Global Two Terminal Zener Diode Market

Market Size in USD Million

CAGR :

%

USD

834.10 Million

USD

1,521.10 Million

2024

2032

USD

834.10 Million

USD

1,521.10 Million

2024

2032

| 2025 –2032 | |

| USD 834.10 Million | |

| USD 1,521.10 Million | |

|

|

|

|

What is the Global Two Terminal Zener Diode Market Size and Growth Rate?

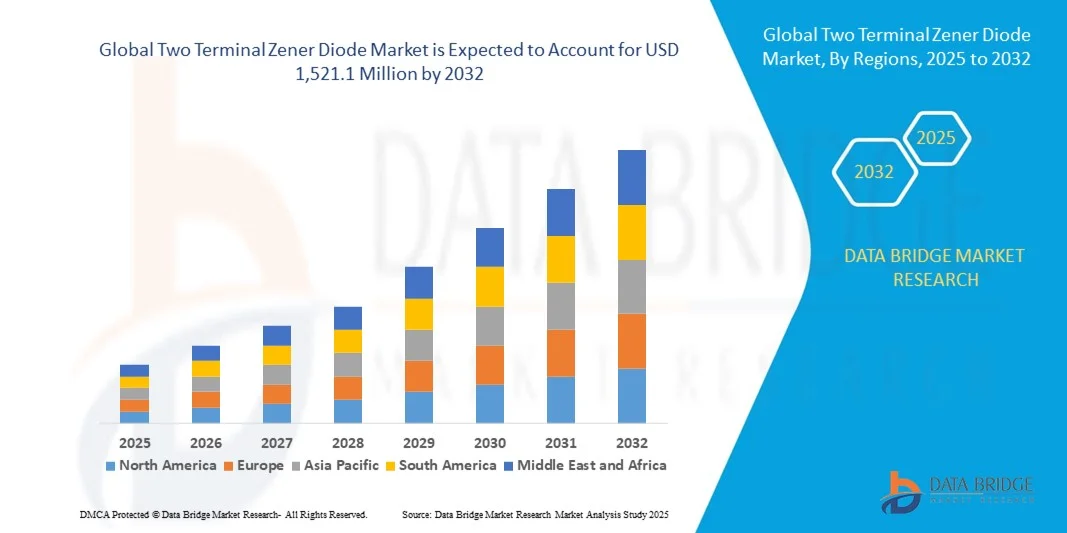

- The global two terminal zener diode market size was valued at USD 834.1 million in 2024 and is expected to reach USD 1,521.1 million by 2032, at a CAGR of 7.80% during the forecast period

- Increasing number of applications of the product across consumer electronics, rising usages of the diodes in electronic tools and electrical equipment, adoption of advanced diodes along with growing number of semiconductor manufacturing hubs, growth of the semiconductor industry across the globe, rising trends of device miniaturization are some of the major as well as important factors which will likely to augment the growth of the two terminal zener diode

What are the Major Takeaways of Two Terminal Zener Diode Market?

- Growing number of research and development activities along with increasing applications in various industries which will further contribute by generating immense opportunities that will led to the growth of the two terminal zener diode market in the above-mentioned projected timeframe

- High cost of product along with design complexities which will likely to act as market restraints factor for the growth of the two terminal zener diode in the above-mentioned projected timeframe. Regulatory framework of the market will become the biggest and foremost challenge for the growth of the market

- North America dominated the two terminal zener diode market with the largest revenue share of 36.21% in 2024, driven by a strong presence of semiconductor manufacturers, advancements in power electronics, and the growing adoption of energy-efficient circuit designs

- The Asia-Pacific two terminal zener diode market is poised to grow at the fastest CAGR of 13.7% during 2025–2032, driven by the region’s expanding electronics manufacturing base, rapid urbanization, and rising consumer demand for smart devices

- The Surface Mount Technology (SMT) segment dominated the market with the largest revenue share of 64.3% in 2024, attributed to its compact size, superior thermal efficiency, and compatibility with automated assembly processes

Report Scope and Two Terminal Zener Diode Market Segmentation

|

Attributes |

Two Terminal Zener Diode Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Two Terminal Zener Diode Market?

Rising Adoption of Miniaturized and Energy-Efficient Zener Diodes

- A major trend in the global two terminal zener diode market is the increasing focus on miniaturization and energy-efficient circuit designs to meet the evolving demands of compact electronic devices and power-sensitive applications. The development of low-power, high-precision Zener diodes is becoming crucial for modern electronics, including IoT devices, wearables, and automotive electronics

- Manufacturers are innovating to deliver high-performance Zener diodes with lower leakage current and tighter voltage tolerances, catering to next-generation applications such as 5G, EV systems, and portable medical devices. For instance, ROHM Co., Ltd. recently introduced miniaturized Zener diodes designed to ensure stable voltage regulation with reduced power loss

- The integration of advanced semiconductor materials and new packaging technologies is enabling Zener diodes with improved thermal stability, enhanced reliability, and reduced footprint, making them suitable for high-density circuit designs

- Moreover, the trend toward sustainable and energy-conscious electronics is driving the demand for Zener diodes that help minimize energy consumption in consumer and industrial systems. This aligns with global efforts toward greener and more efficient electronic manufacturing

- This focus on miniaturized and power-efficient Zener diodes is reshaping product design and driving innovation across various sectors such as automotive, telecommunications, and consumer electronics

- As device manufacturers seek to balance performance, efficiency, and form factor, this trend is expected to remain central to market expansion, fostering advancements in low-voltage protection and precision circuit regulation technologies

- The demand for two terminal zener diodes that offer seamless AI and voice control integration is growing rapidly across both residential and commercial sectors, as consumers increasingly prioritize convenience and comprehensive smart home functionality

What are the Key Drivers of Two Terminal Zener Diode Market?

- The growing adoption of electronic devices and automotive electronics, coupled with the need for voltage regulation and surge protection, is a major driver of the Two Terminal Zener Diode market. Zener diodes play a critical role in ensuring circuit stability and protecting sensitive components from voltage fluctuations

- For instance, in April 2024, NXP Semiconductors N.V. introduced its next-generation automotive-grade Zener diodes, optimized for EV battery management systems and advanced driver-assistance systems (ADAS), addressing the increasing need for reliable voltage reference components

- The rapid proliferation of consumer electronics, including smartphones, laptops, and IoT devices, continues to boost the demand for miniature Zener diodes that provide efficient voltage stabilization

- In addition, the expansion of industrial automation and communication infrastructure, especially with the rollout of 5G, is fueling the adoption of Zener diodes in high-frequency and high-voltage systems

- Furthermore, the increasing investments in semiconductor R&D and advancements in fabrication processes are enabling the production of highly precise Zener diodes with improved efficiency and longevity, making them indispensable across diverse applications

- The combined impact of these factors is reinforcing the market’s growth trajectory, positioning Two Terminal Zener Diodes as a fundamental component in modern electronic design and power management systems

Which Factor is Challenging the Growth of the Two Terminal Zener Diode Market?

- The fluctuating prices of raw semiconductor materials such as silicon and gallium arsenide present a significant challenge to the steady growth of the Two Terminal Zener Diode market. Rising production costs often translate into higher prices for end products, affecting adoption in price-sensitive markets

- For instance, periodic supply disruptions and rising costs in the global semiconductor value chain have increased the manufacturing expenses for leading producers such as Infineon Technologies AG and STMicroelectronics, creating pressure on profit margins

- Moreover, the limited breakdown voltage range of certain Zener diode models restricts their usage in high-power circuits, prompting designers to seek alternative solutions such as transient voltage suppression (TVS) diodes in some applications

- The growing miniaturization of electronic components also poses challenges for thermal management and long-term reliability, necessitating more advanced materials and design improvements

- Another restraint is the intense competition from substitute technologies offering similar protection functions at lower costs, potentially slowing down Zener diode demand in specific end-use segments

- Addressing these challenges through continuous innovation, material optimization, and diversification into advanced diode technologies will be crucial for manufacturers to maintain market competitiveness and meet evolving application requirements

How is the Two Terminal Zener Diode Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the two terminal zener diode market is segmented into Through Hole Technology and Surface Mount Technology. The Surface Mount Technology (SMT) segment dominated the market with the largest revenue share of 64.3% in 2024, attributed to its compact size, superior thermal efficiency, and compatibility with automated assembly processes. SMT Zener diodes are widely adopted in high-density circuit designs across consumer electronics, automotive, and industrial applications, where space optimization and performance reliability are critical.

The Through Hole Technology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its robust mechanical strength and suitability for high-power and high-temperature environments. This technology continues to hold relevance in heavy-duty industrial systems and aerospace applications where long-term durability and stability under mechanical stress are essential. The coexistence of both types reflects the balance between innovation and reliability in Zener diode integration across industries.

- By Application

On the basis of application, the two terminal zener diode market is segmented into Computing, Industrial, Telecommunications, Automotive, Communication, Manufacturing, Consumer Electronics, and Others. The Consumer Electronics segment dominated the market with the largest revenue share of 38.6% in 2024, driven by the growing demand for compact, energy-efficient voltage regulators in smartphones, wearables, and IoT devices. The increasing miniaturization of consumer gadgets has significantly accelerated Zener diode adoption for circuit protection and voltage stabilization.

The Automotive segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rising integration of Zener diodes in electric vehicles (EVs), ADAS, and infotainment systems. Their role in ensuring voltage precision and component safety under varying load conditions makes them indispensable in modern automotive electronics. Moreover, expanding EV production and government support for sustainable mobility are set to reinforce the demand for Zener diodes in the automotive sector.

Which Region Holds the Largest Share of the Two Terminal Zener Diode Market?

- North America dominated the two terminal zener diode market with the largest revenue share of 36.21% in 2024, driven by a strong presence of semiconductor manufacturers, advancements in power electronics, and the growing adoption of energy-efficient circuit designs

- The region’s demand is largely fueled by the widespread integration of Zener diodes in automotive electronics, industrial automation, and consumer devices requiring stable voltage regulation and circuit protection

- Moreover, rising investments in EV infrastructure, coupled with innovations in miniaturized and high-power diodes, have strengthened North America’s leadership position in the global market

U.S. Two Terminal Zener Diode Market Insight

The U.S. two terminal zener diode market captured the largest revenue share of 82% in 2024 within North America, driven by the rapid technological advancement in consumer electronics and the growing penetration of electric vehicles. The country’s well-established semiconductor ecosystem, led by companies such as Texas Instruments, ON Semiconductor, and Vishay Intertechnology, is fostering innovation in precision voltage regulation and low-noise circuit protection. Moreover, the increasing demand for Zener diodes in industrial control systems, renewable energy equipment, and automotive sensors continues to expand the market’s footprint. The U.S. market remains a critical hub for research, design, and manufacturing excellence in power semiconductor devices.

Europe Two Terminal Zener Diode Market Insight

The Europe two terminal zener diode market is projected to grow at a substantial CAGR during the forecast period, primarily driven by the region’s strong focus on sustainability, electric mobility, and industrial automation. The implementation of energy efficiency directives by the European Union and the rising adoption of EVs are contributing to increased diode demand in automotive and renewable energy sectors. Furthermore, Zener diodes are gaining traction in consumer and telecommunication electronics, where they support stable voltage control and device protection. Europe’s strong R&D base and the presence of semiconductor giants such as Infineon Technologies and STMicroelectronics reinforce its position as a key player in the global market.

U.K. Two Terminal Zener Diode Market Insight

The U.K. two terminal zener diode market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by advancements in industrial automation and the growth of consumer electronics manufacturing. The country’s increasing focus on electric vehicles and renewable power systems has elevated the demand for efficient, low-power semiconductor components, including Zener diodes. Moreover, the U.K.’s expanding telecommunication infrastructure and 5G rollout are generating additional opportunities for diode integration in signal protection and circuit stability applications. The continued emphasis on innovation, design optimization, and green electronics is expected to accelerate market growth in the coming years.

Germany Two Terminal Zener Diode Market Insight

The Germany two terminal zener diode market is expected to expand at a considerable CAGR, driven by the country’s leadership in automotive manufacturing, renewable energy, and industrial engineering. Zener diodes are integral to Germany’s rapidly evolving EV ecosystem, where they are used for voltage stabilization, protection circuits, and power management. Furthermore, the emphasis on high-performance electronics, coupled with the country’s sustainability-driven design approach, promotes the adoption of compact, energy-efficient diode solutions. With strong semiconductor R&D capabilities and advanced production infrastructure, Germany remains a cornerstone of diode innovation in Europe.

Which Region is the Fastest Growing Region in the Two Terminal Zener Diode Market?

The Asia-Pacific two terminal zener diode market is poised to grow at the fastest CAGR of 13.7% during 2025–2032, driven by the region’s expanding electronics manufacturing base, rapid urbanization, and rising consumer demand for smart devices. Countries such as China, Japan, South Korea, and India are at the forefront of production, benefiting from robust semiconductor fabrication and favorable government policies promoting digital and industrial growth. The growing penetration of electric vehicles and renewable energy systems further accelerates diode demand. As APAC continues to dominate global semiconductor exports, the availability of cost-effective materials and large-scale manufacturing facilities ensures sustained market expansion and technological advancement.

Japan Two Terminal Zener Diode Market Insight

The Japan two terminal zener diode market is gaining momentum due to its strong foundation in precision electronics, automotive innovation, and miniaturized component manufacturing. The country’s focus on developing high-reliability semiconductor components for consumer and automotive applications drives adoption across various industries. Japanese manufacturers are investing heavily in developing compact, high-temperature Zener diodes for next-generation electric vehicles and energy-efficient devices. Moreover, Japan’s robust semiconductor R&D ecosystem ensures continuous innovation in performance, stability, and environmental compliance.

China Two Terminal Zener Diode Market Insight

The China two terminal zener diode market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the nation’s dominance in electronics manufacturing and large-scale semiconductor production. The country’s growing adoption of renewable energy systems, electric vehicles, and smart consumer devices continues to propel market growth. In addition, the Chinese government’s emphasis on developing domestic semiconductor capabilities has significantly boosted production capacity and innovation. With local companies increasingly manufacturing cost-effective, high-quality Zener diodes, China remains the key growth engine of the Asia-Pacific market.

Which are the Top Companies in Two Terminal Zener Diode Market?

The two terminal zener diode industry is primarily led by well-established companies, including:

- Vishay Intertechnology, Inc. (U.S.)

- Diodes Incorporated (U.S.)

- Semiconductor Components Industries, LLC (onsemi) (U.S.)

- ROHM Co., Ltd. (Japan)

- NXP Semiconductors N.V. (Netherlands)

- Microsemi (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

- TOREX SEMICONDUCTOR LTD. (Japan)

- GOOD-ARK SEMICONDUCTOR (China)

- Renesas Electronics Corporation (Japan)

- Comchip Technology Co., Ltd (Taiwan)

- ANOVA Technologies Co., Ltd (China)

- Bourns, Inc. (U.S.)

- Guangdong Kexin Electronic Co., Ltd. (China)

- MCC (Micro Commercial Components) (U.S.)

- Comchip Technology Co., Ltd. (Taiwan)

- LRC (Leshan Radio Company, Ltd.) (China)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Northrop Grumman Corporation (U.S.)

What are the Recent Developments in Global Two Terminal Zener Diode Market?

- In October 2023, xTool, a leader in the laser engraving industry, introduced the innovative xTool S1, a 40W enclosed class 1 diode laser machine designed to meet the rising demand for high-powered systems and enhanced safety compliance. This development represents a significant step towards safer and more efficient laser-based manufacturing and creative applications. This launch underscores xTool’s commitment to advancing laser diode technology with a focus on user safety and performance

- In October 2023, Magnachip Semiconductor announced the launch of its 6th-generation 600V Super Junction Metal Oxide Semiconductor Field Effect Transistor (SJ MOSFET), enhanced through advanced microfabrication techniques. The MOSFET features an embedded Zener diode between the gate and source, providing improved reliability by preventing damage from external surges or electrostatic discharges (ESD). This innovation reinforces Magnachip’s position in delivering robust, high-performance semiconductor solutions for power management and industrial applications

- In October 2022, Ushio introduced two new 405 nm, 600 mW (CW) laser diodes—HL40173MG and HL40175MG—offering lifespans nearly twice as long as conventional products. Both laser diodes include an integrated Zener diode to safeguard against electrostatic discharge (ESD), ensuring stable performance and durability. This advancement highlights Ushio’s focus on reliability and extended operational life for industrial and optical applications

- In November 2021, Nexperia unveiled the industry’s first A-selection Zener diodes, the BZT52H-A (SOD123F) and BZX384-A (SOD323) series, featuring a 1% voltage tolerance, outperforming the traditional B (2%) and C (5%) variants. These diodes are available as Q-portfolio devices, tailored for mobile, portable, automotive, and industrial applications, meeting stringent regulatory standards. This product launch demonstrates Nexperia’s commitment to precision, quality, and compliance in Zener diode manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Two Terminal Zener Diode Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Two Terminal Zener Diode Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Two Terminal Zener Diode Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.