Futuristic Climate Controls (India)

- AZoNetwork (U.K.)

- Sicube Photonics Co., Limited (China)

- Rockwell Automation, Inc. (U.S.)

- by Cortem (Italy)

- Alstom (France)

- BASF SE (Germany)

Latest Developments in Global Two Terminal Photo Cell Market

- In July 2025, Lucy Zodion launched the HAWK3, a next-generation digital photocell, at the ILP Lighting Live event in Glasgow. This product introduces a highly sustainable and user-friendly solution for street lighting control, featuring advanced switching capabilities, improved asset management, and enhanced energy efficiency. Its innovative design is aimed at smart cities and municipal lighting applications, setting new benchmarks for reliability, performance, and environmental responsibility. The launch is expected to accelerate adoption of intelligent lighting systems and influence competitors to innovate, thereby strengthening the overall market

- In June 2025, the HAWK3 photocell received the Build Back Better GREEN Award for its exceptional environmental performance and design innovation. This recognition highlights the growing emphasis on sustainability in the market and positions Lucy Zodion as a leader in energy-efficient photocell solutions. The award is expected to boost confidence among municipal and commercial buyers, encouraging wider adoption of eco-friendly, high-performance photocells in both existing and new infrastructure projects

- In July 2025, Schneider Electric acquired the remaining 35% stake in its Indian subsidiary from Temasek for €5.5 billion ($6.4 billion), gaining full ownership. This strategic move strengthens Schneider Electric’s presence in India, one of its fastest-growing markets, and enhances operational efficiency and decision-making. By expanding its local footprint, Schneider Electric is better positioned to deliver advanced automation solutions, including photocells, for industrial, commercial, and smart city applications. The acquisition is likely to intensify competition and stimulate product innovation within the regional market

- In February 2021, SICK AG introduced the W4F, a miniature photoelectric sensor designed to reliably detect challenging objects, including jet black, highly reflective, flat, or transparent surfaces. The sensor also provides precise distance measurement, helping identify process errors in automated systems. This development significantly improves operational accuracy and reliability in manufacturing, logistics, and other industrial sectors, driving demand for miniature, high-precision photocells in modern automation applications

- In August 2020, Schneider Electric completed the acquisition of the Electrical and Automation business of Larsen & Toubro (L&T) in India. This acquisition expanded Schneider Electric’s capabilities in industrial automation, enabling it to integrate L&T’s technologies and manufacturing expertise into its product portfolio. The move strengthens its market position and accelerates innovation, particularly for photocell-based automation solutions used in industrial, commercial, and smart infrastructure projects, further driving market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Photo Cell Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Photo Cell Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Photo Cell Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.