Global Two Terminal Tvs Transient Voltage Suppressor Diode Market

Market Size in USD Billion

CAGR :

%

USD

3.70 Billion

USD

5.78 Billion

2024

2032

USD

3.70 Billion

USD

5.78 Billion

2024

2032

| 2025 –2032 | |

| USD 3.70 Billion | |

| USD 5.78 Billion | |

|

|

|

|

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Size

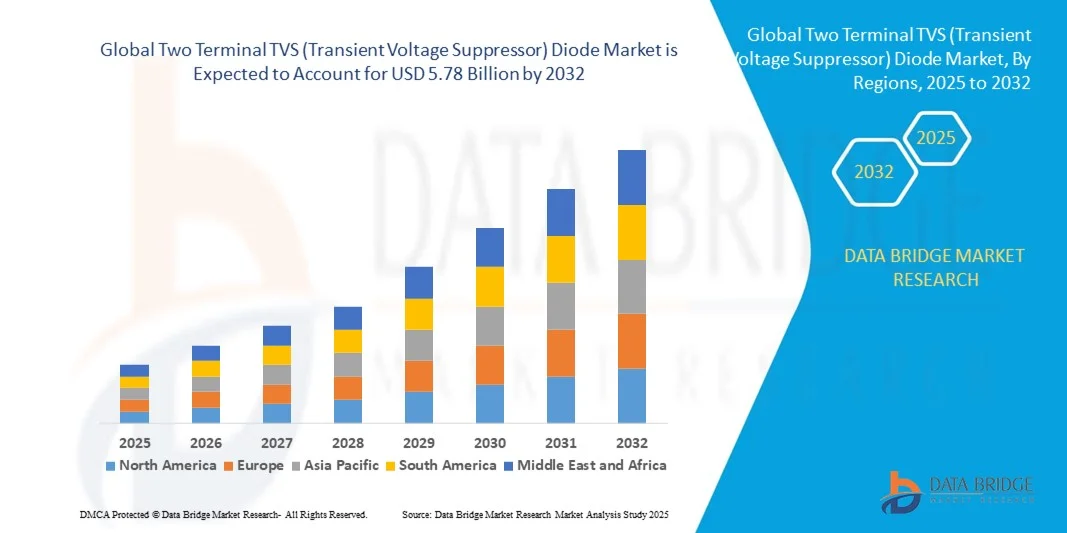

- The global two terminal TVS (Transient Voltage Suppressor) diode market size was valued at USD 3.70 billion in 2024 and is expected to reach USD 5.78 billion by 2032, at a CAGR of 5.75% during the forecast period

- The market growth is largely fueled by the increasing demand for protection of sensitive electronic components from voltage spikes, surges, and electrostatic discharge across automotive, industrial, telecommunications, and consumer electronics applications

- Furthermore, rising adoption of high-speed communication systems, electric vehicles, and industrial automation is driving the need for reliable transient voltage suppression. These converging factors are accelerating the deployment of TVS diodes, thereby significantly boosting the market's growth

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Analysis

- Two Terminal TVS diodes are semiconductor devices designed to protect circuits from voltage transients by clamping voltage to safe levels. They are used across AC/DC power lines, data and signal lines, telecommunication equipment, microprocessors, MOS memory, and low-energy circuit systems

- The escalating demand for TVS diodes is primarily fueled by the growing automotive electronics sector, increasing deployment of IoT and smart devices, rising data traffic requiring high-speed communication protection, and stringent standards for electronic device reliability and safety

- North America dominated the two terminal TVS (Transient Voltage Suppressor) diode market in 2024, due to the strong presence of automotive, industrial, and electronics manufacturing sectors

- Asia-Pacific is expected to be the fastest growing region in the two terminal TVS (Transient Voltage Suppressor) diode market during the forecast period due to rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, and India

- Unidirectional segment dominated the market with a market share of 62.5% in 2024, due to its wide adoption in protecting sensitive electronic components against voltage spikes in DC circuits. Unidirectional TVS diodes are preferred for their simplicity, reliability, and high surge absorption capacity, making them a go-to choice in automotive electronics, consumer devices, and industrial control systems. Their compatibility with diverse power supply configurations and proven track record in mitigating transient voltage events further contribute to their market leadership

Report Scope and Two Terminal TVS (Transient Voltage Suppressor) Diode Market Segmentation

|

Attributes |

Two Terminal TVS (Transient Voltage Suppressor) Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Trends

Growing Use of Electric Vehicles and High-Speed Communication Systems

- The two terminal TVS diode market is witnessing strong growth as demand rises from sectors such as electric vehicles (EVs), automotive electronics, telecommunications, and industrial automation. The increased integration of high-speed and high-voltage circuits in modern systems has intensified the need for reliable overvoltage protection solutions such as TVS diodes, which safeguard components from transient surges caused by switching events, electrostatic discharge (ESD), and lightning strikes

- For instance, Vishay Intertechnology and Littelfuse Inc. are developing high-power two-terminal TVS diodes optimized for EV powertrains, onboard chargers, and DC fast-charging infrastructure. Similarly, Nexperia and STMicroelectronics have launched ultra-fast TVS diode solutions capable of protecting sensitive communication lines and sensors operating in 5G and optical networking environments

- The accelerating adoption of EVs, hybrid vehicles, and advanced driver assistance systems (ADAS) is a major contributor to market growth. These applications require stable transient protection for electronic control units (ECUs), inverters, and battery management systems operating under varying voltage and environmental conditions

- In addition, the expansion of data centers, optical transceivers, and next-generation communication infrastructures is driving demand for compact and low-capacitance TVS diodes that ensure signal integrity and reliability at higher frequencies. TVS diodes are increasingly integrated into interfaces such as USB Type-C, Ethernet, HDMI, and high-speed differential lines where surge suppression and low leakage current are critical

- Ongoing advancements in semiconductor miniaturization, material innovation, and packaging design are improving TVS diode performance while reducing footprint and response time. This aligns with the rising trend of embedding protection components directly onto high-density circuit boards used in intelligent electronics and IoT hardware

- As industries shift toward high-performance electronic ecosystems—from EV platforms to ultra-fast communication networks—the role of TVS diodes as essential surge protection components is becoming more prominent. The trend underscores the technology’s growing importance in ensuring system reliability and longevity in modern electronic architectures

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Dynamics

Driver

Rising Need to Protect Sensitive Electronic Components”

- The increasing complexity and sensitivity of modern electronic systems have intensified the need for effective transient voltage protection, driving demand for TVS diodes across multiple industries. These components play a vital role in safeguarding circuits against high-voltage spikes that can damage integrated circuits (ICs), microcontrollers, and communication ports

- For instance, ON Semiconductor and Bourns, Inc. offer a wide range of automotive-grade and industrial TVS diodes designed to protect power and data lines in control systems, sensors, and infotainment units. Their ultra-fast response and strong clamping capability make them vital for maintaining signal integrity and preventing component failure in mission-critical electronic assemblies

- Rising miniaturization of devices and proliferation of IoT-enabled electronics have significantly increased susceptibility to electrostatic discharge and voltage surges. TVS diodes, due to their compact size and millisecond-level reaction time, provide an efficient solution without adding significant bulk or complexity to circuit designs

- In addition, with electronics becoming central to functions across medical instruments, telecommunications equipment, and renewable energy systems, ensuring circuit stability under transient conditions is a priority. TVS diodes enable manufacturers to meet reliability standards while extending product lifecycle and operational safety

- As industries continue to digitalize and integrate more microelectronics into high-energy environments, the use of TVS diodes for robust voltage protection will remain indispensable. Their combination of speed, durability, and cost-efficiency ensures ongoing relevance as foundational elements in advanced electronic protection design

Restraint/Challenge

Complexity of Circuits Needing Ultra-Low Capacitance TVS Diodes

- The increasing demand for high-speed, low-capacitance TVS diodes presents design and integration challenges, especially in systems where maintaining signal integrity is crucial. Circuits operating at gigabit frequencies or differential signaling often require ultra-low capacitance diodes to avoid signal distortion, but developing and integrating such devices adds technical complexity and cost

- For instance, manufacturers such as Nexperia and Semtech Corporation face difficulties producing diodes that maintain both ultra-low capacitance and strong surge tolerance, as these parameters inherently conflict within semiconductor design. Balancing protection capability with minimal impact on signal performance remains a core technical hurdle

- Furthermore, integrating TVS diodes into increasingly compact and multilayered circuit boards introduces layout challenges. Engineers must carefully manage trace lengths, parasitic effects, and grounding to preserve high-frequency performance, increasing design time and validation requirements

- Cost constraints also arise as high-precision fabrication processes and specialized testing are required to produce reliable low-capacitance components suitable for 5G, fiber optics, and advanced communication interfaces. This limits widespread adoption in budget-sensitive consumer electronics sectors

- While advances in materials science, such as silicon-carbide-based protection devices and improved fabrication techniques, are gradually easing these challenges, achieving broad scalability remains complex. To enable broader deployment, manufacturers will need to develop standardized design frameworks and hybrid protection solutions that balance capacitance, clamping voltage, and frequency performance without compromising circuit reliability

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Scope

The market is segmented on the basis of device type, arrays, application, and end user.

- By Device Type

On the basis of device type, the Two Terminal TVS Diode market is segmented into unidirectional and bidirectional. The unidirectional segment dominated the largest market revenue share 62.5% in 2024, driven by its wide adoption in protecting sensitive electronic components against voltage spikes in DC circuits. Unidirectional TVS diodes are preferred for their simplicity, reliability, and high surge absorption capacity, making them a go-to choice in automotive electronics, consumer devices, and industrial control systems. Their compatibility with diverse power supply configurations and proven track record in mitigating transient voltage events further contribute to their market leadership.

The bidirectional segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing demand in AC circuits and bidirectional signal lines requiring symmetrical voltage protection. Increasing deployment in telecommunication, computing, and high-speed data lines is driving adoption. Bidirectional TVS diodes offer effective protection in scenarios where voltage transients can occur in either polarity, making them increasingly relevant in modern electronics that demand robust, flexible surge protection solutions.

- By Arrays

On the basis of arrays, the market is segmented into ultra low capacitance (less than 5pF), low capacitance (5 to 100pF), and standard capacitance (less than 100pF). The ultra low capacitance segment dominated the market in 2024, driven by the need to protect high-speed data lines and sensitive semiconductor devices without affecting signal integrity. Ultra low capacitance TVS diodes are critical in applications such as telecommunication equipment, high-frequency computing circuits, and modern microprocessor designs, where even minimal signal distortion can impact performance. Their adoption is supported by the increasing deployment of high-speed interfaces and strict EMI/ESD compliance requirements.

The low capacitance segment is projected to witness the fastest growth rate from 2025 to 2032, propelled by demand in mixed-signal applications, general-purpose electronics, and data line protection. These TVS diodes balance effective transient suppression with minimal capacitance interference, making them suitable for versatile circuits and evolving IoT and automotive electronics. Growing consumer electronics production and industrial automation further accelerate market growth for low capacitance arrays.

- By Application

On the basis of application, the market is segmented into AC power lines, data and signal lines, telecommunication equipment, microprocessors and MOS memory, and clamping in low energy circuits and systems. The data and signal lines segment dominated the largest market share in 2024, owing to the increasing reliance on high-speed digital communication and the critical need for protecting sensitive signal paths from voltage transients. These applications require TVS diodes that offer fast response times, high surge current capability, and minimal signal distortion, making them indispensable in computing, telecommunications, and networking equipment.

The AC power lines segment is expected to witness the fastest CAGR from 2025 to 2032, driven by industrial electrification, smart grid deployments, and increasing renewable energy integration. Protection of AC circuits from voltage spikes, lightning surges, and switching transients is crucial in power distribution systems. Rising investment in industrial automation and energy-efficient infrastructure further boosts adoption of TVS diodes in AC line protection applications.

- By End User

On the basis of end user, the market is segmented into automotive, industry, power supplies, military/aerospace, telecommunications, computing, consumer, and others. The automotive segment dominated the market in 2024, driven by the rapid electrification of vehicles, increasing integration of advanced driver-assistance systems (ADAS), infotainment systems, and battery management systems that require robust surge protection. The expanding production of electric and hybrid vehicles has further increased demand for reliable TVS diodes that ensure long-term performance under harsh operating conditions.

The telecommunications segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by growing deployment of 5G infrastructure, data centers, and high-speed networking equipment. The surge in high-frequency signal transmission and sensitive communication systems increases the need for TVS diodes that provide fast transient suppression without impacting signal quality. Rising global data traffic and ongoing network expansion in emerging economies further accelerate growth in this segment.

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Regional Analysis

- North America dominated the two terminal TVS (Transient Voltage Suppressor) diode market with the largest revenue share in 2024, driven by the strong presence of automotive, industrial, and electronics manufacturing sectors

- Companies in the region are increasingly focusing on protecting sensitive electronic components and high-speed communication lines from transient voltage spikes, creating steady demand for TVS diodes

- The widespread adoption is further supported by high R&D investments, technologically advanced manufacturing infrastructure, and stringent standards for electronic device protection, establishing TVS diodes as critical components across automotive, industrial, and consumer electronics applications

U.S. Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The U.S. market captured the largest revenue share in North America in 2024, fueled by extensive industrial automation, growing demand for automotive electronics, and expansion of data centers. High adoption of electric and hybrid vehicles, coupled with increasing reliance on microprocessors and semiconductor devices, drives the need for reliable transient voltage suppression. In addition, rising investment in telecommunications infrastructure and high-speed data networks further propels the market. The integration of TVS diodes in advanced electronics to protect against voltage spikes is a key factor supporting growth in the U.S. market.

Europe Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent electronic safety regulations and growing industrial automation. Rising adoption of automotive electronics, telecommunication equipment, and smart manufacturing systems is fostering demand for TVS diodes. European companies are emphasizing the reliability and robustness of electronic devices, which increases the integration of TVS diodes across microprocessors, MOS memory, and AC/DC line applications. The market also benefits from increased focus on renewable energy systems and smart grids, where voltage protection is critical.

U.K. Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The U.K. market is expected to grow at a noteworthy CAGR over the forecast period, fueled by rising investments in telecommunications infrastructure and the automotive electronics sector. The emphasis on protecting high-speed data lines, sensitive electronics, and industrial control systems is driving adoption. In addition, the trend toward connected devices, IoT, and smart city projects is encouraging both commercial and residential users to adopt voltage suppression solutions to ensure system reliability.

Germany Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The Germany market is anticipated to expand significantly during the forecast period, supported by strong automotive, industrial, and electronics sectors. The demand for robust protection against transient voltages is heightened by the country’s advanced manufacturing landscape and focus on Industry 4.0. Germany’s emphasis on high-quality, durable electronics and energy-efficient systems fosters widespread integration of TVS diodes in both new and existing equipment.

Asia-Pacific Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, and India. The region’s expanding electronics manufacturing base, rising automotive production, and growing deployment of telecommunication networks are key factors propelling market growth. In addition, government initiatives supporting smart grid implementation and IoT adoption are increasing demand for reliable transient voltage protection solutions across multiple applications.

Japan Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The Japan market is gaining momentum due to high technological adoption, advanced electronics manufacturing, and strong automotive and semiconductor sectors. The market growth is further supported by increasing deployment of high-speed data communication lines and integration of TVS diodes in industrial automation and consumer electronics. Japan’s emphasis on safety, reliability, and precision in electronic systems drives consistent demand for transient voltage suppression solutions.

China Two Terminal TVS (Transient Voltage Suppressor) Diode Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s extensive electronics and automotive manufacturing ecosystem. China is a hub for semiconductor production and high-speed telecommunication infrastructure, creating strong demand for TVS diodes. Rising urbanization, industrial automation, and government-led initiatives for smart cities and energy-efficient electronics further drive adoption. Domestic manufacturers and cost-effective production capabilities make China a dominant player in the APAC market.

Two Terminal TVS (Transient Voltage Suppressor) Diode Market Share

The two terminal TVS (Transient Voltage Suppressor) diode industry is primarily led by well-established companies, including:

- Infineon Technologies AG (Germany)

- Taiwan Semiconductor Manufacturing Company (Taiwan)

- Bourns, Inc. (U.S.)

- PROTEK Devices (U.S.)

- Solid State Manufacturing (U.S.)

- Littelfuse, Inc. (U.S.)

- Semtech Corporation (U.S.)

- Electronics Industry Public Company Limited (EIC) (Thailand)

- Sensitron Semiconductor (U.S.)

- Continental Device India Pvt. Ltd. (India)

- Vishay Intertechnology, Inc. (U.S.)

- Nexperia B.V. (Netherlands)

- AMAZING Microelectronic Corp. (Taiwan)

- Wayon Electronics Co., Ltd. (China)

- BrightKing (Taiwan)

- Semiconductor Components Industries, LLC (U.S.)

- MDE Semiconductor (U.S.)

- Diodes Incorporated (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- ANOVA Technologies Co., Ltd. (China)

Latest Developments in Global Two Terminal TVS (Transient Voltage Suppressor) Diode Market

- In May 2025, Alpha and Omega Semiconductor launched the AOZ8S205BLS series of ultra-low capacitance TVS diodes designed to protect high-speed data lines such as USB4.0 and Thunderbolt 5. These diodes offer extremely low capacitance, ensuring superior ESD protection while maintaining signal integrity in high-frequency applications. This development addresses the growing demand for reliable protection in next-generation electronic devices, enhancing the performance and reliability of high-speed interfaces across consumer electronics and computing systems

- In February 2025, ROHM introduced new low-capacitance TVS diodes for high-speed CAN FD in-vehicle communication systems, essential for autonomous driving applications. By reducing terminal capacitance to a maximum of 3.5pF, these diodes prevent signal degradation and provide higher surge current ratings. This innovation strengthens the reliability of automotive electronics, supporting the growing adoption of advanced in-vehicle communication systems and safety-critical components in the automotive sector

- In February 2025, Littelfuse unveiled the TPSMB-L Series Automotive TVS Diodes for Battery Management Systems in 800V electric vehicles. Featuring ultra-low clamping voltage, these diodes provide enhanced protection for sensitive components such as Analog Front End (AFE) and Battery Management ICs. This launch addresses the increasing need for robust protection in EV applications, contributing to safer, more efficient battery management and supporting the expansion of the electric vehicle market

- In December 2024, Littelfuse introduced the TPSMB Asymmetrical TVS Diode Series for SiC MOSFET gate driver protection in automotive power applications. The asymmetrical design accommodates differing positive and negative gate driver voltages, ensuring optimal performance for EV traction inverters, onboard chargers, and I/O interfaces. This innovation simplifies circuit design by reducing component requirements, advancing the efficiency and reliability of automotive power electronics

- In August 2024, Shindengen Electric Manufacturing launched the ST20-FY series TVS diodes for in-vehicle equipment. These diodes reduce package size by 62.5% compared to conventional products and enhance negative surge protection by 20%. This advancement aligns with the automotive industry’s trend toward compact, high-performance electronics, improving safety and efficiency in automotive electronic systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Tvs Transient Voltage Suppressor Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Tvs Transient Voltage Suppressor Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Tvs Transient Voltage Suppressor Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.