Global Two Wheeler Handlebars Market

Market Size in USD Million

CAGR :

%

USD

538.20 Million

USD

801.25 Million

2024

2032

USD

538.20 Million

USD

801.25 Million

2024

2032

| 2025 –2032 | |

| USD 538.20 Million | |

| USD 801.25 Million | |

|

|

|

|

Two Wheeler Handlebars Market Size

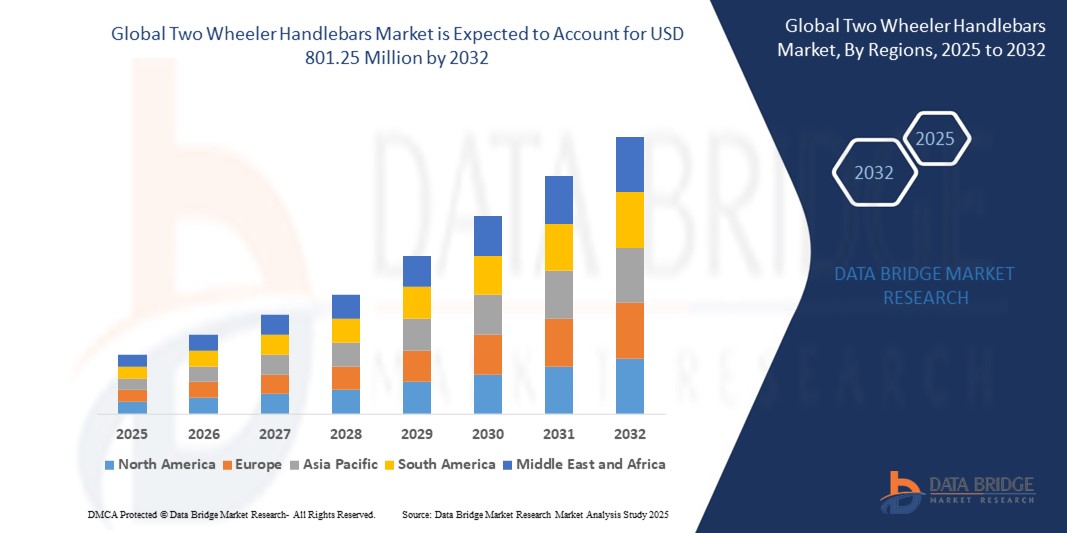

- The global two wheeler handlebars market size was valued at USD 538.20 million in 2024 and is expected to reach USD 801.25 million by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fueled by the rising demand for two-wheelers globally, especially in emerging economies, coupled with increasing consumer preference for motorcycles and scooters as cost-effective and fuel-efficient transportation options. This surge in two-wheeler adoption is significantly boosting the need for durable and ergonomically designed handlebars that enhance vehicle control, rider comfort, and safety

- Furthermore, the increasing customization trends among motorcycle enthusiasts and growing popularity of adventure and sports bikes are establishing handlebars as a vital component of vehicle performance and aesthetics. These converging factors are accelerating the uptake of Two Wheeler Handlebars solutions, thereby significantly boosting the industry's growth across both OEM and aftermarket channels

Two Wheeler Handlebars Market Analysis

- Two-wheeler handlebars, essential components for steering control and rider ergonomics, are increasingly gaining importance in both motorcycles and scooters across commuter, touring, and sports categories due to their direct impact on performance, safety, and rider comfort

- The growing demand for customized and ergonomically designed handlebars is primarily driven by the rising adoption of two-wheelers, increased consumer focus on vehicle aesthetics and handling, and the expansion of the motorcycle customization market

- North America dominated the two wheeler handlebars market with the largest revenue share of 37.6% in 2024, characterized by a strong aftermarket customization culture, high penetration of cruiser and touring bikes, and the presence of prominent motorcycle manufacturers. The U.S. experienced substantial growth in handlebar upgrades, especially for Harley-Davidson and other premium bike segments, supported by rising demand for better ergonomics and performance

- Asia-Pacific is expected to be the fastest growing region in the two wheeler handlebars market with a CAGR of 9.2% during the forecast period due to increasing urbanization, rising disposable incomes, and high two-wheeler ownership rates in countries like India, Indonesia, and Vietnam. The region is also witnessing strong OEM and aftermarket demand for lightweight and durable handlebar materials like aluminum and carbon fiber

- The Aluminum segment dominated the two wheeler handlebars market with a market share of 45.2% in 2024, owing to its lightweight, corrosion resistance, and strong structural integrity. It is widely used across premium and mid-range motorcycles and scooters, making it a preferred material choice for manufacturers seeking a balance between performance and durability

Report Scope and Two Wheeler Handlebars Market Segmentation

|

Attributes |

Two Wheeler Handlebars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Two Wheeler Handlebars Market Trends

“Rising Demand for Ergonomics and Rider Comfort”

- A significant and accelerating trend in the global two wheeler handlebars market is the growing emphasis on ergonomics and rider comfort, driven by an increasing number of long-distance riders, delivery services, and commuter traffic in urban environments

- For instance, the demand for adjustable handlebars in adventure and touring motorcycles is rising, enabling riders to fine-tune their grip height and width for better posture and reduced fatigue. Similarly, cruiser and standard bikes are adopting swept-back handlebar designs to improve wrist alignment and comfort on longer rides

- Manufacturers are focusing on developing lightweight yet durable handlebars made from aluminum and alloy materials to provide better control, shock absorption, and maneuverability. Off-road and sports bikes particularly benefit from these advancements, where responsive handling is critical

- In the scooter segment, compact and integrated handlebar units with embedded controls for indicators, braking, and throttle are gaining traction, especially in electric models. These designs support a cleaner aesthetic and simplify vehicle controls for novice riders

- The market is also witnessing innovations in textured grip designs and anti-vibration mounts, which enhance rider safety and reduce discomfort during prolonged usage

- This shift toward ergonomically optimized handlebars is expected to further fuel the demand from both OEMs and aftermarket providers, as consumers increasingly prioritize riding comfort and personalized control

Two Wheeler Handlebars Market Dynamics

Driver

“Growing Need Due to Rising Customization Trends and Performance Enhancement”

- The increasing demand for personalized bikes and performance upgrades among two-wheeler enthusiasts is significantly driving the growth of the Two Wheeler Handlebars Market. Riders are increasingly opting for handlebars that enhance control, aesthetics, and comfort across motorcycles, scooters, and electric bikes

- For instance, in April 2024, Renthal Ltd. introduced a new line of lightweight, reinforced aluminum handlebars for sports and dirt bikes, aimed at improving ride stability and shock absorption. Such product innovations are anticipated to fuel the market during the forecast period

- As consumers prioritize ergonomic designs, better handling, and improved riding posture, aftermarket and OEM manufacturers are developing handlebars suited for specific riding conditions—ranging from urban commuting to off-road racing

- In addition, the surge in electric two-wheeler adoption has increased the need for handlebar systems that accommodate digital dashboards, brake sensors, and throttle controls, reinforcing their role as both structural and technological components

- The trend of DIY bike modifications, social media influence, and the growing number of biking clubs have further supported market demand, as consumers seek handlebars that align with their style preferences and riding performance expectations

Restraint/Challenge

“High Manufacturing Costs and Compatibility Issues”

- The relatively high cost of manufacturing high-performance or customized handlebars, especially those made from carbon fiber, titanium, or CNC-machined aluminum, poses a restraint to the broader market—particularly in price-sensitive developing economies

- Moreover, compatibility issues between aftermarket handlebars and existing bike models may hinder adoption, as modifications often require additional components like clamps, risers, or brake line extensions

- For instance, while premium brands such as Flanders Inc. and Burleigh Bars offer precision-engineered handlebar options, the need for professional installation or limited model compatibility can dissuade entry-level customers or casual riders

- Regulatory standards related to bike modifications in certain regions also limit the types of handlebars that can be legally installed, further complicating the upgrade process for consumers

- Overcoming these challenges will require greater standardization across handlebar components, as well as the introduction of more modular and affordable product lines that cater to a wider range of bike types and consumer budgets

Two Wheeler Handlebars Market Scope

The market is segmented on the basis of type, material type, distribution channel, and application.

• By Type

On the basis of type, the two wheeler handlebars market is segmented into motorcycles, standard, cruiser, sports, off-road, scooters, standard, maxi, and enclosed. The standard motorcycle segment dominated the largest market revenue share of 38.6% in 2024, driven by its wide popularity among daily commuters and general-purpose users. Its simple design, cost-effectiveness, and compatibility with various handlebar types make it a top choice in both developing and developed markets.

The sports motorcycle segment is anticipated to witness the fastest CAGR of 20.3% from 2025 to 2032, propelled by increasing demand from younger consumers, performance enthusiasts, and growing popularity of motorsports. These handlebars are designed to support aggressive riding posture, offering precision control and aerodynamics.

• By Material Type

On the basis of material type, the two wheeler handlebars market is segmented into steel, aluminum, and alloy. The aluminum segment held the largest market revenue share of 45.2% in 2024, owing to its lightweight, corrosion resistance, and strong structural integrity. It is widely used across premium and mid-range motorcycles and scooters.

The alloy segment is projected to grow at the fastest CAGR during the forecast period, due to its strength-to-weight ratio and increased demand for durable and customizable solutions in off-road and adventure bike categories.

• By Distribution Channel

On the basis of distribution channel, the two wheeler handlebars market is segmented into online and offline. The offline segment captured the largest market share of 62.7% in 2024, driven by the dominance of traditional automotive dealerships, service centers, and aftermarket accessory stores. These channels provide instant product availability and professional installation services.

The online segment is expected to register the fastest growth rate through 2032, fueled by the rise in e-commerce platforms, direct-to-consumer brands, and consumer preference for home delivery and digital browsing of options.

• By Application

On the basis of application, the two wheeler handlebars market is segmented into Original Equipment Manufacturers (OEMs) and aftermarket. The OEMs segment dominated the market with a share of 57.8% in 2024, due to the rise in two-wheeler production and increasing incorporation of customized handlebars in factory models.

The aftermarket segment is forecasted to grow at the fastest CAGR of 18.9% from 2025 to 2032, owing to rising customization trends among motorcycle enthusiasts, frequent replacements, and the growing popularity of DIY modifications.

Two Wheeler Handlebars Market Regional Analysis

- North America dominated the two wheeler handlebars market with the largest revenue share of 37.6% in 2024, driven by the strong culture of motorcycle touring, rising interest in bike customization, and increasing demand for performance-enhancing accessories across the U.S. and Canada

- Consumers in the region increasingly favor premium handlebars designed for comfort, ergonomic support, and style, especially in cruiser and adventure bike segments

- The widespread adoption of high-performance motorcycles, along with a growing aftermarket for modifications and accessories, positions North America as a major contributor to global market revenue

U.S. Two Wheeler Handlebars Market Insight

The U.S. two wheeler handlebars market captured the largest revenue share of 79.3% in 2024 within North America. This growth is primarily attributed to the strong aftermarket industry, growing sales of Harley-Davidson, Indian, and other heavyweight motorcycles, and a trend toward custom chopper builds. Rising e-commerce penetration and a do-it-yourself (DIY) culture among riders also fuel sales of bolt-on handlebar accessories and kits.

Europe Two Wheeler Handlebars Market Insight

The Europe two wheeler handlebars market is projected to register a steady CAGR of 6.7% during the forecast period. The region’s mature motorcycle culture, along with increasing adoption of bicycles and electric two-wheelers, is fueling demand. Consumers seek lightweight, durable handlebars tailored for urban commuting, off-road riding, and racing applications. Regulatory emphasis on safety and ergonomic standards further boosts premium product demand.

U.K. Two Wheeler Handlebars Market Insight

The U.K. two wheeler handlebars market is expected to grow at a CAGR of 7.1%, supported by a rise in eco-friendly mobility options and strong growth in the e-bike segment. An increase in last-mile delivery services and cycling tourism has also elevated demand for ergonomic and adjustable handlebars, particularly among courier fleets and leisure cyclists.

Germany Two Wheeler Handlebars Market Insight

The Germany two wheeler handlebars market is projected to grow at a CAGR of 6.9%, driven by the country’s leadership in automotive and bike engineering. German consumers value durable, precision-engineered handlebars for motorcycles, road bikes, and mountain bikes. The growth in e-bike exports and technological innovation in materials like carbon fiber and titanium also support market expansion.

Asia-Pacific Two Wheeler Handlebars Market Insight

The Asia-Pacific two wheeler handlebars market is poised to grow at the fastest CAGR of 9.2% from 2025 to 2032. The region benefits from surging two-wheeler ownership in countries like India, Indonesia, and Vietnam, combined with rising investments in electric scooters and motorcycles. Increasing disposable income and urban mobility demands are boosting aftermarket customization, including handlebars, as a key personalization component.

Japan Two Wheeler Handlebars Market Insight

The Japan two wheeler handlebars market is gaining traction due to its technologically advanced two-wheeler manufacturing industry and a strong culture of innovation. With a focus on electric mobility and compact urban bikes, handlebars featuring integrated control panels, navigation, and smart brake systems are gaining popularity. Japan’s aging population is also driving demand for ergonomically designed handlebars that reduce strain.

China Two Wheeler Handlebars Market Insight

The China two wheeler handlebars market accounted for a dominant share of 41.6% within Asia-Pacific in 2024, owing to its large-scale production and consumption of motorcycles, mopeds, and electric bikes. With government support for EV adoption and smart mobility, the demand for high-quality, lightweight, and feature-rich handlebars is rapidly increasing. China also serves as a manufacturing hub, contributing significantly to both local sales and global exports.

Two Wheeler Handlebars Market Share

The Two Wheeler Handlebars industry is primarily led by well-established companies, including:

- Kohli Bullet Accessories (India)

- Renthal Ltd (U.K.)

- FLANDERS Inc. (U.S.)

- J&P Cycles (U.S.)

- Accell Group (Netherlands)

- Burleigh Bars (Australia)

- Dorel Industries (Canada)

- Accell Group (Netherlands)

- Shimano Inc. (Japan)

- SRAM LLC (U.S.)

- Hero Cycles Ltd (India)

- Campagnolo S.R.L. (Italy)

- Merida Bikes (Taiwan)

- Specialized Bicycle Components (U.S.)

- Rohloff AG (Germany)

- Giant Bicycles (Taiwan)

- Currie Technologies (U.S.)

- OMAX Corporation (U.S.)

- Trek Bicycle Corporation (U.S.)

- Marin Bikes (U.S.)

- Atlas Cycles (Haryana) Ltd (India)

Latest Developments in Global Two Wheeler Handlebars Market

- In October 2023, Yamaha has introduced the Yamaha Motoroid 2, a groundbreaking self-balancing electric motorcycle that ditches traditional handlebars. This innovative design marks a significant departure from conventional motorcycle mechanics, pushing the boundaries of what an electric motorcycle can be. The Motoroid 2 blends futuristic aesthetics with advanced technology, offering a glimpse into the future of motorcycling

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.