Global Two Terminal Pin Diode Market

Market Size in USD Billion

CAGR :

%

USD

2.70 Billion

USD

3.58 Billion

2024

2032

USD

2.70 Billion

USD

3.58 Billion

2024

2032

| 2025 –2032 | |

| USD 2.70 Billion | |

| USD 3.58 Billion | |

|

|

|

|

Two Terminal PIN Diode Market Size

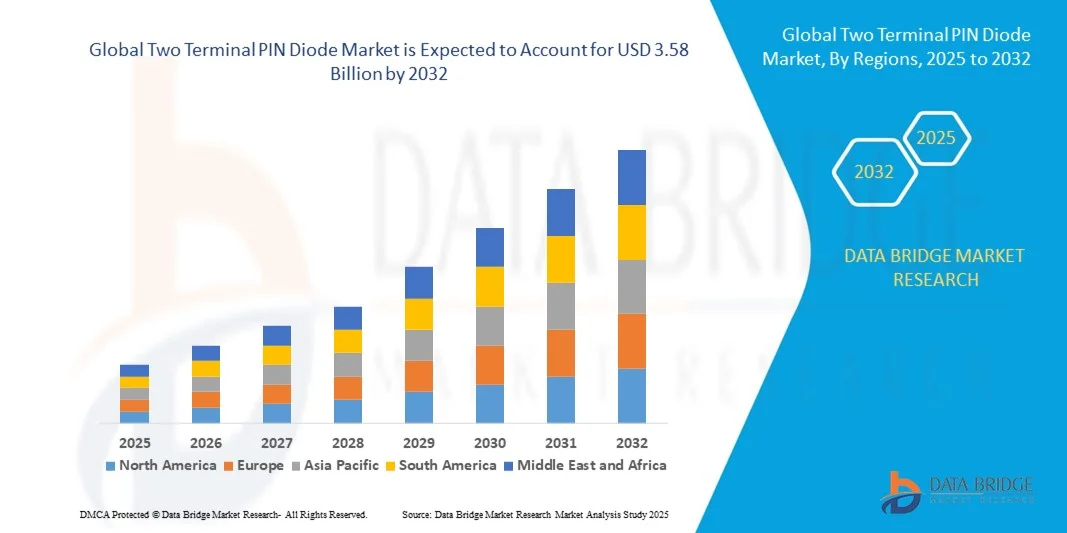

- The global two terminal PIN diode market size was valued at USD 2.7 billion in 2024 and is expected to reach USD 3.58 billion by 2032, at a CAGR of 3.60% during the forecast period

- The market growth is largely fuelled by the rising demand for high-speed communication systems, radar technologies, and advanced electronic switching applications

- In addition, the increasing integration of PIN diodes in 5G infrastructure, satellite communication, and optoelectronic devices is expected to further accelerate market growth over the forecast period

Two Terminal PIN Diode Market Analysis

- The growing adoption of two terminal PIN diodes in RF, microwave, and photodetector applications is driving market expansion, supported by ongoing advancements in semiconductor technologies.

- Increasing usage across defense, telecommunication, and consumer electronics sectors is enhancing product demand, as manufacturers focus on improving performance efficiency, low noise, and high-frequency response

- North America dominated the two terminal PIN diode market with the largest revenue share in 2024, driven by the growing demand for high-frequency communication, radar systems, and defense electronics

- Asia-Pacific region is expected to witness the highest growth rate in the global two terminal PIN diode market, driven by rapid urbanization, rising electronics manufacturing, expansion of 5G networks, and increased adoption of advanced radar and photonics applications

- The RF PIN Diode segment held the largest market revenue share in 2024, driven by its extensive use in high-frequency communication, radar systems, and RF switching applications. RF PIN diodes are preferred for their fast switching capabilities, high isolation, and low insertion loss, making them critical components in modern wireless and defense technologies

Report Scope and Two Terminal PIN Diode Market Segmentation

|

Attributes |

Two Terminal PIN Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Two Terminal PIN Diode Market Trends

Increasing Integration of PIN Diodes in 5G and High-Frequency Applications

- The growing deployment of 5G networks is significantly influencing the demand for two terminal PIN diodes, as they play a critical role in high-frequency switching, attenuation, and modulation applications. Their ability to operate efficiently at microwave and millimeter-wave frequencies makes them essential in 5G base stations and communication systems

- The expanding use of high-frequency electronic devices across telecommunications, defense, and automotive sectors is propelling market growth. PIN diodes are increasingly preferred for their fast response time, low distortion, and superior power handling capabilities, meeting the evolving needs of next-generation wireless communication systems

- The miniaturization trend in consumer electronics is encouraging manufacturers to develop compact, energy-efficient PIN diodes compatible with integrated circuit designs. This is enhancing their usage in RF front-end modules and radar systems

- For instance, in 2024, several RF component manufacturers introduced advanced PIN diode switches optimized for 28 GHz and 39 GHz 5G bands, improving data transmission speed and network reliability. Such innovations are reshaping the communication infrastructure and expanding the diode application spectrum

- While the integration of PIN diodes in 5G systems offers strong market potential, continuous R&D in materials and manufacturing techniques is crucial to meet performance, cost, and reliability requirements. Companies investing in advanced fabrication technologies and high-frequency designs are likely to lead the next phase of industry growth

Two Terminal PIN Diode Market Dynamics

Driver

Rising Demand for High-Speed Communication and Radar Systems

- The growing adoption of 5G technology and next-generation radar systems in defense and telecommunications is driving demand for high-performance PIN diodes. Their high switching speed, low capacitance, and wide frequency range make them ideal for RF, microwave, and photonic circuits. With global 5G rollout accelerating, PIN diodes are becoming indispensable for achieving reliable, low-latency data transmission in high-frequency environments

- The increasing focus on improving signal integrity and bandwidth efficiency across wireless communication networks is pushing manufacturers to incorporate PIN diodes in amplifiers, limiters, and modulators. These components enable faster data handling and reduce signal distortion, supporting the demand for ultra-reliable communication infrastructure in both civilian and defense sectors

- Rapid advancements in automotive radar and satellite communication systems are creating new opportunities for PIN diode manufacturers. These components are essential for enhancing radar accuracy, object detection, and range performance, while maintaining energy efficiency in vehicles and aerospace systems

- For instance, in 2023, leading semiconductor companies expanded their RF component portfolios to include PIN diodes optimized for automotive ADAS and defense radar applications, strengthening their presence in high-frequency domains. Such innovations are also improving system miniaturization, making next-gen radar and telecommunication devices more compact and powerful

- The expanding use of radar and communication equipment across commercial and military sectors will continue to stimulate market demand, supported by ongoing infrastructure investments and technology upgrades. This trend aligns with the global push for digital transformation, smart mobility, and enhanced security systems, further reinforcing market growth

Restraint/Challenge

High Manufacturing Cost and Design Complexity of High-Frequency PIN Diodes

- The fabrication of high-frequency PIN diodes involves advanced semiconductor materials such as silicon, GaAs, and InP, along with precision photolithography and doping techniques. These processes significantly increase production costs, making large-scale manufacturing economically challenging for smaller companies. This cost barrier limits product diversification and hinders penetration in cost-sensitive markets such as consumer electronics

- The design complexity associated with maintaining performance stability at very high frequencies poses challenges for engineers, often requiring extensive simulation, validation, and prototyping. Even minor deviations in material uniformity or junction design can affect diode performance, forcing manufacturers to adopt costly quality assurance and testing procedures

- Limited availability of skilled professionals and specialized fabrication facilities further restricts scalability, particularly in emerging markets with underdeveloped semiconductor ecosystems. The lack of infrastructure and technical expertise delays innovation and limits the establishment of local manufacturing hubs

- For instance, in 2023, several small and medium-scale RF component producers reported delays in product launches due to the high cost of gallium arsenide (GaAs) wafers and testing equipment used in high-frequency PIN diode production. These delays have also disrupted supply chains and extended lead times for major clients in telecommunications and defense

- To overcome these challenges, manufacturers must invest in cost-efficient fabrication technologies such as MEMS-based integration and wafer-level packaging. In addition, partnerships with research institutes and semiconductor foundries can help accelerate innovation, enhance yield rates, and ensure long-term competitiveness in the global two terminal PIN diode market

Two Terminal PIN Diode Market Scope

The market is segmented on the basis of product type, mounting type, diode configuration, and application.

- By Product Type

On the basis of product type, the two terminal PIN diode market is segmented into PIN Photodiode, RF PIN Diode, PIN Switch Diode, and Others. The RF PIN Diode segment held the largest market revenue share in 2024, driven by its extensive use in high-frequency communication, radar systems, and RF switching applications. RF PIN diodes are preferred for their fast switching capabilities, high isolation, and low insertion loss, making them critical components in modern wireless and defense technologies.

The PIN Photodiode segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in optical communication, medical devices, and photonic applications. PIN photodiodes are valued for their high-speed response, sensitivity, and reliability in detecting light signals, which makes them ideal for fiber-optic communication systems and advanced imaging technologies.

- By Mounting Type

On the basis of mounting type, the market is segmented into Surface Mount and Through Hole. The Surface Mount segment held the largest market revenue share in 2024, attributed to its compact design, ease of integration with printed circuit boards, and suitability for high-frequency applications. Surface mount diodes also enable efficient mass production, reducing assembly time and cost for electronic manufacturers.

The Through Hole segment is expected to witness the fastest growth from 2025 to 2032, driven by its enhanced durability, high thermal stability, and reliability in high-power and rugged electronic applications. These diodes are particularly preferred in industrial, aerospace, and defense systems where robust performance is critical.

- By Diode Configuration

On the basis of diode configuration, the market is segmented into Common Cathode and Common Anode. The Common Cathode segment held the largest market revenue share in 2024, owing to its wide compatibility with electronic circuits and efficient performance in RF, microwave, and photonic applications. It is widely adopted in high-speed switching and signal processing equipment.

The Common Anode segment is expected to witness the fastest growth from 2025 to 2032, fueled by the demand for flexible circuit integration and improved current handling capabilities in specialized applications. This configuration is particularly advantageous for customized electronic designs and industrial automation systems.

- By Application

On the basis of application, the market is segmented into Attenuator, High Voltage Rectifier, RF Switch, RF Limiter, Photo Detector and Photovoltaic Cell, and Industrial Applications. The RF Switch segment held the largest market revenue share in 2024, driven by its extensive use in communication infrastructure, radar systems, and aerospace technologies requiring fast switching and high reliability.

The Photo Detector and Photovoltaic Cell segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising adoption in optical communication networks, solar energy harvesting systems, and medical imaging devices. The increasing demand for high-precision, high-speed photonic components is significantly contributing to this growth.

Two Terminal PIN Diode Market Regional Analysis

North America dominated the two terminal PIN diode market with the largest revenue share in 2024, driven by the growing demand for high-frequency communication, radar systems, and defense electronics

The region’s focus on advanced semiconductor technologies, coupled with strong R&D capabilities and robust manufacturing infrastructure, is supporting widespread adoption of PIN diodes across commercial, military, and industrial applications

High investments in 5G, satellite communications, and automotive radar solutions are further fueling market growth, establishing North America as a key hub for PIN diode innovation and deployment

U.S. Two Terminal PIN Diode Market Insight

The U.S. two terminal PIN diode market captured the largest revenue share in 2024 within North America, fueled by increasing investments in 5G networks, defense electronics, and wireless communication systems. PIN diodes are increasingly integrated into RF switches, limiters, and high-speed photonic applications. The adoption of advanced semiconductor materials, combined with strong engineering expertise and domestic manufacturing capabilities, further propels market expansion. Moreover, government and private sector initiatives to upgrade communication and radar infrastructure are significantly contributing to the market’s growth.

Europe Two Terminal PIN Diode Market Insight

The Europe two terminal PIN diode market is expected to witness the fastest growth from 2025 to 2032, primarily driven by rising adoption of radar and high-frequency communication systems in automotive and aerospace applications. Increasing investments in smart transportation, defense modernization, and 5G network deployment are fostering the use of PIN diodes across multiple sectors. European manufacturers are also focusing on high-performance and energy-efficient diode solutions, supporting the region’s transition toward advanced electronics and communication technologies.

U.K. Two Terminal PIN Diode Market Insight

The U.K. two terminal PIN diode market is expected to witness rapid growth from 2025 to 2032, driven by the rising demand for next-generation radar systems, telecom infrastructure upgrades, and defense electronics. Increased focus on research and development for RF and microwave applications is encouraging PIN diode adoption. Furthermore, the U.K.’s growing aerospace and automotive electronics sectors, combined with strong support for high-frequency communication projects, is expected to boost market demand significantly.

Germany Two Terminal PIN Diode Market Insight

The Germany two terminal PIN diode market is projected to witness the fastest growth rate from 2025 to 2032, fueled by investments in advanced radar systems, industrial automation, and high-speed communication networks. Germany’s emphasis on technological innovation, semiconductor research, and eco-friendly manufacturing practices promotes the adoption of PIN diodes in both commercial and defense applications. The integration of PIN diodes in automotive radar, 5G infrastructure, and satellite communication systems is also expanding rapidly, reflecting the region’s commitment to high-tech electronics solutions.

Asia-Pacific Two Terminal PIN Diode Market Insight

The Asia-Pacific two terminal PIN diode market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrialization, expanding 5G infrastructure, and rapid technological advancements in countries such as China, Japan, and South Korea. The region’s growing electronics manufacturing sector and strong government initiatives supporting defense and telecom industries are fueling the adoption of PIN diodes. Moreover, the affordability of locally produced components and the availability of skilled engineering talent are further boosting market penetration across residential, commercial, and industrial applications.

Japan Two Terminal PIN Diode Market Insight

The Japan two terminal PIN diode market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced electronics manufacturing capabilities, increasing radar and communication infrastructure, and high demand for automotive and industrial applications. Japanese manufacturers are focusing on high-speed, high-reliability PIN diodes for use in photonic devices, RF switches, and satellite communications. The integration of PIN diodes with emerging technologies in defense, telecommunications, and automotive electronics is significantly driving market expansion.

China Two Terminal PIN Diode Market Insight

The China two terminal PIN diode market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, massive telecom network expansion, and strong electronics manufacturing capabilities. China stands as a major hub for PIN diode production, serving domestic and international demand for high-frequency communication, radar, and photonic applications. The government’s focus on 5G deployment, smart transportation, and defense modernization, coupled with the availability of cost-effective components, is fueling widespread adoption and market growth in China.

Two Terminal PIN Diode Market Share

The Two Terminal PIN Diode industry is primarily led by well-established companies, including:

- M/A-COM Technology Solutions Inc. (U.S.)

- Albis Optoelectronics AG (Germany)

- Cobham Limited (U.K.)

- Semiconductor Components Industries, LLC (U.S.)

- GeneSiC Semiconductor Inc. (U.S.)

- Infineon Technologies AG (Germany)

- LASER COMPONENTS (Germany)

- LITEC CORPORATION (Japan)

- MCC (U.S.)

- Microsemi (U.S.)

- NXP Semiconductors (Netherlands)

- Qorvo, Inc (U.S.)

- Renesas Electronics Corporation (Japan)

- ROHM CO., LTD. (Japan)

- Skyworks Solutions, Inc. (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- VISHAY INTERTECHNOLOGY, INC. (U.S.)

- Avago Technologies (U.S.)

- Kexin (China)

- LESHAN RADIO COMPANY, LTD (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Pin Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Pin Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Pin Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.