Global Two Terminal Vertical Cavity Surface Emitting Laser Market

Market Size in USD Billion

CAGR :

%

USD

2.30 Billion

USD

10.15 Billion

2024

2032

USD

2.30 Billion

USD

10.15 Billion

2024

2032

| 2025 –2032 | |

| USD 2.30 Billion | |

| USD 10.15 Billion | |

|

|

|

|

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Size

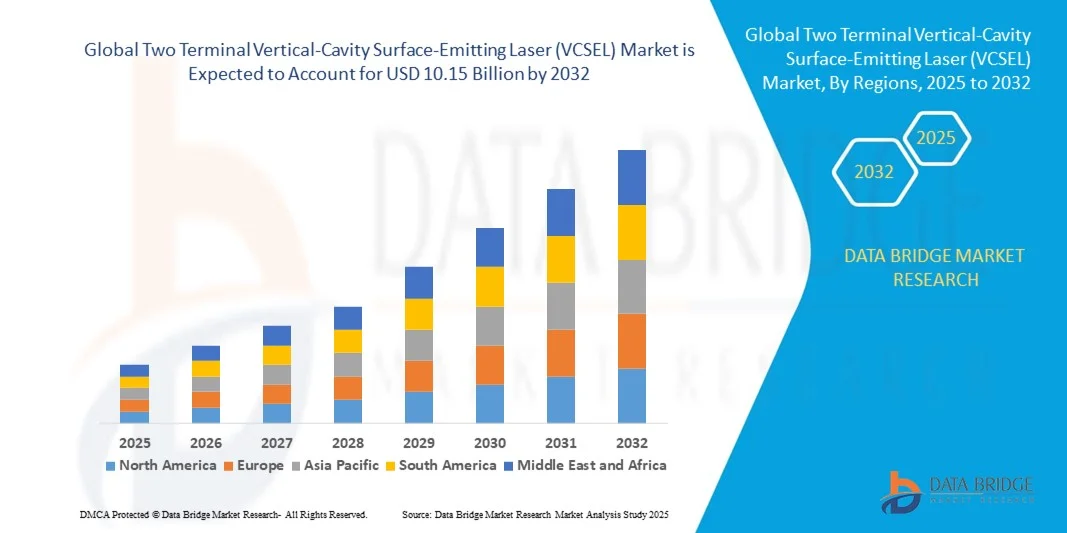

- The global two terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) market size was valued at USD 2.30 billion in 2024 and is expected to reach USD 10.15 billion by 2032, at a CAGR of 20.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of 3D sensing, LiDAR systems, and high-speed optical communication, driven by technological advancements in consumer electronics, automotive, and data center applications

- Furthermore, rising demand for precise, energy-efficient, and compact light sources for sensing, imaging, and communication applications is establishing Two Terminal Vertical-Cavity Surface-Emitting Lasers as a preferred choice across multiple industries. These converging factors are accelerating the uptake of VCSEL devices, thereby significantly boosting the market's growth

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Analysis

- Two Terminal Vertical-Cavity Surface-Emitting Lasers are semiconductor light sources that emit vertically from the surface of the chip, offering high efficiency, reliability, and compact form factor. They are used in applications such as facial recognition, industrial sensing, automotive LiDAR, and high-speed optical data transmission

- The escalating demand for these devices is primarily fueled by the proliferation of smartphones and wearable devices, increasing deployment of LiDAR in automotive safety systems, and the growing need for fast, reliable optical interconnects in data centers and telecom networks

- North America dominated the two terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) market in 2024, due to the increasing adoption of 3D sensing, LiDAR, and high-speed data communication applications

- Asia-Pacific is expected to be the fastest growing region in the two terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) market during the forecast period due to rapid urbanization, rising disposable incomes, and technological advancement in countries such as China, Japan, South Korea, and India

- Near Infrared (NIR) segment dominated the market with a market share of 93.5% in 2024, due to its extensive adoption in 3D sensing, facial recognition, and proximity detection applications. NIR VCSELs provide safe and efficient illumination for consumer electronics while offering compatibility with standard silicon photodetectors. Their ability to operate reliably under low-light conditions and across varying ambient environments supports strong demand. NIR wavelength devices are also favored in high-volume applications due to cost efficiency and ease of integration into compact devices

Report Scope and Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Segmentation

|

Attributes |

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Trends

Increased Use of VCSELs in 3D Sensing

- The two terminal VCSEL market is experiencing significant growth driven by the rising demand for 3D sensing technologies in consumer electronics, automotive, and industrial automation. VCSELs provide compact, efficient, and reliable optical sources that are ideal for depth mapping, facial recognition, gesture control, and LiDAR systems, offering advantages in precision and energy efficiency compared to other laser technologies

- For instance, Lumentum Holdings Inc. and ams OSRAM have developed high-performance VCSEL arrays used extensively in smartphone 3D facial recognition systems and augmented reality devices. Similarly, II-VI Incorporated is supplying VCSELs for advanced driver-assistance systems (ADAS) and autonomous vehicle LiDAR units, enabling high-resolution environmental mapping with rapid response times

- The proliferation of VCSEL-based 3D sensing in smartphones is driving mass production volumes, especially for applications such as biometric unlock systems, proximity sensing, and AR/VR interaction. These sensors utilize VCSEL technology for stable and consistent illumination, ensuring accuracy under varying environmental conditions

- In addition, the integration of VCSELs into industrial robotics and manufacturing equipment enables precise object detection and spatial mapping, enhancing automation efficiency and safety. Medical devices are also adopting VCSEL-based optical sensing for accurate patient monitoring and imaging diagnostics

- As 3D sensing becomes a standard feature in mobile, automotive, and industrial platforms, VCSEL technology is poised to play a central role due to its high reliability, scalability in arrays, and compatibility with CMOS electronics. The trend highlights VCSELs as a foundational enabler of next-generation sensing and imaging solutions across multiple high-tech sectors

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Dynamics

Driver

Demand for High-Speed Optical Communication

- The growing demand for high-speed, high-bandwidth optical communication is a major driver for the VCSEL market, as these devices provide efficient light sources for short-range, high-data-rate interconnects in data centers, enterprise networking, and high-performance computing environments

- For instance, Broadcom Inc. and Finisar Corporation produce VCSEL-based transceivers for 400G and higher Ethernet applications, supporting rapid data exchange between servers and storage arrays. VCSELs ensure low power consumption, compact design, and high modulation speeds, making them ideal for large-scale data communication infrastructures

- In addition, VCSELs’ compatibility with multimode optical fibers and their ability to deliver reliable signal transmission over short distances without complex cooling systems reduces deployment costs for data center operators. Their performance characteristics and scalability also meet the needs of expanding cloud services and AI-driven workloads that depend heavily on fast data transfer

- The continued evolution toward edge computing and high-volume cloud operations reinforces the need for optical communication solutions capable of supporting ultra-low latency and high throughput. VCSELs meet these requirements while offering improved manufacturability and integration flexibility compared to other semiconductor laser types

- As global data traffic continues to surge, driven by streaming, IoT, 5G, and AI applications, VCSELs will remain critical for delivering cost-effective, high-speed optical links in next-generation network architectures

Restraint/Challenge

High Production Cost

- Despite their advantages, VCSEL manufacturing is capital-intensive due to complex epitaxial growth, precision wafer processing, and stringent quality control measures required to achieve consistent optical output and reliability. This high production cost is a key challenge limiting broader adoption in price-sensitive markets

- For instance, manufacturers such as II-VI Incorporated and Lumentum face significant investment in state-of-the-art MOCVD (metal-organic chemical vapor deposition) and lithography equipment needed to produce high-yield VCSEL wafers. The need for precise cavity structuring, advanced mirror deposition, and defect control adds to fabrication complexities and expenses

- VCSEL arrays, particularly for applications such as LiDAR and high-resolution 3D sensing, require extremely tight tolerances in wavelength stability and beam alignment, which further increases production costs. Yield losses due to micro-defects or inconsistencies in epitaxial layers also impact profitability

- In addition, market pressure for miniaturization and integration with driver electronics demands additional R&D and engineering resources, increasing cost overheads for product development cycles. This is particularly challenging for smaller manufacturers competing against established semiconductor giants with larger economies of scale

- While advancements in wafer-scale manufacturing and process automation are expected to gradually reduce production costs, the complexity of VCSEL fabrication will remain a barrier for widespread deployment in low-margin applications. Overcoming this challenge will require innovations in cost-effective materials, streamlined fabrication processes, and collaborative supply chain models to expand accessibility across broader market segments

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Scope

The market is segmented on the basis of fabrication method, technology, type, material, wavelength, application, data rate, and industry.

- By Fabrication Method

On the basis of fabrication method, the VCSEL market is segmented into selective oxidation and ion implantation. The selective oxidation segment dominated the market in 2024 due to its ability to create precise current confinement and high-efficiency devices. It is widely adopted for producing uniform VCSEL arrays, critical in applications such as optical communication and 3D sensing. The high reproducibility and lower defect rates of selectively oxidized VCSELs make them favorable for large-scale manufacturing. Their compatibility with various epitaxial layers and ability to maintain performance under varying temperatures further reinforce their market dominance. Selective oxidation VCSELs also benefit from reduced operational power requirements and enhanced modulation speeds, which are essential for modern high-speed applications.

The ion implantation segment is anticipated to witness the fastest growth from 2025 to 2032, driven by its flexibility in customizing device characteristics and compatibility with next-generation photonics applications. Ion implantation enables precise tailoring of current paths and optical modes, supporting higher density integration for data communication and sensing. Its adoption is accelerating in emerging applications where design-specific VCSEL performance is critical.

- By Technology

On the basis of technology, the market is segmented into dot projector, time-of-flight (TOF), and flood illuminator. The dot projector segment held the largest market share in 2024, largely due to its extensive use in facial recognition systems and secure authentication devices. Dot projectors enable high-resolution pattern projection, making them suitable for precise 3D sensing applications in consumer electronics and smartphones. The segment also benefits from the growing adoption of biometric security solutions and AR/VR devices. High manufacturing maturity and the availability of reliable VCSEL arrays contribute to its dominant position. Dot projectors’ efficiency in low-light conditions and strong performance in compact designs further strengthen market preference.

The TOF segment is expected to record the fastest CAGR from 2025 to 2032, fueled by increasing demand in autonomous vehicles, robotics, and industrial 3D mapping. TOF VCSELs provide fast distance measurements and enhanced depth accuracy, supporting real-time spatial sensing in critical applications. Continuous technological advancements and expanding adoption in automotive LiDAR systems are major growth drivers.

- By Type

On the basis of type, the market is segmented into single-mode and multimode VCSELs. The multimode segment dominated the market in 2024 due to its simplicity, lower cost, and suitability for short-distance data communication and consumer electronics applications. Multimode VCSELs are favored in optical interconnects and proximity sensing, where high data rates over moderate distances are sufficient. Their wide beam divergence and ease of integration into large arrays make them ideal for mass-market deployment. The segment also benefits from mature fabrication techniques and strong supply chain support.

The single-mode segment is anticipated to witness the fastest growth from 2025 to 2032, driven by rising demand in high-speed data transmission, long-distance communication, and precision sensing applications. Single-mode VCSELs offer superior coherence, minimal dispersion, and high-performance operation in fiber optic networks.

- By Material

On the basis of material, the VCSEL market is segmented into gallium arsenide (GaAs), indium phosphide (InP), and others. The GaAs segment held the largest revenue share in 2024 due to its high optical efficiency, thermal stability, and established use in consumer electronics and data communication devices. GaAs VCSELs are preferred for short- to medium-range optical links, providing reliable performance across varying temperatures. Their cost-effectiveness and compatibility with existing semiconductor fabrication processes contribute to their dominance. GaAs devices also support large-scale wafer processing and robust emission properties, enhancing their applicability across multiple industries.

The InP segment is expected to register the fastest growth from 2025 to 2032, driven by its suitability for long-wavelength, high-speed applications, particularly in telecom, LiDAR, and emerging industrial sensing. InP VCSELs offer high modulation bandwidths and excellent performance at longer infrared wavelengths, supporting advanced optical communication networks.

- By Wavelength

On the basis of wavelength, the market is segmented into red, near-infrared (NIR), and short-wave infrared (SWIR). The NIR segment dominated the market with a share of 93.5% in 2024 due to its extensive adoption in 3D sensing, facial recognition, and proximity detection applications. NIR VCSELs provide safe and efficient illumination for consumer electronics while offering compatibility with standard silicon photodetectors. Their ability to operate reliably under low-light conditions and across varying ambient environments supports strong demand. NIR wavelength devices are also favored in high-volume applications due to cost efficiency and ease of integration into compact devices.

The SWIR segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing adoption in industrial inspection, autonomous vehicles, and medical imaging. SWIR VCSELs enable long-range sensing, high penetration through obscurants, and specialized imaging applications, driving demand in emerging sectors.

- By Application

On the basis of application, the VCSEL market is segmented into sensing, data communication, industrial heating and laser printing, emerging, and other applications. The sensing segment dominated the market in 2024 due to its critical role in consumer electronics, automotive LiDAR, and industrial 3D mapping. VCSELs in sensing applications provide accurate depth mapping, gesture recognition, and proximity detection, making them indispensable in modern electronic devices. The segment also benefits from widespread integration in smartphones, AR/VR systems, and robotics. High reliability, fast response times, and low power consumption enhance the segment’s prominence.

The data communication segment is expected to record the fastest growth from 2025 to 2032, driven by the surge in demand for high-speed optical interconnects in data centers and telecom infrastructure. VCSELs enable high-bandwidth, low-latency transmission while supporting energy-efficient network scaling.

- By Data Rate

On the basis of data rate, the market is segmented into up to 10 Gbps, 10.1 to 25 Gbps, and above 25 Gbps. The up to 10 Gbps segment dominated the market in 2024 due to its suitability for standard data center interconnects and consumer electronics applications. It offers sufficient bandwidth for mainstream communication needs while maintaining cost efficiency and energy savings. Mature manufacturing techniques and widespread adoption across large-scale networks further support market leadership.

The above 25 Gbps segment is expected to witness the fastest growth from 2025 to 2032, fueled by growing demand for high-speed optical networks, next-generation data centers, and telecom infrastructure. High-data-rate VCSELs support advanced optical communication and emerging 6G technologies.

- By Industry

On the basis of industry, the VCSEL market is segmented into consumer electronics, data center, automotive, commercial and industrial, healthcare, and military. The consumer electronics segment dominated the market in 2024 due to the proliferation of smartphones, AR/VR devices, and wearable gadgets incorporating VCSELs for facial recognition and gesture sensing. Widespread adoption in mass-market products, combined with high-volume manufacturing capabilities, reinforces market leadership. Consumer demand for advanced security and interactive features further strengthens growth.

The automotive segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing integration of LiDAR, driver-assistance systems, and autonomous vehicle technologies. VCSELs in automotive applications provide precise 3D sensing, long-range detection, and reliable performance under harsh conditions, driving rapid adoption.

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Regional Analysis

- North America dominated the two terminal vertical-cavity surface-emitting laser (VCSEL) market with the largest revenue share in 2024, driven by the increasing adoption of 3D sensing, LiDAR, and high-speed data communication applications

- Companies in the region are investing heavily in next-generation data centers, consumer electronics, and automotive technologies, fueling demand for VCSEL devices

- The region benefits from a technologically advanced ecosystem, high R&D spending, and strong manufacturing infrastructure, supporting rapid commercialization of VCSEL-based solutions. In addition, the growing integration of VCSELs in smartphones, AR/VR devices, and industrial sensing applications reinforces market dominance

U.S. Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

The U.S. two terminal vertical-cavity surface-emitting laser market captured the largest revenue share in North America in 2024, driven by widespread adoption in smartphones, 3D sensing, and automotive light detection and ranging systems. High demand for fast, reliable optical interconnects in data centers and telecommunication infrastructure further propels growth. The presence of leading semiconductor and photonics companies, combined with advanced manufacturing capabilities, supports rapid deployment of two terminal vertical-cavity surface-emitting laser technologies. Moreover, the growing focus on smart home devices, wearable electronics, and emerging industrial applications is expected to continue boosting market expansion.

Europe Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

The Europe two terminal vertical-cavity surface-emitting laser market is projected to expand at a substantial compound annual growth rate during the forecast period, driven by strong demand in industrial automation, automotive, and consumer electronics sectors. Increasing adoption of 3D sensing technologies and high-speed optical communication networks in countries such as Germany, France, and the United Kingdom is promoting market growth. Stringent quality standards, a well-developed infrastructure, and the push for energy-efficient and high-performance photonic solutions are fostering two terminal vertical-cavity surface-emitting laser adoption. European manufacturers are also leveraging collaborations and innovations to strengthen market penetration across both commercial and industrial applications.

U.K. Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

The U.K. two terminal vertical-cavity surface-emitting laser market is anticipated to grow at a notable compound annual growth rate during the forecast period, fueled by adoption in automotive light detection and ranging, data centers, and consumer electronics. The country’s focus on smart technology integration and optical communication networks supports strong demand. Increased investments in photonics research and emerging applications in augmented reality and virtual reality devices and industrial sensing are expected to drive growth.

Germany Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

Germany’s two terminal vertical-cavity surface-emitting laser market is expected to expand at a considerable compound annual growth rate, supported by industrial automation, automotive innovation, and high adoption of optical communication technologies. Germany’s advanced manufacturing ecosystem, emphasis on research and development, and sustainability-focused initiatives encourage deployment of two terminal vertical-cavity surface-emitting laser devices in various sectors. The integration of two terminal vertical-cavity surface-emitting laser devices with Internet of Things and smart systems further strengthens market potential.

Asia-Pacific Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

The Asia-Pacific two terminal vertical-cavity surface-emitting laser market is poised to grow at the fastest compound annual growth rate during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and technological advancement in countries such as China, Japan, South Korea, and India. The region is witnessing strong adoption of smartphones, augmented reality and virtual reality devices, automotive light detection and ranging, and data center optical interconnects. Government initiatives supporting digitalization and smart city projects are accelerating two terminal vertical-cavity surface-emitting laser deployment. The presence of leading semiconductor manufacturers and cost-effective production capabilities further enhance market accessibility and adoption.

Japan Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

Japan’s two terminal vertical-cavity surface-emitting laser market is gaining momentum due to high technological adoption, urbanization, and demand for advanced consumer electronics. The market emphasizes precision 3D sensing, industrial automation, and automotive applications. Integration with Internet of Things, smart devices, and augmented reality and virtual reality technologies is driving growth, while aging demographics increase demand for accessible and reliable sensing solutions.

China Two Terminal Vertical-Cavity Surface-Emitting Laser Market Insight

China accounted for the largest revenue share in the Asia-Pacific two terminal vertical-cavity surface-emitting laser market in 2024, driven by high adoption in smartphones, automotive light detection and ranging, and emerging industrial applications. Strong domestic manufacturing capabilities, expanding technology infrastructure, and rapid urbanization support market leadership. Government initiatives promoting smart cities and digitalization, coupled with affordable two terminal vertical-cavity surface-emitting laser production, are key factors driving the market.

Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market Share

The two terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) industry is primarily led by well-established companies, including:

- II-VI Incorporated (U.S.)

- Lumentum Operations LLC (U.S.)

- ams AG (Austria)

- TRUMPF (Germany)

- Broadcom Inc. (U.S.)

- Leonardo Electronics US, Inc. (U.S.)

- SANTEC CORPORATION (Japan)

- VERTILAS GmbH (Germany)

- Vertilite (U.K.)

- Alight Technologies ApS (Denmark)

- FLIR Systems, Inc. (U.S.)

- Inneos LLC (U.S.)

- Vixar Inc. (U.S.)

- IQE PLC (U.K.)

- Thorlabs, Inc. (U.S.)

- TriLumina (U.S.)

- TT Electronics plc (U.K.)

- Ushio America, Inc. (U.S.)

- WIN Semiconductors (Taiwan)

- Finisar Corporation (U.S.)

Latest Developments in Global Two Terminal Vertical-Cavity Surface-Emitting Laser (VCSEL) Market

- In August 2025, Sika USA launched a new line of high-strength hot melt adhesives tailored for automotive assembly applications. These adhesives are designed to enhance structural integrity and reduce vehicle weight, aligning with the industry's shift towards lightweight materials. This development indirectly impacts the Two Terminal Vertical-Cavity Surface-Emitting Laser market by supporting the automotive sector, which increasingly integrates VCSEL technology in LiDAR, in-cabin monitoring, and advanced driver-assistance systems, thereby fostering demand for photonics components

- In October 2024, TriEye Ltd. and HLJ Technology introduced a collaborative Short-Wave Infrared sensing and imaging solution utilizing a 1135nm Two Terminal Vertical-Cavity Surface-Emitting Laser. This partnership combines CMOS-based SWIR sensors with advanced VCSEL arrays to provide cost-effective and efficient imaging solutions. The integration is expected to enhance performance in automotive, industrial, and consumer sensing applications, broadening the adoption of Two Terminal Vertical-Cavity Surface-Emitting Laser devices across multiple markets

- In September 2024, TRUMPF Photonic Components showcased its next-generation Two Terminal Vertical-Cavity Surface-Emitting Laser devices at a major European optical communication conference. The innovations include improved single-mode performance, faster speeds, and reduced thermal impedance, specifically targeting low-power optical and co-packaged optics applications. These advancements strengthen the Two Terminal Vertical-Cavity Surface-Emitting Laser market by meeting rising demands in high-speed data communication and optical interconnects, positioning it for wider adoption in telecom and data center infrastructure

- In June 2024, ROHM developed a new VCSELED infrared light source by combining the properties of Two Terminal Vertical-Cavity Surface-Emitting Lasers and light-emitting diodes. This compact and efficient light source is intended for automotive driver and in-cabin monitoring systems. Its introduction is expected to expand the use of Two Terminal Vertical-Cavity Surface-Emitting Laser technology in the automotive sector, improving safety features and enhancing the market for infrared sensing applications

- In April 2024, TriEye Ltd. partnered with Vertilas GmbH to demonstrate a 1.3µm Two Terminal Vertical-Cavity Surface-Emitting Laser-powered SWIR sensing system. The collaboration integrates CMOS-based SWIR sensors with indium phosphide VCSEL arrays, creating cost-effective solutions for industrial and consumer applications. This development highlights the growing relevance of Two Terminal Vertical-Cavity Surface-Emitting Laser technology in precision sensing, imaging, and LiDAR systems, driving further market growth and adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Vertical Cavity Surface Emitting Laser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Vertical Cavity Surface Emitting Laser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Vertical Cavity Surface Emitting Laser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.