Global Type K Copper Tubes Market

Market Size in USD Billion

CAGR :

%

USD

11.90 Billion

USD

18.68 Billion

2024

2032

USD

11.90 Billion

USD

18.68 Billion

2024

2032

| 2025 –2032 | |

| USD 11.90 Billion | |

| USD 18.68 Billion | |

|

|

|

|

Type K Copper Tubes Market Size

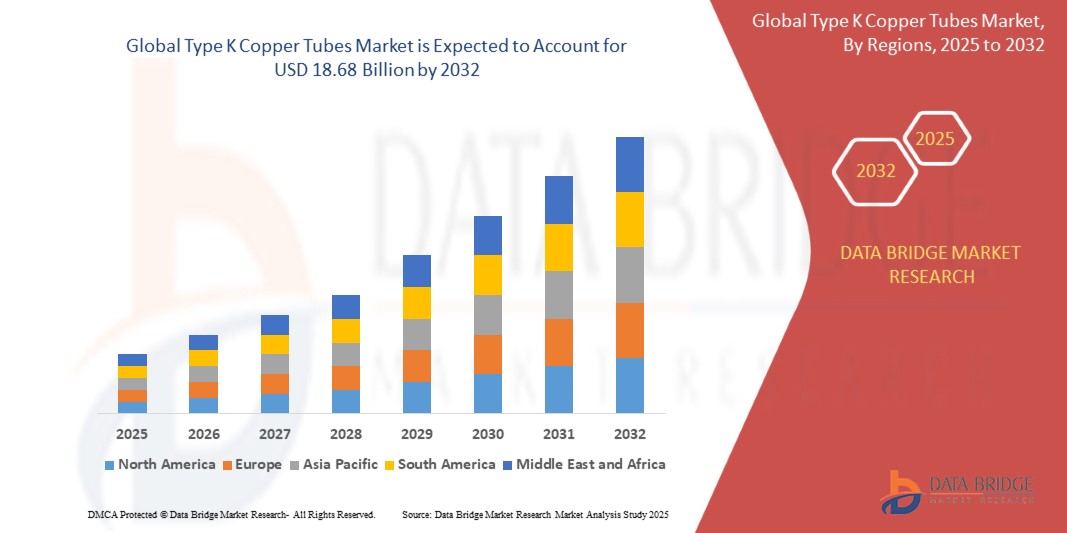

- The global type k copper tubes market size was valued at USD 11.90 billion in 2024 and is expected to reach USD 18.68 billion by 2032, at a CAGR of 5.8% during the forecast period

- The market growth is largely fuelled by the increasing use of type K copper tubes in plumbing, HVAC systems, and medical gas distribution due to their superior corrosion resistance, high durability, and ease of installation

- Rapid urbanization, rising residential and commercial construction activities, and stringent building codes that favor copper for safety and performance are further propelling the demand

Type K Copper Tubes Market Analysis

- Technological advancements in manufacturing processes and improved recycling of copper materials are reducing production costs and enhancing product availability, supporting steady market expansion

- Growing environmental concerns and the shift toward sustainable building materials are promoting copper tube adoption, as copper is fully recyclable and offers a long operational life with minimal maintenance requirements

- Asia-Pacific dominated the type K copper tubes market with the largest revenue share in 2024, driven by expanding construction projects, strong demand for HVACR systems, and widespread adoption in residential and commercial plumbing applications

- North America region is expected to witness the highest growth rate in the global type k copper tubes market, driven by increased demand for durable, corrosion-resistant tubing in HVACR, medical gas delivery, and commercial plumbing applications

- The straight tubes segment dominated the market with the largest market revenue share in 2024, driven by their widespread usage in plumbing and heating systems. Their uniform shape, high strength, and ease of installation make them ideal for fixed piping in both residential and commercial buildings. In addition, their compatibility with press-fit and soldering methods enhances installation flexibility across varying project requirements

Report Scope and Type K Copper Tubes Market Segmentation

|

Attributes |

Type K Copper Tubes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Type K Copper Tubes Market Trends

Rising Use of Type K Copper Tubes in Healthcare Infrastructure

- The increasing investments in hospital infrastructure and the growing need for safe, reliable medical gas delivery systems are accelerating the demand for Type K copper tubes. Their compatibility with high-pressure gases, corrosion resistance, and proven long-term performance make them ideal for such critical applications. These features enhance patient safety and ensure uninterrupted gas flow in medical environments.

- Governments in both developed and emerging economies are expanding healthcare networks, especially in response to rising respiratory illnesses and emergency preparedness measures. This has led to widespread use of Type K copper tubing in oxygen and vacuum line installations in hospitals. These projects often prioritize certified, durable piping systems to ensure compliance with international health standards.

- The trend is further reinforced by regulatory bodies mandating copper piping for medical gas lines due to its safety, non-permeability, and bacterial resistance. Type K’s thick wall design enhances its suitability for these highly regulated environments. It reduces leakage risk, improves longevity, and simplifies compliance with plumbing codes.

- For instance, in 2023, major healthcare construction projects in the Middle East and Southeast Asia prioritized the installation of medical gas systems with Type K copper tubing, citing regulatory compliance and system integrity. These projects highlighted copper’s reliability in extreme environmental and operational conditions.

- Although the healthcare sector is a key driver, continued market growth depends on sustainable pricing, reliable supply chains, and tailored product specifications for diverse regional regulations and building codes. Supplier partnerships and localized inventory management will play a critical role in maintaining demand.

Type K Copper Tubes Market Dynamics

Driver

Surge in Demand for Durable Plumbing Solutions Across Residential and Commercial Projects

- The rising focus on long-lasting and low-maintenance plumbing systems in urban development is significantly driving demand for Type K copper tubes. Their superior strength, high pressure rating, and excellent corrosion resistance make them a preferred choice in new building constructions and pipe retrofitting projects. This makes them suitable for both high-rise and large-scale infrastructure.

- Real estate developers and contractors are increasingly adopting Type K copper tubes to meet building codes, especially in regions with aging infrastructure or harsh water conditions. These tubes reduce the risk of pipe failures, leaks, and contamination, thus minimizing maintenance costs over the system’s lifecycle. Their high thermal conductivity also ensures consistent water temperatures.

- The push for green buildings and sustainable construction materials is also contributing to the increased use of copper, which is 100% recyclable and offers a lower environmental footprint compared to plastic alternatives. This aligns with global trends toward environmental certification and resource-efficient building practices.

- For instance, in 2022, several smart city developments in the U.S. and India integrated Type K copper tubing for both potable water and fire suppression systems due to their proven reliability and durability. These systems ensure safety, meet local codes, and require minimal servicing over time.

- While construction demand remains a major growth driver, the market’s expansion will rely on competitive pricing, skilled labor availability for installation, and manufacturer focus on regional specification compliance. Workforce development and technical education initiatives can further promote copper adoption.

Restraint/Challenge

Volatility in Copper Prices and Competition From Low-Cost Alternatives

- Fluctuations in global copper prices, influenced by supply chain disruptions, geopolitical tensions, and mining output, pose a major restraint for the Type K copper tubes market. High raw material costs directly affect product pricing and profitability for manufacturers and distributors. This creates uncertainty for large procurement contracts in infrastructure projects.

- Many developers, especially in cost-sensitive regions, are increasingly exploring alternative materials such as cross-linked polyethylene (PEX), chlorinated polyvinyl chloride (CPVC), and stainless steel. These materials offer lower installation costs and competitive durability, challenging the dominance of copper. Their lightweight nature also reduces labor and shipping expenses.

- The availability of cheaper substitutes with easier installation methods can limit copper tube adoption, particularly in residential sectors with constrained budgets. This shift is more prominent in emerging markets lacking strong regulatory enforcement or skilled copper installation professionals. Installation training and awareness often fall short in rural areas.

- For instance, in 2023, several municipal housing projects in Southeast Asia switched to PEX systems to reduce plumbing infrastructure costs, leading to a decline in copper tube procurement despite higher performance reliability. Cost pressures outweighed long-term operational benefits for project planners.

- To maintain market position, copper tube manufacturers must innovate with value-added solutions, promote long-term savings over initial costs, and invest in awareness initiatives to highlight the safety and longevity advantages of Type K tubes over plastic alternatives. Emphasis on lifecycle costs and environmental advantages can help regain market share.

Type K Copper Tubes Market Scope

The market is segmented on the basis of form and application.

• By Form

On the basis of form, the Type K copper tubes market is segmented into straight tubes, coils, capillary tubes, and other forms. The straight tubes segment dominated the market with the largest market revenue share in 2024, driven by their widespread usage in plumbing and heating systems. Their uniform shape, high strength, and ease of installation make them ideal for fixed piping in both residential and commercial buildings. In addition, their compatibility with press-fit and soldering methods enhances installation flexibility across varying project requirements.

The coils segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand in HVACR systems and refrigeration applications. Coiled Type K tubes offer excellent flexibility, making them suitable for tight spaces and complex routing, especially in compact commercial setups. Their ability to reduce the number of fittings and joints contributes to lower leakage risks and better efficiency, driving their popularity in both new installations and retrofits.

• By Application

On the basis of application, the Type K copper tubes market is segmented into HVACR, plumbing, industrial, automotive, medical, and other applications. The plumbing segment held the largest market revenue share in 2024, attributed to the rising need for durable, corrosion-resistant piping solutions in water distribution networks. Type K copper tubes are preferred for their long service life, ability to withstand high pressures, and adherence to building codes, making them the go-to option for both residential and commercial plumbing projects.

The HVACR segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing investments in energy-efficient buildings and climate control systems. The excellent thermal conductivity and formability of Type K copper tubes enhance their efficiency in heat exchange systems, ensuring optimal performance. Moreover, as the demand for sustainable cooling and heating solutions rises, the use of copper in HVACR systems continues to gain traction across both developed and developing economies.

Type K Copper Tubes Market Regional Analysis

- Asia-Pacific dominated the type K copper tubes market with the largest revenue share in 2024, driven by expanding construction projects, strong demand for HVACR systems, and widespread adoption in residential and commercial plumbing applications

- The region benefits from growing urban populations, government investments in infrastructure, and increasing preference for durable, corrosion-resistant piping systems. Type K copper tubes are highly valued for their safety, longevity, and performance in high-pressure environments

- This dominance is further supported by rising awareness of sustainable construction materials and the shift toward recyclable, energy-efficient building solutions, positioning copper tubes as a preferred alternative to plastic-based piping across the region

China Type K Copper Tubes Market Insight

The China type K copper tubes market captured the largest revenue share within Asia-Pacific in 2024, driven by the country’s booming construction sector and large-scale urban infrastructure initiatives. Ongoing real estate developments, smart city rollouts, and stringent plumbing codes are contributing to the strong adoption of copper tubing in both residential and commercial buildings. Furthermore, China’s position as a major producer of copper components ensures cost-effective availability and encourages widespread usage across diverse industrial applications.

Japan Type K Copper Tubes Market Insight

The Japan type K copper tubes market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's emphasis on precision engineering, aging infrastructure upgrades, and robust demand from the healthcare sector. With Japan’s high safety and quality standards, copper tubing is preferred for medical gas systems, clean water supply, and fire safety installations. The market is also supported by the country’s commitment to eco-friendly construction practices, where recyclable and long-lasting materials such as copper are increasingly favored in residential, commercial, and institutional applications.

North America Type K Copper Tubes Market Insight

North America is expected to witness the fastest growth rate from 2025 to 2032, driven by widespread usage in plumbing, HVACR, and medical gas applications across commercial and residential construction. The region benefits from mature infrastructure standards, regulatory requirements mandating copper use in medical and safety-critical systems, and a strong emphasis on energy efficiency and sustainability in construction practices. This continued adoption is also supported by an established construction ecosystem, skilled workforce, and consistent demand for reliable, corrosion-resistant, and high-pressure tolerant materials, particularly in urban and healthcare developments

U.S. Type K Copper Tubes Market Insight

The U.S. type K copper tubes market is expected to witness the fastest growth rate from 2025 to 2032, driven by extensive demand across building renovations, new construction, and infrastructure upgrades. Strict building codes that mandate copper tubing for potable water and gas systems reinforce its market dominance. Moreover, the rise in green building certifications and emphasis on long-term plumbing reliability are encouraging widespread copper tube adoption in both residential and institutional settings.

Europe Type K Copper Tubes Market Insight

The Europe type K copper tubes market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong regulatory compliance, renovation of aging water supply systems, and growth in energy-efficient buildings. Increased awareness around recyclable and sustainable construction materials is driving copper demand. In addition, European developers are increasingly specifying copper tubing for its antimicrobial properties and long-term performance in high-demand sectors such as healthcare and commercial plumbing.

Germany Type K Copper Tubes Market Insight

The Germany type K copper tubes market is expected to witness the fastest growth rate from 2025 to 2032, supported by advanced building standards, rising demand for precision plumbing, and strong sustainability policies. Germany's commitment to energy-efficient infrastructure and preference for durable materials fuels demand for copper tubes in both urban and industrial projects. The country's strong manufacturing base and high plumbing quality standards further enhance market adoption.

U.K. Type K Copper Tubes Market Insight

The U.K. type K copper tubes market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing urban redevelopment initiatives and the shift toward eco-conscious construction materials. Copper’s recyclability, resistance to corrosion, and long service life align with the U.K.’s green building targets and retrofit goals. Rising adoption in healthcare facilities and commercial establishments for gas and water delivery is also reinforcing the market’s growth trajectory in the country.

Type K Copper Tubes Market Share

The Type K Copper Tubes industry is primarily led by well-established companies, including:

- Mueller Industries, Inc. (U.S.)

- Wieland Group (Germany)

- KME Group S.p.A. (Italy)

- Mexichem (Mexico)

- Cerro Flow Products LLC (U.S.)

- Luvata (Finland)

- Hailiang Group Co., Ltd. (China)

- Golden Dragon Precise Copper Tube Group Inc. (China)

- Cambridge-Lee Industries LLC (U.S.)

- Lawton Tubes Ltd (U.K.)

Latest Developments in Global Type K Copper Tubes Market

- In August 2024, Mueller Industries acquired Elkhart Products Corporation, a U.S.-based manufacturer of copper solder fittings with facilities in Indiana and Arkansas. Previously owned by Aalberts N.V., this acquisition enhances Mueller’s capability to supply plumbing and HVAC industries—key application areas for Type K copper tubes—thereby strengthening its market position across construction and industrial segments in North America

- In March 2023, Wieland introduced Cuprolife, a copper tube made from 100% recycled material, aimed at promoting sustainability in the building sector. This innovation supports the Type K copper tubes market by offering an environmentally responsible alternative without compromising on quality, aligning with the growing demand for green construction solutions

- In July 2023, Wieland Group acquired Farmers Copper Ltd., a leading supplier of copper, brass, and bronze alloys in North America. The acquisition expands Wieland’s market reach and distribution network, especially in plumbing and HVAC segments where Type K copper tubes are commonly used, thus reinforcing its presence in the region

- In January 2023, Wieland Group acquired Small Tube Products, a manufacturer of small-diameter copper and alloy tubes. The move broadens Wieland’s product range, particularly in precision tubing, and supports the supply of Type K copper tubes for specialized applications in HVAC and industrial infrastructure, strengthening its manufacturing base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Type K Copper Tubes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Type K Copper Tubes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Type K Copper Tubes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.