Global Two Terminal Schottky Diode Market

Market Size in USD Billion

CAGR :

%

USD

3.09 Billion

USD

3.76 Billion

2024

2032

USD

3.09 Billion

USD

3.76 Billion

2024

2032

| 2025 –2032 | |

| USD 3.09 Billion | |

| USD 3.76 Billion | |

|

|

|

|

Two Terminal Schottky Diode Market Size

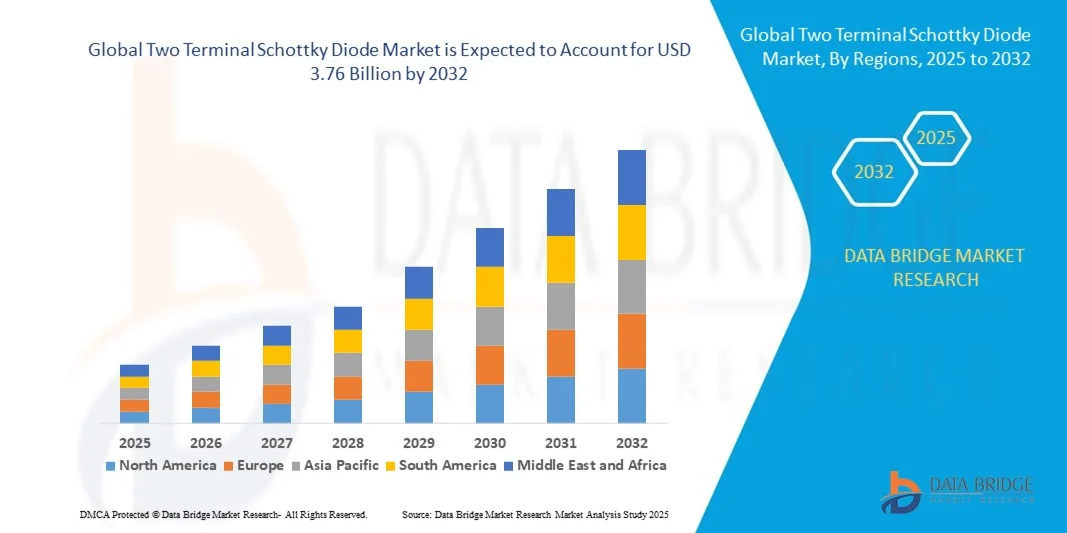

- The global two terminal schottky diode market size was valued at USD 3.09 billion in 2024 and is expected to reach USD 3.76 billion by 2032, at a CAGR of 2.50% during the forecast period

- The market growth is largely fuelled by increasing adoption of high-speed switching devices, rising demand in power electronics, and growing applications in automotive, consumer electronics, and telecommunication sectors

- The expanding use of energy-efficient devices and growing investments in renewable energy systems are also supporting the market growth

Two Terminal Schottky Diode Market Analysis

- The two terminal Schottky diode market is witnessing significant growth due to its high efficiency, low forward voltage drop, and fast switching capabilities, making it suitable for rectifiers, power management, and RF applications

- Increasing integration of Schottky diodes in electric vehicles, solar inverters, and industrial power supplies is further boosting market demand

- North America dominated the two terminal Schottky diode market with the largest revenue share in 2024, driven by a strong electronics manufacturing base, advanced semiconductor infrastructure, and widespread adoption of energy-efficient consumer and industrial electronics

- Asia-Pacific region is expected to witness the highest growth rate in the global two terminal schottky diode market, driven by expanding consumer electronics, telecommunications infrastructure, and rising demand from automotive and industrial electronics applications in countries such as China, Japan, and South Korea

- The SMD/SMT segment held the largest market revenue share in 2024, driven by the rising demand for miniaturized electronic components and automated assembly processes. SMD/SMT Schottky diodes offer compact design, enhanced reliability, and ease of integration, making them highly preferred in consumer electronics and industrial applications

Report Scope and Two Terminal Schottky Diode Market Segmentation

|

Attributes |

Two Terminal Schottky Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Two Terminal Schottky Diode Market Trends

Increasing Adoption of High-Efficiency Power Electronics Applications

- The growing adoption of two terminal Schottky diodes in power electronics is transforming the industry by enabling faster switching speeds and lower forward voltage drops. These benefits improve overall energy efficiency in devices, particularly in high-performance consumer electronics and industrial power systems

- Rising demand for electric vehicles, renewable energy inverters, and industrial automation is accelerating the use of Schottky diodes in rectifiers, voltage clamping, and power conversion circuits. Their high efficiency helps reduce energy losses and enhances system reliability

- The development of advanced diode materials such as silicon carbide (SiC) and gallium nitride (GaN) is making Schottky diodes more reliable and versatile. These materials offer improved thermal stability and switching performance, increasing their adoption across critical applications

- For instance, in 2023, several European EV manufacturers integrated GaN-based Schottky diodes into their vehicle powertrains, boosting efficiency and reducing heat generation, thereby enhancing system durability and reducing operational costs

- While Schottky diodes are accelerating energy efficiency and high-speed performance, their impact depends on continued innovation, cost optimization, and widespread adoption in emerging markets. Manufacturers must focus on localized production and application-specific designs to fully capitalize on demand

Two Terminal Schottky Diode Market Dynamics

Driver

Increasing Demand for Energy-Efficient Electronics and Industrial Applications

- The rising need for energy-efficient consumer electronics and industrial systems is pushing manufacturers to prioritize Schottky diodes as essential components. Their ability to reduce power losses, support high-speed switching, and enhance device reliability drives adoption across multiple sectors. Increasing energy costs and sustainability goals further emphasize the need for efficient semiconductor solutions

- Electric vehicle and renewable energy adoption has increased the demand for Schottky diodes in inverters, chargers, and motor controllers. These components enhance overall system efficiency and reliability, reduce thermal losses, and contribute to longer equipment lifespans. The integration of these diodes enables high-performance, eco-friendly solutions across transportation and energy industries

- Technological improvements in diode materials, packaging, and thermal performance are further fueling market growth. Innovations in GaN and SiC diodes provide higher voltage tolerance, lower forward voltage drops, and better heat dissipation, attracting industrial, automotive, and consumer applications. These improvements also reduce system size and enhance power density, making designs more compact and cost-efficient

- For instance, in 2022, a leading North American EV manufacturer integrated SiC Schottky diodes into its charging infrastructure, improving energy efficiency, enabling faster charge cycles, and reducing overall energy consumption. This strategic adoption demonstrated tangible cost and performance benefits, reinforcing industry trust in advanced diode technologies

- While industrial and consumer electronics growth drives demand, continued R&D, standardization of high-performance components, and material innovation are essential to maintain high adoption rates and support next-generation applications. Companies focusing on cost reduction and product reliability are likely to gain a competitive advantage

Restraint/Challenge

High Cost of Advanced Schottky Diodes and Supply Chain Limitations

- Advanced Schottky diodes, particularly those using GaN and SiC technologies, are expensive, limiting their use to high-end consumer electronics, industrial systems, and automotive applications. Small and medium enterprises often struggle to adopt these components due to cost barriers, impacting market penetration in emerging economies. Price volatility of raw materials further exacerbates the challenge

- Complex fabrication processes and material shortages contribute to supply chain challenges, delaying production and distribution. This impacts timely deployment in emerging markets where demand is growing rapidly and can lead to project delays and increased operational costs. Disruptions in global logistics or semiconductor production cycles may further hinder availability

- Limited technical expertise for integrating high-performance Schottky diodes in specialized applications can reduce adoption rates. Manufacturers and end users require additional training, process optimization, and system-level integration support to fully leverage these components. Lack of knowledge may also result in underutilization of the diode’s capabilities and lower system efficiency

- For instance, in 2023, electronics manufacturers in South America reported delays in high-speed diode integration due to material shortages, production bottlenecks, and insufficient local technical support, highlighting the vulnerability of the supply chain. These challenges forced companies to revise timelines and seek alternative suppliers

- While Schottky diode technology continues to advance, addressing cost, supply chain reliability, and technical knowledge gaps is crucial. Industry stakeholders are focusing on scalable production, localized manufacturing, workforce training, and modular product designs to enable wider adoption and ensure long-term market growth

Two Terminal Schottky Diode Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the two terminal Schottky diode market is segmented into Screw Mount and SMD/SMT. The SMD/SMT segment held the largest market revenue share in 2024, driven by the rising demand for miniaturized electronic components and automated assembly processes. SMD/SMT Schottky diodes offer compact design, enhanced reliability, and ease of integration, making them highly preferred in consumer electronics and industrial applications.

The Screw Mount segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its robustness and suitability for high-power and high-current applications. Screw mount diodes are particularly favored for heavy-duty industrial equipment and automotive systems where durability and thermal management are critical, ensuring consistent performance under challenging conditions.

- By Application

On the basis of application, the two terminal Schottky diode market is segmented into LNB Mixers, WLAN Detector, Low Barrier Detector, 24GHz Radar, and Others. The LNB Mixer segment held the largest market revenue share in 2024, driven by the increasing deployment of satellite communication systems and broadband connectivity worldwide. LNB Mixer applications benefit from Schottky diodes’ high switching speed and low forward voltage drop, enabling better performance and signal integrity.

The 24GHz Radar segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in automotive, industrial, and security applications. High-frequency radar systems rely on Schottky diodes for fast switching and efficient detection, supporting the development of advanced driver-assistance systems (ADAS) and industrial sensing solutions.

- By End User

On the basis of end user, the two terminal Schottky diode market is segmented into Industrial, Automotive, Communication, Consumer Electronics, Telecommunication, and Others. The Industrial segment held the largest market revenue share in 2024, driven by the growing use of Schottky diodes in power conversion, rectification, and high-frequency switching applications across manufacturing and energy sectors.

The Automotive segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing electric vehicle production and the integration of Schottky diodes in inverters, chargers, and motor controllers. Automotive applications benefit from enhanced energy efficiency, reliability, and thermal performance provided by modern Schottky diodes.Two Terminal Schottky Diode Market Regional Analysis

Two Terminal Schottky Diode Market Regional Analysis

- North America dominated the two terminal Schottky diode market with the largest revenue share in 2024, driven by a strong electronics manufacturing base, advanced semiconductor infrastructure, and widespread adoption of energy-efficient consumer and industrial electronics

- Key players in the region focus on continuous R&D, innovation in GaN and SiC technologies, and robust supply chain networks, which further strengthen market dominance

- High demand from automotive, industrial, and consumer electronics applications, coupled with government incentives for energy-efficient technologies, is establishing North America as a leading market for Schottky diodes

U.S. Two Terminal Schottky Diode Market Insight

The U.S. two terminal Schottky diode market captured the largest revenue share in North America in 2024, driven by rapid adoption of electric vehicles, renewable energy systems, and advanced industrial electronics. Manufacturers are increasingly integrating GaN and SiC Schottky diodes into high-speed and energy-efficient applications. The growing focus on next-generation electronics and semiconductor innovation, alongside government support for clean energy and smart technologies, continues to propel market growth.

Europe Two Terminal Schottky Diode Market Insight

The Europe two terminal Schottky diode market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent energy efficiency regulations, growing automotive and industrial electronics demand, and the expansion of semiconductor manufacturing hubs. The increasing adoption of electric vehicles and renewable energy systems further fuels demand. European consumers and industrial players are also investing in compact, high-performance diodes for automation, smart grids, and energy-efficient devices.

U.K. Two Terminal Schottky Diode Market Insight

The U.K. two terminal Schottky diode market is expected to witness significant growth from 2025 to 2032, supported by rising investments in energy-efficient electronics, automotive electrification, and industrial automation. Government policies promoting clean energy and innovation in semiconductor technologies encourage adoption. In addition, the U.K.’s strong electronics and R&D ecosystem, along with increasing awareness of energy-saving technologies, continues to drive market expansion.

Germany Two Terminal Schottky Diode Market Insight

The Germany two terminal Schottky diode market is expected to witness rapid growth from 2025 to 2032, fueled by strong industrial manufacturing, automotive electrification, and adoption of renewable energy systems. Germany’s focus on sustainable technology, innovation, and high-tech electronics drives demand for high-performance Schottky diodes. Integration with smart electronics, energy-efficient industrial systems, and advanced automotive applications is further supporting market growth.

Asia-Pacific Two Terminal Schottky Diode Market Insight

The Asia-Pacific two terminal Schottky diode market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising electronics manufacturing, and the growing adoption of electric vehicles and industrial automation. Countries such as China, Japan, and India are investing heavily in energy-efficient and high-speed semiconductor components. The expansion of consumer electronics, automotive, and industrial sectors, along with government initiatives supporting clean energy and smart technologies, is significantly propelling market adoption.

Japan Two Terminal Schottky Diode Market Insight

The Japan two terminal Schottky diode market is expected to witness robust growth from 2025 to 2032, supported by the country’s focus on high-tech electronics, electric vehicles, and industrial automation. Increasing demand for energy-efficient components in consumer and industrial electronics, coupled with strong semiconductor R&D, fuels adoption. The integration of GaN and SiC Schottky diodes in high-performance devices further strengthens market growth.

China Two Terminal Schottky Diode Market Insight

The China two terminal Schottky diode market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrialization, expansion of consumer electronics, and increasing EV adoption. Strong domestic semiconductor manufacturing, availability of cost-effective high-performance diodes, and government support for clean energy technologies are major factors propelling market growth. The push towards smart cities and automation in industrial and automotive sectors further accelerates market demand.

Two Terminal Schottky Diode Market Share

The Two Terminal Schottky Diode industry is primarily led by well-established companies, including:

- Semiconductor Components Industries, LLC (U.S.)

- Mouser Electronics, Inc. (U.S.)

- ROHM CO., LTD. (Japan)

- Infineon Technologies AG (Germany)

- Microchip Technology Inc. (U.S.)

- Cree, Inc. (U.S.)

- GeneSiC Semiconductor Inc. (U.S.)

- IXYS Corporation (U.S.)

- Littelfuse, Inc. (U.S.)

- Nexperia (Netherlands)

- Rectron Semiconductor (U.K.)

- Toshiba India Pvt. Ltd. (India)

- TT Electronics (U.K.)

- NXP Semiconductors (Netherlands)

- Shanghai WillSemi (China)

- Diodes Incorporated (U.S.)

- PANJIT (Taiwan)

- Taiwan Semiconductor (Taiwan)

- UnitedSiC (U.S.)

- WeEn Semiconductors (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Schottky Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Schottky Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Schottky Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.